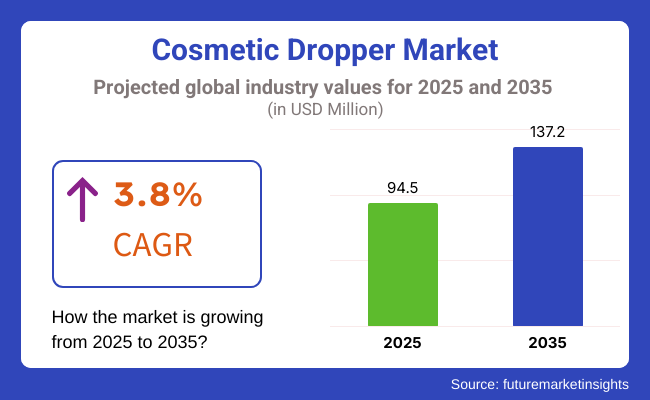

The market for cosmetic dropper is estimated to generate a market size of USD 94.5 million in 2025 and would increase to USD 137.2 million by 2035. It is expected to increase its sales at a CAGR of 3.8% over the forecast period 2025 to 2035. Revenue generated from cosmetic dropper in 2024 was USD 91.1 million

Skin care will continue to hold over 56% of the cosmetic dropper market share in 2035. All these are originated from skin care products like serum, facial oil, or moisturizer, which usually are used in certain measurements to allow the proper use and droppers provide the ideal method for dispensing these liquid-formulated products with the control and measured amounts, which are quite essential for strong formulae.

Thus, this further drives market growth for cosmetic droppers, particularly considering growing space in the field of skin care in such household categories as anti-aging, acne treatment, moisture substitution, etc. Droppers have also been the initial preference since they are convenient and waste-free. Additionally, they have also tagged the skin care products as luxury or premium; applying droppers is an increased sense of quality.

The glass cosmetic dropper leads in the market by capturing a 65% market share, supported primarily by the premium touch it offers, and its use on high-end packaging for cosmetics. Glass droppers offer greater defense against chemical interaction, which raises the level of preservation for delicate formulations. Conversely, plastic cosmetic droppers capture a wider target market. The plastic dropper, although boasting a lower share in the market, is recommended for lighter package weight, reduced transportation costs, and compatibility for mass-market lines.

The cosmetic dropper market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 46.2 million and will increase 1.5 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global cosmetic dropper market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 3.7% (2024 to 2034) |

| H2 | 3.9% (2024 to 2034) |

| H1 | 2.8% (2025 to 2035) |

| H2 | 4.8% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.7%, followed by a slightly higher growth rate of 3.9% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 2.8% in the first half and remain relatively moderate at 4.8% in the second half. In the first half (H1) the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed an increase of 90 BPS.

Greater Accuracy and Measurement for Skincare and Wellness Products Enhance the Market Growth

Individuals are becoming more conscious about the amount of product they apply to their skin, particularly to fix serums, facial oils, and essential oils. Droppers allow applying such products under controlled conditions so that wastage is avoided, and excessive application becomes less likely. This accuracy is particularly crucial in the case of very concentrated products that work best when administered in tiny, controlled doses, such as those with CBD, vitamins, and anti-aging ingredients.

With high-potency smaller items more and more loved by consumers, thus the need for dropper-type packaging is on the rise globally. The continuously growing market is increasingly shifting towards pure herbal extracts, liquid nutritional supplements, and pharmaceutical blends for skin care applied by wellness and medical professionals, hence opening it up to other possible uses outside the traditional beauty products.

The Rise of Zero-Waste and Refillable Beauty Products Packaging propels the cosmetic dropper industry

Beauty product reusable packaging is being adopted by consumers and businesses in an effort to cut down on plastic waste. Most companies now offer glass droppers with bottle refills or refill pouches so that consumers can reuse their packaging instead of discarding it. Customers are looking for sustainable products without reducing the quality or convenience of their products, the trend is increasingly gaining popularity.

Zero-waste refill programs whereby customers buy refillable sustainable pouches to replace their products or return used-up bottles to have them refilled are being embraced by luxury beauty companies and boutique beauty brands. Dropper packs are becoming more and more a long-term, sustainable packaging alternative in the beauty industry as a result of the trend.

The Challenge of Recycling Droppers with Mixture of Materials

The fact that most cosmetic droppers consist of a number of different materials, including rubber, plastic, and glass, complicates their recycling for the company. Most droppers end up in the landfills rather than being recycled because the materials have to be separated before recycling.

While some companies are developing fully recyclable or biodegradable droppers, these are not yet widely available and are not yet affordable. The waste issue may hinder the growth of the dropper market in the lack of more efficient recycling systems and eco-friendly solutions.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability & Eco-Friendly Materials | As demand for sustainable beauty packaging continues to rise, investment in recyclable glass, biodegradable plastics, and refillable dropper formats will support environmental objectives. |

| Precision & Controlled Dispensing | Sophisticated dropper designs that promote precise and controlled dispensing will improve the user experience and lower product wastage. |

| Premium & Aesthetic Design | High-end, customizable droppers with luxury finishes (frosted glass, metallic accents, distinctive shapes) will find their way into premium cosmetic and skincare brands. |

| Durability & Leak-Proof Sealing | Increasing durability of droppers and integrating leak-proof systems will enhance product shelf life and consumer satisfaction. |

| Customization & Branding | Providing different sizes of droppers, colors, and branding will enable cosmetic businesses to differentiate their products in a competitive marketplace. |

The global cosmetic dropper market achieved a CAGR of 2.7% in the historical period of 2020 to 2024. Overall, the cosmetic dropper market performed well since it grew positively and reached USD 91 million in 2024 from USD 81.1 million in 2020.

The market for cosmetic droppers grew steadily between 2020 and 2024, fueled by growing demand for accurate dispensing in beauty and skincare products, growing consumer demand for premium and eco-friendly packaging, and innovation in glass and recyclable dropper materials.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Market Growth | Consistent growth led by expanding demand for facial oils, serums, and skincare. |

| Material Trends | Domination by glass droppers with rubber or plastic parts for convenience. |

| Regulatory Environment | Compliance with safety standards and regulations for cosmetic packaging and material toxicity. |

| Consumer Demand | High demand from luxury skincare and beauty brands, particularly for premium serums and oils. |

| Technological Advances | Enhanced design for controlled, leak-proof dispensing and handling. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Robust growth driven by growth in premium skincare products, online shopping, and demand for specialized and environmentally friendly packaging solutions. |

| Material Trends | Movement toward eco-friendly materials, such as reusable glass and biodegradable, environmentally friendly plastic substitutes. |

| Regulatory Environment | Tighter regulations encouraging the use of non-toxic, BPA-free, and eco-friendly packaging materials for cosmetics. |

| Consumer Demand | Growing demand for air-tight, hygienic, and easy-to-use packaging with exact dosing functionalities. |

| Technological Advances | Advances in smart packaging, including anti-theft sensors and augmented reality (AR) for an individualized consumer experience. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Performance (Precision, Leakage, Durability) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Smart Features & Technology Integration |

|

| Reusability & Circular Economy |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Performance (Precision, Leakage, Durability) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Smart Features & Technology Integration |

|

| Reusability & Circular Economy |

|

During 2025 to 2035, cosmetic droppers demand is anticipated to increase owing to increasing applications in serums, essential oils, and organic beauty products, rising use of eco-friendly and refillable packaging solutions, and rising innovations in ergonomic and leak-proof dropper designs for improved user convenience and product durability.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include Virospack SL, AptarGroup, Inc., LUMSON S.p.A, Comar LLC.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include FusionPKG, Quadpack, HCP Packaging, DWK Life Sciences Ltd, Paramark Corporation, Adelphi Healthcare Packaging, SONE Products Ltd, FH Packaging.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| North America | Growth in premium and luxury cosmetic packaging. |

| Latin America | Preference for small-sized and travel-friendly droppers. |

| Europe | Leading market due to strict sustainability regulations and high beauty product consumption. |

| Middle East & Africa | Emerging market with increasing demand for luxury cosmetics in the UAE and Saudi Arabia. |

| Asia Pacific | Leading market due to strict sustainability regulations and high beauty product consumption. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| North America | Increasing adoption of refillable and reusable dropper packaging. |

| Latin America | Shift toward biodegradable and cost-effective dropper materials. |

| Europe | Further shift toward fully recyclable and biodegradable dropper materials. |

| Middle East & Africa | Expansion of regional manufacturing to reduce reliance on imports. |

| Asia Pacific | Further shift toward fully recyclable and biodegradable dropper materials. |

The section below covers the future forecast for the cosmetic dropper market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 2.7% through 2035. In Europe, Spain is projected to witness a CAGR of 3.4% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.7% |

| Germany | 2.3% |

| China | 4.7% |

| UK | 2.2% |

| Spain | 3.4% |

| India | 4.9% |

| Canada | 2.5% |

Beauty droppers are conforming to become eco-friendlier legislation, and Germany is leading the way with green packaging for cosmetics. Plastics are being trimmed to avoid wastage and recycled materials employed as a result of the high recycling and sustainability laws in the country, such as the German Packaging Act. Fill-and-refill packs of droppers are thus being launched by many German beauty firms so that customers can purchase green refills rather than disposing of used bottles.

With glass droppers, biodegradable rubber bulbs, and reusable packaging ideas, hip German beauty companies. German consumers also prefer unadorned, functional packaging, which has prompted companies to design droppers that are not only pleasing but also sustainable.

Droppers are perfect for medical-grade and dermatologist-recommended skin care because they allow consumers to precisely control the volume of product being applied. Demand is also being spurred on by the wellness space, as consumers increasingly look to gain health benefits from herbal extracts, liquid supplements, and essential oils. Mainstream brands such as Drunk Elephant, Kiehl's, and The Ordinary are adopting glass droppers for their high-concentration offerings. The trend is also seeping into hair care, scalp treatments, and anti-aging solutions.

The section contains information about the leading segments in the industry. In terms of material type, glass cosmetic bottle is being estimated to account for a share of 67% by 2025. By capacity type, up to 2 ml are projected to dominate by holding a share above 38.7% by the end 2025.

| Material Segment | Market Share (2025) |

|---|---|

| Glass Cosmetic Bottle | 67% |

Glass cosmetic droppers are arguably the most popular choice in the cosmetic packaging market, especially for luxury and high-end brands. They take a market-leading position since glass provides several advantages that are friendly to the luxury cosmetic demands of the brand as well as the purchase needs of quality packaging buyers.

Also, Glass is very attractive to high-end skincare products like serums, essential oils, and luxury beauty products. It gives a feel of quality, which is crucial for premium products sold at a premium price. It is hard and resistant material, meaning that it is not likely to be physically damaged while in handling and storing. It's also non-reactive, so that the product inside, particularly sensitive ones, are not destroyed and are safe for a long time. This makes glass ideal in keeping the purity of ingredients like oils or serums, which could react negatively to some materials.

| Capacity Segment | Market Share (2025) |

|---|---|

| Up to 2 ml | 38.7% |

The up to 2 ml capacity cosmetic dropper market is majorly used in the eye drops, oils, or serums. The small volume is best for products that need accuracy in dosing, with users receiving the correct amount of product without loss. Having a smaller size, the up to 2 ml dropper enables accurate dispensing. This is particularly important in high-concentration products, where only a few drops are sufficient to produce the desired effect, and thus best suited for such products as anti-aging creams or essential oils.

Moreover, Smaller packaging facilitates portability by the consumer, particularly when traveling. It enables customers to try a product before deciding on larger packs, thus maximizing repeat purchases. Small sizes would usually be in lower price brackets, promoting trials, as well as ensuring products with more fragile active ingredients. It keeps the efficacy of the product by reducing contact with air and light.

Key players of global cosmetic dropper industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies

Key Developments in Cosmetic Dropper Market

| Manufacturer | Vendor Insights |

|---|---|

| Virospack SL | Expert in creative and tailor-made droppers, with a variety of designs to suit different cosmetic packaging requirements. |

| LUMSON S.p.A | Offers premium primary packaging solutions, such as droppers that are both functional and beautiful. |

| Williamson Manufacturing | Supplies a range of precision dropper assemblies for the unique demands of the cosmetic market. |

| Remy & Geiser GmbH | Reputed for manufacturing dependable and effective dropper systems, emphasizing quality and user-friendliness. |

| Pacific Vial Manufacturing Inc. | Produces a large variety of glass vials and droppers with a focus on quality control and customization. |

Key Players in Cosmetic Dropper Market

The global cosmetic dropper industry is projected to witness CAGR of 3.8% between 2025 and 2035.

The global cosmetic dropper industry stood at 91.1 million in 2024.

Global cosmetic dropper industry is anticipated to reach USD 137.2 million by 2035 end.

East Asia is set to record a CAGR of 4.9% in assessment period.

The key players operating in the global cosmetic dropper industry include Virospack SL, AptarGroup, Inc., LUMSON S.p.A, Comar LLC.

In terms of material, the industry is divided into glass cosmetic dropper and plastic cosmetic dropper.

In terms of capacity, the industry is segregated into up to 2 ml, 3 ml-6 ml, 7 ml- 10 ml, and above 10 ml.

In terms of end use, the industry is segregated into hair care, skin care, makeup. Makeup further divided into lip care, eye care and others.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thermochromic Labels Market Insights - Innovations & Growth 2025 to 2035

Topical Drugs Packaging Market Growth & Forecast 2025 to 2035

Vinyl Extrusion Equipment Market Insights - Growth & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.