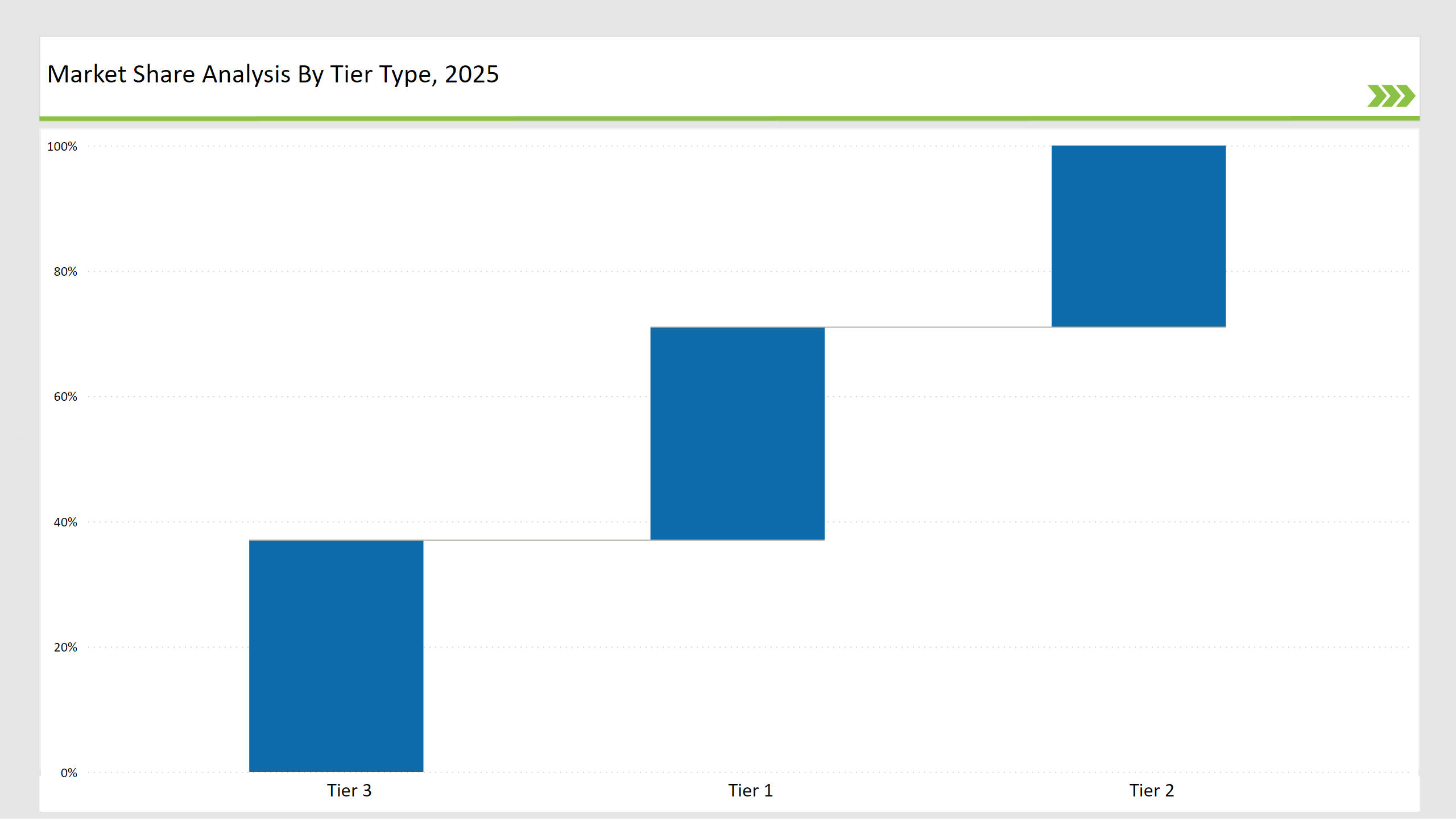

Highly segmented and competitive, the global Corrugated Octabins Market consists of players graded by tier-Tier 1, Tier 2, and Tier 3 classification based on market presence and strategies. Key players such as Smurfit Kappa, DS Smith, and Mondi Group, which occupy 60% of the market share, dominate as Tier 1 companies. These have been able to do so through the benefits of scale economies, top-notch R&D, and a robust global distribution network.

They are focused on sustainability initiatives and innovative packaging solutions catering to industrial bulk packaging, chemical, and agricultural sectors. Strategic partnerships, technological advancements, and eco-friendly designs help Tier 1 companies maintain an edge through premium pricing and strong demand.

Tier 2 players, such as International Paper and WestRock, represent approximately 25% of the global market share. They target regional markets and mid-sized industries, focusing on cost-effective and customizable bulk packaging solutions. By enhancing operational efficiency and offering specialized services, Tier 2 players have solidified their position in growing markets.

Tier 3 players, including smaller regional manufacturers, startups, and private labels, contribute approximately 15% to the global market share. These players cater to localized needs and specialize in custom-designed Octabins for niche applications, including hazardous material packaging and eco-friendly alternatives.

Despite limited resources, Tier 3 players’ agility allows them to address gaps in the market and compete effectively. Collectively, these three tiers drive a dynamic and evolving market landscape emphasizing bulk efficiency, sustainability, and innovation.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Smurfit Kappa, DS Smith, Mondi Group) | 14% |

| Rest of Top 5 (International Paper, WestRock) | 7% |

| Next 5 of Top 10 (Rengo Co. Ltd., Saica Group, Stora Enso, Europac, Tri-Wall) | 13% |

The market remains consolidated at the top, with Tier 1 players benefiting from global reach and Tier 3 players driving localized innovation and specialization.

Type of Player & Industry Share (%) 2025

| Player Tier | Industry Share (%) |

|---|---|

| Top 10 Players | 34% |

| Next 20 Players | 29% |

| Remaining Players | 37% |

The Corrugated Octabins Market is segmented based on its primary end-use industries, which include:

Vendors cater to diverse and evolving industry needs by offering a variety of innovative and customizable products:

Beyond these categories, vendors are integrating smart tracking technology and improved stacking features to optimize storage and reduce waste.

This section highlights key companies shaping the Corrugated Octabins Market in 2025, focusing on sustainability, innovation, and efficiency to maintain global leadership.

Year on Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Smurfit Kappa, DS Smith, Mondi Group |

| Tier 2 | International Paper, WestRock |

| Tier 3 | Rengo Co. Ltd., Saica Group, Tri-Wall, niche startups |

| Manufacturer | Latest Developments |

|---|---|

| Smurfit Kappa | In January 2024, launched high-strength recyclable Octabins. |

| DS Smith | In March 2024, introduced enhanced digital printing for bulk packaging. |

| Mondi Group | In February 2024, expanded fiber-based Octabin production. |

| International Paper | In June 2024, integrated smart tracking technology into Octabin designs. |

| WestRock | In April 2024, improved stackable and modular designs for space efficiency. |

| Rengo Co. Ltd. | In May 2024, introduced multi-layer Octabins for enhanced durability. |

| Saica Group | In July 2024, expanded production facilities to meet rising bulk packaging demand. |

| Tri-Wall | In September 2024, launched heavy-duty Octabins for industrial applications. |

The Corrugated Octabins Market will witness growth through automation, sustainability, and smart logistics integration. Demand for customized, reusable packaging will increase, while companies focus on cost optimization through AI-driven manufacturing.

As companies seek to improve packaging efficiency, lightweight but durable materials will gain traction. Smart Octabin designs with enhanced stacking and space utilization features are expected to become a standard in bulk packaging. Additionally, investments in eco-friendly adhesives and coatings will support industry-wide sustainability goals.

The growing shift toward biodegradable and fiber-based alternatives is projected to drive innovation across the market. With increasing regulatory policies on waste reduction, manufacturers will need to align their processes with global environmental standards.

Leading manufacturers include Smurfit Kappa, DS Smith, Mondi Group, International Paper, and WestRock.

The top 10 players collectively account for approximately 34% of the global market.

Market concentration in the Corrugated Octabins industry for 2025 is assessed by the dominance of Tier 1 players, who control 14% of the market.

Tier-3 companies, including startups and regional players, contribute 37% by offering localized and specialized solutions.

Innovations in the Corrugated Octabins industry revolve around advancements in sustainability, automation, and smart packaging technologies.

Explore Packaging Formats Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.