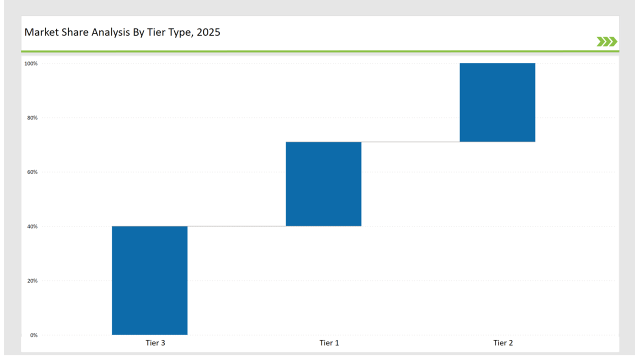

Highly segmented and competitive, the global Corrugated Box Printer Slotter Machine Market consists of players graded by tier-Tier 1, Tier 2, and Tier 3 classification based on market presence and strategies. Key players such as BOBST, Mitsubishi Heavy Industries, and Dongfang Precision Group, which occupy 60% of the market share, dominate as Tier 1 companies. These have been able to do so through the benefits of scale economies, top-notch R&D, and a robust global distribution network.

They are focused on sustainability initiatives and advanced automation technologies serving the packaging, e-commerce, and FMCG sectors. Strategic partnerships as well as new age practices help Tier 1 companies maintain an edge through premium pricing and strong demand.

Tier 2 players, such as Fosber Group and ISOWA Corporation, represent approximately 25% of the global market share. They target medium-sized enterprises and regional sectors, focusing on cost-effective and customizable packaging solutions. By enhancing operational efficiency and offering tailored products, Tier 2 players have carved out a strong position in emerging markets.

Tier 3 players, including smaller regional manufacturers, startups, and private labels, contribute approximately 15% to the global market share. These players cater to localized needs and specialize in niche markets. Many focus on flexographic and digital printing innovations, such as eco-friendly water-based inks, to attract cost-conscious and environmentally focused clients.

Despite limited resources, Tier 3 players’ agility allows them to address gaps in the market and compete effectively. Collectively, these three tiers drive a dynamic and evolving market landscape emphasizing automation, sustainability, and precision printing.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (BOBST, Mitsubishi Heavy Industries, Dongfang Precision Group) | 11% |

| Rest of Top 5 (Fosber Group, ISOWA Corporation) | 7% |

| Next 5 of Top 10 (EMBA Machinery, BW Papersystems, MarquipWardUnited, Heidelberger Druckmaschinen, Veit Group) | 13% |

The market remains consolidated at the top, with Tier 1 players benefiting from global reach and Tier 3 players driving localized innovation and specialization.

Type of Player & Industry Share (%) 2025

| Player Tier | Industry Share (%) |

|---|---|

| Top 10 Players | 31% |

| Next 20 Players | 29% |

| Remaining Players | 40% |

The Corrugated Box Printer Slotter Machine Market is segmented based on its primary end-use industries, which include:

Vendors cater to diverse and evolving industry needs by offering a variety of innovative and customizable products:

Under these categories, vendors are further integrating advanced technologies, such as AI-driven automation and real-time monitoring, towards enhanced operation efficiency and traceability

This section highlights key companies shaping the Corrugated Box Printer Slotter Machine Market in 2025, focusing on sustainability, innovation, and efficiency to maintain global leadership.

Year on Year Leaders

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | BOBST, Mitsubishi Heavy Industries, Dongfang Precision Group |

| Tier 2 | Fosber Group, ISOWA Corporation |

| Tier 3 | EMBA Machinery, BW Papersystems, MarquipWardUnited, Heidelberger Druckmaschinen, Veit Group |

| Manufacturer | Latest Developments (Month, Year) |

|---|---|

| BOBST | In January 2024, implemented AI-powered automation for efficiency tracking. |

| Mitsubishi Heavy Industries | In March 2024, expanded digital printing capabilities for e-commerce packaging. |

| Dongfang Precision Group | In February 2024, launched energy-efficient slotting machines for large-scale use. |

| Fosber Group | In June 2024, developed modular slotting systems for scalability. |

| ISOWA Corporation | In April 2024, introduced compact, high-speed slotter solutions for regional markets. |

| EMBA Machinery | In May 2024, focused on flexible digital printing innovations. |

| BW Papersystems | In July 2024, expanded product line with high-speed printing and slotting solutions. |

| MarquipWardUnited | In September 2024, invested in AI-driven defect detection for enhanced quality control. |

The Corrugated Box Printer Slotter Machine Market is set to grow through advancements in automation, AI-driven solutions, and sustainable practices. The companies are mainly concerned with reducing cost in production and implementing Predictive Maintenance System for a better operational flow.

Secondly, the market will also add IoT-enabled solutions to monitor the machines and products in real-time, resulting in minimum downtime. Industrial automation is on the rise in emerging economies, and the demand for customized packaging solutions fuels market growth.

Manufacturers are also under pressure due to sustainability concerns, adopting eco-friendly production methods and recyclable materials, thus gaining customer preference from an environmentally conscious consumer segment.

Leading manufacturers include BOBST, Mitsubishi Heavy Industries, Dongfang Precision Group, Fosber Group, and ISOWA Corporation.

The top 10 players collectively account for approximately 31% of the global market.

Market concentration in the Corrugated Box Printer Slotter Machine industry for 2025 is assessed by the dominance of Tier 1 players, who control 11% of the market.

Tier-3 companies, including startups and regional players, contribute 40% by offering localized and specialized solutions.

Automation, sustainability, and digital printing are the key drivers of innovation in the industry.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.