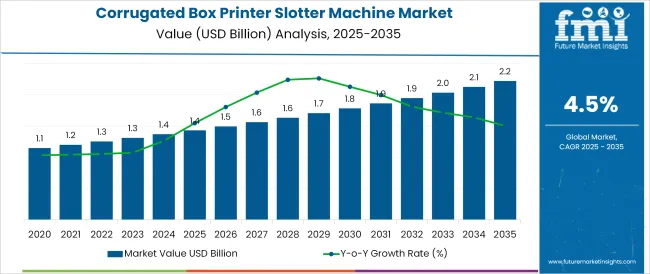

The Corrugated Box Printer Slotter Machine Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The corrugated box printer slotter machine market is experiencing notable growth, supported by rising global packaging demands, particularly in e-commerce, food, and retail distribution. As supply chains prioritize sustainability and cost-efficiency, corrugated boxes remain a preferred packaging material due to their recyclability and structural flexibility.

Advancements in high-speed printing and automated box slotting systems have enabled greater customization and throughput, reducing turnaround time while maintaining print quality and dimensional accuracy. Automation trends are transforming packaging operations, leading to increased investment in machinery that offers reduced waste, quick changeovers, and integration with digital printing workflows.

Regulatory and consumer pressure for sustainable packaging, coupled with the growth of regional distribution hubs, is prompting converters and packaging firms to adopt flexible, efficient slotter machines. Going forward, market expansion will be shaped by the rise of smart packaging lines, integration of robotics, and investments in energy-efficient manufacturing infrastructure.

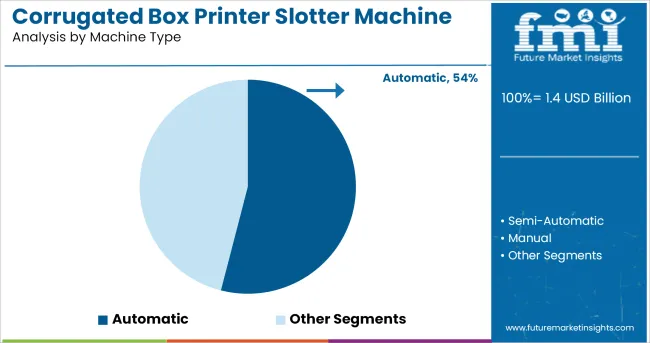

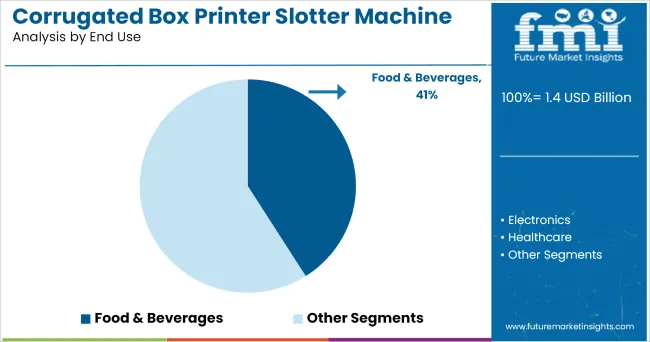

The market is segmented by Machine Type and End Use and region. By Machine Type, the market is divided into Automatic, Semi-Automatic, and Manual. In terms of End Use, the market is classified into Food & Beverages, Electronics, Healthcare, and Other End Use.

Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Automatic corrugated box printer slotter machines are projected to account for 54.0% of the total market revenue in 2025, establishing themselves as the dominant segment. Their leadership is being driven by increased demand for high-speed, error-free, and labor-efficient packaging operations. Automatic machines enable consistent quality through digital controls, auto-alignment features, and servo-driven systems that enhance precision in both printing and slotting.

Their ability to reduce manual interventions not only shortens production cycles but also minimizes setup time and material waste. These systems are well suited for high-volume manufacturing environments where consistency, uptime, and adaptability are critical. As businesses scale operations and prioritize smart factory models, automatic machines offer enhanced productivity and cost optimization through integrated data monitoring and predictive maintenance features.

Their compatibility with rapid box design changes, combined with improved ink management and die-cutting accuracy, continues to reinforce their widespread adoption across global packaging operations.

The food & beverages industry is expected to hold 41.0% of the total market revenue in 2025, emerging as the leading end-use segment. This dominance is being supported by the growing consumption of packaged food products, increased shelf-ready packaging demand, and stringent hygiene and labeling standards.

Corrugated boxes used in this industry must meet regulatory requirements while ensuring product safety during storage and transportation, prompting reliance on high-quality printing and slotting machines.

The segment benefits from the rapid turnover of SKUs and the need for vibrant branding, both of which require efficient printing solutions. Additionally, the ability to integrate flexographic printing with automated die-cutting enables faster response to changing packaging designs and seasonal campaigns.

With manufacturers focusing on recyclable and lightweight packaging formats, the use of corrugated box solutions is expected to continue rising, solidifying this segment's role as the primary driver of machine adoption within the market.

Modern-day consumers and manufacturers are demanding high-speed production, whether it may be of products or packaging solutions. The most trending demands of the market for fast-paced production offered in a single production line is now made possible with the usage of corrugated box printer and slotter machine.

Advanced machinery solutions and high-tech technology make it possible for corrugated box manufacturers to slot, glue and print the corrugated boxes in a single machine, which helps them to achieve large scale outputs with minimum human interference and reducing the possible defect in the corrugated boxes made out of it.

Overall, the corrugated box printer slotter machine is expected to register a healthy growth rate over the forecasted period due to its sharp rise in demand in all parts of the world.

The ever-growing demand for corrugated boxes all the world for several end-use applications such as food & beverages, pharmaceutical, e-commerce, household and many others. Demand for high-speed automated machinery solutions by large as well as medium-size manufacturers of corrugated boxes in developed as well as developing regions of the world.

Along with that sharp rise in demand for printed and customized corrugated boxes designed according to prevailing consumer trends, all these factors are increasing the sales of corrugated box printer and slotter machines and eventually results in the positive growth of the global corrugated box printer and slotter machine market.

The cost incurred in purchasing and setting up of corrugated box printer slotter machine unit is quite expensive as compared to other machinery solutions, also the automated machines require high maintenance costs and up keeping expenses. The power consumption of these latest machines is quite high as compared to different machines used for corrugated box making combined.

Also, these machines are only suited for large scale production makes it unaffordable for small scale manufacturers, despite the few hindrances the above mentioned are expected to limit the growth of the global corrugated box printer slotter machine market.

The choice of customized cutting and printing of corrugated boxes offered by corrugated box printer slotter machines enables market players to serve the end-use industries as per the latest trends and requirements.

The introduction of rotary die-cutting can allow them to produce corrugated boxes of irregular sizes and complex design with ease, also the increased production directly grows the profitability margin of key market players.

Along with that rising demand for these automated corrugated box printer slotter machines in developing countries of the world, provides several lucrative growth opportunities for the global corrugated box printer slotter machine market.

The fast-paced development of industrial infrastructure in the country along with the entry of newer market players in the production of the machinery industry, and high demand for corrugated boxes of different sizes and types.

Easy availability of raw materials used in manufacturing machinery solutions, along with that availability of skilled labour at a cheaper rate allows manufacturers in India and China to produce corrugated box printer slotter machines at the lowest prices. All these growth factors indicate healthy growth of the corrugated box printer slotter machine market in both above-mentioned countries.

The presence of global manufacturing giants holding a major market share of the corrugated box printer slotter machine market in the country, and demand for fully automated machinery solutions with customizations restricts the entry of small and medium-sized market players in the industry.

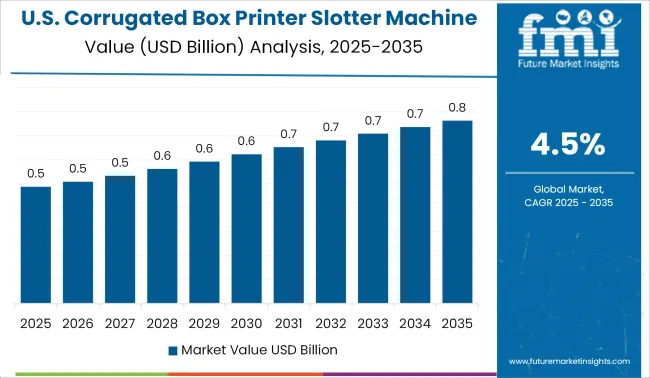

Successively growing demand for corrugated boxes by food & beverages is met by giant industry players, according to the latest industry standards. Moreover, the corrugated box machine market in the USA is mature but eventually expected to grow over the upcoming decade.

The global corrugated box printer slotter machine market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the corrugated box printer slotter machine market is projected to reach USD 2.2 billion by 2035.

The corrugated box printer slotter machine market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in corrugated box printer slotter machine market are automatic, semi-automatic and manual.

In terms of end use, food & beverages segment to command 41.0% share in the corrugated box printer slotter machine market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

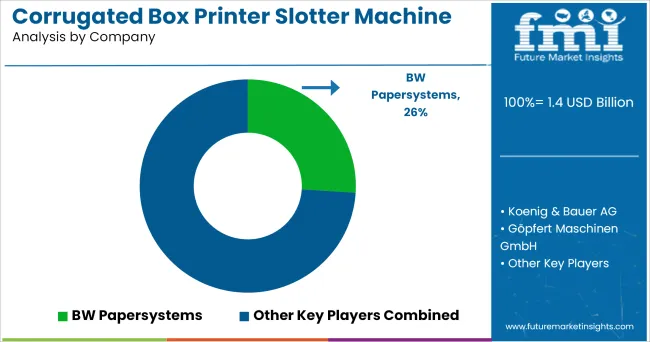

Competitive Breakdown of Corrugated Box Printer Slotter Machine Providers

Corrugated Box Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Making Machine Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Box Market Size, Share & Forecast 2025 to 2035

Breaking Down Market Share in the Corrugated Box Industry

Box Filling Machine Market from 2025 to 2035

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Corrugated Bin Boxes Market by Dividers, Totes, Jumbo, Kraft Open Top Forecast 2025 to 2035

Evaluating Corrugated Bin Boxes Market Share & Provider Insights

Corrugated Paper Machine Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Corrugated Paper Machine Market Share

Corrugated Handle Box Market

Smart Boxing Machine Market Size and Share Forecast Outlook 2025 to 2035

Non-Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Corrugated Plastic Box Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of the Corrugated Plastic Box Industry

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Insulated Corrugated Boxes Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Leading Insulated Corrugated Boxes Manufacturers

Precision Gearbox Machinery Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA