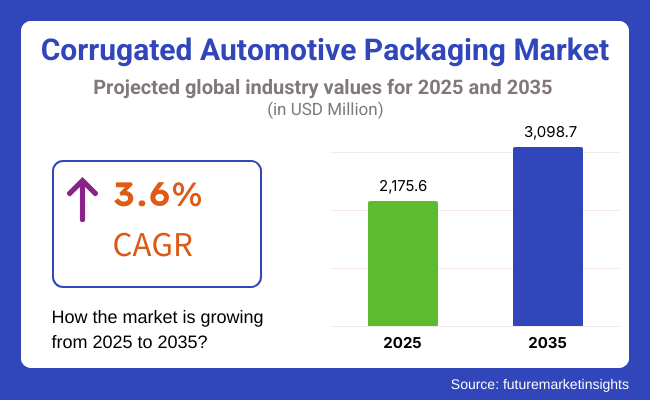

The market for corrugated automotive packaging is estimated to generate a market size of USD 2,175.6 million in 2025 and would increase to USD 3,098.7 million by 2035. It is expected to increase its sales at a CAGR of 3.6% over the forecast period 2025 to 2035. Revenue generated from corrugated automotive packaging in 2024 was USD 2,100 million.

The corrugated automotive packaging market would continue to be an essential part of the packaging industry. Packages used to transport parts such as bumpers, seats, and engine parts have grown substantially with the worldwide growth of automobiles.

Automakers today invest a great deal of money in packaging because it guards their products and is environmentally friendly. The automobile sector is striving to eliminate plastic with recyclable or biodegradable packaging in the wake of increasing consumer pressure for environmentally friendly packaging.

In the automotive part segment, filters are likely to account for over 27.8% of the market share over the forecast period. Automotive filters lead the way because of the heavy replacement rate and mass transport. Air, oil, and fuel system filters need protective packaging to preclude contamination and physical damage.

Corrugated packaging provides shock attenuation and protects product integrity in extended transit times. Furthermore, aftermarket demand for automotive filters is high, which contributes further to packaging demand. The manufacturers are increasingly employing tailored partitions inside corrugated boxes to provide extra filter protection, and hence it is the leading segment in the market.

The corrugated automotive packaging market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 998.7 million and will increase 1.5 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global corrugated automotive packaging market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 3.5% (2024 to 2034) |

| H2 | 3.7% (2024 to 2034) |

| H1 | 2.8% (2025 to 2035) |

| H2 | 4.4% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.5%, followed by a slightly higher growth rate of 3.7% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 2.8% in the first half and remain relatively moderate at 4.4% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed an increase of 70 BPS.

Increasing Application of Green Packaging in Automobile Supply Chains

Automobile producers globally are switching to greener and recyclable packaging in an effort to cut down their carbon footprint as dictated by stringent legislation from host countries. The traditional plastic and metal are therefore replacing low-weight, biodegradable, and cheaper corrugated cardboard packaging materials.

Toyota, Ford, and Volkswagen are presently greening packaging to achieve their carbon neutrality ambitions and waste generation reduction in their production and delivery operations. Along with this, all the governments around the globe are framing much stricter regulation on packaging wastes, hence driving companies to redirect towards reused and recyclable products.

Corrugated car packing provides tremendous strength, security, and shock absorbing for batteries, electronics, and auto components in a way to transport perfectly without wastage of materials. Consequently, aligning with the world's priorities of the world's automakers embracing green supply chain strategies, so the need for green customizable corrugated packaging solutions is increasing, realizing its increasingly enhanced role as part of a much-preferred option in the automotive logistics market.

Growth of the Electric Vehicle (EV) Market and Protective Packaging Demand

The rapid development of the electric vehicle (EV) industry has played a part in the worldwide trends in demand for packaging that is resistant to a great deal of abuse and is lightweight. These components are the light, delicate wiring systems that must be kept safe from damage during shipping and price-sensitive imports such as lithium-ion batteries and electronic control units.

Corrugated packaging owing to its multi-layer feature is gaining popularity for ensuring secure shipping of auto parts. Furthermore, EV makers are now being provided government peer assistance by the European, Chinese, and American Governments in order to stimulate EV production, which generates demand for automotive components and tailor-made packaging solutions as well.

Many EV-makers have come up with custom-designed specially corrugated boxes with anti-static finishes and reinforced inner ply to shield their high-value parts from moisture, impact, and static electricity. With this emerging global EV market, there are in fact rising trends among suppliers and manufacturers in adopting corrugated auto packaging to offer supply chain streamlining, weight reduction, and sustainability measures.

Limited Durability for Heavy-Duty Applications may Restrict the market

Corrugated car packaging is heavily employed to cushion auto parts in storage and shipping. Its biggest drawback, however, is that it will not survive heavy-duty application. Because corrugated packaging is made from paper-based fibers, these are strength and weight limited.

If applied to heavy auto items such as motors, transmissions, or heavy metal components, the packing will sag, cave in, or burst under pressure. This raises the chances of damage to the product, which incurs producers a higher cost of replacement and return. Additionally, repetitive stacking and handling during transport might lead to loss of stiffness of the corrugated structure, particularly when transported in damp or harsh environments.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability & Recyclable Materials | With an aggressive move towards green solutions, investing in 100% recyclable and biodegradable corrugated packaging will allow automotive brands to lower their ecological footprint. |

| Strength & Durability | Improving structural strength by multi-layered corrugated structures will provide protection for heavy and delicate automotive parts during transportation. |

| Lightweight & Affordable Solutions | Utilizing lightweight but strong corrugated materials will keep shipping costs down while still preserving protection, to the advantage of manufacturers and suppliers. |

| Customization & Branding | Providing bespoke packaging solutions with exact fitments, branding, and convenient designs to assemble will enhance efficiency and brand presence. |

| Automation & Supply Chain Optimization | Automating packaging manufacturing and intelligent tracking (RFID, QR codes) will automate logistics, eliminate waste, and enhance supply chain management. |

The global corrugated automotive packaging market achieved a CAGR of 3% in the historical period of 2020 to 2024. Overall, the corrugated automotive packaging market performed well since it grew positively and reached USD 2,100 million in 2024 from USD 1865.8 million in 2020.

The corrugated automotive packaging market grew steadily from 2020 to 2024, supported by rising demand for light-weight and cost-saving packaging, growth in automotive production and aftermarket sales, and the development of sustainable and recyclable packaging materials.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Market Growth | Moderate growth driven by increasing automotive production and global supply chain expansion. |

| Material Trends | Predominantly single-wall and double-wall corrugated board with foam inserts for protection. |

| Regulatory Environment | Adherence to automotive safety and packaging waste regulations. |

| Consumer Demand | High demand for protective and custom-fit corrugated packaging for delicate automobile parts. |

| Technological Innovation | Development of water-resistant and high-load-carrying corrugated packaging. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Strong growth fueled by rising demand for sustainable, lightweight, and cost-effective packaging in electric vehicle (EV) and automotive components logistics. |

| Material Trends | Shift towards high-strength, recyclable, and biodegradable corrugated materials with enhanced durability. |

| Regulatory Environment | More stringent environmental regulations encouraging environmentally friendly, recyclable, and reusable packaging options. |

| Consumer Demand | Rising use of returnable, reusable, and environmentally friendly corrugated packaging across the automotive supply chains. |

| Technological Innovation | Smart packaging innovations with RFID tracing, IoT-based monitoring, and automation for logistics optimization. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Cost & Pricing |

|

| Performance (Durability, Strength, Protection) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Reusability & Circular Economy |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Cost & Pricing |

|

| Performance (Durability, Strength, Protection) |

|

| Aesthetics & Branding |

|

| Product Availability & Convenience |

|

| Reusability & Circular Economy |

|

During 2025 to 2035, the demand for corrugated auto packaging is likely to increase with increasing use in shipping electric vehicle (EV) components, rising usage of environmentally friendly and biodegradable packaging, and growing innovation in customized and impact-resistant corrugated packaging for improved part protection and logistics optimization.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include International Paper Company, WestRock Company, Greif Inc., DS Smith Plc.

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Smurfit Kappa Group Plc, Nefab Group, Elsons International, Orcon Industries, Sonoco Products Company, Mondi Group Plc, Sealed Air Corporation

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| North America | Rising preference for returnable and reusable corrugated solutions. |

| Latin America | Demand driven by aftermarket parts and auto component exports. |

| Europe | High demand from luxury and electric vehicle manufacturers. |

| Middle East & Africa | Demand driven by import and re-export of auto parts through free trade zones. |

| Asia Pacific | Fastest-growing market due to high automotive production in China, Japan, and India. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| North America | Expansion of automation in packaging for efficiency and cost reduction. |

| Latin America | Wider adoption of biodegradable corrugated materials. |

| Europe | Adoption of modular and custom-fit packaging for precision components. |

| Middle East & Africa | Expansion of manufacturing capacity to support local automotive industries. |

| Asia Pacific | Increased investment in lightweight, durable, and eco-friendly packaging solutions. |

The section below covers the future forecast for the corrugated automotive packaging market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 2.5% through 2035. In Europe, Spain is projected to witness a CAGR of 3.2% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 2.5% |

| Germany | 2.1% |

| China | 4.5% |

| UK | 2.0% |

| Spain | 3.2% |

| India | 4.7% |

| Canada | 2.3% |

Germany, where top car manufacturers such as Volkswagen, BMW, and Mercedes-Benz are based, is seeing its production of electric vehicles (EVs) grow very fast. With the German government encouraging green and carbon-neutral supply chains, automakers are turning raw materials more and more to corrugated packaging to transport batteries, electronics, and light automotive components EV manufacturers require light yet strong packaging to protect sensitive components while maintaining minimal shipping weights.

Additionally, Germany's strict recycling policy and green initiatives such as the Packaging Act are encouraging businesses to replace plastic-packaging with fully recyclable corrugated cardboard. Many businesses are investing in custom, multi-layer corrugated packages with inner inserts to make packages stronger and safer for what they hold. As Germany moves towards a more sustainable automobile supply chain, the demand for corrugated packing solutions will probably rise exponentially in the automotive logistics sector.

The USA auto sector opts for light-weight, environmentally friendly packaging, which is cost-saving in shipping and minimizes the carbon footprint. The trend has been followed by top automobile manufacturers, such as Ford, General Motors, and Tesla, that have made green logistics a priority by substituting conventional packaging with biodegradable, recyclable, light-weight corrugated cardboard alternatives instead of plastic and metal for parts constraints.

Corrugated packaging generates freight savings via lower total vehicle part shipping weight, which in turn translates into less fuel consumption in supply chains. The United States Environmental Protection Agency (EPA) and other regulatory authorities are promoting more environmentally friendly packaging for carbon neutrality embracing.

Hence, there is an increasing demand for tough, personalized, and protective corrugated car packaging since the automobile manufacturers are forced to cut their carbon footprint, and this has made it the most desired mode of shipping and storing car components, batteries, and other accessories throughout the USA.

The section contains information about the leading segments in the industry. In terms of product type, boxes are being estimated to account for a share of 38.4% by 2025. By layer type, single wall is projected to dominate by holding a share above 42% by the end 2025.

| Product Type | Market Share (2025) |

|---|---|

| Boxes | 38.4% |

Corrugated boxes are the beneficial method of car packaging for transportation because they are strong, sturdy, and environmentally friendly. Corrugated boxes serve to prevent damage in motor components, batteries, and electrical devices when in transportation and storage by providing extra structural support.

They reduce expenditures and enable the products to be moved around cheaply and safely without damage because they are slim but extremely sturdy. The need to manufacture green and safe packaging due to the rise in EV usage sparked the corrugated box market. They tend to have specially created partitions and inserts to provide room for the fragile car parts.

| Layer Segment | Market Share (2025) |

|---|---|

| Single Wall | 42% |

Single-wall packaging is protective, light in weight, and economical, all of which make it widely used in the market. It is used on smaller vehicle parts, including electrical components, light parts, or filters, where more protection is not utilized.

Another reason making the automobile industry opt for mass packaging is that the product is economical and versatile. The second reason that hastened the need for single-wall corrugated packaging may be linked to growing e-commerce trends for the distribution of auto-car spare parts.

Key players of global corrugated automotive packaging industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies

Key Developments in Corrugated Automotive Packaging Market

| Manufacturer | Vendor Insights |

|---|---|

| International Paper Company | A world leader in fiber-based packaging solutions, supplying rugged and recyclable corrugated packaging to the automotive market. |

| Smurfit Kappa | Provides eco-friendly corrugated packaging solutions that target the lowering of environmental footprints and supply chain optimization. |

| WestRock | Company Excels in high-performance corrugated packaging for automotive parts, providing strength and protection. |

| Mondi Group | Offers innovative, sustainable corrugated packaging solutions specific to automotive components and supply chain optimization. |

| DS Smith Plc | Large provider of environmentally sustainable corrugated packaging, focusing on lightweight, protective, and tailored solutions. |

The global corrugated automotive packaging industry is projected to witness CAGR of 3.6% between 2025 and 2035.

The global corrugated automotive packaging industry stood at 2,100 million in 2024.

Global corrugated automotive packaging industry is anticipated to reach USD 3,098.7 million by 2035 end.

East Asia is set to record a CAGR of 4.7% in assessment period.

The key players operating in the global corrugated automotive packaging industry include DS International Paper Company, WestRock Company, Greif Inc., DS Smith Plc.

The corrugated automotive packaging market is categorized based on product type into boxes, crates, trays, partitions, pallets, octabins, and PoP displays.

The market is segmented by layer type into single face, single wall, double wall, and triple wall.

The market includes different automotive parts such as automotive filters, batteries, engine components, lighting components, underbody components, electrical components, and cooling systems.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

Nitrogen Flushing Machine Market Report – Trends, Size & Forecast 2025-2035

Pan Liner Market Insights – Demand, Growth & Industry Trends 2025-2035

Perfume Filling Machine Market Report – Trends, Demand & Industry Forecast 2025-2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.