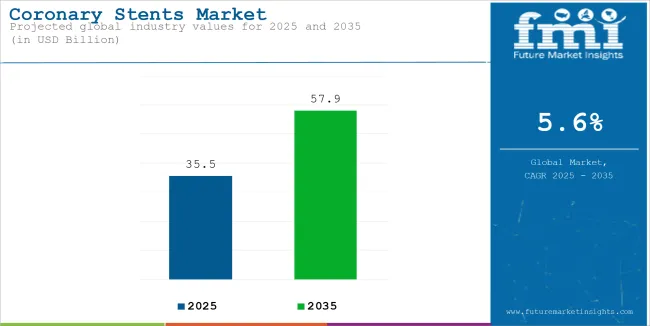

The global coronary stents market was estimated to account for USD 35.5 billion in 2025. It is anticipated to grow at a CAGR of 5.6% during the assessment period and reach a value of USD 57.9 billion by 2035.

| Attributes | Description |

|---|---|

| Estimated Global Coronary Stents Market Size (2025E) | USD 35.5 billion |

| Projected Global Coronary Stents Market Value (2035F) | USD 57.9 billion |

| Value-based CAGR (2025 to 2035) | 5.6% |

The coronary stents market involves the development, manufacturing, distribution, and sale of stents, which are small mesh tubes inserted into coronary arteries to maintain blood flow, typically following angioplasty. These stents are used to treat coronary artery disease (CAD), where arteries become narrowed or blocked by plaque buildup.

Cardiovascular implants, notably drug-eluting stents (DES), are the primary devices for the treatment of blocked arteries that improve blood flow. The increasing incidence of cardiovascular diseases, rise in technological development, and the growing number of elderly people in the society are the major driving forces for the expansion of the coronary stents market including the increase in the admissions of patients in treatment centers in developing countries.

It is anticipated to grow with the help of innovations in stent technology such as biodegradable and drug-eluting stents. The stent market is segmented based on stent type, material, and region.

CVD Cases by Country

| Country | Total CVD Cases (millions) (2023) |

|---|---|

| China | 101 |

| India | 74.2 |

| Russia | 18.7 |

| United States | 16.9 |

| Indonesia | 18.7 |

| Brazil | 8.9 |

| Pakistan | 9.9 |

| Nigeria | 5.7 |

| Bangladesh | 8.7 |

| Japan | 5.6 |

Healthcare Expenditure as a Percentage of GDP (2022)

| Country | 2022 |

|---|---|

| India | 3.0% |

| China | 5.6% |

| Brazil | 10.3% |

| South Africa | 8.6% |

| Indonesia | 3.4% |

Based on this information, Brazil exhibited the highest growth in terms of percentage, while India, China, South Africa, and Indonesia reported steady or modest rises in 2022.

| Attributes | Details |

|---|---|

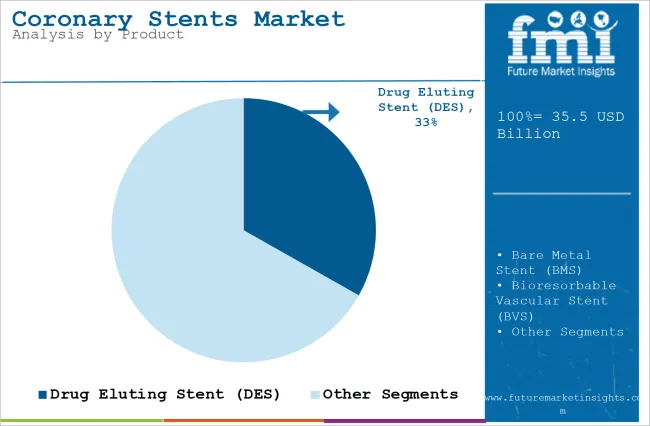

| Top Source Type | Drug-Eluting Stents (DES) |

| Market Share in 2025 | 33.2% |

Drug-eluting stents (DES) is expected to account for a leading coronary stent market share of 33.2% in 2025. The Drug Eluting Stent has the capability to prevent the risks of restenosis (the process of the arteries getting smaller again), which is known to be caused by scar tissue, and it does this by means of drugs that prevent the production of the scar tissue. The rise in coronary artery disease, which is a common health problem, has resulted in a demand for the newest stent technologies like DES. These particular types of stents perform better in challenging cases of surgery.

| Attributes | Details |

|---|---|

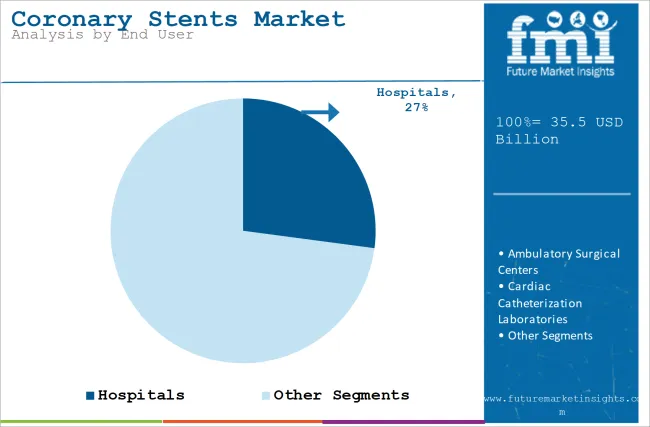

| Top Source Type | Hospitals |

| Market Share in 2025 | 27.1% |

Hospitals are poised to occupy 27.1% of the coronary stents market in 2025 due to the advanced clinical facilities. Hospitals, particularly the larger medical center types, are outfitted with the newest equipment and have specialized cardiology departments, therefore, they are the best choice for complex heart procedures.

On the other hand, the adoption of new technologies by manufacturing for stent models ensures the production of higher quality products while minimizing environmental impact, waste generation, energy consumption, and other costs. Hospitals primarily offer after-procedure care like dosage control, angiogram as a follow-up treatment, and lifestyle changes advice which together, help in the recovery of patients and also promote the stay of the stents in the bodies of the patients, especially in the healthcare systems that are good.

High Prevalence of Cardiovascular Diseases Pushes the Demand for Minimally Invasive Procedures

Cardiovascular diseases (CVDs) have become more common worldwide, and the need for coronary stents has grown exponentially, throughout the years of the pandemic. The predominant risk factors are poor diet, smoking, sedentary lifestyle, and stress. According to World Health Organization (WHO) CVDs are primarily responsible for premature deaths among the population with about 18 million fatalities every year.

The coronary stent sector is seeing technological progress with items like drug-eluting stents (DES) which are capable of discharging medicine meant to obstruct restenosis, biodegradable stents that erode after a certain period of time, and state-of-the-art imaging equipment like OCT (optical coherence tomography) which comes in handy for proper stent placement.

Technological Advancements in Stent Design Improves Patient Outcomes

Technological advancements in stent design are significantly improving patient outcomes. Drug-eluting stents (DES) release medication that prevents tissue overgrowth, reducing restenosis rates compared to traditional bare-metal stents. Bioabsorbable stents, which dissolve over time, offer the advantage of eliminating long-term complications.

Additionally, advanced coatings have improved biocompatibility and minimizes the risks of stent thrombosis. Healthcare providers have turned to coronary stents due to different innovations in the sector such as Drug Eluting Stents, Biodegradable Stents and Bioresorbable Vascular scaffolds which give higher effectivity and safety.

| Aspect | Details |

|---|---|

| Complex Regulations | Coronary stents are objects that are directly placed inside the human body. They are strictly bound to the safety and efficacy standards. From a regulatory aspect organizations such as FDA (USA), EMA (Europe), and CDSCO (India), underlines extensive clinical trials and tight testing to be conducted prior any approval. A manufacturer undergoing the approval period often faces a complex procedure that might negatively impact their market entry. |

| Cost of Compliance | Significant expenditure is involved in compliance with regulatory standards that often impacts the overall operations. It is imperative that production enterprises incur cost investments for research, clinical trials, and meet sustainability standards. The aforementioned factors may be the rationale for the high overall product price and postponement of the product launch. |

| Regional Variations | The cross-market strategies of companies are hampered by regional variances in disease prevalence, health care systems and economic factors thus rendering it harder for companies to implement the same strategies across the board. They have to tailor their products, pricing, and regulations to the requirements of every market. |

| Impact | The strict regulatory framework can slow innovation and limit the availability of new products. For smaller manufacturers, the barriers to entry can restrict competition, ultimately affecting the variety of treatment options available to patients. |

| Aspect | Details |

|---|---|

| Pricing Challenges | The pricing of state-of-the-art coronary stents, especially drug-eluting and bioabsorbable is on the higher side as they involve advanced technology and materials. These elevated prices make the products unaffordable thus, stents are inaccessible to many parts of the population, particularly in underdeveloped countries and even some middle-income countries. The costs involved can influence patient decision to choose stent therapies. |

| Reimbursement Limitations | Reimbursement restrictions manifested in the coronary stents market due to the existence of different healthcare policies in different areas, which frequently set restrictions on the use of high-cost stents like drug-eluting and biodegradable ones. These limitations cause patients to be dependent on cheaper bare-metal stents thus, affecting the market growth for CRT and innovative technologies. |

| Health Disparities | Rural or underserved spaces often lack access to high-end cardiac care including stent implantation. The deficit of adequate resources and capital is the main reason for the increased obstructions in healthcare in these areas. Hence, the population from such areas lack access to life-saving techniques leading to fatality from cardiovascular diseases. |

| Impact | The capacity of advanced cardiac care like stenting is very low in rural and underserved parts.. The absence of necessary facilities and qualified personnel in these parts is the major reason why healthcare disparities are so acute.. |

The increasing acceptance of bioabsorbable stents (also referred to as bioresorbable vascular scaffolds or BVS) is a notable trend. These state-of-the-art stents outperform conventional permanent stents in terms of dissolving cells over time, which results in no permanent implant in the body.

| Countries | CAGR |

|---|---|

| The USA | 1.5% |

| Canada | 2.7% |

| Germany | 1.6% |

| France | 2.4% |

| Italy | 2.9% |

| UK | 1.9% |

The USA dominates the coronary stents market with a sizeable share of global sales. Factors such as availability of an advanced medical care system and the high prevalence of cardiovascular diseases (CVDs) in the population. The popularity of drug-eluting and bioabsorbable stents is leading to high demand.

Abbott Laboratories and Boston Scientific are significantly invest in innovations in the field of high-technology drug-eluting stents, bioresorbable stents, and next-gen imaging devices, particularly. Abbott's Xience drug-eluting stent and Boston Scientific's Synergy stent are both, demonstrating the development methods for the leading-edge innovation of coronary stents.

Researchers and manufacturers are focusing on combining imaging, stent technology, and personalized medicine to improve outcomes. This includes developing advanced imaging tools for better stent placement and creating stents tailored to individual patient needs.

Europe is the fast-growing market thanks to its advanced healthcare system and a high rate of lifestyle-related health issues, Germany is leading the European coronary stents market. The government and the private companies are dedicated to improving medical devices through innovation by provide funding, resources, and incentives to support the development of new technologies in healthcare. Angioplasty and stent procedures are widely accessible through health insurance.

The coronary stent market has made impressive strides of progress throughout the past years in factors such as new product launches, market entrants, and the changing regulatory landscape.

Elunir-Perl Drug-Eluting Stent by Medinol

Elunir-Perl was FDA approved in October 2023 and is a new stent for coronary artery disease that is designed to provide patients with a safe and effective treatment.

Xience Sierra by Abbott Laboratories

Xience Sierra was FDA approved in 2018 and is a drug-eluting stent which features a lower profile and better flexibility and is produced in small diameters and longer lengths. It's meant to assist complex percutaneous coronary interventions (PCI), thus aiding in a better patient outcome.

Resolute Onyx 2.0mm by Medtronic

Resolute Onyx 2.0mm was FDA approved in 2018. It is a tiny drug-eluting stent that is made for patients with small coronary arteries thus making it more effective in treating the problems of patients with complicated anatomy.

Emerging startups are driving the advancement of bioresorbable stent technology; they are now targeting next-generation solutions, which are the ones that naturally dissolve in the body; this way, there is no need for permanent implants. These stents are a safe alternative to metal stents as they prevent complications like late stent thrombosis and are actually safer than traditional metal stents. A few notable companies in the field include:

Drug Eluting Stents (DES), Bare Metal Stents (BMS), Bioabsorbable Stents, Self-expanding Stents, Balloon-expandable Stents, etc.

Hospitals, Cardiac Centers, Ambulatory Surgical Centers, and Other Healthcare Settings.

Cobalt-Chromium, Stainless Steel, Platinum-Chromium, Nickel-Titanium, Polymer

North America, Latin America, Western Europe, South Asia and Pacific, East Asia, Middle East and Africa.

The coronary stents market is expected to grow at a rate of 5.6% per year from 2025 to 2035.

Asia-Pacific is fast-growing with China and India dominating the coronary stents markets.

Drug-eluting stents (DES) are the most popular and hold 33.2% of the market share.

Hospitals use the most coronary stents because they perform the highest number of heart procedures and have advanced medical equipment.

Challenges include the high cost of stents, lengthy approval processes, and limited access to healthcare.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Coronary Artery Bypass Grafts Market Size and Share Forecast Outlook 2025 to 2035

Coronary Intravascular Lithotripsy Market Size and Share Forecast Outlook 2025 to 2035

Coronary Guidewires Market

Bioresorbable Coronary Scaffolds Market

Industrial Analysis of Coronary Stent in India Size and Share Forecast Outlook 2025 to 2035

Venous Stents Market Size and Share Forecast Outlook 2025 to 2035

Enteral Stents Market

Nephrology Stents and Catheters Market

Non-Vascular Stents Market Growth - Trends & Forecast 2025 to 2035

Bioabsorbable Stents Market Growth – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA