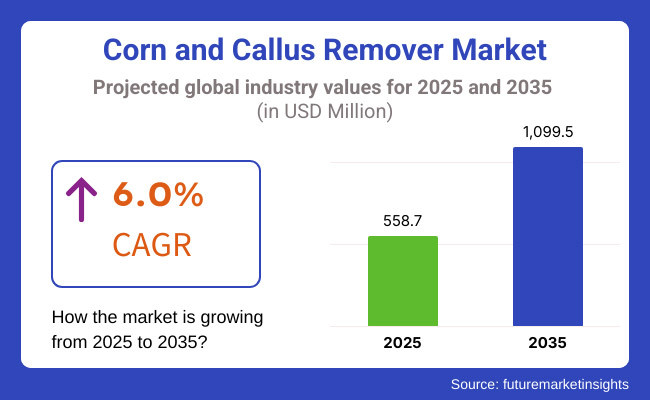

The global corn and callus remover market is expected to witness steady growth in the coming years. In 2025, the market is estimated to reach USD 558.7 million, driven by increasing awareness of foot care and personal grooming.

By 2035, the market is projected to surpass USD 1,099.5 million, growing at a CAGR of 6.0%. The rising demand for effective solutions to treat foot corns and calluses, coupled with advancements in dermatological treatments, is fueling this expansion. Consumers are increasingly opting for medicated pads, electronic removers, and natural treatments, contributing to the growing adoption of these products worldwide.

The market’s growth is further supported by the increasing prevalence of foot-related issues caused by prolonged standing, improper footwear, and diabetes-related complications. The availability of advanced and easy-to-use solutions is encouraging consumer adoption across various demographics. Additionally, e-commerce platforms and pharmacy chains are boosting market accessibility, making these products more convenient for customers.

Companies are investing in product innovation, sustainable packaging, and organic ingredients, aligning with consumer preferences for safe and eco-friendly options. With a strong market trajectory, the industry is set to witness significant developments in the coming years.

Explore FMI!

Book a free demo

Between 2020 and 2024, the corn and callus remover market grew steadily as awareness of foot health increased, foot-related ailments became more prevalent, and treatment options advanced. The market expanded from USD 527.1 million in 2024 to an estimated USD 1,035.4 million by 2034, maintaining a 6.0% CAGR during this period.

Educational initiatives and public health campaigns drove demand for removal products and services. Innovations in treatment procedures made solutions safer, more effective, and cost-efficient. Additionally, the aging population contributed significantly to market growth, as elderly individuals required specialized foot care solutions to manage corn and calluses.

Between 2025 and 2035, the market is set to continue its upward trend, reaching USD 1,099.5 million by 2035 while maintaining a 6.0% CAGR. The demand for home-based solutions is expected to rise, as consumers seek convenient and cost-effective self-care options.

Smart technologies will enhance foot care devices, improving treatment efficiency and user experience. Sustainability will also shape industry trends, with manufacturers adopting eco-friendly materials and packaging. As consumer expectations shift, companies will need to prioritize innovation, personalization, and environmental responsibility to remain competitive in this expanding market.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Focus on product safety and efficacy, with regulations ensuring accurate labeling and claims. |

| Technological Advancements | Growth in user-friendly and cost-effective treatment procedures and medications. |

| Consumer Demand | Increased awareness of foot health, leading to higher demand for professional removal services and OTC products. |

| Market Growth Drivers | Rising prevalence of foot-related ailments, particularly among the elderly, and increased use of footwear necessitating regular foot care. |

| Sustainability | Initial steps toward eco-friendly packaging and natural ingredient sourcing. |

| Supply Chain Dynamics | Reliance on traditional distribution channels, with growth in e-commerce platforms enhancing product accessibility. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter regulations on home-use devices and smart technologies to ensure user safety and data privacy. |

| Technological Advancements | Development of smart corn and callus removal tools with real-time treatment tracking. |

| Consumer Demand | Growing preference for convenient, effective, and safe home-based solutions with smart technology integration. |

| Market Growth Drivers | Expansion into emerging markets, continuous product innovation, and the incorporation of advanced technologies. |

| Sustainability | Comprehensive adoption of biodegradable materials, recyclable components, and carbon-neutral manufacturing. |

| Supply Chain Dynamics | Enhanced supply chain transparency, ethical sourcing, and AI-driven inventory management. |

| Challenges | Opportunities |

|---|---|

| Potential skin irritation and allergic reactions from chemical-based removers. | Growing consumer preference for natural and organic foot care products. |

| Limited awareness in certain regions. | Development of innovative formulations with enhanced skin compatibility. |

| High competition from alternative foot care solutions like professional pedicures and home remedies. | Expansion of e-commerce channels for direct product distribution. |

| Compliance with varying safety regulations and ingredient restrictions across regions. | Rising popularity of foot care devices, such as rechargeable callus removers. |

| The presence of counterfeit and low-quality products is undermining consumer trust. | Collaborations between podiatrists and skincare brands for dermatologically tested solutions. |

| High consumer sensitivity toward product efficacy and safety. | Growth of subscription-based foot care services and auto-refill programs. |

| Fluctuating raw material costs and supply chain disruptions affect pricing strategies. | AI-powered skincare analysis tools enabling personalized product recommendations. |

The North American market is expected to dominate due to high consumer awareness regarding foot health, strong demand for OTC foot care products, and widespread availability of advanced callus removal solutions. The presence of leading dermatological and pharmaceutical companies, coupled with increasing disposable income, is fuelling market growth. Additionally, the rising adoption of natural and chemical-free corn and callus removers is shaping consumer preferences.

The expansion of online pharmacies and direct-to-consumer (DTC) sales channels is making foot care products more accessible, particularly in the USA and Canada. The increasing demand for professional pedicure services and dermatology clinics offering advanced foot treatments is further contributing to market expansion. Additionally, the rise in foot-related complications due to lifestyle factors such as prolonged standing, improper footwear, and obesity is increasing the need for effective at-home foot care solutions.

Europe represents a mature market with strong regulatory oversight ensuring product safety and efficacy. Countries such as Germany, France, and the UK are seeing increasing adoption of foot care treatments, particularly among the elderly population. The rising trend of medical pedicures and professional foot care services is contributing to market growth.

Additionally, European consumers are prioritizing sustainability, driving demand for eco-friendly and biodegradable foot care products. Retail pharmacies, specialty foot care clinics, and e-commerce platforms are key distribution channels supporting product penetration.

Increased emphasis on dermatological research and collaborations between skincare brands and podiatrists are fostering the development of innovative, clinically tested foot care solutions. Furthermore, government-backed initiatives promoting foot health awareness and preventive care programs for diabetic patients are influencing consumer behaviour and driving product sales.

The Asia-Pacific region is anticipated to witness the highest growth due to increasing disposable incomes, rising foot health awareness, and expanding retail access to dermatological products. Markets such as China, India, and Japan are seeing a surge in demand for herbal and non-invasive callus removers, reflecting consumer preference for traditional remedies.

The growing popularity of at-home foot care routines and the expansion of online beauty and wellness platforms are further accelerating market penetration. Manufacturers in the region are developing cost-effective, multifunctional foot care solutions to cater to a broad consumer base.

The increasing presence of global skincare and personal care brands in the region, coupled with local brands introducing innovative herbal-based formulations, is expanding market competition. Additionally, advancements in digital marketing and influencer-driven promotions are playing a crucial role in educating consumers and driving sales.

The corn and callus remover market includes medications and devices, both driving significant growth. Salicylic acid-based treatments remain dominant due to their keratolytic properties, breaking down thickened skin effectively. Available as liquids, gels, pads, and plasters, they offer easy at-home treatment, with North America and Europe leading in sales.

Meanwhile, electric callus removers are gaining traction for their quick, effective exfoliation using rotating rollers and rechargeable batteries. The rising demand for foot care and personal grooming fuels this segment. Future trends include AI-powered skin analysis, smart foot care devices, biodegradable medicated patches, and antimicrobial roller heads, enhancing user experience and hygiene.

The corn and callus remover market is expanding through pharmacies, drug stores, and online platforms. Pharmacies and drug stores remain the primary sales channels, offering trusted, dermatologist-recommended treatments with strong OTC availability in North America and Europe. Meanwhile, the online segment is rapidly growing due to e-commerce convenience, exclusive discounts, and direct-to-consumer brands.

Asia-Pacific is witnessing rising sales through platforms like Amazon, Alibaba, and Flipkart. Future trends include AI-powered virtual consultations, telehealth-integrated pharmacy services, subscription-based foot care solutions, and smart packaging with QR codes, enhancing consumer accessibility, engagement, and treatment guidance.

The corn and callus remover market in the United States is experiencing steady growth, driven by increasing awareness of foot health and the availability of over-the-counter treatments. In 2025, the market is projected to reach approximately USD 527.1 million, with expectations to grow at a compound annual growth rate (CAGR) of 6.0% through 2035.

Factors contributing to this growth include the rising prevalence of foot-related ailments, an aging population, and the development of innovative, user-friendly, and cost-effective treatment solutions. Additionally, the trend towards self-care and home-based treatments has bolstered the demand for corn and callus removal products.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Million) | 558.7 |

| CAGR (2025 to 2035) | 6.0% |

| Year | 2035 |

|---|---|

| Market Size (USD Million) | 1,099.5 |

| CAGR (2025 to 2035) | 6.0% |

Germany's corn and callus remover market is poised for growth, supported by a well-established healthcare system and a significant aging population. The market is expected to expand at a CAGR of 5.2% from 2025 to 2035. Factors such as increasing awareness of foot health, the prevalence of foot-related ailments, and the availability of advanced treatment products contribute to this positive outlook. Moreover, collaborations between public and private sectors enhance the efficiency and reach of foot care services.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Million) | 310.5 |

| CAGR (2025 to 2035) | 5.2% |

| Year | 2035 |

|---|---|

| Market Size (USD Million) | 518.2 |

| CAGR (2025 to 2035) | 5.2% |

China's corn and callus remover market is undergoing significant expansion, driven by government investments in healthcare infrastructure and initiatives to improve foot health awareness. The market is projected to grow at a CAGR of 7.1% through 2035.

Factors such as the increasing prevalence of foot-related issues, a growing middle-class population, and the development of advanced foot care facilities contribute to this growth. Additionally, the integration of modern technologies and training programs enhances the effectiveness of foot care services.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Million) | 420.8 |

| CAGR (2025 to 2035) | 7.1% |

| Year | 2035 |

|---|---|

| Market Size (USD Million) | 835.6 |

| CAGR (2025 to 2035) | 7.1% |

India's corn and callus remover market is experiencing growth, influenced by efforts to improve healthcare accessibility and foot health awareness. The market is expected to align with a CAGR of 6.0% from 2025 to 2035. Challenges such as a high incidence of foot-related issues and disparities in healthcare access are being addressed through strategic investments and policy reforms.

The adoption of mobile health technologies and community-based training programs further enhances the reach and efficiency of foot care services in the country.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Million) | 275.8 |

| CAGR (2025 to 2035) | 6.0% |

| Year | 2035 |

|---|---|

| Market Size (USD Million) | 494.8 |

| CAGR (2025 to 2035) | 6.0% |

Brazil's corn and callus remover market is expanding due to increasing awareness of foot health, a rising middle-class population, and the influence of personal hygiene trends. The country’s tropical climate and widespread use of open footwear contribute to higher instances of foot-related issues, driving demand for corn and callus removers.

Additionally, the growing availability of over the counter (OTC) solutions, along with an expanding pharmacy and e-commerce network, is improving product accessibility. The market is expected to grow at a CAGR of 5.5% from 2025 to 2035.

Market Forecast

| Year | 2025 |

|---|---|

| Market Size (USD Million) | 290.3 |

| CAGR (2025 to 2035) | 5.5% |

| Year | 2035 |

|---|---|

| Market Size (USD Million) | 495.7 |

| CAGR (2025 to 2035) | 5.5% |

Advancements in Non-Invasive Foot Care Solutions

The introduction of gentle exfoliating foot masks, laser-based corn removal treatments, and moisture-rich callus softening creams is improving consumer options for pain-free foot care. The integration of clinically proven ingredients such as urea, lactic acid, and essential oils in foot care products is enhancing treatment effectiveness.

Growth in Professional and At-Home Foot Care Products: The increasing availability of dual-purpose foot care tools, including electric callus removers with antimicrobial properties, is addressing consumer demand for effective, salon-quality treatments at home. Subscription-based models offering foot care kits with step-by-step usage guides are gaining popularity among consumers seeking convenience.

Regulatory and Policy Developments

Stricter safety regulations by governing bodies such as the FDA and EMA are ensuring higher standards for medicated foot care products, leading to improved consumer confidence and product transparency. Compliance with sustainability initiatives and eco-friendly packaging regulations is further influencing product innovation and brand positioning.

Rise of Sustainable and Natural Foot Care Solutions: Increasing consumer demand for chemical-free, plant-based formulations is driving manufacturers to develop organic corn and callus removers with soothing botanical extracts. The use of upcycled ingredients and biodegradable packaging is becoming a key differentiator in the market.

Integration of Smart Foot Care Technologies: The development of digital foot health monitoring apps and AI-powered skincare tools is enabling consumers to track foot conditions and receive personalized product recommendations for preventive care. The introduction of wearable foot health sensors that monitor pressure points and detect early signs of callus formation is expected to revolutionize foot care diagnostics and treatment options.

The corn and callus remover market are highly competitive, driven by increasing consumer awareness of foot health, rising demand for non-invasive treatments, and advancements in skin care formulations. Companies are investing in medicated pads, liquid solutions, and electronic callus removers to maintain a competitive edge.

The market is shaped by well-established personal care brands, pharmaceutical manufacturers, and specialty foot care companies, each contributing to the evolving landscape of callus and corn treatment solutions.

| Company Name | Estimated Market Share (%) |

|---|---|

| Dr. Scholl’s (Bayer) | 22-26% |

| Curad (Medline) | 18-22% |

| Amope (Reckitt Benckiser) | 10-14% |

| CVS Health Brand | 8-12% |

| Kerasal (Advantice Health) | 5-9% |

| Other Companies (combined) | 25-35% |

Key Company Insights

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

Corn and callus removers come in medicated treatments (like salicylic acid patches and gels) and devices (such as electric callus removers).

Rising foot health awareness, personal grooming trends, and increasing cases of diabetes are key growth drivers.

They are widely available in pharmacies, drug stores, and online platforms like Amazon and Flipkart.

AI-powered foot health analysis, biodegradable patches, and smart callus removers are emerging trends.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.