The copper pipes and tubes market is forecasted to reach USD 37.1 billion in 2025 and USD 49.8 billion in 2035, growing at a CAGR of 3.2% during the forecast period. The gradual growth of this industry stems from increasing urbanization, which has led to a boom in infrastructure development and construction.

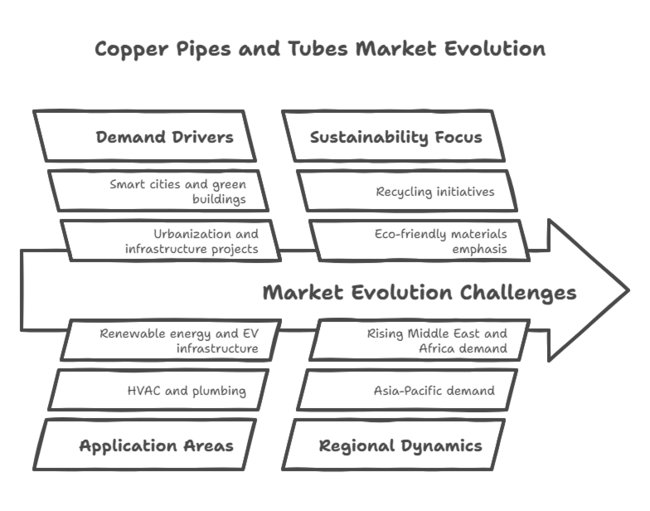

In 2024, the global copper pipes and tubes segment has witnessed remarkable advancements in numerous regions and applications. The high demand from HVAC & Refrigeration, plumbing, and medical gas transit industries, among others, has been a key driver of market growth. This growth was due in large part to the boom in urbanization and infrastructure projects, including the government's smart city initiatives.

The growth of the renewable energy and industrial manufacturing sectors in will also accelerate sales. Demand is expected to be continuous due to raw material price volatility and competition from substitutes such as glass fiber. However, technological advancements and government initiatives supporting sustainable infrastructure are expected to drive demand. These excellent indicate for manufacturers and investors alike also predict steady growth in the copper pipes and tubes sector.

Key Market Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 37.1 Billion |

| Industry Size (2035F) | USD 49.8 Billion |

| CAGR (2025 to 2035) | 3.2% |

Explore FMI!

Book a free demo

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Urbanization and infrastructure projects drove demand | Smart cities and green buildings will fuel growth |

| HVAC and plumbing were the primary application areas | Renewable energy and EV infrastructure will expand usage |

| Recycling became a key sustainability focus | Stronger emphasis on eco-friendly materials and energy efficiency |

| COVID-19 disruptions affected supply chains | Price volatility and material competition (plastic & composites) may challenge copper |

| Moderate technological advancements in HVAC | Smart HVAC, energy-efficient plumbing, and digital infrastructure adoption |

| Asia-Pacific (China, India) led global demand | Asia-Pacific remains dominant, with rising demand in the Middle East & Africa |

| Copper mining expansion and fluctuating prices | Increased focus on recycling and supply chain resilience |

| Steady growth with post-pandemic recovery | Innovation-driven expansion with sustainability as a core focus |

Regional Variance

High Variance

ROI Perspectives

70% of USA stakeholders found IoT-enabled copper solutions worth the investment, whereas only 38% in Japan were willing to adopt them due to cost concerns.

Consensus

Copper remained the preferred material (72% globally) due to its excellent thermal conductivity and durability in various applications.

Regional Variance

Shared Concerns

85% of stakeholders cited rising raw material costs (copper up 25%, copper alloys up 20%) as a major challenge.

Regional Differences

Manufacturers

Distributors

End-Users

Global Trends

74% of manufacturers plan to increase R&D spending on automation and predictive maintenance technologies related to copper applications.

Regional Focus Areas

High Consensus:

Quality assurance, sustainability, and automation remain universal priorities.

Key Variances

Strategic Insight

A one-size-fits-all strategy won’t work-companies must adapt product portfolios to regional demands.

| Country/Region | Key Policies & Regulations |

|---|---|

| United States |

|

| European Union |

|

| South Korea |

|

| China (Global Influence) |

|

The copper pipes and tubes industry depicts a competitive set up, wherein the leading players are focusing on multiple pricing strategies, product enhancements, collaterals, strategic alliances, and their reach across the globe. With raw material costs fluctuating, some manufacturers prioritize cost-efficient production and supply chain optimization, while others focus on high-performance, sustainable copper solutions to maintain a competitive edge.

Expansion plans can center around capacity, geographic spread and green manufacturing. Active players are investing in new production facilities in the country, responding to increasing demand in emerging sectors such as the Asia-Pacific region and the Middle East. Many firms are investing in circular economy initiatives that focus on recycling and low-carbon copper production as they seek to comply with stringent environmental regulations in Europe and North America.

Market Share Analysis

Mueller Industries Inc.- 15-18%

Wieland-Werke AG- 12-15%

KME Group S.p.A.- 10-12%

Aurubis AG- 8-10%

Luvata- 6-8%

MM Kembla- 5-7%

Cambridge-Lee Industries LLC- 4-6%

Key Developments

BHP Expands Copper Operations Despite Profit Decline (February 2025)

USA Government Orders Investigation into Copper Imports (February 2025)

India’s Copper Pipes & Tubes Surges (January 2025)

The copper pipes and tubes landscape is an important division in the industries of industrial metals, construction materials, and HVAC equipment. It serves a significant purpose in plumbing, refrigeration, air conditioning, automotive, and industrial uses. The performance of the sector is highly correlated with world economic growth.

The speedy urbanization, infrastructure growth, and industrialization in emerging countries such as India, China, and Southeast Asia are experiencing consistent demand owing to green building projects and refurbishment of old infrastructure. Inflation, increasing raw material prices, and volatile copper prices can affect the stability of the sector, which affects production expenses and end-user affordability.

In 2025 and beyond, ongoing supply chain disruptions, geopolitical tensions, and evolving trade policies are likely to reshape global copper production and distribution strategies, prompting increased investment in domestic manufacturing and recycling. Meanwhile, sustainability trends, electrification, and investments in renewable energy will drive copper consumption.

Increased interest rates can slow construction activity in the near term, but long-term demand remains robust with rising investments in smart cities, green plumbing solutions, and industrial automation. The industry will experience consistent growth backed by worldwide infrastructure and sustainability development.

The copper pipes and tubes landscape by product type classified into seamless and welded types. Seamless copper tubes and pipes are preferred extensively in uses that involve high strength, corrosion resistance, and pressure resistance. These pipes provide enhanced durability and are popular in applications where leak-proof operation is of importance.

On the other hand, welded copper pipes and tubes are relatively inexpensive and suitable for low- to medium-pressure applications like domestic plumbing and general-purpose industrial applications.

Seamless pipes are the more desirable pipe to use for high-performance applications. However, welded tubes are garnering more demand as they offer benefits of economic and easy manufacturing making welded pipes a leading option for infrastructure mega projects.

The end-use segment is driven by sectors such as HVAC, industrial heat exchange, plumbing, and others. HVAC (heating, ventilation, and air conditioning) systems account for a significant share, fueled by increasing demand for energy-efficient cooling and heating solutions in residential, commercial, and industrial buildings projected to grow at a CAGR of 3%.

The industrial heat exchange sector also heavily relies on copper pipes due to their excellent thermal conductivity, essential in power plants, chemical processing, and refrigeration systems.

Plumbing applications benefit from copper’s anti-microbial and corrosion-resistant properties. Other segments, including renewable energy, automotive cooling, and medical gas distribution, are witnessing steady growth, driven by technological advancements and sustainability-focused initiatives.

Demand from the construction, HVAC, plumbing, and industrial segments is fueling the USA landscape for copper pipes and tubes, which is growing steadily. Energy efficient heating and cooling systems are leading to increased demand in copper based HVAC applications. Government infrastructure spending, particularly through the Bipartisan Infrastructure Law, has boosted demand for copper in water distribution and plumbing. However, trade policies are influencing industry dynamics.

In 2025, the USA government launched a probe into copper imports, which could lead to higher tariffs and increased local production incentives. While this move may strengthen domestic mining and refining, it could also increase raw material costs.

The rise of Smart HVAC and IoT-enabled industrial systems require durable, high-performance copper pipes for efficient heat exchange, real-time leak detection, and automated maintenance, driving further industry growth.

FMI estimates that the United States copper pipes and tubes sales will expected to grow at a CAGR of 2.7% through 2025 to 2035, with the industry value estimated to reach USD 8.65 billion by 2035.

In the UK, its copper tubes and pipes landscape is shaped by sustainability-based construction patterns and regulatory guidelines like the UK net zero strategy. The sector is seeing an increase in low-carbon HVAC systems, and there is pressure from manufacturers to come up with recyclable and light-weight copper products.

Post-Brexit supply chain reconfigurations have affected copper imports, but the industry remains stable due to high demand from the plumbing sector and industrial heat exchange industry.

A move towards modular building and prefabrication is boosting the use of precision-built copper tubing. Increasing energy efficiency requirements are also driving investments in heat pump HVAC systems, in turn boosting demand for smooth copper pipes.

FMI estimates that the United Kingdom copper pipes and tubes sales will grow at nearly 2.9% CAGR through 2025 to 2035.

France's sector for copper pipes and tubes is dominated significantly by its emphasis on sustainable building and energy efficiency regulations. The government's promotion of green buildings and HVAC upgradation in terms of the RE2020 environmental norms is leading to heightened demand for copper pipe in heating, ventilation, and refrigeration use.

Growth of district heating grids and industrial cooling systems is also contributing to the segment expansion. French manufacturers of copper tubes are embracing recycled copper materials in response to the EU's circular economy objectives.

Further, the renewable energy segment, including solar thermal and geothermal heat, is turning out to be a prominent growth area, with copper pipes serving a significant role in heat exchangers and thermal conductivity systems.

FMI estimates that the France copper pipes and tubes sales will grow at nearly 3.1% CAGR through 2025 to 2035.

Germany boasts one of the most technologically advanced copper pipes and tubes industries, driven by precision engineering, automation, and green initiatives. The requirement for high-performance copper tubing is on the rise in industrial heat exchanger systems, automotive production, and heating, ventilation, and air conditioning systems.

Germany's dominance in renewable energy, such as solar thermal heating, is promoting the application of copper tubes in solar collectors and heat pump equipment.

The government's CO₂ reduction targets are motivating industries to move towards energy-efficient copper-based piping systems. In addition, Germany's industrial automation industry, particularly in chemical processing and electricity generation, is playing a part in the gradual expansion of seamless copper tubes used for high-pressure purposes.

FMI estimates that the Germany copper pipes and tubes sales will grow at nearly 3.3% CAGR through 2025 to 2035.

Italy's copper pipes and tubes industry is growing due to increasing demand for HVAC and plumbing applications, especially in urban regeneration programs.

Government stimulus through the program has contributed heavily to energy-efficient renovation of buildings, driving demand for copper tubing in heating and cooling systems.

There is also a strong automotive and manufacturing sector in the Italian sector, where heat exchangers and industrial cooling use copper tubing. Increased raw material and import costs are compelling manufacturers to investigate alternative production routes and lightweight copper alloys.

FMI estimates that the Italy copper pipes and tubes sales will grow at nearly 2.8% CAGR through 2025 to 2035.

South Korea's copper tube and pipe landscape is experiencing growth because of the nation's focus on high-tech production, miniaturized HVAC systems, and factory automation. Miniaturized and high-efficiency copper tubing demand is increasing in the electronics, semiconductor, and automotive sectors. South Korea's shift to green building technologies is also promoting the use of low-emission and antimicrobial copper piping in new housing developments.

The HVAC sector is moving towards next-generation heat pump technology, driving the need for precision copper pipes used in refrigeration and air conditioning applications. Premium copper costs, though, have compelled some manufacturers to seek composite or hybrid materials.

FMI estimates that the South Korea copper pipes and tubes sales will grow at nearly 3.6% CAGR through 2025 to 2035.

Japan's market for copper tubes and pipes is characterized by its emphasis on space-efficient, high-performance, and compact piping solutions. Due to limited urban space, Japan's construction industry favors lightweight, thin-walled copper tubing suitable for compact building layouts. Japan's HVAC and refrigeration sector is still among the biggest users of copper pipes due to demand for efficient cooling solutions.

The increasing population and aging factor, and healthcare industry development, are further driving the demand for medical gas distribution piping where the antimicrobial characteristics of copper are greatly preferred. Nevertheless, cost sensitivity is an issue, with most producers looking for low-cost, high-efficient production techniques in order to battle regional sectors.

FMI estimates that the Japan’s copper pipes and tubes sales will grow at nearly 2.5% CAGR through 2025 to 2035.

China is the largest sector for tubes and pipes of copper due to the high level of industrialization, urbanization, and infrastructure growth. The greatest demand for copper tubing is experienced in HVAC systems, plumbing, industrial heat exchangers, and renewable energy. The government's carbon neutrality goals are boosting the use of cleaner HVAC technologies, further elevating copper consumption.

Continuing to drive demand is China's building boom and growth in its manufacturing and power generation industries. Supply chain disruptions and volatile copper prices, though, are providing challenges. Significant investments in recycling and secondary processing of copper are being seen in the industry to make it sustainable and less dependent on imports.

FMI estimates that the China copper pipes and tubes sales will grow at nearly 4.1% CAGR through 2025 to 2035 and industry value is estimated to attain USD 11.27 billion by 2035

The Australia-New Zealand copper tubes and pipes landscape is expanding with increasing demand in the construction, plumbing, and HVAC industries. Australia's robust residential and commercial property development is fueling copper pipe usage in water supply, air conditioning, and drainage systems. The region's growing emphasis on sustainable and fire-resistant building materials is enhancing the popularity of copper, as it is non-combustible and extremely durable.

In New Zealand, there is rising demand for copper piping in geothermal heating systems, especially in a population that is keen on renewable energy solutions. Both sectors are threatened by import dependence and unstable global copper prices, prompting the quest for localized recycling processes.

FMI estimates that the Australia and New Zealand copper pipes and tubes sales will grow at nearly 3.2% CAGR through 2025 to 2035.

The Copper Pipes and Tubes landscape offers several growth opportunities, especially in smart plumbing, sustainable construction, renewable energy, and healthcare infrastructure. As the demand for energy-efficient HVAC systems and environmentally friendly buildings grows, copper pipes are still a top option because they are thermally efficient and recyclable.

The growth of IoT-based monitoring systems and smart plumbing solutions is another area of opportunity, with leak detection and automated water management. In addition, growth in solar thermal and geothermal heating systems is stimulating demand for copper tubes, particularly in Germany, China, and Australia, where sustainability efforts are high on the agenda.

New entrants will benefit from a well-formulated sector entry strategy. High-growth industries like HVAC, plumbing, and the renewable energy sector, where demand is increasing, are areas where companies should be active. Compliance with world environmental standards (like REACH and RoHS) will be critical to obtaining acceptance, especially in Western Europe and the Americas.

Secure local representation through partnerships with distributors, construction companies, and HVAC manufacturers can facilitate easier segment entry while providing a cost-efficient supply chain. Differentiation will be crucial, and new players must provide added-value solutions, e.g., pre-insulation of pipes, corrosion protection, and IoT-based monitoring systems.

Electrical conduits, pipelines and tubes, military installations and components account for much of the demand, but HVAC systems, plumbing applications, industrial heat exchangers and renewable energy projects are other growth segments.

As sustainable building material and energy-efficient system concerns are increasing, copper pipes are increasingly being utilized in the construction industry for their recyclability, longevity and energy-saving capabilities in HVAC and plumbing systems.

Urbanization, industrial expansion, and investment in smart infrastructure have fueled significant growth in areas like China, Germany, and the USA. Even South Korea and Japan are embracing compact, high-efficiency copper solutions in electronics and advanced HVAC systems.

These innovations include pre-insulated copper tubing, anti-corrosion coatings, and Internet-of-Things (IoT)-enabled leak detection protocols. This keeps the pipes flexible for new, modern plumbing, industrial applications, as well as smart buildings.

Governments across the globe are also introducing tougher environmental and safety regulation, including REACH compliance in the EU, OSHA in the USA, and energy efficiency regulations in China.

Seamless and Welded.

HVAC, Industrial Heat Exchange, Plumbing, and Others.

North America, Latin America, Europe, Asia Pacific, and The Middle East and Africa.

Glass Door Merchandisers Market Growth - Trends & Forecast 2025 to 2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Retail Printers Market Growth - Trends & Forecast 2025 to 2035

Rubber Extruder Market Growth - Trends & Forecast 2025 to 2035

Factory Automation And Industrial Controls Market Growth - Trends & Forecast 2025 to 2035

Extrusion Equipment Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.