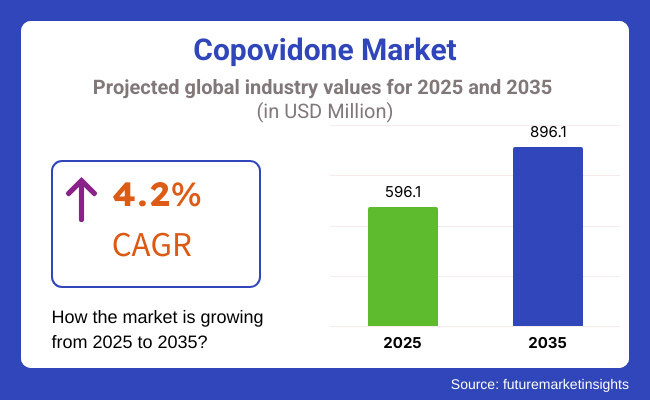

The Copovidone Market is valued to be around USD 596.1 million in 2025 and is projected to grow to USD 896.1 million by 2035, with a CAGR of 4.2% from 2025 to 2035.

The Copovidone Industry continues to expand steadily because it finds increasing use as a pharmaceutical excipient. As a copolymer between vinylpyrrolidone and vinyl acetate Copovidone exists as an essential pharmaceutical ingredient used for binding and film-making purposes and solubility enhancement in drug formulations.

The robust binding abilities of Copovidone establish its necessary position in producing tablets and sustaining and managing drug release periods. Its adoption continues to increase due to rising requirement for oral dispersible tablets and developing drug delivery systems.

The pharmaceutical sector aside copovidone facilitates usage in the cosmetics industry and food sector as it stabilizes products while generating film structures thereby expanding its business opportunities.

Market developments occur through new drug formula innovations and rising requirements for effective excipients. The industry faces regulatory hurdles together with rigorous quality standards that force manufacturers to stick to safety requirements and efficacy criteria.

The market shows an increasing preference for sustainable excipients which are biodegradable because industries actively pursue environmentally responsible as well as safer options. The ongoing development research of copovidone plays a fundamental role in multiple industries through its capabilities to improve drug stability, bioavailability, and formulation efficiency.

Explore FMI!

Book a free demo

Growing Pharmaceutical Applications

Copovidone brought into the pharmaceutical industry originally functions among skincare products and hair treatments as essential stabilizing and film-forming agent. The functionality of hair gels and sprays improves through copovidone application because it delivers flexible hold and protects against humidity but in skincare it provides better texture and enhances both spreading and sunscreens' resistance to water.

Nanhang Industrial the company provides the versatile excipient copovidone which serves for skincare as well as haircare formulations. Nanhang Industrial applies copovidone to create formulations which strengthen hair gels as well as improve spreadability in serums and mousses and add extra protection to sunscreens.

American specialty chemicals company Ashland applies the film-forming and binding and stabilizing abilities of copovidone to improve the performance of haircare and skincare products. The pharmaceutical industry once relied on copovidone but now this ingredient plays a vital role in forming flexible yet durable hair products including gels and sprays.

The cosmetic industry employs copovidone to enhance the texture of creams and sunscreens as well as improve their spreadability and make them resistant to water.

Excipient Evolution - Copovidone in Skincare & Haircare

The pharmaceutical industry seeks Copovidone for its uses as a binding element and film-forming agent and stabilizing component for tablets and capsules. The compatibility and effectiveness of oral drug production has elevated copovidone to its position as a fundamental excipient that enhances medicine stability and bioavailability as well as performance levels.

Merck KGaA produces copovidone as a principal excipient for pharmaceutical formulations and markets Kollidon® which strengthens drug stability and consistency during oral dosing. The pharmaceutical properties of Kollidon® copovidone used as binder and film-former and stabilizer enhance tablet and capsule formulations to deliver drugs reliably through effective drug delivery systems.

Merck KGaA produces pharmaceutical excipients of superior quality which enable powerful medication development within the industry.

The pharmaceutical manufacturer BASF SE creates Polyplasdone® which serves as a copovidone substance for pharmaceutical applications. The pharmaceutical substance Kollidon® copovidone functions simultaneously as binding and disintegrating and stabilizing agent to make tablets and capsules work more efficiently.

The drug delivery systems benefit from Polyplasdone® which provides reliable drug performance for oral medical treatments.

Increased R&D Investments

The market for copovidone experiences rising research and development investments which focus on improving its functional capabilities as an excipient material. Pharmaceutical formulation optimization requires companies to enhance both solubility and stability performance of copovidone to reach its maximum potential.

The research dedicated to copovidone aims to improve its pharmaceutical performance for better bioavailability of drugs while enhancing their delivery and absorption potential. Research developments strengthen the performance of copovidone in applications that need stable tablets and capsules alongside controlled drug delivery systems.

The companies Merck KGaA and BASF SE through their brands Kollidon® and Polyplasdone® dedicate resources to ongoing research initiatives that aim to create copovidone-excipients with better features for pharmaceutical applications.

A variety of industries are utilizing existing research and development initiatives to expand the usage spectrum of copovidone for cosmetics and personal care sectors. Science-based work on upgraded copovidone formulations aims to boost its capacities for film-patterning and binding as well as stabilizing capacity to strengthen its potential in skincare and haircare product development.

Through its R&D activities Ashland seeks to optimize the functional performance of copovidone so it can be used across multiple commercial sectors.

| Particular | Value CAGR |

|---|---|

| H1(2024 to 2034) | 4.2% |

| H2(2024 to 2034) | 5.1% |

| H1(2025 to 2035) | 5.2% |

| H2(2025 to 2035) | 6.0% |

The Copovidone market is expected to grow steadily with notable half-yearly compound annual growth rates (CAGR). From 2025 to 2035, H1 shows a growth rate of 4.2%, while H2 is slightly higher at 5.1%. Moving to the 2025-2035 period, H1 is projected to grow at 5.2%, indicating a positive trend. In H2 growth for the same period is slightly higher at 6.0%.

From 2020 to 2024 global industries producing copovidone expanded at a consistent pace because this material finds multiple applications between pharmaceuticals and cosmetics and food manufactures. The pharmaceutical industry uses copovidone as a binding agent for oral drugs which booste demand and the drug coating applications for tablets promoted further usage.

The Asia-Pacific region established itself as a vital industry for copovidone expansion because of the fast-developing pharmaceutical industries and rising market need for cosmetic products incorporating this ingredient in China and India.

Across the period from 2025 to 2035 the market demand for copovidone is predicted to experience substantial expansion. The growing pharmaceutical industry will heavily depend on copovidone functioning as a formulation excipient because of ongoing biopharmaceutical and drug delivery system advancements.

The demand for better drug formulations will increase because of recent drug production advancements and rising rates of chronic diseases alongside global population aging. Industry growth in copovidone production will accelerate due to mounting sustainability demands within the cosmetics and personal care industries and eco-friendly production methods.

Regional market demand in Asia Pacific countries and similar emerging Industry will serve as the major driving force behind sector growth throughout the forecast period.

The copovidone market exhibits strong competition according to three distinct revenue sections. The top three market revenue contributors belong to Tier 1 which includes Ashland and BASF SE and Boai NKY Pharmaceuticals Ltd among them.

These companies control extensive shares because they possess extensive product collections built upon strong distribution networks across the world in pharmaceuticals together with food and cosmetics businesses. The pharmaceutical market showcases Ashland and BASF SE with their top-quality copovidone drug formulation products and Boai NKY Pharmaceuticals Ltd with PVP and derivative solutions for multiple industrial uses.

Nanhang Industrial coupled with Merck KGaA and Huangshan Bonsun Pharmaceuticals Co., Ltd form the second tier of companies that generate 30% of industry revenue. The sector of the market is dominated by medium-sized pharmaceutical and specialty chemical firms who operate at a scale slightly below Tier 1 companies.

The remaining 20% of market companies categorized as Tier 3 are made up of Hangzhou Motto Science & Technology Co., Ltd. and Shanghai Yuking Water Soluble Material Tech Co., Ltd. The manufacturers in this category supply copovidone specifically for pharmaceutical applications as well as adhesives and personal care production.

The sector continues evolving through constant research efforts that shape upcoming developments mainly in drug delivery methods as well as excipient innovations.

The following table shows the estimated growth rates of the top three territories. Canada, Spain and Australia are few attractive countries to look upon.

| Country | CAGR,2025 to 2035 |

|---|---|

| Canada | 7.3% |

| Spain | 8.2% |

| Australia | 7.8% |

The Canadian market for copovidone is expanding because forecasts show a compound annual growth rate (CAGR) of 7.3%. The pharmaceutical and nutraceutical industries are leading the increasing demand for copovidone because the polymer functions both as a stabilizer and an ingredient in drug formulations.

The pharmaceutical sector uses copovidone in two main roles: medication stabilization and tablet binding yet manufacturers also employ it for cosmetic emulsion processes. Health Canada maintains strict regulatory standards which uphold product safety throughout the supported market.

The industry keeps expanding because of growing interest in innovative drug delivery systems and clean-label products within the cosmetic industry. Markets see growth expansion because consumers choose personalized medicine sustainable release drugs organic cosmetic components yet raw material price volatility and regulatory screening presents ongoing difficulties.

The Spain copovidone advertise proper to grow at a CAGR of 8.2%, indicating the important growth of the European pharmaceutical manufacturing. Driven apiece increasing demand for generics and the increasing need for persuasive excipients in drug formulations, copovidone is generally secondhand as a binder in the result of spoken dimensional dosage forms, specifically tablets.

The demand is helped for one expanding healthcare subdivision and a rise in drug production, as Spain continues to devote effort to something economical answers in the pharmaceutical manufacturing. However, stock exchange faces challenges on account of accurate regulatory flags for drug excipients, that may limit the effort of new advertise performers.

With technological progresses and growing endorsement of generics, the market is balanced for constant progress.

The Australian copovidone market will demonstrate a compound annual growth rate (CAGR) of 7.8% due to rising requirements for advanced drugs and generic pharmaceuticals along with growing nutraceuticals and cosmeceutical business segments.

The Therapeutic Goods Administration of Australia serves as regulator of pharmaceutical excipients including copovidone which operates under International Council for Harmonisation (ICH) standards as well as guidelines from United States Pharmacopeia (USP) and European Pharmacopoeia (Ph. Eur.).

The pharmaceutical industry can obtain steady access to compliant copovidone through TGA efforts to implement Good Manufacturing Practice (GMP) standards and validate international quality certification programs. The alignment of Australian regulations with worldwide standards simplifies regulatory processing for domestic drug producers while guaranteeing both safety and effectiveness of medicines sold to consumers who meet international standards.

| Segment | Value Share (2025) |

|---|---|

| Function- Granulating Agent | 34% |

The pharmaceutical industry employs Copovidone as a granulating agent because it functions as a superior binder and forms film membranes alongside promoting drug solubility. The chemical ensures both proper flow of powders during manufacturing and strong compressibility that results in rapid disintegration of tablets.

The drug distribution uniformity enabled by copovidone results in steady measurements during granulation procedures because of its suitability in these processes. The choice of copovidone in wet granulation processes is preferred because it boosts bioavailability through improved solubility of drugs that have poor water solubility. CP-123A shows flexibility in drug development because it works well with numerous active pharmaceutical ingredients (APIs) during pharmaceutical formulations.

| Segment | Value Share (2025) |

|---|---|

| Form-Powder | 67% |

The pharmaceutical industry employs copovidone in its powder form for numerous purposes which include applications within pharmaceuticals and nutraceuticals as well as industries. It functions as a free-flowing material that allows excellent material blend and processing uniformity for consolidated dosage forms.

The powder nature provides excellent solubility alongside compression and binding characteristics which allow its usage in dry and wet granulation and direct compression and film coating procedures.

Pharmaceutical industry relies heavily on microcrystalline cellulose because of its ability to remain stable and its capability to mix with different formulation components. Manufacturers choose this substance because of its ability to adapt across different production approaches for achieving drug development consistency and efficiency.

The copovidone market maintains average competitive levels while BASF SE Ashland Global Holdings Inc. JRS Pharma and Shin-Etsu Chemical Co. Ltd. hold control over the industry. These corporations primarily work to improve drug dissolution and bio accessibility properties of pharmaceutical formulations so copovidone stands as a critical component in these medicines.

The Industry features multiple barriers to entry because of rigorous FDA and EMA regulatory license requirements that restrict new company participation. The competitive position of businesses depends heavily on research and development (R&D) because companies dedicate funds to enhance product performance to align with changing pharmaceutical requirements and standards.

The pharmaceutical excipients market's leading sectors exist between North America and Europe due to their robust regulatory systems coupled with their active pharmaceutical excipients producers. Asia Pacific market demonstrates rapid expansion because Indian and Chinese generic drug manufacturers benefit from competitive advantages stemming from economical production costs.

The local competition intensifies as regional manufacturers supply cheaper versions of global pharmaceutical products to the market .Industry strategic alliances alongside mergers and acquisitions serve to shape the business because leading pharmaceutical manufacturers pursue Sector expansion and distribution network strengthening in emerging economies.

The global industry is estimated at a value of USD 596.1 million in 2025.

The global demand for copovidone Market is forecasted to surpass USD 896.1 million by the year 2035.

The industry is projected to grow at a forecast CAGR 4.2 % from 2025 to 2035.

The global copovidone market is expected to be dominated by the pharmaceutical industry over forecast period 2022 to 2032.

Nanhang Industrial, Merck KGaA, Boai NKY Pharmaceuticals Ltd., BASF SE, Huangshan Bonsun Pharmaceuticals Co., Ltd., Ashland, Hangzhou Motto Science & Technology Co. Ltd., Shanghai Yuking Water Soluble Material Tech Co. Ltd., others are some of the leading players in the prominent copovidone Industry.

The North America, Latin America, Europe, East Asia, Oceania, Middle east and Africa are the prominent countries driving the demand for Copovidone Industry.

By function, granulating agents aid aggregation, retarding agents slow reactions, film-forming agents create coatings, lubricants reduce friction, thickening agents increase viscosity, dispersants improve dispersion, binding agents hold ingredients together, emulsifying agents stabilize mixtures, fining agents clarify, and blocking agents prevent interactions.

Find the product in liquid and powder and additional forms.

The product delivers three distinct versions for food use as well as pharmaceutical requirements and industrial purposes.

The product serves multiple sectors which include food & beverage and cosmetics along with personal care and pharmaceuticals plus adhesives together with battery applications and water treatment.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

USA Bubble Tea Market Analysis from 2025 to 2035

Food Testing Services Market Trends - Growth & Industry Forecast 2025 to 2035

USA Dehydrated Onions Market Insights – Size, Trends & Forecast 2025-2035

Latin America Dehydrated Onions Market Outlook – Demand, Share & Forecast 2025-2035

Europe Dehydrated Onions Market Analysis – Growth, Trends & Forecast 2025-2035

ASEAN Dehydrated Onions Market Trends – Size, Demand & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.