The worldwide conveyors and belt loaders market will grow further from 2025 to 2035 at a uniform growth, fueled by increasing orders in the warehousing, logistics, and material handling industries. Conveyors and belt loaders help the flow of goods, packages, and materials in the industries at a smooth pace, alleviating manpower and elevating the efficiency of operations.

The uses of these conveyors and belt loaders expanded from airport baggage handling systems to distribution facilities and are today a requirement in today's supply chains.

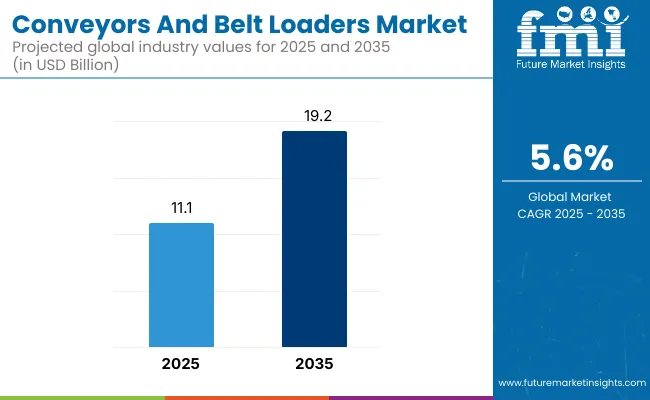

The market for conveyors and belt loaders was around USD 11.1 Billion in 2025. It will grow to USD 19.2 Billion at a CAGR of 5.6% through 2035. The growth indicates the growing dependence on automated material handling systems because of the need of businesses to improve workflow efficiency, mitigate risks, and save costs.

Emerging technology developments such as smart controls, IoT-based monitoring, and energy efficiency are also promoting adoption across industries.

North America is a growing and mature conveyor and belt loader market due to the region's logistic and distribution strength. Increased growth in e-commerce, fuelled by increased online shop sales, has driven the demand for advanced handling systems within fulfillment warehouses and distribution centres.

The larger players are placing their bets on automated solutions in order to have timely delivery times as well as cost competitiveness. USA and Canadian airports are also replacing their outdated baggage handling systems, adding to the demand for conveyors and belt loaders in the region.

Europe is a base market, with the extensive use of automation in manufacturing and logistics. Automotive, food and beverage, and pharmaceutical sectors in the region are among the largest users of conveyors and belt loaders. EU workers' protection regulations and efficiency requirements are compelling businesses to adopt automated material handling systems.

Focus on airport infrastructure development and cargo handling capacity building is also driving steady market growth. Dominant established producers and the introduction of new technology, including smart sensors and power-saving motors, are also determining the European market.

Asia-Pacific is also witnessing the fastest growth in the conveyors and belt loaders segment in view of speedy industrialization and expansion of infrastructure. China, India, and Japan are also witnessing investment in manufacturing hubs, logistics parks, and airport developments. Regional e-commerce players are constructing giant-sized distribution centers, demanding automated material handling solutions.

With labor cost rising and companies wanting to increase productivity, Asian-Pacific companies are adopting conveyors and belt loaders to work in an efficient way. Government-led trade and industrial automation initiatives make the firmness of the region's growth curve stronger.

Challenge

Concerns about Maintenance Costs and Efficiency

The Conveyor and Belt Loaders Market is challenged by high maintenance costs, operational inefficiencies, and regulatory requirements related to workplace safety. Our solutions include conveyor systems and belt loaders that are an essential component of material handling in industries ranging from logistics and mining to food processing and airport luggage handling.

But they also have common problems that increase capital expenditures, such as constant mechanical failures, high energy consumption, and maintenance requirements. Moreover, monitoring workplace safety standards (OSHA, ISO, etc.) as well as implementing these standards require regular updates of automation and worker protection systems.

This can include investing in predictive maintenance solutions, using energy-efficient motor systems, and integrating real-time condition population monitoring of equipment to improve reliability and minimize downtime.

Opportunity

Increasing Adoption of Automation and Smart Logistics Solutions

Demand for automation in warehouses and smart warehouses is increasing due to the growing need for energy-efficient material handling systems, and also to reduce the manual labour which enables growth for the Conveyors and Belt Loaders Market. Intelligent conveyor systems are gaining traction owing to the growth of the e-commerce sector, growth of airport infrastructure, and technological advancements in industrial automation.

For example, AI-driven sorting mechanisms are being implemented, as are Iota-enabled real-time tracking and robotic belt loaders-all of which make airports more efficient and less reliant on human labour. Furthermore, lightweight, modular conveyor designs and low-friction belt materials are improving energy efficiency and sustainability in material transportation.

Competitors that can leverage the potential of predictive analytics powered by AI, autonomous operation of conveyor belts, and sustainable material solutions will be at the forefront of this changing landscape.

The Conveyors and Belt Loaders Market observed a steady growth from 2020 to 2024 due to the growing automated warehousing, rising demand for air travel, and industrial sector growth. High-speed, AI-assisted conveyor systems improved logistics hubs, manufacturing plants, and airport baggage handling.

But high energy costs and the limited availability of space and maintenance facilities in urban logistics hubs proved problematic as well. To overcome these challenges, companies integrated innovative machine learning algorithms (AI-driven diagnostics) into their conveyor belt systems, modular conveyor systems, and energy-efficient motors to optimize performance while keeping costs low.

By 2025 to 2035, all the system will have complete autonomy with Artificial Intelligence (AI) based predictive maintenance and ultra-lightweight belt loader materials that will outdistance other systems to dominate the market. Carbon-neutral warehousing, solar-powered conveyor networks, and machine-learning-based load optimization will set new industry standards.

Evolution of smart cities and modernization of transportation hubs will increase the utilization of advanced conveyor solutions with remote monitoring technology, intelligent traffic flow analysis, and digital twin technology. The future of the Conveyors and Belt Loaders Market will be dominated by companies focusing on automation, sustainability, and digital integration.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with safety and efficiency regulations for conveyors |

| Technological Advancements | Growth in high-speed conveyor systems and smart tracking |

| Industry Adoption | Increased use in e-commerce logistics, manufacturing, and airport baggage handling |

| Supply Chain and Sourcing | Dependence on traditional conveyor belt manufacturing and metal components |

| Market Competition | Dominance of established conveyor system providers |

| Market Growth Drivers | Rising demand for efficient material transport, e-commerce fulfilment, and air travel growth |

| Sustainability and Energy Efficiency | Early adoption of low-friction belt materials and energy-efficient motors |

| Integration of Smart Monitoring | Limited predictive maintenance and performance analytics |

| Advancements in Material Handling | Traditional conveyor belt models with manual oversight |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of AI-driven compliance monitoring, workplace automation safety mandates, and energy efficiency regulations. |

| Technological Advancements | Widespread adoption of AI-powered material handling, autonomous sorting systems, and ultra-lightweight belt materials. |

| Industry Adoption | Expansion into carbon-neutral warehousing, robotic conveyor systems, and smart city logistics hubs. |

| Supply Chain and Sourcing | Shift toward sustainable material sourcing, composite conveyor belts, and localized smart manufacturing. |

| Market Competition | Rise of automation-driven logistics start-ups and digital twin-enabled conveyor system providers. |

| Market Growth Drivers | Increased investment in self-learning conveyor networks, autonomous warehouses, and AI-driven logistics optimization. |

| Sustainability and Energy Efficiency | Large-scale deployment of carbon-neutral conveyor systems, solar-powered loaders, and regenerative braking technology. |

| Integration of Smart Monitoring | AI-powered fault detection, real-time conveyor load tracking, and cloud-integrated system diagnostics. |

| Advancements in Material Handling | Evolution of AI-assisted, voice-controlled, and fully autonomous conveyor networks with self-repairing capabilities. |

Bose Corporation, GIFAS, CTS, Steinweg, Airbus Group, UPS, DGI, Koch Industries Inc., idle air technologies` av freight, and Swiss freight ag food logistics are some of the prominent players in the global United States conveyors and belt loaders market. Fulfillment centers have been established by e-commerce behemoths such as Amazon and Walmart, resulting in a growing demand for automated conveyor systems.

The aviation industry is a key focus for the advancement of high-efficiency belt loaders, with major hubs such as Atlanta, Los Angeles, and Chicago experiencing continuous investments in advanced baggage handling infrastructures. Mining in Texas, Arizona and similar areas comprises another hotbed of heavy-duty conveyor adoption for bulk material handling.

Driven by continuous innovations in technology such as AI-powered sorting solutions and integration of smart conveyor segments, the market is poised to continue to grow steadily across the USA conveyors and belt loaders market.

| Country | CAGR (2025 to 2035) |

|---|---|

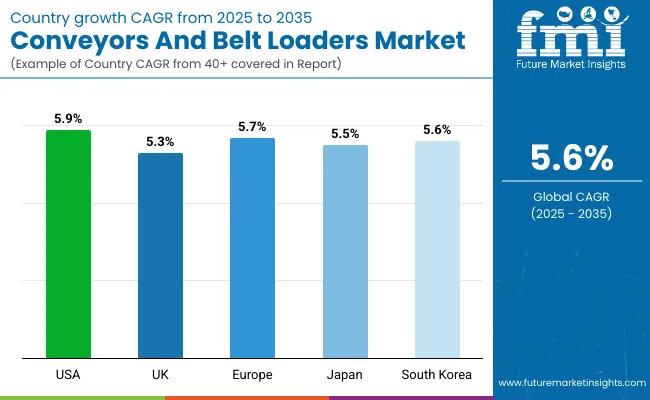

| USA | 5.9% |

The United Kingdom conveyors and belt loaders market is witnessing growth owing to the increasing investments for warehouse automation, rising demand for baggage handling systems, at key airports, and very high adoption in manufacturing sectors. Automated conveyor systems in a distribution centre are booming in the logistics and e-commerce industry, particularly Amazon UK and Ocado.

Heathrow, Gatwick and Manchester, for example, are large airports all investing in their baggage handling infrastructure, increasing demand for versatile belt loaders and sorting conveyors. The sanitary conveyor systems market is also driven by the growth of food and beverage processing industries

The UK conveyors and belt loaders market is expected to witness moderate growth on the back of sustained investments in smart logistics and rising adoption of AI-powered material handling solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.3% |

Introduction to the Market: The European Union conveyors and belt loaders market is primarily driven by the rising adoption of Industry 4.0 automation across various sectors, increasing investments for logistics infrastructural development, and growing needs for energy efficient conveyor systems. Germany (with its automotive and industrial machinery), France, and Italy are also top adopters of these technologies.

The European Union’s sustainable and energy-efficient reuse initiative is driving the industry towards the implementation of low-energy conveyor belts and artisanal material handling solutions. Growing demand for advanced belt loaders, also connected to the upgrade of baggage handling systems at key European airports, such as Frankfurt, Paris Charles de Gaulle and Amsterdam Schiphol.

Thus, with strong policy backing to continue with automation, and strong investment in logistics and airport infrastructure, we expect the EU conveyors and belt loaders market is likely to report steady growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.7% |

The Japanese conveyors and belt loaders market is being driven by strong demand from advanced sectors of manufacturing, the expansion of an airport, and the increasing adoption of automation in warehouse logistics. Japan’s carmakers, including industry giants Toyota and Honda, along with its electronics sector represented by Sony, are top buyers of precision conveyor systems for assembly and production lines.

Demand for AI-integrated and robotic conveyor systems is growing as a wave of automated warehouses springs up to address Japan’s labor shortages. Moreover, the increasing international travel segment and modernizing airport development schemes are fueling the demand for advanced belt loaders for baggage handling.

Along with ongoing investments in robotics powered material conveying and growing requirement for high-speed conveying solutions, the Japanese conveyors and belt loaders market is poised for steady growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.5% |

The South Korean conveyors and belt loaders market is growing at a moderate pace due to vibrant demand for automation in logistics, increasing investments in smart manufacturing, and growing expansion in the airport infrastructure. In South Korea, the e-commerce industry, which is dominated by companies such as Coupang, is quickly implementing automated conveyor and sorting systems in the company’s distribution centers.

Automated conveyor systems, particularly high-precision systems, are gaining traction due to their extensive and high-tech production practices, such as in the manufacturing of semiconductors and automobile production. Moreover, this requirement for such high-speed baggage handling conveyors and belt loaders CDGs supported at the time of airport expansions such as of incheon international airport.

Meanwhile, the South Korea conveyors and belt loaders market is projected to steadily grow due to continuous investments in industrial automation and logistics infrastructure.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.6% |

The belt conveyors segment and the pallet conveyors segment share a large part of the Conveyors and Belt Loaders market due to developments in automated material handling systems that cut down on labour dependency and help firms enhance productivity and streamline warehouse and manufacturing processes.

These critical conveyor system types are crucial to enhancing logistics workflows, optimizing manufacturing throughput and lowering operational costs in many different industries, and are central to warehouse, airport, factory and distribution centre operations.

They are also good for high-speed transportation and are suitable for almost all load types. Belt conveyors, unlike other types of conveyors, allow for the smooth horizontal and inclined transport of goods - making them critical for logistics hubs, warehouse distribution and assembly lines.

Belt conveyor adoption in e-commerce and retail sectors has been trending due to increasing demand for fast sorting and automated warehouse solutions, which are integrated with conveyor systems featuring barcode scanning and AI-invoked inventory tracking. The demand for advanced conveyor solutions remain strong with research suggesting more than 70% of worldwide distribution centers utilize belt conveyors within their logistics systems.

As these trends have gained steam, they have further boosted e-commerce, just-in-time inventory management that features automated package handling and same-day delivery logistics, and it will continue to strengthen market demand, leading to greater adoption of belt conveyor systems in large-scale fulfilment centers.

AI-powered conveyor monitoring, with predictive maintenance and automated adjustment of speed to real-time load changes has been integrated that provide better operational reliability and savings, leading to increased adoption.

Adoption of energy-efficient belt conveyor systems using low-friction materials and regenerative braking technology, optimizing the market growth and sustainability of industrial material handling.

For instance, the implementation of modular and scalable designs of belt conveyors, including interchangeable components and both fixed and flexible configurations, has bolstered market growth, enabling enhanced functionality across a variety of industries.

While belt systems are considered to be better in the vertical and horizontal transport, their adaptability to the position and automation, the major drawbacks of belt conveyors include high maintenance costs, wear and tear of the conveyor belts and limitation to use in space-restricted applications.

In contrast, however, smart conveyor analytics, AI-powered route optimization, and robotic sorting integration innovations are paving the way for efficiency, durability, and automated capabilities toward belt conveyor systems and keeping the market one step ahead.

The pallete conveying systems have shown good market acceptance in sectors like manufacturing, food beverage, and larger logistics as businesses are in deepening investment in automated bulk handling, focus towards leading throughput and reduction of manual work.

When it comes to moving heavy loads, pallet conveyors are the right solution for moving bulk materials and finished goods in industrial environments-unlike lightweight conveyors.

Industries that prioritize efficiency in warehouse management and material transport have contributed to the increasing deployment of pallet conveyors, which are expected to witness a proliferation of automated pallet handling solutions featuring robotic palletizing and depalletizing systems integrated with conveyors.

According to studies, more than 60% of industrial warehouses and factories use pallet conveyors to transport bulk material, creating a solid demand for these heavy-duty conveyor solutions.

This has strengthened the demand in the market for automated storage and retrieval systems (AS/RS) integrated with pallet conveyor networks and AI-powered sorting solutions for re-shuffling goods, ensuring higher levels of automation in large-scale warehousing and logistics business.

The growth in adoption has also been attributed to the integration of smart conveyor sensors that allow real-time load tracking and the advanced ability to adjust conveyor speeds automatically, ensuring improved safety and operational efficiency.

Low-noise operation of systems, improvements in motor systems for energy-efficient operation, and higher durability have optimized market growth to a large extent, and which is making industrial operations more sustainable.

For instance, the integration of hybrid conveyor systems that include pallet conveyors with automated guided vehicle (AGV) compatibility is fostering further growth for the market, aligning with the future of warehouse automation.

While pallet conveyor segment will have advantages in terms of bulk transport, durability, and high-load capacity, it poses challenges such as high initial investment costs coupled with complex installation requirements, and space constraints in smaller industrial facilities.

New developments in AI-managed conveyor fleet optimization, modular conveyor expansion systems, and robotics-assisted pallet handling, however, are enhancing efficiency, adaptability, and ROI, allowing pallet conveyor systems to thrive.

Packaging warehouse distribution and automotive transportation segments one of the two significant market drivers, with industries adopting more automated conveyor and belt loader solutions to facilitate logistics, improve production and increase operational efficiency.

Packaging warehouse distribution is one of the fastest-growing conveyors and belt loaders, due to its automated sorting, high-speed transport of materials, and compatibility with logistics management systems. Traditional material handling processes often suffer from problems such as delayed order processing, poor inventory tracking, and heavy reliance on human labourers; conveyor-integrated warehouse automation resolves all these issues.

As e-commerce and retail logistics drive the need for optimized warehouse operations, there has been increased adoption of conveyor and belt loader systems that enable high-speed sorting and automated fulfilment with conveyor-integrated robotic arms and AI-powered package scanning. More than 75% of e-commerce fulfilment centers use automatic conveyor systems-holding high demand for high-speed sorting and distributing schemes, according to the study. The significant market demand, which ensures higher adoption rate for automated material handling solutions has been supported with the rising last-mile delivery hubs, comprising conveyor-based automated sorting centers in addition with day to day package delivery in real-time.

The incorporation of AI-based inventory control with real-time stock tracking and optimized package flow automation has accelerated adoption even further, providing improved efficiency and order fulfilment accuracy.

Eco conveyor materials are being developed with low-energy motors and recyclable conveyor belts, and this has further optimized market growth by offering greater sustainability in warehouse automation.

The use of automated conveyor hubs that can be built in modular conveyor networks and can route packets with AI-based control has also sustained the growth of the market, as they will provide better operational scalability to growing logistics operations.

The physical packaging automation sector within warehousing and distribution benefits from increased warehouse automation, logistics efficiency, and order fulfilment speed, but it is tempered by the high initial investment cost, maintenance of the system, and integration with existing logistics infrastructure. Emerging innovations, such as smart conveyor tracking, AI-powered sorting algorithms, and modular conveyor automation, are enhancing efficiency, adaptability, and cost-effectiveness, paving the way for sustained expansion of the conveyor systems market in packaging and distribution.

The automotive transportation system has achieved significant market adoption, most notably in vehicle manufacturing and assembly line automation applications, where manufacturers are incorporating various types of conveyor systems to streamline vehicle production, minimize labour dependency, and enhance assembly precision. Conveyor-integrated automotive manufacturing provides a streamlined assembly operation that minimizes downtime, increasing vehicle output when compared to manual vehicular handling.

The increased need for high-efficiency vehicle assembly lines-incorporating automated conveyor-based transportation and robotic-assisted assembly of components-has also led to the adoption of conveyor and belt loader systems as automakers gravitate toward lean manufacturing and process optimization. It is found that more than 65% of vehicle manufacturers have conveyor based assembly lines, thereby creating a strong demand for automotive material handling solutions.

The increasing production of electric vehicles (EVs), with dedicated conveyor designs for battery and other component transport, has bolstered market demand, driving the wider adoption of next-generation automotive conveyor solutions.

Adoption has been additionally propelled by the integration of AI-powered assembly line monitoring (for example, real-time defect detection and mechanized quality control), which guarantees a superior degree of accuracy and efficiency in production.

While the automotive transportation segment has benefits due to the scalability of production, automation, and process efficiency, the existing Marketplace state faces weaknesses like high conveyor installation costs, the complexities of maintenance, and integration needs with legacy manufacturing systems. New advances in AI-driven predictive maintenance, modular conveyor assembly line designs and robotics-enhanced vehicle manufacturing are increasing efficiency, scalability and ROI enabling continued growth of conveyor systems within the automotive manufacturing sector.

Increased demand for automation revolutionizing material handling across e-commerce, aviation, warehousing and manufacturing sectors has been a driving factor to the growth of the conveyors & belt loaders market.

To improve operational efficiency, safety, and cost-effectiveness, companies are focusing on AI-powered conveyor automation, energy-efficient belt loader systems, and IoT-integrated predictive maintenance solutions. Includes global providers from the material handling equipment market, belt loader solution providers, and more which promote technological developments in global baggage handling, automated assembly lines, and high-speed logistics operations among others.

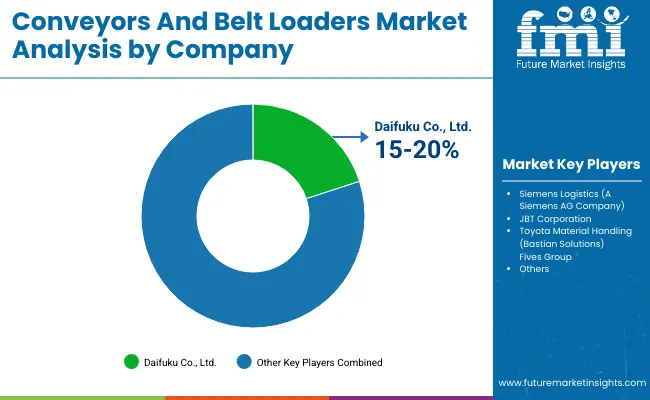

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Daifuku Co., Ltd. | 15-20% |

| Siemens Logistics (A Siemens AG Company) | 12-16% |

| JBT Corporation | 10-14% |

| Toyota Material Handling (Bastian Solutions) | 8-12% |

| Fives Group | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Daifuku Co., Ltd. | Develops automated conveyor systems, high-efficiency belt loaders, and baggage handling solutions for airports. |

| Siemens Logistics | Specializes in AI-powered conveyor belt systems for logistics, warehouse automation, and parcel sorting. |

| JBT Corporation | Manufactures electric belt loaders, aviation ground support equipment, and smart baggage conveyors. |

| Toyota Material Handling (Bastian Solutions) | Provides AI-integrated conveyor solutions, autonomous material handling, and robotic loading systems. |

| Fives Group | Offers high-speed conveyor technology for industrial automation and high-volume baggage processing. |

Key Company Insights

Daifuku Co., Ltd. (15-20%)

Daifuku has a dominant position with conveyors and belt loaders, with offerings including fully automatic logistics solutions, airport luggage handling systems, and AI-based conveyor tracking.

Siemens Logistics (12-16%)

Siemens specializes in intelligent conveyor automation for warehouses, e-commerce fulfillment centers, and manufacturing assembly lines

JBT Corporation (10-14%)

With advanced State-of-the-Art belt loaders and other various service equipment, JBT are industry leaders in airport baggage handling optimization.

Toyota Material Handling (Bastian Solutions) (8-12%)

Toyota robotic conveyor systems act as the backbone of warehouse automation and offers high-speed, low-maintenance operation.

Fives Group (5-9%)

The Fives group is the operator of intelligent conveyor and belt loader systems designed for the flexible and high-performance industrial logistics.

Other Key Players (40-50% Combined)

Next-gen conveyor belt innovations, AI-powered tracking solutions, and sustainable belt loader designs: next-gen conveyor belt innovations, AI-powered tracking solutions, and sustainable belt loader designs. These include

The overall market size for Conveyors and Belt Loaders Market was USD 11.1 Billion in 2025.

The Conveyors And Belt Loaders Market is expected to reach USD 19.2 Billion in 2035.

The demand for the conveyors and belt loaders market will grow due to increasing automation in manufacturing and logistics, rising air cargo and e-commerce activities, expanding industrialization, and the need for efficient material handling solutions to improve productivity and operational efficiency.

The top 5 countries which drives the development of Conveyors and Belt Loaders Market are USA, UK, Europe Union, Japan and South Korea.

Belt Conveyors and Pallet Conveyors Drive Market to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pack Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Chain Conveyors Market Size and Share Forecast Outlook 2025 to 2035

Vibrating Feed Conveyors Market

UV-C Sterilizing Conveyors Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA