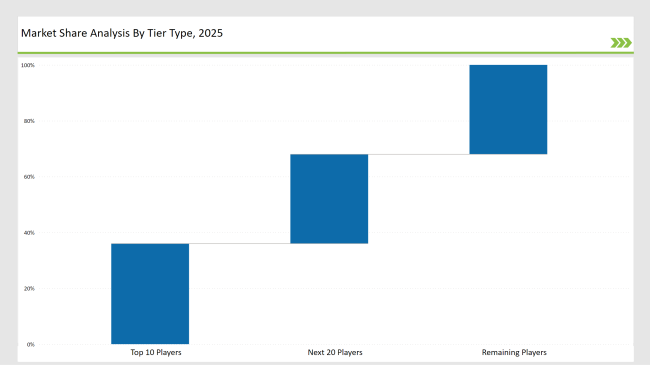

The steady growth for the converter aluminum foil market comes from growing demand for lightweight, flexible, and high-barrier packaging solutions. The market is divided into three tiers based on production capacity and market share. Leading companies such as Amcor, Novelis, and UACJ Corporation dominate 35% of the market, leveraging cutting-edge manufacturing technologies, robust global distribution networks, and a commitment to continuous innovation.

Tier 2 includes Reynolds Group, Hindalco, and China Hongqiao Group, which control 30% of the market. These companies serve mid-sized businesses by offering cost-effective, customized foil solutions for packaging and industrial applications. Tier 3 players hold the remaining 35%, consisting of regional and niche manufacturers focusing on specialized applications such as food service, pharmaceuticals, and flexible packaging.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Novelis, UACJ Corporation) | 18% |

| Rest of Top 5 (Reynolds Group, Hindalco) | 12% |

| Next 5 of Top 10 (China Hongqiao Group, Alcoa, Carcano, Aleris, Toyo) | 5% |

The converter aluminum foil market serves various industries, including

To address evolving industry demands, companies focus on

Companies are making investments in the new technologies of materials and sustainable alternatives to achieve regulatory and consumer requirements for eco-friendly packaging.

There is an investment in automation, AI-driven quality control, and sustainable materials. Increased competition is the result as companies expand their research and development in introducing next-generation aluminum foil solutions with improved efficiency and performance.

Year-on-Year Leaders

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

| Tier 1 | Amcor, Novelis, UACJ Corporation |

| Tier 2 | Reynolds Group, Hindalco, China Hongqiao |

| Tier 3 | Alcoa, Carcano, Aleris, Toyo |

| Manufacturer | Latest Developments |

|---|---|

| Amcor | In March 2024, expanded recyclable aluminum foil solutions for packaging applications. |

| Novelis | In August 2023, launched lightweight, high-performance foil for flexible packaging. |

| UACJ Corporation | In May 2024, introduced high-durability, corrosion-resistant aluminum foils. |

| Reynolds Group | In Nov 2023, developed ultra-thin, high-quality aluminum foils for various applications. |

| Hindalco | In Feb 2024, invested in AI-driven production processes for sustainable aluminum foil. |

| China Hongqiao | In Jan 2024, expanded its production capacity to meet rising global demand for foil packaging. |

| Carcano | In Apr 2024, introduced innovative, high-barrier foil for pharmaceutical packaging. |

| Toyo | In June 2024, developed eco-friendly aluminum foil laminates for food preservation. |

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

The aluminum foil industry, in converting applications, is continually evolving by adding automation, materials innovation, and sustainability developments. Companies are also integrating blockchain technology for traceability, closed-loop recycling investments, and developing smart packaging solutions that improve efficiency and environmental performance.

Increasing investment in AI-driven predictive maintenance is further optimizing manufacturing processes. Additionally, the development of ultra-thin, high-strength foils is improving cost-effectiveness and reducing material consumption.

Leading players include Amcor, Novelis, UACJ Corporation, Reynolds Group, and Hindalco.

The top 3 players collectively account for approximately 18% of the global market.

The market concentration is considered medium, with top players controlling 35%.

Key drivers include sustainability, automation, material innovation, and regulatory compliance.

Asia-Pacific and Latin America are expected to lead in growth, while Europe and North America focus on regulatory compliance and advanced recycling solutions.

Explore Function-driven Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.