The market for converted flexible packaging is growing rapidly due to the increasing demand for lightweight, cost-effective, and sustainable packaging solutions. Companies are focusing on advanced material technologies, eco-friendly designs, and enhanced barrier properties to meet global environmental regulations and evolving consumer preferences. Moreover, automation and digital printing innovations are improving production efficiency and customization capabilities, further fueling market growth.

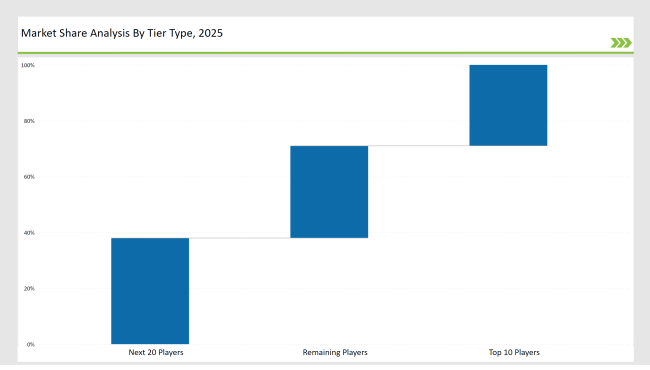

Tier 1 industry leaders such as Amcor, Sealed Air, and Berry Global dominate 29% of the market by leveraging cutting-edge manufacturing processes, global distribution networks, and continuous product innovation.

Tier 2 players, including Mondi Group, Constantia Flexibles, and Coveris, control 38% of the market. These firms cater to mid-sized businesses by offering customized, high-performance converted flexible packaging solutions, benefiting from cost-efficient production and strict regulatory compliance.

Tier 3 consists of regional and niche manufacturers specializing in food, healthcare, and personal care packaging, representing the remaining 33% of the market. These companies serve specific consumer needs with tailored designs, localized supply chains, and adaptive production methods to accommodate emerging industry trends.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Amcor, Sealed Air, Berry Global) | 16% |

| Rest of Top 5 (Mondi Group, Constantia Flexibles) | 8% |

| Next 5 of Top 10 (Coveris, ProAmpac, Glenroy, Sonoco, UFlex) | 5% |

The converted flexible packaging market caters to various industries that require innovation, sustainability, and cost efficiency. Emerging markets are accelerating demand, especially in food, beverage, and pharmaceutical sectors.

To meet the evolving industry demands, manufacturers focus on improving material efficiency, reducing environmental impact, and enhancing packaging performance.

Manufacturers will intensify the competition through AI-driven quality control, automation, and the use of friendly ecology materials. Companies increase the R&D investments to make a cost-efficient, sustainable flexible packaging light in strength and flexibility. The advancement in digital printing has improved mass customization and optimized reduction in lead times and branding.

Technology suppliers should integrate smart packaging solutions and enhance sustainable material offerings to meet industry trends. Collaborating with raw material providers can drive cost-efficient and innovative flexible packaging solutions.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Amcor, Sealed Air, Berry Global |

| Tier 2 | Mondi Group, Constantia Flexibles |

| Tier 3 | Coveris, ProAmpac, Glenroy, Sonoco, UFlex |

Leading manufacturers are expanding production capabilities, incorporating sustainable materials, and developing smart packaging features.

| Manufacturer | Latest Developments |

|---|---|

| Amcor | Introduced a fully recyclable high-barrier flexible pouch in March 2024. |

| Sealed Air | Launched ultra-lightweight, sustainable flexible films in August 2023. |

| Berry Global | Developed flexible packaging with 50% post-consumer recycled content in May 2024. |

| Mondi Group | Expanded regional manufacturing for increased supply chain efficiency in November 2023. |

| Constantia Flexibles | Released ultra-lightweight pharmaceutical flexible packaging in February 2024. |

| Coveris | Enhanced its flexible packaging portfolio with digital printing solutions in January 2024. |

| ProAmpac | Focused on innovative resealable flexible pouches for food applications in April 2024. |

The competitive landscape in the converted flexible packaging market is evolving rapidly. Key players are investing in sustainability, automation, and advanced barrier technologies to maintain a strong market position.

Growth drivers in the market will be automation, material innovation, and sustainability. Companies will implement smart tracking systems, invest in compostable materials, and improve product performance. The functional and customizable packaging in food, beauty, and pharmaceutical industries will further boost market growth. Manufacturers will focus on AI-driven quality control to minimize defects and enhance production efficiency. Digital printing technology will help with faster turnaround times and personalized packaging solutions. Also, companies will build multi-layered barrier films for better preservation of products and shelf life. Further investment in the circular economy will increase the speed of sustainable packaging development.

Leading players include Amcor, Sealed Air, Berry Global, Mondi Group, and Constantia Flexibles.

The top 3 players collectively control 16% of the global market.

The market shows medium concentration, with top players holding 29%.

Key drivers include sustainability, automation, material innovation, and regulatory compliance.

Vietnam Plastic Pail Market Analysis by Material, Capacity, End Use, and Sub-Region 2025 to 2035

Western Europe Barrier Coated Paper Market by Material, Coating, Application, End user, and Country 2025 to 2035

Bamboo Packaging Market Trends – Innovations & Growth 2025 to 2035

Balsam Bottle Market Analysis – Size, Growth & Forecast 2025 to 2035

Korea Industrial Electronics Packaging Market Analysis by Material Type, Product Type, Packaging Type, and Province through 2035

Snap-Lock Closure Market Analysis by Material Type, Application, and Region through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.