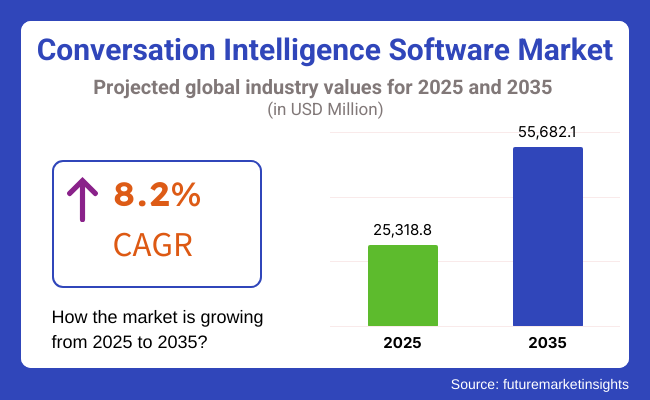

The global sales of Conversation Intelligence Software are estimated to be worth USD 25318.8 million in 2025 and anticipated to reach a value of USD 55682.1 million by 2035. Sales are projected to rise at a CAGR of 8.2% over the forecast period between 2025 and 2035. The revenue generated by Conversation Intelligence Software in 2024 was USD 23400.0 million. The market is anticipated to exhibit a Y-o-Y growth of 8.2% in 2025.

The global Conversation Intelligence Software Market, focuses on which, is AI-powered in gives a voice and textual-based conversations and extracts valuable insights for the businesses. These platforms use natural language processing (NLP), machine learning (ML), and speech analytics for sales, customer service, and operational decision-making. Automatically transcribing, summarizing, and analyzing conversations, businesses gain deeper visibility into customer sentiment, sales performance, and engagement trends.

Widely adopted by sales teams, customer support centers, and enterprises, conversation intelligence software benefits coaching, compliance monitoring, and revenue forecasting. As we see greater adoption of AI across call centers, remote work environments, and sales intelligence tools, the demand for these solutions will only continue to grow. The market is projected to experience massive growth as companies drive towards data-led decision making, propelled by advancements in AI and automation technologies.

AI-powered analytics, speech recognition, and natural language processing (NLP) tools drive rapid market growth of Conversation intelligence software across industries. Companies have been using these solutions to understand customer interactions, improve sales productivity, and fine-tune customer service. Strong demand is seen in call centers, sales teams, healthcare, and financial services. The growing trend of remote work and automation, along with customer engagement analytics, is also driving the market growth.

Consequently, cloud-based deployment models are becoming increasingly popular, as they provide scalability and cost efficiency. North America holds the largest market share due to the adoption of the early technology while Europe and Asia-Pacific are at the second and third places as they are going through digital transformation at an accelerating pace.

The market can expect a lot of growth with improving AI, big data analytics, and conversational AI. Companies are investing in enterprise intelligence and data-driven business strategy improvements, and this focus will drive growth in the market.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global Conversation Intelligence Software market over several semi-annual periods spanning from 2025 to 2035. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 7.3%, followed by a slightly higher growth rate of 7.9% in the second half H2 of the same year.

| Particular | Value CAGR |

|---|---|

| H1, 2024 | 7.3% (2024 to 2034) |

| H2, 2024 | 7.9% (2024 to 2034) |

| H1, 2025 | 8.2% (2025 to 2035) |

| H2, 2025 | 8.6% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035 the CAGR is projected to increase slightly to 8.2% in the first half and remain relatively moderate at 8.6% in the second half. In the first half H1 the market witnessed a decrease of 50 BPS while in the second half H2, the market witnessed an increase of 40 BPS.

Increasing Adoption of AI-Powered Sales and Customer Analytics to Improve Revenue Performance.

The increase in adoption of AI-based Sales intelligence and customer analytics is another factor fueling the growth of Conversation Intelligence Software Market. AI enabled ML and NLP algorithms are being used by businesses to analyze customer conversations to identify their intent to buy or to predict the outcome of a sale. Sales teams marvel at automated coaching, real-time feedback to improve deal closures, and the recommendations of personalized engagement strategies.

Furthermore, organizations utilize these insights to improve marketing strategies, strengthen customer experiences and optimize support interactions. This ability of AI to derive insights from various types of voice and text data in real-time holds tremendous potential across the e-commerce, BFSI and healthcare industries where customer engagement has a direct impact on revenue generation and profitability.

Rising Demand for Real-Time Speech Analytics and Sentiment Analysis Across Industries.

Increase in focus on real-time analytics of speech and sentiment analysis is boosting the demand for the conversation intelligence software. Organizations ranging from customer service to banking to healthcare are employing AI-powered analytics to track customer interactions, analyze sentiment, and identify compliance risks. These solutions allow organizations to accelerate response times, improve service quality, and reduce customer attrition.

Enterprise-level features like emotion detection, voice biometrics, and automatic transcription allow companies to delve deeper into customer preferences and behavior. Businesses can detect communication trends, automate compliance checks, and initiate proactive customer engagement techniques. More omnichannel interactions are taking place every day - through various voice, email, and chat platforms - and the industry will see greater adoption of real-time analytics in the coming years.

Growing Integration with CRM and Business Intelligence Platforms to Optimize Enterprise Workflows

The integration of conversation intelligence software onto CRM (Customer Relationship Management) and business intelligence (BI) platforms. There is increasing demand for seamless workflows that tie together sales, marketing and customer service data into a single platform. EXAMPLES: Automated call logging, conversation analysis, and insight generation: Conversation intelligence tools help you to enhance your CRM with enriched call data, rich customer interactions with context triggered actions that can drive better lead qualification and follow-up.

DM integrations support visualization of conversational trends and pushing KPIs to improve enterprise performance. In addition, vendors are also extending their platforms with API-first approaches and plug-and-play integrations with Salesforce, HubSpot and Microsoft Dynamics, making it much easier for businesses to deploy AI-powered conversation analytics. Such trend is especially strong in enterprises who want to drive data-empowered decision making and enhance overall customer lifecycle management.

Data Privacy and Compliance Challenges in Handling Sensitive Customer Conversations

Privacy and compliance regulations- One of the major restraints for Conversation Intelligence Software Market. These platforms manage a significant volume of customer interactions, call recordings, and sensitive company information, which are all subject to strict regulations including but not limited to GDPR (General Data Protection Regulation), CCPA (California Consumer Privacy Act), and HIPAA (Health Insurance Portability and Accountability Act) compliance.

Organizations in highly regulated industries like finance, healthcare and legal services must ensure recorded interactions are in line with data protection laws. Moreover, concerns about data security breaches, unauthorized access, and micro-management in monitoring employee calls using AI severely limit the potential for adoption.

More enterprises are turning to an on-premise or private cloud solution with added encryption capabilities, user access controls, and audit logs to minimize compliance-related risk. Organizations leverage AI-driven conversation intelligence platforms; hence, vendors need to consistently improve their security structure to overcome these concerns and foster trust among enterprises.

The global Conversation Intelligence Software industry recorded a CAGR of 7.9% during the historical period between 2020 and 2024. The growth of Conversation Intelligence Software industry was positive as it reached a value of USD 23400.0 million in 2024 from USD 17072.9 million in 2020.

The Conversation Intelligence Software Market grew at a high CAGR during the assessment period (2020 to 2024), due to increasing demand for AI, NLP, and speech analytics across industries Increasing demand for remote sales enablement, virtual customer service, and automated coaching solutions further drove the expansion of the market.

In particular, enterprises, especially those in BFSI, healthcare, and retail, leaned on AI-powered conversation analytics to maximize sales strategies and improve customer engagement. The market experienced a growth rate of double digits, predominantly been the cloud-based deployment format due to scalability and cost-effectiveness.

Between 2025 and 2035, conversation intelligence software is projected to experience an exponential surge in demand as real-time voice intelligence, hyper-personalization, and deeper AI-CRM integrations emerge. The adoption will be further enhanced by advancements in Faamsa and other technologies, such as multilingual speech processing, voice biometrics, and emotion detection.

Also sustained demand will come from expanded use cases in compliance monitoring, fraud detection and workforce optimization. As AI and automation become more sophisticated, businesses will sink additional budgets into enterprise-grade analytics and industry-specific solutions, defining the future market landscape.

Tier 1: Gong. io, Chorus. ai (ZoomInfo), Salesloft. These companies will dominate the conversation intelligence software market, with AI-driven sales analytics, real-time coaching, and automated call transcription. They provide services to large enterprises and Fortune 500 firms, offering smooth integration with CRM software like Salesforce and HubSpot. Their solutions utilize advanced machine learning, natural language processing, and predictive analytics to maximize sales success.

They remain at the top through unending innovation, deep funding, and smart acquisitions. Gong. io is known for its in-depth sales insights - Chorus. ai (which was acquired by ZoomInfo) is an example of this, improving revenue intelligence. Salesloft combines AI with conversation intelligence, and the company-embraced by large sales teams and enterprises-offers a sales engagement tool.

Tier 2: CallRail, Dialpad, Wingman (Clari), Talkdesk. These companies specialize in AI-based call analytics, engagement, and voice intelligence for mid-size and niche markets. Dialpad has great cloud-based communication with AI voice transcription, and CallRail focuses more on call tracking for marketing analytics. Wingman (which was acquired by Clari) is also expanding rapidly with its offering of real-time sales coaching and conversation insights built for B2B businesses.

As the industry-leading cloud contact center technology, Talkdesk is the only provider of contact center AI solutions with integrated conversation intelligence for customer service teams. Tier 2 players include those focused on affordability, AI-fueled automation and CRM connectivity, and enable companies to automate and gain efficiencies in sales and customer support processes, while competing with Tier 1 players.

Tier 3: Jiminny, ExecVision, Observe. AI. Fast forward to 2018 and the rise of conversation intelligence players targeting SMBs that are capable of not only providing a wealth of features but also being affordable and flexible. Jiminny delivers conversation insights powered by AI, with a heavy emphasis on sales coaching and pipeline optimization.

ExecVision stands out to the crowd with AI-generated call coaching and compliance monitoring for highly regulated industries such as finance and health care. Observe. AI provides contact center AI, leveraging speech analytics for better quality of service and optimization of the workforce. These companies appeal to growing businesses that seek to improve sales and customer interactions with low cost, industry specific AI-powered insights that act as plugins for existing processes.

The section below covers the industry analysis for the Conversation Intelligence Software market for different countries. The market demand analysis on key countries in several countries of the globe, including USA, Germany, UK, China and India are provided.

The united states are expected to remains at the forefront in North America, with a value share of 65.2% in 2025. In South Asia & Pacific, India is projected to witness a CAGR of 8.5% during the forecasted period.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

| Germany | 6.4% |

| UK | 6.9% |

| China | 8.2% |

| india | 8.5% |

Rapid AI adoption, widespread enterprise adoption, and a mature tech ecosystem have made the USA the largest market for Conversation Intelligence Software. Several major companies in the BFSI, healthcare, retail, and technology sectors are pouring money into AI-driven sales analytics and customer engagement platforms. The dominating presence of AI-powered software companies such as Gong. io, Salesloft, and Dialpad5 increase market penetration.

Another reason is the USA’s dominance in CRM solutions (Salesforce, HubSpot) creates strong integration opportunities for the conversation intelligence software. High penetration of internet in the country, digital transformation initiatives, and remote work trends further propel the demand. Due to the growing investitures in AI/ML based real time voice insights, speech analytics, and AI-based coaching solutions, the USA is expected to remain the largest and most technologically advanced trans-national market in this space.

AI-driven automation, rising customer insight demand, and the growth of AI-powered call centers have led to the rapid acceptance of Conversation Intelligence Software in Japan. The highly structured nature of corporate Japan places great emphasis on precision, efficiency, and data-driven decision-making - all of which makes conversation intelligence a key asset for sales and customer service optimization. Japanese general companies in the banking, insurance, telecommunications, and e-commerce sectors utilize AI-powered speech analytics to improve customer engagement and ensure compliance monitoring.

NLP capabilities specifically designed for Japanese language also exist, further speeding up the adoption. Furthermore, the aging workforce in countries like Japan and an increased focus on AI-powered automation in contact centers are expected to drum up investment in conversation intelligence, making it an important market for AI-based voice analytics and business intelligence solutions.

The China Conversation Intelligence Software market is experiencing rapid growth owing to government-driven investments in AI, and significant e-commerce industry and rapid adoption of cloud-based speech analytics. The country’s tech big guns (Alibaba, Tencent, Huawei) are massively investing in AI-based voice intelligence, conversational AI and sales automation platforms.

In China’s bustling e-commerce and fintech sectors, AI-driven conversation intelligence works behind the scenes to power real-time customer interactions, automated sales coaching and even fraud detection.

Increasing pressure to adopt multilingual speech processing technologies as well as advanced voice biometrics are other factors driving demand. Apart from this, with growing digitalization in the financial services and regulatory compliance areas, the enterprises are opting for AI-powered conversation intelligence solutions, thereby, making China one of the fastest-growing market in the predicted market.

The section contains information about the leading segments in the Conversation Intelligence Software industry. by End Users, the Large Enterprises segment has holding the share of 55.6% in 2025. Moreover, By Deployment, the Cloud-based segment is estimated to grow at a CAGR of 9.1% during the forecasted period.

| End Users | Share (2025) |

|---|---|

| Large Enterprises | 55.6% |

The conversation intelligence software has several sub-segments such as large enterprises, small and medium enterprises (SMES) and others. The majority share in the market is acquired by the large enterprises due to the growing need for AI-powered analytics, advanced sales intelligence and scalable customer engagement solutions. Industries such as BFSI, healthcare, retail and IT & telecom utilize conversation intelligence software for improved sales coaching, customer interaction monitoring and automatic compliance tracking.

For these organizations, real-time call analytics, sentiment analysis, and AI-driven decision-making tools are essential to improve sales strategies and enhance customer support operations. Enterprise: Seamless integrations to your CRM platforms (Salesforce, Microsoft Dynamics, HubSpot) products that will help drive better workflows.

Growing investments in AI, big data, and cloud-based infrastructure - Larger enterprises continue to fuel robust demand for conversation intelligence solutions, cementing their defining position in the landscape.

| Deployment | CAGR (2025 to 2035) |

|---|---|

| Cloud-based | 9.1% |

By deployment type, the cloud based deployment segment is growing at the highest CAGR in the Conversation Intelligence Software Market, deduced to its scalability, cost-effectiveness along with being easy to integrate with enterprise applications. Cloud-based solutions typically have lower upfront costs them on premise counterparts, flexible pricing (such as subscription-based SaaS), and remote accessibility, making them preferable for global sales teams and customer support centers.

Cloud-based conversation intelligence platforms utilize AI-powered speech analytics, real-time call transcription, and predictive insights without needing any hefty on premise infrastructure. The increased adoption of cloud-based hybrid and multi-cloud environments is also driving demand, particularly in industries such as e-commerce, telecom, and BFSI, where organizations are looking to leverage AI-powered customer engagement solutions.

Cloud-based conversation intelligence software will dominate the fastest growing market in the forecast period as organizations take a data-driven decision-making approach and an Omni channel sales strategy.

The conversation intelligence software market is highly competitive, with key players focusing on AI-driven innovation, CRM integrations, and industry-specific solutions. Market leaders such as Gong. io, Chorus. These leading platforms (i.e. ai (ZoomInfo), Salesloft) using machine learning to provide deep sales intelligence, common-sense speech analytics, and predictive insights. Mid-tier companies such as Dialpad, CallRail, and Wingman (Clari) rely on call tracking, real-time coaching, and SMB-centric solutions.

With a focus on this, the market is observing a growing number of strategic acquisitions, partnerships, and AI improvements for speech recognition, sentiment analysis, and multilingual processing capabilities. Vendors are focusing on cloud & cloud-based platforms which is gaining momentum for security, scalability and API based integrations.

To date, AI has been a high-growth sector on the enterprise technology stack and as enterprises invest in an ever-widening range of AI-driven customer engagement and sales automation, competition among new entrants and established vendors continues to increase, leading to innovation as providers seek to gain market share amidst a growing demand.

Recent Industry Developments in Conversation Intelligence Software Market

The global Conversation Intelligence Software industry is projected to witness CAGR of 8.2% between 2025 and 2035.

The global Conversation Intelligence Software industry stood at USD 25318.8 million in 2025.

The global Conversation Intelligence Software industry is anticipated to reach USD 55682.1 million by 2035 end.

East Asia is set to record the highest CAGR of 8.7% in the assessment period.

The key players operating in the global Conversation Intelligence Software industry include Gong.io, Chorus.ai (ZoomInfo), Salesloft, Dialpad, CallRail and others.

In terms of Deployment, the segment is segregated into On-Premise and Cloud-Based solutions.

In terms of End Users, the segment is distributed into SMEs and Large Enterprises.

In terms of Vertical, the segment is categorized into IT & Telecommunications, Retail, BFSI, Real Estate, and Other Verticals.

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & pacific, Middle East and Africa (MEA) have been covered in the report.

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Microsoft Dynamics Market Trends - Demand & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.