Furthermore, the COVID-19 outbreak has led to a greater demand for hygiene and cleanliness, resulting in a growing need for professional cleaning services, thereby creating a positive outlook for the global Contractual Cleaning Services market from 2025 to 2035.

Whether it is an office space, a hospital, a retail chain or a manufacturing unit, the hygiene and sanitization of all workspaces is a requirement from a hygiene perspective as well as a workplace safety compliance perspective, that is where contractual cleaning services come to the rescue. Rising adoption of green cleaning methodologies, along with technological advancements in cleaning technology and automation are fueling market growth.

Furthermore, the continuous evolution of this industry is driven by the expansion of facilities management services, growing investment in smart cleaning solutions, as well as increasing consumer awareness related to hygiene and disinfection.

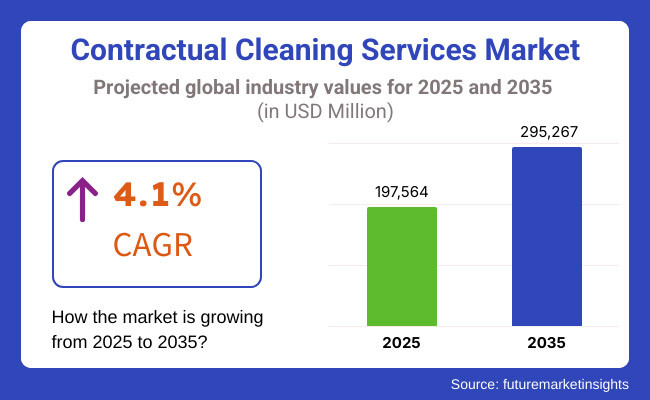

The contract cleaning services market was around USD 197,564 Million worth of in 2025. Forecasted to increase by USD 295,267 Million by 2035, at a CAGR of 4.1% in the upcoming years. This growth is mainly attributed to growing awareness relating to workplace hygiene, stringent hygiene regulatory frameworks in healthcare and hospitality and increasing investments in sustainable cleaning solutions.

Furthermore, the increasing adoption of AI-based cleaning automation, smart disinfection technology and cost-effective operational models are aiding the market growth. In addition, provision of specialized cleaning services of high-risk places like hospitals and food processing units is also majorly contributing in the market penetration and customer acceptance.

Explore FMI!

Book a free demo

North America is the largest market for contractual cleaning services, due to strong regulatory frameworks, high level of awareness of hygiene standards and significant demand from corporate and institutional clients-this trend is also reflected on the latest report directly mentioned above and indicates the continuing importance of contractual cleaning services in that region.

Countries across North America, particularly the United States and Canada, are at the forefront of this trend, having embraced special types of cleaning services such as green cleaning, electrostatic disinfection, and robotic cleaning solutions.

Growing post-pandemic cleaning protocols demand, regulation on workplace sanitation, and outsourcing of cleaning services by enterprises are supporting the growth of the market. And the trend of subscription-based cleaning service models and digital booking platforms also contribute to the growth of the industry.

Europe’s market is shaped by the growing demand for sustainable cleaning solutions, favorable government initiatives promoting workplace hygiene, and innovations in automated cleaning technologies. Germany, France, and the UK, and some of the leading countries that are working on developing high-efficiency cleaning solutions for commercial buildings, public institutions, and healthcare facilities.

The increasing focus on environmentally friendly cleaning chemicals, smart cleaning robotics, and research for antimicrobial surface coatings is also supporting market adoption. Apart from that, the increasing use of industrial deep cleaning, hospitality sanitation, and facility management outsourcing services is providing further potential for cleaning service providers.

Contractual cleaning services market in Asia Pacific is expected to grow at the highest CAGR during the forecast period due to faster urbanization, increasing number of commercial real estate projects, and rising concern about health and hygiene. Commercial cleaning infrastructure is witnessing significant investments from China, India, and Japan, which is further complemented by a growing trend towards outsourcing facility maintenance services and smart cleaning solutions.

Rapidly growing demand for hygiene-centric services in shopping malls, offices, hotels, and hospitals, as well as changing government regulations regarding sanitation practices will progressively drive regional market expansion.

Moreover, a growing awareness regarding disinfection services, integration of facility management in disinfection services, and robotic cleaning basics based on artificial intelligence are also contributing to increasing penetration of the market. Domestic cleaning service providers and partnerships with global facility management companies are also injecting the market growth.

The Latin American market is steadily growing on the back of rising awareness about sanitation standards, increasing demand for professional cleaning services and the growing trend of outsourcing in the corporate and the industrial sectors. Countries driving growth in the market like Brazil and Mexico are channeling focus towards increasing accessibility to industrial-grade contractual cleaning services to various industry verticals including but not limited to hospitality, healthcare, and manufacturing.

Sustainable cleaning chemicals, economical service models, and promotional campaigns for hygiene maintenance are also the factors contributing to the market growth. Moreover, the implementation of government sanitation programs, a surge in investments for cleaning of industrial facilities, and fetal cleaning driven demand for residential cleaning services is improving access to the service across the region.

After the European & Americas regions, the Middle East & Africa is the slowest-growing market for Contractual cleaning services owing to the less sustainability and geographical areas for cleaning drive and even for maintenance of cleaning service contracts, but it is gradually emerging as a part of the growing plans for local infrastructure, bands for cleaning services in tourism, and for commercial real estate property management.

By OCTOBER 2023 responsblade.org The UAE and Saudi Arabia are at the forefront in optimizing service availability and technology in this space. Technological advancements in facility management, increase in demand for deep cleaning especially in luxury hotels and commercial buildings, and growing partnerships between international and local cleaning service providers are other factors fuelling growth of this market.

Moreover, favorable government policies regarding workplace hygiene, innovations in automated and robotic cleaning systems, and demand for disinfection solutions driven by consumers are supporting long-term industry expansion. Increasing adoption of hygiene awareness campaigns and growing presence of professional cleaning service providers in the region are also driving the market growth.

The market for Contractual cleaning services is expected to grow at a steady pace over the coming years, given the continuous developments in cleaning technologies, sustainable chemical formulation and automation-driven sanitation systems. In the quest for efficiency, market appeal, and long-term customer retention, companies are driving innovation in AI-powered cleaning robots, eco-friendly disinfectants, and digital booking platforms.

Furthermore, a growing consumer awareness of workplace cleanliness, the incorporation of digitalisation into service management and the move towards fixed-price facility maintenance are shaping what the future of the industry looks like.

Globally, the need for optimizing operational efficiency and providing top-notch contractual cleaning services have become achievable with the integration of AI-powered cleaning analytics, IoT-enabled hygiene monitoring, and Green cleaning certification programs.

Challenge

Rising Labor Costs and Workforce Shortages

Rising labor costs and an ongoing shortage of skilled cleaning personnel present challenges for the Contractual cleaning services market. Tighter minimum wage legislation, employee benefits, and labor law compliance have increased the operational costs of cleaning service providers.

High turnover and a lack of retention of experienced staff are also prevalent issues, creating workforce management problems. Thereby, the companies should make an effort to conduct employee training programs, provide competitive pay scales, and implement automated and robotic cleaning solutions to limit the costs associated with manual labor.

Stringent Hygiene and Environmental Regulations

Government agencies and more industry regulators are tightening hygiene, sanitation and environmental requirements for cleaning service providers. Regulatory standards [such as Occupational Safety and Health Administration (OSHA) standards, Environmental Protection Agency (EPA) guidelines, and COVID-19 sanitation measures] have added complications to operations.

Moreover, it involves the adoption of eco-friendly cleaning practices that necessitate the use of biodegradable cleaning agents and an investment in green cleaning technologies driven by increased demand for sustainable waste management practices. To comply with regulations and ensure client confidence, organizations need to implement sustainable practices, obtain industry quality assurance certifications, and implement quality management processes.

Opportunity

Growing Demand for Specialized Cleaning Services

Specialized cleaning services are in increasing demand due to the need for better sanitation and disinfection services within healthcare, hospitality, commercial and industrial sectors. Deep cleaning, antimicrobial surface solutions, and cleaner air appliances are seeing a boom in demand as consumers increase hygiene awareness from the pandemic.

Also, as companies and other establishments are now focusing on long-term cleaning services to remain hygienic-based and maintain compliance. Organizations providing customized cleaning services, innovative sanitation technologies, and industry-specific knowledge will harness this increasing demand and grow their market share.

Advancements in Automation and Smart Cleaning Technologies

Automated, AI and IoT-enabled Cleaning Solutions are Revolutionizing the Contractual Cleaning Services Market Robotic vacuum cleaners, UV-disinfection robots, and AI-powered quality control systems are improving efficiencies, lowering costs, and reducing human error.

Smart propulsion systems have also contributed to improved efficiency. In the evolving landscape of cleaning services, the companies that will survive and thrive are the ones that are investing in robotic cleaning technology, IoT-based monitoring, and AI-driven service customization.

Contractual cleaning services market Trends: Market Dynamics and Future Outlook (2025 to 2035) Between 2020 and 2024, the Contractual cleaning services market experienced significant shifts due to the increased demand for sanitation stemming from the impact of the COVID-19 pandemic.

Businesses turned their focus to regular deep cleaning, managing air quality, and ensuring compliance with hygiene, which led to a notable uptick in demand for cleaning contracts from specialists. Yet labor shortages, cost pressures and regulatory compliance posed operational challenges. In response, companies implemented green cleaning solutions, enhanced workforce training, and used digital management tools to optimize service delivery.

In fact, between 2025 to 2035, we can expect to see the market being propelled by even more advanced automation, service optimization through AI, and sustainable cleaning practices. The introduction of fleets of robotic cleaners, real-time tracking of cleanliness, and nanotechnology-based coatings for surfaces will set new industry norms.

Furthermore, cleaning using eco-friendly products, smart facility management, and contract sanitation services would lead to the market development. Only the few who embrace technology, sustainability, and service innovation will be the leaders in the next generation of contractual cleaning services.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter COVID-19 sanitation mandates and workplace hygiene requirements |

| Technological Advancements | Growth in electrostatic spraying, UV-disinfection, and fogging technology |

| Industry Adoption | Increased demand for disinfection in healthcare and commercial spaces |

| Supply Chain and Sourcing | Dependence on chemical-based cleaning products and manual labor |

| Market Competition | Dominance of traditional cleaning service providers |

| Market Growth Drivers | Demand for deep cleaning and antimicrobial treatments |

| Sustainability and Energy Efficiency | Initial focus on reducing chemical waste and energy consumption |

| Integration of Smart Monitoring | Limited use of IoT-enabled cleanliness tracking |

| Advancements in Cleaning Innovation | Adoption of green-certified cleaning solutions and high-efficiency tools |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Expansion of global eco-cleaning standards, AI-driven compliance monitoring, and carbon-neutral service solutions |

| Technological Advancements | Expansion of autonomous cleaning robots, AI-powered quality assurance, and real-time cleanliness tracking |

| Industry Adoption | Widespread integration of smart cleaning systems, data-driven facility maintenance, and predictive cleaning analytics |

| Supply Chain and Sourcing | Shift toward biodegradable cleaning agents, AI-managed inventory control, and automation-driven cleaning solutions |

| Market Competition | Rise of tech-driven cleaning startups, robotic cleaning firms, and on-demand service platforms |

| Market Growth Drivers | Expansion of subscription-based cleaning services, smart facility management, and eco-friendly cleaning contracts |

| Sustainability and Energy Efficiency | Large-scale implementation of water-saving cleaning systems, sustainable packaging, and net-zero cleaning services |

| Integration of Smart Monitoring | AI-powered real-time hygiene monitoring, predictive maintenance, and data-driven sanitation management |

| Advancements in Cleaning Innovation | Introduction of self-cleaning surfaces, nanotechnology-based coatings, and autonomous deep-cleaning solutions |

The United States holds the largest market share of the Contractual cleaning services market owing to the growing demand for commercial cleaning solutions, increased hygiene awareness, and the rising adoption of green cleaning technologies. While the significant growth of service providers and the rise of automated cleaning equipment will boost the market.

The demand for environment-friendly and chemical-free cleaning solutions by consumers and the development of robotic cleaning systems, antimicrobial coatings, and smart cleaning devices further flex the market growth. There’s also the increased efficiency with AI-powered scheduling, IoT-enabled cleaning devices and data-oriented maintenance programs.

The report pointed out that introducing specialized cleaning services for healthcare, hospitality, corporate, etc., are also amongst the key trends contributing to the business growth. The growing adoption of outsourced cleaning services in retail, transportation, manufacturing, and other industries is further propelling market growth in the USA

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

Key Reasons to Purchase this Report: The gratifyingly Low Land Price Alienation of Commercial Cleaning Services in the UK. The UK represents a significant market for contractual cleaning services in view of the greatly restricted cleaning prerequisites, rising interest for expert facility management and an ascent in the spotlight on economical cleaning arrangements. Growing trend of outsourcing cleaning services in corporate and industrial sectors is also a major contributing factor for its demand.

Increasing market growth is also attributed to government rules to support sanitation in workplaces along with increasing uptake of green cleaning chemicals and energy-efficient cleaning equipment. Furthermore, advancements in UV-based disinfection technologies, touch-free sanitation and electrostatic spraying are starting to catch on.

Businesses are also investing in workforce training and digital reservation platforms to generate demand and strengthen customer service efficiency. In the United Kingdom, a growing consumer preference for specialized cleaning solutions for high-risk environments, including hospitals and laboratories, additionally propels the market growth. Moreover, businesses and households are opting for flexible cleaning contracts and on-demand services.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The European Contractual cleaning services market is mainly concentrated in Germany, France and Italy, which benefit from strong regulations on workplace hygiene, increasing the adoption of facility management services, and growing awareness of eco-friendly cleaning practices.

EU regulations aimed at chemical reduction in cleaning and investment in automated cleaning technology and sustainable waste management are contributing to market growth at a high pace. Moreover, the adoption of smart cleaning solutions, AI-powered quality control, and biodegradable cleaning agents to enhance service efficiency.

Growing need for hygiene-sensitive cleaning services for industries like healthcare, food processing, and hospitality is additionally contributing to the increasing market growth. Additional improvements in the quality of cleaning services throughout the EU are also being driven by the deployment of robotic cleaning technology and the introduction of AI-driven cleanliness monitoring systems.

In addition, government initiatives for green building upkeep and eco-friendly facility maintenance are hastening the transition to green cleaning services.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.1% |

Contribution in the market: Japan’s Contractual cleaning services market is thriving with the particular attention being paid towards hygiene, as demand for automated cleaning solutions and adaptability of hygiene protocols in commercial spaces is growing. Market growth is being driven by the increasing demand for highly efficient cleaning technologies in high-traffic urban environments.

The country’s focus on robotic cleaning, combined with the application of AI-powered cleaning-monitoring have ignited innovation. Furthermore, stringent government regulations for disinfection standards and growing demand for contactless cleaning services are stimulating companies to design novel solutions.

The increase of a necessity for specialized cleaning services in elderly care services, public transportation, and high rise office buildings is also driving market growth in urban areas within Japan. What’s more, the country’s commitment to UV-C disinfection robots and advanced smart cleaning tech is transforming the future of facility cleanliness.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.2% |

Contract cleaning market in South Korea is also gaining popularity owing to an increasing hygiene consciousness, higher demand for professional cleaning solutions, and government-supported sanitation programs in public settings.

Market growth is further propelled by stringent workplace hygiene regulations and rising adoption of eco-friendly cleaning products and automated cleaning solutions. Moreover, the country is working on increasing the quality of services through smart cleaning devices, AI-powered scheduling, and IoT-based sanitation tracking to improve competitiveness. Increasing need for specialized cleaning across hospitals, airports, and residential complexes shall also boost market adoption.

Companies are investing in high-tech cleaning innovations: autonomous robotic vacuums, touchless restroom sanitation, sustainable cleaning agents. Further, an increase in smart city infrastructure and digitalization in facility management across South Korea facilitates the growth of advanced contractual cleaning services in the nation.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

Cleaning the exteriors of commercial and residential premises are integral to preserving their appearance, safety and well-being. A well-maintained and inviting environment is only possible with the help of services like cleaning of parking lots, street cleaning, window washing, and others. Commercial businesses and municipalities use high-pressure washing systems, automated street sweepers, and green detergents to maintain outdoor cleanliness and compliance with sanitation regulations.

The increasing adoption of eco-friendly cleaning solutions and smart waste management systems has also accelerated the demand for professional exterior cleaning solutions. Furthermore, its growing urbanization leading to high footfalls in public areas has increased the demand for commercial vertical solutions, for sidewalks as well as building facades, which have significant growth.

Interior cleaning services are a key part of contractual cleaning and ensure that the indoor parts stay bacteria-free and hygienic and ensure a good environment. Floor and corridor cleaning, lobby maintenance, and deep-cleaning protocols for high-traffic areas are critical for sectors like healthcare, hospitality and corporate offices.

Advancements in interior cleaning operations have been in robotic vacuuming, antimicrobial surface treatments and touchless disinfection systems. The demand for sustainable and allergen-free cleaning products for residential and educational settings is also on the rise. Contractual interior cleaning services are growing to meet these changing consumer demands as businesses and households recognize the high importance of having clean indoor air quality and green cleaning solutions.

There are many uses for contracts cleaning services which is why the commercial sector accounts for the largest portion of the industry with the use of the service covering all industries from schools and colleges to hotels, health and retail and corporate office. Businesses care about cleanliness because they have to be compliant with health regulations, for customer experience and employee health.

With growing hygiene concerns and stricter sanitation standards, there is increasing demand for customized cleaning contracts, 24/7 janitorial services and specialized disinfection protocols. Furthermore, the rise of smart cleaning devices, automatic scheduling software, and sensor-based monitoring systems have enabled companies to optimize their commercial cleaning processes.

What is Professional Cleaning Services in Industrial Sector? Deep-cleansing solutions, hazardous waste removal, and high-pressure washing systems are necessary for factories, warehouses, and manufacturing plants to provide a contaminant-free environment.

Industrial grade cleaning robots, antimicrobial coatings and chemical free sanitation solutions played an important role in improving workplace hygiene and reduce environmental impact. In fact, pharmaceuticals, food processing, and automotive manufacturing verticals require high compliance with cleaning standards which is ultimately leading to increased demand for contract-based industrial sanitation services.

Growing demand for hygiene, sanitation, and facility management services across residential, commercial, and industrial sectors are expected to drive the contractual cleaning services market. As cleaning firms aim to stand out from the competition, they are making a large effort towards eco friendly cleaning solutions, automation, cleaning services outsourcing and many more. Some important trends are robotic cleaning systems, green cleaning products, and integrated facility management solutions.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| ABM Industries Inc. | 17-21% |

| ISS A/S | 13-17% |

| Sodexo | 10-14% |

| Jani-King International | 7-11% |

| Mitie Group plc | 5-9% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| ABM Industries Inc. | Leading provider of janitorial and integrated facility cleaning services for commercial and industrial clients. |

| ISS A/S | Specializes in smart cleaning solutions with a focus on sustainability and automation. |

| Sodexo | Develops hygiene and sanitation services for healthcare, corporate, and educational institutions. |

| Jani-King International | Offers franchise-based commercial cleaning services with customized solutions for various industries. |

| Mitie Group plc | Focuses on eco-friendly and technology-driven cleaning services for businesses and public institutions. |

Key Company Insights

ABM Industries Inc. (17-21%)

ABM commands the Contractual cleaning services space with a portfolio of janitorial and facility management services for large enterprises.

ISS A/S (13-17%)

With a focus on sustainability, ISS A/S offers smart cleaning solutions, including AI and IoT-enabled solutions to optimize facility maintenance.

Sodexo (10-14%)

Sodexo’s hygiene and sanitation services are second to none, especially for healthcare and education clients as well as corporate customers.

Jani-King International (7-11%)

Jani-King follows a franchise-based business model that provides specialized commercial cleaning services for various industries.

Mitie Group plc (5-9%)

Mitie focuses on sustainable, automated cleaning technologies for corporate offices, public institutions and industrial facilities.

Other Key Players (35-45% Combined)

Some emerging customers include mega-players but also global and regional service providers that generate some innovations in contractual cleaning (automation, green cleaning, deep cleaning etc.). Key players include:

The overall market size for Contractual cleaning services market was USD 197,564 Million in 2025.

The Contractual cleaning services market expected to reach USD 295,267 Million in 2035.

Factors such as growing awareness of hygiene and sanitation, increasing demand for these services from commercial and residential sectors, rising outsourcing, detached compliance standards for niche markets, and the tendency toward more ecological and advanced cleaning technologies for efficiency and cost-effectiveness will drive the growth of the contractual cleaning services market.

The top 5 countries which drives the development of Contractual cleaning services market are USA, UK, Europe Union, Japan and South Korea.

Exterior and interior cleaning services growth to command significant share over the assessment period.

E Commerce Logistics Market Analysis – Trends, Growth & Forecast 2025 to 2035

Mosquito Repellent Candles Market Analysis – Trends, Growth & Forecast 2025 to 2035

Natural Insect Repellent Market Analysis - Trends, Growth & Forecast 2025 to 2035

Agri Natural Enemy Pest Control Market Analysis – Trends, Growth & Forecast 2025 to 2035

Water Hauling Services Market Analysis by Application, End user and Region- Growth, Trends, and Forecast 2025 to 2035

E-Waste Management Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.