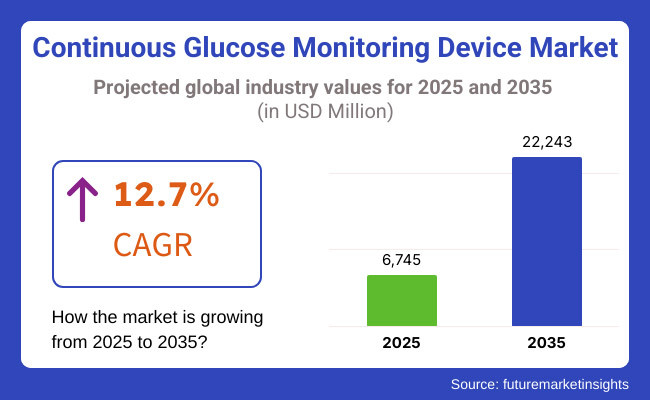

Continuous Glucose Monitoring (CGM) Device Market will expand exponentially from 2025 to 2035 after the extremely high rate of diabetes and the growing need for real-time glucose monitoring devices. The market will be approximately USD 6,745 million in 2025 and may reach USD 22,243 million in 2035 with a compound annual growth rate (CAGR) of 12.7% during the forecast period.

Three market drivers of strategic significance are the rising incidence of diabetes in the Asia-Pacific, North American, and European economies that is propelling the growing trend towards the adoption of the application of CGM devices mostly. Finger-sticking is declining with real-time feedback use of CGM systems, fewer finger-pricking occurrences, and improved disease control.

Besides it, convergence of CGM technology with insulin pumps, cell phone-based software, and artificial intelligence-based diabetes therapeutic devices enhances patient satisfaction as well as clinical outcomes. Reimbursement issues as well as very high costs are the key deterrents to market growth. These issues are being tackled by companies with cost-effective as well as easily available CGM devices.

CGM products fall under the category of stand-alone, sensor-based dual insulin pumps, and in-patient-based observation systems. Single-person CGM products are employed frequently in type 2 and type 1 diabetes patients where prolonged monitoring of the blood glucose levels is necessary. Insulins administered through pumps like Medtronic and Tandem Diabetes Care give rise to closed-loop insulin infusion pumps, the most significant advance for diabetes care.

In hospital ICUs, sensors of CGM are being used more and more to monitor critically ill patients so that complications can be avoided by preventing hyperglycemia or hypoglycemia. Regional Market Trends

Explore FMI!

Book a free demo

The North American market is the most dynamic market for CGM devices with large diabetes patient bases, a robust healthcare system, and the use of advanced technology. The United States is at the forefront, followed by leaders of big markets such as Dexcom, Abbott, and Medtronic in the North American market. The use of CGM devices among insulin-dependent diabetes patients is driving the growth of the market.

Regulatory approval, such as FDA approval for long-term wear and non-invasive continuous glucose monitoring, is also propelling adoption. Better private payers' and Medicare reimbursement policy to increase patients' access to novel glucose monitoring technology is also propelling adoption. Increasing demand for predictive analytics-facilitated and artificial intelligence-based CGM devices for patient-focused diabetes care is also prevalent in the region.

Europe is among the key market participants of the CGM device, and under their umbrella are Germany, France, and the United Kingdom, which are the key market participants. The region is witnessing a rising number of diabetic and aging populations, thereby boosting the demand for continuous glucose monitoring solutions. Moreover, efficient healthcare programs and governmental initiatives towards the management of diabetes are further propelling the market.

Regulators in Europe are enabling the construction of cheaper CGM devices so that they fit into a low-cost segment. Telemedicine therapy and online medicine services, particularly in the United Kingdom and Germany, are also inducing the demand for remote systems of CGM monitoring. Regulators wish to introduce CGM technology in form of wearables to provide mass real-time observation and ease for patients.

The Asia-Pacific region will also witness the fastest growth rate in the market for CGM devices due to a higher population of diabetics, greater healthcare expenditure, and an improved healthcare infrastructure. India, Japan, China, and South Korea are the highest consumers among them, with the highest consumer being China with the highest population of diabetics.

India's diabetic population base will be more than 100 million by 2035, thereby generating tremendous demand for the CGM device in turn. Government actions toward diabetes early detection and screening programs are enticing industry growth. Cost remains a concern in the industry, however, as companies are attempting to avoid it by launching cost-friendly CGM systems designed especially for the emerging economies.

Challenge

Staggering Costs and Reimbursement Challenges

CGM systems are quite effective, but even so they are expensive and therefore not within the reach of poor individuals anywhere in the world yet. Replacement of sensors with frequent sensor replacement is another expense for the patient. There also exist reimbursed patterns that vary geographically, and in other countries, insurance for CGM systems is still turned off, restricting access. Insurers are discovering cost-containment strategies and encouraging increased insurance coverage to provide better access to the patient.

Opportunity

Convergence of AI and Sensor Technology Innovations

Growth opportunities lie in nanotechnology, biosensor technology, and artificial intelligence innovations. Technological advancements in long-term, non-invasive, and minimally invasive CGM sensors are balancing the drawback of patient discomfort and sensor wear time. Diabetes management platforms created by AI allow for disease prediction so that patients and clinicians can make informed decisions.

Other than this, companies are developing smart CGM devices with in-built connectivity to smartphones and wearables to enhance the user experience and real-time glucose information. Trends will certainly drive market growth and the effectiveness of diabetes management worldwide.

Between 2020 and 2024, the adoption of CGM devices increased with increasing diabetes disease awareness, technology growth, and increased healthcare spending. The COVID-19 pandemic kept driving telemedicine, remote patient, and product and service monitoring expansion and introduced additional use of CGM devices for home glucose management.

The next few years will witness revolutionary evolution of CGM technology between 2025 to 2035. The technology would be headed towards non-invasive glucose monitoring, AI-driven diabetes systems, and health-tech wearables. Greater affordability and greater insurance cover would be some of the determinants that would make the CGM system viable for diabetics in general. Product development would also be encouraged as a part of sustainability initiatives as there is an attempt to reduce single-use sensor-based medical waste.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory bodies highlighted enhancing levels of accuracy and safety of CGM systems. FDA approvals for real-time monitoring systems grew. |

| Technological Advancements | Improvements in technology in the realm of designing minimally invasive sensors and smartphone app interfaces enhanced user experience. More long-lasting wearable CGM systems gained increased acceptability. |

| Adoption in Diabetes Management | Endocrinologists and diabetes doctors prescribed CGM devices primarily to Type 1 diabetes patients. Type 2 diabetes patients also slowly adopted CGM devices. |

| Connectivity & Integration | Bluetooth-enabled CGM products facilitated clandestine data transmission between healthcare providers and mobile applications. Real-time control came with insulin pump support. |

| Affordability & Insurance Coverage | CGM equipment was expensive with diminished insurance support, making access in low-income people difficult. Subscription-based sensor CGM model versions were implemented. |

| Data Security & Privacy | Initial data confidentiality and security concerns were promoted by cloud storage and third-party application connectivity. There were recommendations given by the regulating bodies about this. |

| Market Growth Drivers | Growing incidence of diabetes, patient requirement for real-time information, and technological innovation accelerated market growth. Growing demand for better glycemic control drove usage of CGM. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Strict worldwide regulations highlight cybersecurity, data privacy, and interoperability of CGM devices. Insurance coverage expansions are urged by governments to enhance access. |

| Technological Advancements | AI-powered analytics advance predictive glucose monitoring, and completely non-invasive CGM solutions appear in commercial markets. Smart insulin delivery integration with CGM is common. |

| Adoption in Diabetes Management | Mainstream adoption in Type 2 diabetes patients, prediabetic people, and general wellness tracking. Corporate wellness programs fuel usage in non-diabetic populations. |

| Connectivity & Integration | CGM systems become an integral part of smartwatches, AI-powered virtual assistants, and cloud-based health platforms for remote monitoring. Telemedicine integration further boosts real-time diabetes management. |

| Affordability & Insurance Coverage | Insurance coverage extends worldwide, and CGM becomes affordable for a larger population. Governments subsidize CGM for diabetes prevention initiatives. Sensor manufacturing cost reductions enhance accessibility. |

| Data Security & Privacy | Encrypted blockchain-based storage of CGM data ensures security and transparency. Patients have greater control over data sharing, minimizing risks of unauthorized access. |

| Market Growth Drivers | Predictive analytics aided by AI, greater emphasis on preventive medicine, rising need for customized medicine, and the spread of digital health environments drive the expansion of the CGM market. |

United States has an enormous market for CGM devices with increasing diabetes prevalence, availability of a well-established healthcare infrastructure, and the evolution of technology. Coverage for CGM considerably enhanced for both Type 1 and Type 2 diabetic individuals. Physicians' and payers' demand for remote patient monitoring is fueling adoption.

More Utilization of AI-based Diabetes Management: America dominates the application of AI-based diabetes management platforms, which may be combined with CGM devices. Technology firms and new players such as startups are developing predictive analytics software that offers real-time predictions of glucose patterns, enabling it to overcome the drudgery of diabetes complications.

With more than 37 million Americans living with diabetes, CGM uptake will experience explosive growth. Improvements in sensor accuracy and insulin pump compatibility have also enabled more accurate glycemic control and patient compliance. Value-based healthcare policy reform is open to using CGM for early intervention and improving patient outcomes.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 12.6% |

The British economy is gaining strength through National Health Service (NHS) initiatives that encourage the use of CGM among Type 1 and Type 2 diabetic patients. Growing necessities for stylish wearables and governmental policy efforts to cover diabetic treatment devices are boosting demand.

Government-reimbursed CGM Access Programmes: The NHS extended coverage for CGM in additional patients with Type 2 diabetes and gestational diabetes. While the UK continues to spend more than £10 billion annually on diabetes care, CGM systems are an expensive intervention that are being researched for the prevention of diabetes complications. Digital health pressure and increasing smart healthcare wearables usage are driving continued market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.7% |

The European Union market for CGM is growing with greater awareness, reimbursement, and technological advancements in non-invasive blood glucose monitoring systems. Germany, France, and Italy are the top three most advanced markets for CGM because they possess a robust healthcare system and favorable regulatory climate for digital health.

Development of Non-Invasive CGM Devices: The non-invasive glucose monitoring technology is in development, and several EU-based firms are developing optical and transdermal glucose sensors. Our EU medical device regulations provide a high degree of security and performance, and thus the customer will be more confident. Moreover, the European Commission's initiative to harmonize digital healthcare is influencing the use of CGM in most healthcare environments.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 12.9% |

The Japanese CGM market is growing with the aging population, rising incidence rates of diabetes, and enhanced healthcare Internet of Things (IoT). Remote monitoring systems are in great demand, particularly among older patients and among those patients with limited access to diabetes specialists.

IoT-based CGM Solutions among Elderly People: IoT-based CGM solutions are used across geriatric care services in healthcare facilities in Japan's healthcare sector to enable diabetes management with predictive data analysis and continuous real-time monitoring. The government is pushing digital health solutions aggressively aimed at slowing the steeply rising cost of chronic illness, long-term business opportunity in the industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.4% |

South Korea is becoming a market driver for CGM owing to higher growth in smart health technology, government aggressive thrust in e-health, and rising incidence of diabetes. South Korea's policy of technology-based healthcare is driving CGM innovation.

Intelligent Healthcare Integration Drives Market Expansion: South Korea's healthcare industry is driving the adoption of AI and big data analytics to enhance the precision and effectiveness of CGM. Government initiatives promoting the application of telemedicine and remote patient monitoring have also boosted the adoption rate of CGM. South Korean tech firms are also developing next-generation devices for CGM that enable sensors with extended lifespan and connectivity.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.6% |

Sensors are the most common in the market of CGM sensors due to the fact that they are the most crucial part of real-time glucose monitoring. The subcutaneously implanted sensor is constantly checking blood glucose round the clock and transmitting it to receivers or cellular phones, and enables timely treatment intervention in diabetic management.

Companies such as Dexcom and Abbott among the makers of CGM sensors have produced highly advanced sensor technology with more extended wear duration and higher accuracy.

Applications of long-life minimally invasive CGM sensors have been propelling them to achieve expanding and progressively broader acceptance in the market. Expanding diabetic patients switching from painful finger-pricking-based intermittent blood glucose meters daily is fueling demand. Technology like factory-calibrated sensors without fingerstick calibration is another driver of growth in the market.

Transmitters are significant parts in CGM systems since they give real-time glucose readings to external devices such as smartphones, insulin pumps, or proprietary receivers. The use of transmitters is significantly on the rise with the use of Bluetooth and wireless communications technologies in CGM devices for convenient data transfer to healthcare providers and diabetes management software.

There are some other competitors in the industry such as Medtronic and Senseonics that have developed waterproof and rechargeable transmitters to provide better comfort to the wearer. Even more newer on-board sensor CGM systems do have internal transmitters, but single transmitters are needed in reusable CGM designs. Growth in digital health ecosystems and remote patient monitoring has also been driving the demand for transmitters in the CGM device market even further.

Home care has the largest market size of CGM devices due to diabetic patients' preference for self-performance rather than repeated hospital visits. Increased usage of CGM devices in type 2 and type 1 diabetes patients for improved glucose control has increased the demand for home use CGM systems. Abbott's FreeStyle Libre and Dexcom G7 are easy-to-use personal use meters, both of which are utilized worldwide because of ease of use as well as compatibility with smart phones.

The ease of real-time glucose monitoring, and increased awareness of the need for ongoing diabetes management, encourages the spread of CGM use in home care. Insurers' reimbursement policy in developed nations, especially in the USA and Europe, also encourages patients to invest in CGM devices for long-term blood glucose management.

Hospitals and healthcare centers remain a large end-use sector, especially for inpatient diabetic therapy and critical care. The CGM system is increasingly being utilized in hospitals to monitor glucose levels of patients with unstable blood glucose, especially in post-op recovery wards and ICUs.

Hospital use of CGM devices is also driven by gestational diabetes requirements and by cases of severe insulin resistance in order to be able to monitor glucose continuously. Home care trails overall CGM penetration, but the hospital is a major segment in end-use since healthcare professionals require CGM information in order to make real-time insulin dosing decisions and maximize patient outcomes.

The CGM Device Market is led by mature global players and emerging companies propelling its growth. The market leaders possess sizable market shares, driving innovation, sensor precision, and digital health platform integration. The companies are interested in producing minimally invasive and real-time monitoring devices for diabetes management.

The industry contains a mix of mature companies and innovative companies, which drive industry trends with innovative products and partnership agreements.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Dexcom, Inc. | 30-35% |

| Abbott Laboratories | 25-30% |

| Medtronic plc | 15-20% |

| Senseonics Holdings, Inc. | 5-9% |

| Roche Diabetes Care | 3-7% |

| Other Companies (combined) | 15-25% |

| Company Name | Key Offerings/Activities |

|---|---|

| Dexcom, Inc. | Manufactures real-time CGM systems, including the Dexcom G7, offering high accuracy and smartphone integration. Focuses on AI-driven analytics and user-friendly wearables. |

| Abbott Laboratories | Produces the FreeStyle Libre CGM series, known for affordability and extended sensor wear duration. Invests in AI-powered glucose trend predictions. |

| Medtronic plc | Develops Guardian Connect CGM with predictive alerts and integration with insulin pumps. Emphasizes closed-loop insulin delivery systems. |

| Senseonics Holdings, Inc. | Specializes in implantable CGM technology with extended sensor life (up to six months). Targets patients seeking long-term monitoring solutions. |

| Roche Diabetes Care | Provides CGM solutions under Accu-Chek, focusing on interoperability with diabetes management apps. Expands digital health ecosystem through partnerships. |

Key Company Insights

Dexcom, Inc. (30-35%)

Dexcom, Inc. enjoys monopoly status in the global CGM market with its real-time glucose monitoring products, i.e., Dexcom G6 and new G7 device. Dexcom constantly improves sensor accuracy, wireless connectivity, data interpretation, and user streamlining for monitoring glucose levels.

Dexcom relies on AI-based insights to lead diabetes patients to make the right choice, increases its market share by strategic partnerships with digital health platforms and insulin pump manufacturers.

Abbott Laboratories (25-30%)

Abbott Laboratories dominates the CGM space with its FreeStyle Libre. Abbott's FreeStyle Libre 3 is diminutive, inexpensive, sensor-glucose monitor without ubiquitous fingersticks. Abbott is committed to making access happen through glucose trend prediction by artificial intelligence (AI)-driven assistance and cost-control initiatives to place CGM technology on more patients in developed economies and emerging economies.

Medtronic plc (15-20%)

Medtronic plc leads in diabetes management with the integration of insulin therapy and CGM. Medtronic Guardian Connect CGM provides real-time glucose and predictive alert capabilities to facilitate active diabetes management. Medtronic's closed-loop insulin pump, MiniMed 780G, uses CGM data to give dosing of insulin automatically for easier patient life.

Medtronic keeps pushing the limits through continued investment in research to advance accuracy further and improve real-time data transmission ability.

Senseonics Holdings, Inc. (5-9%)

Senseonics Holdings, Inc. has pioneered implantable CGM technology such as the Eversense CGM system with six-month sensor life. Senseonics targets patients who desire longer sensor use with less replacement. Senseonics partners with Ascensia Diabetes Care to drive market penetration, capitalizing on ultra-long-term glucose monitoring solutions to provide improved diabetes care.

Roche Diabetes Care (3-7%)

Roche Diabetes Care integrates the CGM business under the Accu-Chek brand with emphasis on connectivity and integration with digital health platforms. Roche collaborates with software developers to make diabetes management tools available with personalized data and remote monitoring capabilities. Roche extends its CGM ecosystem through collaboration with healthcare professionals so that it can be easily integrated into existing treatment protocols.

Other Key Players (15-25% Combined)

Several emerging and established companies hold a notable share in the CGM device market, driving innovation, affordability, and accessibility. These include:

The overall market size for continuous glucose monitoring (CGM) devices was USD 6,745 million in 2025.

The continuous glucose monitoring (CGM) device market is expected to reach USD 22,243 million in 2035.

The increasing prevalence of diabetes, advancements in CGM technology, rising awareness about diabetes management, and growing healthcare spending are the key factors driving the demand for CGM devices during the forecast period.

The top 5 countries contributing to the development of the continuous glucose monitoring device market are the United States, Germany, Japan, the United Kingdom, and China.

The Prurigo Nodularis (PN) Treatment Market is segmented by product, and end user from 2025 to 2035

Warm Autoimmune Hemolytic Anemia (WAIHA) Treatment Market Analysis by Drug Class, Distribution Channel, and Region through 2035

Atrophic Vaginitis Treatment Market Analysis And Forecast by Diagnosis, Treatment, Therapy Type, Distribution Channel, and Region through 2035

Adrenal Crisis Management Market Analysis and Forecast, By Diagnosis Method, Treatment Method, Distribution Channel, and Region, through 2035

Birch Allergy Treatment Market Analysis by Drug Class, Route of Administration, Distribution Channel and Region: Forecast from 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.