The content service platform market worldwide is expected to grow in the forecast period of 2025 to 2035, owing to the rising demand of efficient content management, digital transformation, and demand of collaboration enhancements tools in enterprises.

Content service platforms offer businesses an end-to-end environment for content management, storage, and retrieval with a unified solution that streamlines data governance alongside workflow automation and ensures compatibility across disparate systems for specific departmental needs.

Increased adoption of cloud-based content management and rising artificial intelligence (AI) and machine learning (ML) for security and content classification is driving the market growth. In addition, the recent surge of remote working setups, increased investment in digital workplace, and rise in statutory requirements for data management are driving the industry's massive transformation.

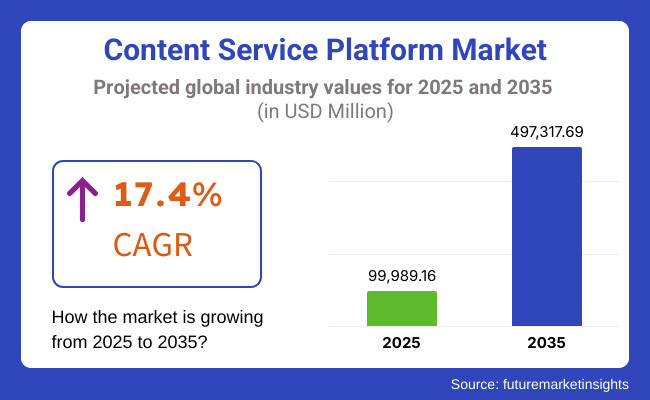

By 2025, the Content service platform market size was estimated to be worth USD 99,989.16 Million. It is expected to be USD 497,317.69 Million by 2035, with a compound annual growth rate (CAGR) of 17.4%. Market growth is primarily attributed to the increasing need for enterprise-level content solutions, growing implementation of AI-based automation in document management, and increasing investments in cybersecurity for content protection.

Further supporting the expansion of the market is the integration of intelligent search capabilities, advanced data analytics, and economical cloud storage solutions. Moreover, industry-specific content service platforms developed for healthcare, finance, and government organizations is significantly contributing to the market penetration and the end-user adoption.

Explore FMI!

Book a free demo

As North America continues to be a widely-leading market for content service platforms due to higher enterprise uptake of cloud technology, greater demand for workflow automation and increased investments of AI-driven content solutions. The USA and Canada are at the forefront in proactive content service platforms which integrate document management, workflow automation, and compliance-driven content security.

The market is growing as a result of the increasing trend of remote work, regulatory mandates for data privacy, and the increasing adoption of AI-powered enterprise search tools. The rising adoption of the digital experience platform (DXP), along with the growing trend of AI-infused customer engagement solutions is also powering the product innovation and subsequent adoption.

The European Market Overview presents growing investments in various content management solutions aligned with GDPR across different sectors, increased digital transformation initiatives led by the government for organizational efficiency, and technological developments in cloud-based collaboration platforms. Germany, France, and the UK, for example, have all set their sights on high-security, scalable content service platforms for finance, healthcare, and manufacturing.

In addition, the increased focus on enterprise content automation, expanding adoption in knowledge management, and ongoing research to improve classification of content using artificial intelligence are major contributors behind adoption in market. Furthermore, emerging applications across smart governance, digital archiving, or hybrid cloud integration are also offering additional opportunities for content service providers.

The Content service platform market in the Asia-Pacific region is projected to expand at the highest CAGR during the forecast period, as the increasing digital adoption by enterprises, exponential cloud investments, and growing demand for scalable content management solutions are attracting organizations in this region.

The nations investing over USD 1 billion for AI powered content intelligence, enterprise knowledge management, and regulatory-compliant document storage solutions include China, Japan, and India.

End-use such as government and utilities demand for mobile-first access to contents is gaining traction, consequently prompting an increased focus on emerging opportunities at regional levels with the help of requisite Infrastructure (such as IT infrastructure expansion), regulatory frameworks evolving for data security, and governments incentives to accelerate digital business are few of the factors pushing the regional market.

In addition, the rising fluency with content automation and intelligent knowledge lakes continue to push the market further over the edge.| other factors driving market growth include the emergence of domestic cloud providers and partnerships with global technology companies.

Growth in this market in Latin America is being driven by the rising awareness regarding enterprise content management, growing adoption of cloud storage systems, and increasing deployment of digital transformation projects. Brazil and Mexico are major players, concentrating efforts on increasing access to AI-powered content platforms for banking, healthcare, and retail use cases.

Market growth is also attributed to the sinking of economical document processing and localization data governance as well as the implementation of promotional campaigns for enterprise digitalization. The rise of AI-led automation, increased funding for cloud-based IT solutions and consumer-driven demand for digital-first workplace tools are also enabling better service accessibility across the region.

Gradually The Middle East & Africa region is making its presence felt in the Content service platform market with an increase in investments in digital infrastructure, cybersecurity compliance, and enterprise data management. In this sector, the UAE and Saudi Arabia are spearheading the drive for content security, workflow automation, and document analytics powered by artificial intelligence.

The increase in enterprise cloud adoption, the need for intelligent content workflows and the collaboration of global IT service providers with regional IT service providers is expected to boost the growth of the market even further.

In addition, government initiatives for paperless administration, new multilingual content-processing systems, and consumer-based demand for easy-to-use digital collaborative functions are driving long-term growth for the industry. Market growth is also being fuelled by the growing scope of digital government initiatives and increasing penetration of AI-based automation solutions into business processes in the region.

The Content service platform market is anticipated to grow substantially over the next 10 years with constant innovations in AI-powered automation, cloud content management and regulatory-compliant data governance. Many businesses are working on innovation for aspects like intelligent document recognition, enterprise-wide search capabilities, and AI-powered content security to enhance functionality, market appeal, and long-term relevance.

Enterprise interest in hybrid cloud solutions, digital transformation strategies and developing AI capabilities also are shaking up the fabulous future of the segment. Furthermore, by integrating machine learning-powered content recommendations; using blockchain to secure, document verification; and implementing predictive analytics for workflow optimization, global market efficiency gains continues including ensuring quality, content management solutions.

Challenge

Data Security and Compliance Risks

What are the challenges expected to impact the Content service platform market? As digital content continues to grow in volume, businesses must comply with stringent data protection laws, including GDPR, CCPA, and other local regulations.

Failure to comply can lead to expensive fines and damage to reputation. Moreover, content management becomes even more complex due to the risk of cyberattacks, unauthorized access, and data breaches. The solution, therefore, is more investment in encryption, multi-factor authentication, and AI-driven compliance monitoring to both protect data from cyber threats and satisfy regulatory oversight.

Integration Complexities and Legacy System Compatibility

Enterprise content management systems are often decoupled from more modern content service platforms. Data migration from legacy platforms to cloud- or AI-enabled systems can be expensive, arduous, and technically challenging when massive amounts of content need to be moved.

Furthermore, a strong API connectivity is also needed to integrate content services with enterprise resource planning (ERP), customer relationship management (CRM), and artificial intelligence (AI) tools. Enterprise migration will happen through modular architectures, integration-friendly platforms, and migration support, leading to smoother transitions and better adoption rates.

Opportunity

Rising Demand for AI-Driven Content Management

Demand for AI-powered content service platforms is being driven by the growing volume of unstructured data, which ranges from documents to images, videos to emails. Mistakenly thinking that Ai is just for high-end business, it is being used to automate tagging, content indexing, and smart search for enhanced productivity in various industries.

Improvements in Natural language processing (NLP) and machine learning (ML) capabilities are helping content recommendations, personalization, and automated workflows. The rise of AI writing - Content automation, smart metadata management, and predictive analysis will give companies a clear advantage in providing effective and intuitive content solutions.

Growth in Remote Work and Digital Collaboration

The demand for content service platforms has only increased with the movement to hybrid and remote work environments that create a need for cloud-based services. Maintaining operational efficiency across distributed teams requires organizations to access documents in real time, control document versions, and share files safely with different stakeholders.

Content service providers can capitalize on this opportunity as digital workplaces, enterprise collaboration tools, and virtual content hubs emerge and flourish. With increasingly remote workforces, there will be rising demand for tools that offer seamless UI, mobile access, and secure collaboration features, making this a favorable move for organizations that want to continue digital workplace transformation.

Content service platform Market Dynamics: Trends, Chains, Shifts (2020 to 2024) - 5(+10) future shifts (2025 to 2035) The Content service platform market registered enormous adoption during the period (2020 to 2024), owing to digital transformation (elasticity towards data analytics), cloud computing advancements, big data management needs.

Firms adopted AI-powered content platforms, automated processes, and stronger cyber defenses. Despite this, compliance complexity, integration challenges, and cost constraints continued to hinder growth. Corporations reacted by allocating resources for compliance-compatible solutions, API-based architectures, and solutions for hybrid content management.

In the forecast period of 2025 to 2035, the market would explore blockchain-enabled content authentication, decentralized cloud storage, and immersive content experience with augmented reality (AR) and virtual reality (VR). Quantum encryption will be adopted, zero-trust security frameworks established, and real-time content analytics replace content service platforms as we know them today.

It will also foster the innovation of AI-generated content creation, voice-enabled document navigation, and automated compliance auditing. The Content service platform market is ready to enter the next stage of its growth; organizations that will leverage these technological trends, keep data security at the forefront and work on improving the experience of their users will resonate with the masses.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Stricter compliance with GDPR, CCPA, and regional data protection laws |

| Technological Advancements | Adoption of AI-powered content indexing and automation |

| Industry Adoption | Growth in enterprise content management and cloud-based collaboration |

| Supply Chain and Sourcing | Dependence on centralized cloud storage providers |

| Market Competition | Dominance of major cloud service providers and enterprise tech firms |

| Market Growth Drivers | Increased demand for secure content collaboration and workflow automation |

| Sustainability and Energy Efficiency | Initial focus on data center energy efficiency and carbon footprint reduction |

| Integration of Smart Monitoring | Limited AI-driven content monitoring and security tracking |

| Advancements in Content Innovation | Development of AI-driven search, tagging, and indexing |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance automation, blockchain-enabled content security, and enhanced global regulatory frameworks |

| Technological Advancements | Expansion of decentralized storage, quantum encryption, and immersive content experiences |

| Industry Adoption | Widespread adoption of AI-driven content creation, autonomous content workflows, and voice-activated platforms |

| Supply Chain and Sourcing | Shift toward decentralized cloud infrastructure, edge computing, and sustainable data storage solutions |

| Market Competition | Rise of AI-driven content startups, blockchain-powered content ecosystems, and open-source collaboration platforms |

| Market Growth Drivers | Growth in intelligent content personalization, zero-trust security adoption, and real-time content analytics |

| Sustainability and Energy Efficiency | Large-scale implementation of green computing, energy-efficient AI models, and sustainable cloud infrastructure |

| Integration of Smart Monitoring | AI-powered real-time threat detection, deep learning for content verification, and predictive compliance auditing |

| Advancements in Content Innovation | AI-generated content creation, interactive document processing, and adaptive content delivery systems |

The region is driven by a cost-effective solution offered by major technology providers and adoption of cloud-based content management solutions and growing demand for enterprise collaboration tools in the United States. Market growth continues to be fueled by the rapid transition to digital transformation and remote work solutions.

Additionally, the increasing investments in AI-powered content automation, advanced data analytics, and scalable content storage solutions are contributing to the market growth. Moreover, the use of machine learning for intelligent content classification, blockchain for secure content management, and IoT-enabled document workflows are further improving how these platforms function.

Another trend is the development of low-code and no-code content platforms with a focus on accessibility and user adoption. Additionally, the market growth is further augmented by the increasing demand for regulatory-compliant content services across industries, such as healthcare, finance, and legal in the USA

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 17.7% |

Content service platform market in the United Kingdom is expected to grow as the demand for digitalization initiatives, AI-powered content solutions, regulatory requirements for data security and compliance will increase in the region. Market growth is also being propelled by the demand for cloud-based collaboration tools.

The market growth is also boosted by government policies promoting data protection and the growth of intelligent content management. Plus, real-time document collaboration, automated metadata tagging, and AI-powered insights are other concepts gaining traction all over.

Businesses are also leveraging hybrid cloud solutions and edge computing to optimize content storage and accessibility. This is further propelling adoption in the UK owing to increasing digital workplace solutions and enterprise content automation. The growth of work from home culture, as well as the increased need for integrated content workflow solutions, as mentioned before, is fuelling the adoption of platforms across sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 17.1% |

Germany, France, and Italy are leading in the European Content service platform market, supported by rising enterprise digitalization efforts, a growing emphasis on data privacy regulations, and reinforced adoption of AI-driven content management solutions.

Rapid growth in the market is supported by the European Union’s focus on GDPR compliance along with investments in the cloud-based content security and workflow automation solutions. Moreover, AI-powered document processing, automated compliance monitoring, and real-time content analytics are increasing operational efficiency.

Demand for intelligent content services in various industries including manufacturing, education, and financial services is another factor fuelling market growth. In particular, the proliferation of multi-cloud architectures, advanced search capabilities and AI-based content curation tools are driving broader use in the EU. Moreover, digital innovation initiatives sponsored by government bodies are driving the adoption of content service platforms in government and commercial organizations.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 17.3% |

The expanding market for Content service platforms in Japan can be attributed to the country’s keen focus on AI-driven automation technologies, growing adoption of digital business solutions, and increased demand for secure content collaboration tools. This inclination to intelligent enterprise content management is contributing to market growth.

The focus relies on advanced technology, and the integration of machine learning-based content recommendations and AI-enhanced data processing is also fueling innovation in the country. Additionally, stringent government regulations on data privacy & compliance are driving the company to develop deliver impeccable security features in content platforms.

Additionally, with Japan being a tech-centered business ecosystem, the need for more multi-lingual content service offerings, digital asset management, and cloud-based document control is also facilitating greater market growth. Japan and our investments in hybrid cloud content management and secure digital archiving solutions are defining what the future of enterprise content services looks like.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 17.5% |

With accelerated cloud adoption, increased spending on AI and big data analytics, and a growing focus on digital collaboration in enterprises, South Korea is becoming an important market for content service platforms.

Robust government initiatives in support of digital transformation and widespread adoption of AI-enabled document processing along with automated content workflows aid market growth. Moreover, diversification of the economy and investment in blockchain-based content security, as well as AI-driven compliance tracking, is fuelling competitiveness of the country.

The increasing need for content service platforms across e-commerce, media and financial services further boosts market proliferation. To enhance user experience, these companies are betting on things like hybrid cloud architectures, intelligent content retrieval systems, and real-time collaboration tools. Additionally, this is chiefly due to the increasing adoption of smart workplace solutions and enterprise AI integration in South Korea that is propelling the demand for improved content service platforms.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 17.6% |

The document and record management solutions are still a key part of the content service platforms, allowing businesses to store, retrieve and manage high volumes of both physical and digital documents securely. Such solutions aid organizations to improve compliance, regulatory compliance, and operational efficiency by enabling version control, tagging of metadata, and automated retention policies.

Document management systems are heavily used in sectors like BFSI, healthcare, and government to create data integrity, access, and collaboration with other documents. Document management systems are also incorporating AI, ML, and blockchain technology to enhance security, analytics, and workflow automation, this has propelled the market growth.

Workflow management solves this problem because it enhances process automation, task tracking, and cross-functional collaboration. They allow organizations to develop unique workflows, increase approval cycle processes, along with doing away with duplication, streamlining overall operations.

Low-code and no-code workflow automation solutions emerged to meet the demand by enabling individuals with limited technical experience to set up and hone workflows without the need for extensive IT resources. Workflow management solutions are widely adopted among industries such as media & entertainment, telecom, IT, and retail to support agile operations and support real-time decision-making.

SMEs are increasingly embracing content service platforms to streamline document processing, automate workflows, and enhance data security. One of the advantages for SMEs is that they get cost-effective and scalable solutions which are designed to facilitate remote collaboration, secure cloud storage and compliance with industry regulations.

Subscription based and pay as you go pricing models are also encouraging SMEs to adopt sophisticated content services with minimal capital expenditure. Moreover, with the popularity of hybrid work models, SMEs are investing more into document sharing solutions based on the cloud, e-signature services (Viseven most recently launched an e-signature solution called ViSiC) and AI-based content retrieval systems.

Content service platforms are utilized by large enterprises to manage complex data ecosystems, enable secure content collaboration, and enhance end-to-end enterprise-wide workflow automation. Large organizations, owing to the massive amounts of structured and un-structured data, are forced to invest in high-performance, scalable, and AI integrated solutions that enhance business continuity, risk mitigation and organizational performance.

Adoption of content services across large enterprises is further catalyzed by real-time analytics, role-based access control, and intelligent search functions. Banking, healthcare and some government agencies are investing heavily in enterprise-grade content service platforms to ensure compliance with data privacy regulations and enhance customer experience.

INFRASTRUCTURE & FRAMEWORKS Cloud Cloud Content Service Platforms Content service platforms are increasingly being deployed in the Cloud, enabling greater scalability, economical pricing and collaboration capabilities. Cloud solutions have become the preferred option for organizations across industries to facilitate remote work, seamlessly integrate third-party applications, and automate backups in a push for the digital transformation of business operations.

Rising adoption of AI-powered cloud content management, compliance-friendly document repository, and real-time access management has propelled market growth. Moreover, the adoption of multi-cloud strategies and hybrid cloud architectures has also spurred businesses to move towards cloud-based content services.

On-premise deployment is still a must for organizations that are obsessed with sovereignty, security and compliance with industry-specific laws. On-premises solutions are favored by government agencies, financial institutions, and healthcare organizations to have complete control over data access, security protocols, and an organization’s own infrastructure.

Although cloud-based solutions are gaining popularity, on-premises deployments are still preferred by enterprises that need personalized Content Service Platforms, encryption, disaster recovery mechanisms, and flexibility to minimize reliance on 3rd party vendors.

The BFSI is one of the major content service platform’s biggest adopters, with the platform being used for secure document storage, risk management, regulatory compliance, and other activities. These solutions are used by financial institutions to record clients digitally, automate approval processes, and strengthen fraud detection capabilities.

Advanced data protection measures have also come in the form of AI-powered content analytics and blockchain-based document verification systems. Furthermore, the growing adoption of e-signature solutions, automation of loan documents, and customer service chatbots have led to an increase in demand for highly integrated content service platforms in the BFSI vertical.

To make IT workflows, data governance, and digital collaboration easier, the IT & telecommunication industry heavily depends on content service platforms. Tech firms exploit these very platforms for knowledge management, software doc and workflow optimization.

As more organizations adopt 5G connectivity and edge computing, IT companies will continue to integrate cloud-native content service platforms with AI-powered search and automated document classification. Increased demand for improving data security, faster access to content in real-time, and adherence to regulations such as the GDPR and CCPA have further boosted market demand in the IT and telecommunications market.

The growing need for efficient content management systems, digital collaboration, and workflow automation in various sectors is propelling the growth of the Content service platform market. Vendor attention has turned to AI-powered automation, cloud-based content services, and stronger-security features to optimize enterprise content management. Some key trends involve hybrid cloud deployment, AI-enabled search functions, and compliance-oriented content governance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Microsoft Corporation | 18-22% |

| Open Text Corporation | 14-18% |

| IBM Corporation | 11-15% |

| Box, Inc. | 8-12% |

| Hyland Software | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Microsoft Corporation | Leading provider of cloud-based content services through Microsoft SharePoint and OneDrive. |

| Open Text Corporation | Specializes in AI-powered content management and compliance solutions for enterprises. |

| IBM Corporation | Develops advanced content services with AI-driven automation and governance capabilities. |

| Box, Inc. | Offers secure cloud content management solutions with workflow automation and collaboration features. |

| Hyland Software | Focuses on intelligent content services and process automation through the On Base platform. |

Key Company Insights

Microsoft Corporation (18-22%)

Microsoft also leads the Content service platform market through the integration with Microsoft 365 productivity and workflow solution and a cloud-based collaboration and enterprise content management.

Open Text Corporation (14-18%)

Open Text focuses on content services powered by AI, offering more automation, better security and compliance for corporate customers.

IBM Corporation (11-15%)

AI-driven enterprise content that facilitates intelligent document editing and AI-driven business insights.

Box, Inc. (8-12%)

Box is a leader in secure cloud content management, providing businesses with scalable workflow automation and collaboration capabilities.

Hyland Software (6-10%)

Hyland offers process automation and intelligent content management solutions that help enterprises streamline document workflows.

Other Key Players (30-40% Combined)

Innovations in cloud-based platforms, AI-driven automation, and enterprise content governance are not only fuelled by but also fuelled for a multitude of global and regional content service providers. Key players include:

The overall market size for Content service platform market was USD 99,989.16 Million in 2025.

The Content service platform market expected to reach USD 497,317.69 Million in 2035.

Increasing digital transformation initiatives, high need for efficient data management, rising adoption of cloud-based solutions, rapid advancement of AI and automation as well as enterprises across a range of sectors seeking improved collaboration and compliance will drive the content service platform market.

The top 5 countries which drives the development of Content service platform market are USA, UK, Europe Union, Japan and South Korea.

Cloud and on-premises deployments cater growth to command significant share over the assessment period.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.