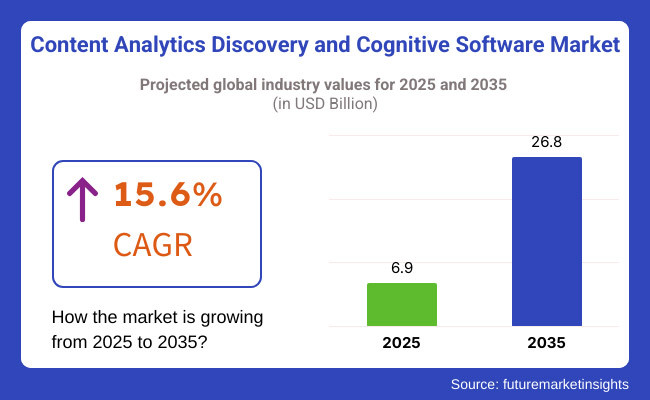

The content analytics, discovery, and cognitive software market is posed to experience explosive growth from 2025 to 2035. Demand for AI-driven data insights, real-time analytics, and solutions find increasing sophistication are fueling this trend. The industry is expected to grow from USD 6.9 billion in 2025 to USD 26.8 billion in 2035, a CAGR of 15.6%, according to the forecast.

As the volume of unstructured data grows, and enterprises turn to more and more AI-based business intelligence solutions, there is demand for platforms for intelligent content analysis and discovery in industry categories across the board.

In the era of digital transformation, companies produce vast quantities of data, and the ability to detect sentiment and obtain useful opinions from this has become a necessary skill for the continued functioning of operational effectiveness and for strategic decision-making.

It has taken advantage of artificial intelligence, machine learning, natural language processing (NLP), and predictive analytics to automate processes, improve security, maximize customer engagement, and fuel competitive intelligence.

Companies in such industries as healthcare finance, retail services, and information technology have started to use this software to ensure their regulatory compliance is on the one hand becoming more automated, and on the other able to yield ever deeper insights from structured and unstructured data. Many factors contribute to the growth of the industry. Companies are obliged to invest in AI-driven analytics and discovery capabilities as real-time data processing is increasingly required.

Content analytics is also used by organizations to improve fraud detection, risk assessment and compliance management, particularly in highly regulated sectors. The increasing use of IOT (Internet of Myriads), and cloud computing also contributes to the further development of demand for cognitive software that is capable of processing complex data and automatic responses.

Companies increasingly use sentiment analysis and prediction tools based on customer behavior to improve the user experience and customize services. Nevertheless, the industry is also fraught with challenges. The large costs involved in implementing and integrating cognitive software solutions are expected to deter the smaller startup firms, at least initially. Data privacy issues and strict regulations are another headache: companies must comply with international laws on data protection.

In addition, the persisting challenge for successful analytics is its reliance upon quality data and AI-powered insights – organizations must spend money on data governance and management schemes. The industry is currently undergoing unprecedented technological innovation at a rapid pace, which gives rise to the openings for innovation.

Generative AI and advanced NLP are picking up errors that are not readily apparent on the first pass of content analysis and are also context aware as certain kinds of construction are used. Through the use of hybrids and multi-clouds, analytical solutions are becoming accessible and scalable for companies. Strategic partnerships among tech players and leaders are yielding sector-specific cognitive software that satisfies domain-specific requirements. With the continuous development of AI and automation techniques, the industry is about to take the lead in ushering in a digital tomorrow based foremost on smart business processes and data-informed decision-making.

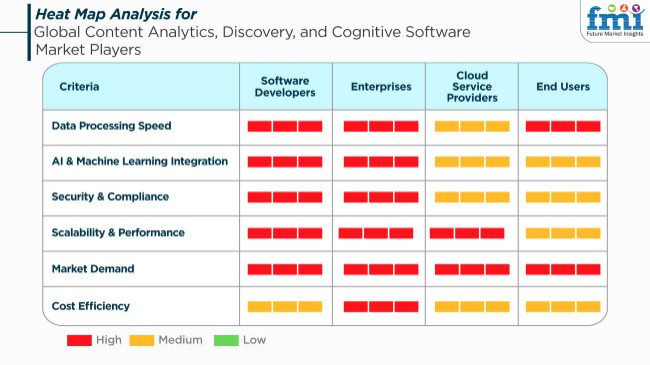

The industry is witnessing significant development due to the ever-growing requirements of instant data insights, automation, and AI-assisted decision-making throughout all sectors. Businesses are giving preference to software making the content search easier, run workflows automatically, and bond with the already existing IT ecosystems, while software writers are concentrating on optimization of the NLP, the machine learning models, and the sentiment analysis competency.

Infrastructure service providers are the main providers as they offer the necessary flexible scalable infrastructure to carry out real-time data processing and predictive analytics. The end-users have the advantages of better search functions, targeted recommendations on products/services, and automatic insights, hence increasing the overall experience. The most typical purchasing features are AI automation, total enterprise applications integration, meeting regulatory standards, and cost-effectiveness. As companies are more dependent on big data and predictive analytics, the need for cloud-based and AI-enabled content analysis solutions is expected to boost the industry in the future.

Contract & Deals Analysis – Content Analytics, Discovery, and Cognitive Software Market

| Company | Contract/Development Details |

|---|---|

| IBM Corporation | IBM secured a multi-year contract with a leading financial services firm to implement AI-driven content analytics and cognitive search solutions for real-time data insights and regulatory compliance. |

| Microsoft Corporation | Microsoft entered into an agreement with a global healthcare provider to deploy cloud-based cognitive software for medical data discovery and predictive analytics, enhancing clinical decision-making. |

| Oracle Corporation | Oracle expanded its content analytics portfolio through a strategic partnership with a multinational retail company, focusing on AI-powered consumer sentiment analysis and personalized marketing insights. |

| SAP SE | SAP announced a collaboration with a top-tier legal technology firm to integrate AI-driven content discovery software for contract analysis, risk management, and automated compliance tracking. |

Between 2020 and 2024, the industry grew steadily as enterprises prioritized data-driven decision-making, regulatory compliance, and automation. The rising adoption of AI-powered text and speech analytics, natural language processing (NLP), and machine learning enhanced information retrieval, fraud detection, and sentiment analysis across industries.

Cloud-based solutions gained momentum, allowing companies to process and analyze unstructured data at scale. Yet, issues like data privacy, integration challenges, and the requirement for skilled workers held back adoption in some industries, leading vendors to invest in user-friendly, low-code AI platforms.From 2025 to 2035, innovations in generative AI, real-time cognitive automation, and multimodal analytics will redefine the industry. Predictive insights and autonomous data classification will be leveraged by more businesses to deliver operational efficiency as well as regulatory compliance.

Combination of content discovery with augmented intelligence will increase better decision-making within legal, health, and finance domains. Enterprise adoption of decentralized AI-powered content analytics for the processing of sensitive data in adherence to regulatory policies will rise while edge computing and federated learning enhance data protection.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Tougher regulations like GDPR and CCPA necessitated the use of AI-based content analytics solutions by companies for compliance and risk management. | Blockchain-based audit trails combined with AI-driven, real-time compliance engines ensure secure content discovery, privacy protection, and automatic regulatory compliance across industries. |

| AI-based NLP enhanced sentiment analysis, automated content classification, and real-time data discovery for business. | AI-enabled cognitive systems independently interpret, create, and suggest content, powering hyper-personalized digital experiences, predictive decision-making, and knowledge automation. |

| Businesses used AI-driven tools to process huge volumes of unstructured data from emails, social media, and documents. | Sophisticated AI primitives, such as multimodal learning and generative AI, normally derive high-level insights from unstructured data that serve the timely feed into business intelligence and strategy development. |

| AI-powered search solutions mainly streamline enterprise knowledge retrieval, directly helping productivity and therefore minimizing content silos. | AI engines offer context-aware real-time search-driven insights, enabling companies to act on what is at hand within relevant information. |

| Document processing supported by AI materialized into real-time decision making by integrating with enterprise BI platforms. | Generative AI goes deep into its ability to discover trends in businesses, and thus prospects; they might even be self-enhancing decision-support systems that can respond topically at any given moment, thus discerning momentous changes in industry conditions. |

| Organizations have accepted AI-based applications on sentiment analysis for their brand, customer feelings and competitors. | Emotionally-aware AI engines deliver for hyper-personalized marketing, reading real-time audience sentiment, and unambiguously observing dynamic content strategies emerging through user interaction patterns. |

| AI-driven document processing helped fund real-time applications in financial, healthcare, legal, and compliance sectors. | AI-powered cognitive automation platform performs real-time document analysis, legal agreement identification, and automated knowledge extraction with near-human precision while learning constantly from its operations. |

| Explain ability keeps a business setting on trust and supporting responsible longstanding decision making in AI-based content analytics. | Explain ability-based AI-driven content analytics present bias-free insights to promote compliance and business thrust on ethical AI acceptance. |

| The intelligence behind the AI language translation and multilingual NLP makes fast cataloging with global content access and directly correlates with instant sentiment analysis. | Real-time AI-driven cognition across multiple languages-on-demand linguistic systems undertake effective language-based business collaboration and insights in both highly dynamic and varied industries. |

| This brings about the thrust for AI models that are energy-efficient on saving huge costs in computation that would have been otherwise spent on big analytics content. | Here arises the need to optimize the Green AI methods which lower power usage of AI-driven AI-enabled cognitive software for green enterprise content processing and discovery. |

Risks identified in the industry include data privacy laws, AI prejudice, cybersecurity threats, as well as industry competition and the necessity for the enterprise to transform.

New laws that protect the privacy of data, like the GDPR, the CCPA, and the HIPAA, set conditions on how businesses can obtain and analyze customer data. Hefty fines, loss of reputation, and no client trust are the costs of breaking these rules. Companies are required to take optimal measures such as secure data handling, and encryption of data along with the user's consent mechanism.

The challenge of AI bias and accuracy has its implications on the matters of content discovery and cognitive analytics. Even if it is the AI-driven systems that misinterpret or lag behind data, the enterprise may suffer from penalties and lowered credibility. Therefore, it is important to keep on improving the machine-learning models and be transparent in the AI decision-making phase.

The issue of threats from cybersecurity still stands since content analytics software is usually connected to the processing of sensitive business affairs, intellectual properties, and customer data. The things that can break a company are such acts as data breaches, insider threats, and malfunctioning of the system due to malware. Therefore, laying down multi-layered security protocols is of the essence.

The quick pace at which companies change requires innovation to keep pace. As more companies seek to use real-time content analytics, predictive intelligence, and cognitive automation instead of just reading and writing to the file system, software providers must remain one step ahead of any technical breakthroughs to avoid obsolescence.

With Test Software solutions, organizations can analyze,process, and translate large volumes of multilingual data to ensure they can tailor communications for global audiences. These solutions are especially valuable for companies that operate in a variety oflinguistic landscapes, including multinationals, media companies, and government bodies dealing with multilingual communication.

IBM Watson, Google Cloud AI, and Microsoft Azure Cognitive Services are a few examples ofleading AI-powered test software companies that are using natural language processing (NLP) and machine learning (ML) algorithms to improve automated translations, sentiment analysis, and text analytics, among others. Rich Media Tagging is becoming more popular withthe increasing consumption of digital media in audio, video, and picture formats.

Current organizations are turning toAI-powered content analytics to auto-exaggerate and categorize multimedia data for the improvement of searchability, metadata management, and user experience. The boom of digital transformation and the expansion of video-oriented social content haveled enterprises to shift from media to the internet + industry model, pouring money into automated image identification, voice-to-text transcription, and deep learning-based media analytics in sectors such as entertainment, social media, and e-commerce.

Content analytics and cognitive software are heavily used in the government and public sector, and it is one ofits biggest industries because it uses content analytics to manage public data, domestic security, law enforcement, and defense and provide services to citizens. Governments can utilize AI-powered content analytics toanalyze large quantities of datasets, track fraudulent activities, and augment cybersecurity.

NLP-based software is also beingelected on real-time policy analysis, multilingual translation services, and automated public service interactions by governments. Key players,such as Palantir Technologies, IBM, and SAS, offer AI-powered content analytics for government agencies, helping them to analyze potential insights from structured and unstructured data in terms of making decisions and improving the delivery of public services. Also, an increased demand for cognitive software is being observed in the application of risk assessment, fraud detection, and customer interaction inthe Finance, Banking & Insurance (BFSI) sector.

Further, AI-based content analytics helps financial organizations analyze unstructured data, identify anomalies, andenhance regulatory compliance. This practice can now be seen in the rising adoption ofchatbots, robo-advisors, and AI-powered sentiment analysis to provide tailored customer experiences in banks and insurance companies. Salesforce, IBM Watson, and OpenText are at the forefront of AI-based analytics in financial content, delivering applications that automate document processing,credit scoring, and investment forecasting.

| Country | CAGR (%) |

|---|---|

| USA | 9.5% |

| China | 10.2% |

| Germany | 8.8% |

| Japan | 9.1% |

| India | 10.4% |

| Australia | 8.9% |

The USA industry is expanding at a rapid rate, driven by increasing demand for AI-driven data insights, real-time decision-making solutions, and cognitive computing solutions across sectors such as finance, healthcare, and retail. The USA technology sector is leveraging content analytics and discovery software to enhance business intelligence, automate processes, and predictive analytics.

With further investments in artificial intelligence (AI) cognitive solutions, natural language processing (NLP), and big data analytics, the demand for advanced content analytics continues to grow. In 2024, the USA government and private sector collectively invested more than USD 15 billion in AI-driven content intelligence. FMI is of the opinion that the USA industry is slated to grow at 9.5% CAGR during the forecast period.

Growth Drivers in The USA

| Drivers of Growth | Description |

|---|---|

| Emergence of AI-Powered Decision-Making and Automation | Increased adoption of cognitive analytics by data-driven business models. |

| Advances in Natural Language Processing and Machine Learning | AI-powered innovations enhance search, discovery, and content recommendation. |

| Increased Applications in Healthcare, Financial Services, and Retail | Content analytics maximizes operational effectiveness and customer experience. |

China's industry is growing with a faster rate of AI research, increased government efforts towards digitalization, and increased application of big data solutions for banking and e-commerce industries. Being the most populous nation with the largest online population in the world, China is witnessing a huge increase in demand for AI-based content analytics in moderation, sentiment, and anti-fraud.

The government's step towards AI regulation and technological sovereignty has also assisted with further industry growth. China invested USD 18 billion in AI analytics and cognitive computing in 2024. FMI anticipates the China industry will grow at 10.2% CAGR through 2035.

Growth Drivers in China

| Key Drivers | Facts |

|---|---|

| Government Support towards AI and Digital Transformation | Policies driving AI-enabled business intelligence driving adoption. |

| Expansion of E-Commerce and Financial AI Solutions | More cognitive software is used in risk analysis and focused marketing. |

| More usage of NLP and Speech Recognition technology | AI-supported chatbots and virtual assistants enhance customer engagement. |

The industry in Germany is gaining momentum due to its sturdy industrial infrastructure, increasing usage of AI in production, increasing necessity of compliance as well as data protection laws, and increasing requirements for GDPR readiness. Germany, Europe's technology forefront, is aiming for AI-facilitated analytics-driven anti-money laundering fraud, predictive maintenance and repair, and supply chain analytics.

Increasing emphasis on compliance with GDPR regulation, as well as ethical AI development, have also been driving growth for advanced content discovery solutions in the nation. FMI is of the opinion that the German industry is slated to grow at a CAGR of 8.7% during the forecast period.

Growth Drivers in Germany

| Critical Drivers | Description |

|---|---|

| Robust Financial and Industrial Adoption | German industries apply cognitive analytics for business efficacy and compliance. |

| Increasing Need for AI-Powered Fraud Detection and Risk Scoring | AI-based technologies enhance financial safety and regulatory compliance. |

| Enhanced AI and IoT-Powered Content Discovery | Increased investment in predictive analytics and industrial applications of AI. |

Japan's industry is expanding with robot technology, artificial intelligence-based healthcare solutions, and intelligent city infrastructure. Japan's technology industry is leveraging AI-based content discovery and sentiment analysis to fuel enhanced decision-making and customer interaction. Japan's capabilities in miniature AI computing and high-accuracy analysis led to the development of cognitive computing solutions. FMI believes that Japan's industry will expand at a 9.1% CAGR during the forecast period.

Growth Drivers in Japan

| Top Drivers | Description |

|---|---|

| Adoption of AI in Predictive Analytics and Business Intelligence | Japan leads the world in AI-driven insights applied in retail, banking, and healthcare. |

| Scaling AI-Based Automation and Customer Engagement | Growing needs for NLP-based virtual assistants and recommendations. |

| Growth of AI-driven healthcare and Legal Analytics | Widespread adoption of AI-based diagnostic and legal research solutions. |

India's industry is growing highly with increased investment in AI-driven automation, high-growth demand for cloud-based cognitive computing, and government initiatives towards digitalization. India is seeing high demand for content intelligence solutions at scale under programs such as 'Digital India' and the expansion of AI-based analytics in banking, healthcare, and education. The high-scale adoption of AI-based knowledge management and multilingual NLP is also supporting industry growth.

Growth Drivers in India

| Key Drivers | Information |

|---|---|

| Government Policies for AI Adoption and Intelligent Analytics | Government digital transformation policies promoting the adoption of AI-based analytics. |

| Healthcare and Financial AI Solutions Expansion | Stronger adoption of AI-based patient analytics and fraud detection solutions. |

| Increased Demand for Cost-Effective, Scalable Content Intelligence Solutions | Adoption of AI-driven cognitive computing by large enterprises and SMEs. |

Australia's cognitive software, discovery, and content analytics industry is on a gradual growth due to an upsurge in AI-driven business intelligence, intelligent data solutions, and cybersecurity analytics. AI-driven content analytics is being adopted by Australian organizations, including financial services firms, healthcare firms, and government agencies, for fraud detection, regulatory compliance, and making autonomous decisions. The country's push to develop AI innovation and leverage AI ethically is driving the demand for new-generation cognitive analytics platforms.

Growth Drivers in Australia

| Key Drivers | Information |

|---|---|

| Government Action Toward AI-Powered Digital Economy and Cybersecurity | Policy-led growth backed by measures to cultivate ethical AI and digital content examination. |

| Boost of AI-Powered Predictive Analysis and Smart Search Engines | The expected boom in the application of AI-powered search tools for business data. |

| Rising Demand for NLP-Powered Sentiment Examination and Market Insights | Industrial businesses leverage AI-powered analytics to make efficient decisions and monitor consumers' behavior. |

The industry is global and majorly competitive as of now. This is mainly because of high demand, rapidly evolving industries, along with compelling needs for automated content analysis, cognitive computing solutions, and AI-powered data insights that spur adoption across different organizations.

Most organizations integrate such technologies to boost decision-making processes, maximize interaction with customers, and manage unstructured data. Of course, the major impetus would be the fast trend toward machine learning (ML), natural language processing (NLP), and predictive analytics, which allow actionable intelligence extraction from massive amounts of data.

Leading players like IBM, Microsoft, Google, OpenText, and SAS Institute are adopting advanced inputs from artificial intelligence, cloud computing, and enterprise-grade analytics for several industries like finance, healthcare, and retail. The industry primarily focuses on such platforms, including AI-driven content discovery, text and sentiment analytics, intelligent search, enterprise knowledge management, and deep learning-based cognitive solutions. Vendors are giving prime importance to automation, contextual analysis, and personalized recommendations to improve experience and engagement.

Real-time content analytics, ethical AI frameworks, and hybrid cloud adoption are driving the industry's market trend. Increasing regulatory compliance regarding GDPR and CCPA is further accelerating innovation in secure and transparent AI-driven analytics solutions to deliver compliant and privacy-respected real-time analytics. Companies are investing in strategic acquisitions, an AI-powered workflow, and partnerships with enterprise software developers to establish an edge in competition.

Start-ups make disruptive moves with niche applications in artificial intelligence while established giants develop capabilities around artificial intelligence with research and development dollars and cloud-based cognitive services. The competition in this industry is expected to intensify as enterprises adopt and start using real-time, more intuitive, and scalable analytics tools.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| IBM Corporation | 20-25% |

| Microsoft Corporation | 15-20% |

| Google LLC | 10-15% |

| SAS Institute | 8-12% |

| OpenText Corporation | 5-10% |

| Oracle Corporation | 4-8% |

| Other Companies (combined) | 30-38% |

| Company Name | Key Offerings/Activities |

|---|---|

| IBM Corporation | AI-powered Watson analytics, NLP, and cognitive data solutions. |

| Microsoft Corporation | Azure AI, Power BI analytics, and machine learning-based discovery tools. |

| Google LLC | Cloud-based AI content analytics, BigQuery, and NLP solutions. |

| SAS Institute | Advanced predictive analytics, data mining, and cognitive computing. |

| OpenText Corporation | Enterprise content management, AI-based text analytics, and automation. |

| Oracle Corporation | AI-driven data visualization, cloud-based content discovery, and deep learning analytics. |

Key Company Insights

IBM Corporation (20-25%)

Currently, IBM is leading with Watson in content analytics, and it observes NLP as an advanced setup for predictive modeling and cognitive computing.

Microsoft Corporation (15-20%)

For AI-based content discovery and predictive analytics tools, the research at Microsoft Group is mainly focused on Azure AI and Power BI, aimed mostly at enhancing business intelligence and decision-making.

Google LLC (10-15%)

Google has set itself up in the AI and BigQuery-cloud-based analytics platforms and has specializations in large-scale processing and NLP targeting applications that involve content discovery.

SAS Institute (8-12%)

SAS focuses on providing advanced analytics and cognitive computing to operationalize vast unstructured data and help the enterprise discover accountable insights.

OpenText Corporation (5-10%)

OpenText deals with enterprise content management and builds an automation system for content analytics, which streamlines the data discovery processes.

Oracle Corporation (4-8%)

Oracle works with data illustrated through AI and deep learning analytics for content discovery, an area often referred to as scalable cloud solutions.

Other Key Players (30-38% Combined)

These companies contribute to ongoing advancements in content analytics and cognitive software by integrating AI-driven automation, NLP-based search capabilities, and deep learning insights. The increasing adoption of AI-powered data discovery, enterprise automation, and intelligent analytics continues to shape the competitive landscape of the industry.

By product type, the industry is segmented into test software (in multiple languages) and rich media tagging (audio, video, & image).

By end user, the industry is divided into government & public services, finance, banking & insurance sectors, utilities, telecommunication operators, IT & high-tech ECM providers, healthcare & pharmaceutical sectors, media & web publishing, retail, transport, and real estate.

By region, the industry is segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is projected to reach USD 6.9 billion in 2025.

The industry is anticipated to grow to USD 26.8 billion by 2035.

India is forecasted to grow at a CAGR of 10.4% from 2025 to 2035, making it the fastest-growing industry.

The key players in the industry include IBM, Hewlett-Packard Enterprises, Baidu Inc., Elastic GmbH, Facebook, Google LLC, Oracle Corporation, SAP SE, Symantec Corporation, Adobe Systems Inc., Microsoft Corporation, Wipro Ltd., and LucidWorks Inc.

AI-powered content discovery and analytics are leading technological advancements in the industry.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Content Delivery Network Industry Analysis in Korea Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Content Creation Market Size and Share Forecast Outlook 2025 to 2035

Content Experience Platforms Market Size and Share Forecast Outlook 2025 to 2035

Content Delivery Network (CDN) Market Report - Growth, Demand & Forecast 2025 to 2035

Japan’s content delivery network (CDN) Industry Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Content Service Platform Market Trends - Demand & Growth Forecast 2025 to 2035

Content Intelligence – AI-Powered Insights for Marketers

Content as a Service (CaaS) Market

Content Automation AI Tools Market

Content Delivery Network Security Market

Content Creation Software Market Size and Share Forecast Outlook 2025 to 2035

Content Curation Software Market Size and Share Forecast Outlook 2025 to 2035

Content Distribution Software Market Size and Share Forecast Outlook 2025 to 2035

Content Disarm and Reconstruction Market Size and Share Forecast Outlook 2025 to 2035

Content Protection and Watermarking Market

Content Analytics Software Market Size and Share Forecast Outlook 2025 to 2035

Content Analytics Discovery And Cognitive Systems Market Size and Share Forecast Outlook 2025 to 2035

AI-Powered Content Creation – Automating Digital Media

OTT Content Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA