The contact lenses market is set to experience significant growth from 2025 to 2035, driven by increasing demand for vision correction solutions, rising aesthetic preferences for coloured lenses, and technological advancements in lens materials.

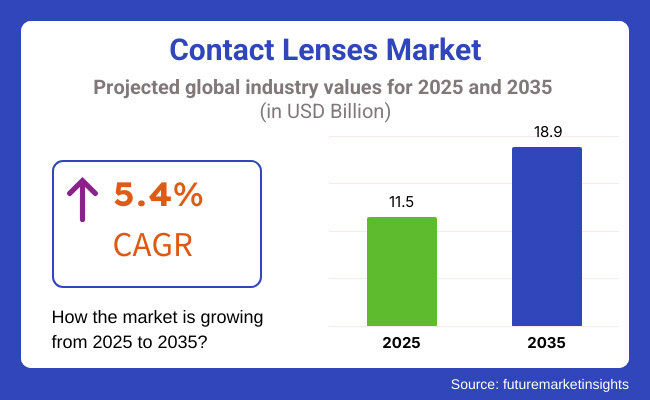

The market is projected to expand from USD 11.5 billion in 2025 to USD 18.9 billion by 2035, reflecting a compound annual growth rate (CAGR) of 5.4% over the forecast period.

This growth is supported by the rising frequency of diplopia and other vision-related diseases, coupled with a shift toward diurnal disposable and silicone hydrogel lenses for enhanced comfort and convenience.

Also, smart contact lenses with stoked reality (AR) capabilities and medicine-delivery mechanisms are becoming crucial inventions in the assiduity. The growing trend of online retail and subscription-grounded lens force services is further boosting request expansion.

Explore FMI!

Book a free demo

North America is anticipated to lead the contact lens request due to the high frequency of vision impairments, strong consumer mindfulness, and a well-established eye care structure.

The region is witnessing a shift toward diurnal disposables and toric lenses, offering better eye health benefits. also, e-commerce platforms are playing a pivotal part in adding availability, with online retailers offering competitive pricing and subscription-grounded delivery models.

Europe will witness steady growth in contact lens requests, driven by a growing population, rising relinquishment of ornamental and specialty lenses, and strong nonsupervisory support for vision care.

The demand for multifocal and cold-blooded lenses is increasing among aged grown-ups, while youngish consumers are gravitating toward coloured and fashion lenses. Sustainable and bio-based lens accoutrements are gaining traction, pushing manufacturers to concentrate on eco-friendly inventions.

Asia-Pacific is anticipated to be the swift-growing region in the contact lens request, with countries like China, Japan, and South Korea driving demand. The increasing frequency of diplopia, especially among youngish populations, is a crucial growth factor. The influence of beauty trends and social media is also fueling the demand for coloured and circle lenses.Likewise, rising disposable inflows and bettered access to vision care services are accelerating request expansion in the region.

One of the major challenges in the contact lenses request is the high cost of advanced lenses, making affordability a concern, especially in developing requests.

Also, indecorous lens operation, lack of hygiene, and extended wear and tear durations increase the threat of eye infections, including corneal ulcers. Educating consumers on lens care, hygiene, and responsible operation remains a critical challenge for manufacturers and eye care professionals.

The rising interest in smart contact lenses, featuring stoked reality (AR), glucose monitoring, and medicine delivery capabilities, presents a significant occasion for request expansion. Leading companies are investing in R&D to develop lenses that go beyond vision correction, integrating technology for enhanced functionalities.

Also, the shift toward sustainable and biodegradable lens accoutrements is gaining instigation, as consumers and controllers emphasize eco-friendly results in the eye care assiduity.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 34.80 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 12.50 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 27.90 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 25.60 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 29.40 |

The USA leads the global contact lens request, driven by high relinquishment rates of diurnal disposable and specialty lenses. Inventions similar as blue light-blocking and humidity-retaining lenses contribute to increase per capita spending.Retail chains, online platforms, and direct-to-consumer subscription models boost availability and affordability

China’s contact lens request is expanding as youngish consumers shift towards aesthetic and vision-correcting lenses. The demand for multicolour lenses is high, told by beauty trends and K- pop culture. Domestic brands contend with transnational manufacturers, and e-commerce platforms similar as JD.com and Taboo drive deals.

Japan has one of the loftiest per capita spending rates on contact lenses, thanks to a strong preference for high-quality and advanced lens technologies. Day disposables dominate the request, and consumers prioritize comfort, UV protection, and antibacterial coatings. Regulatory norms ensure ultra-expensive product quality.

Germany’s contact lens request benefits from rising mindfulness of eye health and a preference for soft, silicone hydrogel lenses. Optic retailers and online platforms see strong growth, while tori and multifocal lenses gain fashion ability among growing consumers

The UK request is fuelled by growing demand for ornamental and corrective lenses.Subscription-grounded models and advancements in traditional digital tradition services simplify access.Consumers decreasingly conclude for decoration lenses with added hydration and anti-fatigue features, supporting request growth.

The contact lens market is expanding rapidly on the strength of mounting requirements for vision correction, cosmetic uses of lenses, and improvements in lens material technologies. The findings of a poll of 250 consumers, practitioners, and industry representatives are predictive of trends driving the market.

Single-use lenses influence consumer demand, and 59% of the subjects prefer single-use lenses as it is convenient, there is an advantage of hygiene, and a lesser opportunity for getting infected. While 27% continue opting for monthlies or fortnightlies as it is cheap and convenient for them.

Cosmetic and colour contact lenses are trendy, and 41% of young consumers (18-35 years) are keen on appearance-enhancing contact lenses for appearance, particularly for social media pictures and festive occasions. Top preferred are natural colour contact lenses and soft enhancement contact lenses with requirement for statement colour and bold colour at 19%.

Innovation in lens material and smart technology are driving demand, with 48% of industry experts selecting silicone hydrogel as their preferred material of choice because of its increased oxygen permeability and comfort.

Another 31% of optometrists predict higher adoption of smart lenses for potential use in augmented reality (AR), monitoring diabetic blood glucose levels, and blue light filtering.

Online shopping and subscription plans are changing the market with 64% of the consumers buying contact lenses online as it is affordable, convenient, and gets delivered to the doorstep.

While 34% of the consumers are enrolled under auto-replenishment and saving plans. Yet, 22% of consumers buy lenses from traditional optometry clinics because of professional fitting and consultation.

Sustainability is in vogue, and 38% of customers want brands to supply recyclable packaging and green disposal schemes. Whilst biodegradable lenses are at the moment a niche product, increased consciousness towards environmentalism will have further advances in sustainable lens production spearhead the charge into the future.

While increasing demands for corrective vision are being driven by innovations in lens technology and changing consumer demands, business stakeholders need to prioritize comfort, convenience, fashion, and sustainability in a quest to compete competitively in the new market of contact lenses.

Contact Lenses Market - Shifts from 2020 to 2024 and Future Trends 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Brands introduced breathable, moisture-retaining lenses with UV protection. Hybrid lenses combining soft and rigid materials enhanced comfort and clarity. |

| Sustainability & Circular Economy | Companies adopted recyclable packaging, daily disposables made from biodegradable materials, and lens recycling programs. Water-efficient production processes gained traction. |

| Connectivity & Smart Features | IoT-enabled smart lenses monitored eye health, glucose levels, and hydration. AR-powered try-ons allowed users to visualize cosmetic lens effects before purchase. |

| Market Expansion & Consumer Adoption | Demand for vision correction, cosmetic, and specialty lenses (e.g., blue light filtering) surged. E-commerce and subscription-based delivery models expanded accessibility. |

| Regulatory & Compliance Standards | Stricter FDA and EU regulations mandated increased transparency in lens safety, antimicrobial coatings, and oxygen permeability. Certifications for sustainable production gained traction. |

| Customization & Personalization | Brands launched AI-assisted lens fitting tools, personalized prescription lenses, and customizable coloured contact lenses. Extended-wear and hybrid options catered to specific needs. |

| Influencer & Social Media Marketing | Eye health professionals, beauty influencers, and gaming communities promoted contact lenses. Tikor and Instagram fueled trends in cosmetic and coloured lenses. |

| Consumer Trends & Behavior | Consumers prioritized comfort, convenience, and long-lasting hydration. Demand surged for blue-light filtering, UV-blocking, and multifocal lenses. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered smart contact lenses offer real-time vision correction, augmented reality (AR) integration, and health monitoring capabilities. Self-cleaning and self-hydrating lenses revolutionize eye care. |

| Sustainability & Circular Economy | Zero-waste, biopolymer-based contact lenses become industry standard. AI-optimized material sourcing minimizes environmental impact while maximizing lens durability. |

| Connectivity & Smart Features | AI-driven adaptive lenses adjust focus dynamically based on lighting conditions and user activity. Blockchain ensures transparency in lens material sourcing and safety compliance. |

| Market Expansion & Consumer Adoption | Emerging markets drive adoption with cost-effective, AI-personalized contact lens solutions. AI-driven analytics refine product recommendations based on user lifestyle, vision needs, and environmental factors. |

| Regulatory & Compliance Standards | Governments mandate AI-driven safety compliance tracking for lens production and distribution. Blockchain enhances traceability of medical-grade lenses, ensuring quality assurance. |

| Customization & Personalization | AI-powered customization tailors contact lenses in real time based on user biometric data. 3D-printed, on-demand contact lenses provide hyper-personalized vision correction and aesthetic enhancements. |

| Influencer & Social Media Marketing | Virtual influencers and met averse-based eye care consultations redefine consumer engagement. AR-powered virtual try-ons enable users to test different lens shades and styles before purchase. |

| Consumer Trends & Behavior | Biohacking-inspired lenses integrate real-time vision enhancement, biometric tracking, and AI-driven eye health insights. Consumers embrace smart, sustainable, and high-tech contact lens solutions for everyday use. |

The USA contact lenses request is witnessing strong growth, driven by adding cases of diplopia and presbyopia, rising demand for diurnal disposable lenses, and advancements in lens material technology. Major players include Johnson & Johnson Vision Care, Alcon, and Bausch Lomb.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.2% |

The UK contact lens request is expanding due to adding relinquishment of vision correction results, rising demand for multifocal lenses, and the growing fashionability of online eye care retailers. Leading brands include Cooper Vision, Specsavers, and Acuvue.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.0% |

Germany’s contact lens request is growing, with consumers favoring high-quality, ophthalmologist-approved lenses and adding demand for diplopia-correcting lenses. crucial players include Carl Zeiss Meditec, Menicon, and Hoya Vision.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.3% |

India’s contact lenses request is witnessing rapid-fire growth, fueled by adding mindfulness of vision correction, rising disposable inflows, and the growing influence of fashion-acquainted multicolored lenses. Major brands include Freshlook, Bausch Lomb, and Titan Eye.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.8% |

China’s contact lens requests is expanding significantly, driven by adding cases of diplopia among youthful consumers, the rising fashion ability of ornamental lenses, and rapid-fire relinquishment of smart contact lens technology. crucial players include Pegavision, Hydron, and SEED.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.0% |

The contact lens request is growing steady growth driven by adding cases of diplopia, presbyopia, and presbyopia, along with rising consumer preference for hassle-free vision correction. also, the fashionability of multicolored and ornamental lenses is expanding, particularly among youngish demographics and beauty suckers. diurnal disposable lenses continue to gain traction due to their convenience and hygiene benefits.

Technological inventions are reshaping the contact lens assiduity, with the preface of silicone hydrogel lenses, humidity- retaining coatings, and oxygen-passable accoutrements that enhance comfort and eye health. The emergence of smart contact lenses with AR/ VR capabilities, glucose monitoring, and medicine delivery systems is farther revolutionizing the request, attracting interest from both medical and tech sectors.

Consumers are decreasingly prioritizing eye health, leading to advanced demand for lenses with UV protection and blue light filtering to combat digital eye strain. With the swell in screen time due to remote work and digital cultures, companies are launching technical lenses designed to reduce fatigue and ameliorate long- term vision health.

Online retail and direct- to- consumer( DTC) models are transubstantiating the contact lens request, offering consumers lesser availability, affordability, and convenience. Subscription- grounded services furnishing automatic lens renewals and virtual eye examinations are gaining fashionability, enhancing client retention. Major brands are also fastening on Omni channel strategies to ground online and offline gests .

The contact lens request is passing steady growth, driven by rising vision correction needs, adding a preference for aesthetic lenses, and advancements in lens accoutrements and technology. Consumers are shifting toward diurnal disposable lenses, silicone hydrogel lenses, and smart contact lenses with UV protection and humidity retention. Leading manufacturers concentrate on invention, comfort, and expanding distribution through e-commerce and optometry networks.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| Johnson & Johnson Vision | 35-40% |

| Alcon | 22-26% |

| CooperVision | 18-22% |

| Bausch + Lomb | 12-16% |

| Other Companies (combined) | 10-15% |

| Company Name | Key Offerings/Activities |

|---|---|

| Johnson & Johnson Vision | Market leader with ACUVUE® brand. Pioneers daily disposable and UV-blocking contact lenses. Investing in smart lenses and digital eye health technologies. |

| Alcon | Strong in multifocal, toric, and colored lenses with DAILIES® and AIR OPTIX®. Expanding silicone hydrogel lenses and lens care solutions. |

| CooperVision | Specializes in Biofinity®, Clariti®, and MyDay® lenses. Focus on myopia control, toric lenses for astigmatism, and sustainability in packaging. |

| Bausch + Lomb | Innovates in moisture-retaining lenses with Ultra® and Biotrue ONEday®. Strengthens presence in eye health and lens care solutions. |

Strategic Outlook of Key Companies

Johnson & Johnson Vision (35-40%)

Johnson & Johnson dominates with its ACUVUE ® brand, known for high-quality disposable lenses with UV protection and humidity retention. The company is investing in smart contact lenses, AI-driven eye health diagnostics, and sustainability enterprise to reduce plastic waste.

Alcon (22-26%)

Alcon is a strong contender with a different portfolio of diurnal, yearly, and specialty lenses. The company is expanding its DAILIES ® and TOTAL30 ® silicone hydrogel lines while enhancing e-commerce and direct-to-consumer deals.

Cooper Vision (18-22%)

Cooper Vision differentiates itself through diplopia operation results, including MiSight ® 1 day, a FDA- approved lens for decelerating diplopia progression in children. The company also focuses on sustainable packaging and expanding into developing requests.

Bausch + Lomb (12-16%)

Bausch Lomb emphasizes comfort and humidity retention with its Ultra ® and Bio true ONE day ® lenses. The company is investing in eye health results, including nutritive supplements and lens care products, to round its contact lens portfolio.

Other Key Players (10-15% Combined)

Numerous emerging players and regional manufacturers contribute to market growth by offering specialized, aesthetic, and affordable contact lenses. Notable names include:

The Contact Lenses industry is projected to witness a CAGR of 5.4% between 2025 and 2035.

The Contact Lenses industry stood at USD 10.2 billion in 2024.

The Contact Lenses industry is anticipated to reach USD 18.9 billion by 2035 end.

North America is set to record the highest CAGR of 7.1% in the assessment period.

The key players operating in the Contact Lenses industry include Johnson & Johnson Vision Care, Alcon, Bausch + Lomb, CooperVision, Hoya Corporation, and Menicon.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.