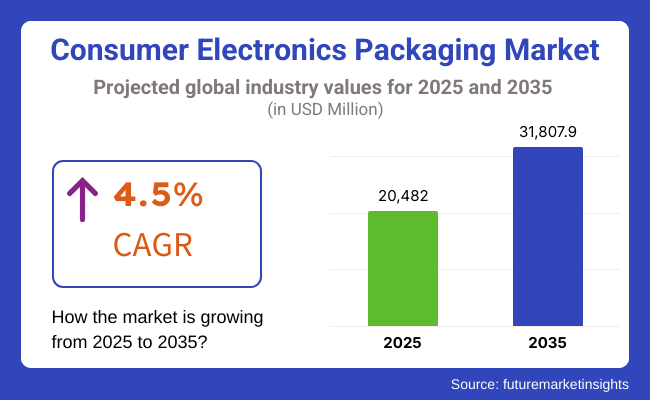

The market for consumer electronics packaging is estimated to generate a market size of USD 20,482 million in 2025 and would increase to USD 31,807.9 million by 2035. It is expected to increase its sales at a CAGR of 4.5% over the forecast period 2025 to 2035. Revenue generated from consumer electronics packaging in 2024 was USD 19,600 million.

Mobile Phones will continue to hold over 30% of the consumer electronics packaging market share in 2035. The smartphone market is leading because of the huge demand for smartphones worldwide. Brands like Apple, Samsung, and Xiaomi spend a lot of capital on green and innovative packaging to make their brand stand out.

As phones are being sold increasingly online, the packaging must be product-safe, lightweight, and inexpensive. High-end mobile phones require high-end protective packaging, including tamper-evident packs, paperboard boxes, and inserts. Businesses have also been forced by the green packaging movement to switch from plastic-based packaging to recyclable and biodegradable packaging.

In the material segment, paper and paperboard is likely to account for over 48% of the market share over the forecast period. Many electronics companies are moving away from plastic to biodegradable packaging materials that meet environment-friendly laws. The segment includes corrugated boxes, rigid paperboard boxes, and molded fiber trays used extensively in retail and e-commerce packaging of smartphones, laptops, and game consoles.

The consumer electronics packaging market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 12,207.9 million and will increase 1.6 times the current value by 2035.

Explore FMI!

Book a free demo

The below table presents the expected CAGR for the global consumer electronics packaging market over several semi-annual periods spanning from 2024 to 2034.

| Particular | Value CAGR |

|---|---|

| H1 | 4.4% (2024 to 2034) |

| H2 | 4.6% (2024 to 2034) |

| H1 | 3.8% (2025 to 2035) |

| H2 | 5.2% (2025 to 2035) |

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.4%, followed by a slightly higher growth rate of 4.6% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 3.8% in the first half and remain relatively moderate at 5.2% in the second half. In the first half (H1) the market witnessed a decrease of 60 BPS while in the second half (H2), the market witnessed an increase of 60 BPS.

The market is expanding due to advancements in intelligent and smart packaging solutions

The consumer electronics industry is using innovative and creative packaging approaches to promote security, functionality, and customer connection. Brands are incorporating near-field communication (NFC) labels, QR codes, and RFID tags into packaging to facilitate interactive user experiences, product tracking, and anti-counterfeiting. Consumers can use their smartphones to scan QR codes on packages and view user guides, product setup instructions, and warranty details, minimizing the consumption of printed paper inserts.

Moreover, nanotechnology-based coating technologies are strengthening packaging's resilience without keeping it heavy or non-renewable. Other companies are introducing biodegradable and renewable materials such as seaweed packaging and biopolymers that can compost, replacing traditional plastics.

Such advancements are making it possible for businesses to manufacture working yet green packaging solutions that promote customer satisfaction, add security, and serve sustainability goals. With technology becoming more advanced, smart packaging solutions will take the lead in dictating the destiny of consumer electronics packaging.

Increased E-Commerce Growth and Protective Packaging Needs propel the growth of the market

The availability of internet shopping sites such as Amazon, Alibaba, and eBay has raised the market for consumer electronics packaging that is lightweight, protective, and durable by thousands. Such products such as smartphones, tablets, gaming devices, and headsets tend to go a long distance and require protection in terms of shock-absorbing and secure packaging so that they will not be harmed.

Companies are investing in innovative and sustainable packaging materials that protect products while minimizing the amount of material waste as more individual’s shop for products online today. Companies are trying out fiber-based inserts, pulp mold packaging, and biodegradable air cushions as substitutes for traditional plastic fillers without compromising product integrity.

Exorbitant Cost of Environment-Friendly Packaging Material

Another issue facing the market for consumer electronics packaging is that sustainable materials cost more than standard plastic packaging. Biodegradable foam, pulp molding, and recycled paperboard are examples of environmentally friendly alternative packaging materials but need specialized processes to produce, along with finer-quality raw material, which creates higher production costs. Sustainable materials also need to pass rigorous test requirements for protective qualities and toughness to keep the electronics safe for shipping, all of which costs more.

Whereas big corporations can pay for these adjustments, small and medium-sized electronics brands will find it difficult to handle the increased cost of green packaging solutions. Additionally, creating and testing new biodegradable materials to make sure they offer the same protection, moisture resistance, and shock absorption as plastic takes time and money. While reduction of production cost and availability of sustainable materials become cheap, use of sustainable packages by the electronic sector might grow at a slower rate.

| Key Investment Area | Why It’s Critical for Future Growth |

|---|---|

| Sustainability & Eco-Friendly Materials | Increasing environmental issues lead to investing in reusable, recyclable, and biodegradable packaging to curtail waste generation and comply with regulatory standards. |

| Protective & Shock-Resistant Design | Making packaging perform better in impact resistance, anti-static protection, and cushioning will ensure products are not damaged during shipping and handling. |

| Lightweight & Economical Solutions | The creation of lightweight materials will reduce shipping costs without compromising on durability, helping manufacturers and consumers alike. |

| Customization & Branding | Embossing, high-quality printing, and bespoke packaging designs will improve consumer experience and brand identity. |

| Smart & Tamper-Proof Packaging | Combining QR codes, RFID tracking, and tamper-evident seals will enhance security, allow authentication, and increase supply chain transparency. |

The global consumer electronics packaging market achieved a CAGR of 2.8% in the historical period of 2020 to 2024. Overall, the consumer electronics packaging market performed well since it grew positively and reached USD 19,600 million in 2024 from USD 17,550.3 million in 2020.

The consumer electronics packaging market experienced steady growth from 2020 to 2024, driven by increasing sales of smartphones, wearables, and smart home devices, rising demand for protective and sustainable packaging solutions, and advancements in lightweight and shock-resistant materials.

| Market Aspect | 2020 to 2024 (Past Trends) |

|---|---|

| Market Growth | Steady growth driven by rising sales of smartphones, laptops, and smart devices. |

| Material Trends | Predominantly plastic, foam inserts, and corrugated cardboard for protection. |

| Regulatory Environment | Compliance with extended producer responsibility (EPR) laws and packaging waste regulations. |

| Consumer Demand | High demand for protective and aesthetically appealing packaging, especially for high-end electronics. |

| Technological Advancements | Improved shock-resistant and lightweight packaging materials to protect fragile electronics. |

| Market Aspect | 2025 to 2035 (Future Projections) |

|---|---|

| Market Growth | Strong growth fueled by increasing e-commerce, demand for sustainable packaging, and premium unboxing experiences. |

| Material Trends | Shift towards biodegradable, molded fiber, and plastic-free packaging to enhance sustainability. |

| Regulatory Environment | Stricter global mandates on reducing single-use plastics and encouraging recyclable and compostable materials. |

| Consumer Demand | Increasing preference for minimalistic, eco-friendly, and reusable packaging that aligns with brand sustainability goals. |

| Technological Advancements | Integration of smart packaging with NFC, QR codes, and augmented reality (AR) for interactive consumer experiences. |

| Factor | Consumer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Sustainability |

|

| Performance (Protection, Durability, Shock Resistance) |

|

| Product Availability & Convenience |

|

| Reusability & Circular Economy |

|

| Food Safety & Hygiene |

|

| Factor | Manufacturer Priorities (2019 to 2024) & (2025 to 2035) |

|---|---|

| Sustainability |

|

| Performance (Protection, Durability, Shock Resistance) |

|

| Product Availability & Convenience |

|

| Reusability & Circular Economy |

|

| Food Safety & Hygiene |

|

Between 2025 and 2035, the demand for consumer electronics packaging is expected to rise due to expanding e-commerce and direct-to-consumer sales, growing adoption of eco-friendly and recyclable packaging materials, and increasing innovations in smart and tamper-evident packaging for enhanced product security and user experience.

Tier 1 companies comprise market leaders capturing significant market share in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base. They provide a wide range of series including recycling and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within tier 1 include DS Smith Plc, Mondi Group, International Paper Company, Sonoco Products Company, Sealed Air Corporation

Tier 2 companies include mid-size players having presence in specific regions and highly influencing the local market. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in tier 2 include Huhtamaki Oyj, Smurfit Kappa Group PLC, WestRock Company, UFP Technologies, Inc., Stora Enso Oyj, Pregis Corporation, Dordan Manufacturing Company.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

| Region | 2019 to 2024 (Past Trends) |

|---|---|

| North America | High demand due to growth in smartphones, laptops, and smart devices. |

| Latin America | Demand mainly from Brazil, Mexico, and Argentina due to rising disposable income. |

| Europe | High consumer preference for minimalistic and eco-friendly packaging designs. |

| Middle East & Africa | Emerging market with increasing adoption of smartphones, tablets, and wearables. |

| Asia Pacific | Rapid market growth due to booming consumer electronics sector in China, Japan, and India. |

| Region | 2025 to 2035 (Future Projections) |

|---|---|

| North America | Increased focus on sustainable and plastic-free packaging. |

| Latin America | Shift towards lightweight, cost-effective, and recyclable packaging. |

| Europe | Expansion of reusable and modular packaging concepts. |

| Middle East & Africa | Growth in premium and luxury electronics packaging due to rising disposable income. |

| Asia Pacific | Expansion of high-performance protective packaging for fragile electronics. |

The section below covers the future forecast for the consumer electronics packaging market in terms of countries. Information on key countries in several parts of the globe, including North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe and MEA is provided. USA is expected to account for a CAGR of 3.4% through 2035. In Europe, Spain is projected to witness a CAGR of 4.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.4% |

| Germany | 3.0% |

| China | 5.4% |

| UK | 2.9% |

| Spain | 4.1% |

| India | 5.6% |

| Canada | 3.2% |

Direct-to-consumer electronics firms and tech subscription services in the United States are growing, and so is the need for customized and efficient packaging solutions. Google, Apple, and Samsung are selling directly to consumers from web stores and device monthly subscription services such as smartphones, game devices, and wearables. This shift requires secure, light, and sustainable packaging that maintains the product safety during transit without causing excessive waste.

Also, with the growth of tech rental and subscription services such as Apple's iPhone Upgrade Program and Xbox Game Pass hardware subscription, brands are experimenting with reusable and returnable packaging that enables customers to return products without generating too much waste. With a view to enhancing customer experience and brand image, several companies are also embracing minimalist, frustration-free pack styles made from biodegradable or recyclable materials. As the market for DTC electronics expands, packaging innovation will remain a top priority.

Germany has remarkable green regulations that are among the strictest in the world, requiring the use of sustainable consumer electronics packaging. The Extended Producer Responsibility (EPR) law requires companies that produce electronics to be in charge of waste disposal from packaging their products, which has motivated them to introduce recyclable, reusable, and compostable packaging materials.

Additionally, Closed-loop packaging systems are gaining popularity among most German companies, where cardboard, molded pulp, and bioplastics are recovered or recycled effectively. The nation's advanced infrastructure of waste separation and recycling guarantees that environmentally friendly packaging solutions are readily embraced and easily recyclable.

The section contains information about the leading segments in the industry. In terms of product type, corrugated boxes are being estimated to account for a share of 39.4% by 2025. By application type, mobile phones are projected to dominate by holding a share above 30% by the end 2025.

| Product Type | Market Share (2025) |

|---|---|

| Corrugated Boxes | 39.4% |

Packaging of consumer electronics is primarily created using corrugated boxes. Corrugated boxes are used most often for transporting and retail packaging of products like laptops, smartphones, TVs and home appliances because they are sturdy, shock-proof, and affordable. They're superb at cushioning and damage protection during transit, which is especially important for delicate electronics. Moreover, its brand ability, printing, and die-cutting options allow it to be suitable for high-end and sustainable packaging solutions.

As the name suggests and with the soaring e-shopping and direct customer selling, requires a type of the packaging material that is lightweight but still tough enough to do the job. In addition, as the raw materials needed for the manufacturing of corrugated boxes are eco-friendly, recyclable and sustainable, companies are inclined towards this type of packaging for their green packaging option.

| Application Segment | Market Share (2025) |

|---|---|

| Mobile Phone | 30% |

The consumer electronics packaging market is now made up largely of smartphones with significant market share. Leading companies such as Apple, Samsung, and Xiaomi move products by the million each year, increasingly burdening their manufacturers with the need for effective, secure, and pleasing packaging. An instance is Apple, which has lightened its packaging in weight and removed plastic covers to save transportation expenses and carbon footprint. In addition, with the heightening e-commerce trend, companies are using light-weight yet durable packaging to avoid payment of extra reimbursement costs for the favored dispatch of the product by the customer. With this combination, the mobile phone packaging has become the front-running across industries concerning sustainability.

Key players of global consumer electronics packaging industry are developing and launching new products in the market. They are integrating with different firms and extending their geographical presence. Few of them are also collaborating and partnering with local brands and start-up companies

Key Developments in Consumer Electronics Packaging Market

| Manufacturer | Vendor Insights |

|---|---|

| WestRock | Company Provides comprehensive packaging solutions for consumer electronics, combining innovative design with sustainable materials to meet diverse industry needs |

| DS Smith Plc | Expert in sustainable packaging solutions, including consumer electronics packaging, highlighting recyclability and effective design to minimize environmental footprint. |

| Pregis Corporation | Offers diverse protective packaging solutions designed for consumer electronics with a focus on innovation and sustainability in their product portfolio. |

| Sonoco Products Company | Provides consumer electronics packaging solutions that specialize in protective packaging, ensuring the product is safe in transit and during handling. |

| Sealed Air Corporation | Sealed Air Corporation famous for its protective packaging solutions, Sealed Air offers innovative packaging materials and designs to protect consumer electronics through the supply chain. |

Key Players in Consumer Electronics Packaging Market

The global consumer electronics packaging industry is projected to witness CAGR of 4.5% between 2025 and 2035.

The global consumer electronics packaging industry stood at 19,600 million in 2024.

Global consumer electronics packaging industry is anticipated to reach USD 31,807.9 million by 2035 end.

East Asia is set to record a CAGR of 5.6% in assessment period.

The key players operating in the global consumer electronics packaging industry include DS Smith Plc, Mondi Group, International Paper Company, Sonoco Products Company, Sealed Air Corporation.

The consumer electronics packaging market is categorized based on product type into corrugated boxes, paperboard boxes, thermoformed trays, bags & pouches, blister packs & clamshells, protective packaging, and others.

The market is segmented by application into mobile phones, computers, TVs, DTH & set-top boxes, music systems, printers, scanners & photocopy machines, game consoles & toys, camcorders & cameras, electronic wearables, digital media adapters, and others. The computers segment is further divided into laptops & tablets and desktops & servers.

The market includes different material types such as plastic, paper & paperboard, and others. The plastic segment is further divided into polyethylene (PE), polypropylene (PP), polyvinyl chloride (PVC), polyamide (PA), polyethylene terephthalate (PET), polystyrene (PS), and others.

Key Countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe and Middle East & Africa are covered.

Specialty Pulp and Paper Chemicals Market Analysis – Growth & Forecast 2025 to 2035

Kraft Paper Machine - Market Outlook 2025 to 2035

Stainless Steel Water Bottles Market Trends – Growth & Forecast 2025 to 2035

Kraft Paper Bags Market Growth – Demand & Forecast 2025 to 2035

Hang Tags Market Insights – Growth & Trends Forecast 2025 to 2035

Reconditioned IBC Market Analysis by Material, Capacity and End Use Through 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.