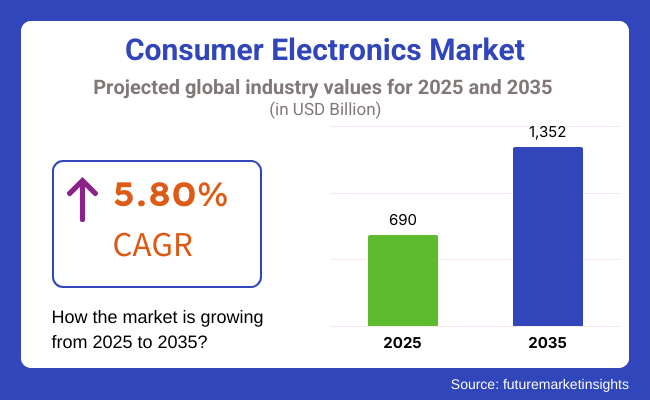

The consumer electronics market is set for substantial growth from 2025 to 2035, driven by rapid technological advancements, increasing adoption of smart devices, and the integration of artificial intelligence (AI) and iot in consumer products. The market size is projected to expand from USD 690 billion in 2025 to USD 1,352 billion by 2035, registering a compound annual growth rate (CAGR) of approximately 5.80% over the forecast period.

The growing demand for smartphones, smart home devices, wearable technology, and high-performance computing gadgets is fueling industry expansion. Additionally, the increasing emphasis on sustainability, energy-efficient products, and circular economy practices is influencing market trends. E-commerce platforms and direct-to-consumer sales channels are also playing a pivotal role in reshaping consumer purchasing behaviour.

Explore FMI!

Book a free demo

North America is expected to dominate the consumer electronics market due to strong consumer demand, early adoption of advanced technologies, and the presence of key industry players. The USA and Canada are witnessing increased sales of AI-powered smart home devices, gaming consoles, and high-end personal gadgets. Additionally, growing investments in 5G infrastructure are propelling demand for next-generation mobile devices.

Europe remains a significant market for consumer electronics, with increasing demand for sustainable and energy-efficient devices. Countries such as Germany, the UK, and France are emphasizing eco-friendly manufacturing practices, driving the adoption of recyclable and modular electronics. The region is also experiencing growth in premium electronics, including high-end audio systems and AR/VR-enabled products.

Asia-Pacific is anticipated to witness the fastest growth, fueled by rising disposable incomes, rapid urbanization, and the expansion of the middle class. Countries like China, India, Japan, and South Korea are driving market expansion through high smartphone penetration, increasing demand for smart tvs, and a growing inclination towards advanced home automation systems. Additionally, local manufacturing capabilities and competitive pricing strategies are accelerating regional growth.

The Middle East & Africa region is experiencing a surge in demand for high-end consumer electronics, particularly in luxury smartphones, gaming devices, and home entertainment systems. Countries like the UAE and Saudi Arabia are investing in smart city initiatives, further boosting demand for IoT-enabled consumer products. Additionally, Africa's rising digital adoption and increasing mobile penetration are key growth drivers.

Rising Raw Material Costs and Global Supply Chain Disruptions

One of the major challenges in the consumer electronics market is the volatility in raw material prices, particularly for semiconductors, lithium batteries, and rare earth metals. Supply chain disruptions, geopolitical uncertainties, and stringent regulatory policies further impact production and product pricing.To mitigate these challenges, industry players are investing in local sourcing, enhancing manufacturing automation, and optimizing supply chain resilience through strategic partnerships.

Expansion of AI, 5G, and Smart Technologies

The increasing integration of AI, machine learning, and 5G connectivity presents significant growth opportunities. Smart home ecosystems, voice-assisted technologies, and wearable health monitoring devices are witnessing surging demand. The emergence of foldable smartphones, AR/VR headsets, and autonomous consumer electronics is set to redefine market dynamics.

Additionally, the expansion of e-commerce and direct-to-consumer sales is enabling brands to reach a wider audience. Companies that leverage digital retail strategies, personalized product offerings, and subscription-based service models will gain a competitive advantage in the evolving consumer electronics landscape.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 1,820.50 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 1,230.80 |

| Country | India |

|---|---|

| Population (millions) | 1,450.9 |

| Estimated Per Capita Spending (USD) | 430.90 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 1,580.60 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 1,410.70 |

The USD 628.64 Billion USA consumer electronics market is driven by premium smartphone upgrades, gaming consoles, smart home gadgets, and wearable tech. Apple, Samsung, and Microsoft lead the industry, with rising demand for AI-powered devices, OLED tvs, and AR/VR headsets. E-commerce, brand-owned stores, and tech subscription models are gaining traction.

China’s USD 1.75 Trillion consumer electronics sector thrives on massive domestic production, 5G adoption, and AI-powered devices. Huawei, Xiaomi, and Lenovo dominate, with rising demand for smartphones, smart TVs, and electric appliances. Live-stream shopping, social commerce, and aggressive online retail expansion are key growth drivers in the world's largest electronics market.

India’s USD 625.03 Billion consumer electronics market is expanding rapidly due to affordable smartphones, increasing internet penetration, and growing disposable income. Budget-friendly brands like Realme, Xiaomi, and Samsung cater to mass consumers, while premium brands see steady growth. Festive sales, e-commerce boom, and government initiatives on local production drive demand.

Germany’s USD 132.93 Billion consumer electronics industry is defined by high-quality standards, premium home appliances, and smart home integration. Bosch, Siemens, and Miele lead in home tech and appliances, while Sony and Apple dominate personal electronics. Rising demand for energy-efficient devices and government incentives for eco-friendly products influence buying behavior.

The USD 96.34 Billion UK consumer electronics market is fueled by rising adoption of smart home devices, gaming consoles, and streaming technology. Apple, Sony, and Dyson lead the industry, with AI-powered home automation and foldable smartphones gaining popularity. Retailers like Currys, Argos, and Amazon play a major role in market distribution.

The consumer electronics market is experiencing dynamic growth, driven by technological advancements, increasing disposable income, and evolving consumer preferences.

A survey of 250 respondents across the USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and the Middle East highlights key trends shaping purchasing behavior. 72% of respondents prioritize product performance and innovation, with 70% in the USA and UK valuing cutting-edge features such as AI integration, smart connectivity, and enhanced battery life. 65% of consumers in Korea and Japan prefer premium brands like Sony, Samsung, and Apple, while 60% in Southeast Asia and China seek affordable yet feature-rich alternatives from brands like Xiaomi and Realme.

Pricing sensitivity varies across regions, with 68% of respondents in North America and Europe willing to pay USD 500+ for premium smartphones, laptops, and smart home devices, while only 48% in Southeast Asia and the Middle East opt for high-end options. 54% of global buyers prefer a balance of affordability and advanced features, making the mid-range segment a key market driver.

E-commerce is a dominant sales channel, with 70% of respondents in the USA, UK, and China purchasing consumer electronics online from platforms like Amazon, Best Buy, and Alibaba. 55% of buyers in Korea and Japan still prefer in-store experiences, where they can test products before purchasing. 60% of global respondents rely on expert reviews, influencer recommendations, and online ratings to make purchasing decisions.

Sustainability is an emerging priority, with 62% of respondents in the UK and EU favoring energy-efficient, eco-friendly electronics with recyclable materials. 58% of buyers in Australia and the Middle East seek premium, long-lasting devices, while 50% in Southeast Asia and China prioritize cost-effective, feature-packed gadgets.

High-end electronics dominate in North America, Europe, and Japan, while affordable and mid-range devices drive growth in Southeast Asia and China. E-commerce, AI-driven personalization, and sustainable innovations are reshaping the market, making digital engagement, product longevity, and repairability crucial for brands.

Local manufacturers have an opportunity to introduce cost-effective solutions, while global players must emphasize performance, connectivity, and eco-conscious innovation to maintain market share. The consumer electronics market is evolving, with strong opportunities in 5G, AI, smart home integration, and circular economy models.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Companies introduced AI-powered smart home devices, foldable screens, and wearable health monitors. 5G connectivity and IoT integration reshaped consumer electronics. |

| Sustainability & Circular Economy | Brands prioritized energy-efficient devices and sustainable manufacturing practices. Recycling programs for e-waste and modular repairable designs gained traction. |

| Connectivity & Smart Features | IoT-enabled devices, voice assistants, and seamless multi-device ecosystems gained widespread adoption. Edge computing enhanced real-time data processing. |

| Market Expansion & Consumer Adoption | Demand surged for home office gadgets, gaming consoles, and smart wearables. E-commerce and DTC sales models became dominant. |

| Regulatory & Compliance Standards | Governments implemented stricter data privacy laws and security protocols for connected devices. Sustainable electronic certifications gained importance. |

| Customization & Personalization | Brands introduced modular smartphones and customizable smart devices. Subscription-based models for device upgrades gained popularity. |

| Influencer & Social Media Marketing | Tech influencers and YouTubers played a significant role in consumer purchasing decisions. Social media platforms drove viral product launches. |

| Consumer Trends & Behavior | Consumers prioritized seamless integration, energy efficiency, and enhanced privacy in smart devices. The shift towards premium, high-performance gadgets increased. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-driven hyper-personalized electronics adapt to user behavior. Quantum computing and neural interface devices revolutionize the industry. |

| Sustainability & Circular Economy | Zero-waste electronics production has become the standard. Biodegradable and self-repairing electronic components drive sustainability efforts. |

| Connectivity & Smart Features | AI-powered personal assistants provide predictive automation. Seamless brain-computer interfaces enable direct control of smart devices. |

| Market Expansion & Consumer Adoption | Growth accelerates in emerging markets, with localized product designs. AI-driven consumer analytics optimize personalized offerings. |

| Regulatory & Compliance Standards | Global regulatory bodies mandate carbon-neutral electronics production. Blockchain ensures transparency in ethical sourcing and digital security. |

| Customization & Personalization | AI-powered consumer electronics automatically adapt features based on user needs. On-demand 3D printing enables real-time personalized gadgets. |

| Influencer & Social Media Marketing | Virtual influencers and metaverse-based tech showcases redefine digital marketing. Augmented reality shopping enhances consumer experiences. |

| Consumer Trends & Behavior | Biohacking-inspired electronics integrate wellness features like cognitive enhancement and biometric monitoring. Consumers embrace AI-driven digital lifestyles with embedded smart technology. |

The USA consumer electronics market is experiencing steady growth, driven by increasing demand for smart devices, high-speed connectivity, and home automation solutions. Major players such as Apple, Samsung, and Sony dominate the sector.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

The UK consumer electronics market is expanding due to increasing digital transformation, rising e-commerce sales, and strong demand for premium gadgets. Companies such as Dyson, Sony, and LG play a major role.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.8% |

Germany’s consumer electronics market is growing, with demand for high-quality, precision-engineered devices and home entertainment systems. Companies like Bosch, Siemens, and Panasonic lead the industry.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.0% |

India’s consumer electronics market is experiencing rapid expansion, fueled by increasing smartphone penetration, rising disposable incomes, and government initiatives promoting digital adoption. Major brands like Xiaomi, Samsung, and OnePlus dominate the sector.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

China’s consumer electronics market is booming, driven by innovation in 5G, artificial intelligence, and smart home integration. Companies such as Huawei, Xiaomi, and Lenovo lead global advancements.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 8.0% |

Consumers increasingly prioritize smart home appliances, smartphones, and connected entertainment systems, integrating AI-driven functionalities for enhanced convenience. The demand for voice-controlled assistants, smart TVs, and home security systems grows as IoT adoption accelerates.

Sustainability trends push manufacturers toward energy-efficient appliances, eco-friendly packaging, and repairable electronic designs. Solar-powered gadgets, low-energy consumption devices, and recycling initiatives gain traction, with brands emphasizing green technology.

Online platforms dominate consumer electronics sales, offering competitive pricing, product comparisons, and AI-driven recommendations. Direct-to-consumer (DTC) models allow brands to engage with customers, leveraging influencer marketing, live-stream shopping, and subscription-based gadget services.

Advancements in AI-powered personal assistants, IoT-connected devices, and wearable health tech fuel market expansion. Consumers embrace smartwatches, AR/VR headsets, and AI-driven home automation, with brands focusing on personalization, data security, and seamless connectivity.

The global consumer electronics market is experiencing robust growth, driven by rapid technological advancements, increasing disposable incomes, and a rising demand for smart and connected devices. The market encompasses a wide range of products, including smartphones, laptops, televisions, wearable devices, and smart home appliances.

Companies are focusing on innovation, sustainability, and strategic partnerships to strengthen their market positions. The industry is characterized by both established multinational corporations and emerging players striving to capture market share through diverse product offerings and targeted marketing strategies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Samsung Electronics Co., Ltd. | 18-22% |

| Apple Inc. | 15-19% |

| LG Electronics Inc. | 10-14% |

| Sony Corporation | 8-12% |

| Panasonic Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Samsung Electronics Co., Ltd. | Offers a comprehensive range of consumer electronics, including smartphones, televisions, home appliances, and wearable devices. Focuses on innovation with products like foldable smartphones and QLED TVs, and invests heavily in research and development to maintain technological leadership. |

| Apple Inc. | Known for its premium products such as the iPhone, iPad, Mac computers, and Apple Watch. Emphasizes a seamless ecosystem, user-friendly design, and strong brand loyalty. Continuously innovates with new product launches and services like Apple Fitness+ and Apple One. |

| LG Electronics Inc. | Provides a diverse portfolio of consumer electronics, including OLED TVs, home appliances, and smartphones. Focuses on energy efficiency and smart technology integration, with products like InstaView refrigerators and AI-powered washing machines. |

| Sony Corporation | Offers a wide range of products, including gaming consoles (PlayStation), televisions, cameras, and audio equipment. Leverages its strong brand in entertainment and technology to deliver high-quality products and immersive experiences. |

| Panasonic Corporation | Provides various consumer electronics, including televisions, home audio systems, and kitchen appliances. Focuses on sustainability and energy-efficient products, with initiatives to reduce environmental impact through eco-friendly technologies. |

Strategic Outlook of Key Companies

Samsung Electronics Co., Ltd. (18-22%)

Samsung leads the consumer electronics market with a broad product portfolio and a strong emphasis on innovation. The company invests heavily in research and development to introduce cutting-edge technologies, such as foldable smartphones and advanced display technologies. Samsung also focuses on expanding its presence in emerging markets and enhancing its smart home ecosystem through interconnected devices.

Apple Inc. (15-19%)

Apple maintains a significant market share through its premium product offerings and a loyal customer base. The company emphasizes a seamless user experience across its devices and services, fostering a strong ecosystem. Apple continues to innovate with new product launches and services, aiming to enhance user engagement and expand its market reach.

LG Electronics Inc. (10-14%)

LG focuses on delivering high-quality, energy-efficient consumer electronics with smart technology integration. The company invests in developing innovative products, such as AI-powered home appliances and advanced display technologies. LG also emphasizes sustainability initiatives, aiming to reduce its environmental footprint through eco-friendly products and practices.

Sony Corporation (8-12%)

Sony leverages its strong brand presence in entertainment and technology to offer a diverse range of consumer electronics. The company focuses on delivering high-quality products and immersive experiences, particularly in gaming and audio-visual equipment. Sony continues to innovate with new product launches and aims to strengthen its position in the premium segment of the market.

Panasonic Corporation (6-10%)

Panasonic emphasizes sustainability and energy efficiency in its consumer electronics offerings. The company invests in developing eco-friendly technologies and products, aiming to reduce environmental impact. Panasonic also focuses on expanding its smart home appliance portfolio and enhancing product connectivity to meet evolving consumer preferences.

Other Key Players (30-40% Combined)

Several other companies contribute to the growth of the consumer electronics market by focusing on niche segments, innovative designs, and competitive pricing. Notable brands include:

These companies leverage their unique strengths and market insights to offer products that cater to specific consumer preferences. They employ strategies such as product diversification, strategic partnerships, and investments in emerging technologies to enhance their market positions.

The Consumer Electronics industry is projected to witness a CAGR of 5.80% between 2025 and 2035.

The Consumer Electronics industry stood at USD 614 billion in 2024.

The Consumer Electronics industry is anticipated to reach USD 1,352 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 7.8% in the assessment period.

The key players operating in the Consumer Electronics industry include Samsung, Apple, Sony, LG Electronics, Panasonic, and others.

Coffea Arabica (Coffee) Seed Oil Market - Trends, Growth & Forecast 2025 to 2035

Dog Collars, Leashes & Harnesses Market Analysis by Dog Collars, Dog Leash, Dog Harness, Material Type, Distribution Channel and Region Through 2025 to 2035.

Cat Toys Market Analysis by Product Type, Material Type, Sales Channel, End-User, Application and Region Through 2035

Baby Swing Market Analysis by Seat Type, Sales Channel, End User, and Region, Forecast through 2035

Anti-Pollution Hair Care Market Analysis by Product Type, Packaging Type, and Region - Trends, Growth & Forecast 2025 to 2035

Electric Toothbrush Market by Product Type, Price, Head Movement, Sales Channel, and Region - Trends, Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.