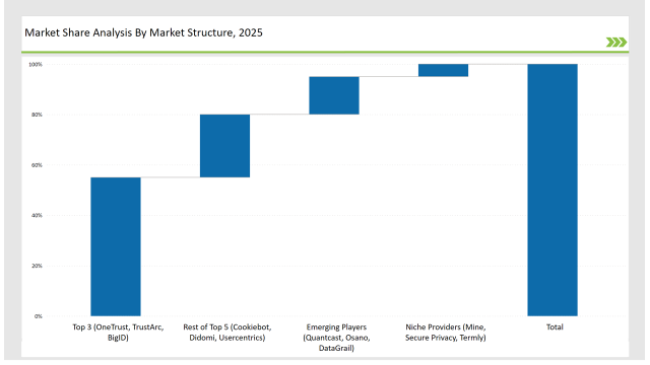

The Consent Management market is witnessing rapid growth as organizations prioritize compliance with global data protection regulations, including GDPR, CCPA, and other privacy laws. Leading vendors such as OneTrust, TrustArc, and BigID dominate the market, collectively holding 55% market share due to their AI-driven compliance automation and robust consent preference management capabilities. The next-tier players, including Cookiebot, Didomi, and Usercentrics, capture 25%, focusing on cookie consent and data subject rights management. Emerging providers like Quantcast, Osano, and DataGrail account for 15%, offering innovative solutions in vendor privacy risk management and automated privacy assessments. Niche vendors, such as Mine, Secure Privacy, and Termly, hold the remaining 5%, catering to specialized needs like privacy-focused user experience and streamlined compliance for SMEs

Explore FMI!

Book a free demo

| Category | Industry Share (%) |

|---|---|

| Top 3 (OneTrust, TrustArc, BigID) | 55% |

| Rest of Top 5 (Cookiebot, Didomi, Usercentrics) | 25% |

| Emerging Players (Quantcast, Osano, DataGrail) | 15% |

| Niche Providers (Mine, Secure Privacy, Termly) | 5% |

The Consent Management market is highly consolidated, with the top firms holding around 65-75% market share. Industry leaders such as OneTrust, TrustArc, and BigID set pricing and technological standards, creating high entry barriers for new competitors.

By Solution

The Consent Management industry is segmented into various solution categories catering to different aspects of data privacy and regulatory compliance.

By Deployment

The market is also segmented by deployment models:

AI-Driven Privacy Automation: Enhancing Compliance and Data Security

As businesses navigate these compliance requirements, they are increasingly turning to AI-based solutions to manage the complexities of user consent. Powerful AI-led compliance automation helps businesses achieve that by ensuring managed and real-time compliance with global privacy regulations such as GDPR, CCPA, and other country/privacy-specific laws that are constantly evolving.

Cloud-Based Consent Management: Driving Scalability and Global Compliance

Businesses are transitioning to cloud and hybrid infrastructures, and so the need for cloud-native consent management platforms is also on the rise. You refer to cloud-based solutions that allow global enterprises to simplify their multi-jurisdictional consent collections.

Integration with Data Security and IT Governance

Standalone consent management solutions are evolving into integrated privacy ecosystems, incorporating IT governance, cybersecurity, and identity management tools. Enterprises seek to embed consent management into broader security architectures to mitigate risks related to unauthorized data processing.

Automated Data Subject Rights (DSAR) Management

Increasing regulatory pressure on organizations to efficiently process user privacy requests AI-based DSAR tools automate the request processing, thereby minimizing operational cost and enhancing compliance with GDPR, CCPA, and other regulations.

Cross-Industry Adoption: Expanding Applications in Healthcare, Finance, and E-Commerce

Industries such as healthcare, finance, and e-commerce are increasingly using consent management solutions to improve regulatory compliance and user trust.

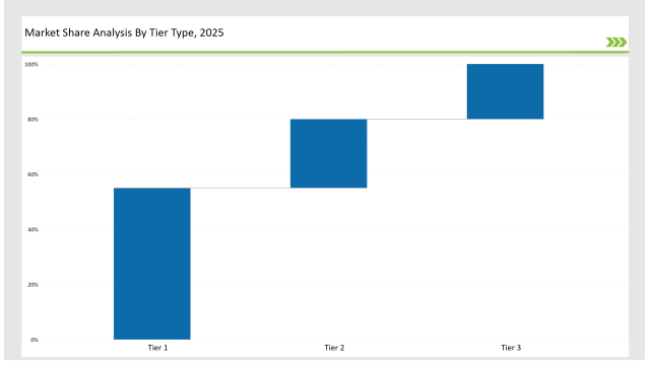

| Tier | Tier 1 |

|---|---|

| Vendors | OneTrust, TrustArc, BigID |

| Consolidated Market Share (%) | 55% |

| Tier | Tier 2 |

|---|---|

| Vendors | Cookiebot, Didomi, Usercentrics |

| Consolidated Market Share (%) | 25% |

| Tier | Tier 3 |

|---|---|

| Vendors | Quantcast, Osano, DataGrail, Mine, Secure Privacy, Termly |

| Consolidated Market Share (%) | 20% |

| Vendor | Key Focus |

|---|---|

| OneTrust | Expanding AI-driven consent lifecycle management and regulatory automation. |

| TrustArc | Strengthening AI-powered privacy risk assessments and compliance tools. |

| BigID | Advancing automated data subject rights management and vendor risk assessment. |

| Cookiebot | Enhancing cookie consent automation for global web compliance. |

| Didomi | Improving user-centric consent preference management. |

| Usercentrics | Integrating privacy analytics and personalized compliance dashboards. |

Vendors must leverage AI and blockchain technologies to enhance transparency, automation, and security in consent management. Predictive compliance analytics will drive proactive risk mitigation, while automated privacy assessments will optimize operational efficiency.

Emerging markets present vast opportunities for growth, particularly in Asia-Pacific and Latin America, where regulatory frameworks are evolving rapidly. Vendors should focus on localization, multi-language support, and scalable cloud deployments to cater to diverse business needs.

Leading vendors OneTrust, TrustArc, and BigID control 55% of the market.

Emerging players Quantcast, Osano, and DataGrail hold 15% of the market.

Niche providers Mine, Secure Privacy, and Termly hold 5% of the market.

The top 5 vendors (OneTrust, TrustArc, BigID, Cookiebot, Didomi) control 80% of the market.

Market concentration is categorized as medium, with the top 10 players controlling around 75% of the market.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.