The global connected game console market is set to experience USD 25.5 billion in 2025. The industry is poised to register 15.1% CAGR from 2025 to 2035 and reach USD 105.6 billion by 2035.

Changes in the distribution landscape with the rise of digital platforms for games continue to shape how the game industry sidles, toning down the reliance on physical media while providing major conveniences for gamers around world. The flourishing e-sports and competitive gaming also provides the fuel that drives growth of the industry. The inclusion of AR/VR technologies is also changing gameplay with more realistic experiences.

From 2025 to 2035, the industry is set to grow rapidly due to the increasing popularity of games being distributed digitally, the fast-growing e-sports, and growing adoption of new technologies like augmented reality (AR) and virtual reality (VR) in gaming consoles. The demand for high-performance gaming equipment, cloud gaming apps, and AI-based gaming experiences are disrupting the industry, allowing gamers access to highly immersive, delicate, and interactive programs.

Cloud gaming enables players to access and stream high-quality games without needing to invest in costly hardware upgrades. High-speed internet, 5G, and edge computing allowing streaming of higher quality games over the internet to consoles are also improving the cloud gaming aspect, expanding console gamers more. AI-based gaming functionality such as real-time content suggestion, dynamic difficulty adjustment, and personalized gaming sessions are also transforming the industry through player engagement and retention.

As technology continues to advance, the industry is likely to see long-lasting innovations as manufacturers invest in next-gen game consoles, cloud computing, and AI-enabled improvements. As demand for high-end gaming experiences, streamlined connectivity, and interactive entertainment rises, the industry will not only grow but fundamentally reshape the future of the gaming domain.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 25.5 billion |

| Industry Value (2035F) | USD 105.6 billion |

| CAGR (2025 to 2035) | 15.1% |

Explore FMI!

Book a free demo

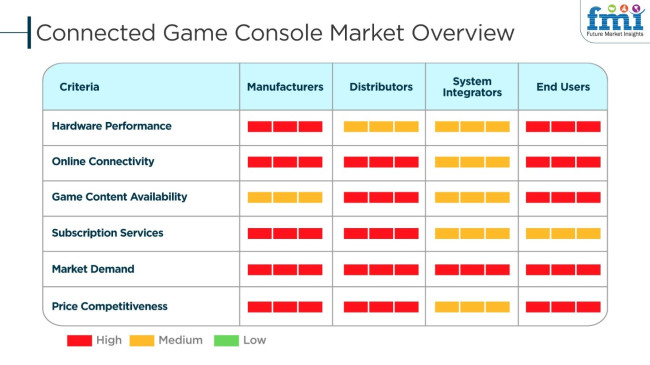

The industry has been through a major shift due to the configuration changing which brings cloud gaming, cross-platform integration, and subscription-based gaming models into the picture. Hardware manufacturers accentuate the hardware advancements, online capabilities, and exclusive game content so as to create a loyal user base.

Game developers choose to put the emphasis on multiplayer, high-quality graphics, and trouble-free connection, thus they use the cloud computing and the AI in order to enthrall the players. Distributors take on a major role in supply chain management and the digital game distribution, by securing the easily obtainable hardware and software.

The business of game-as-a-service (GaaS), esports, and 5G connectivity has had an incredible impact in the industry, thus bringing the opportunity for low latency gaming and real-time streaming. On the contrary, VR and AR technologies have extended console capabilities, so improving console demand for the next generation type of games.

The most important effects on consumer choice are the price competitiveness, availability of the subscription-based models, and the bundled offers that tilt the scales toward affordability in purchasing decisions.

| Company | Sony Corporation |

|---|---|

| Contract/Development Details | Sony announced plans to release a new version of its PlayStation console, featuring enhanced online connectivity and integration with cloud gaming services. This development aims to strengthen Sony's position in the industry. |

| Date | November 2024 |

| Contract Value (USD Million) | Approximately USD 800 - USD 1,200 |

| Estimated Renewal Period | 4 - 6 years |

| Company | Microsoft Corporation |

|---|---|

| Contract/Development Details | Microsoft secured a partnership with a leading cloud service provider to enhance the online capabilities of its Xbox consoles. This collaboration focuses on improving streaming quality and expanding the range of available online services for Xbox users. |

| Date | January 2025 |

| Contract Value (USD Million) | Approximately USD 1,000 - USD 1,500 |

| Estimated Renewal Period | 5 - 7 years |

| Company | Nintendo Co., Ltd. |

|---|---|

| Contract/Development Details | Nintendo announced plans to release a new version of its Switch console, featuring enhanced online connectivity and integration with cloud gaming services. This development aims to strengthen Nintendo's position in the industry. |

| Date | December 2024 |

| Contract Value (USD Million) | Approximately USD 600 - USD 900 |

| Estimated Renewal Period | 4 - 6 years |

In late 2024 and early 2025, the industry witnessed significant developments as major industry players focused on enhancing online capabilities and cloud integration. Sony's announcement of a new PlayStation version with improved connectivity reflects its commitment to maintaining a competitive edge in the industry. Similarly,

Microsoft's partnership to bolster Xbox's online services underscores the growing importance of seamless streaming and expansive online offerings. Nintendo's plans to upgrade its Switch console with advanced online features further highlight the industry's shift toward connected gaming experiences. These initiatives indicate a concerted effort by leading companies to adapt to evolving consumer preferences for integrated and accessible gaming platforms.

Challenges

In spite of the quick uptake, expensive consoles, reliance on stable high-speed internet, and competition from mobile gaming are still the major challenges. Security issues with online gaming data and cyberattacks also pose threats to developers and consumers alike.

Developers are increasingly under pressure to improve cybersecurity protocols to safeguard user information and uphold trust. Consumers expect smooth, lag-free experiences, which entail ongoing investment in strong infrastructure. Meanwhile, mobile gaming’s convenience and affordability continue to attract users, intensifying competition in the gaming industry.

Opportunities

The expanding convergence of AI-powered gaming, blockchain-based digital asset management, and metaverse gaming experiences is offering promising opportunities. The rising use of subscription-based game streaming services, advanced social gaming networks, and AR/VR-supported gameplay is likely to broaden industry applications. In addition, investments in adaptive cloud gaming technologies and immersive user experiences are likely to define the future of the industry.

The industry was booming from 2020 to 2024 with the advent of cloud gaming, open cross-platform play, and gaming experiences based on AI. The increased proliferation of virtual reality, eSports, as well as dynamic multiplayer communities generated higher demands for powerful consoles with real-time connectivity.

AI-driven game analytics, cloud streaming, and adaptive rendering technology enhanced gaming performance by minimizing latency and maximizing graphics. This call for digital game infrastructure created investment in virtual reality (VR), augmented reality (AR), and blockchain-based virtual economies. It was not without challenges, including cybersecurity threats, expensive infrastructure, and platform locking.

In 2025 to 2035, there will be personalized gaming based on AI. Data will be protected through blockchain. AI that can improve on itself, will facilitate adaptive difficulty and dynamic storylines, maximizing player participation. Decentralized gaming platforms will diminish central server dependence for better security and scalability. A focus on sustainability will come into play with environmentally friendly hardware and AI-tailored cloud gaming reducing cost and environmental footprint for increased accessibility in gaming.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Regulatory agencies focused on data privacy, gaming content standards, and compliance with digital entertainment policies. | AI-driven regulatory compliance automation, blockchain-secured game asset verification, and decentralized gaming networks will shape future governance. |

| Improvements in AI-driven game mechanics, cloud streaming, and real-time graphics rendering enhanced gaming experiences. | Quantum-enhanced gaming computation, AI-powered predictive game balancing, and blockchain-enabled secure in-game economies will redefine the connected game console industry. |

| Connected game consoles were widely used in multiplayer gaming, streaming services, and competitive esports. | AI-powered autonomous game worlds, decentralized gaming economies, and immersive VR/AR-driven gaming experiences will expand industry applications. |

| Cloud-based game streaming, AI-powered game recommendations, and cross-platform play improved user engagement. | AI-integrated real-time game analytics, decentralized player data management, and ultra-secure blockchain-based gaming transactions will drive adoption. |

| AI-driven player behavior analysis, real-time game difficulty adjustments, and predictive game engagement tracking optimized gaming experiences. | Quantum computing-powered player analytics and gaming behavior modeling will introduce a radical shift in predictive gaming analytics. |

| Cybersecurity problems, shifts in regulating content, and costly cloud gaming infrastructure posed challenges. | AI-optimized game development workflows, decentralized game distribution platforms, and blockchain-secured in-game transactions will boost industry accessibility. |

The primary vulnerabilities in the connected game console industry include cyber hacking and security concerns regarding user data. Gaming consoles are now fundamentally exposed to hacking, account profiling, and data theft as they get more and more interlinked to cloud gaming, digital wallets, and online services.

Components scarcity are treated as the second major challenge. Nonetheless, the wide range of gaming devices are heavily dependent on the top-tier commuter chips, that is, GPUs, and high-speed storage components. The prolonged chip shortages, logistic constraints, and trade embargoes can lead to delays in console production and, subsequently, price volatility, which will have a direct effect on sales and industry availability.

Regulatory adherence and content necessities are other critical threats. Countries put their own enforceable regulations on online gaming, content moderation, and in-game transactions. The inherent problems concerning loot boxes, age limits, and mechanics that simulate gambling can draw the attention of the government and the punishment can be in the form of fines and restrictions on platforms in specific areas.

Industry rivalry and price reductions are additional obstacles that drag profitability down. The connected game console market is largely occupied with major concerns, for instance, Sony (PlayStation), Microsoft (Xbox), and Nintendo (Switch). Startups that dare to enter encounter the high entry barriers, whereas the firms that are already on the industry have to be in continuous innovative mode if they are to remain competitive.

Shifts in consumer preferences, and digital change affects the industry. Digital game download switch and cloud gaming subscriptions (like the ones offered XBOX Gamepass or Play Station+) directly affect the console sales and revenue models. Businesses are supposed to embrace the evolving model of trade while at the same time holding on to their profitability.

Connected game consoles have become popular worldwide for a number of reasons, fueled by advances in technology, changing consumer behavior, and increasing demand for interactive and online gaming experiences.

Among the primary reasons for their widespread adoption is the incorporation of online features that enable gamers to enjoy a vast array of content, ranging from digital game downloads and updates to online multiplayer gaming. With cloud gaming features, the games can be accessed easily by players with no need for physical discs, allowing them to play anywhere, anytime, given internet access.

eSports and digital game streaming platforms are leveraging connected consoles for high-performance gameplay, real-time audience engagement, and competitive gaming analytics. As organizations prioritize immersive gaming experiences, investments in AI-powered and cloud-enabled gaming solutions are increasing.

As demand for high-speed and cross-platform gaming rises, businesses are developing advanced gaming ecosystems with AI-driven content curation, cloud streaming, and 5G-enabled gaming services. Looking ahead, enterprises will continue to explore next-generation connected gaming strategies to enhance user retention and interactive gameplay experiences.

| Countries | CAGR (%) (2025 to 2035) |

|---|---|

| USA | 9.5% |

| China | 10.1% |

| Germany | 8.9% |

| Japan | 9.2% |

| India | 10.3% |

| Australia | 8.7% |

The USA industry is growing with the growth in the adoption of cloud gaming, rising high-speed internet penetration, and the evolution in gaming technology. The industry employs connected consoles not only to enable multiplayer interaction, game personalization using artificial intelligence but also for digital content streaming. With ongoing investment in 5G networks, cloud gaming, and the future generation of consoles, the demand is surging. FMI projects the USA industry to witness 9.5% CAGR from 2025 to 2035.

USA Growth Drivers

| Key Drivers | Description |

|---|---|

| Cloud Gaming & Streaming | Accessibility is made available through subscription-based online gaming services. |

| AI-Powered Game Optimization | AI streamlines game mechanics and customized gameplay. |

| 5G & High-Speed Internet Adoption | Increased speed enables multiplayer gaming in real-time. |

The Chinese industry is expanding with the booming gaming industry, growing console penetration, and eSport activities being supported by governments. China, as one of the biggest gaming markets in the world, has high demand for AI-based content recommendations, multiplayer, and cloud services. Government emphasis and digital entertainment are stimulating industry expansion. FMI is of the opinion that the Chinese connected game console market is slated to grow at 10.1% CAGR during 2025 to 2035.

China Growth Drivers

| Key Drivers | Details |

|---|---|

| Government Support for Gaming & eSports | Policies support the pro-use of online gaming platforms. |

| AI & Big Data in Gaming | Machine learning enhances the gaming experience. |

| Subscription-Based & Cloud Gaming | Console connectivity provides games from ginormous game libraries. |

Germany's industry is expanding steadily with a strong established gaming culture, increasing broadband penetration, and interactive gaming demand. The country is one of the most robust European gaming markets, which spends money on cloud gaming, multiplayer infrastructure, and secure digital platforms. Data privacy and security concerns in the country also increase connected gaming adoption. FMI estimates Germany's industry to expand at 8.9% CAGR between 2025 to 2035.

Germany Growth Drivers

| Drivers | Description |

|---|---|

| Adoption of Cloud Gaming | Subscription online behavior opens up access. |

| Safe Online Gaming | Investment in cyber security is fueled by EU regulation. |

| VR & AR Integration | Increased application of immersive gaming tech. |

Japan's industry is growing due to trend-setting gaming hardware, fast internet connectivity, and console-mobile cross play gaming. The industry taps AI-driven suggestions and cloud gaming to maximize multiplayer experiences. With its HeadStart in gaming software and hardware innovation, Japan paces the game regarding 5G-enabled and cloud gaming. FMI expects a 9.2% CAGR from 2025 to 2035.

Growth Drivers in Japan

| Leading Drivers | Description |

|---|---|

| AI & Cloud Gaming | AI-driven personalization and cloud-based accessibility enhance the experience. |

| Expansion in Multiplayer & eSports | Competitive and interactive streaming fuels adoption. |

| Next-gen Game Hardware with Next-Generation Features | Ray tracing and real-time next-gen console AI. |

India's industry is growing tremendously with growing internet penetration, growing discretionary incomes, and a young gaming population. Policies like 'Digital India' support broadband's growth, which facilitates industry demand. Subscription gaming and local language content increase user interest. FMI projects a 10.3% CAGR from 2025 to 2035.

Growth Drivers in India

| Leading Drivers | Description |

|---|---|

| Digital Entertainment & Internet Growth | Government policies lead to the growth of broadband. |

| Mobile & Cloud Gaming Adoption | Stream and multiplayer game interaction. |

| Budget-Friendly Game Solutions | Artificially intelligent platforms attract competitive and casual gamers. |

Australia's market is expanding steadily with investment in 5G, cloud gaming, and eSports infrastructure. Players stream live and engage in multiplayer games using connected consoles. Government efforts toward game development drive the market. FMI forecasts a 8.7% CAGR from 2025 to 2035.

Drivers for Australia Growth

| Key Drivers | Information |

|---|---|

| Government Support Towards Online Gaming | Gaming infrastructure investment is driving the market. |

| AI & Machine Learning-Driven Game Analytics | Machine learning fuels personalization and gameplay. |

| Cloud & Cross-Platform Gaming | Connected consoles deliver seamless gaming experiences. |

The connected game console market is a highly contested market, driven by advances in cloud gaming, the availability of high-speed access to the web, and the preferences of consumers who want to experience games more immersively.

The ongoing transformation that is moving the market focus towards the digital distribution of multiplayer ecosystems and game streaming services has further intensified the market scenario by making the big names focus more on hardware innovation and AI-driven gaming improvements that exist under platform-cloud bases.

Companies that emerge as leaders include Sony (PlayStation), Microsoft (Xbox), and Nintendo, and they dominate this market with top and state-of-the-art console hardware systems, exclusive game titles as well as subscription services like PlayStation Plus, Xbox Game Pass, and Nintendo Switch Online. These companies keep on updating their ecosystems through backward compatibility, cross-platform integration, and real-time performance optimizations.

The peripheral competition added by the emergence of cloud gaming platforms such as NVIDIA GeForce Now and Google Stadia (before it was discontinued) pushed the console majors to integrate their systems with a cloud feature, allowing gamers to experience their games without needing high-end hardware. Furthermore, alliance partnerships with telco companies and the improvement of 5G connectivity will shape the future of streaming games.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sony Interactive Entertainment | 30-35% |

| Microsoft Xbox | 25-30% |

| Nintendo | 15-20% |

| Google Stadia | 5-10% |

| NVIDIA GeForce Now | 4-8% |

| Other Companies (combined) | 15-20% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sony Interactive Entertainment | PlayStation consoles, cloud gaming via PlayStation Now, exclusive game titles. |

| Microsoft Xbox | Xbox Series X/S, Xbox Game Pass subscription, cloud gaming through xCloud. |

| Nintendo | Nintendo Switch, hybrid gaming, online multiplayer services. |

| Google Stadia | Cloud-based gaming service with seamless streaming on multiple devices. |

| NVIDIA GeForce Now | Cloud gaming with high-performance GPU rendering and AI-enhanced gaming. |

Key Company Insights

Sony Interactive Entertainment (30-35%)

Sony created a monopoly in the market for game consoles linked to the internet through its PlayStation ecosystem, which provides its customers with exclusive titles, first-class gaming hardware, and cloud gaming services such as PlayStation Now.

Microsoft Xbox (25-30%)

Microsoft has become the leader in cloud gaming with its Xbox Game Pass, xCloud services, and powerful hardware innovations; these innovations present a very sharp market entry.

Nintendo (15-20%)

Nintendo positions itself very well because of its hybrid gaming experience, family-friendly titles, and involvement in the community of its players.

Google Stadia (5-10%)

Google's cloud gaming platform uses its strong infrastructure in its favor for seamless, high-quality streaming of games.

NVIDIA GeForce Now (4-8%)

NVIDIA provides high-performance GPUs and AI-driven improvement in real-time game streaming technology in their Cloud Gaming set capabilities.

Other Key Players (15-20% Combined)

The industry is slated to reach USD 25.5 billion in 2025.

The industry is predicted to reach USD 105.6 billion by 2035.

Sony, Microsoft, Nintendo, Tencent Holdings Ltd., Activision Blizzard, Inc., Valve Corporation, Rockstar Games, Sega Games Co. Ltd., Square Enix Holdings Co. Ltd., and Capcom Company Ltd. are major players in the gaming industry.

India, slated to grow at 10.3% CAGR during the forecast period, is poised for the fastest growth.

Gaming is the key application.

By product type, the market is segmented into connected console, standalone console, handheld console, services, prepaid service, and other direct service.

In terms of application, the market is segmented into gaming and non-gaming applications.

In terms of region, the market is segmented into North America, Latin America, Europe, Asia Pacific, and Middle East & Africa (MEA).

Remote Construction Market Analysis by Component, Application, End-use Industry and Region Through 2035

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Procurement as a Service Market Trends – Growth & Forecast 2025 to 2035

Massive Open Online Course Market Analysis – Growth, Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Healthcare Virtual Assistants Market Analysis by Product, End User and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.