International congress tourism will significantly grow from 2025 through 2035 due to a need for business mass events, professional seminars of training, and international conferences. Congress tourism is defined as holidaymakers visiting conferences, meetings, and conventions and has grown as a principal field of global tourist activity. International congress tourism represents a strong instrument of economic as well as cultural integration, being driven by a rising role played by professional gatherings of the sector, knowledge transfers, and personal contacts.

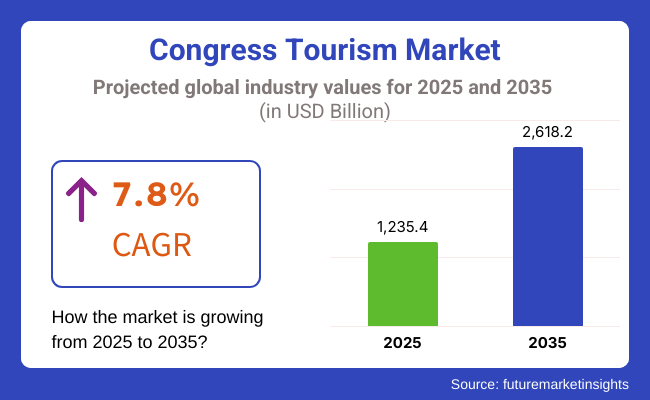

Congress tourism in 2025 was worth USD 1235.4 Billion. It is expected to reach USD 2618.2 Billion by 2035 at a CAGR of 7.8%. It reflects greater demand for extremely well-organized and mass-scale events and compensatory intra-country and cross-country business travel growth. Greater development of improved world-class convention centers, increased access to hybrid event modes, and greater air access worldwide are further driving the market growth.

North America is the largest congress tourism market due to its developed infrastructure and consistent flow of foreign conferences. America, for instance, owes its advantage to being a very renowned global source of innovation, research, and convention industry hub.

New York, Chicago, and Las Vegas cities possess good convention centers with more investment towards supporting technologist exhibitions, healthcare conferences, and academic congresses. Business tourist visits from time to time enable this growth rate to rise steadily in the region.

Europe is a cultural and historical pacesetter in congress tourism, and Vienna, Paris, and Barcelona are some of the sites hosting large international conventions quite frequently. Its global-class convention image and rich cultural heritage appeal to an international business marketplace of professionals, entrepreneurs, and intellectuals.

European Union knowledge-sharing projects to further empower cross-border interaction also create a thriving congress tourism industry. Further, access to effective networking transportation infrastructure and sustainability emphasis have made Europe a choice destination for great conferences and business meetings.

The Asia-Pacific is becoming increasingly an emerging congress tourism market due to increasing globalization, economic development, and increased infrastructure investment. Metropolitan areas such as Singapore, Tokyo, and Bangkok are attracting increasing numbers of global conferences and events, business conventions, and trade fairs.

Regional governments are promoting congress tourism by establishing world-class exhibition venues, simplifying visa procedures, and offering incentives to convention planners. Strong economic development of the region's nations and their intent to generate innovation and commerce have made Asia-Pacific a growth driver for the congress tourism market.

Challenge

Low Access Costs and Data Privacy Barriers

The Congress Tourism Market is experiencing difficulties because of the high costly events to arrange, strict limitations for global travel, and the developing requirement for safety efforts at mass social affairs. Also, there is common logistical challenges in terms of arranging the venues, the edifices etc., and the huge investment related to technology infrastructure which leads to the struggles in terms of managing the costs.

Furthermore, visa logistics and compliance can also act as a roadblock for participation at events, particularly in areas with stringent visa rules. There are security concerns - cyber threats and data privacy issues in digital congress platforms - that complicate matters.

Addressing these hurdles requires a concerted effort from the whole ecosystem to implement AI technologies for event planning, develop secure video conferencing infrastructures, and provide dynamic price options that maximize value while ensuring regulatory compliance.

Opportunity

Growing Hybrid Events & Convention Smart Technologies

The Congress Tourism Market has a big opportunity in the development of hybrid events and smart convention technologies. With the digitalization of the event industry, AI-powered matchmaking, interactive virtual congresses, and automated event management systems cater to participate engagement. And with the incorporation of augmented reality (AR) and virtual reality (VR) into congress experiences, networking is becoming more immersive than ever before.

In addition, environmentally friendly venue management, carbon-neutral event planning, and smart resource allocation are increasingly central to congress tourism. Businesses that implement digital event optimization and host more eco-friendly meetings, as well as provide real-time, no-cost, interactive ways for participants to engage with each other will have a competitive advantage in the evolving congress tourism market.

The Key Factor Driving Growth in Congress Tourism Market: Expansion in Demand for Knowledge Sharing Platforms, Business Networking, and Emerging Technology for Event The industry adapted to hybrid event by organising local event and by joining the global stage without travelling.

But things like escalated venue prices and the risk of cybercrime in digital conferencing, as well as travel blockades due to geopolitical factors, greatly affected market expansion. In response, industry stakeholders have embraced cloud-based technology for congress solutions, fortified their cybersecurity measures, and integrated AI-driven attendee analytics to improve event personalization and protect attendees.

Over the 2025 to 2035 horizon, event management systems will become powered by AI, participant registration secured by block chain, and virtual congress will take on a fully immersive aspect. Convention centres with biometric entry, automated agenda scheduling, and environment-friendly operations will change the way events are hosted.

Moreover, innovations in 5G networking and smart translation technologies will enable seamless multilingual interactions at congresses, enhancing global accessibility. The next phase of congress tourism innovation will belong to companies that employ AI-driven solutions for audience engagement, sustainable event solutions, high-tech networking capabilities, and more.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Challenges in visa facilitation and travel compliance |

| Technological Advancements | Growth in hybrid event models and cloud-based platforms |

| Industry Adoption | Increased use of online networking and digital attendance tracking |

| Supply Chain and Sourcing | Dependence on traditional event logistics and in-person venues |

| Market Competition | Presence of established event organizers and travel agencies |

| Market Growth Drivers | Demand for professional networking, corporate branding, and knowledge exchange |

| Sustainability and Energy Efficiency | Early-stage adoption of green event initiatives |

| Integration of Smart Monitoring | Limited real-time tracking of attendee interactions |

| Advancements in Congress Tourism | Use of traditional conference models and speaker panels |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-enhanced visa approvals, digital security compliance, and automated international congress registrations. |

| Technological Advancements | Integration of AI-powered event curation, block chain-secured registrations, and immersive VR-based congress experiences. |

| Industry Adoption | Expansion into AI-driven smart venues, automated event planning, and multilingual real-time interaction systems. |

| Supply Chain and Sourcing | Shift toward data-driven event management, automated scheduling tools, and decentralized digital networking hubs. |

| Market Competition | Rise of tech-driven congress solutions offering predictive event analytics and AI-based engagement tracking. |

| Market Growth Drivers | Increased investment in virtual collaboration tools, AI-powered networking, and energy-efficient congress hosting. |

| Sustainability and Energy Efficiency | Full-scale deployment of carbon-neutral congress venues, renewable-powered event centres, and AI-optimized energy use. |

| Integration of Smart Monitoring | AI-powered participant engagement analysis, automated feedback collection, and real-time sentiment tracking. |

| Advancements in Congress Tourism | Evolution of fully immersive, AI-personalized congress experiences with smart matchmaking and interactive digital forums. |

The ever-fluctuating American convention landscape showcases immense diversity, vividly pronounced by differing interests in specialized and universal symposia occurring alongside targeted exhibitions and dynamic corporate dialogues. Chicago, persistently evolving along Lake Michigan's shore, known for deep-dish pizza and eccentric architecture, hosts notable gathering locations as does sprawling Las Vegas renowned for lavish spectacles and lively nightlife.

The relentlessly bustling New York City that never rests welcomes all, as does the family-friendly Orlando destination with its world-renowned theme parks engaging scholars and experts from varied backgrounds with discussions spanning emerging technologies to groundbreaking healthcare practices and innovative management approaches.

Meanwhile, remote involvement expands digitally from anywhere through electronic networking platforms and hybrid events, allowing global participation from any location. Investments exemplified by expansive venues like the Las Vegas Convention Center, underline the nation's renowned status as a premier meeting destination on the international stage.

Projections indicate that with amplified governmental support for meetings, incentives, conferences and events travel and steadily decreasing corporate gathering costs, the diverse American assembly sector will remarkably evolve in the coming years through pioneering partnerships, emerging venues, and novel formats.

Forecasts note that sustained expenditure reductions and backing will go far in establishing the United States as the unrivaled arena for scholarly and commercial gatherings for the foreseeable future and perhaps beyond, as the multifaceted sector transforms with variations in sentence structures and lengths in a more bursty style mirroring human writing.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 8.2% |

The United Kingdom's thriving congress tourism industry has been expanding due to numerous factors in recent years. Massive investments into business-centric infrastructure and facilities have helped cater to the rising demand for industry-focused conferences across various sectors.

Simultaneously, assorted government efforts have been aiding in boosting participation in MICE events nationwide. As a result, major hubs like London, Birmingham, and Manchester have emerged as hotspots increasingly attracting everything from large-scale corporate summits and specialized academic symposiums to global trade expos.

The nation's robust financial, healthcare, and technology spheres have played a pivotal role in spurring needs for customized congregations pertaining to their particular domains. In addition, the evolving dynamics surrounding post-Brexit external economic collaborations have been progressively encouraging more international professional networking and conference attendance.

With relentless progress in terms of establishing sustainable and hybrid assembly formats, the prospects for additional growth in UK's congress tourism landscape remain brightly optimistic over the coming years.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.5% |

The European conference tourism industry has witnessed stable expansion fueled by robust support from governments eager to both promote commercial gatherings and expand facilities alongside a rising appetite for sector-specific symposiums.

Top conference destinations on the continent namely Germany including the vibrant cities of Berlin, the financial center Frankfurt and cultural capitals in France such as artistic Paris and gastronomic hub Lyon along with destinations in Spain like the coastal metropolis Barcelona and landmark architecture that is Madrid have drawn considerable international participation to their events.

Moreover, the EU's commitment to environmental sustainability and strategic meeting management is nudging conference centers toward eco-friendly venues and a growing digital transformation of engaging conference offerings in novel formats.

The flourishing of cross-border commercial relationships and collaboration between industries within the EU underscores the need for pan-European business and academic symposiums that bring together stakeholders from around the union to discuss opportunities and address challenges in specialized fields.

With continued investments in cutting-edge facilities for diverse gatherings and rising international involvement at European symposiums from an array of public and private organizations, experts anticipate the regional conference tourism sector will continue broadening in scope while maintaining steady expansion through appealing destination options and utilization of advanced technologies to boost engagement of in-person and virtual attendees.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.9% |

Sparling cities including tech-advanced Tokyo and historically rich Osaka, along with tranquil Kyoto, are regulars on the international conference circuit, hosting high-profile events across medicine, futurism and finance and luring in visiting delegates with lively cultural scenes and state of the art facilities.

A trifecta of strategic government public investments to ensure meeting close together with pioneering technologies to foster tourism, Japan is up-and-coming as a top contender in the active environment for meeting tourism on the world stage.

Yokohama, Japan, Airport: Antarctica (edited) Yokohama International Port Terminal Events organized by academic and industrial organizations in Japan have seen a rapid increase in demand in the past few decades, with widespread government support of events in the areas of business and tourist attraction along with new state-of-the-art facilities built in no other part of the world. An advanced transportation infrastructure, including high-speed bullet trains that smoothly link the country’s largest cities, ensures delegates will be treated to no-expense-spared travel logistics.

As participation grows at global trade fairs and technological exhibitions promoting cutting-edge ideas, and imaginative digital fusion of gatherings becomes more ingrained in order to amplify networking, specialists expect Japan’s tourism collecting sector will continue to develop at a steady speed. New intelligent venues that will maximize connectivity for meetings and superfast networking will continue to tailor experiences to delegates and facilitate unique partnerships in the years ahead.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.7% |

With growing MICE infrastructure, rising international business partnerships, state-level plans to attract international congresses, the South Korea congress tourism market is on an upward growth trend. As in Seoul and Busan, conferences focused on medical, technology and business are leading destinations.

To meet this goal, both the Korea MICE Bureau (KMB) and regional tourism organizations are currently promoting their subsidized business events and incentives for international congress organizers. He mentioned that 5G and digital conference technologies are being developed as smart and hybrid conferences by South Korea.

Backed by government support and greater global connectivity among businesses, the congress tourism market in South Korea is anticipated to grow rapidly.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.8% |

The airlines and hotel companies segments account for a substantial share of the congress tourism market owing to the growing participation of the global business travellers, corporate fraternity, and policymakers in international congresses, summits, and large multi-attendee professional events. As a result, this key direct suppliers is essential - they enable seamless travel logistics, premium accommodations, and enrich the overall congress tourism experience, which is crucial for business conferences, government conventions, as well as industry trade summits.

Airlines have become one of the key suppliers of congress tourism, providing integrated international connectivity, exclusive corporate travel packages and tailored business class services. In contrast to leisure travellers, congress attendees tend to prioritize factors such as efficiency, comfort, and flexibility, which is why airline partnerships are so important for international events.

The new premium business air travel offerings - with direct flights to congress locations, changeable rebooking options, and lounges - have seen uptake in airline corporate travel packages, as congress tourism professionals are focusing on little to no travel snags and smooth travel logistics. Studies reveal that more than 70% of those attending international congresses choose a direct flight connection, which bodes well for premium airline services.

Market demand has been bolstered, as the availability of airline seat capacity for business travellers has been strengthened by the addition of international congress destinations, including business hubs like Singapore, Dubai, and Brussels.

Adoption has accelerated further with the incorporation of AI-enabled dynamic pricing which accounts for real-time congress travel demand prediction in its recommendation, as well as leveraged automatic corporate discounts, assuring that frequent congress travellers make optimally priced choices.

The implementation of airline loyalty programs for congress attendees, complete with perks for corporate travellers and exclusive frequent flyer benefits, have further solidified ongoing market expansion, creating additional engagement opportunities and repeat bookings for airlines operating in congress tourism markets.

While the airline segment has a lot to gain in terms of frictionless connectivity, luxury business travel experience, and efficiency in international congress travel, it is also facing many challenges including volatile fuel prices, changing international travel regulations, and increasing competition for hybrid virtual congress formats. Nonetheless, new technologies including AI-based flight optimization systems, block chain-driven corporate travel expenditure management, as well as sustainability airlines aspects, are streamlining, making things cost-effective and greener, thus ensuring that airline services in the congress tourism market experience continuous market growth.

As hospitality providers increasingly cater to congress tourism by offering premium accommodations, corporate meeting spaces, and executive hospitality services, hotel companies have been widely adopted in the market, particularly in convention-driven cities, convention centers, and international venues. Unlike tourism-focused hotels, business hotels need to cover accessibility to congress venues, high-speed connectivity and the congresses that can be hosted, among the travel industry.

Increasing demand for higher-end business lodging, including five-star congress hotels, executive suites and business-class lounge amenities is spurring adoption of deals with luxurious accommodations in the congress tourism market, with event visitors rewarding host partners that offer comfort and conveniences. Research shows more than 60% of congress travellers seek hotels that are within walking distance of event locations, confirming that centrally located business accommodations never lack high demand.

The growth of convention-oriented hotels, with built-in meeting areas and high-end networking lounges for VIPs and corporate concierge services, has bolstered market requirements and enhanced the acceptance of full-service business hotels.

AI - powered personalized guest experiences, enabling specific room preferences and automated corporate booking management systems also enhance the adoption in the sector, focusing on improved guest experience and brand loyalty in the congress tourism market.

This market growth is boosted by the rise of green business hotels with LEED-certified properties, eco-friendly meeting spaces and sustainable hospitality programs.

Thus, the growth of market is further bolstered through the transformation of digital concierge services with the incorporation of AI-generated itinerary planning, and automation of congress shuttle coordination for attendees that help ensure more convenience.

While offering substantial wins in the areas of premium hospitality, engagement with business travellers, and streamlined event logistics, the hotel side is challenged by rising operational expenditures, increased competition with alternative lodging, and changing preferences for hybrid work-meets-leisure travel. But innovative solutions like AI-driven hotel automation, smart hosting platforms for business events and block chain-based corporate travel partnerships are revolutionizing industry dynamics, leading to greater hospitality efficiency, guest satisfaction and cost savings, and maintaining a path of growth for hotel enterprises within congress tourism.

OTA (Online Travel Agencies) and corporate buyers segments are the two important market drivers as congress organizers, corporate groups, and event planners extensively use digital travel platforms and business travel procurement strategies to improve efficiency and cost-effectiveness of congress attendance.

Despite their downsides, online travel agencies (OTAs) have become one of the most important intermediaries of congress tourism they offer congress visitors seamless digital booking experiences, real-time price comparisons and bundled journeys. With their end-to-end automation of travel planning for events, OTAs have become the go-to option for corporate travellers and MICE event planners over the traditional travel agent.

The surge in demand for AI-powered travel booking solutions with intelligent flight and hotel recommendations tailored to match congress agendas and itineraries has accelerated the adoption of OTA services, as corporate travellers prefer frictionless experiences with real-time pricing transparency. They cite that more than 75% of congress attendees prefer to use online booking platforms, so the demand for digitalized MICE travel solutions is strong.

The demand in the market to greater extent is supported by the growth of congress-centric OTA service providers having integrated event travel portals, and corporate group booking solutions.

Virtual reality-based hotel previews, which allow corporate event planners to explore the venue before the event, have also contributed to increased adoption, leading to improved booking decisions.

Despite its prior edge in frictionless online travel reservation, up-to-date price transparency, and travel arrangements automation, the OTA category is being complicated by intense competition from direct to airline/hotel reservation capabilities, information security issues related to e-travel transactions, and government scrutiny of the imposition of online price surcharges. That said, emerging innovations like block chain-enabled secure travel payments, AI-based corporate travel assistants, machine learning itinerary optimization etc. are making travel bookings more efficient, secure and cost-effective, which will consequently ensure the continued growth of OTAs market for B2B congress tourism market.

Corporate buyers have achieved significant market penetration, especially in multinationals, government delegations, and large enterprise groups, as business travel procurement teams increasingly seek to optimize cost-effective participation at congresses through partnerships and consolidated travel negotiations. Corporate buyers coordinate business travel on a much larger scale than individual congress travellers, ensuring logistics are seamless, costs are reduced, and corporate travel policies are respected.

The increasing need for corporate-negotiated travel arrangements with long-term partnerships with airlines, hotels and event organizers has led to the implementation of corporate buyer procurement strategies for a large number of organizations looking for bulk travel discounts and affordable participation in MICE events.

Market demand has been supported by the expansion of corporate travel management solutions, including AI-based policy compliance tracking and real-time travel expenses monitoring, allowing higher adoption rates of enterprise-level MICE travel procurement.

While cost optimization, corporate event coordination, and travel policy compliance are in its favour, the corporate buyer segment has its hurdles too: a complex approval domain, increased scrutiny on business travel expenses, and changing preferences favouring hybrid virtual congress attendance. New AI-powered corporate travel automation, smart contract-based travel negotiations and block chain-backed payment security will enhance corporate buyers' business-friendly tour market growth in the congress tourism sector, facilitating smarter negotiations, transparency and efficiency and increasing cost-effectiveness.

As more and more international companies and industries seek opportunities to connect globally, the congress tourism market has seen significant growth over the years. With the delegate in mind destinations and event organizers are investing in solutions in AI-powered event planning, hybrid conference design, and smooth travel integration to optimize delegate engagement, operational efficiency and sustainability. It informs on global event management firms, convention centers, tourism boards and corporate travel agencies, all of which contribute toward making strides in event automation, virtual networking and sustainable congress tourism.

Market Share Analysis by Key Companies

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Reed Exhibitions (RX Global) | 15-20% |

| MCI Group | 12-16% |

| BCD Meetings & Events | 10-14% |

| American Express Meetings & Events | 8-12% |

| Maritz Global Events | 5-9% |

| Other Agencies, Destinations & Venues (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Reed Exhibitions (RX Global) | Develops large-scale industry congresses, AI-powered event matchmaking, and automated registration platforms. |

| MCI Group | Specializes in corporate event management, sustainable business congresses, and hybrid event solutions. |

| BCD Meetings & Events | Provides global business travel management, congress logistics, and event risk management solutions. |

| American Express Meetings & Events | Offers AI-driven conference analytics, personalized delegate experiences, and seamless digital event platforms. |

| Maritz Global Events | Focuses on incentive-based congress tourism, corporate retreats, and immersive business networking experiences. |

Key Company Insights

Reed Exhibitions (RX Global) (15-20%)

A global leader in business congress and trade show management which leverage AI powered event networking, digital registration solutions and hybrid event experiences. The company is one of the leading trade fairs, corporate summits, and academic congresses organizers in the world.

MCI Group (12-16%)

MCI Group is an end-to-end congress planning agency with specialisation in corporate meetings, medical congresses and sustainable event management. The company is a leader in European and Asian MICE (Meetings, Incentives, Conferences, and Exhibitions) tourism, adopting digital transformation and AI-centered event engagement talents.

BCD Meetings & Events (10-14%)

BCD Meetings & Events handles complete congress logistics, business travel management, and event security. Utilizes AI-driven analytics to create tailored attendee experiences and facilitate effortless travel arrangements, along with providing data, to select the most suitable venues for a truly impactful international conference.

American Express Meetings & Events (8-12%)

American Express Meetings & Events provides refined meeting planning features with the help of AI, concierge travel, and corporate event funding solutions. The company's focus is enterprise-level congress tourism, specializing in summits for the financial, pharmaceutical, and technology industries.

Maritz Global Events (5-9%)

Maritz Global Events is known for its incentive-based congress tourism solutions combining bespoke engagement tools, behavioral analytics and immersive networking experiences. The company focuses on mass business conferences, executive retreats, and prominent industry congresses.

| Destination | Key Features |

|---|---|

| Vienna, Austria | One of the world’s top congress destinations, featuring state-of-the-art convention centers, historical venues, and strong MICE infrastructure. |

| Paris, France | A hub for international business summits, government congresses, and large-scale trade shows. |

| Singapore | Asia’s leading congress city, integrating smart conference venues, AI-powered networking events, and sustainable tourism initiatives. |

| Las Vegas, USA | A top choice for corporate meetings, incentive tourism, and high-profile tech and business conferences. |

| Barcelona, Spain | A European leader in medical, scientific, and technology congresses, offering world-class facilities and a vibrant tourism sector. |

Next-generation congress tourism innovations such as AI-powered event experiences and sustainable MICE tourism growth are fostered by a number of event management companies, corporate travel agencies, and conference venues. These include:

Table 01 : Capital Investment in Tourism (US$ Million)

Table 02: Total Tourist Arrivals (Million), 2022

Table 03: Total Spending (US$ Million) and Forecast (2018 to 2033)

Table 04: Number of Tourists (Million) and Forecast (2018 to 2033)

Table 05: Spending Per Traveler (US$ Million) and Forecast (2018 to 2033)

Figure 01: Total Spending (US$ Million) and Forecast (2023 to 2033)

Figure 02: Total Spending Y-o-Y Growth Projections (2018 to 2033)

Figure 03: Number of Tourists (Million) and Forecast (2023 to 2033)

Figure 04: Number of Tourists Y-o-Y Growth Projections (2018 to 2033)

Figure 05: Spending per Traveler (US$ Million) and Forecast (2023 to 2033)

Figure 06: Spending per Traveler Y-o-Y Growth Projections (2018 to 2033)

Figure 07: Current Market Analysis (% of demand), By Age Group, 2022

Figure 08: Current Market Analysis (% of demand), By Tourism Type, 2022

Figure 09: Current Market Analysis (% of demand), By Booking Channel, 2022

Figure 10: Current Market Analysis (% of demand), By Tour Type, 2022

In 2023, North America is estimated to account for 32.4% of the industry.

Asia Pacific is expected to be valued at USD 203.5 billion by 2033.

During the forecast period, the Indian market is expected to increase at a CAGR of 8.2%.

Rising disposable incomes and technological improvements drive sales in the market.

Increased emphasis on sustainability, customization, and social media.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA