The congenital adrenal hyperplasia treatment market is valued at USD 478.36 million in 2025. As per FMI's analysis, the industry will grow at a CAGR of 8.31% and reach USD 1,040 million by 2035.

In 2024, the industry witnessed significant advancements in therapeutic options, with a notable emphasis on gene therapy and enzyme replacement treatments. Pharmaceutical companies accelerated clinical trials for novel drugs, contributing to a more robust pipeline.

Regulatory approvals for innovative treatments expanded patient access, particularly in regions with a high prevalence of CAH. Additionally, strategic partnerships between biotechnology firms and healthcare providers fostered further research and development. On the diagnostic front, the adoption of newborn screening programs increased, leading to early diagnosis and timely intervention.

Moving into 2025 and beyond, the industry is expected to experience steady growth driven by the rising incidence of genetic disorders, increased awareness, and enhanced healthcare infrastructure. Governments and healthcare organizations are likely to invest more in screening initiatives and patient support programs.

Personalized medicine is also anticipated to play a larger role, with treatments tailored to individual genetic profiles. Furthermore, advancements in telehealth services will facilitate remote patient monitoring and improve treatment adherence, driving overall industry expansion.

While challenges such as high treatment costs and limited availability in certain regions remain, continuous research and technological innovations are expected to mitigate these barriers, ensuring sustained industry growth.

Market Value Insights

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 478.36 million |

| Industry Value (2035F) | USD 1,040 million |

| CAGR (2025 to 2035) | 8.31% |

Explore FMI!

Book a free demo

The Congenital Adrenal Hyperplasia (CAH) Treatment Industry is on a steady growth trajectory, driven by advancements in gene therapy, enzyme replacement treatments, and increasing newborn screening initiatives.

Pharmaceutical companies and biotech innovators are benefited from expanded treatment options and growing patient awareness. However, high treatment costs and limited healthcare access in certain regions pose challenges for industry penetration.

Market Expansion and Investment

Alignment with Market Trends

Partnerships and Growth

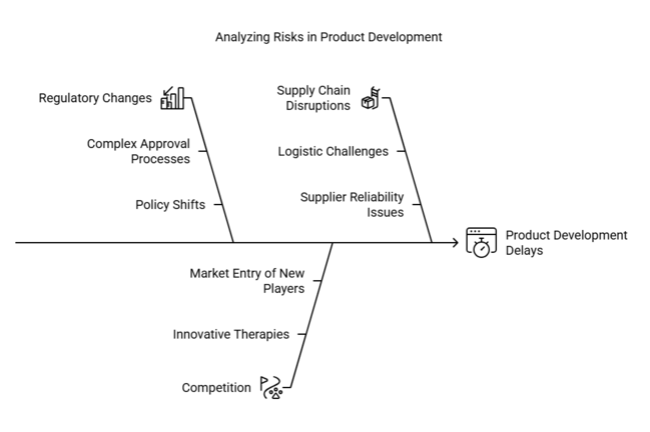

| Risk | Probability / Impact |

|---|---|

| Regulatory Changes Delaying Product Approvals | High Probability / High Impact |

| Competition from Emerging Therapies | Medium Probability / High Impact |

| Supply Chain Disruptions Affecting Distribution | Low Probability / Medium Impact |

| Priority | Immediate Action |

|---|---|

| Accelerate Drug Development for CAH Treatments | Conduct feasibility studies on novel therapies and gene editing tech. |

| Strengthen Industry Position | Initiate partnerships with healthcare providers and advocacy groups. |

| Expand Global Reach | Launch targeted distribution partnerships in underserved regions. |

To stay ahead, companies must accelerate investment in innovative therapies and personalized treatments for Congenital Adrenal Hyperplasia (CAH). Forming strategic partnerships with biotech firms and healthcare providers will enable faster industry entry and improved patient access.

Additionally, expanding distribution networks in underserved regions will enhance global reach. Monitoring regulatory landscapes and adapting swiftly to emerging trends will ensure sustained competitive advantage. By aligning research and development efforts with industry demands, companies can differentiate their offerings and drive long-term growth in the CAH treatment industry.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across pharmaceutical companies, healthcare providers, patients, and regulators in the USA, Western Europe, Japan, and South Korea)

Regional Variance:

High Variance:

Convergent Perspectives on ROI:

70% of USA stakeholders viewed personalized medicine investments as highly beneficial, while only 35% in Japan showed interest in premium-priced therapies.

Consensus:

Corticosteroid Therapy: 64% globally preferred established steroid-based treatments for affordability and accessibility.

Variance:

Shared Challenges:

87% of stakeholders cited rising drug development costs as a major concern.

Regional Differences:

Manufacturers:

Healthcare Providers:

Patients:

Alignment:

78% of pharmaceutical companies globally plan to invest in gene therapy research and clinical trials.

Divergence:

High Consensus:

All regions identified treatment affordability, access to advanced therapies, and diagnostic improvements as major concerns.

Key Variances:

Strategic Insight:

A region-specific strategy is essential for industry success. Tailoring treatment offerings, regulatory engagement, and affordability measures based on local priorities will drive industry penetration and improve patient outcomes.

| Countries | Regulations and Impact |

|---|---|

| The USA | FDA regulates drugs via the Orphan Drug Act, offering incentives for rare disease treatments. |

| UK | MHRA fast-tracks approvals for paediatric drugs; NICE evaluates cost-effectiveness for NHS adoption. |

| France | ANSM mandates stringent pharmacovigilance; CNEDiMTS assesses therapeutic value for reimbursement. |

| Germany | BfArM supports expedited approvals for rare diseases; G-BA influences pricing and reimbursement. |

| Italy | AIFA collaborates with EMA for faster drug approvals and provides incentives for rare disease research. |

| South Korea | MFDS promotes orphan drug development through fee reductions and industry exclusivity. |

| Japan | PMDA's Sakigake Designation expedites innovative treatments, with additional support for rare diseases. |

| China | NMPA provides conditional approvals under priority review; rare disease drugs may be exempt from tariffs. |

| Australia-NZ | TGA and Medsafe offer accelerated pathways for orphan drugs with government subsidies for access. |

The type segment is expected to grow at a CAGR of 7.9% from 2025 to 2035. This segment includes various diagnostic approaches and therapies used for managing the condition. Traditional therapies remain the dominant choice due to their affordability and established efficacy. However, advancements in genetic screening and the growing adoption of precision medicine are driving growth within this segment.

Additionally, increased awareness and early diagnosis contribute to the demand for more accurate diagnostic tools. Companies investing in innovative treatment approaches and expanding diagnostic capabilities are likely to capture a significant industry share.

The treatment segment is projected to experience robust growth with a CAGR of 8.3% from 2025 to 2035. Significant advancements in novel therapies, including gene therapies and targeted hormone replacement treatments, are fueling this growth. The rising availability of FDA-approved drugs and the expansion of clinical trials further drive demand.

Additionally, pharmaceutical companies are increasingly focusing on personalized treatment options, catering to individual patient needs. Supportive government policies, accelerated approvals for orphan drugs, and increased healthcare expenditure also contribute to the strong growth outlook for the treatment segment.

The end user segment is expected to grow at a CAGR of 8.0% from 2025 to 2035. Hospitals and specialty clinics remain the primary treatment centres due to their advanced facilities and access to experienced healthcare professionals. Additionally, home care settings are witnessing increasing adoption, driven by advancements in telehealth services and the growing preference for home-based treatments.

Collaborations between healthcare institutions and pharmaceutical companies are further improving patient access to innovative therapies. The presence of specialized centres and government initiatives promoting early diagnosis and effective treatment continue to support the segment's growth.

The industry in the USA is estimated to grow with approx. 7.8% CAGR from 2025 to 2035. The USA is a key driver for the industry growth supported by the advanced healthcare infrastructure, extensive insurance coverage, and high patient awareness. Government programs and investments in orphan diseases also drive research and development.

Pharma companies are pursuing new therapies, such as gene therapies and precision medicine. Moreover, leading biotech companies and regulatory approvals within a similar timeframe guarantee fast commercialization of therapies. There are advocacy groups in the USA that work to increase the speed of diagnosis and improve treatment options.

The UK industry is estimated to grow at a CAGR of 7.2% between 2025 to 2035. The country’s industry growth is primarily attributable to a well-established National Health Service (NHS) which offers subsidized treatments for rare diseases. Collaborations between pharma companies and research institutes, along with heavy investments in medical research, drive innovations.

Rising diagnostic rates and more accessibility to specialists increase the growth of the industry. Incentives such as government support for orphan drugs help accelerate the advent of new therapies. Emerging awareness of screening programs and increasing public knowledge are other driving forces responsible for the growing industry outlook.

The France is expected to grow with the CAGR of 7.4%, With strong governmental support and patient-oriented campaigns at its core. Comprehensive reimbursement policies guarantee patient access to state-of-the-art therapies. Innovation is further enhanced by the presence of leading pharmaceutical companies and a well-regulated clinical trial environment.

Moreover, collaborations between hospitals and research institutions continue to advance treatment. Early detection of conditions in France, along with innovations in genetics testing, is beneficial for industry growth. Having national rare disease programs helps to further increase access to therapies.

The Germany industry is anticipated to grow at a CAGR of 7.6% between 2025 and 2035. The pharmaceutical sector is also robust in Germany with strong R&D investments making it a key industry in Europe. The country has a well-regulated health care system that allows for specific reimbursement policies on rare diseases.

Pharmaceutical companies invest extensively in clinical trials and work with research institutes to build new therapies. Government initiatives for orphan drug development further boost industry growth. Patient advocacy organisations also play an important role in raising awareness and increasing patient access to treatment.

The CAGR for the Italy industry from 2025 to 2035 is projected to be around 7.3%. Italy’s healthcare system supports the diagnosis and treatment of rare diseases through specialized centres and national programs. Government regulations facilitate the approval and reimbursement of orphan drugs, driving industry growth.

Collaborations between pharmaceutical companies and research institutions accelerate drug development. Increased awareness programs further encourage early diagnosis and treatment. Additionally, advancements in genetic screening techniques provide accurate and timely diagnosis, contributing to the overall expansion of the industry.

South Korea is projected to be CAGR of 8.0%. With a highly developed healthcare infrastructure, patients can easily access specialized care. Apart from these, government initiatives regarding the management of these disorders, and patient support programs also propel the industry. Biopharmaceutical research represents a high investment for pharmaceutical companies, resulting in a variety of innovative therapies.

Growth is also driven by increased involvement in clinical trials and fast-track drug approval systems. In addition, enhanced diagnostic tools and the routine use of genetic testing contribute to timely diagnosis and effective treatment.

Japan industry is estimated to grow at 7.7% CAGR for the period 2025 to 2035. Japan has comprehensive coverage for rare diseases under its healthcare system, contributing to extensive patient access to treatments. A leader in medical research and biotechnology, the country is at the forefront of innovations in gene therapies and new drugs.

Supportive regulation and expedited regulatory pathways for orphan drugs foster industry growth. Moreover, advanced diagnostic technologies aid in early diagnosis. The collaborative relationship with academic institutions leads to powerful Research and Development (R&D) in continuous development of effective treatment.

The CAGR for the China industry from 2025 to 2035 is projected to be around 9.5%. Rapid advancements in healthcare infrastructure, increasing government funding, and growing awareness of rare diseases are key growth drivers. China’s biopharmaceutical sector is rapidly expanding, with companies investing in research and development of gene therapies and precision medicine.

Government policies supporting rare disease treatment and early diagnosis programs contribute significantly to industry growth. Additionally, collaborations with international pharmaceutical companies bring innovative therapies to the industry, providing patients with access to cutting-edge treatments.

The CAGR for the Australia and New Zealand (ANZ) industry from 2025 to 2035 is expected to be around 7.1%. The region's industry benefits from well-established healthcare systems that provide comprehensive coverage for rare disease treatments. Government policies supporting orphan drug approvals and reimbursement schemes ensure patient access to therapies.

Collaborations between research institutions, universities, and pharmaceutical companies drive innovations in treatment. Additionally, increased awareness programs and genetic screening initiatives promote early diagnosis. The presence of specialized centres for rare diseases further strengthens the industry landscape in the region.

In 2024, the Congenital Adrenal Hyperplasia (CAH) treatment industry saw notable developments. Neurocrine Biosciences received FDA approval for Crenessity, offering a new treatment option for CAH patients. Meanwhile, BridgeBio Pharma discontinued its gene therapy program, BBP-631, due to underwhelming results.

Spruce Biosciences continued progressing with its investigational drug, tildacerfont, with key clinical trial results anticipated by the end of the year. Additionally, increased investments in gene therapies and advancements in personalized medicine are driving innovation in the industry.

Neurocrine Biosciences

Estimated Share: ~30-35%

Dominates with its endocrine disorder expertise and established CAH treatments. Maintained leadership through existing therapies but no major 2024 pipeline updates.

Diurnal Limited

Estimated Share: ~20-25%

Key player with Efmody® (modified-release hydrocortisone) in Europe. Focused on commercialization in 2024; no new trials or approvals reported.

Spruce Biosciences

Estimated Share: ~15-20%

Progressed with tildacerfont (CRF1 receptor antagonist):

Adrenas Therapeutics

Estimated Share: ~5-10%

Inactive in 2024 (acquired by Spruce in 2021). No standalone developments.

Emerge Health

Estimated Share: ~5%

Private generic/niche steroid supplier. No public 2024 updates on CAH.

Thermo Fisher Scientific

Estimated Share: ~5-10%

Supplied CAH newborn screening tests but no 2024-specific launches or expansions reported.

Zydus Lifesciences Ltd.

Estimated Share: ~5%

Produced generic CAH therapies (e.g., hydrocortisone) but no 2024 pipeline advancements.

China, South Korea, and the USA are experiencing rapid growth due to advancements in technology and strong government support.

Growth is being driven by advancements in gene therapy, increased research funding, and supportive governmental policies.

Key players in the industry include Neurocrine Biosciences, BridgeBio Pharma, and Spruce Biosciences.

The expected size of the industry is USD 1,040 million by 2035.

Governments provide incentives, orphan drug designations, and research funding to expedite the development of therapies.

The industry is bifurcated into classic congenital adrenal hyperplasia, non-classic congenital adrenal hyperplasia.

The industry is bifurcated into medication, and surgery.

The industry is segmented into hospitals, pharmacies, and specialty clinics.

The industry is studied across North America, Latin America, Europe, South Asia, East Asia, Oceania, Middle East & Africa.

Eyelid Scrub Market Analysis & Forecast by Product, Application and Region 2025 to 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Trends – Innovations & Growth 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.