The condensing unit market is anticipated to experience strong growth between 2025 and 2035 due to growing demand for efficient HVAC and refrigeration solutions in industrial, commercial, and residential segments. Industry size is anticipated to rise from USD 45.2 billion in 2025 to USD 78 billion in 2035 at a CAGR of 5.6% during the forecast period of 2025 to 2035. The growth trend symbolizes the rising urbanization, enhanced infrastructure development, and requirements for stable cooling systems worldwide.

The units are indispensable components of refrigeration systems that handle the discharge of heat collected from the inner side of cooling areas. Their relevance has risen with the emergence of supermarkets, hypermarkets, cold storage facilities, restaurants, hotels, data centers, and healthcare institutions-all depending on effective and uninterrupted cooling processes. Their applications continue to drive the demand for energy-efficient, low-maintenance, and technologically advanced units.

The industry divides by cooling technologies into air-cooled, water-cooled, and fan-cooled equipment, each serving specific applications and environmental conditions. Amongst these, air-cooled units are dominant because they are simple, cheap, and versatile to the point of suitability for most small- and medium-scale commercial applications.

In direct opposition to them are water-cooled units assuming spotlight positions within industry and big business ventures due to greater cooling efficiency and strength, particularly within warm ambient climatic regions. Fan-cooled models are seeing more usage within conditions where very limited installation adaptability and minimum energy requirements rank very high on priority lists. One of the root drivers in the industry is growing emphasis on energy efficiency and environmental protection green. Governments worldwide are imposing strict rules for the utilization of refrigerants and energy consumption.

Accordingly, producers are focusing their interest on R&D to design green condensing units with low-GWP refrigerants and technology such as inverter compressors and smart monitoring systems. Not only do these technologies meet environmental requirements, but they also entice customers in pursuit of lower operating costs. Geographically, the Asia Pacific industry will be the fastest-growing regional industry, driven by quickly developing industrial industries, increasing retail infrastructure, and burgeoning demand for cold storage and logistics services.

China and India are seeing high growth in construction, food processing, and urban development, playing a significant role in driving industry growth. North America and Europe, while mature industries, are also witnessing consistent growth because of the replacement of old infrastructure, focus on green building technologies, and regulatory changes toward low-emission HVAC systems.

Despite having bright growth potential, issues like the high upfront price of high-end options and retrofitting complexity constrain universal adoption, especially in low-cost industries. With increasing availability of finance sources, public-private partnerships, and awareness initiatives, however, such hurdles are slowly disappearing.

The industry is on an upward trend between 2025 and 2035, driven by technological advancement, environmental sustainability, and growing demand for efficient cooling in various industries. The industry is becoming more competitive, leading to growth opportunities in both strategic partnerships, product differentiation, and investment in energy-efficient technologies.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 45.2 billion |

| Industry Value (2035F) | USD 78 billion |

| CAGR (2025 to 2035) | 5.6% |

Explore FMI!

Book a free demo

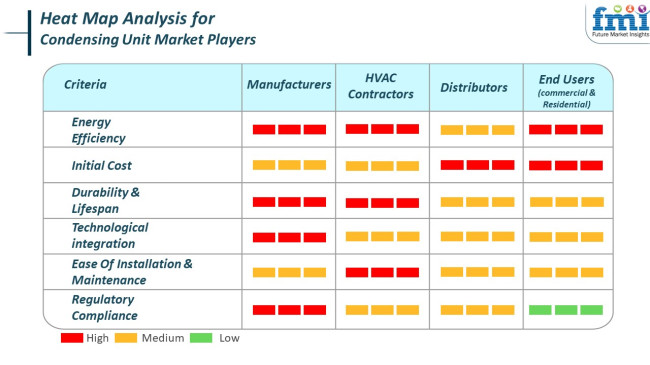

The industry caters to various stakeholders such as manufacturers, HVAC contractors, distributors, and end users, each having varied criteria as priorities. The manufacturer considers energy efficiency, longevity, and regulatory compliance to make sure their product complies with industry requirements and sustainability demands.

HVAC installers and service technicians, who perform the installation and maintenance, appreciate ease of installation, ease of maintenance, and cooling operation reliability in order to facilitate simple operation and customer satisfaction. Distributors are concerned with initial cost and availability and seek to acquire low-cost, hot-selling units that can be readily shipped from industry to industry.

End users, residential and commercial, value energy efficiency, performance, and cost because these directly affect the operating cost and comfort. As the demand for smart cooling solutions and energy-efficient solutions is on the rise, technology innovation is rapid. Urbanization, growth of commercial infrastructure, and environment legislations in the GCC region keep the industry going, forcing all the stakeholders to keep pace with evolving customer demands and sustainability needs.

Between 2020 and 2024, the industry expanded due to increased demand in cold storage, retail refrigeration, and HVAC applications. Rapid urbanization, growing food preservation needs, and pharmaceutical logistics pushed manufacturers to enhance unit performance. The emphasis was placed on energy-saving compressors, inverter technology, and phase-wise transitions to low-GWP refrigerants based on regulatory compulsion. Traditional synthetic refrigerants remained dominant nonetheless. Cost, the environment, and operation noise were constant concerns, especially in high-density urban areas.

Forward to 2025 to 2035, the industry will become greener, intelligent, and modular. Natural refrigerants like CO₂, ammonia, and propane will outstrip high-GWP synthetics, fueled by stricter climate norms. Convergence of predictive diagnostics from AI-IoT will drive intelligent performance monitoring, remove wastage of energy, and enable real-time fault detection.

They will be decentralized, compact in size, and noise-optimized for smart and urban building integration. Modular systems will support flexible deployment in off-grid and commercial setups with hybrid sources of power like solar and battery-supported technologies. The future of the industry will be shaped by green innovation, automation, and net-zero energy alignment.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Demand for cold chain, HVAC, and food storage. | Sustainability, decentralized cooling, and smart infrastructure. |

| Synthetic refrigerants (R404A, R134a) were the mainstay, with low-GWP options being used in limited applications. | Natural refrigerants (CO₂, ammonia, hydrocarbons) require climate compliance barriers to be broken. |

| Greater energy consumption by inverter compressors and improved insulation. | AI-adaptive systems will balance energy in real time. |

| Remote monitoring on low-end models; manual interfaces. | Predictive maintenance and automation using embedded AI- IoT systems. |

| Fixed, centralized systems; used more space and installation time. | Modular, plug-and-play, low-footprint architectures for flexible deployment. |

| High operating noise and cooling inefficiencies in high-density environments. | Low-noise, low-power systems designed for smart cities and indoor proximity. |

| Regulation-based sustainability with partial VOC and GWP considerations. | Carbon-neutral objectives and recyclable material usage throughout the full lifecycle. |

| Food logistics, commercial retail cooling, and HVAC. | Broader use in data centers, EV battery cooling, vertical farming, and prefabricated construction. |

| Manual maintenance scheduling and performance tracking. | Predictive, autonomous diagnostics and smart building system integration. |

| Grid-dependent systems with high energy draw. | Solar-assisted, hybrid-energy, and load-balancing systems to reduce carbon and energy costs. |

The industry is witnessing tremendous growth based on the growing demand for effective cooling solutions in multiple industries, such as food and beverage, pharmaceutical, and commercial buildings.

Even with this favorable trend, the industry is exposed to a number of risks that may affect its growth. Among the key issues is the regulatory environment of refrigerants. There is growing environmental regulation that forces producers to move towards environmentally friendly refrigerants. This change calls for a huge investment in research and development to design compliant products, and in case of non-compliance, industry share erosion or legal actions may ensue.

Supply chain interruption is also a major risk. Manufacturing is dependent on an advanced web of suppliers for components like compressors, heat exchangers, and controls. Geopolitical tensions, tariffs, or pandemics can derail this supply chain, hindering production and increasing costs. Companies must develop robust supply chain strategies to mitigate these threats.

Economic conditions can also affect industry conditions. The demand is greatly influenced by building and industrial activity, which is extremely cyclical. In times of recession, low investment in new buildings can lead to reduced demand for HVAC equipment such as condensing units. The manufacturers must diversify their product base and venture into new industries to act as a buffer against such downturns.

Technological innovation and changing customer tastes also bring challenges. Increasing focus on smart technologies and energy efficiency in HVAC solutions is something that doesn't go unnoticed. Companies that are not innovating and incorporating these elements into their offerings risk losing competitive advantage and failing to meet customer needs. Adapting to technology expenditure and staying informed on industry trends are essential to maintaining industry share.

In 2025, the industry will be largely governed by the supremacy of air-cooled condensing units, which are expected to account for approximately 55% of the total industry share. Air-cooled systems remain the predominant choice for residential, commercial, and light industrial applications due to their inexpensive installation and minimal maintenance.

In contrast to water-cooled systems, these units do not require a separate water supply line or cooling tower, thus rendering them viable for sites restricted in space or lacking in water resources. The units find a prominent application in rooftop HVAC systems, commercial refrigeration systems in supermarkets, and small cold storage systems.

Major manufacturers such as Emerson Electric Co., Carrier Global Corporation, and Danfoss are the leaders in manufacturing high efficiency air-cooled condensing units. The Copeland™ condensing unit made by Emerson, for example, features energy-efficient scroll compressors combined with smart monitoring capabilities, thus allowing retailers and food service businesses to be guaranteed reliable performance combined with low operational costs.

In 2025, conservatively speaking, water-cooled condensing units will occupy roughly 30% of the global industry. Lesser fate than its air-cooled neighbor, water-cooled ones are favored for large industrial and commercial buildings where cooling loads are very high, and efficiency over the long term is paramount.

Overall, these types of systems offer better heat transfer and are operationally efficient in constant temperature environments. Companies like Johnson Controls and GEA Group maintain high performance in water-cooled solutions designed for heavy-duty air conditioning and industrial refrigeration applications like data centers and manufacturing plants.

Air-cooled units will prevail due to their flexibility in operations and lesser requirements for infrastructure; water-cooled ones are still important in high-capacity and mission-critical environments.

In 2025, R404A and R134a in refrigerant type with an upper hand in the global industry projected to gain shares of 22% and 20% respectively.

R404A has captured about 22% of the industry and continues to be the preferred option for commercial refrigeration, for instance, low- and medium-temperature applications such as walk-in freezers, refrigerated transportation, and supermarket cold chain systems.

These factors make it thermodynamically stable and compatible with existing components to give a good, reliable option to companies. Refrigerant R404A is in demand even though environmental regulations are becoming stricter because it is one of the condemned refrigerants present in the condensing units by manufacturers like Emerson, Bitzer, and Tecumseh.

It holds 20% of the industry, mainly for medium temperature usages, such as in household refrigerators, some automotive air conditioning, and certain industrial applications. It has good energy efficiency while having lower discharge temperatures, thus making it suitable for those applications whose temperature stability is very important, as well as minimal wear of the compressor.

The largest companies with products in the industry, Danfoss and Johnson Controls, manufacture condensing units for R134a, which are widely used in beverage coolers, vending machines, and HVACs applicable in the retail and hospitality sectors.

In light of all this, the industry leaders now start innovating totally with alternatives having low GWP numbers because of the resistance from policies like the Kigali Amendment and EU F-Gas regulations, which will phase out the use of HFCs. Alternatives such as R290 (propane) and R513A are beginning to be considered, but large-scale acceptance is still under development.

The trend, therefore, is that R404A and R134a will potentially lead the industry in 2025, with the current boom in the transition to environmentally friendly refrigerants going at quite a fast pace while companies are changing their portfolios to suit global compliance and environmental objectives.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

| UK | 4.8% |

| France | 4.6% |

| Germany | 4.9% |

| Italy | 4.4% |

| South Korea | 5.1% |

| Japan | 4.5% |

| China | 6.2% |

| Australia | 4.7% |

| New Zealand | 4.3% |

The USA industry is anticipated to record a 5.3% CAGR between 2025 to 2035. The growth is led mainly by aggressive investments in commercial HVAC systems, food processing units, and retail refrigeration systems. Demand is also supported by growing stringent environmental regulations promoting energy-efficient and low-emission units. Deep penetration of grocery stores and quick-service restaurants in the industry also fuels the demand for high-end refrigeration solutions.

Major industry participants in the USA are Emerson Electric Co., Heatcraft Refrigeration Products LLC, and Lennox International Inc., which remain focused on innovation in modular and scroll condensing units. The movement toward natural refrigerants such as hydrocarbons and CO₂ is influencing product enhancement and buying behaviors. The development of digital monitoring and intelligent control technologies is also shaping competition.

The UK industry is forecast to expand at a CAGR of 4.8% over the forecast period. Increased installation of HVAC and refrigeration equipment in urban development projects and healthcare properties is propelling the demand for high-performance options. Additionally, adherence to regulations under F-Gas regulations is compelling the replacement of high-GWP refrigerants with low-GWP refrigerants in commercial refrigeration applications.

With the adoption of compact, air-cooled condensing units, organizations such as Johnson Controls, Daikin Applied UK Ltd., and GEA Group are leaders in system efficiencies and environmental adaptability. The adoption trend of compact, air-cooled condensing units continues to extend to smaller- and medium-sized retail and hospitality sectors. Decarbonization and sustainability will continue to drive more innovation and adoption of technology across the industry.

The French industry is projected to grow at a CAGR of 4.6% between 2025 and 2035. The growth is driven by growth in the food retail industry, expansion in cold storage logistics, and retrofitting of commercial refrigeration equipment. Compliance with European directives on energy efficiency and climate objectives continues to drive the product mix.

Industry players such as Schneider Electric, Danfoss, and Panasonic are engaged in unit design optimization for reduced energy consumption and environmental footprints. Air-cooled products continue to have a strong industry presence due to commercial applications in urban industries. Integration of digital building blocks for performance monitoring and pre-emptive maintenance is fueling adoption across varied end-use segments.

Germany is anticipated to achieve growth at a CAGR of 4.9% during the forecast period, led by a well-established industrial base and rising environmental consciousness. Industrial and commercial refrigeration industries are shifting towards high-efficiency heat recovery systems and natural refrigerants. Efficient supermarket and logistics hub construction also aids in the growth of the industry.

Industry participants such as Bitzer, Güntner GmbH, and Emerson are putting money into R&D to develop low-noise, high-efficiency condensing units with robust environmental features. Growing demand for decentralized cold chain networks and retail infrastructure energy optimization is boosting sales of electronic, intelligent condensing units. Government policies supporting the adoption of green technology will also fuel industry growth.

Italy's industry is likely to grow at a CAGR of 4.4% through 2035, driven by increasing demand in the hospitality, food service, and pharmaceutical sectors. The replacement of aging infrastructure with energy-efficient alternatives and adherence to EU-wide refrigerant phase-down regulations are key drivers.

Industry pioneers such as LU-VE Group, Dorin, and Embraco are responding by offering tiny, environmentally friendly boxes. The units that can be placed remotely are on the rise within inner-city business applications where space available as much as sound level is a main concern. Technical advances permitting wider thermal control and refrigerant management of the kind outlined will be responsible for longer-term trends in take.

South Korea is anticipated to grow at a CAGR of 5.1% during the forecast period, based on expansion in deployment in electronics manufacturing, biotech facilities, and high-end retail refrigeration. Local, new companies are concentrating on miniaturization and green performance, which is in line with nationwide energy-saving initiatives.

These key players - LG Electronics, Samsung HVAC, and Carrier Korea - dominate the technology developments of inverter-based condensing systems. IoT-based platform integration and focus on refrigerant leakage control and detection are increasing industry attractiveness. Government incentives for energy-efficient technology are also increasing investments towards developing new products.

The Japanese industry is expected to record a CAGR of 4.5% between 2025 and 2035. Industry leadership is dominated by technological advancement, space-saving system demand, and energy-driven commitment. Drivers are shifting refrigeration needs of the food processing, pharmaceutical, and convenience store sectors.

Industry leaders such as Daikin Industries, Panasonic Corporation, and Mitsubishi Electric continue to launch variable speed and CO₂-based solutions. Super-silent, compact units are being spurred by consumer demand in high-density urban areas, influencing product design. Advanced sensor technology and automation features are improving operating efficiency and cost savings in installations.

China is expected to lead global growth in the industry at a CAGR of 6.2% over the forecast period. Rapid industrialization, expansion in cold chain logistics, and high government focus on food safety and urban infrastructure development are major growth drivers. The commercial refrigeration industry is benefiting from the surge in the development of supermarkets and hypermarkets.

Domestic players such as Haier, Midea, and Highly Refrigeration are going up against global players in terms of economic and scalable condensing solutions. Green technology focus and a move towards R290 and CO₂ refrigerants are pushing new products into the marketplace. Cloud monitoring and compatibility for smart grids is increasingly applied at a mass scale in commercial uses.

Australia's industry will grow at a CAGR of 4.7% until 2035. Industry growth is stimulated by increasing demand in agriculture-based cold storage, food retail chains, and infrastructure development. Policy regulations on energy use and emissions are impacting system design and refrigerant selection.

Key industry players such as Kirby HVAC&R, Heatcraft Australia, and Actrol are marketing sustainable, modular units appropriate for varied climatic conditions. There is a strong demand for outdoor air-cooled systems with durable and corrosion-resistant materials. Solar-compatible and hybrid energy models will grow in accordance with national decarbonization policy.

New Zealand is projected to grow at a CAGR of 4.3% over the forecast period, driven primarily by investment in low-GWP alternatives for sustainable agriculture, food export logistics, and commercial energy-efficient buildings. The refrigeration sector is responding to government policies mandating the transition to low-GWP alternatives.

Industry leaders such as Patton Refrigeration, Realcold, and Emerson are prioritizing reliable system performance for seashore and rural use. Climate-proof, remote-monitoring-capable units are the prime driver of buying intentions. The increasing focus on operating sustainability and life-cycle efficiency is set to drive product innovation and uptake.

The industry is characterized by global industrial refrigeration and HVAC manufacturers having tough competition among themselves, with an important focus on energy efficiency, sustainability and refrigerant transition. Industry leaders such as Emerson Electric Co., Danfoss, and Daikin Applied have developed next-gen units with variable-speed compressors using eco-friendly refrigerants with IoT-enabled monitoring systems for operational efficiency upgrades.

Companies are investing heavily in low-GWP (Global Warming Potential) refrigerants, hydrocarbon-based ones, and CO₂ transcritical systems due to the increasing tightening of environmental regulations around the globe, including the regulatory frameworks of the EU F-Gas Regulation or Kigali Amendment to the Montreal Protocol within which they operate.

Industry consolidation and strategic collaborations are shaping the competitive landscape, with companies leveraging the global manufacturing footprints and forming alliances with refrigeration component suppliers while streamlining their processes for better cost efficiencies.

For instance, Tecumseh Products and BITZER are using their technical know-how in hermetic and semi-hermetic compressors to expand their offering portfolio towards applications involving commercial as well as industrial refrigeration. However, companies such as Hussmann and Voltas are enhancing their presence within emerging industries through localized distribution networks partnered with food retail as well as cold storage providers.

Technological advancements such as smart refrigeration predictive maintenance will form key differentiators among companies. In contrast, AI-driven diagnostics, cloud monitoring, and remote maintenance will all be incorporated into companies' systems to bring down downtime and increase reliability.

Modular designs are the focus of GEA Group and Heatcraft Worldwide Refrigeration. These designs will offer scalable cooling capacity, high energy savings and the ability to automate performance adjustments. The innovation seeks to meet the increasing demand for energy-efficient refrigeration in supermarkets, food processing facilities, and industrial cooling applications.

The competition remains on sustainability and cost optimization, a trend that has prompted the shift towards natural refrigerants (CO₂, ammonia, and propane) coupled with energy-efficient inverter-driven units.

Differentiation is occurring through offerings that feature low-noise, compact, high-efficiency units designed for commercial refrigeration, industrial cold storage, and HVAC applications. As the industry continues to change over time, companies that focus much on digitalization, compliance with regulations, as well as customizations for the end-user will continue to have a competitive advantage.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Emerson Electric Co. | 18-22% |

| Danfoss | 12-16% |

| Daikin Applied | 10-14% |

| Tecumseh Products Company | 8-12% |

| BITZER | 6-10% |

| Combined Others | 30-40% |

| Company Name | Key Offerings and Activities |

| Emerson Electric Co. | Leading supplier of intelligent condensing units with IoT -enabled diagnostics, energy-efficient compressors, and natural refrigerant compatibility. |

| Danfoss | Specializes in low-GWP refrigerant condensing units, integrating variable-speed compressors for precise cooling and energy savings. |

| Daikin Applied | Develops advanced HVAC and refrigeration condensing units with smart inverter technology for optimized energy performance. |

| Tecumseh Products Company | Manufactures hermetic and semi-hermetic compressors for commercial refrigeration and air conditioning applications. |

| BITZER | Offers CO₂ transcritical and ammonia-based condensing units for industrial refrigeration and food processing applications. |

Key Company Insights

Emerson Electric Co. (18-22%)

Dominates the industry with IoT-enabled units featuring AI-driven predictive maintenance and advanced compressor technology for energy-efficient refrigeration solutions.

Danfoss (12-16%)

Leads in low-GWP refrigerant solutions, integrating variable-speed compressors and electronic expansion valves to enhance efficiency and compliance with global regulations.

Daikin Applied (10-14%)

Expands its smart HVAC and refrigeration solutions, leveraging IoT connectivity and adaptive cooling for commercial and industrial applications.

Tecumseh Products Company (8-12%)

It focuses on high-performance hermetic compressors and launches eco-friendly units that meet the evolving demand for compact, as well as energy-efficient cooling systems.

BITZER (6-10%)

Strengthens its position in CO₂ and ammonia-based refrigeration, providing high-efficiency, modular units for supermarkets and food processing industries.

Other Key Players

The industry is estimated to be USD 45.2 billion in 2025.

By 2035, the industry is expected to grow to approximately USD 78 billion.

China is projected to witness a 6.2% CAGR, supported by rapid industrialization, urbanization, and the growth of cold chain logistics.

Air-cooled condensing units are the leading segment, favored for their lower installation costs and ease of maintenance.

Key players include Emerson Electric Co., Danfoss, Daikin Applied, Tecumseh Products Company, BITZER KÜHLMASCHINENBAU GMBH, Hussmann Corporation, Voltas Limited, Patton Ltd, GEA Group, Heatcraft Worldwide Refrigeration, Rivacold UK Ltd, and JINAN RETEK INDUSTRIES INC.

By type, the industry is segmented into air-cooled, water cooled, and fan cooled.

By refrigerant type, the industry is segmented into R404A, R134a, R407A/R407C/R407F, R507A or R22, and green refrigerants.

By compressor technology, the industry is segmented into reciprocating, hermetic, semi-hermetic, open, rotary, scroll, rotary vane, screw, and centrifugal.

By application, the industry is segmented into high-temperature, medium temperature, and low temperature.

By end use, the industry is segmented into residential, commercial, and industrial.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

Precipitation Hardening Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Polyethylene Terephthalate Glycol (PETG) Market Growth - Innovations, Trends & Forecast 2025 to 2035

Sodium Bicarbonate Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Plywood Market Growth - Innovations, Trends & Forecast 2025 to 2035

Phenylethyl Market Growth - Innovations, Trends & Forecast 2025 to 2035

PP Homopolymer Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.