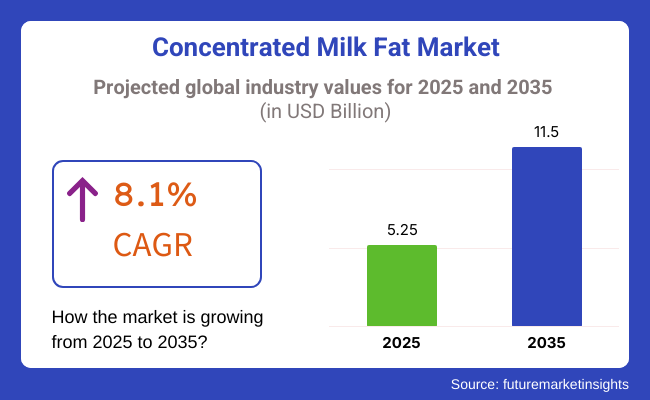

The global concentrated milk fat market is estimated to be worth USD 5.25 billion in 2025. It is projected to reach USD 11.5 billion by 2035, expanding at a CAGR of 8.1% over the assessment period of 2025 to 2035. The concentrated milk fat sector is performing consistently well, fueled by the rising popularity of high-quality dairy raw materials in the food and beverage sector.

Concentrated milk fat, which is anhydrous milk fat or butter oil as well, is mostly utilized in bakery, confectionery, dairy, and cooking applications owing to the fact that it has a rich taste, a better texture, and a longer shelf life. Further, the shift towards the use of natural and top-grade dairy fats is being made, asserts market development is rising.

The market growth is basically propelled by the soaring consumption of bakery and confectionery products, where the concentrated milk fat stands out in improving both the flavor and the mouthfeel. The increasing use of milk fat as a functional ingredient in the production of premium chocolates, pastries, and dairy spreads has been the main reason for the issuing of more butter oils. Furthermore, the popularity of keto and high-fat diets is a factor that increases consumer choice in concentrated dairy fats.

Innovations include fractionation and improved quality of milk fat; thus, it is now a go-to choice for various food producers. The development of both dairy re-exporting and free trade agreements have also driven market growth, mainly in regions with high dairy consumption, such as North America, Europe, and Asia-Pacific.

However, players face challenges like dynamic commodity prices of raw materials and the supply chain due to climate change and regulatory issues on dairy production. There is increasing competition from alternatives based on plant sources, and consumers are also inclined to consume non-dairy fats, which results in hindrances to industry growth.

Through the utilization of plant-based ingredients, manufacturing companies are taking proactive actions aimed at aligning their operations with sustainability, improving process methods, and coming up with new products that cater to the evolving market

The rising demand for organic and grass-fed dairy products actualizes a whole new avenue for the premium milk fat sector. Equally, the trend for functional and fortified dairy ingredients, which embrace the ones with omega-3 fatty acids and probiotics, is likely to induce more experimentalism. As food manufacturers carry out their strategy of prioritizing high quality, good taste, and environmental sustainability, the sector is slated for significant prolonged expansion.

Explore FMI!

Book a free demo

The market for concentrated milk fat witnessed steady growth between 2020 and 2024 due to the growing demand for premium dairy ingredients and functional food products in the food industry. Growing consumer aspiration towards intense, full-bodied texture and genuine dairy flavor underlaid consumption of milk fat concentrate in processed dairy, bakery, and confectionery.

Growing demand from consumers towards health-related consumption patterns triggered businesses to deliver products that encompass clean-label ingredients and improved nutrition content. Increased processing of milk, such as improved separation and purification processes, enabled the production of finer-quality and more uniform milk fat.

Greater overseas trading and demand by the Third World for Western-style bread further accelerated market development. Stability within the market, nonetheless, was secured through milk price volatility as well as interruptions of supplies. Sustainability, technological innovations, and changing consumer values will shape the industry from 2025 through 2035.

Precision fermentation and other lactation technologies will enable the production of substitutes with similar flavor and textural profiles but with reduced environmental impacts. AI-managed manufacturing processes will maximize yield and consistency with reduced waste. Organic and grass milk fat products will become increasingly popular as consumers drive higher demands for transparency and ethical origins.

Concentrated milk-fat foods with functional significance that are enriched with omega-3s, probiotics, and vitamins will appeal to health-conscious consumers who would like to capitalize on milk fat. Blockchain technology will support traceability and authenticity and further reinforce consumer confidence. On top of that, regulatory requirements for reducing saturated fat content and improved nutritional labeling will drive reformulation activity industry-wide.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Increased demand for premium and authentic dairy flavors. | Precision fermentation for environmentally friendly milk fat production. |

| Improvements in dairy processing and purification methods. | AI-based optimization of manufacturing processes. |

| Growing applications in bakery and confectionery industries. | Growing demand in the market for grass and organic milk fat ingredients. |

| Disruption of supply chains and volatile prices of milk. | Blockchain traceability and authenticity. |

| Clean labeling is driven by health-conscious consumers. | Functional milk fat ingredients with probiotics and omega-3 added. |

The industry is growing consistently, and the demand for premium dairy ingredients in various food processes and bakery applications adds to it. For both consumers and manufacturers, the most important products are the high-purity, long-shelf-life dairy fats, which, according to their words, make products better, more textured, and creamier.

In the dairy sector, milk fat is used to fortify butter, cheese, and cream-based products, where the issues of purity and clean-label sourcing are of primary importance. The bakery and confectionery industries regard it as the best solution because of its added butter aroma, soft and full-bodied mouthfeel, and emulsion stability, especially in chocolate bars and pastries.

Cost-effectiveness, without quality loss, is the priority for processed food and food service segments, yet the retail sector has seen more organic and minimally processed product requests. As the demand for clean labels and the trend for natural ingredients increase, the market is transitioning to non-GMO products. On top of that, the technological steps forward in fractionation and lipid structuring are permitting these dairy fats to find their way in a wider range of industries.

There is a surge in sales, primarily because of the upswing in the demand from sectors like dairy, bakery, and confectionery. However, the compliance issues are mainly due to the rigorous food safety regulations, quality standards, and package labeling requirements. The companies are to be mainly cognizant of the changes in laws, obtain the necessary certificates, and maintain transparency in order to ensure their trust and approval.

Moreover, the issue of supply chain interruptions, such as the inconsistency of raw milk and long-haul transport routes added to the volatility of product prices, generates negative consequences to production stability and costs. Climate alteration, pandemics in the livestock population, and trade restrictions due to political conflicts can cause a substantial amount of risk. Diversified sourcing strategies are to be established, and local production investment should be the first step in minimizing these threats.

The increased shift of consumers to plant-based and lactose-free alternatives inherently creates problems for the concentrated milk fat that is produced by traditional dairy farmers. The main cause of this competitive situation is the increase in the vegan and health-oriented lifestyle that triggers the use of more plant-based fats and oils. Companies need to come up with brand-new ideas, such as additional products and processing, that respect the sustainability principle if they are to have a proper position in the industry.

The growing rival of plant oils such as margarine and vegetable-based oils, which has adverse effects on pricing and industry positioning, is the reason for product improvement and research and development. The path to success is through companies investing in product functionality, R&D, and finding niche applications in high-end food & beverage sectors to resolve competition challenges.

Industry growth is subject to economic volatility, shifts in trade policy, and changes in consumer food choices. In their endeavor to have a competitive advantage, companies ought to refashion their supply chains for maximum efficiency, explore fledging segments, and cooperate with other food producers in creating innovative dairy fat products adhering to shifting consumer demands.

| Countries | CAGR (2025 to 2035) |

|---|---|

| The USA | 5.8% |

| China | 5.5% |

| Germany | 5.0% |

| Japan | 4.5% |

| The UK | 4.8% |

| France | 4.7% |

| Italy | 4.6% |

| South Korea | 4.9% |

| Australia | 4.3% |

| New Zealand | 4.2% |

The USA is expected to lead, with a 5.8% CAGR during 2025 to 2035. It is primarily driven by increasing demand for premium dairy ingredients in food processing and food service industries, particularly premium dairy ingredients.

Concentrated milk fat is a premium ingredient with better taste and functionality, and it is a perfect solution in numerous applications like bakery, confectionery, and culinary. The clean-label and natural trend is also driving the consumption of milk fat concentrate among health-conscious consumers. As more consumers look for high-quality, full-flavored foods in their diets, demand for milk fat concentrate should rise as part of a broader premium dairy trend in the USA

Major dairy players such as Land O'Lakes and Dairy Farmers of America are driving this growth. Such customers are investing in more premium dairy processing machinery in an attempt to attain product uniformity and even create the functional advantage of concentrated milk fat.

Further, the ever-increasing demand for the digital infrastructure utilized by online trade in an attempt to deliver milk also drives growth, where improved-quality dairy constituents become more accessible to companies as well as ultimate consumers.

China is expected to expand at a CAGR of 5.5% for ten years. The incredible expansion is primarily attributed to the rapid growth of the dairy processing industry and growth in consumption by clients of dairy and dairy products. Urbanization and increasing disposable incomes are transforming emerging demand for bakery and confectionery products where concentrated milk fat is increasingly becoming a critical ingredient.

Other than this, government interventions in terms of policies benefiting the dairy sector and quality enhancements are compelling businesses to utilize high-quality ingredients like concentrated milk fat in their products.

With increasing growth in the Chinese industry, concentrated milk fat will be bound to be consumed more due to shifts in the demand of consumers and the increasing demand for diversified dairy products. Large players in the dairy industry, such as Yili Group and Mengniu Dairy, are broadening their product offerings to include high-quality dairy fats.

The players emphasize R&D towards providing improved nutritional functionality to dairy ingredients for premium dairy-based foodstuffs that need fulfillment by consumers. China's increasing bakery industry, driven by Western dietary trends, is driving milk fat concentration in various applications and hence propelling growth.

Germany will grow at a 5.0% CAGR until 2035. High demand for food quality and sustainability in the nation strongly boosts demand for densified milk fat, especially among upscale confectionaries and baked products.

Increasing German consumer demands for natural foods that are less processed strongly propel the usage of concentrated milk fat, pushing the growth. In addition, the presence of well-established dairy cooperatives and advanced processing units ensures a consistent supply of high-quality concentrated milk fat, and this encourages innovation in the sector.

As consumers prioritize premium quality and sustainability for food, Germany follows a sustained growth pattern that shows its commitment to quality dairy products. Structured brands such as DMK Group and Hochland specialize in the production of high-quality dairy fats.

The company's focus is on green processing and sustainable sourcing so that they can take advantage of the demand for ethically sourced and organic dairy products. Moreover, Germany's vibrant dairy ingredient export industry makes concentrated milk fat a leading force in Germany's food market.

Japan is expected to witness a CAGR of 4.5% during 2025 to 2035. Growth is spurred by growing demand for dairy ingredients with enhanced functionality, including concentrated milk fat. Japanese consumers consider food texture and quality extremely important, and concentrated milk fat is a key ingredient in Japan's confectionery, bakery, and premium dessert industries. Along with this, more and more Western-type coffee houses and

Japanese bakeries have also fuelled the expanding application of dairy fat in chocolates, cakes, and pastries. Japanese dairy companies such as Meiji Holdings and Morinaga Milk Industry expand product portfolios to capture evolving consumer preferences.

These companies invest in R&D to develop superior shelf life and texture-dairy products. Besides, Japan's superior food safety protocols ensure the manufacture of quality condensed milk fat, which makes it a highly sought-after domestic and international ingredient.

Italy is expected to grow at a CAGR of 4.6% through 2035. The country's strong food culture and centuries-long dairy heritage are firm demand drivers for concentrated milk fat. Italian consumers place very high value on authentic taste and high-quality dairy ingredients, which are the focus of traditional pastry, bakery, and gelato production. The country's emphasis on artisan foods also underpins the demand for natural dairy fats.

Leaders such as Granarolo and Parmalat continue to invest in innovation to process dairy better and to make better quality concentrate milk fat supply. The increased popularity of Italian pastries globally also assisted in creating export-led industries.

South Korea will grow at a CAGR of 4.9% between 2025 and 2035. The popularity of the Western diet is boosting demand for bakery and confectionery items based on dairy. South Koreans demand high-quality dairy ingredients to improve taste and texture.

Seoul Milk and Namyang Dairy Products are targeting the production of superior-quality dairy fats. The rising café culture of the country with rising demand for specialty bakery foodstuffs and sweets provides growth momentum.

The Australian market is likely to achieve a CAGR of 4.3% until 2035. The highly developed dairy export base and manufacturing of high-quality pure milk drive the demand in the country at a global level. Leading companies such as Devondale and Bega Cheese maintain sustainable dairy processing. Australia's image of producing high-quality dairy products contributes to its dominance in the industry.

New Zealand is expected to grow at a 4.2% CAGR between 2025 to 2035. New Zealand's dairy industry is highly developed, with innovation and quality being the top priority. Fonterra, the global leader in the dairy industry, is one of the drivers of the growth. Global demand for high-quality dairy fats is fueling New Zealand's leading export-oriented dairy industry

| Segment | Value Share (2025) |

|---|---|

| Conventional (By Nature) | 78.5% |

Based on nature, the entire industry can be segmented into conventional and organic. Standard milk fat retains the largest share of about 78.5%. This has made it the preferred choice for large manufacturers of food and processors of dairy products due to its cost-effective and well-established supply chains. The leading companies in this industry, like Fonterra, Arla Foods, and Lactalis, provide conventional fat for use in bakery, confectionery, and dairy products with consistent quality and availability.

In contrast, organic concentrated milk fat holds a 21.5% share but demonstrates significant growth, as consumers are leaning toward clean-label and sustainable products. The organic dairy transition is being spearheaded by the health-conscious consumer who wants products free of synthetic additives, antibiotics, and pesticides.

Anticipating the growing trend, Organic Valley and Friesland Campina, for example, have developed their organic dairy range. Furthermore, regulatory support for organic farming practices in regions such as North America and Europe also boosts growth.

| Segment | Value Share (2025) |

|---|---|

| Bakery & Confectionery (By Application) | 46.2% |

By application, the bakery & confectionery segment accounted for 46.2% of the share in 2025. This dominance is driven by the wide use of milk fat in bakery items like croissants, pastries, cookies, and chocolates. Premium bakery brands also use it for its capabilities to improve texture.

Top players like Barry Callebaut, Cargill, and Puratos utilize concentrated milk fat to enhance the richness of chocolate coating and fillings, thus catering to the increasing consumer demand for indulgent and top-quality confectionery products.

The Soups & Sauces dominate segment share at 20.0% and is motivated by the surging demand for creamy and variety of flavor formulations. Dairy-based sauces, gravies, or soups such as alfredo and cheese sauces contain concentrated milk fat that alters the viscosity or texture of the dish, adding a smooth and rich flavor to complement the other ingredients.

Big food manufacturers like Nestlé, Campbell's, and Unilever are using concentrated milk fat to improve the characteristics of their soup and sauce ranges. The opening of this segment is fueled by an increasing interest in ready-to-eat and convenience foods, especially in North America and Europe.

Soups & Sauces are developing into a new growth segment as food companies test out more dairy-based formulations in response to shifting consumer tastes. At the same time, Bakery & Confectionery continue to dominate as the main application due to their functional benefits in premium products.

There has been a steady growth due to the increased demand for premium quality dairy ingredients, clean label formulations, and functional food applications in processing. Companies invest in new innovative products and sustainable sourcing, coupled with strengthening their networks for improved distribution to gain a chunk of the growing industry.

The top players of this industry are Fonterra, FrieslandCampina, Lactalis Ingredient, Arla Foods, and Darigold, known for formulating best-in-class butterfat solutions for use in bakery, confectionery, and dairy applications. Fonterra, for instance, has developed tailor-made milk fat products to improve texture as well as shelf life in food formulations. At the same time, FrieslandCampina is now embraced as an advocate of sustainable dairy fat solutions that respond to changing consumer needs.

Industry evolution is propelled by the extent to which dairy-based fat substitutes are being adopted, advancements in milk fractionation technologies, and the shift from conventional to organic as well as non-GMO dairy ingredients. Companies have increased production units, such as Arla Foods' investment in safe dairy processing plants for sustainable marketing growth.

Strategic drivers influencing competition also include cost-effective production, regulatory compliance, and partnerships with food manufacturers. The force of competition includes improving global supply chain networks while resorting to environmentally friendly processing techniques as well as digital platforms to optimize sales and consumer engagement.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Fonterra Co-operative Group Limited | 20-24% |

| FrieslandCampina N.V. | 14-18% |

| Lactalis Ingredients | 12-16% |

| Arla Foods | 8-12% |

| Darigold, Inc. | 6-10% |

| Other Players (Combined) | 25-35% |

| Company Name | Key Offerings & Focus |

|---|---|

| Fonterra Co-operative Group Limited | A global leader in premium concentrated milk fats, focusing on sustainable dairy farming, high-quality anhydrous milk fat (AMF), and butter oil solutions. |

| FrieslandCampina N.V. | Specializes in functional milk fat ingredients for bakery and confectionery applications, with an emphasis on European dairy quality and sustainability efforts. |

| Lactalis Ingredients | Offers high-purity milk fat solutions for food processing and dairy manufacturing, expanding its global dairy supply chain presence. |

| Arla Foods | Focuses on organic and clean-label dairy fat products, investing in innovative butterfat solutions for high-end food applications. |

| Darigold, Inc. | A key player in North American dairy exports, providing customized milk fat blends for industrial food applications. |

Key Company Insights

Fonterra (20-24%)

A key leader in the premium milk fat segment advocates sustainable dairy farming and offers high-quality AMF solutions for global applications.

FrieslandCampina (14-18%)

A strong contender in Europe, it's using high-quality dairy sources and innovative development in milk fat formulations.

Lactalis Ingredients (12-16%)

Widening its global dairy supply chain with investments in functional and highly pure milk fat solutions.

Arla Foods (8-12%)

Most renowned organic and clean-label milk fats serving the premium and specialty markets.

Darigold, Inc. (6-10%)

American giant dairy focused on milk fat solutions for exports with specific ingredient provisions.

Other Key Players

The global concentrated milk fat market is expected to grow at a compound annual growth rate (CAGR) of approximately 8.1% from 2025 to 2035.

The market is projected to reach a value of approximately USD 11.5 billion by 2035.

The bakery & confectionery segment is anticipated to grow the fastest, driven by increasing demand for premium baked goods and confections that utilize concentrated milk fat for enhanced flavor and texture.

Key growth drivers include rising consumer preference for natural and clean-label ingredients, increasing applications in bakery and confectionery products, and expanding demand in emerging markets due to urbanization and changing dietary habits.

The segmentation is into conventional and organic types.

The segmentation is into soups & sauces, bakery & confectionery, dairy products, and others.

The segmentation is into liquid and dry forms.

The segmentation is into direct sales (B2B) and indirect sales (B2C).

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and the Middle East & Africa.

Liqueurs Market Analysis by Type, Packaging, Distribution Channel, and Region - Growth, Trends, and Forecast from 2025 to 2035

Yeastless Dough Market Growth - Innovations & Consumer Preferences 2025 to 2035

Japan Dietary Supplements Market, By Ingredients, Form, Application, and Region through 2035

Dehydrated Pet Food Market Insights – Premium Nutrition & Market Trends 2025 to 2035

Date Syrup Market Growth – Natural Sweetener Trends & Industry Demand 2025 to 2035

Cat Food Market Insights – Trends & Growth Opportunities 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.