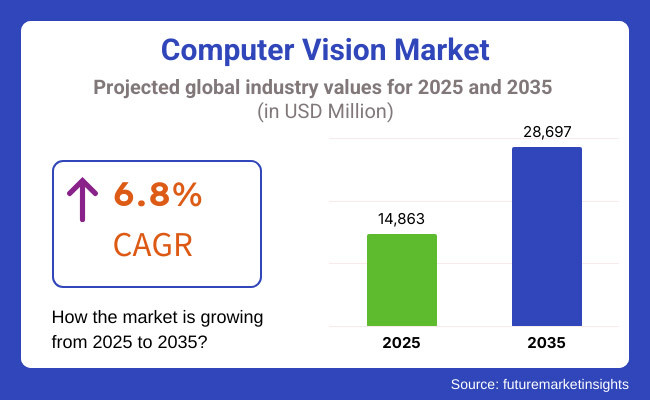

The market is projected to reach USD 14,863 Million in 2025 and is expected to grow to USD 28,697 Million by 2035, registering a CAGR of 6.8% over the forecast period. The integration of AI-powered computer vision in smart surveillance, augmented reality (AR), and IoT-enabled vision systems is fueling market expansion. Additionally, rising investments in edge computing, 3D imaging, and vision-based robotics are shaping the industry's future.

As between 2025 and 2035, multiple factors come together. This is essentially fueled by the gradual integration of AI-driven devices and deep learning algorithms. The increasing use of computer vision in autonomous systems such as self-driving cars, drones, and robots proves to be a big factor driving market growth. Computer vision is increasingly being adopted by the automotive, health care, retail and manufacturing industries to improve efficiency and enhance accuracy in their operations across the board.

Moreover, it enables instant decision-making in real time. Its capacity to interpret and analyze visual data means that computer-vision technology is transforming a wide range of applications, from face recognition and image-based authentication to prognostic maintenance and process automation. With automation and data-driven decision-making now a priority for one enterprise after another, the market for computer vision solutions is forecast to grow.

AI, neural networks, edge computing and other rapid technology advances are enhancing the capabilities of computer vision systems making them ever more accurate, efficient and versatile. For example, in the healthcare sector computer vision is transforming medical diagnostics by enabling early disease detection through advanced imaging techniques coupled with AI-assisted analysis.

The retail industry is likewise seeing a trend, where computer vision-powered solutions create more wonderful experiences for customers through automation systems that check customers out, track inventory and make personalized recommendations.

In addition, the production processes of manufacturing industry has strict quality control requirements and with industrial automation makes use of computer vision to realize defect detection production monitoring. Therefore, the future of computer vision market looks set for a strong boost in the coming decade, as new technologies continue to arise and more money goes into AI and automation.

The Computer Vision Market is expected to be dominated by North America, as artificial intelligence investment deep learning and robotics which have aroused strong wind of investment blow. In the region where it leads, United States and Canada have high rates of computer vision self-driving cars adn healthcare diagnostics.

In addition, major technology companies like Google, Amazon, Microsoft, and NVIDIA are all making heavy investments in AI-backed image processing edge computing for real-time visual analysis. On top of that, the rising importance of facial recognition and biometric authorization in banking, law enforcement consumer electronics has expanded markets in a big way.

Germany, the UK, France, and Italy are the leaders in industrial automation, AI-driven quality control and digital transformation. Europe holds a large share of Computer Vision, with countries like these actively pursuing its development in everyday life.

The European Union's(EU) regulations on AI ethics and facial recognition are shaping the adoption of responsible programs for computer vision in public surveillance, healthcare and automotive safety. Europe, led by Volkswagen, BMW and Mercedes-Benz is using computer vision for Advanced Driver Assistance Systems (ADAS), automatic inspections and assembly lines done by robotics. Currently, retailers are integrating AI-vision systems in cashier-less stores, smart inventory management and personalized shopping experiences.

Rapid AI R&D, government investment in intelligent cities, and the digital transformation of industries such as manufacturing and health care are all helping Asia-Pacific’s Computer Vision Market grow fastest. So far, China, Japan, India, and South Korea appear to be the leaders when it comes to AI research as well as chip and robot innovation.

Large-scale facial recognition, smart traffic monitoring and other AI safety products have been widely laid out directly unrelated to China's ever-expanding surveillance network. The growth in AI technology use in India for agriculture, an emerging e-commerce product line based on automation and telemedicine services is increasing demand for real-time image processing solutions considerably. In addition, Japan and South Korea's top position in the fields of robotics, augmented reality (AR) as well as intelligent factories is helping to improve the market's overall result.

Challenges

Privacy Concerns and High Computational Costs

Privacy and ethical considerations are one of the biggest challenges in the Computer Vision Market, with facial recognition, biometric data collection, AI surveillance embedded among these areas of focus. Many national governments around the world have issued stringent data protection regulations interfering with the deployment of vision-based security systems and consumer tracking technologies.

Also, realtime visual analysis was inadequate in restricted-resource situations due to high computation expenses and data processing complexity, in addition to a requirement for high-performance GPUs or AI accelerators. Edge computing and AI optimization techniques aid raise energy efficiency and cost-effectiveness.

Opportunities

AI-Powered Edge Vision, 3D Imaging, and Smart Healthcare Applications

Although facing challenges, computer vision market shall offer significant growth opportunities. The uptake of AI-powered edge vision systems, which process visual data locally on edge devices, smart cameras, etc. is lowering delay and reducing cloud dependence.

Proponents of 3D imaging as well as LiDAR-based computer vision in AR/VR, robotics, and industrial automation to create new revenue sources for hardware and software companies. Meanwhile, from AI-assisted medical imaging to remote patient monitoring and automated pathology diagnostics computer vision systems in healthcare are turning out to perform early disease detection or help cure diseases.

In response to this rising demand for autonomous drones, intelligent agricultural solutions and AI-powered quality inspection in manufacturing are over to push investment into high-precision, low-powered vision systems. Innovations in neuromorphic computing, federated learning and quantum-enhanced vison processing are anticipated to reshape real-time AI vision capabilities.

Between 2020 and 2024, the computer vision market, along with advances in AI-powered image processing and deep learning visual analytics, and increasingly extensive application in autonomous systems has had a hot growth surge.

In 2020 industries including healthcare, automobile manufacturing retail and security are use computer vision solutions, for real-time object detection and quality inspection, facial recognition system and robotic automation. Edge AI, cloud-based image processing and 3D vision technologies are expanding, accelerating the adoption of better and faster visual data interpretation.

The period from 2025 to 2035 will see the computer vision market undergo fundamental changes as a result of new technologies such as neuromorphic vision processing and decentralized AI-powered visual recognition along with quantum-enhanced imaging.Biological vision chips that replicate how the human brain processes visual information will make computer vision much more efficient.

Having low-power and real-time adaptive image processing--that is also stable for edge devices in robot control systems. AI-driven autonomous vision models will fundamentally change the way we monitor and analyze things across industries from autonomous systems to intelligent surveillance.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with GDPR, NIST AI standards, and ethical AI vision regulations. |

| Technological Advancements | Growth in deep learning-based image recognition, edge AI vision processing, and cloud-based video analytics. |

| Industry Applications | Used in healthcare, automotive, security, retail, and industrial automation. |

| Adoption of Smart Equipment | Integration of IoT-connected vision sensors, AI-powered security cameras, and automated manufacturing quality control systems. |

| Sustainability & Cost Efficiency | Shift toward energy-efficient AI processing, edge computing for reduced power consumption, and eco-friendly vision hardware. |

| Data Analytics & Predictive Modeling | Use of machine learning-based object recognition, predictive vision analytics, and AI-powered decision support systems. |

| Production & Supply Chain Dynamics | Challenges in AI model training costs, real-time video analytics scalability, and limited edge AI deployment. |

| Market Growth Drivers | Growth fueled by AI-driven automation, increasing demand for real-time analytics, and expansion in smart security systems. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-backed AI vision governance, AI-powered privacy-preserving computer vision, and quantum-secure visual data encryption. |

| Technological Advancements | Quantum-enhanced imaging, neuromorphic vision chips, and AI-powered real-time 3D spatial perception. |

| Industry Applications | Expanded into AI-driven autonomous robots, real-time medical vision diagnostics, and decentralized smart city surveillance. |

| Adoption of Smart Equipment | AI-enhanced neuromorphic vision for edge computing, real-time AI-powered emotion recognition, and human-centric adaptive vision AI. |

| Sustainability & Cost Efficiency | Zero-carbon AI vision computing, blockchain-secured AI vision data, and AI-powered waste reduction via smart vision analytics. |

| Data Analytics & Predictive Modeling | Quantum-AI-driven predictive visual analytics, real-time AI-powered situational awareness modeling, and blockchain-secured facial recognition logs. |

| Production & Supply Chain Dynamics | Decentralized AI vision processing hubs, AI-powered supply chain quality monitoring, and real-time fraud detection via blockchain-verified AI vision. |

| Market Growth Drivers | Future expansion driven by autonomous AI vision intelligence, sustainable AI-powered imaging, and next-generation adaptive vision systems. |

The computer vision industry in the USA is growing rapidly driven mainly by a surge in AI-driven automation, increasing installation rates of cameras on autonomous cars, and rising application scenarios in both health and retail sectors. Heavy USA investments in computer vision research have been made by the Department of Defense as well as by the National Institute of Standards and Technology (NIST), including video surveillance, security, and applications in highly automated manufacture.

The combination of deep learning and edge computing has brought real-time image processing to our grasp: Object detection capabilities were added. Also in this last year computer vision in autonomous driving, industrial robotics, as well as video games reached a new level and is beginning to grab on.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

The United Kingdom Computer Vision Market is growing as a result of increased investments in AI-powered healthcare diagnostics, the growth of facial recognition use in security systems, and the rise in adoption in smart retail solutions. The UK Research and Innovation (UKRI) and the Alan Turing Institute are funding computer vision initiatives in industries including healthcare, defense, and fintech.

The growth of automated quality inspection systems in manufacturing and the use of AI-based video analytics for smart cities are also fueling market growth. The UK government is also implementing ethical AI regulations to promote responsible use of computer vision in surveillance and biometric authentication.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.5% |

The industry of Computer Vision in the European Union is getting a boost from active research into Artificial Intelligence, applications in Industry 4.0 and greater investment in smart city infrastructure. Under the European Union's Horizon Europe project, applications of computer vision in robotic technologies, transportation that can run automatically and medical imaging have all been given large sums for development.

In automobile, security, retail automation, Germany, France, and The Netherlands take the lead among the 27 E.U. nations. Furthermore, E.U.'s AI Act molds regulations for Ethical AI deployment and sets out rules governing the proper use of computer vision technology in such things as biometric authentication as well as automated decision making systems.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.8% |

The rise of Japan’s Computer Vision Market was fuelled by an ever-growing requirement for AI-assisted drones, higher penetration in factory automation and breakthroughs in intelligent healthcare solutions. Japan's Ministry of Economy, Trade and Industry (METI) is pushing for AI-based industrial automation as well as self-driving mobility. Rolling out further support for these areas will be the ministry’s goal in the future.

To this end, Japanese firms like Sony, Fujitsu and Hitachi have invested heavily in edge AI-based vision systems for autos, security or medical imaging. Meanwhile, the merging of AI-powered computer vision with elder care robotics products or smart monitoring networks is also helping to drive new activity on the market today.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.0% |

The market for computer vision in South Korea is experiencing rapid growth, and this is in part caused by expanding AI research, the growing adoption of AI in autonomous vehicles, as well as a demand from manufacturing and smart retail for computer vision technologies.

The South Korean MSIT (Ministry of Science and ICT) is investing in AI-assisted security surveillance, smart city infrastructure through intelligent transportation systems (RTCs), new-generation mobile network (5G) development, as well as industrial automation. It is also looking ahead to application scenarios like traffic management or even road safety management based on traffic data assurance.

South Korea's semiconductors and electronics industry is thriving, and it has caused strong demand for computer vision applications in defect detection, automated quality control, and smart logistics. Moreover, artificial intelligence is being used in more and more CAD/CAM applications and projects to assist designers.

It helps them within the initial stage of design performance-- simplifying material selection based on a variety of factors such as strength, conductivity or weight. AI-supported facial recognition and emotional analysis are gaining a following in South Korea's finance, entertainment businesses, as well as health-care sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.2% |

The growth of the computer vision market is fast, due to advances in artificial intelligence and deep learning algorithms. Also, the incremental demand for automation among enterprises on many fronts ensures a warm future ahead. In terms of components, hardware and software both dominate this market. This combination is capable of real-time image processing, target tacking (or object detection) and application-based decision systems.

Computer imaging systems are built around fundamental, computing backbone hardware components. They enable high-speed image capture, real-time data processing and execution of deep-learning models. This market segment is growing rapidly due to increased use of high-resolution sensors, LiDAR, and 3D cameras in industrial automation, healthcare and self-driving cars.

The appeal of artificial Intelligence powered edge computing hardware is already on the rise, as are various other market segments. In response to enterprises who demand faster real-time image analysis in a more cost/price low fashion- where latency is lessened with the ever-increasing demands from industry for this type of technology- the most cutting-edge accommodations, such as high-performance neuromorphic computing and embedded vision chips now in their own right. FPGA-based vision accelerators further improve operational efficiency.

Yet, despite their high performance, challenges still remain in costs, power consumption and heat dissipation. It is anticipated that hardware capabilities for computer vision applications will be improved by innovations in AI-optimized vision processing units (VPUs), quantum computing applications and custom AI chips.

Analyzing, interpreting, and making sense of visual data in facts means good computer vision software tools. Machine learning-based vision models, open-source deep learning frameworks, and the rise of cloud-based vision APIs are all opening up the adoption of computer vision software across a wide range of industries.

AI-driven analytics, self-learning algorithms, and real-time video recognition solutions are not only enhancing image recognition and facial recognition technologies; they also develop future applications such as automated decision-making. Moreover, low-code and no-code computer vision platforms make AI vision available to even those companies lacking in-house AI expertise.

Although the demand for computer vision software is increasing, hurdles still stand in the way--concerns over data privacy, the complexity of model training, and a lack of computational resources. Still, advanced techniques such as AI-assisted model compression for vision models, federated learning, and real-time cloud-vision processing are helping to make computer vision software both more efficient and scalable.

The demand for computer vision systems is primarily driven by smart camera-based and PC-based solutions, enabling real-time image analysis, defect detection, and quality control across industries.

Smart camera-based computer vision systems are becoming a new trendy topic because of their compact design, on-chip processing capabilities, and independence from the external computing units. Such systems combine AI-based image processing, integrated MML and edge computing for instant visual analytics across industrial automation, security and retail domains.

The increasing use of smart cameras in autonomous vehicles, surveillance, and healthcare diagnostics, is also propelling market growth. Moreover, neuromorphic vision sensors, 3D vision technology, and AI-enabled image enhancement are enhancing smart camera performance and efficiency.

While portable and easy to deploy, smart cameras struggle with minimal processing capabilities, limited data storage, and complex interactions with cloud-based AI models. The active reach of AI-optimized edge vision chips, high-speed wireless connectivity, and self-learning camera systems may also drive the adoption of smart cameras in real-time vision applications.

PC-based computer vision systems remain a dominant solution for computationally intensive vision applications in manufacturing, scientific research, healthcare imaging, and robotics. These systems use powerful CPUs, GPUs, and deep learning accelerators to process high-resolution images and videos at ultra-fast speeds.

The demand for PC-based vision systems continues to expand in automated quality inspection, medical imaging diagnosis, and robotic vision. Precision, accuracy, and high-speed data processing are critical in all these applications. Moreover, AI-driven object recognition, predictive maintenance, and digital twin technology are all enriching the capabilities of PC-based vision systems.

However, other issues around high hardware costs and space requirements and complexity of system integration mean they are not generally adopted. There will be increased efficiency and extensibility for PC-based vision systems as innovation around cloud-based vision processing, AI-powered automation and edge-cloud hybrid computing models takes shape.

Due to the rising use of self-governing vehicles, AI-based surveillance systems, industrial control and medical imaging, the computer vision market is growing fast. It consists of three main areas-advances in deep learning; high speed and GPGPUs available to replace CPUs portions of image data for real time analysis object recognition systems.

Business Owners rely on AI augmented Vision software tools which call for cloud-based image recognition service powered by image capture embedded systems which have the benefits of in high operating accuracy and automation throughout all industries.

These enterprises include significant AI corporations, semiconductor companies, as well as computer vision system suppliers. In each, leading technologies contribute to developments in 3D vision, human-computer interaction and real time video analytics.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| NVIDIA Corporation | 18-22% |

| Intel Corporation (Mobileye) | 12-16% |

| Google LLC (Alphabet Inc.) | 10-14% |

| Microsoft Corporation | 8-12% |

| Amazon Web Services (AWS) | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| NVIDIA Corporation | Develops AI-powered GPUs, edge computing devices, and deep learning vision platforms for autonomous vehicles and robotics. |

| Intel Corporation (Mobileye) | Specializes in computer vision chips for ADAS, autonomous driving, and real-time image processing. |

| Google LLC (Alphabet Inc.) | Provides Google Cloud Vision AI, AI-powered image recognition, and deep learning vision APIs. |

| Microsoft Corporation | Offers Azure Computer Vision services, AI-powered facial recognition, and cloud-based vision analytics. |

| Amazon Web Services (AWS) | Focuses on AWS Rekognition for AI-driven image and video analysis in security, e-commerce, and media applications. |

Key Company Insights

NVIDIA Corporation (18-22%)

NVIDIA is a leader in AI-driven computer vision, providing GPUs, AI accelerators, and deep learning models for real-time vision applications.

Intel Corporation (Mobileye) (12-16%)

Intel’s Mobileye division specializes in computer vision-based ADAS (Advanced Driver Assistance Systems) and autonomous vehicle vision processing.

Google LLC (Alphabet Inc.) (10-14%)

Google focuses on cloud-based AI vision services, offering Google Cloud Vision API for object detection, OCR, and facial recognition.

Microsoft Corporation (8-12%)

Microsoft’s Azure AI vision solutions integrate real-time facial recognition, optical character recognition (OCR), and industrial automation vision tools.

Amazon Web Services (AWS) (6-10%)

AWS provides AI-powered video and image recognition services through AWS Rekognition, catering to security, retail, and media industries.

Other Key Players (30-40% Combined)

Several AI-driven vision technology providers, semiconductor companies, and cloud-based vision analytics firms contribute to advancements in real-time visual perception, edge computing, and deep learning-based image recognition. These include:

The overall market size for the Computer Vision Market was USD 14,863 Million in 2025.

The Computer Vision Market is expected to reach USD 28,697 Million in 2035.

Rising adoption in autonomous vehicles, advancements in AI-driven image recognition, and increasing demand in healthcare, retail, and manufacturing sectors will drive market growth.

The USA, China, Germany, Japan, and South Korea are key contributors.

Machine learning-based computer vision is expected to dominate due to its ability to enhance accuracy in image and object recognition.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 10: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 18: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 20: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 21: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: South Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 23: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: South Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 26: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 27: East Asia Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 28: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 29: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: East Asia Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 31: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Oceania Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 33: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 35: Oceania Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 36: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 37: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 38: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 39: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 21: Global Market Attractiveness by Component, 2023 to 2033

Figure 22: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by End Use, 2023 to 2033

Figure 25: Global Market Attractiveness by Region, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 29: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 30: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 42: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 44: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 45: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 46: North America Market Attractiveness by Component, 2023 to 2033

Figure 47: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 48: North America Market Attractiveness by Application, 2023 to 2033

Figure 49: North America Market Attractiveness by End Use, 2023 to 2033

Figure 50: North America Market Attractiveness by Country, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 55: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 56: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 57: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 58: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 59: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 60: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 61: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 67: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 68: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 69: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 70: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 73: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 74: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 75: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 78: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 79: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 80: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 82: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 83: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 84: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 85: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 86: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 87: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 88: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 89: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 90: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 94: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 95: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 96: Europe Market Attractiveness by Component, 2023 to 2033

Figure 97: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 98: Europe Market Attractiveness by Application, 2023 to 2033

Figure 99: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 100: Europe Market Attractiveness by Country, 2023 to 2033

Figure 101: South Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 102: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 103: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 104: South Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 105: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 106: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 107: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 108: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 109: South Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 110: South Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 111: South Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 112: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 116: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 117: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 118: South Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 119: South Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 120: South Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 121: South Asia Market Attractiveness by Component, 2023 to 2033

Figure 122: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 123: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 124: South Asia Market Attractiveness by End Use, 2023 to 2033

Figure 125: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ Million) by Component, 2023 to 2033

Figure 127: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: East Asia Market Value (US$ Million) by End Use, 2023 to 2033

Figure 130: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 131: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: East Asia Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 135: East Asia Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 136: East Asia Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 137: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 138: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 139: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 140: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 141: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 142: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 143: East Asia Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Component, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 149: East Asia Market Attractiveness by End Use, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: Oceania Market Value (US$ Million) by Component, 2023 to 2033

Figure 152: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 154: Oceania Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 158: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 159: Oceania Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 160: Oceania Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 161: Oceania Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 162: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 163: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 164: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 165: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 166: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 167: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 168: Oceania Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 169: Oceania Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 170: Oceania Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 171: Oceania Market Attractiveness by Component, 2023 to 2033

Figure 172: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 173: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 174: Oceania Market Attractiveness by End Use, 2023 to 2033

Figure 175: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 176: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 177: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 178: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 179: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 180: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 182: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 183: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 185: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 186: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 188: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 189: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 190: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 191: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 192: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 193: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 194: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 195: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 196: MEA Market Attractiveness by Component, 2023 to 2033

Figure 197: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 198: MEA Market Attractiveness by Application, 2023 to 2033

Figure 199: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 200: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Computer Vision in Healthcare Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Computer Keyboard Market Size and Share Forecast Outlook 2025 to 2035

Computer Aided Facility Management (CAFM) Market Size and Share Forecast Outlook 2025 to 2035

Computerized Physician Order Entry (CPOE) Market Size and Share Forecast Outlook 2025 to 2035

Computer Keyboard Industry Analysis in East Asia Size and Share Forecast Outlook 2025 to 2035

Computer Graphics Market Size and Share Forecast Outlook 2025 to 2035

Computer Peripherals Market Size and Share Forecast Outlook 2025 to 2035

Computer-aided Design (CAD) Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Computer Microchips Market Size and Share Forecast Outlook 2025 to 2035

Computer-aided Engineering Market Analysis - Size, Share, and Forecast 2025 to 2035

Computerized Maintenance Management Systems (CMMS) Market Trends – Size, Share & Growth 2025–2035

Computer Assisted Coding Software Market Analysis by Solution, Deployment, Application, and Region Through 2035

Computer Aided Trauma Fixators Market

Computer-To-Plate And Computer-To-Press Systems Market

Dive Computer Market Forecast and Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Brain-Computer Interface Implant Market Analysis Size and Share Forecast Outlook 2025 to 2035

Refurbished Computers and Laptops Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA