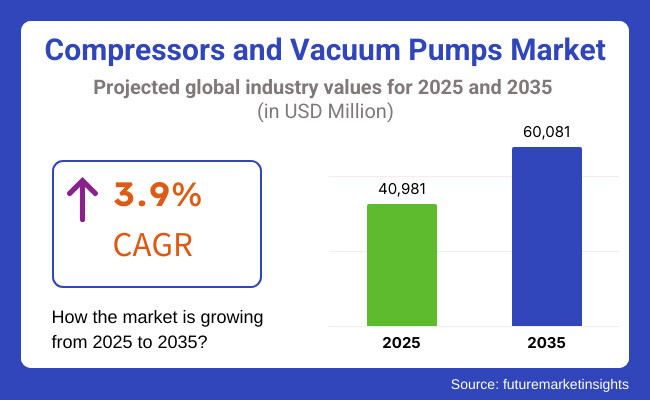

The industry is expected to achieve USD 40,981 Million revenue levels in 2025 while forecast showing potential expansion to USD 60,081 Million by 2035 through a projected CAGR rate of 3.9% until 2035.

The market will continue to grow because of rising Industry 4.0 adoption along with smart monitoring systems and recent advances in oil-free compressors and high-efficiency vacuum pumps. The market is benefited by rising demand for cleanroom applications and medical-grade vacuum pumps and high-performance gas compression systems.

The Compressors and Vacuum Pumps Market will experience continuous growth from 2025 to 2035 because these industries are expanding their demand for these systems across industrial manufacturing, oil & gas, healthcare and semiconductor applications.

The role of these devices ensures application success in various fluid transportation processes as well as air compression operations and pressure regulation tasks at power plants and food processing facilities as well as pharmaceutical plants and water treatment plants.

The industrial automation expansion along with process optimization drives market growth because manufacturers need reliable efficient solutions that improve productivity and operational efficiency. The market expansion of vacuum pumps continues to rise as their application grows within semiconductor fabrication along with chemical processing and medical uses.

The market experiences a fundamental change due to manufacturers replacing traditional systems with energy-efficient and smart automation-powered as well as oil-free solutions. Sustained environmental regulations and sustainability programs force industry adoption of maintenance-friendly high-performance compressors and vacuum pumps to help reduce power usage and minimize greenhouse gas generation.

The market transformation occurs through the combination of IoT technology with AI capabilities and predictive maintenance functions that enable real-time system monitoring and operation management enhancements. The market will generate emerging business opportunities in the next decade because of the growing interest in compressed air energy storage (CAES) systems and advanced vacuum solutions that support 5G infrastructure development and electric vehicle (EV) battery production.

Explore FMI!

Book a free demo

The North American market will capture a major portion of the Compressors and Vacuum Pumps Market because of expanding industrial automation and healthcare sector expansion along with rising investments in oil and gas infrastructure.

The high usage of efficient air compressors in manufacturing together with rising medical vacuum pump requirements in hospitals and pharmaceutical facilities gives the United States and Canada their leadership position in the North American region.

The market experiences growth because of two factors: increasing demand for sustainable and oil-free compressors and technological improvements in smart pressure monitoring and IoT-based pump diagnostics. EPA and OSHA regulations about food processing and chemical manufacturing air quality standards drive the market to require high-purity compressed air and vacuum solutions.

The European Compressors and Vacuum Pumps Market exhibits significant market penetration through major industrial sectors of Germany, United Kingdom, France and Italy where renewable energy implementation and automation and clean energy deployment create strong demand. The European Union through its energy efficiency directives requires low-emission and high-efficiency compressor and vacuum pump solutions.

Advanced dry vacuum and turbo molecular pumps receive increased investment because semiconductor fabrication along with pharmaceutical processing and food packaging together create rising vacuum pump demand. Artificial Intelligence provides predictive maintenance alongside digital twins which improves operational efficiency and decreases downtime within compressed air systems.

The Compressors and Vacuum Pumps Market expects rapid growth from Asia-Pacific territories because industrial activities expand vigorously while authorities invest increasingly into semiconductors and electronics production and strengthen their infrastructure networks.

The air compressor production leadership along with vacuum pump technology development and smart manufacturing adoption is advancing in China and Japan as well as India and South Korea.

The growing automotive and electronics sectors together with renewable energy developments create market demand for energy-efficient oil-free air compressors throughout China. The pharmaceutical and water treatment industries in India have created rising market demand for medical vacuum pumps combined with high-efficiency gas compressors. Additionally, Japan and South Korea are at the forefront of next-generation semiconductor manufacturing, requiring high-precision vacuum pumps for wafer processing and chip fabrication.

Challenges

High Energy Consumption and Maintenance Costs

The major challenge facing the Compressors and Vacuum Pumps Market arises from high energy usage in industrial-scale air compression and vacuum creation operations. Energy waste containment and steady pressure management present industries with their main operational challenge.

Continuous air and vacuum supply to industries faces various challenges such as increased maintenance expenses and component degradation and equipment non-operation periods. The process of connecting smart monitoring systems to traditional compressor designs creates adoption barriers specific to specific regions.

Opportunities

Growth in Smart Monitoring, Energy-Efficient Solutions, and Clean Energy Applications

The Compressors and Vacuum Pumps Market presents multiple growth prospects despite existing market hindrances. The industry benefits from improved operational efficiency and lower costs through three distinct IoT-based predictive maintenance systems along with AI-enabled pressure optimization measures and real-time energy monitoring capabilities.

The food processing industry along with pharmaceuticals and medicine are boosting innovative development of pollution-free compressed air solutions powered by sustainable energy sources for air compressors. marchées for sustainable energy creation and aerospace use emerge through developments in hydrogen fuel cells and high-efficiency centrifugal compressors as well as regenerative vacuum pumps.

Governments together with industries throughout the world continue investing in mechanical and renewable energy systems for compressors and vacuum pumps which enables manufacturers to create streams of revenue while supporting sustainable development and green energy compliance standards.

The market for compressors and vacuum pumps demonstrated remarkable expansion from 2020 through 2024 due to increasing automation activities and expanding production industries together with rising need for energy-efficient air compression and vacuum technologies.

The process requirements of industries including oil & gas and food & beverage as well as pharmaceuticals and semiconductors and healthcare used sophisticated compressor and vacuum pump systems to achieve efficiency and precisions in their operations and control contamination.

Throughout 2025 to 2035 the compressors and vacuum pumps market will transform significantly because of predictive maintenance powered by artificial intelligence coupled with blockchain-based asset tracking and next-generation hybrid compression technologies. Advanced AI diagnostics and self-adjusting compression systems will optimize operational performance by detecting predictions of system faults and enabling live energy conservation.

The rise of smart vacuum pumps with IoT integration will allow remote monitoring, cloud-based analytics, and adaptive suction control for precision applications in electronics, semiconductor manufacturing, and cleanroom environments.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Compliance with ISO 8573 air quality standards, DOE energy efficiency mandates, and EC emissions control policies. |

| Technological Advancements | Growth in VSD compressors, oil-free air compressors, dry vacuum pump systems, and smart monitoring sensors. |

| Industry Applications | Used in oil & gas, pharmaceuticals, food & beverage, semiconductor manufacturing, and industrial automation. |

| Adoption of Smart Equipment | Adoption of IoT-enabled compressor monitoring, cloud-based data analytics, and remote diagnostics. |

| Sustainability & Cost Efficiency | Shift toward low-energy air compressors, dry vacuum technologies, and energy recovery solutions. |

| Data Analytics & Predictive Modeling | Use of basic efficiency monitoring, scheduled maintenance alerts, and cloud-based reporting. |

| Production & Supply Chain Dynamics | Challenges in raw material fluctuations, long production cycles, and high equipment costs. |

| Market Growth Drivers | Growth fueled by industrial expansion, energy efficiency mandates, and increasing automation in manufacturing. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Blockchain-based compliance tracking, AI-powered emissions reduction strategies, and next-gen sustainable compressor designs. |

| Technological Advancements | AI-integrated real-time system diagnostics, hydrogen-powered compressors, and self-learning vacuum pump networks. |

| Industry Applications | Expanded into AI-driven clean energy storage, space vacuum processing, and high-precision nano-manufacturing. |

| Adoption of Smart Equipment | AI-powered predictive maintenance, autonomous vacuum pump control, and decentralized energy-efficient compression hubs. |

| Sustainability & Cost Efficiency | Carbon-neutral vacuum systems, hydrogen-powered industrial compressors, and regenerative compression cycles. |

| Data Analytics & Predictive Modeling | Quantum-AI-driven system optimization, real-time pressure fluctuation analytics, and self-regulating compressor ecosystems. |

| Production & Supply Chain Dynamics | 3D-printed compressor components, decentralized vacuum system manufacturing, and AI-enhanced supply chain logistics. |

| Market Growth Drivers | Future expansion driven by AI-powered compressor intelligence, sustainable vacuum processing solutions, and next-generation industrial automation. |

The USA market for compressors and vacuum pumps maintains its steady upward trend since industrial manufacturers show increasing demand and semiconductor producers are expanding their use together with pharmaceuticals as well as healthcare.

The USA Department of Energy (DOE) together with Environmental Protection Agency (EPA) work to market new technology standards for compressors which help industries meet pollution regulations while boosting their operational operations.

High-efficiency rotary screw compressors together with IoT-enabled systems and predictive maintenance technologies boost system reliability as they reduce downtime performance. The market continues to grow because manufacturers keep increasing their investments in low-noise oil-free vacuum pumps intended for cleanroom work and medical instruments.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

The UK Compressors and Vacuum Pumps Market expands due to increasing sustainable energy requirements along with accelerating industrial automation and direct governmental support for energy-efficient equipment.

The UK Health and Safety Executive (HSE) continues enforcing air quality workplace standards that push pharmaceutical manufacturers and food processors to adopt oil-free compressors with high-purity vacuum pumps.

Hydrogen energy projects along with carbon capture technologies are driving up the demand for compressors that perform gas storage and transportation. Smart vacuum pump systems that control pressure in real-time bring value to science research and advanced manufacturing operations.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.7% |

The European Union's compressors and vacuum pumps industry demonstrates stable growth patterns because of strict EU guidelines about energy conservation and the rising adoption by automotive sectors and semiconductor developers while receiving increased funding for automation applications. The European Commission's Energy Efficiency Directive carries out a policy that directs organizations to upgrade their old compressed air and vacuum setups with modern high-efficiency solutions.

Precision air compression and vacuum solutions face rising demand in Germany and France as well as Italy primarily because of automotive and electronics industries and industrial processing requirements. The increasing usage of renewable energy and hydrogen production projects drives up demands for industrial vacuum systems together with high-pressure compressors.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.9% |

The Compressors and Vacuum Pumps Market in Japan has expanded substantially owing to rugged demand from electronics, semiconductor, and robotics industries requiring groundbreaking solutions to energize their intricate procedures. Initiatives by the Ministry of Economy, Trade, and Industry as well stimulate growth by advocating energy-proficient fabrication routines and endorsing adoption of eco-friendly compressor innovations particularly in industrial environments.

Similarly, government projects spur extension by advocating for energy-proficient producing practices and sanctioning the reception of eco-friendly compressor technologies generally in commercial circumstances.

Japanese businesses are making sizable investments in advanced vacuum pump technology including ultra-quiet compressors integrated with smart sensors and predictive analytics capabilities. These innovations allow for precise monitoring of performance to maximize uptime and efficiency across various precision industries.

Meanwhile, rising needs associated with expanding hydrogen fuel cell applications meant to store and transport gas have led to increased requirements for specially designed compression hardware as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.0% |

The Compressors and Vacuum Pumps Market in South Korea undergoes swift modifications, propelled by the expanding semiconductor fabrication sector in search of increasing investments in leading-edge smart manufacturing technologies and the surging needs from biotech and pharmaceutical industries demanding high-purity vacuum systems.

Furthermore, the progressive South Korean Ministry of Trade, Industry, and Energy actively advocates adopting subsequent-generation vacuum pumps and highly proficient air compressors through industrial proficiency projects motivating corporations to renovate current frameworks.

Meanwhile, specialized component makers collaboration with major procedure device corporations to develop incorporated answers integrating vapour pumps and compressors customized for distinct sector applications. The marketplace is predicted to different significantly within the subsequent five years as new players access with pioneering products whereas current corporations enlarge R&D spending to stay ahead of the curve.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The compressors and vacuum pumps markets thrive thanks to escalating industrial automation adoption, the increasing call for energy-efficient air compression solutions, and greater vacuum-based process utilization in manufacturing and medical care. Positive displacement and dynamic compressors, which ensure high effectiveness, dependability, and flexibility across diverse uses, comprise the bulk of supply.

Though these product varieties dominate, some projects employ less conventional designs that gamble on new efficiencies. Meanwhile, certain vacuum applications explore alternate approaches through research and development. Overall, innovations aimed at enhanced sustainability and cost savings should shape the industry's evolution. Adaptability to emerging needs will likely determine participants' long-term success.

Positive displacement compressors, renowned for their high-pressure prowess, power proficiency and constant air flow retention, remain the most commonly used variety. By capturing and compacting air molecules to boost barometric burden, these compressors prove ideal for industrial procedures, vigor victualing, HVAC structures, and pneumatic implement applications.

The acceptance of screw, reciprocating, and rotary vane positive displacement compressors continues broadening among automotive, petroleum and grub processing ventures, where compressed atmosphere is quintessential for functions. Furthermore, evolutions in oil-free and energy-proficient compressor technologies are serving businesses reduce operational outlays and meet ecological statutes.

Despite their high effectiveness and dependability, issues like warm generation, raucous levels, and maintenance costs stay matters of concern. However, next-generation compressor designs with ameliorated chilling systems, noise deduction attributes, and smart observation capabilities are enhancing their execution and adoption crosswise industries.

Dynamic compressors, including centrifugal and axial flow compressors, are gaining popularity in industries requiring immense, unceasing airflow such as power plants, chemical processing facilities, and enormous refrigeration systems.

Unlike positive displacement compressors which utilize alternating volumes to push air, dynamic compressors employ extremely rapid impellers to accelerate air transforming kinetic energy into pressure rendering them suitable for extremely demanding applications.

The rising demand for energy-efficient and oil-free air compression remedies in industrial and commercial applications is fueling the adoption of state-of-the-art centrifugal compressors with high-speed magnetic bearings and minimal-friction impeller designs simultaneously cutting energy consumption.

Additionally, incorporating artificial intelligence-based management systems and internet of things-enabled surveillance is bettering operational efficiency and reducing maintenance expenditures.

Despite their tremendous capacity and efficiency, dynamic compressors necessitate significant preliminary investment and precise working situations to maintain output. However, continuous innovations in air dynamics, material science, and real-time system diagnosis are addressing these complications, ensuring smoother procedures and extended apparatus lifespan.

The demand for compressors and vacuum pumps is primarily driven by industrial and commercial applications, where compressed air and vacuum systems play a critical role in automation, material handling, and environmental control.

Growing Manufacturing and Increasing Automation Boost Demand for Gas Compression & Vacuum Pumps In the industrial domain, compressors and vacuum pumps are mostly required for power operating machinery, process automation, gas separation and any of numerous material vacuumings.

Industries as diverse as automotive production, chemical refining, pharmaceutical manufacture and food and drink preparation are built on the dc use of high-performance compressors and vacuum pumps. These make sure things operate smoothly and efficiently.

With rising Industry 4.0 and clever manufacturing, predictive servicing, remote observation, and energy-savvy compressor designs have become key trends in industrial air and vacuum systems. Furthermore, developments in oil-free compression, low-care vacuum pump designs, and sustainable compressed air solutions drive further market growth.

However, challenges including lofty energy use, servicing costs, and operational noise persist in impacting adoption. The debut of variable-speed drive compressors, AI-powered system optimization, and next-generation lubricants is expected to better efficiency and lessen operational costs in industrial settings.

The commercial domain is now seeing an increase in the adoption of compressors and vacuum pumps, particularly for use in HVAC systems, medical air supply and environmental control systems. This means shopping malls, hospitals, laboratories and data centers-high-efficiency air compression and vacuum solutions for the purposes of ventilation, sterilization and climate regulation are fundamental to big establishments.

A shift in emphasis towards energy efficient building infrastructure and clean indoor air quality has created demand for both low-noise, oil free compressors and high performance vacuum pumps to fit commercial installations. And, as compact and modular designs make ever easier to integrate air management systems into the tight spaces of commercial environments.

Despite the market growth potential, commercial users demonstrating continued concerns about area limitations, unpredictable energy costs and maintenance complications. Nevertheless, it is anticipated that advances in hybrid air-vacuum systems, ecologically sound coolants, and digital compressor diagnostics will improve the reliability and efficiency of commercial air and vacuum solutions.

The Compressors and Vacuum Pumps market has been expanding continuously for three reasons. First, the growing demands for more efficient air and gas handling solutions in many industries, especially manufacturing, oil gas, healthcare and food beverage sectors. Second, increasing industrial automation is driving up the need of energy-saving technologies; and under pressures from regulations on national environmental protections, it can also help open new markets for providers of compressed air solutions everywhere.

It is emphasized by the manufacturers to high-performance compressors, oil-free vacuum pumps and intelligent monitoring systems that they strive for the most optimal operational efficiency in terms of reliability &energy. Third, major companies in the industrial equipment field and air or gas system companies are making fine performances.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Atlas Copco AB | 18-22% |

| Ingersoll Rand Inc. | 12-16% |

| Gardner Denver (Part of Ingersoll Rand) | 10-14% |

| Busch Vacuum Solutions | 8-12% |

| Pfeiffer Vacuum Technology AG | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Atlas Copco AB | Develops high-performance air compressors, oil-free vacuum pumps, and industrial gas systems with energy-saving technologies. |

| Ingersoll Rand Inc. | Specializes in rotary screw compressors, centrifugal compressors, and dry-running vacuum pumps. |

| Gardner Denver (Part of Ingersoll Rand) | Manufactures vacuum pumps, compressed air systems, and medical-grade air and gas solutions. |

| Busch Vacuum Solutions | Provides dry screw, rotary vane, and liquid ring vacuum pumps for industrial and laboratory applications. |

| Pfeiffer Vacuum Technology AG | Focuses on high-vacuum and ultra-high-vacuum (UHV) technology for semiconductor, pharmaceutical, and research sectors. |

Key Company Insights

Atlas Copco AB (18-22%)

Atlas Copco is a global leader in air compression and vacuum solutions, offering energy-efficient, oil-free compressors and high-performance vacuum pumps for industrial applications.

Ingersoll Rand Inc. (12-16%)

Ingersoll Rand specializes in reliable compressed air and vacuum systems, integrating smart automation and predictive maintenance technologies.

Gardner Denver (10-14%)

Gardner Denver provides customized vacuum and compressed air systems, catering to healthcare, industrial, and commercial applications.

Busch Vacuum Solutions (8-12%)

Busch develops dry screw and rotary vane vacuum pumps, focusing on low-maintenance and high-efficiency solutions for industrial use.

Pfeiffer Vacuum Technology AG (6-10%)

Pfeiffer is a leader in high-vacuum technology, serving semiconductor manufacturing, scientific research, and pharmaceutical industries.

Other Key Players (30-40% Combined)

Several industrial equipment manufacturers, energy-efficient air system providers, and vacuum technology firms contribute to advancements in low-energy consumption, digital integration, and sustainable air compression solutions. These include:

The overall market size for the Compressors and Vacuum Pumps Market was USD 40,981 Million in 2025.

The Compressors and Vacuum Pumps Market is expected to reach USD 60,081 Million in 2035.

Growing industrial automation, rising demand in oil & gas, pharmaceuticals, and semiconductor manufacturing, and advancements in energy-efficient compressor technologies will drive market growth.

The USA, China, Germany, Japan, and India are key contributors.

Rotary screw compressors are expected to dominate due to their high efficiency, durability, and widespread use in industrial applications.

Power Tool Gears Market - Growth & Demand 2025 to 2035

Surge Tanks Market Growth - Trends & Forecast 2025 to 2035

Radial Drilling Machine Market Growth & Demand 2025 to 2035

External Combustion Engine Market Growth & Demand 2025 to 2035

Vision Guided Robots Market - Trends & Forecast 2025 to 2035

Portable Metal Detectors Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.