The global compressor rental industry is valued at USD 4.85 billion in 2025. According to FMI’s analysis, the compressor rental sector will grow at a CAGR of 7.5% and reach USD 10 billion by 2035. Rising demand for economic and flexible air compression solutions among various sectors will accelerate the sales of compressor rental solutions.

During 2024, the compressor sector underwent a transformative shift, prompted by surging demand in construction, mining, oil & gas, and manufacturing industries. Furthermore, the sudden preference to rental alternatives was encouraged by cost savings, operational versatility, and lower maintenance requirements, enabling companies to maximize resources without large capital outlays.

In 2025, the industry is set to grow further with support from continued infrastructure growth and a mounting trend towards rental-based solutions. Demand for rental compressors will increase as companies focus more on efficiency, flexibility, and cost control due to changing project requirements.

Rising industrialization in developing economies and increasing investments in oil & gas exploration operations are expected to further support industry growth, cementing the position of compressor rentals as a strategic option for companies seeking to achieve a balance between performance and financial leeway.

| Metric | Value |

|---|---|

| Industry Value (2025E) | USD 4.85 billion |

| Industry Value (2035F) | USD 10 billion |

| CAGR (2025 to 2035) | 7.5% |

Explore FMI!

Book a free demo

The compressor rental industry is booming with high growth, driven by booming infrastructure projects, changing energy regulations, and a strategic turning toward cost-effective, on-demand equipment offerings. With industries focusing on agility and capital flexibility, rental companies are set to take the benefits, whereas conventional equipment players banking on outright purchases might fail to keep up. This shift marks a resolute trend towards scalable, high-performance solutions that complement contemporary industrial requirements.

Redefine Value Proposition with Service-Driven Rentals

Move beyond standard equipment leasing by incorporating added-value services like performance data analytics in real time, remote diagnostics, and predictive maintenance. Providing end-to-end service packages will distinguish rental companies and create long-term customer relationships.

Take Advantage of Green Transition and Regulatory Changes

Align with increasing emission controls and sustainability objectives through growth of environmentally friendly compressor fleets, such as hybrids and electrics. Firms that make advance investment in cleaner technology will win contracts with eco-friendly industries and have a regulatory edge.

Accelerate Industry Consolidation for Competitive Supremacy

Use mergers, acquisitions, and joint ventures to gain a foothold in strategic growth areas. Enhancing supply chain resilience and maximizing fleet utilization through strategic alliances will provide sustained profitability and scalability.

| Risk | Probability & Impact |

|---|---|

| Growing Competitive Pressure - New rental suppliers and direct manufacturer leasing programs can steal industry share from established players. | High Probability, High Impact |

| Fluctuating Industrial Demand - Downturns in the economy, halted infrastructure expansion, or decreased investments in oil & gas can cause insecure periods of rental demand. | Medium Probability, High Impact |

| Shifting Client Preferences - Increased demand for on-demand, digitalized rental arrangements can disrupt classical long-term leasing contracts, and this requires business model change with speed. | High Probability, Medium Impact |

| Priority | Immediate Action |

|---|---|

| Optimize Rental Models for High-Variability Demand | Introduce dynamic pricing and short-term leasing solutions specific to industries with changing equipment requirements. |

| Leverage AI for Proactive Fleet Management | Use predictive analytics to reduce downtime, improve equipment effectiveness, and increase asset longevity. |

| Expand Footprint in Emerging Clean Energy & Industrial Cooling Sectors | Create specialized rental solutions for hydrogen production, carbon capture, and large-scale cooling. |

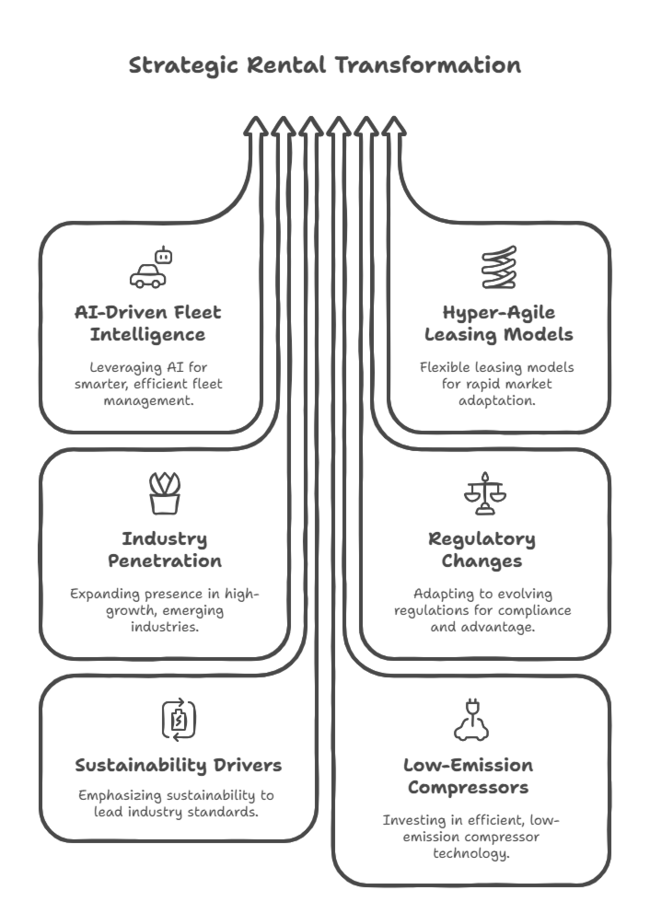

To stay ahead, companies must redefine their rental strategies with precision, agility, and technological foresight. Advancing further requires a bold shift to AI-driven fleet intelligence, hyper-agile leasing models, and profound industry penetration in high-growth sectors such as renewable energy and industrial cooling.

Regulatory change and sustainability drivers will be the differentiators between innovators and laggards, and investments in low-emission, high-efficiency compressors will be non-negotiable. Industry leaders need to act swiftly to future-proof their businesses, outcompete competition, and design a rental ecosystem that excels on agility and value-driven differentiation.

Rotary screw compressors will be the sector leaders from 2025 to 2035, spurred by their high efficiency, continuous operation, and reduced maintenance. High-performance, oil-free, and energy-efficient solutions will see industries turn towards these compressors, especially for large-scale industrial and construction activities. With an estimated CAGR of 7.4%, rotary screw compressors will outpace reciprocating models, which are ideal for intermittent usage and low-pressure applications.

Reciprocating compressors will continue to have applications in specialized industries that demand accurate pressure regulation, but their use will be restricted by increased maintenance expenses and inefficiencies in operation. As companies focus on reliability, affordability, and sustainability, rotary screw compressors will become the first choice, especially in high-load industries like power generation, mining, and mass production.

The construction industry will drive compressor rental demand, with a forecast CAGR of 7.2% during 2025 to 2035. Rising global infrastructure activities, urbanization, and public sector investment in roads, bridges, and commercial buildings will continue to keep adoption levels high.

Mining and oil & gas sectors will be the major consumers, utilizing compressor rentals to fulfill variable operational requirements without incurring heavy capital outlays. Power plants will incorporate rental compressors to provide backup power solutions, especially in energy-transitioning regions with grid instability.

The manufacturing industry will depend on compressor rentals to automate production processes, minimize downtime, and stay cost-effective. Chemical processing facilities, with their critical operational demands, will keep on investing in high-performance compressed air systems.

With industries moving toward flexible, scalable, and cost-effective solutions, rental compressors will be important in ensuring operating efficiency across the board.

The United States will remain a leading contributor to the compressor rental industry due to massive infrastructure growth and development of the energy sector. Increased oil & gas activities, in addition to growing emphasis on the integration of renewable energy, will continue to provide high rental demand.

Manufacturing and construction companies will favor rental compressors more and more to ensure maximum operating cost optimization and increase project flexibility. Investment in data centers and semiconductor manufacturing will also build new growth paths. FMI forecasts that the CAGR of the United States compressor rental industry will be 7.6% from 2025 to 2035.

India's rental compressor industry will see strong growth, driven by fast-paced urbanization, infrastructural development programs initiated by the government, and high industrialization growth trends. Mega construction programs such as metro rail expansion and smart city constructions will propel the demand for transportable and efficiency compressors.

The growing take-up of renting solutions in mining activities, with rising coal and mineral excavation activities, will support industry growth as well. The use of IoT-enabled compressors will improve fleet management and operational efficiency. FMI projects that the CAGR of the Indian compressor rental industry will be 8.1% from 2025 to 2035.

China's compressor rental industry will continue to grow steadily, led by its huge industrial and infrastructure growth. The government's drive for high-technology manufacturing as well as large-scale energy projects will sustain the demand. Shifting towards cleaner forms of energy solutions, such as hydrogen and wind energy, will further spur rental compressor usage, especially for temporary power solutions.

As China consolidates its role as a world manufacturing center, sectors like electronics, automotive, and aerospace will increasingly rely on rental compressors for cost-effectiveness and operational convenience. The construction industry, supported by continued urban redevelopment efforts, will also be a major demand driver. FMI opines that the CAGR of China’s compressor rental industry will be 7.9% from 2025 to 2035.

United Kingdom's compressor rental industry will grow steadily, led by rising investments in infrastructure and a growing movement towards rental-driven models. Demand for energy-saving air compressors will increase, driven by pressure for green building projects and green construction methods. The UK's robust offshore wind and renewable power sector will be another driving factor, demanding efficient compressors to install and service equipment.

Increased use of modular construction methods and prefabrication will also drive rental demand as businesses opt for equipment sourcing flexibility. The emphasis on decarbonization and industrial electrification will drive the uptake of low-emission compressor technologies. FMI forecasts that the CAGR of the UK compressor rental industry will be 7.4% from 2025 to 2035.

Germany's compressor rental industry will gain from the nation's dominance in industrial automation, engineering prowess, and green initiatives. The automotive industry's transition to electric vehicle manufacturing will further raise dependence on rental solutions to deal with changing assembly line requirements. Furthermore, the growth of wind and solar power infrastructure will propel compressor consumption in maintenance and energy storage uses.

The presence of major industrial equipment companies will also promote technology innovation in rental products, enhancing efficiency and decreasing operating expenses. FMI projects that the CAGR of Germany’s compressor rental industry will be 7.5% from 2025 to 2035.

South Korea's compressor rental industry will pick up pace with improvements in semiconductor production, shipbuilding, and heavy industry sectors. The nation's emphasis on innovation and high-tech industries will propel the demand for precision-driven compressed air solutions. The increasing use of AI-integrated compressors in smart factories will further boost rental industry potential.

The boom in offshore construction and marine projects will also generate consistent demand for temporary compressed air solutions. As South Korea improves its industrial competitiveness, rental solutions will emerge as a strategic option for companies that require cost-effective scalability. FMI opines that the CAGR of South Korea’s compressor rental industry will be 7.8% from 2025 to 2035.

Japan's rental compressor industry will increase steadily, supported by the nation's advanced manufacturing ecosystem and focus on energy efficiency. The increasing application of automated production lines in electronics and robotics sectors will drive demand for high-precision, oil-free rental compressors. In addition, Japan's infrastructure resilience efforts, including earthquake-resistant structures and extended high-speed rail networks, will drive rental industry growth.

The technological push of the aerospace sector will continue to spur rental demand. As rental models evolve, companies will increasingly seek customized compressor solutions to meet special operating requirements. FMI projects that Japan's compressor rental industry CAGR from 2025 to 2035 will be 7.3%.

France's compressor rental industry will be influenced by its strong infrastructure modernization programs and strict environmental regulations. Increased investments in green hydrogen production and carbon capture technologies will generate substantial demand for high-end rental compressors. Growth in aerospace and automotive production will also fuel demand for temporary compressed air solutions, especially in prototyping and test facilities.

The focus of the French government on green urbanization will promote the use of energy-saving rental machinery in construction projects. Moreover, the active refining of oil and chemical processing sector of the country will generate constant rental demand. FMI projects that the CAGR of France’s compressor rental industry will be 7.5% from 2025 to 2035.

Italy's rental industry for compressors will grow as industrial end-use sectors take greater advantage of adaptable, price-effective equipment options. The renewal of manufacturing production, especially auto and machinery assembly, will spearhead rental requirements. Italy's emphasis on highway and rail route development, or the rehabilitation of its infrastructure, will also serve compressor uptake on heavy construction works.

The shift of the energy sector to renewables and cleaner fuels will lead to new prospects for rental providers of high-efficiency, oil-free air compressors. Additionally, Italy's dominance in the food and beverage sector will ensure rental demand for clean and contaminant-free compressed air solutions continues. FMI opines that the CAGR of Italy’s compressor rental industry will be 7.4% from 2025 to 2035.

Australia and New Zealand's rental compressor sector will see growth, fueled by massive mining activities, growing renewable energy projects, and rising infrastructure spending.

The mining industry, a leading end-user, will keep relying on rental compressors for extraction and treatment operations, particularly in remote areas. The region's rising offshore wind farms and solar power projects will generate new temporary compressed air demand for installation and maintenance activities.

In a region where industries are moving towards rental structures for cost leverage, service-centric offerings and technology-enabled fleet management will be paramount to sector success. FMI forecasts that the CAGR of Australia & New Zealand’s compressor rental industry will be 7.7% from 2025 to 2035.

(Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, contractors, and industrial end-users in the USA, Western Europe, China, Japan, and India)

Regional Difference:

High Variance:

Convergent and Divergent Perceptions of ROI

Consensus:

Variance:

Shared Challenges

Regional Differences:

Manufacturers:

Distributors:

End-Users (Industrial Customers & Contractors):

Alignment:

76% of global rental suppliers plan to invest in next-generation hybrid and electric compressors to address sustainability needs.

Divergence:

High Consensus

Operational efficiency, cost pressures, and demand for durable rental compressors are universal considerations.

Key Variances:

Strategic Insight:

No "one-size-fits-all" applies to the compressor rental sector. Regionalization matters-North America and Europe require low-emission and digitalized solutions, but China, India, and Japan require cost-effective, flexible rental models to suit the reality of the industries.

| Countries | Regulations & Impact |

|---|---|

| USA | EPA Tier 4 Final requires low-emission compressors; OSHA regulates workplace safety. |

| India | BEE efficiency standards promote energy-saving models; CPCB regulates emission limits. |

| China | China VI standards drive electric compressors; CCC certification is mandatory for entry. |

| UK | Net Zero Strategy prefers low-carbon rentals; BS EN ISO 8573-1 regulates air quality. |

| Germany | EU Green Deal encourages carbon-neutral compressors; DIN EN 1012 regulates safety. |

| South Korea | Energy Master Plan encourages efficiency; KS standards regulate imports. |

| Japan | Top Runner Program establishes efficiency goals; JIS B 8392 controls air cleanliness. |

| France | ADEME policy drives energy efficiency; AFNOR certification guarantees compliance. |

| Italy | SEN plan assists low-energy compressors; UNI EN ISO 3744 restricts noise. |

| Australia-NZ | NGER Scheme drives electrification; AS/NZS 1210 guarantees safety. |

The compressor rental industry is fragmented, with a combination of global players, regional experts, and local rental firms competing for market share. The industry is, however, slowly trending toward consolidation as larger companies acquire smaller rivals to increase their geographic reach and service offerings.

Industry leaders in the compressed air rental sector are leveraging innovation, sustainability, and growth to remain competitive. Pricing strategies remain aggressive, particularly in high-demand sectors such as North America and Europe, where construction and manufacturing activity fuels rental volumes. Firms are spending on low-emission and energy-efficient compressors to meet tougher environmental legislation.

Compressor rental companies experienced significant movements during 2024, including acquisitions, product releases, and going green efforts.

United Rentals broadened its market reach through the acquisition of Apex Pumps and Compressors in January 2024, enhancing its presence in the USA Gulf Coast region. In addition, Aggreko collaborated with a European renewable energy company in February 2024 to provide hybrid compressor solutions for wind farm projects, enabling the transition to green energy

United Rentals - ~20-25%

Atlas Copco - ~15-20%

Aggreko - ~10-15%

Sunbelt Rentals (Ashtead Group) - ~8-12%

Herc Rentals - ~6-10%

Caterpillar (through Cat Rental Stores & dealers) - ~5-8%

Improved infrastructure development, stringent emission regulations, and cost savings are driving broad-based adoption.

Businesses are focusing on energy-efficient, low-emission units to keep up with tightening environmental laws.

Construction, oil & gas, and manufacturing are increasingly turning to rentals as a means of boosting flexibility and minimizing capital spend.

Intelligent monitoring, automation, and hybrid power systems are maximizing performance, decreasing downtime, and increasing energy efficiency.

Volatility of supply chains, changing compliance rules, and increasing raw material costs are mounting pressure on profitability and business.

Rotary Screw, Reciprocating

Construction, Mining, Oil & Gas, Power, Manufacturing, Chemical, Others

North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, Middle East and Africa

Domestic Booster Pumps Market Growth - Trends, Demand & Innovations 2025 to 2035

Condition Monitoring Service Market Growth - Trends, Demand & Innovations 2025 to 2035

Industrial Robotic Motors Market Analysis - Size & Industry Trends 2025 to 2035

Ice Cream Processing Equipment Market Growth - Trends, Demand & Innovations 2025 to 2035

Large Synchronous Motor Market Analysis - Size & Industry Trends 2025 to 2035

Machine Mount Market Analysis - Size & Industry Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.