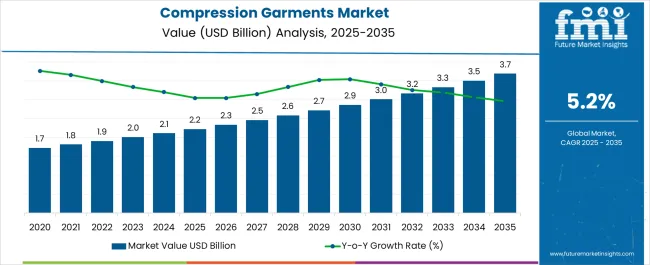

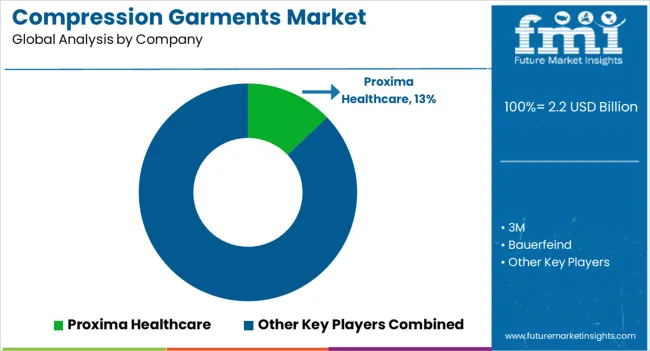

The Compression Garments Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.7 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

| Metric | Value |

|---|---|

| Compression Garments Market Estimated Value in (2025 E) | USD 2.2 billion |

| Compression Garments Market Forecast Value in (2035 F) | USD 3.7 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The compression garments market is expanding consistently, driven by rising awareness of their therapeutic benefits and increasing usage in both medical and lifestyle contexts. Industry reports and healthcare publications have emphasized the effectiveness of compression garments in improving blood circulation, reducing swelling, and supporting post-surgical recovery, which has significantly enhanced adoption across patient populations.

In addition, growing participation in sports and fitness activities has fueled demand for compression wear due to its performance-enhancing and recovery-support attributes. Hospitals, clinics, and rehabilitation centers have incorporated compression garments as part of prescribed treatment plans, while consumer interest in preventive healthcare has further broadened the market.

Continuous innovation in fabrics, including breathable and moisture-wicking materials, has improved wearer comfort and boosted compliance. Looking ahead, the market is expected to grow as demographic shifts, such as aging populations and rising incidence of venous disorders, increase clinical need, while expanding retail and e-commerce availability drive broader consumer adoption across both developed and emerging economies.

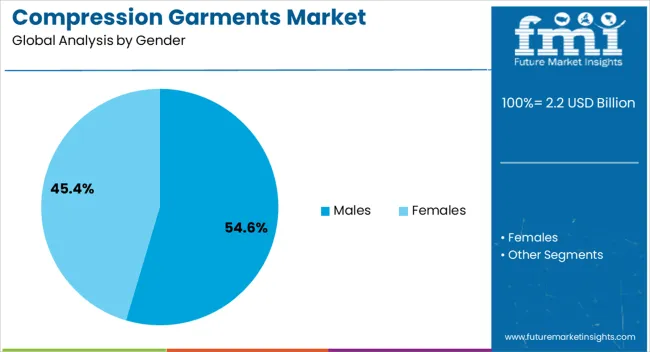

The Males segment is projected to account for 54.6% of the compression garments market revenue in 2025, making it the leading gender category. Growth of this segment has been supported by a higher prevalence of venous diseases and varicose veins among men, which has increased medical adoption.

Healthcare providers have also prescribed compression garments more frequently for male patients recovering from surgeries and managing chronic conditions, strengthening demand. Additionally, men’s participation in competitive sports, fitness routines, and weight training has contributed to greater use of compression wear for performance support and injury prevention.

Market adoption has also been aided by the availability of male-specific designs that combine therapeutic functionality with comfort and aesthetics. As awareness of circulatory health and recovery benefits continues to expand, the Males segment is expected to sustain its leading role in the compression garments market.

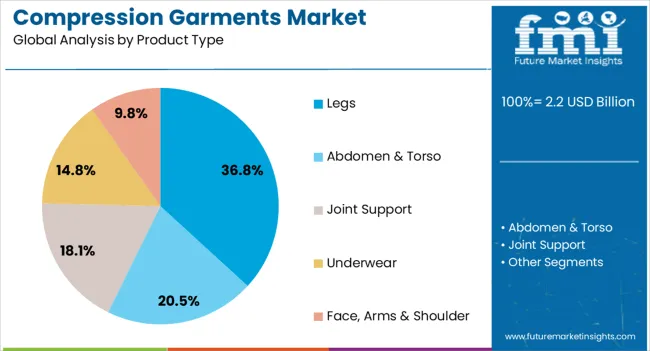

The Legs segment is projected to capture 36.8% of the compression garments market revenue in 2025, maintaining its dominance in product type usage. This growth has been driven by the high incidence of leg-related venous insufficiency, deep vein thrombosis, and lymphedema, which require therapeutic compression solutions.

Medical journals have highlighted that compression therapy for the legs delivers significant improvements in circulation, reduction of swelling, and prevention of clot formation. The segment has also gained traction from its role in sports and fitness, where leg compression supports muscle recovery and minimizes fatigue.

Increasing adoption of graduated compression stockings and sleeves for daily wear has further boosted usage. Technological improvements in textile design, including seamless construction and enhanced elasticity, have improved compliance and comfort for long-term users. With rising cases of leg-related circulatory conditions and wider acceptance of compression therapy, the Legs segment is expected to remain the primary revenue generator in the market.

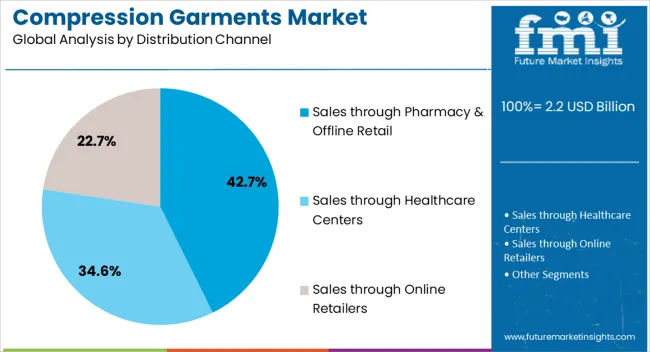

The Sales through Pharmacy & Offline Retail segment is projected to represent 42.7% of the compression garments market revenue in 2025, holding the top position among distribution channels. This growth has been driven by consumer reliance on pharmacies and medical retailers for trusted health-related purchases and professional guidance.

Pharmacists and healthcare providers have played a key role in recommending appropriate compression garments, especially for therapeutic use cases, strengthening retail sales. Offline retail stores have also offered consumers the advantage of trying products for size, fit, and comfort before purchase, ensuring higher satisfaction.

Additionally, partnerships between manufacturers and pharmacy chains have expanded product accessibility across regions. The importance of immediate availability and personalized recommendations has sustained the offline channel’s relevance, even with the rise of e-commerce. As medical awareness and preventive health adoption expand, sales through pharmacy and offline retail are expected to continue as the dominant channel in the compression garments market.

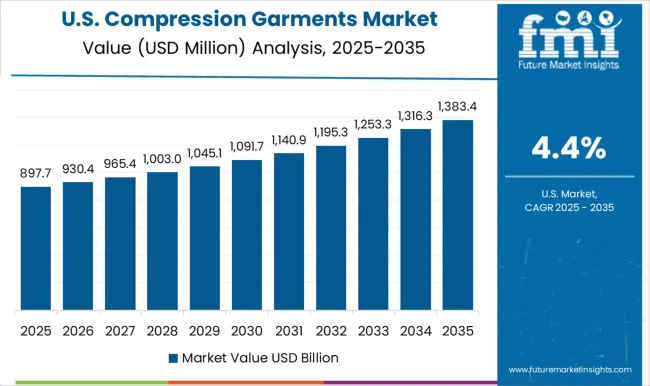

The global demand for compression garments is projected to increase at a CAGR of 5.2% during the forecast period between 2025 and 2035, reaching a total of USD 3,316.3 million by 2035, according to a report from Future Market Insights (FMI). From 2020 to 2025, sales witnessed significant growth, registering a CAGR of 4.1%.

The valuation of the industry is increasing with an increase in certain disorders that require compression garments to manage their disease conditions. For instance, according to SAGE Journal’s publication, there were approximately 122,000, 263,000, 345,000, 253,000, 85,000, 230,000, and 643,000 new or recurrent deep venous disease-related venous leg ulcers (DRV) in Australia, France, Germany, Italy, Spain, United Kingdom, and the USA respectively in the year 2020.

These leg ulcers have mainly a venous origin and are caused by high pressure in the veins. This can further lead to blockage and weakness of the valves in the veins of the leg. To prevent and treat venous ulcers, one has to reduce the pressure using external appliances such as compression garments, which absorb the shock, or pressure on the legs.

Increasing cases of obesity are also playing a key role in driving the market for compression garments. Obesity has various associated issues such as swelling of the foot due to poor circulation. Obesity has been noted by the WHO to be common in the pediatric population as well.

For instance, according to WHO, there were approximately 2.1 million overweight or obese children under the age of 5 in 2024. Thus, to manage the swelling of the foot due to poor circulation, this population uses compression garments and stockings that benefit the industry by increasing the volume of products manufactured and distributed.

The compression therapy market is growing fast. The rise of the diseases like lymphedema and the overall growth of the healthcare industry’s massive global aging population which is easily affected by age-related muscular problems and the steady rise of the fitness and sports industry are some of the drivers which are pulling up the potentiality of the compression garments market globally.

Compression-based garments are mostly used by physicians for treating specific ailments. The compression garments provide instant relief from muscle pain and help in repairing any torn tissue. They are specifically made to protect and heal a specific set of injured muscles.

The entire manufacturing market of compression garments is concentrated in Australia and the supply of clothes and an overall positive scene of the textile market is also fuelling the growth of the compression garments market.

The demand for compression garments soared as athletes are preferring them to avoid any kind of possible injury during an event. The producers are constantly innovating with the materials and revamping styles to woo more consumers. The compression garments market is extremely prosperous because of the constant modernization drive happening in the sports, fitness, and healthcare sector.

The global compression garments market is on the rise. But the production of these stylized garments is limited to the clutches of a few major manufacturers and exporters who are camping in a specific corner of the world.

This autonomy is not only restricting the growth of the compression garments market but is also affecting the pricing of these medicated garments. The high pricing is a major factor that is also dipping the global growth of the compression garments market.

In terms of geographic divisions, North America accumulated the maximum revenue, accounting for a 48.2% share in compression garments in 2025. According to Future Market Insights analysis, the region is projected to maintain its governance over the projection period, backed by the increasing participation of women in sporting events and championships.

Today in the USA over one-third of all female students in high school play sports, and the number of women participating in university sports has tripled. Women now compete in almost every sport, whether the competition is team, individual, or mixed gender.

Girls and women also are increasingly participants in sports that have traditionally been seen as out of bounds for women, including soccer, ice hockey, lacrosse, wrestling, and rugby. Hence, the increasing participation upsurges the use of compression garments.

The compression wear decreases muscle vibrations. Hence, players wearing it are less likely to experience muscle soreness the next day. Additionally, it provides extra support and improved oxygen flow, which altogether reduces the risk of straining a muscle during games and practice sessions.

The tremendous popularity of major professional sports leagues, commonly referred to as the Big Four which includes Major League Baseball (MLB), the National Basketball Association (NBA), the National Football League (NFL), and the National Hockey League (NHL) in the region is a crucial factor driving the demand for compression garments.

| Country | United States |

|---|---|

| 2025 Value Share in Global Market | 39% |

The United States holds a prominent position in the global compression garments market. The increasing prevalence of chronic conditions such as obesity, diabetes, and cardiovascular diseases has driven the demand for compression garments as part of a holistic healthcare approach. Athletes and fitness enthusiasts also contribute significantly to the market's growth as they seek performance-enhancing products and faster recovery solutions.

The United States compression garments market is poised for further growth due to increasing health consciousness. The healthcare industry plays a crucial role in the United States compression garments market. The sports and fitness culture in the United States is thriving. Athletes, fitness enthusiasts, and weekend warriors are adopting compression garments to enhance performance and facilitate quicker recovery after intense workouts or sports events.

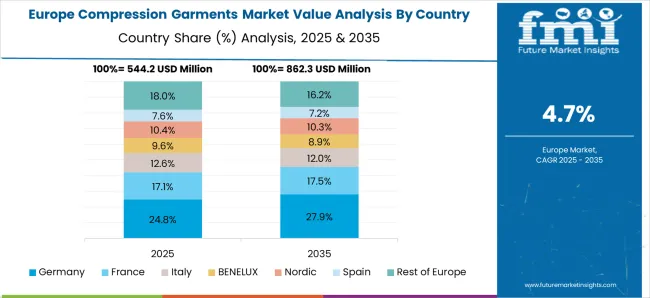

Based on Future Market Insight’s recent analysis, Europe is the second-largest region in terms of revenue share, accounting for nearly 26.8% share of the Compression Garments market. Prominent countries contributing to the regional revenue share of compression garments are Germany, the United Kingdom, and France.

The increasing workload for varicose veins treatments and orthopedic surgeries is observed ahead with advancements in fabric, garment designers are likely to propel the region’s growth.

A textile company-Barcelcom Têxteis in North Portugal has developed new materials and fabric technologies with applications for several medical conditions, from blood circulation in the legs to breast cancer. The company used the funding to finance research and development, in partnership with the University of Minho and a local research organization, TecMinho.

The consortium investigated new technologies and tested new medical devices based on tubular compression meshes that can be worn over the legs and arms. A sleeve for breast cancer treatment was developed. The garment’s material is light and breathable. These advancements in materials and the development of new products are likely to foster the demand for compression garments in the region.

| Country | United Kingdom |

|---|---|

| Value CAGR (2025 to 2035) | 5.1% |

The United Kingdom compression garments market has seen the integration of smart technology into compression garments. This includes sensors that monitor body metrics, biometric feedback, and other performance-related data. Smart compression garments are appealing to tech-savvy consumers and athletes seeking data-driven insights for optimizing their workouts.

Consumers in the United Kingdom are becoming more environmentally conscious, leading to a rising demand for sustainable and eco-friendly compression garments. Manufacturers that adopt environmentally friendly practices and use recycled materials are likely to gain a competitive edge in the market.

| Country | Germany |

|---|---|

| 2025 Value Share in Global Market | 6.8% |

The Germany compression garments market has experienced significant growth over the past few years, driven by increasing awareness about the benefits of compression wear across various age groups and industries. Germany has a reputation for being health-conscious, with individuals increasingly adopting preventive healthcare practices. Compression garments are viewed as a non-invasive method to enhance overall well-being, thereby driving demand.

The country has experienced a surge in fitness and sports activities, ranging from amateur to professional levels. Athletes and fitness enthusiasts use compression wear to improve performance, reduce muscle soreness, and aid in post-workout recovery. As the fitness industry thrives in Germany, the demand for compression garments as workout accessories is on the rise. Gymnasiums and fitness centers promote compression wear, contributing to its market growth.

Increasing Healthcare Spending to Act as a Principal Growth Driver

According to Future Market Insights, the Asia-Pacific market is anticipated to register rapid growth owing to the availability of cheap labor and raw material. The Chinese and Indian products are cost-effective and made of quality textiles. The Indian-made products and making quite a roar in the international arena and giving stiff competition to the international makers of compression garments.

In the Asia Pacific, start-ups, new entrants, and domestic firms have been breaking into the compression garment industry by developing new products for men and women. Compression garment manufacturers are trying out innovative technologies to create new designs and patterns in the clothing line. The latest technological advancements in the compression clothing sector include 3D printing and smart textiles.

The surges in the incidence of sports injuries and accidents, and clinical evidence favoring the adoption of compression therapy in the management of target conditions accelerate the market growth.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| China | 6.3% |

| India | 6.8% |

The adoption of compression garments for medical purposes, such as post-surgery recovery, varicose vein treatment, and lymphedema management, is rising in China. The healthcare industry's emphasis on non-invasive treatments has positively influenced this trend.

China's burgeoning sports and fitness culture has driven the demand for compression garments among athletes and fitness enthusiasts. The products' ability to enhance performance, reduce muscle fatigue, and prevent injuries has made them popular in the sports community.

The increasing penetration of e-commerce platforms in China has made compression garments more accessible to consumers across different regions. Online retail channels offer a wide range of products, easy comparisons, and doorstep delivery, boosting the China compression garments market growth.

China's significant tourism industry has indirectly influenced the compression garments industry. Tourists, especially those engaged in long-haul flights, often purchase compression socks to mitigate the risk of deep vein thrombosis (DVT) during travel.

The India compression garments market exhibits promising growth prospects. A surge in health consciousness, driven by growing disposable incomes and urbanization, has led to a rise in demand for compression garments among individuals engaged in various physical activities.

The rapid growth of sports and athletics in India, including cricket, football, and other sports, has contributed to the increased adoption of compression garments by athletes seeking enhanced performance and reduced injury risks. India's burgeoning fitness and wellness industry, including gyms, yoga studios, and wellness centers, has driven the demand for compression wear as more individuals seek suitable active wear for their workouts.

The proliferation of e-commerce platforms in India has made compression garments easily accessible to consumers across the country. Online retail channels offer a wide range of products and convenient shopping experiences.

The aging population in India is more health-conscious than ever before. Elderly individuals increasingly use compression garments to manage circulation issues and support overall mobility. Celebrities and influencers endorsing compression garments have positively influenced consumer perceptions in India.

| Country | Japan |

|---|---|

| 2025 Value Share in Global Market | 2.7% |

Japan has the maximum aging population in the world. With an increasing number of elderly individuals, there is a greater demand for compression garments to address health issues related to poor blood circulation, joint pains, and muscle weakness.

In Japan, there is a long-standing belief in the concept of Bonyu Sokuhatsu, which translates to preventing illness through the feet. This belief has led to a strong market for compression stockings, as they are considered beneficial for improving circulation and preventing health issues.

The younger population in Japan is becoming increasingly health-conscious, leading to a surge in sports and fitness activities. Compression garments have gained popularity among athletes and fitness enthusiasts because they enhance performance and reduce muscle fatigue.

The Japan compression garments market is influenced by advancements in textile technology. Manufacturers are constantly researching and adopting innovative materials and fabrication techniques to enhance the functionality and comfort of compression wear.

| Segment | 2025 Value Share in Global Market |

|---|---|

| Male | 58.7% |

| Pharmacy & Offline Retailers | 51.3% |

Male Consumers are Driving Unprecedented Growth in Compression Garments Sales

The male gender segment has dominated the market due to various factors. Compression garments are often used in sports and fitness activities. The popularity of such activities among males drives higher demand for compression garments in this segment. Certain professions and industries involve physically demanding tasks. These fields have traditionally employed more men. The presence of men in these industries contributes to their dominance in the market.

Cultural norms and societal expectations regarding body image and appearance also play a role in shaping preferences for compression garments. Furthermore, marketing strategies focused on male consumers, athlete endorsements, and product development tailored to male needs have further reinforced their market dominance. However, as societies evolve and traditional gender roles change, the dynamics in the compression garments market are likely to shift, with increased awareness and adoption among females.

In-person Expertise is the Key to Pharmacy & Offline Retailers' Dominance in Compression Garments Industry

The pharmacy & offline retail distribution channel segment leads the market for several reasons. The widespread accessibility of pharmacies and brick-and-mortar retail stores makes it convenient for consumers to purchase compression garments promptly when needed. In-person assistance provided by knowledgeable staff further increases the value of the buying experience, especially when customers require proper fitting and sizing for medical-grade garments.

Moreover, the well-established distribution networks of these physical stores contribute to wider market reach and better product placement. Additionally, the trust consumers place in these established outlets, particularly in the medical context, encourages them to purchase in-store.

Furthermore, the instant gratification of taking the product home immediately appeals to certain customers compared to waiting for online deliveries. Lastly, the preference of a portion of the target audience for physical stores over online platforms reinforces the dominance of sales through pharmacy & offline retail in the market.

Increasing Popularity of Sporting Events in Several Countries to Augment Demand for Compression Garments

The global compression garments market is segmented into end-user types and regions. Based on the end-user type segment, the men’s subtype holds a majority share in compression undergarments.

As per the recently published report by Future Market Insights, the segment is likely to maintain its governance over the conjecture period, attributed to the increasing number of male athletes and sporting events at the international and domestic levels.

The women segment is also likely to capture a significant share throughout the forecast period. This market growth is attributed to the increasing recognition of different sports championships with the rising number of women’s participation and demand for compression leggings, bras, and socks.

Compression sportswear effectively reduces limb swelling and supports various muscles and ligaments, which are prone to injuries with extensive sports events in a calendar year.

How key Players are Opening Frontiers for Future Growth?

What are the Leading Players in the Compression Garments Market Up to?

What are the Leading Players in the Compression Garments Market Up to?

Key Companies Profiled

The global compression garments market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the compression garments market is projected to reach USD 3.7 billion by 2035.

The compression garments market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in compression garments market are males and females.

In terms of product type, legs segment to command 36.8% share in the compression garments market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Compression Garments and Stockings Market Analysis - Size, Share, and Forecast 2025 to 2035

Abdominal Compression Garments Market Size and Share Forecast Outlook 2025 to 2035

Compression Testers Market Size and Share Forecast Outlook 2025 to 2035

Compression Product Market Size and Share Forecast Outlook 2025 to 2035

Compression Testing Machines Market Size and Share Forecast Outlook 2025 to 2035

Compression Baggers Market Size and Share Forecast Outlook 2025 to 2035

Compression Gas Spring Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Compression Veterinary Bandages Market Trends – Growth & Forecast 2025 to 2035

Market Share Insights for Compression Baggers Providers

Industry Share Analysis for Compression Packing Providers

Compression Therapy Market Insights – Growth & Forecast 2024-2034

Compression Bags Market

Decompression Toys Market Growth - Trends & Forecast 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Radial Compression Devices Market Growth - Trends & Forecast 2025 to 2035

Distal Compression Plates Market

Artery Compression Devices Market

Colon Decompression Kits Market

India Static Compression Therapy Market Report – Trends & Forecast 2016-2026

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA