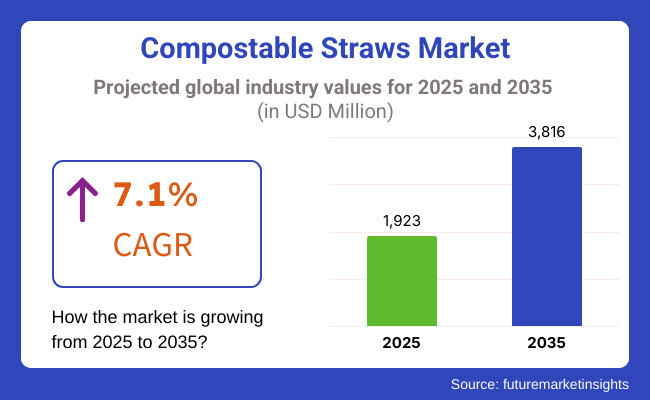

Compostable Straws Market is poised to grow exponentially in 2025 to 2035 as a result of rising consumer awareness towards plastic usage and rapidly escalating demand for environment-friendly products. The market size will be around USD 1,923 million in 2025 and grow to USD 3,816 million in 2035 with a compound annual growth rate (CAGR) of 7.1% during the forecast period.

There are various reasons behind the same. Among the most powerful of these is international pressure to limit the use of plastics, especially in restaurants and hospitality industries. Restaurants, cafes, and companies are switching from plastic straws to compostable straws in bulk, such straws having been produced from polylactic acid (PLA), paper, or wheat stems.

For instance, big fast-food chains such as Starbucks and McDonald's have already moved away from plastic straws in favor of creating paper or composting straw substitutes. But strength, cost, and scalability issues force manufacturers to push limits in the sense of creating innovative material content delivering function but at the expense of not sacrificing biodegradability.

Available composting straw products in the market today include paper straws, PLA straw, and naturally occurring plant-based straw. Paper straws, as fashionable as they are, do not pass by disintegrating over time when submerged. PLA straws derived from cornstarch are durable but need some form of industrial composting to break down.

Wheat stem and sugarcane fiber straws present a raw biodegradable option with little processing. Food and beverages industry is the biggest end-use, and aviation industry replacing plastic straws onboard flights to adhere to sustainability needs. Party planning is another quickly changing sector in which large festivals and corporate events attempt to limit single-use plastics.

Explore FMI!

Book a free demo

It is still a leading market for compostable straws due to stringent laws and increasing customer requirements for sustainable products. The United States and Canada have also devised single-use plastic bans in their big cities, and this has created demand for alternatives. Restaurants in California, for instance, have been compelled to transition to compostable straws after the state-wide ban on plastic straws.

Corporate sustainability initiatives such as by Starbucks and Disney have also generated bulk buying of biodegradable straws. Despite all these efforts, the question of disposal is still there because most compostable straws need industrial composting facilities, which are yet to go mass.

Europe has the highest market share for the business of compostable straws due to stringent European Union regulations and green-conscious customers. Germany, France, and the UK have already prohibited plastic straws as part of the wider circular economy policy. In Italy, where tableware is a staple on every street food stall and cafe, the shift to compost packaging is gaining momentum.

Tesco and Carrefour have also removed plastic straws from their stores, creating market size. European companies are also increasing straw material capacity, and paper straws and rice-and-pasta-based edible straws are being produced for various tastes and customer preferences.

Asia-Pacific will witness strongest growth in compostable straws market due to rising urbanization, government, and environmental awareness. Leading nations to phase out plastic straws are Australia, Japan, India, and China. Single-use plastics like India's banned plastic straws have led to strong demand for cheap compostables.

Chinese manufacturing facilities are ramping up production capacities to make PLA-based low-cost products and bamboo fiber straws exportable. Japan's restaurant business, especially for tea houses and sushi bars, is adopting rice-based and seaweed-based biodegradable straws as a part of ancient green culture.

Challenge: Disposal Infrastructure and Cost Constraints

Maybe one of the largest challenges the compostable straws market faces is a lack of disposal infrastructure to facilitate appropriate biodegradation. Compostable straws are meant to degrade easier than plastic, yet they are most often reliant on industrial composting not accessible to much of the nation. Without a way to obtain it, compostable straws will also end up in landfills and forfeit the environmental advantage they provide.

Another flaw is that they are more expensive than standard plastic straws. The added expense makes them undesirable for small food establishments and dollar stores, where price sensitivity is issue number one. So the utilization of compostable straws is not being promoted on a broad scale, and most companies will not be able to switch over on an expense basis.

Opportunity: Improvements in Material Science and Consumer Demand

Advances in material technology are opening up new avenues of possibility for compostable straws to achieve performance as much as sustainability. New-generation coating technologies are enhancing the water resistance of paper straws in a manner that they can be made robust without sacrificing their biodegradable character.

Other newer options such as seaweed, rice, or tapioca-based edible straws are being found as well, providing new consumer experiences and minimizing waste. This is due to the increasing need for green restaurants, especially from green-conscious millennials and Gen Z.

Their willingness to utilize green alternatives is a gigantic business opportunity for companies that have embraced green practice. As the customers increasingly demand greener products, the companies can gain from the trend towards greener living.

Between 2020 to 2024, the compostable straw market grew rapidly with drivers being regulations and business sustainability. Big foodservice chains, airlines, and hospitality companies started phasing out plastic straws, and therefore, demand for biodegradable ones increased. Raw material shortages and supply chain interruptions were concerns, which made producers diversify raw material sources and invest in domestic manufacturing facilities.

Forward to 2025 to 2035, the market will be driven by consumer-led sustainability, compostable technology trends, and more attractive-performance waste management products. Biopolymer technology development, cost reduction, and growth in the number of industrial composting plants will drive the development.

Growth of the edible and reusable alternative straw market further increases the size of the market opportunity, and as a result, consumers who need to become more sustainable with lower environmental impact are easier to satisfy.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Single-use plastic straw bans skyrocketed around the world, and companies moved to paper and bioplastic straws. Plastic reduction policy compliance grew. |

| Technological Advancements | Biodegradable plastic and paper straw technology enhanced strength and customer experience. |

| Adoption in Food & Beverage Sector | Compostable straws were embraced by fast-food restaurants and coffee shops due to plastic bans and consumer pressure. Some companies experienced cost issues. |

| Consumer Preferences | Green consumers were willing to pay a premium for sustainable products. Sogginess and structural integrity problems persisted. |

| Environmental Sustainability | Transition towards minimizing microplastics in ocean ecosystems by banning plastic straws. Compostable straw uptake was hindered by poor disposal. |

| Production & Supply Chain Dynamics | High production costs and raw material scarcity were challenges. Reliance on few suppliers limited market growth. |

| Market Growth Drivers | Expansion fueled by corporate sustainability pledges, rising plastic bans, and environmentally conscious consumers. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Stricter global regulations aim for complete elimination of non-compostable straws. Governments push for verified compostable certifications and extended producer responsibility (EPR) programs. |

| Technological Advancements | Innovations in seaweed, rice, and starch-based straws enhance decomposition rates and sustainability. Edible and flavored straw options gain popularity. |

| Adoption in Food & Beverage Sector | Cost reductions and economies of scale make compostable straws the default choice in food service. Smart labeling ensures compostability compliance. |

| Consumer Preferences | Widespread acceptance as new materials improve durability and drinking experience. Customizable, brand-specific biodegradable straws become the norm. |

| Environmental Sustainability | Circular economy initiatives ensure full compostability through improved waste management infrastructure and commercial composting facilities. |

| Production & Supply Chain Dynamics | Increased investment in regional production reduces reliance on imports. Sustainable sourcing of materials ensures a stable supply chain. |

| Market Growth Drivers | Market expansion fueled by global mandates, innovations in material science, and cost-effective compostable straw manufacturing. |

US demand for compostable straws grew due to growing environmental consciousness and government restrictions on single-use plastics in the majority of states, including California and New York. Demand has been driven by the foodservice industry, coffee shops, and fast food restaurants.

In coming years, more companies will utilize compostable straws produced from renewable resources such as plant polymers and straw fibers. Compostable straws will be made more durable by coming technology, as well as even more pleasant to use, and they will be food service favorite number one.

Increased Demand by Quick-Service Restaurants: Major chains like McDonald's and Starbucks have launched compostable straw programs, and mass-market expansion has been the result. The close to USD 150 billion USA food delivery market continues to drive demand for biodegradable straws with sustainable packaging increasing more mainstream.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

UK compostable straw market is seeing a fast expansion with the plastic straw prohibition in the 2020 Single-Use Plastics Directive. The environment, social movements, hospitality sector pressure drive the market.

The sector is also investing in completely compostable products such as wheat, bamboo, and PLA straws. The drinks sector and retailers are also adopting completely compostable products in an effort to acquire new customer base via sustainable adoption of straws.

Hospitality and Retail Growth: UK hospitality industry worth more than £100 billion is increasingly turning to compostable straws in its bid for sustainability. Waste management infrastructure growth continues to drive industry expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.8% |

European Union also has been the forerunner in prohibiting single-use plastics with strict control through EU Directive on Plastics. Plastic straws are banned in Germany, France, and Italy, and compostable straws are trending nowadays.

Compostable straws market is growing as consumers are in search of eco-friendly products and CSR. Additionally, R&D effort towards manufacturing technology has made the cost of bio-based straws lower, and now they become affordable to business.

Increased Investment in Sustainable Packaging: The European food and beverage packaging industry valued at approximately €350 billion still contains biodegradable and compostable material, thus further increasing demand for sustainable straws.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.5% |

The market of biodegradable straws in Japan is led by the Japanese government moving away from plastic waste and towards more environmentally friendly alternatives. The Japanese Ministry of the Environment initiated aggressive campaigns to cut plastic waste by 25% in 2030, and it has accelerated the use of biodegradable straws at a faster pace.

They enjoy a longer lifespan of a product and dependability, so very long-lasting products exist in the form of compostable straws which are manufactured using fresh raw materials such as rice, seaweed, and break-down plastic. Convenience stores, supermarkets, and beverage chains employed more and more of the compostable type.

Innovation Technologies of Biodegradable Straws: Nanotechnology-derived bioplastics mixed with very thin but extremely durable material in its bioform already dominating marketplaces Japan first before top rank for green straw manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.9% |

The South Korean market is expanding for biodegradable straws due to strict waste management regulations and consumer demand for eco-friendly products. The government's Zero Waste campaign and banning plastic straws in coffee shops compelled companies to shift to biodegradable straws.

The region's local production is also turning to new material such as cornstarch, bamboo fibers, and bioplastics PLA-based biodegradable materials to manufacture straws sustainable and stronger. South Korea's goal of a carbon-neutral target by 2050 is catalyzing the market demand.

Green Packaging Solution Development: South Korea's green food and retail market with chain leaders such as Starbucks Korea and Paris Baguette adopted compostable straws with total passion, catalyzing growth in the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

Paper-Based Compostable Straws Pioneers due to Cost Savings and Bulk Up-Take Paper-based compostable straws, virgin kraft paper or recycled paper, are pioneers because they are cost-effective and highly taken up by foodservice outlets.

Virgin kraft paper straws are highly up-taken because they are resistant to sogginess and strong and are hence taken up by high-end cafes as well as by chain restaurants like Starbucks and Pret A Manger. But recycled paper straws occupy a niche space in sustainability revolutions and are being embraced by green brands. Government regulation of plastic straws in the European Union and certain USA states has fueled industry expansion.

Bamboo and polylactic acid (PLA) straws are also taking market share, particularly in high-end dining experience and socially responsible businesses. The eco-friendly reusable bamboo straws will appeal to individuals who believe they are sustainable shoppers, and the PLA straws made from cornstarch provide the plastic look without the ecologically dirty residues of the original plastic

The pasta straws, although a niche product, have gained a niche status among specialty coffee shops and bars because they are novel and zero-waste.

Straws measuring less than 7mm in diameter have the largest market share because they are suitable for the consumption of soft drinks, iced coffee, and juice at fast food joints and coffeehouses. McDonald's and Costa Coffee have turned to these narrower compostable straws in an attempt to satisfy sustainability requirements.

The 7-10mm diameter size is needed, particularly by bubble tea and smoothie chains like Jamba Juice and Gong Cha, who need thicker straws for pulp or topping drinks. The 10-15mm size, specialty drink-focused for milkshakes and frozen drinks, is gaining popularity, particularly within the North American and European markets. The straws over 15mm are also a specialty piece, utilized for specialty drink applications with other wider mouths, such as tapioca-thick boba teas.

Manufacturer players get themselves in the market-leading position through the sales of bulk compostable straws to the foodservice category. Market leaders are investing in production lines in a bid to keep up with increased demand, especially where bans of plastic straws are in place.

Mass retailers like supermarkets and specialty shops are market drivers because consumers demand earth-friendly alternatives for domestic purposes. Major retailers like Walmart and Tesco also carry compostable straws among their green products. Green e-stores like Amazon and green specialty stores have also driven consumption with the availability of a variety of compostable straws via bulk orders and customized orders, which appeal to end-consumers and small business customers.

The foodservice industry, from hotels to restaurants, cafes, and quick-service restaurants, continues to be the biggest user of compostable straws. International fast-food chains such as Burger King and Subway have pledged to go plastic straw-free, a trend that has been shaping paper and PLA-based straw demand. Bars and lounges too have adopted bamboo and pasta-based straws as a symbol of going green, especially in upscale cocktail bars.

Film, airline, and rail restaurants also utilize compostable straws as a substitute for single-use plastic straws to contribute to the cause of the environment. Institutional school sub-segments, healthcare facilities, and office parks are even utilizing compostable straws to serve the cafeteria to support internal sustainability plans and regulatory pressures.

Straight compostable straws are the most universally accepted product among all industries, especially foodservice uses. Non-printed ones are most prevalent due to the fact that it has a simpler design and cheaper production, while printed straws with brands or logos are becoming increasingly popular among high-end restaurants and special promotion events.

Printable and flexible compostable straws are finding wider uses in the medical and aviation industries, where ease of use relies entirely on being flexible. Delta and Emirates, among major airlines, have transitioned from plastic to flexible PLA-based straws, also further driving green travel trends. With businesses now concentrating more on eco-friendly substitutes, this market for printable and flexible compostable straws will steadily grow over the next two years.

Compostable straw is a competitive industry with the dominance of powerful global players and a combination of regional producers specializing in sustainable packaging. There are some powerful players with large market shares, specializing in material innovation and sustainable product development.

The companies are leadership-generating in biodegradable alternatives to plastic, responding to global regulatory policy and changing consumer behavior. The market is controlled by a combination of seasoned industry players and new entrants to the market, all of whom have important parts to play in shaping industry trends through technological innovation and strategic partnerships.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hoffmaster Group, Inc. | 15-20% |

| Aardvark Straws (Hoffmaster Group) | 12-16% |

| Footprint, LLC | 8-12% |

| BioPak | 6-10% |

| World Centric | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hoffmaster Group, Inc. | Offers durable, food-safe paper straws with FSC-certified materials. Invests in advanced biodegradable coatings for enhanced product longevity. |

| Aardvark Straws (Hoffmaster Group) | Specializes in premium paper straws that are 100% compostable and marine-friendly. Focuses on USA-based manufacturing for sustainable supply chain control. |

| Footprint, LLC | Develops plant-based fiber straws using patented technology to eliminate plastic waste. Partners with major food chains for large-scale adoption. |

| BioPak | Manufactures compostable straws made from renewable sources such as sugarcane and PLA. Targets the foodservice industry with carbon-neutral packaging solutions. |

| World Centric | Produces compostable straws from cornstarch-based PLA, designed to break down in commercial composting facilities. Promotes social impact through sustainability initiatives. |

Key Company Insights

Hoffmaster Group, Inc. (15-20%)

Hoffmaster Group, Inc. is the leading manufacturer of compostable straws of FSC-certified, durable, and food-grade paper straws. The company invests significant amounts of capital in biodegradable coatings to extend the product's life and meet global sustainability laws as well. Hoffmaster has developed strong relationships with food service chains to advance the plastic straw alternative.

Aardvark Straws (Hoffmaster Group) (12-16%)

Aardvark Straws, a Hoffmaster Group company, is well known for 100% compostable and ocean-safe paper straws. It has US-based production to keep carbon footprint minimal without compromising on quality. Aardvark is a trusted supplier for companies that are ready to adhere to environment-friendly packaging regulations.

Footprint, LLC (8-12%)

Footprint, LLC was the first to introduce patented technology plant-based fiber straws to replace foodservice plastic waste. Footprint has gained large quick-service restaurant (QSR) partners that are driving high-volume uptake of its eco-friendly products. Footprint designs new concepts daily to strengthen straws without compromising compostability.

BioPak (6-10%)

BioPak is emphasizing compostable straws from renewable resources like sugarcane and PLA. Asia-Pacific regionally headquartered, BioPak supplies carbon-neutral foodservice packaging solutions to the food and beverage sector. BioPak's sustainability isn't just product-focused because it also directly supports climate action projects.

World Centric (4-8%)

World Centric employs compostable cornstarch-based PLA straws that are commercially compostable. World Centric is highly known for social mission, donating a portion of its revenue to community-based and environment-based projects. World Centric's dedication to sustainable practices has made it a source partner of green brands.

Other Key Players (40-50% Combined)

Beyond these dominant players, several companies collectively hold a significant market share, contributing to innovation, cost optimization, and sustainability efforts. These include:

The global compostable straws market size was estimated at USD 1,923 million in 2025.

The compostable straws market is expected to reach approximately USD 3,816 million by 2035.

The increasing environmental awareness, government regulations banning single-use plastics, and consumer demand for sustainable alternatives are expected to drive the demand for compostable straws during the forecast period.

The top 5 countries driving the development of the compostable straws market are the United States, Canada, Germany, France, and China.

On the basis of material type, paper-based compostable straws are expected to command a significant share over the forecast period.

Nitrogen Flushing Machine Market Analysis by Automatic and Semi-Automatic Through 2035

Pan Liner Market Analysis by Polyethylene (PE), Nylon, Polypropylene, Polyester, Polytetrafluoroethylene (PTFE) and Biodegradable Plastics Through 2035

Perfume Filling Machine Market Analysis by Automatic Perfume Filling Machines and Manual Perfume Filling Machines Through 2035

Molded Pulp Packaging Machines Market Analysis - Growth & Forecast 2025 to 2035

Packaging Tensioner Market Analysis - Growth & Forecast 2025 to 2035

Packaging Films Market Analysis by Product Type, Material Type and End Use Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.