The industry valuation is expected to grow at a steady rate, with an estimated value of USD 133.3 million in 2025, to reach approximately USD 189.9 million by 2035, growing at a CAGR of 3.6%. Rising organic waste generation and the global trend towards sustainable waste management propel growth. One of the key drivers is growing waste generation from urbanization and industrial farming.

Municipal governments are putting in place composting programs to keep organic materials out of landfills and incinerators, reducing methane emissions and helping achieve carbon neutrality goals. Equipment like compost turners, shredders, in-vessel systems, and aerators is crucial to expanding these efforts.

The emergence of zero-waste policies and circular economy models is also incentivizing institutions, schools, and restaurants to compost on-site. These facilities not only save on disposal expenses but also generate valuable compost for landscaping, agriculture, or resale-consistent with sustainability objectives and regulatory compliance.

Plant growing and agriculture businesses are hard-set customers, particularly in organic growing. Compost equipment aids animal manure management, crop residuals, and other biomass feedstocks, reducing smell, disease-causing agents, and chemical fertilizer needs. As organics continue their demand, a genuine nutrient choice through composting lies ahead.

Technological progress is enhancing the efficiency of the process. Mechanized composting machines, temperature monitoring on a real-time basis, and odor control measures are being introduced into new products to process multiple feedstocks with minimal labor and minimal environmental pressures. Although awareness is on the rise, the industry has its challenges.

Essentially, prohibitive initial capital investment and maintenance requirements on a continuous basis can dissuade small farms or plants with limited financial resources from adoption. In a few areas, a lack of suitable policy incentives and technical expertise geared to the process inhibits the incorporation of composting equipment into usual waste management schemes.

Opportunities are being led by state-supported subsidy programs, public-private partnership initiatives, and awareness campaigns promoting organic waste recycling. Additionally, composting falls within climate change mitigation programs and, as a result, can be eligible for green investment and carbon credit-based financing in specific areas.

Composting Equipment Market

| Market Metrics | Value |

|---|---|

| Industry Size (2025E) | USD 133.3 million |

| Industry Value (2035F) | USD 189.9 million |

| CAGR (2025 to 2035) | 3.6% |

Explore FMI!

Book a free demo

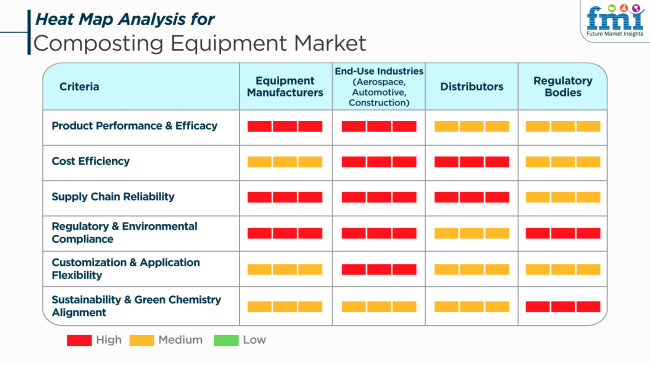

The industry is expanding very rapidly with increased demand from a wide range of industries such as aerospace, automobile, and building. Technological advances in manufacturing technologies and material science have facilitated the production of composite materials possessing record strength-to-weight ratios with better performance for many applications. Increasing demand for lightweight construction materials for fuel-efficient vehicles and energy-efficient buildings is one of the key drivers for this growth.

Manufacturing companies specialize in producing high-performance equipment that meets stringent standards for application. They spend on green production processes and focus on ensuring stable supply chains to meet the rising demand globally.

End use applications, including aerospace, automotive, and construction industries, focus on low-cost and durable solutions to deliver optimum performance in a wide variety of applications. They require materials that have high effectiveness, comply with environmental legislations, and can be formulated to match a specific operating function.

During the period 2020 to 2024, there was a gradual expansion in product sales due to a rising emphasis on the treatment of organic wastes and achieving sustainable objectives both for residential and business purposes. Waste diversion schemes accelerated, and a number of state governments initiated programs for separating and processing organic wastes.

Consequently, small- to medium-scale equipment sales increased in urban and suburban communities. The agricultural industry also incorporated mechanized equipment to enhance soil quality and minimize the use of synthetic fertilizers. Nevertheless, limitations in automation and odor control remained major obstacles in large-scale deployment, particularly in high-density areas.

From 2025 to 2035, the industry will transform. Autonomous systems with odor management, moisture sensors, and AI-based monitoring will become the standard. Urban vertical composters and community-scale smart composters will become the order of the day as cities manage food waste more proactively.

Agricultural composting will also turn technologically oriented, with drone inputs and soil microbiome monitoring to create optimal compost blends. Financing from policy support and green infrastructure will propel the adoption of such systems in emerging economies, while industry consumers will install modular, closed systems to satisfy stricter environmental rules.

A Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Expansion of organic waste regulation, growth of municipal composting programs | Smart city master planning, policy for sustainability, and agricultural land rejuvenation initiatives |

| Basic mechanical systems with very little automation and monitoring | Artificial intelligence-powered composters, real-time data analysis, odor and moisture control, cloud-based management systems |

| Odor management, slow processing rates, space utilization | High initial investment in smart systems, need for expert operation and maintenance |

| High-speed uptake in North America and some European countries because of favorable regulations | Emergence in Asia-Pacific and Latin America, driven by urban waste management and climate resilience legislation |

| Early adoption of food waste diversion mandates | Sophisticated policy that promotes circular economy, qualification of carbon credits for composting operations |

| Design of windrow or drum-type mobile composters | Modular, small-scale, and smart composting solutions with IoT dashboards and integration with urban agriculture infrastructure |

The industry was valued at approximately USD 5.2 billion but will also face some financial and operational risks in the year 2024. One discouraging factor is quite huge initial capital investment and maintenance costs that are not feasible enough for small-scale contractors and municipal buyers in the poorer areas. The applications have been narrowed in developing economies where the budget is more constrained.

Another serious concern is the lack of trained personnel necessary for maintaining and operating modern composting facilities. Most such systems utilize process controls, real-time monitoring, and temperature and moisture control that demand technological skills. Inadequately trained operators result in reduced efficiency, greater downtime, and poor compost quality.

Supply chain disruption remains an ongoing challenge, particularly in procuring parts such as shredders, blowers, and turn-turning systems. Geopolitical tensions or traffic bottlenecks cause delays and lengthen lead times to increase production, negatively affecting manufacturer reliability.

In the future, one of the main predicted threats is the development of novel waste treatment technologies like anaerobic digestion and vermicomposting. These technologies are being considered for use due to their lower emissions and capacity to produce biogas, which can potentially minimize the need for conventional composting facilities.

Another threat is the expected stricter environmental and operating regulations in Europe and North America. New standards on emissions, noise, and waste treatment processes will necessitate ongoing innovation. Those firms that fail to keep up with these changing standards can risk fines through litigation or being locked out of public procurement contracts.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 6.4% |

| UK | 5.5% |

| France | 5.2% |

| Germany | 5.9% |

| Italy | 4.8% |

| South Korea | 5.7% |

| Japan | 5.1% |

| China | 7.3% |

| Australia-NZ | 5.0% |

The USA will advance at 6.4% CAGR in the forecast period. Increasing waste disposal concerns with landfills and growing regulatory approvals for green farm practices are creating demand for composting equipment. Universal adoption of commercial and municipal composting operations, along with increasing awareness from households and big agricultural operations, has resulted in equipment demand growing from aerators and grinders to in-vessel composters.

Government policies to discourage food and green waste in cities are also driving adoption on a state-by-state basis. The increasing popularity of organic farming and closed-loop waste management is also fueling the application of compost as an organic soil supplement, further driving equipment sales.

Furthermore, technological advancements and automation in equipment design are also improving operating efficiency and minimizing dependence on labor. Equipment manufacturers gain from a mature industry with well-defined environmental mandates.

The UK will be growing at 5.5% CAGR during the forecast period. A strong policy environment favoring environmental sustainability and landfill diversion waste is at the heart of growth. Local governments and farm producers are implementing effective composting practices to achieve national recycling goals and lower greenhouse gas emissions. Demand is especially high for modular and compact systems that are appropriate for urban composting as well as mobile units for farm-based use.

Public and private sector investment in waste management infrastructure has facilitated the installation of both static and dynamic composting systems. Growing attention towards food waste recovery and organic waste valorization has resulted in a bigger number of community-level and industrial composting projects.

Also, there is emerging consumer interest in sustainable gardening and local-scale composting practices, which is driving larger-scale industry participation. With waste reduction and organic farming activities developing further, the UK is likely to witness steady growth in both residential and commercial segments.

France is anticipated to expand by 5.2% CAGR during the study period. France has led the way in applying food waste reduction policies and encouraging organic waste recycling via decentralized composting systems. Government regulations for source separation of bio-waste by municipalities and commercial operators are propelling the demand for high-efficiency composting machinery, particularly for food retailers, hospitality industries, and farm cooperatives.

Urban composting initiatives, along with the growth of zero-waste movements, are bringing about a demand for highly technologically developed systems that use minimal energy and space. Composting machinery is also being used in rural settings increasingly to facilitate organic farming methods, which are increasing under the national agroecology initiative.

Increased awareness of soil health and biodiversity protection is promoting the move towards natural fertilizers, with compost taking a central role. These trends make France a developing but stable industry for composting machinery with urban and agricultural uses.

Germany will grow at 5.9% CAGR throughout the study. Strict environmental regulations and a robust recycling culture in Germany are strong drivers for the demand for composting equipment. Well-established composting infrastructure in municipalities and initiatives to further optimize the processing of bio-waste are driving the use of newer, more efficient systems.

High demand exists for in-vessel systems, rotary drum composters, and automated shredders for use in urban and industrial applications. Organic farming in agriculture is growing, with government subsidies and consumer demand for eco-labeled food.

Compost is a key ingredient in organic fertilizer manufacturing, which is stimulating demand for farm-based composting technology. Germany's focus on technological superiority has also encouraged manufacturers to create low-emission, odor-managed, and energy-efficient composting equipment.

Italy is anticipated to expand at 4.8% CAGR over the study period. The Italian composting equipment industry is driven by a growing demand for decentralized waste treatment solutions and renewed interest in sustainable agriculture practices. While there are centralized composting plants in urban areas, the trend is moving toward community-based and household composting, especially in southern and rural areas.

The farming industry, particularly olive farms and vineyards, is incorporating composting machinery to recycle organic wastes and increase soil quality. Government support under the EU circular economy platform is facilitating compost promotion and equipment uptake by municipalities.

Composting is also being utilized to decrease agricultural runoff and increase carbon sequestration in soils. Although the pace of modernization of infrastructure is different by region, Italy is projected to experience modest and steady expansion due to changing environmental and farm policies.

South Korea is anticipated to expand at a 5.7% CAGR over the study period. South Korea possesses one of Asia's most well-organized systems for recycling food waste, a factor that notably contributes to the demand for compost machinery. National initiatives for home food waste segregation and smart waste bin adoption have paved the way for the development of composting infrastructure.

Hospitality and large institutions are also investing in on-site composting systems to meet waste management regulations. Urbanization and space constraints in landfills make in-vessel and automated composting systems particularly appealing for urban municipalities. In the rural sector, government schemes are persuading farmers to cut chemical fertilizer use and opt for organic compost made from livestock manure and crop residues.

The addition of IoT-based monitoring systems also improves composting process efficiency and traceability, paving the way for digitalization in this sector. South Korea's forward-thinking approach to the environment guarantees sustained momentum in the composting equipment sector.

Japan is projected to grow at 5.1% CAGR over the research period. A high social drive for cleanliness, waste sorting, and environmental protection defines the Japanese industry. Local authorities have established sophisticated waste separation systems, and thus, there exists a high availability of organic waste that can be used for composting.

Household and business composting solutions are constantly in demand, especially where incineration capacity is low or landfill prices are high. Japan's graying agricultural workforce and small land size propel the demand for low-footprint, user-friendly composting machines, particularly in rural and mountainous communities.

Public promotion and assistance by farm cooperatives are helping push equipment adoption within the home as well as agriculture environments. Composting is also regarded as an effective means to recycle supermarket food waste and food processing plant wastes, providing an environmentally friendly substitute for incineration. With changing environmental objectives and a requirement for robust waste management technologies, Japan will continue to be progressively stable.

China's market is likely to expand at 7.3% CAGR over the study period. Being the largest agricultural waste and food scraps producer in the world, China is a huge potential market for deploying composting equipment. National efforts to minimize landfill utilization and forestall environmental pollution have triggered attempts at composting organic waste both at municipal and rural levels.

Government subsidies and pilot programs are encouraging composting as an integral component of waste-to-resource schemes. Sustained urbanization and industrial-scale food processing have increased the demand for high-capacity centralized composting units.

In rural areas, composting machinery is gaining traction to process livestock manure, crop residue, and food waste to develop the soil and practice organic agriculture. As more cities implement mandatory food waste separation laws, demand for intelligent and scalable composting systems is rapidly increasing. China's focus on rural revitalization and sustainable development will fuel high growth.

The Australia-New Zealand market is anticipated to expand at 5.0% CAGR over the period under study. Reforms in waste management and rising environmental awareness are creating a solid foundation for demand for composting equipment in the region. Australia's national waste management policy prioritizes the minimization of organic waste to landfills, promoting both municipal and on-site composting practices.

New Zealand, with a high level of commitment to regenerative agriculture, is implementing composting systems to recycle organic waste and minimize the use of synthetic fertilizers. The regional market is enhanced through the active engagement of local councils, community groups, and agricultural producers.

On-farm composting solutions are increasingly being utilized to transform green waste and animal manure into nutrient-dense compost to enable sustainable land management. Composting has also become more available for educational institutions, residential communities, and institutions due to improvements in equipment design.

With levies on landfills increasing and climate action plans becoming more popular, the Australia-New Zealand market for composting equipment is likely to witness stable and policy-driven growth.

By the year 2025, commercial and residential composting solutions are expected to dominate the industry, accounting for 62% of the overall share, followed by equipment for industrial composting, which is expected to account for 38% of the market.

The increasing consumer awareness of environmental sustainability and interest in reducing food waste are driving the commercial and residential composting segment. More households and small businesses are just starting to invest in home composting solutions for recycling organic waste, thereby reducing their carbon footprint and creating nutrient-rich compost for gardens and landscaping.

Leading companies such as Oklin, well known for their small composting machines such as Oklin OPE2000, provide ecological solutions that can be compact, user-friendly, and highly efficient for urban households.

That Earth Machine is also well-known for giving popular home composter products and enabling households to minimize waste for more sustainable gardening. Yet another example is Green Mountain Technologies, which manufactures the Green Mountain Composter. The product is specially designed for residential and community composting needs.

Industrial composting equipment, on the other hand, is gaining popularity as the industry needs systems that can efficiently process organic waste from food processing, agriculture, and municipalities. The industrial piece of equipment is a scale-specific model, usually used for large-scale composting facilities, mainly for municipalities and waste management companies dealing with waste diversion projects.

An example of companies that deliver really big systems like the Crambo series for shredding and composting massive volumes of organic waste is Komptech, an industrial leader in the industry.

Moreover, Thermo King contains temperature-controlled composting systems utilized in industrial setups to ensure favorable conditions for composting. Other prominent players like SUEZ Recycling & Recovery offer advanced composting facilities, which combine aerobic composting and anaerobic digestion technologies to enhance waste treatment and environmental impacts.

The industry will be significantly affected by the gradually increasing consumer preference for compost bins and compost tumblers. Compost bins are likely to occupy almost 28% of the industry, whereas compost tumblers are anticipated to occupy 27%.

Compost bins remain popular due to their simplicity and affordability; they are the first choice for residential and small-scale commercial composting. They make it easy for people to collect and compost organic waste. A company like The Compost Bin, famous for highly durable yet cheap bins, is well-loved by urban gardeners and eco-friendly folks.

Another example includes Envirocycle, which makes closed composting bins that do not smell and are easy to use; these bins are well-suited to urban settings. They appeal to beginner and expert composters alike due to their simplicity and efficiency.

In contrast to this, compost tumblers are fast gaining popularity as they are easy to use and offer faster composting. The tumbling action ensures that good aeration and mixing of materials happen for quick decomposition. They are quickly becoming a valued product among homeowners as well as small commercial enterprises.

Companies like Yardistry and Lifetime Products manufacture top-notch compost tumblers, always with innovative features that assure uninterrupted composting. Tumbleweed also manufactures rotating compost tumblers specifically designed to simplify the mixing process, allowing users to complete the composting process in half the time.

With their ease of use and the quick, high-quality compost production they afford, tumblers win the hearts of environmentally friendly residential and commercial users.

The industry is characterized by a mix of specialized manufacturers and technology-driven firms focusing mainly on efficient organic waste processing, composting system automation, and sustainable waste management solutions. Some of the prominent companies like Midwest Biosystems, Compost Systems and Green Mountain Technologies are investing in high-capacity aerated static pile systems, windrow turners, and in-vessel composting technologies for the growing demand for robust solutions for waste-to-compost conversion.

Innovation in composting equipment design is one of the major competitive strategies, whereby companies like Kollvik Advanced Composting Solutions and BDP Industries integrate AI-driven monitoring, real-time data analytics, as well as automated aeration controls that optimize for composting efficiency and operational cost considerations. Such companies also broaden their collaborations with municipal authorities, agricultural companies, and industrial waste processors to scale up the adoption.

Sustainability and regulatory compliance are the factors affecting industry positioning. For example, leaders Covestro and Blackhawk Composites engineer eco-friendly composite materials for composting equipment, ensuring long-lasting applications with a minimum carbon footprint. Danner and Ershings, Inc., on the other hand, emphasize customized composting solutions for niche industries such as bio waste management as well as agro-industrial composting.

Strategic alliances are shaping the competitive landscape. Companies with strong R&D capabilities and strategies for regional expansion, with emphasis on Europe and North America, have been leveraging their position in waste reduction solutions and sustainable composting practices. Potential for further technological advancement is anticipated as manufacturers take a keen interest in automation, odor control, and efficient microbial composting processes.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Midwest Biosystems, Inc. | 15-20% |

| Compost Systems | 12-16% |

| Green Mountain Technologies | 10-14% |

| Kollvik Advanced Composting Solutions | 8-12% |

| BDP Industries | 5-9% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Midwest Biosystems, Inc. | Specializes in windrow compost turners and high-capacity composting equipment. |

| Compost Systems | Develops automated in-vessel composting systems with real-time monitoring. |

| Green Mountain Technologies | Focuses on aerated static pile composting for municipal and agricultural applications. |

| Kollvik Advanced Composting Solutions | Offers AI-integrated composting systems with odor control technology. |

| BDP Industries | Provides dewatering and solid-waste composting solutions for industrial applications. |

Key Company Insights

Midwest Biosystems, Inc. (15-20%)

A leader in windrow composting technology, Midwest Biosystems supplies high-efficiency compost turners as well as microbial inoculants for industrial-scale applications.

Compost Systems (12-16%)

Compost Systems is a leader in automated composting systems, which incorporate sensor-controlled aeration for maximum organic waste breakdown.

Green Mountain Technologies (10-14%)

Green Mountain Technologies is the leader in modular and scalable composting technology, with a focus on waste-to-soil conversion for agricultural and municipal purposes.

Kollvik Advanced Composting Solutions (8-12%)

Kollvik innovates with artificial intelligence (AI) based composting technology, boosting automation, energy efficiency, and odor management in industrial-scale composting plants.

BDP Industries (5-9%)

BDP Industries extends its revenue size with combined dewatering and composting systems, addressing large-scale food and bio waste management industries.

Other Key Players

The industry is projected to reach USD 133.3 million by 2025.

The market is anticipated to grow to USD 189.9 million by 2035, driven by the rising demand for efficient organic waste processing in both residential and commercial sectors.

China is expected to record a 6.6% CAGR, reflecting growing investment in sustainable waste management and composting infrastructure.

Commercial and residential composting solutions are at the forefront of the market, driven by increased environmental awareness and government regulations promoting composting practices.

Key players include Midwest Biosystems, Inc., Compost Systems, Green Mountain Technologies, Kollvik Advanced Composting Solutions, BDP Industries, Covestro, Blackhawk Composites, Danner, Ershings, Inc., Wet Technologies, and Advanced Process Technology, Inc.

The segmentation is into commercial/residential composting and industrial composting equipment. Commercial/residential composting includes methods such as composting toilets, German mounds, Ecuador composting methods, sheet composting, vermicomposting, container composting, trench composting, and hot container composting. Industrial composting equipment is divided into aerated static pile composting, windrow composting, in-vessel composting, mechanical & biological treatment, high fiber composting, tunnel composting, and vermicomposting.

The segmentation is into compost containers, compost turners, compost bins, and compost tumblers.

The report covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

Photovoltaic Mounting System Market Growth - Trends & Forecast 2025 to 2035

Air Quality Monitoring Equipment Market Growth - Trends & Forecast 2025 to 2035

Commercial Refrigeration Compressor Market Growth - Trends, Demand & Innovations 2025 to 2035

Dry Washer Market Insights - Demand, Size & Industry Trends 2025 to 2035

Airbag Control Unit Sensor Market Growth - Trends, Demand & Innovations 2025 to 2035

Automated Material Handling Systems Market - Market Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.