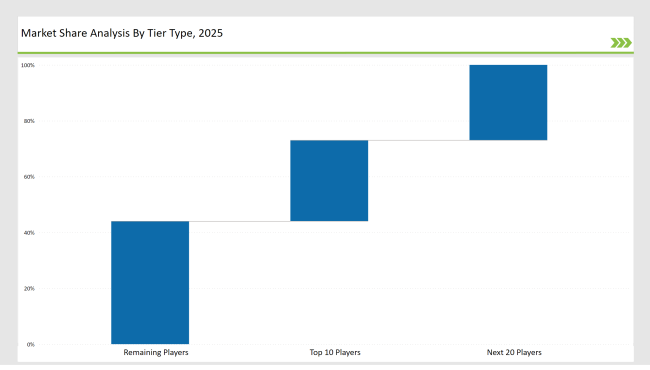

The market for composite cylinders is rising steadily as demand increases for lightweight, high-strength, and corrosion-resistant alternatives to traditional steel cylinders. The industry is tri-stratified according to production capacity and market share. Leading companies such as Hexagon Composites, Worthington Industries, and Luxfer Gas Cylinders dominate 29% of the market, leveraging advanced manufacturing technology, extensive distribution networks, and continuous product innovation.

Tier 2 includes Faber Industrie, Sinoma Science & Technology, and Time Technoplast, which control 27% of the market. These companies serve mid-sized consumers with customized, high-performance composite cylinder solutions. Their competitive advantage is in low-cost production and regulatory compliance. Tier 3 players constitute the remaining 44%, consisting of regional and niche manufacturers with industry-specific applications, such as medical, aerospace, and industrial gases.

Exclusive Offer: 30% Off on Regional Reports

Get a free sample report and customize your regions for a 30% discount on your regional report!

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (Hexagon Composites, Worthington Industries, Luxfer Gas Cylinders) | 15% |

| Rest of Top 5 (Faber Industrie, Sinoma Science & Technology) | 9% |

| Next 5 of Top 10 (Time Technoplast, Ragasco, Aburi Composites, Ullit, Infinite Composites) | 5% |

The composite cylinder market serves various industries, including:

To address evolving industry demands, companies focus on:

Companies are focusing on material innovations that enhance safety, reduce waste and improve extreme conditions use.

The level of investment in AI-driven quality control, automation, and eco-friendly materials increased the level of rivalry among manufacturers. In this regard, companies can increase their research and development intensity into putting forward composite cylinder solutions featuring more efficiency and longer product life. Notably, better techniques enhance the manufacturing process, with reduced production cost and higher consistency in the products. The growing interest in hydrogen storage and alternative fuel-based applications has further shaped the competition.

Check Free Sample Report & Save 40%!

Select your niche segments and personalize your insights for smart savings. Cut costs now!

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Hexagon Composites, Worthington Industries, Luxfer Gas Cylinders |

| Tier 2 | Faber Industrie, Sinoma Science & Technology, Time Technoplast |

| Tier 3 | Ragasco, Aburi Composites, Ullit, Infinite Composites |

| Manufacturer | Latest Developments |

|---|---|

| Hexagon Composites | In March 2024, increased the production capacity for hydrogen storage cylinders. |

| Worthington Industries | In August 2023, developed lightweight LPG cylinders with enhanced safety features. |

| Luxfer Gas Cylinders | In May 2024, focused on sustainable and high-strength composite materials. |

| Faber Industrie | In Nov 2023, introduced innovative NGV applications. |

| Sinoma Science & Technology | In Feb 2024, invested in composite materials for aerospace and defense. |

| Ragasco | In Jan 2024, launched corrosion-resistant LPG composite cylinders. |

| Aburi Composites | In Apr 2024, introduced ultra-lightweight high-pressure cylinders for industrial applications. |

| Infinite Composites | In June 2024, developed smart monitoring technology for hydrogen storage solutions. |

It will be seen through the growth in automation, innovations in materials, and sustainability factors. Companies will incorporate blockchain for enhanced traceability, invest in hydrogen storage solutions, and implement smart monitoring systems for safety and efficiency. Improvements in carbon fiber composites enhance the strength and weight efficiency of cylinders, and emerging aerospace and marine industry applications are spurring further development and market expansion.

Leading players include Hexagon Composites, Worthington Industries, Luxfer Gas Cylinders, Faber Industrie, and Sinoma Science & Technology.

The top 3 players collectively control 15% of the global market.

The market shows medium concentration, with top players holding 29%.

Key drivers include sustainability, automation, material innovation, and regulatory compliance.

Explore Function-driven Packaging Insights

View Reports

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.