The market for composite cardboard tube packaging is experiencing a steady increase due to high demand for green, durable, and customizable solutions. Companies now emphasize eco-friendly materials, new designs, and modern manufacturing processes that meet current consumer preferences as well as environmental regulations. Further growth in this market is contributed to by increased automation, better efficiency, and lower costs due to streamlined production.

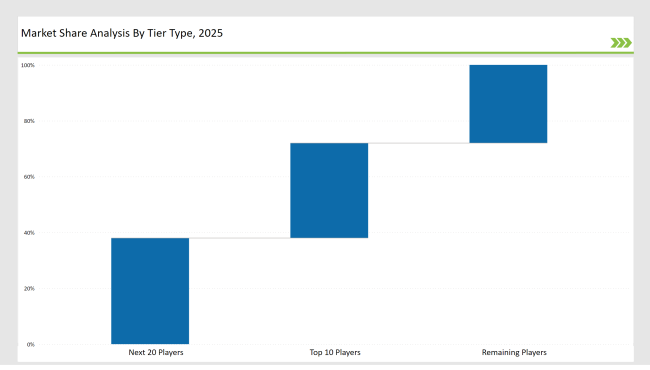

The leading players in Tier 1 have captured 34% of the market. They enjoy the best in class manufacturing technology, powerful distribution networks, and continuous product innovation that ensures a competitive advantage for them.

The Tier 2 players have taken 38% of the market. Mondi Group, CBT Packaging, and Visican are among such players, and they have positioned themselves on the mid-size clients' segment by offering composite tube packaging at an affordable cost and with superior performance and with regulatory compliance.

Tier 3 players include regional and specialized producers, which hold 28% of the market, and have niche markets, such as cosmetics, gourmet food, and premium spirits, where they make a strong mark with regard to custom designs, localized supply chains, and flexible production techniques meeting specific consumer demands.

Explore FMI!

Book a free demo

Global Market Share by Key Players (2025)

| Category | Market Share % |

|---|---|

| Top 3 (Sonoco, Smurfit Kappa, Ace Paper Tube) | 18% |

| Rest of Top 5 (Mondi Group, CBT Packaging) | 10% |

| Next 5 of Top 10 (Visican, Valk Industries, Marshall Paper Tube, Chicago Paper Tube, Nagel Paper) | 6% |

The composite cardboard tube packaging industry serves diverse markets where sustainability, branding, and durability drive innovation. Emerging economies are fueling demand, particularly in premium packaging for consumer goods.

Companies are innovating to improve product functionality, reduce environmental impact, and enhance production efficiency.

More and more manufacturers are using more environmentally friendly materials, automation, and smart packaging solutions to gain an edge in competition. They invest in Research and Development on durability, recyclability, functionality, and more efficient manufacturing methods.

Companies incorporate AI-powered quality control to prevent waste and inconsistency. Innovations in biodegradable materials continually redefine the face of packaging. Industry leaders enter strategic partnerships for faster development of sustainable products.

Year-on-Year Leaders

Technology suppliers should focus on integrating smart features, such as QR codes and NFC-enabled packaging, for enhanced consumer engagement. Additionally, collaboration with raw material suppliers can drive the development of cost-effective, high-performance composite tubes.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | Sonoco, Smurfit Kappa, Ace Paper Tube |

| Tier 2 | HMondi Group, CBT Packaging |

| Tier 3 | Visican, Valk Industries, Marshall Paper Tube, Chicago Paper Tube, Nagel Paper |

Leading manufacturers are expanding production capabilities, adopting sustainable materials, and integrating smart packaging features.

| Manufacturer | Latest Developments |

|---|---|

| Sonoco | Introduced fully recyclable composite tubes with enhanced barrier properties in April 2024 |

| Smurfit Kappa | Expanded production for lightweight e-commerce packaging in June 2024 |

| Ace Paper Tube | Launched luxury-grade composite tubes for premium spirits in May 2024 |

| Mondi Group | Strengthened sustainable packaging solutions for food industry in November 2023 |

| CBT Packaging | Released biodegradable composite tubes for cosmetics in February 2024 |

| Visican | Developed interactive packaging with NFC-enabled tracking in January 2024 |

| Valk Industries | Focused on recyclable protective packaging for industrial applications in March 2024 |

The competitive landscape is evolving as key players prioritize sustainability, automation, and advanced manufacturing techniques to strengthen their market position.

Automation, material innovations, and sustainability will drive growth in the market. Companies will use smart tracking systems, invest in bioplastics, and upgrade protective features in various industries. The increase in post-consumer recycled materials will make the packaging more robust and eco-friendly. Increased demand in the beauty, luxury, and e-commerce sectors will also create more market opportunities.

Leading players include Sonoco, Smurfit Kappa, Ace Paper Tube, Mondi Group, and CBT Packaging.

The top 3 players collectively control 18% of the global market.

The market shows medium concentration, with top players holding 34%.

Sustainability, automation, material innovation, and regulatory compliance shape market trends.

BOPP Film Market Analysis by Thickness, Packaging Format, and End-use Industry Through 2025 to 2035

Korea Tape Dispenser Market Analysis by Material, Product Type, Technology, End Use, and Region through 2025 to 2035

Medical Transport Box Market Trend Analysis Based on Material, Capacity, End-User and Regions 2025 to 2035

Japan Heavy-duty Corrugated Packaging Market Analysis based on Product Type, Board type, Capacity, End use and City through 2025 to 2035

Corrugated Board Market Analysis by Material and Application Through 2035

Waterproof Packaging Market Trends - Demand & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.