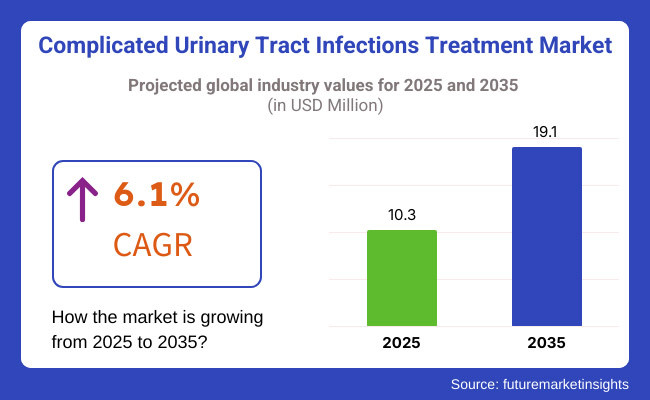

Complicated urinary tract infections (cUTI) treatment market will rise from 2025 to 2035 years because of the growth in incidence rate of antibiotic-resistant bacterial infections, increase in population of age group, and advancement in new antibiotic treatment. Value of the market in 2025 will be USD 10.3 million and will reach up to the maximum of USD 19.1 million in 2035 with 6.1% growth rate in estimated years.

The market is revolutionized by various factors. The strongest driving force is a rising number of patients with complicated urinary tract infection, mostly by drug-resistant pathogens such as Escherichia coli and Klebsiella pneumoniae.

Such patients with co-morbid disease such as diabetes, renal disease, or catheter-associated UTI are at risk of acquiring such infection, and this generates the need for effective treatment as well. But AMR is a massive issue, and the pharmaceutical industry is being compelled to create next-generation antibiotics as well as combination antibiotics against the resistant bacteria.

There are quite well-known drug classes that are prescribed in the case of cUTI and include the beta-lactam drugs, fluoroquinolones, carbapenems, and new combination agents. One such classic combination is ceftolozane/tazobactam as it is highly resistant gram-negative activity. Another such drug that is very potent is meropenem-vaborbactam with wide-ranging activity in candidates who have little left.

Combination therapy is more justified since monotherapy with antibiotics will never cure MDR pathogens. Oral therapy like fosfomycin is only for outpatient treatment and IV therapy with drugs like plazomicin and imipenem-relebactam is still the norm in the inpatient scenario. Host-directed therapy and bacteriophage therapy are emerging and future against AMR infections in cUTIs.

Explore FMI!

Book a free demo

The North American market is a big one for cUTI treatment because of increasing healthcare spending, advanced pharma infrastructure, and MDR rates of bacterial infection. The USA and Canada are plagued by a colossus hospital-acquired UTI epidemic, mainly ICUs and long-term care facilities, where broad-spectrum antibiotics and emerging antimicrobial regimens must be employed.

Greater hospital and healthcare system utilization of antibiotic stewardship programs (ASPs) is revolutionizing the drug treatment process. North American drug companies like Merck & Co. and Pfizer are even providing funding to develop new β-lactamase inhibitors in an effort to fight resistant forms of bacteria.

Initiatives like the United States government's USA CARB-X (Combating Antibiotic-Resistant Bacteria Biopharmaceutical Accelerator) program are accelerating the creation of next-generation antibiotics.

Europe dominates the market for cUTI treatment with the highest contributions from France, the United Kingdom, and Germany. The continent is increasingly being compelled by the regulators to put an end to the abuse of antibiotics, a trend which must be halted by proper diagnosis and optimized antimicrobial therapy.

The Netherlands and Germany are using point-of-care testing (POCT) to avoid the abuse of antibiotics. AstraZeneca and GlaxoSmithKline, global drug firms, are funding studies partnerships to work together on new antimicrobial medicines, including peptide therapeutics and targeted monoclonal antibodies against resistant bacteria.

Asia-Pacific will register the highest market growth for the treatment of cUTI because of growing urbanization, growing antibiotic resistance, and growing population. India, China, Japan, and South Korea are the biggest markets for the treatment of cUTI with antibiotics, and China leads consumption and production.

Growing prevalence of diabetes and chronic kidney disease in India and China is driving risk of recurrent and complicated UTIs, which, in turn, is driving demand for new antibiotic drugs. Abuse and off-counter use of antibiotics in certain markets in Asia, however, are creating MDR strains and need to be tightly regulated for antibiotics.

Indian Council of Medical Research (ICMR) and the Chinese National Health Commission are also establishing antimicrobial surveillance programs to detect trends of drug resistance and expand treatment opportunities.

Challenge: Antibiotic Resistance and Treatment Limitations

The greatest problem unique to the treatment of cUTI is the emergence of antibiotic-resistant bacteria like carbapenem-resistant Enterobacteriaceae (CRE) and extended-spectrum beta-lactamase (ESBL) bacteria. The bacteria undermine the action of the traditional antibiotics to a great degree and result in increased hospital stay and mortality.

Pharma firms have to overcome such huge R&D and regulatory barriers to market new antibiotics. Due to such huge demand for new antimicrobial medicines, no so many firms wish to manufacture antibiotics since profit margins while marketing are slim over curing long-term diseases.

Opportunity: Development of Non-Antibiotic Therapies

The transition from anti-antibiotic treatment is a behemoth market opportunity for cUTI treatment. Scientists are working on bacteriophage therapy, immunotherapies, and probiotic therapy as alternatives to traditional antibiotics. Antimicrobial CRISPR-Cas9-based treatments are also being created that specifically kill and eradicate drug-resistant bacteria without eradicating the remaining microbiota.

In addition, nanotechnology-based drug delivery system innovation is improving existing antibiotics by having lower dosing levels and zero side effects. Use of predictive models developed with the assistance of AI for streamlining clinical practice also enables clinicians to personalize antibiotic therapy according to the patient-specific bacterial strain, thus minimizing unwanted antibiotic use.

From 2020 to 2024, cUTI market paradigm changed with the emergence of new antimicrobial resistance patterns, hospitalization rate growth, and COVID-19 impact on antibiotics. New agents such as cefiderocol and tebipenem HBr introduced new therapies, and AI drug discovery platforms opened doors for next-generation antimicrobial research.

Starting the following decade of 2025 to 2035, there would be several significant trends in the market such as innovation in precision medicine due to the force of genomic sequencing to tailor antibiotic therapy in patients. Bacteriophage and microbiome-modulating therapy as second-line disease management would be more expensive. The rapid diagnostic device will be of mass application as it would be able to give specific and timely treatment for bacterial infection.

Additionally, combination therapy and intravenous (IV) therapy, especially in the medical setting, will see more demand in order to successfully treat serious infections. Lastly, antibiotic stewardship programs will be shared, which may be able to stop the growth of antibiotic resistance and maintain drugs on the market effective. These would drive the health system forward with more focused treatment, more secure infection control, and improved patient outcomes.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory clearances for new urinary tract infection (cUTI) drugs were primarily aimed at new antibiotics against multidrug-resistant (MDR) bacteria. The EMA and FDA granted accelerated approval to various drugs. |

| Technological Advancements | Beta-lactam/beta-lactamase inhibitor and carbapenem-class drug products increased market share. Rapid turnaround diagnosis tests became increasingly popular. |

| Hospital-Acquired Infections (HAI) | cUTIs were a common cause of hospital-acquired infections (HAIs) with increasing rates in catheterized and immunocompromised patients. |

| Multi-Drug Resistance (MDR) Challenges | Increased cephalosporin and fluoroquinolone resistance made the employment of last-line antibiotics inevitable, leading to hospitalization and cost escalation. |

| Outpatient Treatment Trends | Hospital intravenous (IV) therapies dominated treatment approaches, limiting availability and causing healthcare burdens. |

| Environmental Sustainability | Pollution issues due to antibiotic contamination escalated and studies on sustainable production of antibiotics and proper disposal of drug waste began. |

| Production & Supply Chain Dynamics | Supply chain disruption, particularly the COVID-19 pandemic, impacted essential antibiotic and active pharmaceutical ingredient (API) supplies. |

| Market Growth Drivers | Higher incidence of diabetes-associated complicated UTIs, elderly population, and greater use of catheters propelled the market. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Regulatory systems will tighten around antimicrobial stewardship, resistance monitoring, and restricted application of last-resort antibiotics. Governments and healthcare institutions favor emerging antibiotic-free therapies. |

| Technological Advancements | Phage therapy, microbiome, and AI-driven drug discovery progress with accelerating speeds. Nanotech-delivered antibiotics and tailored treatments achieve maximum treatment specificity. |

| Hospital-Acquired Infections (HAI) | Hospital infection prevention protocols emphasize steps such as antimicrobial-coated catheters, sophisticated infection-monitoring devices, and enhanced clinical guidelines to reduce levels of HAI. |

| Multi-Drug Resistance (MDR) Challenges | The market goes to second-line antimicrobial drugs like antimicrobial peptides, bacteriophage therapy, and immunomodulators in order to prevent resistance. |

| Outpatient Treatment Trends | Outpatient and oral treatments increase, such as long-acting injectables and oral broad-spectrum antibiotics, and decrease healthcare expenditure and hospitalization. |

| Environmental Sustainability | Pharmaceutical firms use green chemistry and biomanufacturing technologies for trace levels of antibiotic residues from wastewater, reducing environmental contamination. |

| Production & Supply Chain Dynamics | Investment in local production of antibiotics, diversification of the source of APIs, and application of synthetic biology for the production of antibiotics enable market stability. |

| Market Growth Drivers | Artificial intelligence-based drug discovery, extensive combination therapy, and development of next-generation anti-infectives with new mechanisms of action also drive demand. |

The USA market for the treatment of cUTI is growing due to the increase in the burden of antimicrobial resistance (AMR), hospitalization, and the increased need for the creation of new medicine.

Multidrug-resistant Enterobacterales are a major public health issue as seen by the Centers for Disease Control and Prevention (CDC), and this is financing investment in new antimicrobial medicines. USA healthcare infrastructure is also focusing on outpatient antibiotic treatment and telemedicine-based treatment of UTI in trying to take pressure off hospitals.

The USA market will witness overnight growth in outpatient antibiotic prescriptions, i.e., oral treatment for a longer period, during the next couple of years. Microbiome therapeutics and bacteriophage therapy clinical trials will also drive the market. Rapid diagnostics will have high demand for targeted antibiotic use, resulting in improved outcomes and prevention of antibiotic overuse.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.2% |

The UK cUTI treatment market is a real-time environment, and infection control and antimicrobial stewardship attach gigantic significance. There are stringent regulations devised by the National Health Service (NHS) to prevent abuse of antibiotics, and use of alternative therapies is given strong incentives. The UK's continued investment in phage therapy and artificial intelligence-based drug discovery is providing a window of opportunity for unconventional antimicrobials.

The UK market is also fueled by the growth of outpatient parenteral antibiotic therapy (OPAT) schemes that minimize hospital loads. The trend toward care integration models ensures guaranteed delivery of long-term solution-driven management for patients with chronic cUTI. Government-backed rapid point-of-care diagnosis programs will fuel the treatment efficacy and minimize the emergence of resistance.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 5.8% |

cUTI management in the European continent is regulated by strict antimicrobial resistance (AMR) policy and regulation of antibiotic stewardship guidelines by the European Medicines Agency (EMA). There is a continued increase in organisms of multidrug resistance (MDR) in the European Union, which has pushed the health systems to emphasize new drugs such as bacteriophage therapy and antimicrobial peptide targeting.

Germany, France, and Italy are leaders in clinical trials for next-generation antibiotics and other medication. Hospital groups in these countries are making investment in infection control platforms like AI-powered antibiotic prescribing control platforms and catheter-related infection control platforms. More investment in microbiome-modulating pharmaceuticals will also drive market restructuring.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 6.0% |

The reason why Japan's cUTI treatment market has a rationale lies in its aging population, which is eminently vulnerable to complicated infections. Japan's measures against AMR have been rigorous and included rigorous regulatory actions on broad-spectrum antibiotics and promoting targeted therapy. Japan's pharma giants are relying on the solutions that lie in synthetic biology and nanomedicine to come up with next-generation anti-infectives.

In addition to this, Japanese hospitals are also embracing smart health solutions including infection risk assessment products using artificial intelligence and precise diagnosis equipment. Supporting this is the fact that the nation is also boosting catheter-associated infection prevention activities through the use of biocompatibility products combined with anti-microbial therapy as among the activities in a bid to curb in-hospital acquired UTIs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.9% |

South Korea's pharma market for the treatment of cUTI is expanding with rising cases of multidrug-resistant infections and government support to pharma innovation. South Korea's top biotech companies are heavily investing in synthetic antibiotics and bacteriophage-based drugs to counter AMR challenges.

South Korean investment in precision medicine and artificial intelligence-based drug research enhances the efficiency of treatment. In addition, South Korean hospitals incorporate smart diagnosis platforms with timely and accurate targets of treatment. They are facilitated by governmental agencies for sustainable drug culture with minimal imprinting of the antibiotic traces on the environment to help achieve stability in the long run for the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.1% |

Quinolones are the leaders in the therapy of complicated urinary tract infections (cUTIs) due to their excellent antibacterial activity and effectiveness against resistant microorganisms. Fluoroquinolones such as ciprofloxacin and levofloxacin are commonly most frequently applied for the treatment of cUTIs since they have a good penetration in renal tissue and are excellent bactericidal agents.

They are thus drug of choice in treatment of hospital-acquired infection and multi-drug-resistant (MDR) bacteria infection, e.g., Escherichia coli and Klebsiella pneumoniae. Quinolones remain drug of first line for now, no matter how apprehensive one gets regarding side effects and potential antimicrobial resistance in the future.

European nations and the USA still enjoy unitary demand for the drugs since they are at their rightful place in therapeutic regimens between cUTIs, in the form of complex pyelonephritis or urosepsis. High rates of drug-resistant infection in the Asia-Pacific region have further stimulated demand for quinolones, solidifying their position in the global market.

Cephalosporins are a market leader in the treatment of cUTI, e.g., third- and fourth-generation cephalosporins cefepime and ceftriaxone. Cephalosporins are preferred in first-line inpatient treatment for their outstanding Gram-negative bacteriostasis, e.g., for MDR Enterobacteriaceae.

Growing numbers of extended-spectrum beta-lactamase (ESBL)-producing pathogens have raised the demand for beta-lactamase inhibitor-containing cephalosporins such as ceftazidime-avibactam.

Growing numbers of catheter-associated urinary tract infections (CAUTIs) have raised the demand in Europe and North America for inpatient use of cephalosporins. Antimicrobial stewardship programs are implemented to maintain the drug use in check while ensuring that the drug is effective against resistant pathogens.

Inpatient facilities provide the greatest percentage of cUTIs drug dispensing, as evidenced by the predominant hospitalization rates with complicated and recurrent infections. Intravenous drugs like carbapenems and cephalosporins are dispensed in the greatest percentage in inpatient facilities and used in therapy of the majority of cUTIs. Hospital-acquired UTIs (HAUTIs), particularly in the ICU, deserve inpatient treatment through inpatient facilities.

With increasing numbers of patients infected by MDR bacteria, North American and European antibiotic stewardship hospital-based programs have become more restrictive, regulating drug supply. On top of growing patient admissions of elderly patients that drive surgical-site infections further positions hospital pharmacies as a key force in this specialty.

Gynecological and urology clinics are of the highest importance in cUTIs treatment innovation, particularly recurrent and concomitant with an underlying urologic disorder. Complications of UTI selectively influence women due to anatomy and postmenopausal physiology status, and gynecology clinics are an important channel of selective cures.

There are urology clinics that offer treatment for neurogenic bladder disease causing chronic infection, structural disease, or kidney stones. These doctors do not write long courses of antibiotics or combination therapy depending on the patient's resistance pattern. With increased expenditure on outpatient centers, such a distribution channel is ready for steady growth, particularly in health infrastructure-abundant economies like the United States and Western Europe.

Retail pharmacies and drug stores have a great market share for the treatment of cUTIs due to the fact that oral antibiotics are used to treat mild to moderate infection. Penicillins, azoles, and nitrofurans can easily be found in such drug stores, especially for repeated use for infection administered on an outpatient basis to the patients.

Retail pharmacies in emerging nations are accessible channels for retail sale of antibiotics, and there is not strict prescribing. This has favored traditional antibiotics such as nitrofurantoin and fosfomycin that are prescribed for simple infections but not for complex infections too. Regulation on over-the-counter availability of antibiotics, particularly in emerging nations, can impact future growth of the segment.

The developed cUTI Treatment Market is a battlefield where global pharma multinationals and new start-up biotechs fight to introduce innovation in antimicrobial drugs. Some market leaders have giant market shares waiting for new antibiotics products, combination therapies, and precision medicine technology to be introduced.

The firms want more efficacy against multiresistant microorganisms, fewer regulatory approvals, and more market coverage through collaborations. The sector includes established drug firms and emerging biotech firms, both of which will be responsible for the future of the sector.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Pfizer Inc. | 14-18% |

| Merck & Co., Inc. | 12-16% |

| Shionogi & Co., Ltd. | 9-13% |

| Cipla Ltd. | 6-10% |

| Wockhardt Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Pfizer Inc. | Commercializes and markets ceftolozane/tazobactam (Zerbaxa), an antimicrobial dual combination drug for multidrug-resistant Gram-negative infections, with broader indications and additional clinical trials. |

| Merck & Co., Inc. | Develops imipenem/cilastatin/relebactam (Recarbrio), a new-generation carbapenem-class product for cUTIs. Invests in hospital-based therapy and antimicrobial resistance research. |

| Shionogi & Co., Ltd. | Unveils cefiderocol (Fetroja), a siderophore cephalosporin for carbapenem-resistant pathogens. Unveils partnerships with infectious disease research institutes. |

| Cipla Ltd. | Offers wide-spectrum antibiotics like fosfomycin and nitrofurantoin with a focus on affordability and accessibility in the growing markets. |

| Wockhardt Ltd. | Committed new antibiotics like FDA-approved EMROK (levonadifloxacin) to eradicate drug-resistant bacterial infection. Guided antimicrobial research from India-based. |

Key Company Insights

Pfizer Inc. (14-18%)

Pfizer Inc. leads internationally in the cUTI treating market with its ceftolozane/tazobactam (Zerbaxa) and is widely used in resistant infections. It spends heavily expanding its clinical trials to get extra regulatory clearances for more indications. Having good manufacturing and distribution networks, Pfizer is omnipresent across the world, ranging from hospital to out-of-hospital environments.

Merck & Co., Inc. (12-16%)

Merck & Co., Inc. is a market incumbent with existing cUTI market presence and brand equity for its carbapenem therapy, imipenem/cilastatin/relebactam (Recarbrio). Merck collaborates intensively with international health organizations to combat antimicrobial resistance. In hospital-acquired infections and real-world evidence integration, Merck is next-gen antibiotic solutions.

Shionogi & Co., Ltd. (9-13%)

Shionogi & Co., Ltd. is renowned for cefiderocol (Fetroja), a first-in-class siderophore cephalosporin specifically designed to treat drug-resistant Gram-negative bacteria. The company partners with research institutions worldwide to enhance antibiotic stewardship and optimize treatment strategies. Shionogi’s expansion into the USA and European markets underscores its global ambitions.

Cipla Ltd. (6-10%)

Cipla Ltd. is a pioneer among low-cost antibiotic manufacturers and producers to the market, which supply life-saving drugs like fosfomycin and nitrofurantoin. Cipla has a record of increasing access to emerging economies and creating supply chains for life-saving antibiotics. Its research emphasis on generic and new drugs positions Cipla in the forefront of antimicrobial therapy.

Wockhardt Ltd. (4-8%)

Wockhardt Ltd. is a supporter of antimicrobial research, particularly in tackling the problem of resistant infections. Its newly introduced pharmaceutical drug EMROK (levonadifloxacin) is used to treat resistant infections, difficult-to-treat infections, i.e., resistant pathogen-induced infections. Wockhardt's dedication to India's future challenge of antimicrobial resistance and forays in international markets positioned it for massive market growth.

Other Key Players (45-55% Combined)

Beyond these dominant companies, several emerging players contribute to innovation, affordability, and accessibility in cUTI treatments. These include:

The global Complicated Urinary Tract Infections treatment market size was valued at USD 10.3 million in 2025.

The Complicated Urinary Tract Infections treatment market is projected to reach USD 19.1 million by 2035.

The increasing prevalence of drug-resistant bacteria, overuse of antibiotics, and the rise in research and development activities are expected to fuel the demand for Complicated Urinary Tract Infections treatments during the forecast period.

The top 5 countries driving the development of the Complicated Urinary Tract Infections treatment market are the United States, Germany, France, Italy, and Spain.

On the basis of drug class, Quinolones are highly effective antibiotics in treating urinary tract infections (UTIs) worldwide.

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.