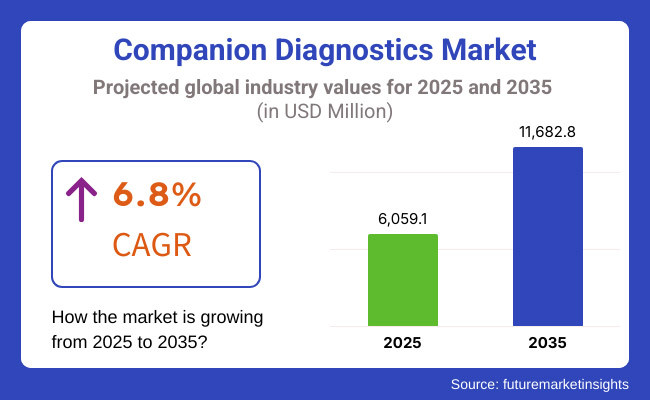

The global market for companion diagnostics is forecasted to attain USD 6,059.1 million by 2025, expanding at 6.8% CAGR to reach USD 11,682.8 million by 2035. In 2024, the revenue of this market was around USD 5,700.5 million.

With the increasing demand for personalized medicine, the Companion Diagnostics (CDx) market is poised for a strong rise. intensifying investment in targeted drug development by pharmaceutical companies thanks to the increasing demand for personalized medicine is another reason for the expected growth of the CDx market.

Since these tumors would be expected to have a higher possibility of response to certain levels of therapy, Companion Diagnostic tests are meant to identify these subgroups. Other driving factors in CDx adoption are rising cancer incidence and chronic conditions, with a level of optimization being sustained in treatment choice and enhanced patient outcomes. Beyond that, authorities such as the FDA and the EMA are encouraging companion diagnostics to accompany new drug approvals, which stimulates market adoption.

Advances in technology on NGS, liquid biopsy, and AI-driven diagnostics are driving additional expansion within this market. These technologies enable companion diagnostics to become faster, cheaper, and precise. This will pave the way for their application in other, possibly broader clinical fields such as neurology or infectious diseases. Plus, co-developing tests with drug companies will create some innovations and will increase accessibility and use for these tests.

In the future, among the promotion of disease-management applications of CDx, more multi-gene panels are expected to find amplification in the market within broad usage. Fields such as theranostics and digital pathology will emerge in further refinement of precision medicine, confirming the presence of companion diagnostics as key players in next-generation healthcare. Continuously evolving this type of landscape will be the driver for sustained market growth.

Companion Diagnostics (CDx) market grew with the shift in disease diagnosis and treatment due to precision medicine. CDx came into prominence as early biomarker-based tests started guiding specific therapies, especially oncology. The tests allowed patients to be matched to treatments based on genetic and molecular profiles to improve clinical decision-making

Regulatory bodies proposed guidelines to marry diagnostics with drug approvals, and this enhanced market uptake. Advancements in next-generation sequencing (NGS) and liquid biopsy enhanced CDx testing accuracy and accessibility. The market, initially focusing on cancer, subsequently expanded to neurology and infectious diseases for CDx uses.

Pharmaceutical and diagnostic companies formed partnerships to create multi-biomarker tests and improve the accuracy of treatment. The partnerships spurred innovation and set the stage for a more individualized healthcare system.

Explore FMI!

Book a free demo

North America is the market leader in companion diagnostics due to its strong healthcare system, presence of major industry players, and complete adoption of precision medicine. Regional growth is led by the USA with increased FDA approvals allowing the co-development of companion diagnostics with precision therapies. Biomarker-led drug development remains attractive for pharma companies, with genomic testing programs making precision medicine more accessible.

The use of next-generation sequencing (NGS)-based companion diagnostics in cancer is on the rise, enabling more accurate treatment choice. Diagnostic solutions based on artificial intelligence are also picking up pace, enhancing test efficacy and accuracy. These developments notwithstanding, high costs of tests and reimbursement issues restrict broader use.

Cooperation between drug companies and diagnostics developers remains robust, promoting innovation. Regulatory bodies are broadening frameworks to accommodate precision medicine, whereas direct-to-consumer genetic testing is boosting patient knowledge and demand. These aspects will propel continued market expansion in North America.

Europe is a prime force behind the companion diagnostics market through supportive government policies, rising adoption of personalized medicine, and technical developments in molecular diagnostics. Robust healthcare expenditures in Germany, France, and the UK drive growth with extensive biomarker testing in cancer therapy.

Though these benefits, regulatory intricacies in the European Medicines Agency (EMA) and reimbursement issues for diagnostic tests hinder market growth. Companies have to maneuver different approval procedures in countries, which affects product availability. Nevertheless, growing investment in next-generation sequencing (NGS) and the growing use of multi-gene panel testing are enhancing diagnostic capacity.

Clinical trials that involve companion diagnostics are increasing, solidifying the market's position in precision medicine. Partnerships among biotech companies and healthcare providers also increase access to advanced diagnostics. With advances in technology and evolving regulatory environments, Europe will see consistent growth in the companion diagnostics market.

Asia-Pacific companion diagnostics market is expanding strongly because of increasing incidence of cancer, growing healthcare infrastructure, and investment in genomics medicine. China, India, and Japan are major markets, where there is government promotion of biomarker-guided drug development and growing demand for targeted therapies.

In spite of this increase, difficulties including a lack of standardized regulation, cost concerns, and low awareness in some areas hinder adoption. Inconsistency in what countries require to be regulated complicates market entry for diagnostic developers. Nevertheless, rising global presence of pharmaceutical firms and local diagnostic laboratory expansion are enhancing market accessibility.

Innovation is accelerating with the use of AI in molecular testing and growing use of liquid biopsy-based companion diagnostics. Government-funded genomic research programs also support market growth, increasing access to precision medicine. With changing regulatory environments and healthcare investment, Asia-Pacific will become a major contributor to companion diagnostics.

Challenges

Lack of reimbursement is limiting the growth of the market

Reimbursement is among the biggest impediments to the adoption of companion diagnostics. Most healthcare systems lack defined policies for reimbursement of these tests, and hence uncertainty of cost exists for patients and providers alike.

Companion diagnostics are based on state-of-the-art technologies like next-generation sequencing (NGS) and liquid biopsy, which are expensive to buy equipment, test, and trained personnel and are thus expensive. In the absence of proper reimbursement, the tests become extremely costly for most patients, and precision medicine becomes out of reach.

Pharmaceutical firms and diagnostic companies have difficulty getting reimbursement approvals because payers need very strong proof of clinical value and cost savings. The prolonged approval process only delays market acceptance further. Where there are decentralized healthcare systems, reimbursement policies become very diverse and create challenges in helping companies come up with stable pricing strategies.

In response to this, stakeholders are advocating for standardized reimbursement models and illustrating the long-term value of companion diagnostics in optimizing treatment outcomes and lowering total healthcare expenses.

Opportunities

Expanding application beyond oncology present lucrative growth opportunity

The strongest opportunities within the companion diagnostics market will lie in growing uses beyond oncology. Companion diagnostics have been largely applied in cancer therapy until now; however, applications in other classes of therapies are growing very quickly. Some emerging areas of use include neurology, cardiology, infectious disease, and autoimmune disease, where biomarker-based diagnostics would potentially enhance the accuracy of treatments.

For instance, in neurology, companion diagnostics may tell which patients would be expected to respond to targeted therapies of Alzheimer's and Parkinson's disease. For infectious diseases, such tests could optimize the use of antiviral and antibiotic therapy for better patient outcomes and lower rates of drug resistance. Furthermore, NGS and artificial intelligence-based diagnostics are increasingly broadening the application of companion diagnostics into multiple disease states.

The requirement for companion diagnostics will increase as pharmaceutical companies invest in biomarker research outside oncology. This diversification presents a huge market growth and innovation opportunity in precision medicine.

The years 2020 to 2024 saw the companion diagnostics market thriving due to increasing demands in personalized medicine and advancement in molecular diagnostics. For cancerous patients, the morbidity numbers and greater government backing for biomarker-driven drug development have further increased the demands for companion diagnostics.

All clinical technologies, such as advanced next-generation sequencing (NGS) and liquid biopsy, have enhanced the accuracy and efficiency of diagnostic testing, leading to glamorous treatment outcomes. But they are also major impediments to mass adoption because of the great costs, reimbursement issues, and regulatory burden.

Fast forward to 2025 to 2035, and the market would thrive on advances in AI-based diagnostics, multi-gene panel testing, and liquid biopsy-based tests for precision medicine. Adoption of companion diagnostics alongside new drug launches would too grow, coupled with support from changing regulatory frameworks.

Increasing focus on genomic medicine and direct-to-consumer genetic testing would also increase demand. Interfirm collaboration among pharmaceutical and diagnostic firms would spur innovation and increased access to advanced diagnostics services, especially in developing countries.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Emphasis on safety and efficacy of companion diagnostics, with regulatory bodies facilitating approvals for tests linked to targeted therapies. |

| Technological Advancements | Adoption of NGS and PCR technologies enhancing the precision of diagnostic tests, enabling better patient stratification for targeted treatments. |

| Consumer Demand | Increased awareness leading to higher demand for personalized medicine approaches, with patients seeking treatments tailored to their genetic profiles. |

| Market Growth Drivers | Rising prevalence of chronic diseases, substantial investments in research and development, and supportive governmental policies promoting innovation in diagnostics. |

| Sustainability | Initial efforts towards eco-friendly manufacturing processes and reducing the environmental impact of diagnostic test production. |

| Supply Chain Dynamics | Reliance on established distribution networks, with a focus on ensuring the availability of diagnostic tests in urban and peri-urban healthcare facilities. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Implementation of comprehensive guidelines for AI-integrated diagnostics, ensuring standardized protocols and data security measures. |

| Technological Advancements | Integration of AI and machine learning to improve diagnostic accuracy and predictive analytics, development of multiplexed assays capable of detecting multiple biomarkers simultaneously. |

| Consumer Demand | Growing preference for comprehensive diagnostic solutions that offer rapid and accurate results, facilitating timely and effective treatment decisions. |

| Market Growth Drivers | Expansion into emerging markets with improving healthcare infrastructures, increased focus on early disease detection and prevention, and strategic partnerships between pharmaceutical companies and diagnostic developers to co-develop therapies and diagnostics. |

| Sustainability | Comprehensive adoption of sustainable practices, including the use of biodegradable materials, energy-efficient manufacturing processes, and initiatives aimed at minimizing waste associated with diagnostic testing. |

| Supply Chain Dynamics | Optimization of supply chains through digital technologies and e-commerce platforms, enhancing transparency, efficiency, and accessibility, ensuring timely delivery of diagnostic tests to a global patient population, including those in remote and underserved regions. |

The companion diagnostics market in the United States is experiencing robust growth, driven by the increasing adoption of personalized medicine and advancements in targeted therapies.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.0% |

Market Outlook

Germany's companion diagnostics market is set for steady growth, supported by a well-established healthcare system and ongoing research in personalized medicine.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.5% |

Market Outlook

China's companion diagnostics market is poised for significant expansion, driven by increasing healthcare investments and a rising focus on precision medicine.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.7% |

India's companion diagnostics market is experiencing robust growth, attributed to increasing disease awareness and improvements in healthcare infrastructure.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.1% |

Brazil's companion diagnostics market is expanding, driven by increasing healthcare investments and a growing focus on personalized medicine.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 7.0% |

Breast cancer are expected to dominate the market due to high number of cases of breast cancer

Breast cancer is the dominant segment in the companion diagnostics market because of its incidence and increasing emphasis on personalized treatment. As breast cancer is one of the most common cancers in the world, precision medicine demand is high. Companion diagnostics serve to identify the appropriate patients for targeted therapies, like HER2-positive therapies, to achieve higher treatment response and reduce side effects.

Growing utilization of biomarkers in treatment decisions in breast cancer and improvement in technologies such as next-generation sequencing (NGS) has propelled the market further. Further, support from the regulators to couple companion diagnostics with approval for new drugs in the treatment of breast cancers has speeded up the adoption process, thus being a foremost application within the field.

Lung cancer segment holds the second largest share due to high demand for diagnostic solution for lung cancer

This has emerged as the second largest market in companion diagnostics because of increasing mortality and growing need for targeted therapies on the lungs. Lung cancer has emerged as one of the most prevalent and aggressive cancers globally, and treatment has become extremely challenging, and therefore precision medicine becomes increasingly important.

Companion diagnostics assist in finding particular genetic mutations like EGFR, ALK, and ROS1, thus facilitating the more efficient use of targeted therapy and immunotherapy. Companion diagnostics assist doctors to select the optimal treatment for better patient outcomes.

The increased adoption of NGS and liquid biopsy technology has boosted the mutation detection rate for lung cancers with further increasing demand for companion diagnostics. With increasing research and regulatory backing, lung cancer thereby becomes a prime candidate for innovation in companion diagnostics.

The molecular diagnostics segment will dominate the market as it is most commonly used technology

Molecular diagnostics is the biggest technology employed in the companion diagnostics market, and it is good at sensitivity and specificity for detecting predictive biomarkers and genetic mutations. Real-time PCR, next-generation sequencing (NGS), and in-situ hybridization techniques fall under this segment that is imperative to the administration of targeted therapies for cancers such as breast, lung, and colorectal cancer.

The growing use of precision medicine, increasing demand for NGS-based multi-gene panels, and increasing use of molecular diagnostics in clinical trials for new targeted therapies are driving market growth. North America and Europe lead in molecular diagnostic adoption, whereas Asia-Pacific is experiencing robust growth because of rising access to genomic testing and increasing regulatory support for companion diagnostics. Predictions for the future are AI-aided interpretation of genomic data, cloud-platform molecular diagnostics, and real-time liquid biopsy to monitor cancer perpetually.

Immunohistochemistry is also a key segment as it is heavily used for breast and lung cancer detection.

Although Immunohistochemistry (IHC) is the gold standard for companion diagnostics, protein biomarkers such as HER2, PD-L1, and hormone receptors in cancer tissues are in fact the preferred ones. The technology is actually a favored instrument for the diagnosis and treatment planning of monoclonal antibody treatments and immune checkpoint inhibitors in breast, lung, and gastric cancers.

Wide adoption of immunotherapy, coupled with demand for automated IHC platforms and increasing use of digital pathology for IHC assessment, drives market growth. North America and Europe lead the market for IHC-based companion diagnostics, while growth in Asia-Pacific is high, owing to increased investment in pathology infrastructure.

Advances in the near future include AI-assisted IHC analysis intending towards precise quantification of biomarkers, multiplex IHC assays for providing simultaneous detection of biomarkers, and the integration of computer-assisted image-based pathology for improved diagnostic precision.

The competing market for companion diagnostics is fueled by a growing need for personalized medicine, advances in biomarker discovery, and the regulatory backing of precision therapies. Companies invest in NGS, liquid biopsy technologies, and AI-based diagnostic platforms to remain competitive. The market is influenced by established diagnostic companies, pharmaceutical collaborations, and new biotech innovators, all of which serve to make companion diagnostics a dynamic arena.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| F. Hoffmann-La Roche AG | 18.7% |

| Qiagen Ltd. | 8.6% |

| bioMérieux Inc. | 11.8% |

| Abbott | 14.1% |

| Thermo Fisher Scientific Inc. | 8.1% |

| Other Companies (combined) | 38.6% |

| Company Name | F. Hoffmann-La Roche AG |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Expanded its companion diagnostics portfolio by launching novel biomarker tests for oncology, enabling better-targeted therapies in breast and lung cancer |

| Company Name | Qiagen Ltd. |

|---|---|

| Year | 2025 |

| Key Offerings/Activities | Introduced a next-generation liquid biopsy platform for early cancer detection, improving non-invasive diagnostic capabilities and supporting personalized treatment approaches. |

| Company Name | bioMérieux Inc. |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Launched a new molecular diagnostic system to enhance the detection of infectious diseases, offering faster, more accurate results for precision treatment in oncology and infectious disease management. |

| Company Name | Abbott |

|---|---|

| Year | 2024 |

| Key Offerings/Activities | Developed a new companion diagnostic test integrating advanced molecular technologies for precision medicine, focused on oncology and autoimmune disease management. |

Key Company Insights

F. Hoffmann-La Roche AG (18.7%)

F. Hoffmann-La Roche is a leader in personalized medicine and companion diagnostics solutions that aid in the development of targeted therapies, primordially in oncology. The company is strictly committed to linking molecular diagnostics with treatment options to enhance patient care through the precise identification of biomarkers. Roche continues to ameliorate its product portfolio, augmenting its liquid biopsy and genomic analysis capabilities, propelling precision medicine through non-invasive, accurate, and cost-effective diagnostic solutions.

Qiagen Ltd (8.6%)

Molecular diagnostics and lab solutions form the backbone of Qiagen, with groundbreaking biomarker detection in their application for oncology, infectious diseases, and other precision medicine principles. The company develops a great number of diagnostic assays and platforms focusing primarily on next-generation sequencing and PCR technologies. Qiagen is highly committed to expanding its pipeline of tests for liquid biopsies for early disease detection and enhancing patient stratification for targeted treatments in oncology as a major competitor in the diagnostics market.

bioMérieux Inc (11.8%)

BioMérieux is a market leader in vitro diagnostics, with core expert functions in molecular diagnostics of infectious diseases, oncology, and chronic diseases. Its diagnostic platforms, including PCR-based tests, are well applied in identifying biomarkers for different cancers. BioMérieux keeps pushing the frontiers with emerging diagnostic technologies by incorporating AI and automation to make the tests more efficient and accurate. The growth of its diagnostic solutions for precision oncology and infectious disease forms the fulcrum on which its fortune in the companion diagnostics market hinges.

Abbott (14.1%)

Abbott is a key player in the companion diagnostics arena, developing cutting-edge molecular diagnostics in oncology, cardiology, and infectious diseases. Abbott commands great respect for the high-value biomarker assays and the surgical relations between their diagnostic platforms, which allow early detection and management of cancers and other diseases. Abbott keeps expanding its know-how in genetics.

Beyond the leading companies, several other manufacturers contribute significantly to the market, enhancing product diversity and technological advancements. These include:

The global companion diagnostics industry is projected to witness CAGR of 6.8% between 2025 and 2035.

The global companion diagnostics market stood at USD 5,700.5 million in 2024.

The global companion diagnostics market is anticipated to reach USD 11,682.8 million by 2035 end.

China is expected to show a CAGR of 7.7% in the assessment period.

The key players operating in the global companion diagnostics industry are F. Hoffmann-La Roche AG, Qiagen Ltd., bioMérieux Inc., Abbott, Thermo Fisher Scientific Inc., Myriad Genetics Inc., Dako Inc., Biogenex Laboratories, Inc., ARUP Laboratories, Ventana Medical Systems Inc., Leica Biosystems Nussloch GmbH and others.

assay, kits & reagents and software and services

immunohistochemistry, molecular diagnostics, in-situ hybridization, real time PCR, and gene sequencing

colorectal cancer, breast cancer, lung cancer, melanoma, urology, and gastric cancer

pharma and biotech companies, clinical research organizations, reference laboratories and others

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa

CGRP Inhibitors Market Trends - Growth, Demand & Forecast 2025 to 2035

Indolent Systemic Mastocytosis treatment Market Insights: Size, Trends & Forecast 2025 to 2035

Intraoperative Fluorescence Imaging Market Report - Demand, Trends & Industry Forecast 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Polymyxin Resistance Testing Market Analysis by Product, Testing Methods, End User, and Region - Forecast for 2025 to 2035

Procalcitonin (PCT) Assay Market Analysis by Component, Type, and Region - Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.