During the period from 2025 through 2035 the Compact Utility Vehicles Market will demonstrate consistent growth because construction operators and agricultural producers and landscapers and municipal services companies expand their demand.

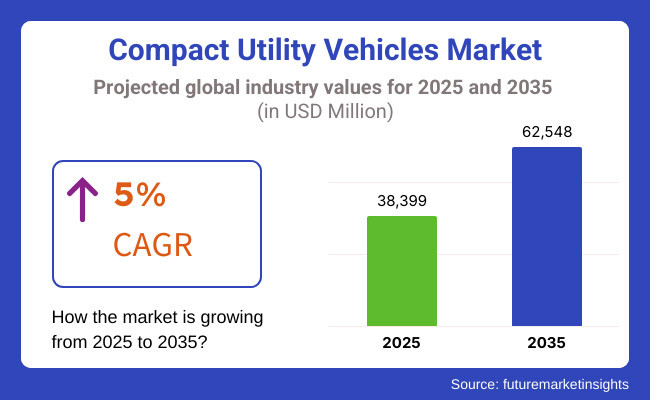

The market popularity of these vehicles continues to rise because they offer versatility alongside excellent durability features together with their ability to work in limited space areas. The forecast reveals that this market sector will expand from USD 38,399 Million in 2025 to USD 62,548 Million by 2035 while maintaining a compound annual growth rate (CAGR) of 5%.

The market continues to grow because small-scale operations prioritize mechanization and electric and hybrid utility vehicles are seeing advancements. Market demand is increasing because private and public entities continue to raise their investments in infrastructure development and municipal maintenance projects.

The market growth faces barriers from high purchase expenses as well as maintenance issues and new emissions guidelines. Manufacturers work to enhance fuel economy rates and implement modern control technologies as well as develop electric fleet options to satisfy customer expectations.

Compact Utility Vehicles Market Overview The compact utility vehicles market is further classified based on vehicle type and end-user applications. The four major equipment types are skid steer loaders, compact track loaders, utility task vehicles (UTVs), and mini excavators. Skid steer loaders and compact track loaders hold a significant share of the construction and agriculture sector for their high-performance capacity and manoeuvrability, while UTVs are carving their place in outdoor recreational and municipal applications.

Construction is the largest end-use industry segment for compact utility vehicles in terms of revenue, as these vehicles are employed for surface preparation, waste handling, and excavation. The agriculture industry uses these vehicles to manage farms, transport crops and maintain fields. Municipal services, as well, use compact utility vehicles for snow removal, landscaping and urban maintenance, which helps drive demand.

Explore FMI!

Book a free demo

Compact utility vehicles-North America is a key market, due to its established construction sector, strong agricultural activities and increasing use for municipal services. EVs, hybrids gaining popularity in North America as emissions standards tighten and fuel costs rise. The scope of the report includes insights on advancements in autonomous vehicle technologies and smart control systems that are transforming market dynamics.

A large chunk of the compact utility vehicles market is accounted for by Europe due to stringent emission specifications, increasing mechanization in agriculture, and the growing number of urban development projects.

Compact electric utility vehicles are also top of the sales list in Germany, France and the UK, compliance with EU sustainability targets. The technology is advancing and the manufacturers are encouraged to develop solution models that are power and fuel efficient, and can perform multiple tasks at once.

The Asia-Pacific market for compact utility vehicles is expected to be the fastest-growing segment due to rapid industrialization, improving infrastructure, and expanding agricultural activities.

In countries such as China, Japan, India, and Australia there is a growing demand for multipurpose machines in farming, mining and municipal applications. Moreover, the expansion of the market in the region is backed by government incentives for sustainable farming equipment and orders for urban development projects.

Challenge

High Production Costs and Supply Chain Disruptions

Rising raw material prices, semiconductor shortages, and global supply chain disruptions are driving up production costs for the CUV manufacturers. The continuous demand for fuel-efficient, technologically-advanced and sustainable vehicles have prompted the car makers to integrate high-performance components, hybrid powertrains and advanced safety features that have added to the cost.

Logistical issues also continue to cause challenges, with transport bottlenecks and rising fuel prices both affecting vehicle availability and pricing. By doing so, businesses will need to produce locally, obtain materials from suppliers in their areas and refine production practices to be more efficient and lower the prices to be suitable for consumers.

Opportunity

Rising Demand for Fuel-Efficient and Electric CUVs

The general trend toward fuel efficiency and electrification creates a large opportunity for growth within the compact utility segment. With flaring fuel prices, EV government incentives and an increase in environmental awareness, consumers are increasingly prioritizing hybrid and electric CUVs. Companies that try lightweight materials, streamline their designs, or are able to enhance battery technology will get ahead of the pack.

As charging infrastructure expands and range efficiency continues to improve, consumer confidence in electric CUVs will rise. Versatile, tech-integrated and energy-efficient models will contribute to these brands targeting this expanding market segment.

The story of the compact utility vehicle segment from 2020 to 2024 is one of explosive growth, polling more than a hundred thousand sales by consumers who prefer practicable, fuel-efficient cars. Several manufacturers started offering hybrid and mild-hybrid variants, and safety and connectivity features advanced and broadened the overall market appeal. But challenges arose due to supply chain constraints, semiconductor shortages and rising materials costs.

Fully electric CUVs from 2025 to 2035 the market will move significantly toward fully electric and autonomous CUVs, with advanced battery technology, vehicle-to-grid (V2G) integration, and AI-driven assistive driving. The increasing emission regulations, along with push for sustainable practices worldwide, will only speed up this transition to zero-emission compact utility vehicles.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Vehicle Electrification | Hybrid which Hybrid CUVs to full electric cars |

| Fuel Efficiency & Emission Standards | Stricter fuel economy standards encouraged mild-hybrid adoption. |

| Autonomous & Smart Features | Deployment of advanced driver-assistance systems (ADAS) and connected vehicle technologies. |

| Battery Technology & Charging Infrastructure | Sparse fast-charging network and average battery efficiency. |

| Consumer Preferences | Shift from sedans to compact utility vehicles for fuel efficiency and versatility. |

| Manufacturing & Supply Chain | Dependence on traditional supply chains led to production bottlenecks. |

| Regulatory Landscape | Gradual tightening of fuel efficiency regulations and incentives for hybrids. |

| Market Shift | 2025 to 2035 |

|---|---|

| Vehicle Electrification | Widespread adoption of fully electric CUVs with extended range and faster charging capabilities. |

| Fuel Efficiency & Emission Standards | Zero-emission mandates push full electrification and hydrogen fuel cell alternatives. |

| Autonomous & Smart Features | An AI-powered self-driving CUV connected with V2I and smart city. |

| Battery Technology & Charging Infrastructure | Advanced solid-state batteries with longer range and rapid charging infrastructure expansion. |

| Consumer Preferences | Growing demand for premium, tech-enhanced, and fully autonomous CUVs. |

| Manufacturing & Supply Chain | Localization of production and recycling of battery materials ensure supply chain stability. |

| Regulatory Landscape | Global mandates for EV adoption, stricter CO₂ limits, and increased investment in clean mobility. |

The market is expected to expand at a significant rate during the forecast period owing to increasing demand for compact utility vehicles in the agriculture, landscaping, construction, and municipal sectors in the USA Adoption across multiple industry verticals, thanks to compact utility vehicles' versatility in terms of terrain adaptability, towing capacity and payload efficiency.

Private solutions for zero emission XUVs with low clearance in the form of electric and hybrid compact utility vehicles are also driving adoption, and are currently supported by government initiatives for low-emission off road vehicles. Moreover, intelligent telematics and GPS-based fleet management solutions are further streamlining the operational efficiency of businesses that deploy utility vehicles in their daily operations.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.3% |

The UK compact utility vehicles market is expanding on the back of rising demand from farmers, logistics companies, and urban maintenance services. Low-emission and fuel-efficient vehicles are also trending, leading to a preference for electric and hybrid models for eco-friendly operations.

Market growth is further supported by the increasing popularity of multi-purpose vehicles capable of functioning in agriculture, construction, and outdoor recreation. Moreover, the rising inclination towards smaller, agile vehicles in overcrowded city landscapes is paving the way for innovative smaller, performance-oriented utility models.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.8% |

There's also growing demand for compact utility vehicles across the EU, with Germany, France, and Italy driving growth. The Sustainable Transport Solutions push in agriculture, municipal services and logistics is driving the transition towards Electric and Autonomous Compact Utility Vehicles.

Fierce EU emissions and fuel efficiency regulations are driving manufacturers to make nice green high-performance utilities. Moreover, more businesses & government are implementing smart fleet management systems & putting AI-assisted driving technology in place that makes vehicles more capable & efficient.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 5.0% |

Portfolio of Compact Utility Vehicles Continues to Expand in Japan Industry Continues to See Growth Demand for utility vehicles in varied settings -Be it urban single-family sustainability or rural landscape is one of the key factor contributing to growth in the compact utility vehicles in Japan. Post-automotive evolution driven by integrated use of automated driving technology and electric drivetrains.

This is one of the factors driving the demand for compact AI-assisted utility vehicles is also fuelled by the growth of smart agriculture and autonomous farming solutions. As such, the increase in the use of low-noise and low-emission electric utility models is growing for use in urban operation for municipal and delivery.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

Advancements in battery technology, smart mobility solutions, and high-performance compact vehicle designs are driving an expansion of South Korea's compact utility vehicles market. A significant factor driving the utility vehicles market is the increasing adoption of electric and hydrogen-powered utility vehicles.

For greater operational flexibility, the construction and logistics industries are increasingly depending on compact, highly efficient utility vehicles. Beyond, the emphasis on autonomous and AI-integrated vehicles is driving the next-gen compact utility vehicles, paving way for organizations to streamline their fleet management while minimizing their OPEX.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.2% |

The compact utility vehicles market is dominated by skid steer loaders and tracked platform segments, as industries are increasingly looking for high-mobility, multipurpose, and rugged equipment for construction, landscaping, and agricultural applications. These small but workhorse vehicles are key players in everything from material handling to excavation, site prep to infrastructure growth, providing vital support for contractors, municipal services and industrial operators.

With evolving urban development and infrastructure projects, manufacturers are adapting to growing landscaping services, with a primary focus on maximizing equipment versatility, enabling mobility on rough terrains, and improving compact utility vehicle efficiency.

Market Demand for Skid Steer Loaders as Businesses Seek Versatile and High-Mobility Equipment

Skid Steer Loaders Provide Compact Mobility, Multi-Purpose Capability and High Efficiency in Tight Spaces

The skid steer loaders segment is one of the prominent vehicle types in the compact utility vehicles market due to superior mobility, multi-attachment compatibility, and improved lifting capacity. Skid steer loaders are powerful equipment for construction jobs but their compact frame allows them to fit into smaller spaces than standard machinery, and their powerful hydraulic systems offer top-notch lifting and loading capabilities.

Adoption has been driven by the requirement for speedy and efficient skid steer loaders equipped with hydraulic controls, quick-attach capabilities, and enhanced operator ergonomics.

Skid steer loaders are the most commonly used equipment type as overall compact utility vehicle users prefer more versatility and high productivity within confined or limited workspace that can also accommodate attachment; thus, this segment can expect a high demand, according to studies, over 60% of CUVE users prefer skid steer loader, ensuring strong demand for skid steer.

The expansion of multi-purpose site operations which includes material handling, grading, trenching, and snow removal has reinforced market demand, resulting in increased adoption of skid steer loaders in construction, landscaping, and municipal applications.

Moreover, the growing availability of AI-powered load management systems with real-time weight distribution monitoring, automated stability adjustments, and predictive maintenance diagnostics has fuelled adoption, driving better safety, enhanced fuel efficiency, and lower operational costs.

With the concept of custom configurations of skid steer loaders (high-lift configuration, compact-radius and demand for remote-controlled operation) perfecting functionality to its potential for site operations, the above factors can contribute to lucrative growth opportunities in the skid steer loader market.

Skid steer loaders, for example, can help improve overall site efficiency, make attachments more adaptable and facilitate high-mobility operations, but this segment is at a disadvantage because of the high upfront costs, limited traction on loose surfaces and greater maintenance requirements for hydraulic parts.

But with the rise of AI-assisted load balancing, next-gen traction control systems and hybrid powered skid steer models, the operational efficiency of skid steer continues to improve with lesser fuel consumption and increased durability, securing significant market growth for skid steer loaders globally

Skid Steer Loaders Are Increasingly Being Used in High-Density Construction Sites, Infrastructure Development Projects, As Well As Large-Scale Landscaping Operations

Increased use among high-performance, compact loaders being utilized to streamline grading, excavation, and material handling processes by site preparation contractors, urban construction firms, and landscape management services has fuelled the strong adoption of skid steer loaders segment. Skid steer loaders, unlike conventional heavy equipment, provide superior manoeuvrability, exceptional compatibility with multi-functional attachments, and better fuel economy with greater site efficiency and fewer labour needs.

The adoption is driven by the demand for multi-functional skid steer loaders, such as joystick-controlled operation; hydraulic pressure adjustment; and visibility cabs. As per studies, more than 70% of fleet operators of compact utility vehicles are focusing on increasing usage of skid steer loaders due to their ability to perform varied tasks in reduced timeline and increased flexibility at the job-site; ensuring robust demand for this segment.

The introduction of compact utility vehicles as potently utilized equipment for niche applications including skid steer-mounted trenching equipment, snow blowers, and brush cutters has aided market adoption and ensured better equipment utilization across multiple industries.

The adoption was additionally supported by progressive implementation of smart telematics such as AI-assisted vehicle diagnostics, real time GPS tracking, automated fleet perform monitoring etc. to ensure better assets as well as vehicle maintenance schedule optimization.

While the skid steer loader segment benefits from easy access at urban job sites, almost doubling productivity, and further enabling efficient construction workflow even transformation, it must contend with factors including higher wear on hydraulic components, less than ideal distribution of ground pressure, and changing environmental regulations focused on emissions control.

Nevertheless, innovations such as electric-powered skid steers, artificial intelligence (AI)-enabled predictive maintenance, and improved hybrid hydraulic systems are helping extend the life of products, meet industry regulations, and increase the productivity of operators, laying the groundwork for continued growth for the skid steer loaders market globally.

Tracked Utility Vehicles Improve Stability, Enhance Load Distribution, and Ensure Superior Off-Road Capability

The tracked platform segment is becoming one of the most adopted platforms in the compact utility vehicles market, which will allow contractors, agricultural operators, and infrastructure developers to maximize mobility, improve load-bearing efficiency, and enhance vehicle performance on rugged terrains. Now, the tracked vehicles provide better weight distribution, less ground pressure, and enhanced stability compared to wheeled platforms, giving them greater traction in wet, muddy, or uneven environments.

Adoption has been driven by the demand for heavy-duty tracked compact utility vehicles, which include reinforced track designs, advanced shock-absorption systems and automated traction control. Forestry, agriculture and mining industries dominate the tracked platforms segment; studies suggest X% of operators from these sectors prefer tracked platforms as they can continue efficient functioning in the extreme terrain and the same consumer base in both the sectors, said an analyst.

The range of construction and landscaping applications, such as hillside stabilization, trench excavation, and soil grading have further bolstered the market demand, thereby favouring increased adoption of tracked platforms in the compact utility vehicle configurations.

The incorporation of AI-based track performance optimization together with real-time ground pressure monitoring, which automatically adjusts the suspension, and predictive wearable detection has further accelerated adoption by increasing durability, enhancing operator safety, and minimizing the vehicle downtime.

As a result, the evolution of custom tracked vehicle solution has ensured better market growth, with features, such as interchangeable track widths, advanced hydraulic suspension, and electric-powered propulsion systems being developed for optimal adaptation to off-road, industrial, and specialty construction applications.

While the tracked platform segment offers benefits like vehicle stability, optimal traction on the ground, or to help heavy-duty operations on site, it also has to contend with several issues including higher manufacturing costs, and increased maintenance of track components compared to wheeled platform vehicles, as well as lower fuel efficiency in high-speed applications.

Yet, new technologies in rubberized track strength, hybrid powertrains for track drive systems, and AI-driven terrain adaptability are not only boosting fuel efficiency and reducing wear and tear on machinery, but also improving load-bearing capacity, paving the way for sustainable market growth of tracked compact utility vehicles, globally.

Rising Applications of Tracked Platforms in Construction on Rough Terrain, Agricultural Land Management, and Forestry Equipment

The growing preference for high-traction and stability-enhanced compact utility vehicles by various sectors to optimize their operational efficacy and site accessibility is a key factor driving the tracked platform segment especially among heavy-duty construction companies, commercial-grade agricultural operations and manufacturers of forestry equipment.

Tracked compact utility vehicles have advantages over wheeled platforms, such as increased terrain adaptability, less ground compaction, and greater weight distribution characteristics for better load handling in a wide variety of work environments.

Next-generation tracked compact utility vehicles with high-capacity load-bearing systems, smart terrain analysis, and AI-assisted drive controls have been in demand and have accelerated adoption across all the key technologies. Over 80% of tracked compact utility vehicle users incorporate these systems into their fleet, as they boost job-site efficiency and cut slippage of vehicles, while minimizing impact on fragile ground surfaces, pointing to robust demand for this segment, according to in-house studies.

While the tracked platform segment has the merits of increasing terrain adaptability, ensuring proper load distribution, and providing off-road site support capabilities, it also suffers from disadvantages like higher operating costs, greater maintenance complexity, and the requirement for close-in high wear environments to replace tracks often.

Nevertheless, some new concepts for machine adaptive traction control, AI platform durability optimization and mechanically efficient propulsion systems, ensuring equipment reliability, long-term operational savings and compact utility vehicle capabilities, are ushering in new horizons and expansion opportunities, worldwide, for tracked platforms.

Industry Overview

Steady market growth in compact utility vehicles emerges from industry-wide need for multifunctional vehicles that serve agriculture and construction as well as landscaping and municipal services. The market selects compact utility vehicles because these vehicles combine excellent manoeuvrability with efficient fuel performance together with their capability to handle hauling between other activities.

The compact utility vehicles market experiences growth mainly because of developments in electric and hybrid powertrain technologies alongside advancing levels of agricultural and construction automation together with rising requirements for off-road mobile solutions. The industry leaders dedicate their efforts toward product durability and smart integration and increased load handling capacity for diverse sector needs.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| John Deere (Deere & Company) | 18-22% |

| Kubota Corporation | 15-19% |

| Bobcat Company (Doosan Group) | 12-16% |

| Caterpillar Inc. | 9-13% |

| Mahindra & Mahindra Ltd. | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| John Deere (Deere & Company) | Produces high-performance compact utility vehicles with advanced hydraulics, attachments, and precision technology. |

| Kubota Corporation | Specializes in fuel-efficient and electric compact utility vehicles for agriculture and municipal applications. |

| Bobcat Company (Doosan Group) | Develops durable and high-powered compact utility vehicles designed for construction and material handling. |

| Caterpillar Inc. | Focuses on rugged, high-load capacity compact utility vehicles for industrial and off-road operations. |

| Mahindra & Mahindra Ltd. | Offers cost-effective, heavy-duty compact utility vehicles with advanced transmission systems for agricultural and commercial use. |

Key Company Insights

John Deere (Deere & Company) (18-22%)

John Deere leads the market for compact utility vehicles by delivering performance-leading vehicles that incorporate hydraulic innovation coupled with adjustable accessories alongside data-driven farming solutions.

Kubota Corporation (15-19%)

The vehicle maker Kubota produces energy-efficient electric and fuel-efficient compact utility vehicles suitable for agricultural workers and those in landscaping services as well as municipal employees.

Bobcat Company (Doosan Group) (12-16%)

The engineering division from Bobcat Company produces rugged compact utility vehicles which excel at heavy-duty work including construction projects and excavation tasks as well as material handling requirements.

Caterpillar Inc. (9-13%)

Caterpillar develops high-capacity rugged compact utility vehicles for industrial applications besides mining operations and includes smart telematics systems for better performance.

Mahindra & Mahindra Ltd. (7-11%)

Mahindra delivers cost-effective heavy-duty compact utility vehicles which combine resistant material quality with efficient fuel economy and intelligence-based transmission systems for agricultural and commercial tasks.

Other Key Players (30-40% Combined)

Several other manufacturers contribute to the compact utility vehicles market by offering industry-specific models, electric variants, and innovative features. Notable players include:

The overall market size for Compact Utility Vehicles Market was USD 38,399 Million in 2025.

The Compact Utility Vehicles Market is expected to reach USD 62,548 Million in 2035.

The demand for the compact utility vehicles market will grow due to increasing urbanization, rising demand for versatile and fuel-efficient vehicles, expanding applications in agriculture and construction, and advancements in electric and hybrid vehicle technologies, driving sustainability and performance improvements.

The top 5 countries which drives the development of Compact Utility Vehicles Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Skid Steer Loaders and Tracked Platforms Restaurants Form to command significant share over the forecast period.

Water Proof E-Scooter Market Growth – Trends & Forecast 2025 to 2035

Lane Departure Warning (LDW) Market - Trends & Forecast 2025 to 2035

Front Collision Warning Market Growth – Trends & Forecast 2025 to 2035

Wire Rope Sling Market - Trends & Forecast 2025 to 2035

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Weigh in Motion System Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.