Compact Construction Equipment Market Share Analysis Outlook from 2025 to 2035

The global compact construction equipment market is projected to grow at a CAGR of 3.1%, reaching USD 48.4 billion by 2035. The increasing demand for versatile, fuel-efficient, and technologically advanced compact machinery is driving market expansion.

The usage of compact construction machinery can be predominantly observed in various areas, including urban infrastructure projects, residential construction, agriculture, and landscaping. On one hand, the industry is undergoing a transition with electric and hybrid-powered compact machines, with telematics, enhanced safety features for operators, and smart city programs supported by government initiatives to modernize infrastructure.

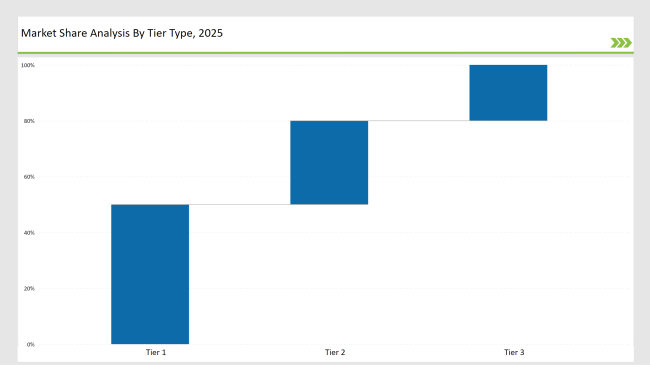

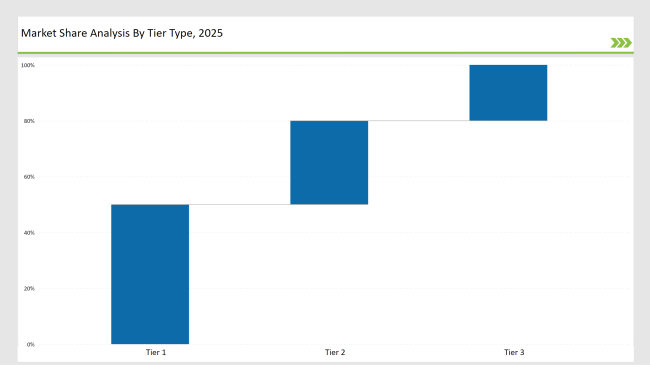

The market remains only moderately consolidated; Tier 1 Players-Caterpillar, Volvo Construction Equipment, Bobcat, JCB, and Komatsu-have around 35% of market share. Between product types, track loaders occupy 28%, and below 100 HP constitutes 45%, because customers gravitate toward fuel efficiency and fewer emissions from smaller, more efficient compact equipment.

| Attribute |

Details |

| Projected Value by 2035 |

USD 48.4 billion |

| CAGR (2025 to 2035) |

3.1% |

Explore FMI!

Book a free demo

Industry Landscape

| Category |

Industry Share (%) |

| Top 3 Players (Caterpillar, Volvo Construction Equipment, Bobcat) |

35% |

| Next 2 of 5 Players (JCB, Komatsu) |

30% |

| Rest of the Top 10 |

35% |

The market is fairly consolidated, with leading companies investing in automation, electric drivetrain integration, and advanced telematics to enhance machine efficiency and reduce operating costs.

Segmental Analysis

By Product Type

- Track Loaders (28% Market Share): Track loaders are the most in-demand compact equipment due to their versatility in excavation, material handling, and site preparation. All-terrain capabilities and high stability make them preferred for construction, forestry, and agriculture applications. Bobcat and Caterpillar are leading in high-performance track loaders with AI-assisted control systems.

- Excavators: Mini-excavators are primarily applied in urban construction, pipeline installation, and trenching applications. Volvo Construction Equipment and Komatsu emphasize mini-excavators with fuel efficiency and low emission for compliance with regulatory requirements.

- Skid Steers: Skid steers are widely used for swift movement in cramped spaces, thereby suited for landscaping, demolition, and road construction applications. JCB and Bobcat are particularly renowned for their multi-attachment skid steers for multiple applications.

- Backhoe Loaders: Backhoe loaders are relatively cheap and effective for small-scale excavation and material handling tasks. Caterpillar and JCB take the lead in advanced hydraulic-powered backhoe loaders with better fuel efficiency.

- Wheel Loaders: These machines are commonly used for material transportation and loading operations in construction and agriculture. Komatsu and Volvo Construction Equipment provide compact, electric-powered wheel loaders.

- Telehandlers: Tele handlers are getting popular due to their multi-functional capabilities for lifting cargo in warehouse as well as construction conditions. Bobcat and JCB emphasize high capacity, terrain-adaptive telehandlers.

- Others: Others include specialized compact construction equipment developed specifically for niche applications in industrial and municipal operations.

By Power Output

- Less than 100 HP (45% Market Share): Low-power compact construction equipment, which is power-efficient, cheap, and apt for urban construction projects, finds a lot of demand. There is a huge trend toward electric-powered models with Bobcat and JCB on the forefront in this area.

- 101 HP to 200 HP : Mid-power solutions are applied as versatile, infrastructural solutions by providing balance for power and good fuel economy. Volvo Construction Equipment and Caterpillar are focused at mid-power solutions in compact loader and compact excavators.

- 201 HP to 400 HP: These compact solutions are focused more on industrial application in construction and mining. Such applications have industrial construction and other forestry services too. In that category, there are leading vendors like Komatsu and Caterpillar.

- More than 400 HP: These high-powered machines cater to specialized construction operations requiring extensive material handling and excavation. Caterpillar and Volvo Construction Equipment dominate this segment with rugged, high-load capacity machines.

Who Shaped the Year?

Several key players contributed to market advancements in 2024

- Caterpillar launched AI-powered compact track loaders with automated terrain adjustment and real-time diagnostics.

- Volvo Construction Equipment introduced battery-electric compact excavators, targeting zero-emission urban construction.

- Bobcat expanded its autonomous skid-steer lineup, integrating machine learning-based efficiency enhancements.

- JCB developed hybrid backhoe loaders to meet low-emission construction requirements.

- Komatsu focused on hydrogen-powered compact wheel loaders, promoting sustainable construction practices.

Key Highlights from the Forecast

- Track Loaders Lead Market Share: These machines hold 28% of total demand, driven by high versatility and adaptability to rugged terrains.

- Below 100 HP Equipment Remains the Preferred Segment: This category accounts for 45% of market demand, fueled by the adoption of electric and hybrid compact construction machines.

- Electrification and Hybridization of Compact Equipment Accelerates: Governments and industries prioritize low-carbon footprint and fuel-efficient compact machinery.

- Advanced Telematics and Automation Transform the Industry: IoT-powered predictive maintenance and AI-based automation are revolutionizing compact equipment performance.

Tier-Wise Industry Classification

| Tier |

Examples |

| Tier 1 |

Caterpillar, Volvo Construction Equipment, Bobcat |

| Tier 2 |

JCB, Komatsu |

| Tier 3 |

Regional and niche players |

Market KPIs

- Integration of AI & Telematics: States are incorporating connected machines, which have an ability to monitor real-time efficiency and predict maintenance.

- Electric & Hybrid Compact Equipment Adoption: Increased adoption of Electric & Hybrid Compact Equipment due to increasing focus on fuel efficiency and emission reduction.

- Multi-Functional Equipment Demand: Greater demand for multi-functional equipment owing to the requirement of doing various operations with interchangeable attachments.

- Urban Infrastructure Development Boosts Growth to spur growth as compact machinery is being used and deployed to aid in new road construction, smart cities, and commercial real estate.

Key Company Initiatives

| Company |

Initiative |

| Caterpillar |

Launched AI-integrated compact track loaders for smart automation in rough terrain. |

| Volvo Construction Equipment |

Developed battery-powered compact excavators for zero-emission construction projects. |

| Bobcat |

Extended autonomous skid-steer product lines for efficiency and safety improvement. |

| JCB |

Introduced hybrid backhoe loaders to meet low-carbon construction requirements. |

| Komatsu |

Focused on hydrogen-powered compact wheel loaders for sustainable construction operations. |

Recommendations for Suppliers

- Invest in Electrification of Compact Equipment: Growing demand for green solutions will bring down the emissions and improve efficiency toward sustainability objectives through electrification and hybrid compact machines.

- Enhance Smart Telematics Integration: Integration with AI-based remote diagnostics and predictive maintenance will ensure real-time monitoring of performance; decrease downtime; and enhance operational efficiencies, leading to a proliferation of advanced telematics in compact equipment.

- Target Urban & Residential Construction: The demand for compact machinery will increase as it will be able to fit into narrow spaces and be used effectively in residential and commercial projects in high-density urban areas.

- Expand Multi-Function Compact Equipment: A modular attachment to versatile machines will meet the requirements of different construction activities, which will be easily executed with flexibility and cost-effectiveness across the different tasks from excavation to material handling and many others.

Future Roadmap

By 2035, compact construction equipment is expected to undergo a revolutionary transformation, becoming AI-driven, electric-powered, and remotely monitored. This change will profoundly impact urban construction, agriculture, and manufacturing industries. With AI, construction machines and equipment will be able to work independently, more efficiently, and with greater precision and safety than ever before.

In AI assistance, the machines are able to adjust to changing conditions, optimize workflows, and complete tasks without human intervention in most stages. This will significantly decrease the chances of mistakes as well as enhance productivity.

Electric-powered compact equipment will contribute more to reduced carbon emissions through replacement of old diesel machines by cleaner, eco-friendly alternatives. The new electricity-driven machinery will be less noisy, energy friendly, and in highest degree fit for deployment in cities since noise level will reduce as well as to reduce adverse effects on the environment.

Third, the ability to monitor from a distance will be integrated into equipment performance and health. This will thereby promote predictive maintenance, reduce downtime, and operate at their best efficiency levels. The running of the equipment would be controlled distantly. Hence, all these innovations, as a package, support higher levels of sustainability and safety in industrial, agricultural, and urban construction contexts.

Frequently Asked Questions

Which Companies hold significant share in the Compact Construction Equipment Market?

Caterpillar, Volvo Construction Equipment, Bobcat holds significant share in the Compact Construction Equipment Market.

Which is the leading product segment in the Compact Construction Equipment Market?

Track Loaders is the leading product in the Compact Construction Equipment Market.

How much share does regional and domestic companies hold in the market?

Around 35% of the market share is captured by the regional and domestic companies in the market.

How is the market concentration assessed in the Compact Construction Equipment Market?

Market is fairly consolidated, representing top 10 players commanding significant share in the market.

By Power Output which type offers significant growth potential to market players?

Less than 100 HP offers significant growth potential to the market players.