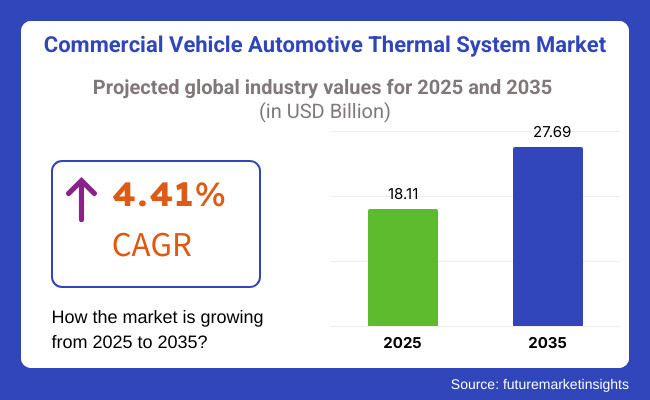

The global commercial vehicle automotive thermal system market is slated to reach USD 18.11 billion in 2025. The industry is poised to grow at 4.41% CAGR from 2025 to 2035 and be worth USD 27.69 billion by 2035.

The primary growth factor is the increasing number of electric commercial vehicles (EVs), the development of thermal management technology, and the regulations promoting reduced emissions and increased energy efficiency.

With more stringent environmental regulations such as the Euro 7 emissions standard and the initiative for carbon-neutral transportation, manufacturers are now more focused on efficient thermal solutions. For example, notable commercial vehicle producers like Volvo and Daimler are equipping their EV models with thermal management systems that are at the forefront of technology as a way of optimizing battery performance and extending vehicle range.

As the transportation industry is making a shift toward greener technology, the requirements for thermal systems that enhance fuel efficiency, make vehicles electrification possible, and boost passenger comfort are persistently increasing.

The market is simultaneously getting advanced by the application of sophisticated cooling and heating technologies in both conventional internal combustion engine (ICE) vehicles and electric commercial vehicles. For instance, Tesla's Semi truck has an innovative thermal system that provides battery temperature control and efficiency under various road conditions.

This table analyzes key criteria for the commercial vehicle automotive thermal market, comparing the priorities of four stakeholder groups include OEMs, aftermarket suppliers, fleet operators, and end users. Thermal efficiency and performance, durability and reliability, and integration with vehicle systems are rated among the highest priorities by OEMs due to their emphasis on both advanced technology and stringent safety standards.

Aftermarket suppliers also emphasize thermal efficiency and durability with high ratings, while cost efficiency is rated high to balance performance with budget constraints; they assign medium importance to integration and innovation. Fleet operators prioritize reliable performance and durability, ensuring optimal operation under demanding conditions, but consider integration and innovation as moderately important.

In contrast, end users place high importance only on thermal efficiency and reliability, rating integration, innovation, and regulatory compliance lower, as these users are concerned with basic performance and maintenance rather than advanced features. In general, the table demonstrates clear variations in stakeholder focus.

The worldwide industry transformed itself from 2020 to 2024, influenced by increasing electrification and stringent standards of emissions, as well as fuel efficiency. Fleet operators tend to invest in innovative thermal management solutions to extend battery performance, improve HVAC performance, and minimize downtimes.

The accelerated change of streamlining traditional ICE cooling to efficient thermal systems in electric and hybrid commercial vehicles fueled the requirement for battery thermal management systems (BTMS), heat exchangers, and low-GWP refrigerants. The challenges among small fleets were further aggravated by the disturbance of the supply chain, semiconductor shortages, and exorbitant future costs of next-generation cooling systems.

From 2025 to 2035, technology very much advances the field of thermal management for commercial vehicles. Predictive cooling will employ very advanced artificial intelligence and phase-change materials to facilitate highly efficient waste heat recovery systems with less energy consumption.

Both bio-based refrigerants and recyclable materials are the drivers of sustainability, while system performance will be enhanced by digital twin technology. With greater acceptance of hydrogen fuel cell trucks, specialized cooling systems will eventually become necessities, ensuring future industry growth and development.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Stricter emissions norms, eco-friendly refrigerant adoption | Carbon-neutral cooling solutions, circular economy thermal materials |

| Transition from ICE cooling to EV thermal management | AI-driven predictive cooling, phase-change materials, waste heat recovery |

| Standard HVAC and battery cooling for commercial EVs | Liquid-cooled fuel cells, advanced thermal control for autonomous fleets |

| Telematics-based thermal monitoring | Digital twin simulation for predictive maintenance and optimization |

| Development of low-GWP refrigerants | Recyclable coolants, closed-loop refrigerant systems, energy-efficient HVAC |

| Limited real-time diagnostics for cooling systems | AI-powered predictive maintenance, machine learning-based temperature control |

| Semiconductor shortages affecting thermal system availability | Scalable supply chains, cost-effective materials for mass production |

| EV adoption, efficiency-driven fleet management | Hydrogen-powered commercial vehicles, rapid electrification of freight logistics |

Demand for advanced thermal management in commercial vehicles is gaining traction due to stringent emissions rules. As zero-emission and other efficiency requirements climb, manufacturers who don’t innovate risk falling out of compliance and losing market share. EU-pushed ICE ban ’35 has fleet operators moving toward electric trucks, driving demand for new cooling systems and forcing suppliers to adjust.

The industry struggles with global supply chain tearing, from factory closure to material shortages during the COVID-19 crisis. Disruption has thrown thermal systems production into risk from semiconductor shortages; It has already motivated government interventions like the USA CHIPS Act aimed at expanding local chip production. This dependence on key suppliers for things like thermal system components - including sensors and control units - adds additional risk.

These include advanced thermal systems, like battery cooling modules and heat pumps, which necessitate high-performance materials - hence, expensive. Small and mid-size fleet owners will struggle to adopt without subsidization. Manufacturers are using government incentives and scale efficiencies to address pricing barriers, but cost risks are still considerable.

Demand ebbs and flows with the economy and vehicle sales cycles. Freight downturns can lead to fewer orders, but rapid electrification can lead to spikes in demand. The ~5.8% decline in trucking employment in 2020 has lowered the demand for the thermal system, showing the importance of flexible production and inventory management.

In both the new entrants and established players, innovation is vital, with many investing heavily in advanced thermal technologies. Tesla and other electric vehicle (EV) OEMS are developing in-house heat pump solutions that threaten incumbents. Companies that provide diesel-only cooling solutions risk being left behind if they do not adapt to electric-focused solutions.

Pricing Strategy for Commercial Vehicle Automotive Thermal SystemIt is primarily B2B, providing’s to vehicle OEMs and fleet retrofitters. Big suppliers like Denso and Valeo compete on technology and cost, while lower-tier producers sell simple parts. Premium, high-performance thermal systems are more expensive than their counterparts, while conventional radiators for old-school trucks have become commoditized.

Advanced thermal systems command a premium price based on their benefits, which include fuel economy, emissions compliance, and longer component life. Fleets can afford to spend more on modified heat exchangers that contribute to uptime, but dollar-conscious operators will always select the cheapest solution. Typical cooling products are subject to cost-based pricing, while next-gen products utilize value-based pricing, with the most current example being a traditional domain: battery thermal management for EVs.

Premium systems developed for high-end or electric commercial vehicles, with capabilities that include heat pumps and digital controls, are part of the category of OEM-installed systems. The budget segment focused on smaller fleets and older vehicles offers an affordable proposition. Value-focused market. However, suppliers like BorgWarner and Denso are working on developing functional yet economical heat exchangers targeting this value-seeking market.

Manufacturers are moving to lifecycle-based pricing, packaging together installation and maintenance with initial purchases. Government incentives enable suppliers to keep falling list prices, while penetration pricing ensures markets open at lower prices before they improve. New trends are subscription-based cooling services for electrifying fleets.

Things that affect pricing the most are material costs like metals, semiconductors, and refrigerants. Price changes have been necessitated by recent input cost increases. Regulatory requirements (e.g., Euro VI, CARB) supports advanced thermal systems, resulting in value-based pricing. Feeding this profitability, it has to achieve the balance between premium pricing on the one hand (for the innovation) and cost (for the cost-sensitive buyers) on the other, while component costs are being driven down by global competition.

The front and rear air conditioning (AC) systems segment accounts for a high industry share due to their wide application in all classes of commercial vehicles, such as trucks and delivery vans and buses. These systems are important for driver and passenger comfort, especially in long-haul transportation and public transit applications.

Fleet operators are looking to curb fuel consumption and emissions, and demand for energy-efficient HVAC solutions is on the rise. For instance, Thermo King's zero-emission cooling solutions are also employed in commercial electric buses, including electric HVAC systems. Furthermore, due to climate rules and also the increase in temperatures across the globe, advanced thermal control technologies are gaining traction.

Light commercial vehicles (LCVs) are the most prominent segment in the industry driven by the expansion of urban logistics, e-commerce and last-mile delivery services. These vehicles operate under relatively difficult stop-and-go operating conditions and require small, lightweight and efficient thermal management systems to maximize fuel economy and emissions. Thermal management through cooling solutions such as high-ground efficiency radiators, compact heating, ventilation, and air conditioning (HVAC) units, and electric LCV battery thermal management systems (BTMS) are emerging as solutions among manufacturers.

Internal combustion engines (ICEs) continue to be the leading form of propulsion within the industry because of their extensive use in heavy trucks, buses, and construction vehicles. The heavy dependence on diesel and gasoline engines for long-haul trucking, freight transportation, and industrial uses guarantees that ICE-powered commercial vehicles continue to account for the largest portion of the industry.

Thermal management systems in internal combustion engine vehicles play a vital role in engine cooling, cabin heating, and exhaust heat recovery, thus being essential for operational efficiency and vehicle life.

Powertrain cooling is the most essential element in commercial vehicle automotive thermal systems because of the extreme thermal loads and consistent operation of internal combustion engines (ICEs) and alternate propulsion technologies. Commercial trucks, buses, and heavy equipment run under austere conditions and need strong cooling solutions to provide optimum engine performance, avoid overheating, and improve fuel efficiency.

The powertrain cooling system serves a critical function of controlling the engine temperature, cooling turbochargers, and controlling the heat dissipation of transmission and exhaust systems, maintaining the vehicle's durability and reliability in harsh use conditions.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

| UK | 7.2% |

| European Union | 8% |

| South Korea | 8.2% |

| Japan | 7.7% |

The USA industry is growing at a fast pace due to the widespread adoption of energy-efficient technology, stringent emissions standards, and growing commercial fleet electrification. The industry growth is based on the shift to electric and hybrid commercial vehicles, which need sophisticated thermal management systems for maximizing the performance of batteries and vehicle efficiency

FMI is of the opinion that the USA commercial vehicle automotive thermal system market is slated to grow at 7.5% CAGR during the study period. Some of the primary drivers are the Bipartisan Infrastructure Law, which encourages the setup of EV charging networks and battery technology, and cooling and heating systems demand for maintaining battery efficiency, particularly in light of growing last-mile delivery services fueled by e-commerce growth.

Dominant Industry Players: There is significant investment by companies such as Cummins, BorgWarner, and Modine Manufacturing in intelligent thermal systems for improved dissipation of heat and fuel consumption and thus decrease overall cost of operations by fleet operators.

Growth Factors in the USA

| Key Drivers | Details |

|---|---|

| Government Support & Funding | The Bipartisan Infrastructure Law finances EV infrastructure and battery technology investments, establishing the demand for sophisticated thermal management systems. |

| Commercial Fleet Electrification | Greater uptake of electric and hybrid commercial transport requires sophisticated thermal management to sustain battery performance. |

The UK industry is growing with government incentives for environmentally friendly transportation, the growth of the electric truck fleet, and higher Euro 7 emission standards. The UK government is expected to phase out diesel commercial vehicles by 2040, and this will be a key driver of demand for premium thermal management solutions in cooling, heating, and ventilation.

Electric commercial vans and buses, especially city-based, growth is driving advancements in waste heat recovery technology. Benteler, Mahle, and Valeo are emphasizing bringing together thermal systems for more efficiency and less emissions. FMI forecasts the UK industry to grow at 7.2% CAGR during the study period. Secondly, growth in commercial hydrogen-powered vehicles is opening a new market for high-pressure fuel cell-based specialty cooling technology.

Growth Factors in the UK

| Key Drivers | Details |

|---|---|

| Government Subsidies & Regulations | Green transport government subsidies and Euro 7 emission standards are driving up demand for thermal systems. |

| Hydrogen Vehicle Development | The demand for high-pressure fuel cell cooling systems is being driven by the drive to develop hydrogen commercial vehicles. |

The European Union industry is growing on the back of higher environmental regulation, adoption of electric vehicles (EVs), and considerable investment in cleaner transportation modes. The commercial fleet, as part of the European Green Deal, is rapidly switching over to zero-emission vehicles, and the demand for next-generation thermal management systems is gaining pace.

FMI forecasts the EU industry to grow at 8% CAGR during the forecast period. Germany, France, and the Netherlands are leading the way, using heat pump-based cooling and high-tech battery cooling technology. AI-driven temperature control systems are also becoming indispensable with autonomous commercial vehicles gaining traction. Industry leaders such as Volvo, Scania, and Daimler are concentrating on cooling solutions that offer maximum thermal efficiency for delivery vans and long-distance haulage.

Growth Factors in the European Union

| Key Drivers | Details |

|---|---|

| Environmental Regulations | Growing environmental regulations and the need for zero-emission cars are propelling thermal system demand that is energy-efficient. |

| Development of Autonomous Vehicles | Artificial intelligence temperature control systems are required to provide the optimal energy efficiency in autonomous commercial vehicles. |

Japanese industry is growing with government intentions for carbon neutrality, thermal management innovation with high efficiency, and increasing interest in hydrogen-powered commercial vehicles. Japan will be carbon neutral by 2050, which will create demand for efficient thermal solutions to reduce the impact on vehicle performance.

FMI is of the opinion that the Japanese industry is set to witness 7.7% CAGR during the study period. Denso, Hitachi, and Panasonic are frontrunners in the development of thermal management technologies that ensure optimum battery performance. The country is also developing solid-state batteries and miniature cooling technology, which gain rising significance globally. These products enhance the energy efficiency and safety of electric and hydrogen buses for commercial use.

Growth Factors in Japan

| Key Drivers | Details |

|---|---|

| Carbon Neutrality Efforts | Japan's goal to achieve carbon neutrality by 2050 is compelling the utilization of high-efficiency thermal management technologies. |

| Solid-State Battery Development | Since solid-state batteries became available, proper thermal solutions have been more sought after than ever before, and they need to be maintained in very strict control. |

South Korean industry is experiencing strong growth as the government invests in advanced battery technology, electric commercial vehicle fleets expand, and hydrogen vehicle development advances. Hyundai and Kia are only a couple of companies that are producing next-generation hydrogen commercial vehicles and next-generation electric trucks that need advanced thermal management systems.

The Ministry of Trade, Industry, and Energy (MOTIE) is spearheading the research and development of phase-change material and AI-based cooling technologies. South Korea is also at the forefront of wireless charging system development for EVs, and it generates demand for high-end liquid cooling systems to provide battery stability. FMI states that the South Korean industry is slated to register 8.2% CAGR during the forecast period.

Key Industry Players: Hanon Systems and Hyundai Mobis are developing thermally adjustable battery packs to enhance the performance and longevity of commercial fleets running in harsh environments.

Growth Factors in South Korea

| Key Drivers | Details |

|---|---|

| Government Investment in Battery Tech | The government of South Korea is investing in the development of new battery technology and AI-driven cooling systems for enhancing vehicle performance. |

| Wireless Charging Systems | Wireless charging system development is fueling demand for high-level liquid cooling technology to ensure battery performance. |

The future of thermal systems for commercial vehicles is the creation of next-generation materials, AI-based cooling technologies, and environmentally friendly refrigerants. Researchers are working with phase-change materials and nano-enhanced heat exchangers to enhance cooling efficiency with reduced system weight and complexity.

AI-driven cooling management will become the norm in commercial fleets, enabling real-time adjustments according to vehicle load, ambient temperature, and route conditions. Machine learning software will make automatic thermal optimization possible, cutting fuel usage and system lifespan.

Sustainability is also a major concern, with players in the industry creating environmentally friendly refrigerants and closed-loop thermal solutions that reduce environmental footprint. Technologies like CO2-based cooling systems and biodegradable heat transfer fluids are likely to revolutionize commercial vehicle thermal management in the next few years.

The commercial vehicle automotive thermal system industry remains very competitive. Key players are innovating, forming strategic partnerships, and providing advanced thermal management solutions to enhance the vehicle efficiency and sustainability. Eberspächer, Hanon Systems, Gentherm Incorporated, BorgWarner Inc., Denso Corporation, Valeo S.A., Continental AG, Robert Bosch GmbH, Mahle GmbH, and Grayson Thermal Systems utilize their heating, cooling, and energy-efficient technologies to meet the ever-changing requirements of the industry.

The commercial vehicle sector is moving toward electrification more often alongside stricter emissions regulations, thereby leading manufacturers in favor of the next-generation thermal systems that enhance performance and reduce environmental impact.

Leaders in the marketplace differ within their defined product portfolios and strategy acquisitions. Eberspächer is known for fuel-operated and electrical heaters and continues to extend its product portfolio to address various vehicle needs. Through acquisition and support of advanced fluid pressure and control technologies, Hanon Systems further solidifies its industry position.

The well-known Gentherm Incorporated Climate Control Seat system extends Gentherm's thermal expertise into other applications such as automotive and healthcare. Valeo S.A., through extensive investments in R&D, continues to target the fields of reduction in carbon footprint and intuitive driving technology.

This landscape is ever-changing based on push factors for thermal efficiency, electrification compatibility, and regulatory compliance, which ultimately presents an opportunity for companies ahead in energy-efficient and intelligent thermal management to secure their long-term leadership in the industry.

Industry Share Analysis by Company

| Company Name | Estimated Industry Share (%) |

|---|---|

| Denso Corporation | 20-25% |

| Valeo | 15-20% |

| MAHLE GmbH | 12-16% |

| Hanon Systems | 10-14% |

| BorgWarner Inc. | 6-10% |

| Other Companies (combined) | 30-40% |

| Other Companies (combined) | 37-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Denso Corporation | Develops high-performance cooling as well as HVAC solutions for heavy-duty and electric commercial vehicles. |

| Valeo | Specializes in electrified thermal management systems, including heat pump solutions for EVs. |

| MAHLE GmbH | Provides engine cooling and cabin climate control solutions with a focus on energy efficiency. |

| Hanon Systems | Innovates in battery thermal management and air conditioning technologies for commercial fleets. |

| BorgWarner Inc. | Focuses on advanced heat exchangers and e-thermal solutions for hybrid and electric vehicles. |

Key Company Insights

Denso Corporation (20-25%)

Denso dominates the commercial vehicle thermal system market by delivering cutting-edge cooling, heating, and HVAC products. The firm is driven by maximizing efficiency and minimizing emissions, and as a result, its products are among the highest-rated for fleet operators.

Valeo (15-20%)

Valeo is a leader in thermal management for electric commercial vehicles with intelligent heat pump systems to minimize energy consumption as well as maximize cabin comfort.

MAHLE GmbH (12-16%)

MAHLE provides innovative engine cooling and air conditioning solutions that enhance commercial vehicle durability and operating efficiency.

Hanon Systems (10-14%)

Hanon Systems is dedicated to next-generation battery thermal management and cabin climate control, which provides stable performance in harsh conditions.

BorgWarner Inc. (6-10%)

BorgWarner leads the innovation in e-thermal solutions with an emphasis on hybrid and electric vehicle heat exchangers to maximize performance and minimize energy loss.

Several firms drive innovation in the commercial vehicle automotive thermal system market by improving system efficiency, lowering the weight, and incorporating AI-based temperature control.

In terms of application, the market is divided into front & rear AC, engine & transmission, seat, battery, waste heat recovery, power electronics, and motor.

By vehicle type, the industry is segregated into light commercial vehicles, medium commercial vehicles, and heavy commercial vehicles.

By propulsion type, the industry is divided into ICE, BEV, PHEV, and FCEV.

By component, the industry is divided into HVAC, powertrain cooling, fluid transport, and others.

Regionally, the industry is divided into Latin America, the Middle East & Africa, North America, Europe, and Asia Pacific.

The market size will be USD 18.11 billion in 2025.

The market is likely to grow to USD 27.69 billion in 2035.

Light commercial vehicles highly use the product.

South Korea, poised to grow at 8.2% CAGR during the forecast period, is slated to experience fastest growth.

Key companies in the market include BorgWarner, Dana Incorporated, Grayson Thermal Systems, Hanon Systems, Eberspacher, Valeo SA, Continental AG, Denso Corporation, Robert Bosch GmbH, and Mahle GmbH.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Propulsion Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Propulsion Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Component, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Propulsion Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Propulsion Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Component, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Propulsion Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Propulsion Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Component, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Propulsion Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Propulsion Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Component, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Propulsion Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Propulsion Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Component, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Application, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Vehicle Type, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Vehicle Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Propulsion Type, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Propulsion Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Component, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Component, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Propulsion Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Component, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Propulsion Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Propulsion Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Propulsion Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Propulsion Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 26: Global Market Attractiveness by Application, 2023 to 2033

Figure 27: Global Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Propulsion Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Component, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Propulsion Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Component, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Propulsion Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Propulsion Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Propulsion Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Propulsion Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 56: North America Market Attractiveness by Application, 2023 to 2033

Figure 57: North America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Propulsion Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Component, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Propulsion Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Component, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Propulsion Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Propulsion Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Propulsion Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Propulsion Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Propulsion Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Component, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Propulsion Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Component, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Propulsion Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Propulsion Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Propulsion Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Propulsion Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 116: Europe Market Attractiveness by Application, 2023 to 2033

Figure 117: Europe Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Propulsion Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Component, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Propulsion Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Component, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Propulsion Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Propulsion Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Propulsion Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Propulsion Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Propulsion Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Component, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Vehicle Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Propulsion Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Component, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Vehicle Type, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Vehicle Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Vehicle Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Vehicle Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Propulsion Type, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Propulsion Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Propulsion Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Propulsion Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Component, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Component, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Component, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Component, 2023 to 2033

Figure 176: MEA Market Attractiveness by Application, 2023 to 2033

Figure 177: MEA Market Attractiveness by Vehicle Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Propulsion Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Component, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Commercial Food Refrigeration Equipment Market Size and Share Forecast Outlook 2025 to 2035

Commercial Flexible Electrical Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Aircraft MRO Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA