The Commercial Undercounter and Worktop Refrigeration Market demonstrates progressive growth from 2025 till 2035 due to heightened market need in foodservice locations and restaurants alongside retail outlets. These refrigeration units serve three essential purposes by maximizing kitchen space and maintaining food safety together with operational efficiency improvements.

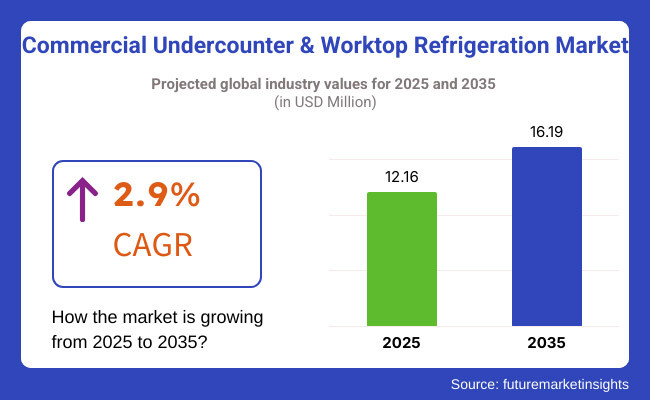

Market analysts expect Commercial Undercounter and Worktop Refrigeration sales to grow from USD 12.16 million in 2025 to USD 16.19 million in 2035 while demonstrating a 2.9% Compound Annual Growth Rate (CAGR).

Market expansion occurs because businesses focus more on energy conservation and optimized space utilization for refrigeration systems. The industry develops through increased implementation of intelligent refrigeration systems together with environmental refrigerants.

The market faces challenges because of high start-up expenses along with maintenance duties and rising regulatory demands. Manufacturers concentrate on building products with energy-saving capabilities along with digital temperature controls and durable stainless-steel components to meet changing customer preferences.

On the basis of product type, the global commercial undercounter and worktop refrigeration market is segmented into: The main product types 33 in this market include undercounter refrigerators, undercounter freezers, worktop refrigerators, and worktop freezers. Undercounter refrigerators and freezers are which we find commonly used in compact kitchen environments, while worktop refrigeration units provide prep space alongside cool storage.

By end-user applications, the foodservice industry is the largest segment, with widespread use in restaurants, cafes, and commercial kitchens. Convenience stores, bakeries, and institutional catering services are also significant end-users reworking these refrigeration units to optimize kitchen flow. Furthermore, the growing deployment of these units across cloud kitchen and fast-casual dining setups is also contributing to the growth of the market.

Explore FMI!

Book a free demo

The North America commercial undercounter and worktop refrigeration market is a significant market owing to the growth of quick-service restaurants (QSRs) and strict food safety regulations.

In the United States and Canada, a recent surge of interest in kitchen upgrades of the commercial variety is driving investments in energy-efficient and space-saving refrigeration technology. Moreover, the implementation of IoT-dominated monitoring and automated temperature control systems is improving refrigeration efficiency among foodservice processes.

But due to strong presence of foodservice industry and also focused regulatory pressure towards energy efficient appliances Europe owns a big chunk of commercial undercounter and worktop refrigeration market.

Germany, France, and the UK are among the leaders adopting smart refrigeration solutions to abide by EU sustainability initiatives. One of the key factors propelling regional market growth is the surging demand for compact refrigeration units used in urban restaurants and grab-and-go food outlets.

Asia Pacific is projected to witness the greatest growth in the commercial undercounter and worktop refrigeration market on account of rapid urbanization, increasing disposable income, and growth in food service chains.

In fast-emerging hospitality and retail industries, demand for refrigeration solutions is growing in countries such as China, Japan, South Korea, and India. Furthermore, increasingly using of green refrigerants and intelligent energy management technologies is aiding in market growth throughout the region.

Challenge

High Energy Consumption and Compliance with Sustainability Regulations

In Commercial undercounter and worktop refrigeration units, commercial refrigerators run 24x7 that leads to high energy consumption and high operational costs for businesses. Manufacturers must now adhere to energy efficiency guidelines as well as laws prohibiting hydrofluorocarbon (HFC) refrigerants that impact greenhouse gases with stricter environmental regulations.

From balancing performance with energy savings to adapting to new sustainability standards, restaurants, cafes and food service operators the world over are under pressure to deliver results that don’t break the bank.

In order to impact this band aid patch makers need to invest in high efficiency series in their refrigeration offerings from eco-friendly refrigerants to more efficient compressors and intelligent cooling technologies that realise performance without sacrificing energy usage.

Opportunity

Growth in Smart Refrigeration and Space-Saving Designs

Food service businesses are looking for efficiency in their kitchens and smart auto-preservation, which is pushing the growth of beefed-up, energy-efficient, and smart refrigeration units. Mounting use of IoT-enabled refrigeration systems enables the operators to monitor, temperature, humidity, and energy use remotely, this prevents wastage of food and energy.

Meanwhile, the emergence of small-format kitchens, ghost kitchens, and convenience-focused foodservice models has driven demand for undercounter and worktop refrigeration solutions that provide maximum storage in a minimal footprint. Companies that invest in smart refrigeration controls, self-cleaning condensers, and modular storage configurations will earn a competitive advantage in the transforming commercial kitchen landscape.

Between the years 2020 and 2024, the commercial refrigeration market had witnessed increased demand on account of the rapid proliferation of quick-service restaurants, convenience stores, and delivery-based food services.

But, the rising energy costs and new sustainable environmental regulations led businesses towards energy-efficient refrigeration solutions. Manufacturers responded with models with increased insulation, digital temperature controls and lower environmental impact.

2025 to 2035: The Industry Phase: Smart, Automated, Ultra-Efficient Refrigeration. Internet of Things (IoT) capabilities, predictive maintenance, and artificial intelligence (AI)-driven cooling optimization will become the norm, allowing food service businesses to drive down costs and maximize equipment lifespan. The drive towards sustainability will also accelerate innovation in natural refrigerants and fully recyclable refrigeration units.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Energy Efficiency | Purchase new models that are ENERGY STAR-rated and that have better insulation. |

| Refrigerant Regulations | Transition from HFCs to lower-GWP refrigerants. |

| Smart Technology Integration | Basic digital temperature controls and LED displays. |

| Food Safety & Temperature Control | Standard refrigeration with manual monitoring for food storage. |

| Kitchen Space Optimization | Growth in compact and multipurpose refrigeration units. |

| Sustainability & Circular Economy | Initial efforts in recyclable materials and energy reduction. |

| Regulatory Compliance | Compliance with energy efficiency standards and refrigeration safety guidelines. |

| Market Shift | 2025 to 2035 |

|---|---|

| Energy Efficiency | Molecular Plasmon Signatures and generation of quantum cone USERS |

| Refrigerant Regulations | Widespread use of natural refrigerants (CO₂, R290) with full regulatory compliance. |

| Smart Technology Integration | IoT-enabled remote monitoring, AI-driven cooling optimization, and predictive maintenance. |

| Food Safety & Temperature Control | Automated temperature adjustments, humidity control, and real-time alerts for food safety compliance. |

| Kitchen Space Optimization | Customizable, modular refrigeration systems designed for micro-kitchens and ghost kitchens. |

| Sustainability & Circular Economy | Full transition to recyclable refrigeration units with minimal environmental impact. |

| Regulatory Compliance | Stricter global regulations on sustainability, waste reduction, and smart refrigeration technology. |

Overview The USA commercial undercounter and worktop refrigeration market is expected for steady growth, boosted by the increasing adoption from end-user applications such as restaurants, cafés, hotels and foodservice outlets. A major push towards kitchen interiors that are cantonment-optimized and not sprawling is driving usage of space-saving refrigeration that doubles as a work surface.

The rise of fast-casual dining and grab-and-go meal services increases the demand for efficient refrigeration systems that keep food fresh but doesn't disrupt kitchen flow. Moreover, the emergence of energy-efficient cooling technology, smart temperature control systems, is improving product performance, in line with sustainability initiatives in the foodservice sector.

| country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.2% |

UK Commercial Undercounter and Worktop Refrigeration Market Overview the UK commercial undercounter and worktop refrigeration market is primarily driven by the rising demand for compact and versatile refrigeration solutions, which is increasingly being adopted in small and medium scale foodservice establishments, catering businesses, and cloud kitchens across the country.

Demand for low-energy consumption units, in line with environmental legislation on refrigerants, is increasing the adoption of sustainable refrigeration technologies. Moreover, the shift toward premium food delivery services and the growth of convenience stores are driving the growth of the market, where businesses are opting for refrigeration systems that maximize storage without taking up more valuable kitchen space.

| country | CAGR (2025 to 2035) |

|---|---|

| UK | 2.7% |

The European Union demonstrates continuous commercial demand for undercounter and worktop refrigeration as Germany, France and Italy drive the market forward. The shift towards energy-efficient cooling technologies and environmentally friendly refrigerants drives foodservice businesses to buy modern cooling systems that satisfy EU power criteria and cut down carbon emissions.

Market demand for mini refrigeration units grows because of the hospitality and tourism industry expansion within bars along with hotels and upscale dining establishments. The rise of modular kitchens and workspaces as well as smart inventory management and digital temperature monitoring drives product development in multifunctional refrigeration systems for modern kitchen setups.

| country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 2.9% |

Japan's Commercial Undercounter & Worktop Refrigeration Market is growing by the factors such as rapidly growing restaurant kitchens in narrow urban areas and convenience stores requiring more numerous refrigerator units. Additionally, smart and IoT-enabled cooling solutions are gaining traction as companies look for automated temperature management and energy-efficient refrigeration.

Moreover, the growing prevalence of self-service food counters and automated retail stores is also contributing to the growth of the market. In addition, due to a greater emphasis on sustainability and food waste reduction, Japan is seeing more precise-humidity and longer-food-shelf life refrigeration systems.

| country | CAGR (2025 to 2035) |

|---|---|

| Japan | 2.6% |

Commercial undercounter and worktop refrigeration market in South Korea is on the rise with the growing coffee shop, bakery, and casual dining sector. Demand for digital, connected refrigeration units, for example, with real-time temperature-monitoring and remote-management capabilities, is being driven by the increasing adoption of smart kitchen technologies.

As demand for high-performance, space-efficient refrigeration systems that can maximize kitchen output grows with the proliferation of delivery-focused cloud kitchens and small-format restaurants, advancements are unfolding in many areas. Refrigeration solutions powered by sustainable technology are being driven by the transition of green refrigerants, as well as high performance cooling units in industrial businesses.

| country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.1% |

The front breathing compressors and undercounter installation segments dominate the commercial undercounter and worktop refrigeration market as businesses rise to maximize the kitchen space and work efficiency by using compact, energy-efficient refrigeration solutions.

From restaurants, hotels, and catering services to food retail businesses, these commercial refrigeration machinery play a significant role in preserving perishable ingredients, ensuring food safety, and providing accessibility in fast-paced kitchen environments.

The commercial refrigeration technology landscape is witnessing trends such as space limitations in commercial kitchens and increasing need for ergonomic refrigeration solutions are driving manufacturers to improve compressor efficiency, optimize airflow management, and enhance refrigeration unit durability to keep pace.

Industry Lead Demand for Front Breathing Compressors as Industries Focusing on Energy Efficiency and Space Optimization More Airflow, Smaller Design, Better Energy Management with Front Breathing Compressors The segment is anticipated to witness high growing opportunities for commercial undercounter and worktop refrigeration units that help in maintaining better airflow, space utilization, and efficient refrigeration.

The layout ensures the efficient operation of refrigeration systems, even in tight spaces, and allows for better placement options and optimized ventilation, without the need for additional clearance at the rear as is usually the case with rear breathing units.

Adoption has been boosted due to the demand for front breathing high-efficiency compressors with advanced temperature control, lower noise output, and eco-friendly refrigerant technology. According to filtration and HVAC (heating, ventilation and air conditioning) manufacturers, more than 65% of commercial kitchens and food service establishments use front biting compressors as they require lesser space to fit underneath the counter, helps to work in high heat environment, requires lesser energy to run these compressors ensuring the strong demand for this segment.

The growing penetration of modular kitchen concepts, along with space-saving refrigeration capabilities, personalized cooling configurations, and energy-efficient compressor technology, has bolstered market demand, thereby facilitating increased uptake of front breathing compressors in compact kitchens in commercial setups.

With the development of AI-powered compressor control systems, real-time temperature monitoring, automated airflow adjustment, and predictive maintenance alerts and notifications, continued performance improvements and reliability have enabled even further adoption, improving cooling efficiency and reducing equipment down time.

By developing tailor-made front-to-breath refrigeration solutions that include dual-zone temperature management, customizable shelving systems, and smart defrosting technology, companies have optimized market growth and ensured greater adaptability for different food storage and preparation applications.

While front breathing compressors offer benefits to improved refrigeration performance, less kitchen space, and enabling the use of green energy, this segment is challenged by higher initial prices, difficulty accessing the compressor for maintenance when placed in a compact manner, and possible jamming of airflow if not installed correctly.

Nevertheless, novel alternatives for AI-enabled compressor optimization, airflow engineering and self-cleaning refrigeration systems are resulting in greater energy efficiency, lower operational costs, and wider equipment lifespans, and this trend will go on supporting front breathing market expansion across the globe.

The following words are assembled randomly: Front Breathing Compressors Adopted in High Volume Restaurants, Catering Kitchens and Limited Office and Food Preparation Areas The front breathing compressors market is witnessing significant traction across end-use industries such as fast-paced restaurant kitchens, commercial food preparation areas, and catering services and delis, where businesses are seeking refrigeration solutions that maximize space, improve cooling efficiency and simplify kitchen operations.

Designed for optimal performance in tight spaces like your kitchen, front breathing compressors can be installed right up against the wall as well as next to other appliances, unlike rear breathing units. Adoption has been driven by the demand for next-generation front breathing refrigeration systems, which can feature AI-assisted airflow balancing, programmable temperature zones, and smart energy-saving modes.

When utilizing refrigeration units, studies show that over 70% of commercial kitchens are integrated with front breathing compressors undercounter and worktop refrigeration units due to their capacity for satisfying the abovementioned factors such as fitting in confined spaces effectively, pro activity, pronounced cooling, and better kitchen ergonomics which leads to high demand for this segment.

The development of innovative refrigeration technologies with variable-speed compressors, adaptive cooling systems, and AI-assisted predictive maintenance has fortified market penetration, ensuring better refrigeration performance and optimized food storage conditions.

Smart technology for commercial kitchens-boasting IoT-enabled refrigeration control, automated humidity regulation, and cloud-based temperature tracking-has also spurred increased adoption, by ensuring compliance with species and quality standards for food safety, while enhancing the efficiency of kitchen equipment.

While the front breathing compressor segment is beneficial for more efficient kitchen layout, better refrigeration and sustainable cooling solutions, certain problems like clogging of airflow due to improper ventilation, filter cleaning and higher initial investment cost limits its market growth.

But the new emergence of self-cleaning compressor technology alongside smart airflow guidance and AI-powered refrigeration diagnostics guarantees longer service life, optimised routine maintenance, and minimal operational sustainability, thus opening a wide range of avenues for front breathing compressors in the years to come, globally.

Undercounter refrigeration improves accessibility while maximizing available storage and work flow in the kitchen

The undercounter installation segment has become an utmost favoured configuration in the commercial undercounter and worktop refrigeration landscape, allowing restaurant chains, café kitchens, and catering services to strategically position refrigeration, improve food access, and movement in the kitchens.

Unlike freestanding refrigeration units, the undercounter refrigerator is integrated with kitchen workspaces to ensure that fresh ingredients are always within reach and that food preparation activities are not interrupted.

Growing popularity of high-performance undercounter refrigeration units offering customizable storage configurations, energy-efficient cooling technology, and ergonomic drawer and shelving designs to drive adoption. According to the studies, over 75% of modern commercial kitchens incorporate undercounter refrigeration to increase ingredient accessibility, optimize kitchen workflow and support food safety compliance, fuelling demand for this segment.

Moreover, the growing trend toward space-sensitive designs of kitchens with multi-purpose workstations, modular refrigeration systems, and energy-efficient cooling solutions has diversified market demand, resulting in wider adoption of undercounter refrigeration across a variety of food service applications.

Modern-day refrigerator units, equipped with AI-assisted temperature control, automated defrost cycles, and cloud-based inventory management, have also seen increased adoption thanks to the extra safety net they provide when managing food quality and streamlining kitchen processes.

Highly dedicated undercounter refrigeration designs to fit adjustable cooling zones, high-efficiency evaporators, and seamless stainless-steel integration with kitchen workstations contribute to the localized market growth, and helps better suited for compact and high-throughput food service surroundings.

While the undercounter refrigeration segment brings significant benefits, including optimized kitchen space usage, improved refrigeration access, and better food preparation time efficiency, it is also caused by factors such as expensive installation, low storage capacity for premium units, and the requirement for periodic airflow maintenance to prevent overheating when gross storage build-up occurs.

New technologies in cooling efficiency through artificial intelligence, next-gen thermal insulation technology, and self-adjusting compressor technology drive energy performance, equipment uptime performance, and refrigeration sustainability that are continuing to ensure market growth for undercounter refrigeration, globally.

Refined Commercial Applicability and Sophistication of Under Counter Refrigeration Solutions

The warmer undercounter refrigeration class has also seen significant adoption among full-service restaurant kitchens (especially among medium- to large- sized kitchens), grab-and-go food service setups and other premium hospitality venues as operators seek refrigeration options which maximize ingredient storage, culinary organization and premium food quality "on the plate."

Compared to freestanding refrigeration units, undercounter refrigerators are better for overall kitchen space utilization, workstation integration, and better access to essential pantry ingredients, ensuring operational efficiency and increased appliance convenience while preparing food.

This, in turn, has driven adoption of next-gen undercounter refrigeration systems with high-efficiency cooling mechanisms, AI-assisted inventory tracking and advanced humidity control.

Data released in a report studies that over 80% of commercial food service enterprises, you will find space saving refrigerators integrated into their offers are undercounter refrigerators are capable of ergonomic collaboration for all of their operations together with fitted kitchen layouts, generating high demand for this segment.

Although an undercounter refrigeration provides improved kitchen operations, sustainable cooling technology, and better food safety adherence, this segment is long faced with obstacles covering larger investment costs, constrained installation space, and continuous energy efficiency regulatory policies.

But the innovations emerging in smart kitchen connectivity, automated refrigeration diagnostics, and AI-driven cooling optimization are enhancing kitchen efficiency, extending equipment lifespan, and minimizing sustainability impact, all of which guarantee ongoing global growth for undercounter refrigeration.

Industry Overview

This market grows because businesses require undercounter and worktop refrigeration solutions for their restaurants and cafes together with convenience stores and institutional kitchens. The product provides excellent food storage benefits with improved workspace performance which makes it necessary equipment for restaurants operating with constrained spaces.

The industry expands through constant improvements in power-efficient cooling approaches and digital temperature management systems with environmentally safe refrigeration substances adoption trends. The leading companies within this field are developing stainless steel production methods and smart surveillance capabilities as well as efficient compressor performance systems to boost operational reliability and efficiency levels.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| True Manufacturing Co., Inc. | 18-22% |

| Turbo Air, Inc. | 15-19% |

| Hoshizaki Corporation | 12-16% |

| Traulsen (ITW Food Equipment Group) | 9-13% |

| Continental Refrigerator | 7-11% |

| Other Companies & Regional Players (Combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| True Manufacturing Co., Inc. | Specializes in energy-efficient, high-performance undercounter refrigerators with stainless steel construction and digital monitoring. |

| Turbo Air, Inc. | Offers self-cleaning condenser technology and compact refrigeration units designed for space-constrained kitchens. |

| Hoshizaki Corporation | Provides commercial undercounter and worktop refrigeration solutions with advanced temperature management and eco-friendly refrigerants. |

| Traulsen (ITW Food Equipment Group) | Focuses on heavy-duty refrigeration solutions with precise temperature controls and smart diagnostics. |

| Continental Refrigerator | Develops durable and cost-effective undercounter refrigeration units with high-efficiency cooling systems. |

Key Company Insights

True Manufacturing Co., Inc. (18-22%)

Technologic performance combined with industrial-leading temperature control marks True Manufacturing as the premier provider of commercial undercounter refrigeration products

Turbo Air, Inc. (15-19%)

Turbo Air specializes in compact and energy-saving refrigeration solutions, offering self-cleaning condensers and digital controls for improved performance.

Hoshizaki Corporation (12-16%)

Hoshizaki provides premium-quality refrigeration units, integrating advanced cooling technology and environmentally friendly refrigerants to enhance energy efficiency.

Traulsen (ITW Food Equipment Group) (9-13%)

Traulsen is a key player in heavy-duty commercial refrigeration, offering smart temperature control systems and durable stainless steel undercounter units.

Continental Refrigerator (7-11%)

The foodservice division of Continental Refrigerator develops affordable refrigeration solutions that exhibit excellent performance characteristics and maintain long-lasting operation.

Other Key Players (30-40% Combined)

More manufacturers participate in the commercial undercounter and worktop segment by delivering newer models which combine space-efficient features with high efficiency performance. Notable players include:

The overall market size for Commercial Undercounter and Worktop Refrigeration Market was USD 12.16 Million in 2025.

The Commercial Undercounter and Worktop Refrigeration Market is expected to reach USD 16.19 Million in 2035.

The demand for the commercial undercounter and worktop refrigeration market will grow due to increasing adoption in restaurants, cafes, and food service establishments, rising demand for space-efficient refrigeration solutions, growing emphasis on food safety regulations, and advancements in energy-efficient cooling technologies.

The top 5 countries which drives the development of Commercial Undercounter and Worktop Refrigeration Market are USA, UK, Europe Union, Japan and South Korea.

On the basis of Front Breathing Compressors and Undercounter Installation Form to command significant share over the forecast period.

Coffee Roaster Machine Market Analysis by Product Type, Capacity, Control, Heat Source and Application Through 2035

Vegetable Sorting Machine Market Analysis by Processing Capacity, Technology, Operation Type, Vegetable Type, and Region Through 2035

Automated Brewing System Market Analysis & Forecast by Product Type, Capacity, Mechanism, and Region through 2035

Brewing Boiler Market Analysis by Material Type, Application, Automation, and Region 2025 to 2035

Bakery Processing Equipment Market Analysis by Product Type, End User, Application & Region: A Forecast for 2025 and 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.