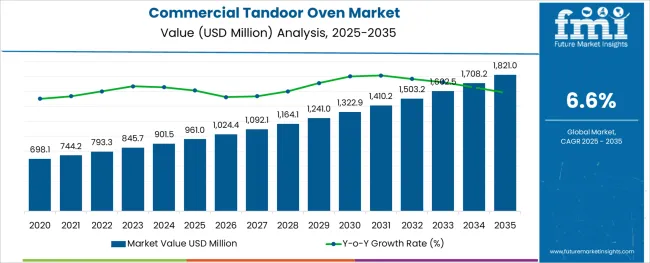

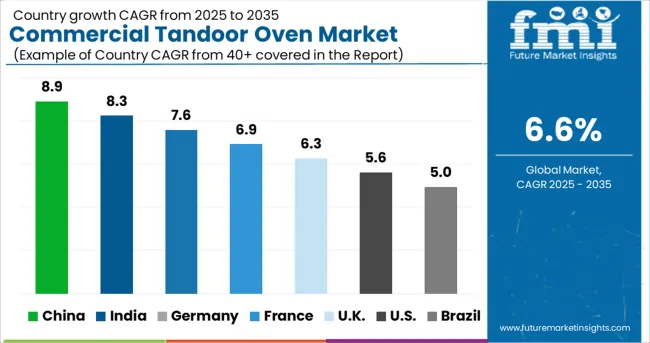

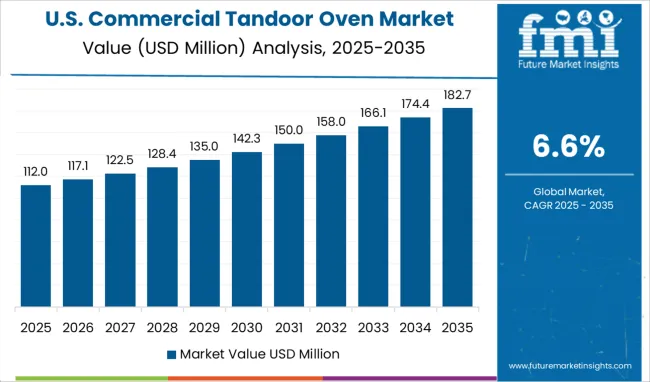

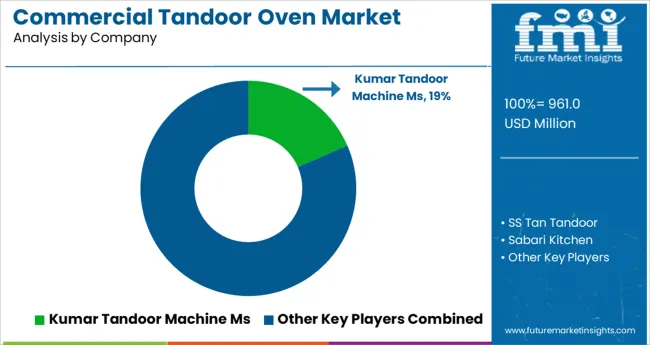

The Commercial Tandoor Oven Market is estimated to be valued at USD 961.0 million in 2025 and is projected to reach USD 1821.0 million by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

The commercial tandoor oven market is undergoing consistent growth as demand from the food service industry aligns with evolving preferences for authentic and efficient cooking solutions. Increasing penetration of specialty restaurants, rising disposable incomes, and a growing inclination toward traditional cuisines are fueling adoption across global markets.

Manufacturers are focusing on enhancing durability, energy efficiency, and ease of maintenance to cater to the needs of high-volume commercial kitchens. Future growth is expected to be driven by the introduction of innovative materials, improved fuel efficiency, and regulatory compliance with food safety standards.

Expansion of organized food service chains, coupled with growing emphasis on operational cost reduction and customer experience enhancement, is creating opportunities for wider deployment of commercial tandoor ovens across diverse culinary establishments.

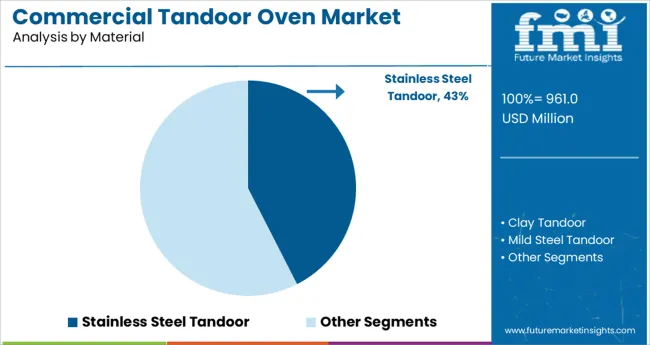

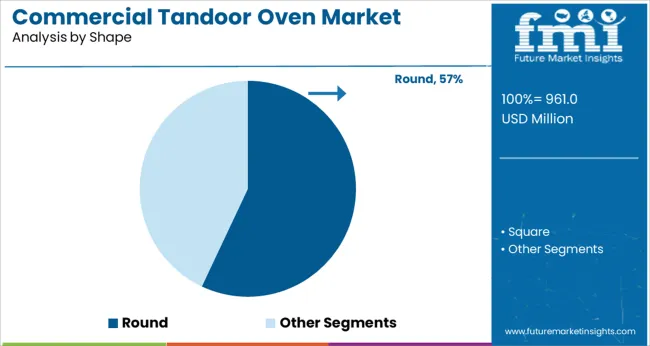

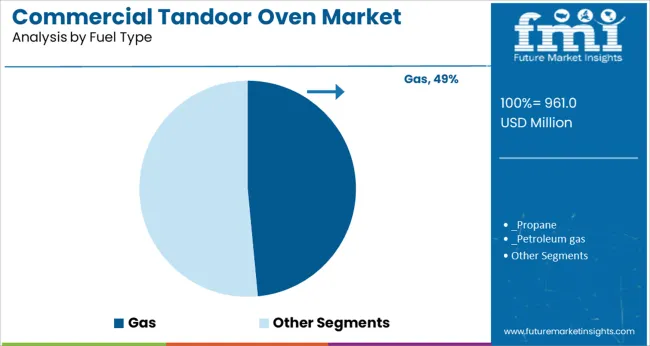

The market is segmented by Material, Shape, Fuel Type, and Capacity and region. By Material, the market is divided into Stainless Steel Tandoor, Clay Tandoor, and Mild Steel Tandoor. In terms of Shape, the market is classified into Round and Square. Based on Fuel Type, the market is segmented into Gas, Electricity, and Natural Sources.

By Capacity, the market is divided into 200-400 Ltrs, 100-200 Ltrs, 400-600 Ltrs, and Above 600 Ltrs. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by material, stainless steel tandoor is expected to account for 42.50% of the total market revenue in 2025, emerging as the leading material choice.

This leadership has been reinforced by the material’s inherent durability, corrosion resistance, and ease of cleaning, which align with the rigorous demands of commercial kitchens. Stainless steel has been widely adopted as it ensures hygiene compliance and maintains structural integrity under high-temperature operations.

Its aesthetic appeal combined with low maintenance requirements has positioned it as a preferred option for both premium and mid-tier establishments. Furthermore, its compatibility with modern kitchen designs and adaptability to different fuel sources have strengthened its dominance within the material segment.

Segmented by shape, round tandoors are projected to hold 57.00% of the market revenue in 2025, maintaining their position as the most favored design. This prominence has been driven by the round shape’s ability to evenly distribute heat, resulting in consistent cooking performance and authentic texture of tandoor-prepared dishes.

The ergonomic design of round tandoors facilitates efficient handling and placement within commercial kitchens, which has contributed to their widespread use. Additionally, their proven ability to retain heat over extended periods and reduce fuel consumption enhances operational efficiency for restaurants with high turnover rates.

The round shape’s traditional appeal coupled with practical functionality has ensured its continued preference across diverse food service environments.

When segmented by fuel type, gas tandoors are anticipated to capture 48.50% of the market revenue in 2025, establishing themselves as the leading fuel choice. This dominance has been supported by the growing need for cleaner and more controllable cooking options in commercial settings.

Gas-powered tandoors offer improved temperature regulation, reduced emissions, and faster start-up times compared to traditional solid fuel alternatives, which has driven their adoption in urban and indoor kitchens. The ability to comply with stringent environmental and safety norms while maintaining cooking authenticity has further reinforced their market position.

Additionally, the cost-effectiveness and convenience associated with gas as a fuel source have made it a practical and reliable choice for a wide range of food service operations.

As per the previous commercial tandoor oven market survey report by FMI, the market grew with an average CAGR of 5.4% between the periods covering the years 2020 to 2025. However, during the following years, with the opening up of local markets, the commercial tandoor oven market restored its business activities and has re-established its previous growth rate for the upcoming years as the manufacturers are getting more orders these years and this promises better growth prospects during the forecast years.

Energy and Time Conservation

Additionally, any food service equipment that decreases labor and boosts productivity is essential because modern restaurant kitchens are getting smaller with space constraints. This is why the equipment that's running smarter, smaller, and easier to operate is favored along with equipment that saves on labor and makes work easier.

Commercial Tandoor can run both with electricity and gases which eventually makes it convenient to use, moreover with its temperature regulation techniques the equipment saves a lot of time in any food service station. The emergence of cloud kitchens in recent years has also increased the demand for commercial tandoor ovens and is predicted to accelerate the target market growth and opportunities.

Multifunctional Kitchen Appliances.

Years following 2025 are also predicted to see a rise in the use of multi-functional kitchen appliances in commercial as well as household kitchens. Restaurant owners strive to maximize their cooking space, and one way they can achieve this is by using equipment that performs numerous tasks. Combination and rapid cook electric tandoor for commercial use, which offers many cooking processes for making a variety of foods, are among the hottest pieces of kitchen equipment.

Visually Appealing and Versatile Cooking Appliances

As the trend toward natural ingredients and clean menus persist, kitchens are implementing open designs and front-of-house prep. Customers want to know where their food originates from and feel involved in the experience, so restaurants need to adapt by putting new cooking technology into place. One trend that we can anticipate during the future years is the use of aesthetically pleasing cooking equipment that can boost the demand for commercial tandoor ovens around the world.

Brightly colored tandoor ovens are examples of some innovative designs that have increased the number of commercial tandoor ovens for sale at local stores. In addition, the new technology replacing large buttons and knobs with sleek touchscreens has rendered the product attractive for many high-end restaurants and hotels in urban areas.

According to FMI commercial tandoor oven market analysis report, the Indian market is estimated to account for more than 50% share of the South Asia market in 2025 and the following years. Indians are known to live for their tandoori cuisine making it the traditional and largest commercial tandoor oven market.

Tandoori food aficionados and tandoori cuisine is found in every nook and cranny of the country, whether it be a street vendor or a fine dining establishment consequently giving rise to the highest demand for commercial tandoor ovens. The earthy flavor and distinctive Smokey hint of tandoori foods, together with the exquisite scent, set them apart from those prepared on a gas stove. All these factors together are also driving the regional commercial tandoor oven market exponentially.

In the year 2025, the North American region accounts for a significant market share in the commercial tandoor oven market with the changing face of authentic and cultural food in America. For instance, the number of Indian restaurants is estimated to be above 10000 in the USA, and they range from Michelin-starred restaurants to family restaurants to small, local joints.

Every American is now familiar with Tandoor chicken and butter naan, and these foods are offered in nearly every part of the world. Everything from traditional and genuine to upscale fusion cuisine is available presenting a huge commercial tandoor oven market opportunity in the region.

Though commercial clay tandoors are the traditional variants with a significant contribution to the market's growth, stainless steel, and mild steel ovens are preferred more these days for their efficiency and utility. Stainless steel has a variety of corrosion-resistant qualities, including not corroding and not rusting which makes it a perfect choice for any type of kitchen utensil and equipment. Also, stainless steel weighs nearly three times as much as aluminum so it provides a sturdy build quality to all types of commercial tandoor for long-term use.

Stainless steel is a low-maintenance metal that is also simple and inexpensive to clean and maintain. Moreover, due to its ease of cleaning and resistance to corrosion, stainless steel tandoor is favored in sterile and clean environments making it the most profitable material for commercial tandoor oven manufacturers these days.

As the major buyers of this product are large restaurants and hotels that require the preparation of bread and naan in large quantities so commercial tandoor ovens with a capacity of more than 600 liters are the highest-selling product. Also, the efficiency and utility of these large ovens make them the preferred product for most end users.

However, as per the commercial tandoor oven market analysis report released by FMI, in recent years there has been a surge in smaller size ovens ranging from 100 liters to 400 liters. This major development is attributed to the growing sales of commercial tandoor ovens to be used for the purpose of domestic cooking and prepared food business in small towns.

Presently, both the gas and electric variant of the product are available contributing equally to the commercial tandoor oven market key trends and opportunities. But, as per the market report, the electric tandoor for commercial use is overtaking the former type for better convenience and ease of use. Moreover, the rising prices of fuel and petroleum gas might prove to be a detrimental factor for the commercial tandoor oven market growth in the gas category. Other than that, some variants that are designed to run on coal and wood also do have a significant share in augmenting the commercial tandoor oven market trends in present times.

As the commercial tandoor oven manufacturers are mostly localized in South Asia region, particularly India, it makes the overall market highly competitive. Nevertheless, the growing popularity of Indian cuisine around the world can be an easy opportunity for any utensil manufacturer to enter the global commercial tandoor oven market.

Some of the major players operating in the commercial tandoor oven market include Kumar Tandoor Machine Ms, SS Tan Tandoor, Sabari Kitchen, Ranvir, Dhanraj Bhati Tandoorwala, Shri Krishna Cooking Equipments, Nand Equipment Pvt. Ltd, Mohanlal Tandoors, Homdoor, Kanhaiyalal Tandoors, GULSHAN TANDOOR, Shiv Tandoor Wala, Bhawani among others.

| Attribute | Details |

|---|---|

| Market Size Value in 2025 | USD 961.0 million |

| Market Forecast Value in 2035 | USD 1821.0 million |

| Global Growth Rate | 6.6% CAGR |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | MT for Volume and million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; and MEA |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, Chile, Peru, Germany, France, Italy, Spain, The United Kingdom, Netherlands, Belgium, Nordic, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Indonesia, Singapore, Australia, New Zealand, GCC Countries, South Africa, Central Africa, North Africa, and others |

| Key Market Segments Covered | Material, Shape, Fuel Type, Capacity, Region |

| Key Companies Profiled |

Kumar Tandoor Machine Ms; SS Tan Tandoor; Sabari Kitchen; Ranvir; Dhanraj Bhati Tandoorwala; Shri Krishna Cooking Equipment; Nand Equipment Pvt. Ltd; Mohanlal Tandoors; Homdoor; Kanhaiyalal Tandoors; GULSHAN TANDOOR; Shiv Tandoor Wala; Bhawani; Others (On additional request) |

| Pricing | Available upon Request |

The global commercial tandoor oven market is estimated to be valued at USD 961.0 million in 2025.

It is projected to reach USD 1,821.0 million by 2035.

The market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types are stainless steel tandoor, clay tandoor and mild steel tandoor.

round segment is expected to dominate with a 57.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA