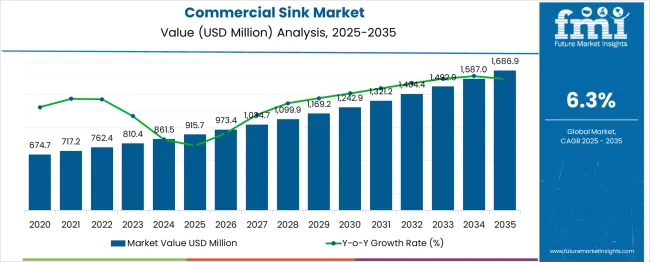

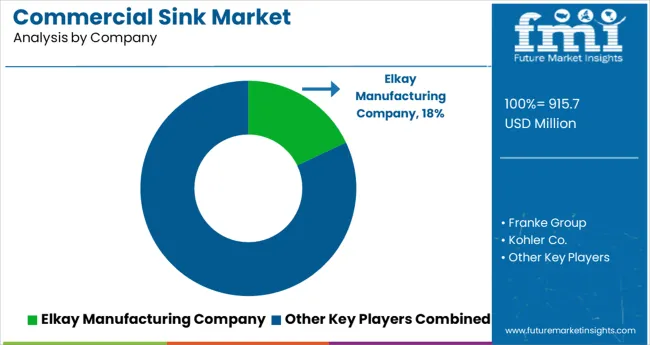

The Commercial Sink Market is estimated to be valued at USD 915.7 million in 2025 and is projected to reach USD 1686.9 million by 2035, registering a compound annual growth rate (CAGR) of 6.3% over the forecast period.

The commercial sink market is experiencing steady growth as hygiene regulations, evolving kitchen designs, and the need for durable, cost-efficient infrastructure drive adoption across hospitality, healthcare, and institutional settings. Growing emphasis on food safety and sanitation compliance has encouraged businesses to invest in high-quality sinks that support rigorous cleaning protocols.

At the same time, advancements in materials and ergonomic designs are enabling sinks to seamlessly integrate into modern commercial kitchens and workspaces, reducing operational inefficiencies. Future expansion is expected to be supported by rising investments in commercial construction, retrofitting projects, and sustainability initiatives that favor long-lasting, recyclable materials.

Enhanced durability, reduced maintenance costs, and the ability to meet aesthetic and functional demands are paving the way for wider market penetration.

The market is segmented by Material, Sink Type, Bowl Type, and End Use and region. By Material, the market is divided into Stainless Steel, Cast Iron, Composite, Granite/Quartz, and Others. In terms of Sink Type, the market is classified into Top Mount, Under Mount, Wall Mount, Flush Mount, and Others. Based on Bowl Type, the market is segmented into Single, Double, and Triple. By End Use, the market is divided into Restaurants, Hotels, Hospitals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

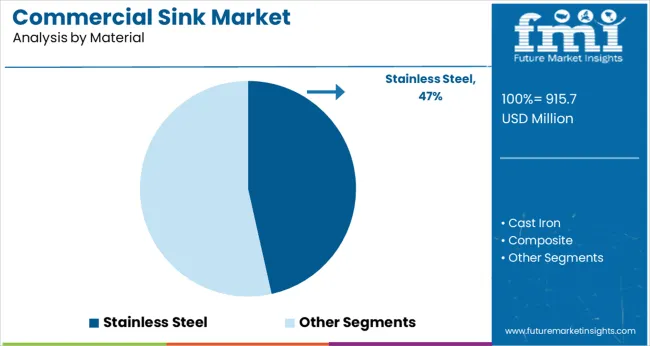

When segmented by material, stainless steel is anticipated to hold 46.5% of the total market revenue in 2025, establishing itself as the dominant material choice. This leadership has been reinforced by its superior resistance to corrosion, ease of cleaning, and compliance with stringent hygiene standards required in commercial environments.

The inherent durability and recyclability of stainless steel have further supported its appeal, offering both environmental and economic benefits over alternative materials. Its ability to withstand heavy usage and exposure to chemicals without degradation has positioned it as the preferred material for foodservice, healthcare, and industrial applications.

Additionally, its sleek aesthetic and compatibility with modern kitchen designs have contributed to sustained demand, ensuring its prominence in the market.

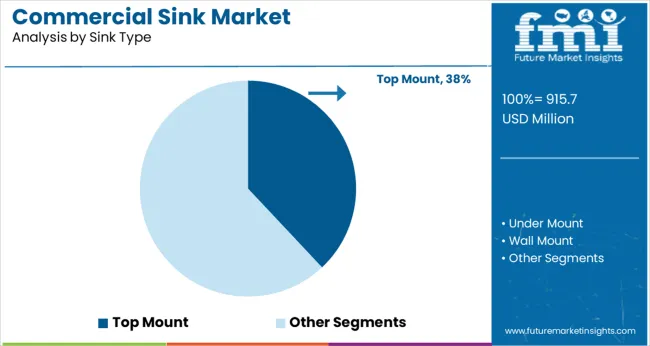

In terms of sink type, the top mount segment is expected to account for 38.0% of the market revenue in 2025, making it the leading sink type. This dominance has been supported by the practicality and cost efficiency of top mount sinks, which simplify installation and maintenance in busy commercial settings.

The secure fit and ability to accommodate varying counter materials have made this type particularly suitable for retrofits and renovations. Its design minimizes installation time and disruption, a factor that has proven critical in operational environments where downtime needs to be minimized.

The versatility and affordability of top mount sinks have consistently appealed to a broad range of end users, consolidating its position as the most widely adopted sink type.

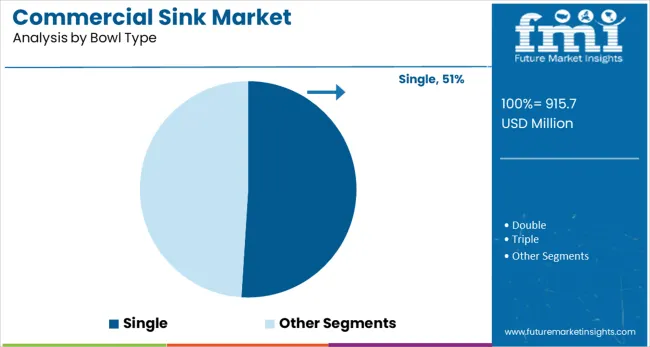

When segmented by bowl type, single bowl sinks are projected to capture 51.0% of the market revenue in 2025, securing their position as the leading bowl configuration. This preference has been driven by the simplicity, space efficiency, and ease of cleaning associated with single bowl designs.

In high-turnover kitchens and work areas, single bowls allow for larger items to be washed more effectively while reducing the risk of contamination between sections. Their straightforward design and lower installation footprint have enabled businesses to maximize available workspace without compromising functionality.

Furthermore, the lower cost of single bowl sinks compared to more complex configurations has reinforced their widespread adoption, particularly among small and medium-scale operations seeking both efficiency and affordability.

This occurred as a result of the lockdown, which was followed by individuals refraining from eating risky outside food to stop the spread of the virus. The high fall in CAGR value results from the complete shutting down of a business to temporarily going out of the funds to renovate or rebuild their business. Though, now with the government support and subsidies along with the high spike in the demand for outside fast food along with the increasing online food demand has finally put the business back on track for the commercial sink vendors.

The major drivers for the commercial sink market are the long list of applications and the rising demand from bars, cafes, restaurants, and hotels. Furthermore, social gatherings such as parties, concerts, and movie shows keep these sinks for serving different kinds of drinks to the end users. The other small-range suppliers who work with medium-scale enterprises in customizing the sink in accordance with their needs can be seen and defined while these verticals can be viewed and understood. The integrated sink holds the fryer and other kitchen equipment for the ease of the chef. Other than this, new and advanced lighting systems with utensil-specific compartments are pushing restaurants to adopt the latest technology including commercial sinks.

Restraints

The biggest factor that hinders the sale of commercial sink systems is the high cost associated with it along with the introduction of cloud kitchen that takes away the whole dining experience with its fast delivery systems.

In 2025, the demand for stainless steel sinks is expected to hold the biggest share of 72.6%. The growth is attributed to its durability and easy supply chain. Other than this, Stainless steel makes the sink steady and easily cleanable due to its smooth surface along with its affordable price and easy moldability. The constant flow of water doesn’t let the rust stick in due to the stainless quality of the sink.

The hotel sector consumes most of the commercial sink market as it demands different types of sinks including kitchen sinks and small-scaled restaurants. It holds a share of 37.4% of the global market. The hotels have multiple operation working that requires a huge number of these sinks as every sink from the global market . The hotels have multiple operation working that requires a huge number of these sinks as every sink is used in a different manner.

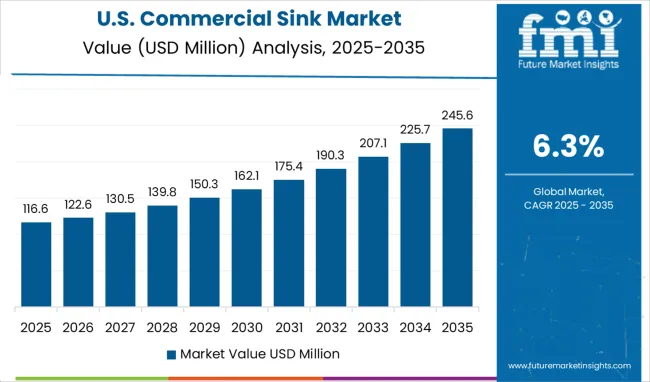

The United States of America holds the largest share of 32.6% in the global market attributed to the higher number of hotels and eateries. The penetration of automated technologies and smart kitchen ideas in the US have fueled the demand for these commercial sinks. The sinks are generally considered one of the important parts of the kitchen as it fastens up the cooking procedures.

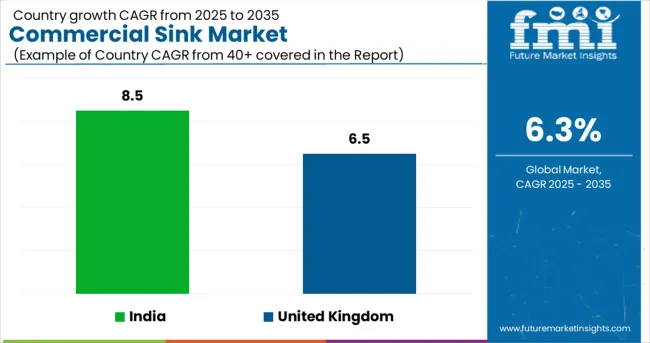

While the United Kingdom is expected to register at a CAGR of 6.5% between 2025 and 2035. The increased number of small-scale eateries and restaurants has fueled the growth of the commercial sink market in the adoption of multi-purpose sinks with customization available, expanding the commercial sink market size.

India becomes the fastest-growing region in the global commercial sink market with an anticipated CAGR of 8.5% between 2025 and 2035. Nation building its healthcare systems and hospitals along with the rising number of hotels and restaurants due to the rising population and tourism has led India to become the fastest growing market in the Asia-Pacific

The UK is expected a healthy CAGR of 6.5% between 2025 and 2035. Setting up more restaurants offering food from every cuisine in the world. These places serve all kinds of international cuisines. As a result, having a commercial sink is essential for doing the dishes and saving effort.

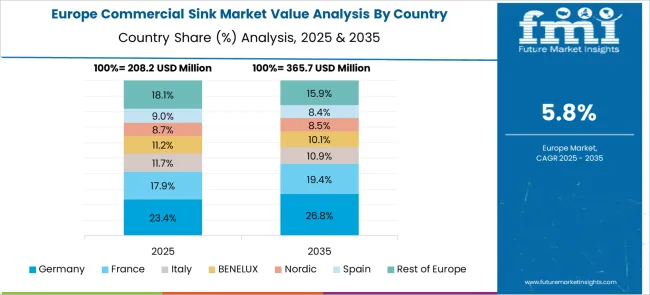

Germany is anticipated to hold a share of 7.1% of the global market. This is attributed to its increasing hotel industry that demands the best kitchenware including multi-purpose sinks, making it one of the prominent markets in the European region. This ultimately fuels the sales of commercial sinks.

Food enthusiasts around the world invest in creating a sustainable solution for hotel and restaurant workers to create a solution for a better dishwashing experience. The use of IoT in smart kitchen ideas is gaining traction in the start-up landscape of the commercial sink market.

The market includes both international and domestic participants. Key market players focus on strategies such as innovation and new product launches in retail to enhance their portfolios and positioning in the market.

Recent Market Developments:

Swanstone sink co. has come up with a long range of single and double bowl configurations, drop-in and undermount style sinks that fuels the sales of commercial sinks in the global market.

| Report Attributes | Details |

|---|---|

| Commercial Sink Market Size (2025) | USD 915.7 million |

| Projected Market Value (2035) | USD 1686.9 million |

| Global Market Growth Rate (2025 to 2035) | 6.3% CAGR |

| USA Market Share (2035) | USD 32.6% |

| UK Market CAGR (2025 to 2035) | 6.5% |

| Key Companies Profiled | Ruvati USA; Kohler Co.; Zuhne; Frigidaire; Swanstone; Acrysil Limited; AGA; Duravit AG; Dornbracht; Roca |

The global commercial sink market is estimated to be valued at USD 915.7 million in 2025.

It is projected to reach USD 1,686.9 million by 2035.

The market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types are stainless steel, cast iron, composite, granite/quartz and others.

top mount segment is expected to dominate with a 38.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA