The commercial refrigeration compressor market is anticipated to grow steadily, reaching an estimated value of USD 42.1 billion in 2025, which is expected to reach around USD 64.1 billion by 2035, growing at a CAGR of approximately 4.3%. This is due to increasing demand in food retail, cold storage, and hospitality industries.

Among the major drivers of the industry is rapid growth in grocery distribution chains and food retail, particularly in emerging industries. Disposable incomes, urbanization, and shifting consumer demand for frozen and fresh food are increasing investment in refrigerated display cases, storage rooms, and transport units.

The rising demand has been further increased due to the spread of quick-service restaurants (QSRs), convenience stores, and cloud kitchens. Such business operations demand low-profile, high-performance compressors that can thrive in high-frequency usage applications as well as experience varying temperatures.Energy efficiency is still a top priority.

Compressors contribute a majority of power consumption in refrigeration equipment. Variable speed compressors, inverter-driven machines, and low-global-warming-potential (GWP) refrigerants are driving operators to comply with energy regulations and lower operational expenditure. Nonetheless, the industry is also confronted with refrigerant regulation issues, especially in Europe and North America.

Phasing out high-GWP refrigerants like R-404A under F-Gas and Kigali Amendment laws is compelling manufacturers to redesign compressor systems to accommodate new environmentally sound alternatives, including hydrocarbons and CO₂.

Price sensitivity among the emerging economies can restrict use of high-efficiency compressor types. Savings through reduced operational cost are evident over the long term, but higher initial expense associated with more complex systems is an obstacle for small and medium-size businesses in price-sensitive industries.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 42.1 billion |

| Industry Value (2035F) | USD 64.1 billion |

| CAGR (2025 to 2035) | 4.3% |

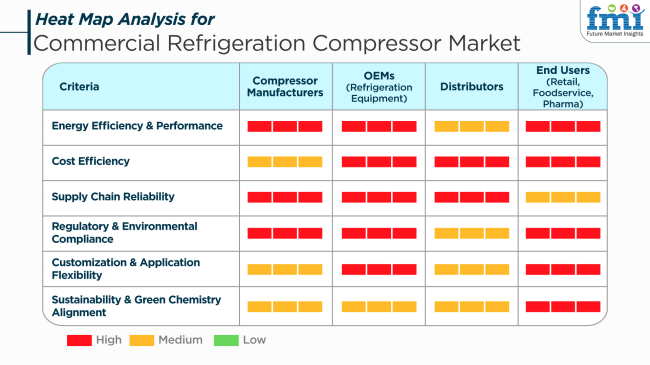

The industry is witnessing high growth fueled by some factors such as increasing demand for energy-efficient refrigeration solutions in numerous industries like food & beverage, pharmaceuticals, and retail.Compressor manufacturers concentrate on creating high-performance compressors that satisfy the high standards of end-use industries.

They invest in research and development to innovate and offer customized solutions that improve energy efficiency, minimize environmental footprint, and meet regulatory requirements.

Distributors highlight the need to have a stable supply chain to satisfy OEMs and end users' needs. They are keen on providing a wide variety of products to suit various applications while ensuring prompt delivery and competitive pricing. End users, such as retail, foodservice, and pharmaceutical, appreciate compressors due to their performance capabilities and the environment.

They require refrigeration equipment that can provide very precise temperature control to be in a position to maintain product quality and safety, as well as look for energy-efficient solutions to help contain operating costs.

The commercial refrigeration compressors industry is characterized by an alliance among stakeholders to design and apply products that meet performance requirements, are environmentally friendly, and address evolving industry requirements.

Between 2020 and 2024, the industry was influenced by the increased demand for cold storage solutions due to changes in food consumption patterns, particularly during the COVID-19 pandemic. Supermarkets, cold chains for pharmaceuticals, and convenience stores increased the deployment of refrigeration equipment, and thus the demand for efficient compressors increased.

But the industry also experienced some issues regarding environmental regulations of refrigerants, which prompted manufacturers to start making a transition to low-GWP solutions. Reliability, energy efficiency, and retrofitting existing systems to meet new refrigerant standards were the focus areas during this period.

From 2025 through to 2035, the industry will continue to trend toward even greener and more intelligent solutions. Solutions will encompass compressors designed exclusively for natural refrigerant applications with CO₂ and hydrocarbons, which are gaining traction owing to sustainability measures. IoT-based diagnostics and predictive maintenance smart compressors will become more common in commercial applications.

In addition, city-centric and lightweight modular systems, as well as mobile refrigeration, will reshape industry demand. Businesses will also be reacting to global decarbonization objectives through manufacturing quieter, lower-energy, and recyclable compressor units.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Cold storage demand surge, food safety regulation, pandemic-driven pharmaceutical logistics | Sustainability regulations, energy-efficient system demand, digitalization and predictive maintenance trends |

| Energy efficiency and conformity to refrigerant regulations | Global adoption of IoT-capable smart compressors and use of natural refrigerants such as CO₂ and R290 |

| Phase-down of high-GWP refrigerants, retrofit cost of systems | Natural refrigerant technological complexity, installation and maintenance training |

| North America and Asia-Pacific leading growth for supermarket and foodservice refrigeration | Growth in Europe and emerging regions driven by sustainability regulations and infrastructure investments |

| Growing regulation of HFCs, launch of refrigerant phase-out guidelines | International demand for low-carbon systems, more aggressive policies promoting natural refrigerants and lifecycle sustainability |

| Emergence of variable-speed and inverter-based compressor designs | Artificial intelligence-based control systems, recyclable materials, cloud-based diagnostics, and energy-optimized hybrid designs |

The industry, valued at USD 21.8 billion in 2024, is significantly vulnerable to stringent environmental legislations. Being compliant with shifting standards for using refrigerants and energy efficiency is a continuous upgrade process. Default can result in legal proceedings and industry share losses.

Supply chain disruptions such as transportation delays and geopolitical tensions present significant threats. The interruptions can prevent the timely delivery of raw materials and finished goods, causing production shutdowns and inability to meet customer demand. Such disruptions have a negative impact on sales and long-term business relationships.

The industry is confronted by the increasing demand for used and rented commercial refrigeration units. This can be detrimental to new unit sales, impacting manufacturers' revenue streams and hindering industry growth.

Technological improvements and the imperatives of innovation bring opportunities and threats. Business firms need to invest in R&D to be innovative and make product offerings improve continuously. Lacking this can lead to being obsolete and losing industry share to nimbler competitors.

Reliance on major industries like food and beverage, pharmaceutical, and retail is such that industry downturns directly affect demand for commercial refrigeration compressors. Diversification of the customer base across a range of industries can reduce the risk.

Overall, the commercial refrigeration compressors industry is at a risk of regulatory challenges, supply chain disruptions, industry competition, technological shifts, and sector-specific economic recessions. Anticipatory actions against these drivers are imperative for maintaining growth and competitiveness in this fast-paced industry.

Scroll compressors should dominate the industry, which is expected to have a 30% industry share in 2025, closely followed by reciprocating compressors with around a 25% industry share.

The scroll compressor segment will hold a high share due to its being highly efficient compared to maintenance costs and hence suitable for almost all commercial refrigeration applications, including supermarket and food storage, as well as for unique refrigeration units.

The increase in commercial refrigeration scroll compressor performance is therefore a function of their quieter operation and a low number of moving parts. Industry leaders such as Danfoss, Emerson Electric Company, and Bitzer manufacture magnificent scroll compressors covering a wide range of refrigeration requests and features regarding energy efficiency and performance upgrades. For example, the Copeland Scroll™ Compressors by Emerson are considered one of the reliable and energy-efficient choices for large-scale refrigeration applications.

Reciprocating compressors, which are expected to capture almost 25% of the industry, are still the favored choice for commercial refrigeration installations, particularly in areas where energy efficiency and value for money are major consideration factors.

Reciprocating compressors have remained in demand due to their solid build and versatile application properties, ranging from small commercial refrigeration units with refrigerated display cabinets to cold stores. The versatile reciprocating compressors used for this application can be sourced from brands such as Carrier and York International, which are known for their strength and performance under heavy-duty applications.

Further, there is also increasing interest in energy-efficient and environmentally friendly compressor technologies, driven by stringent regulations on emissions and energy consumption from refrigerants. Companies are also working toward integrating variable-speed drive technology into their compressors and natural refrigerants such as CO2 to comply with these demands.

This trend is about to augment growth and innovation in the industry, which is expected to see further strides from many players, including LG Electronics and Panasonic, who are heavily investing in sustainable refrigeration solutions.

A visible split is anticipated in the industry in 2025, based on a cooling-capacity basis. The range of 7-10 kW is expected to acquire 20% of the shares of the industry, whereas the 11-15 kW range is expected to gain an estimated industry share of 18%. Cooling capacity influences the compressors' applications in different appliances within various commercial refrigeration systems; hence, other ranges will address different operational requirements.

The compressors in the 7-10 kW range are generally used in smaller and mid-size refrigeration units such as retail refrigeration, beverage coolers, and small food storage. In supermarkets, convenience stores, and restaurants, these low-capacity compressors balance efficiency and free-piston power, thus being the preferred ones.

Emerson Electric Co. makes the Copeland Scroll™ compressors in this range, while Danfoss offers its Danfoss Turbocor™ series; both are considered energy efficient, low in operational cost, and good in reliability in many refrigeration applications.

On the contrary, these 11-15 kW compressors are widely fitting for much larger commercial refrigeration systems, such as cold storage rooms, industrial refrigeration applications, and large-scale food processing units. The need for such capacity has arisen due to the mounting requirements for adequate cooling in large setups.

Carrier 30HXA Chiller Series and Bitzer Orbit 6 Scroll Compressors are rugged, specifically made for handling larger capacity, and are designed for high-performance efficiency at adverse operating conditions.

With rising demand for sustainable cooling solutions, there is considerable uptake for both ranges due to their higher energy efficiency and lower carbon footprint. This scenario is further supported by the global drive for a carbon emissions and energy consumption in commercial refrigeration systems. Thus, growth in these compressor ranges will be supported as businesses and industries increase their drive for sustainability alongside cooling performance.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.9% |

| UK | 4.3% |

| France | 3.9% |

| Germany | 4.1% |

| Italy | 3.7% |

| South Korea | 4.5% |

| Japan | 3.6% |

| China | 5.4% |

| Australia-NZ | 3.8% |

The USA industry is expected to grow at 4.9% CAGR during the forecast period. The growth is due to increased demand from supermarkets, hypermarkets, and hospitality markets. The need for energy-saving and eco-friendly refrigerants is driving the movement towards newer compression technologies. Pollution control regulations are compelling manufacturers to invest in green refrigeration system research and development.

The application of smart technologies to refrigeration systems will again enhance the performance and efficiency of products. In addition, the nation's highly developed cold chain logistics help boost commercial refrigeration compressor demand. Convergence with IoT solutions for real-time monitoring and predictive maintenance is also driving growth.

Technology advancements, such as variable-speed compressors, are gaining traction among retailers and food service businesses. Overall, the USA is in the first position with its innovation-driven ecosystem, premium business infrastructure, and active substitution demand for aging systems.

The UK will see its industry grow at 4.3% CAGR over the forecast period. The industry is influenced by stringent regulations on the usage of refrigerants and carbon emissions, forcing companies to shift towards low-GWP compressors. Urbanization and expansion in food retailing contribute significantly to the growing demand for reliable cold storage facilities.

Convenience stores and small format retailing increasingly employ modular refrigeration units, particularly. Growing penetration of environmentally friendly retail formats and efforts to reduce food waste through better refrigeration technologies propel compressor demand.

UK's aggressive investment in green technology and energy-efficient compressor systems is aligned with global sustainability goals, triggering design innovation in the compressors. Industry growth arises from further demands of pharmaceutical storage facilities and grocery e-commerce platforms. Governmental awareness regarding energy usage and its impact on the environment assists in further driving the growth rate with greater acceptance of efficient cooling equipment.

The French industry will increase by 3.9% CAGR during the forecast period. Growth is driven by the expansion of hospitality and food service industries, fueled by tourism and urban life. Transitioning of the commercial refrigeration industry in France under the F-Gas Regulation using eco-friendly refrigerants results in a shift. Gourmet stores and specialty food stores spread and emphasize temperature-sensitive storage needs, resulting in tremendous demand for high-tech compressors.

In addition, the increasing use of plug-in refrigeration systems in urban areas presents new opportunities for compressor manufacturers. Energy efficiency pressure in commercial buildings drives the application of high-efficiency compressors.

The emphasis on building performance and sustainability in France under its national climate plans improves the technological upgrading of refrigeration. With cold chain logistics becoming highly modernized, especially in city and peri-urban regions, demand for reliable compressor systems continues to increase.

Germany's industry is expected to register a 4.1% CAGR during the study period. The industry growth is dominated by a mature yet evolving commercial refrigeration sector with energy efficiency norms and digitalization.

The country's strong retail infrastructure and mature logistics base generate stable demand. Government incentives to adopt low-carbon technology induce the adoption of energy-efficient compressors in refrigeration.

Germany's focus on industrial automation is propelling smart compressor use with IoT connectivity for diagnostics and energy monitoring. The commercial refrigeration industry, too, is witnessing innovation through partnerships among OEMs and research institutions. With carbon-neutrality objectives getting more emphasis, big supermarket chains, as well as small independent retailers, are also converting to clean cooling technologies. The rapid growth of refrigerated transportation and drug distribution industries also propels the demand for compressors.

The Italian industry will grow at 3.7% CAGR during the study period. Irrespective of economic fluctuations, demand for commercial refrigeration compressors is fueled by tourism, food exports, and the growing hospitality industry. The industry is shifting towards low-emission refrigeration systems due to EU environmental regulations. Small to mid-sized retail formats are increasing the adoption of energy-saving refrigeration units.

The food and beverage processing industry continues to be a significant driver of the support for refrigeration facilities. With the transformation of the urban retail format, investment in efficient and space-efficient refrigeration systems will tend to grow. Additionally, regional food quality and safety preservation stimulates investments in refrigerated environments. Italian businesses are focusing on developing localized solutions for specialized applications, including wine storage and craft food preservation.

The South Korean industry is expected to grow at 4.5% CAGR during the study period. Rapid growth, a strong e-commerce sector, and increasing consumer awareness of food safety fuel urbanization. Technological innovation is the underlying driver, with South Korean firms being famous for integrating leading-edge electronics and smart controls in refrigeration systems.

Government initiatives supporting carbon neutrality and energy conservation are accelerating the use of eco-compressors. Growing healthcare, in turn, requires cold storage space for biomedical and pharmaceutical applications, driving the demand for superior compressor technology.

Apart from that, high-density urban populations for convenience stores drive the demand for highly efficient compact refrigeration technologies. Integration with AI and IoT in commercial equipment has potential future development opportunities.

The Japanese industry will expand at 3.6% CAGR during the forecast period. Industry growth is prompted primarily by the need for energy savings in dense urban spaces. Japanese manufacturers, long focused on innovation, continue to lead the way in designing miniaturized, high-efficiency compressors for space-limited applications. Regulatory regimes for greenhouse gas reductions are driving product development in the industry.

There is a gradual shift towards low-global warming potential refrigerants that align with Japan's sustainability ambitions. There is rapid modernization in the hospitality sector, particularly within urban areas, which requires reliable refrigeration systems. Moreover, aged cold stores are being replaced with technologically advanced ones. Automation and self-diagnostic technologies incorporated in refrigeration systems are helping firms reduce operations costs.

The Chinese industry will increase by 5.4% CAGR between the study years. As the global manufacturing hub, China has a strong demand for commercial refrigeration compressors in retail, logistics, and food service markets.

A growing middle class, rapid urbanization, and digital retailing drive food consumption and demand for cold storage. The government's drive for energy-conserving and eco-friendly construction initiatives is benefitting the nation.

Quick service establishments and the pharmaceutical logistics industry are serving to augment further demand. The local producers invest more in R&D to equal world-class performances. The China Belt and Road Initiative is, in turn, boosting refrigeration equipment export, which is subsequently spurring the indigenous compressor industry. Local manufacturing is driven by exports and augmented local innovation aids in efficient industry performance.

The Australia-NZ industry is expected to grow at 3.8% CAGR during the study period. The industry growth is fueled by robust food retail networks, increasing tourism infrastructure, and demand for sustainable building practices. In Australia, regulations to phase out high-GWP refrigerants are fueling bulk upgrades of commercial refrigeration equipment.

New Zealand's robust farm-based exports and cold-chain transportation fuel the need for strong, energy-efficient compressor technologies. The industry is also spurred by increasing online food delivery and grocery ordering platforms.

Both countries exhibit high adoption of remote monitoring and energy optimization technologies. In addition, government-backed sustainability initiatives are driving the adoption of natural refrigerants and new refrigeration technologies across commercial use cases.

The industry is extremely competitive, with global suppliers concentrating on the efficiency, durability, and performance of their compressors. The major players like the Nidec Corporation, Emerson Electric Co. and Danfoss also focus on improvements in variable-speed compressor designs to enhance cooling effects while lowering energy consumption.

Innovation in compressor design and refrigerant compatibility is a critical competitive factor in the industry. Emerson Electric and Danfoss are investing in compressors that are compatible with low-GWP (Global Warming Potential) refrigerants to meet environmental regulations. At the same time, LG Electronics and Mitsubishi Electric are incorporating IoT-based monitoring systems to provide real-time performance analytics as well as enable predictive maintenance.

Strategic partnerships with OEMs and retailers are vital for industry penetration. HUAYI COMPRESSOR CO., LTD., and Tecumseh Products Company keep close cooperation with commercial refrigeration manufacturers to provide customized compressor solutions for walk-in coolers, display cases and supermarket refrigeration systems.

Manufacturers are also likely to enhance production facilities and supply chains to meet the rising demand for commercial refrigeration solutions. With strong R&D capabilities and a mindset for regional expansion, organizations within this changing industry are fairly expected to be significantly better positioned against the competition.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Nidec Corporation | 18-22% |

| Emerson Electric Co. | 15-20% |

| Danfoss Group | 12-16% |

| Mitsubishi Electric Corporation | 8-12% |

| LG Electronics, Inc. | 5-9% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Nidec Corporation | Specializes in variable-speed and inverter-driven compressors for energy-efficient refrigeration. |

| Emerson Electric Co. | Develops low-GWP refrigerant-compatible compressors with IoT-based monitoring. |

| Danfoss Group | Provides CO₂ and ammonia-based compressors for eco-friendly cooling systems. |

| Mitsubishi Electric Corporation | Focuses on smart cooling solutions integrating AI-driven diagnostics. |

| LG Electronics, Inc. | Offers digital scroll compressors with remote control and energy optimization. |

Key Company Insights

Nidec Corporation (18-22%)

Nidec leads the industry with energy-efficient, variable-speed compressors for supermarket as well as industrial refrigeration applications.

Emerson Electric Co. (15-20%)

Emerson Electric excels in IoT-based compressor monitoring, improving predictive maintenance and operational efficiency.

Danfoss Group (12-16%)

Danfoss enhances its presence with CO₂ refrigeration technology, enabling sustainability and regulatory compliance.

Mitsubishi Electric Corporation (8-12%)

Mitsubishi Electric combines AI-driven performance optimization, enhancing system reliability and energy savings.

LG Electronics, Inc. (5-9%)

LG Electronics features digital scroll compressors, which allow for exact cooling control for business refrigeration units.

Other Key Players

By product type, the industry is segmented into reciprocating, rotary, scroll, screw, and centrifugal compressors.

By cooling capacity, the industry is categorized based on cooling capacity into the following segments: up to 1 kW, 2-6 kW, 7-10 kW, 11-15 kW, 16-20 kW, 21-30 kW, 31-40 kW, and above 40 kW.

By refrigerant type, the industry is divided into refrigerant types including R290, R404A, R410A, R744, R134A, R407C, and other types.

By end use, the industry finds applications in beverage coolers and freezers, refrigerated display cases, transport refrigeration, and other end uses.

By region, the industry spans across North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The industry is estimated to reach USD 42.1 billion by 2025.

Sales are projected to grow significantly, reaching USD 64.1 billion by 2035.

China is anticipated to witness a 5.4% CAGR.

Scroll compressors are dominating the industry due to their compact size, energy efficiency, and suitability across a variety of refrigeration systems.

Key players include Nidec Corporation, Emerson Electric Co., Danfoss Group, Mitsubishi Electric Corporation, LG Electronics, Inc., HUAYI COMPRESSOR CO., LTD., Tecumseh Products Company LLC, Panasonic Corporation, GEA Group AG, Johnson Controls–Hitachi Air Conditioning, BITZER SE, and Carrier Corporation.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Cooling Capacity, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Cooling Capacity, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Refrigerant Type, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Refrigerant Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Cooling Capacity, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Cooling Capacity, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Refrigerant Type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Refrigerant Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Cooling Capacity, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Cooling Capacity, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Refrigerant Type, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Refrigerant Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Cooling Capacity, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Cooling Capacity, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Refrigerant Type, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Refrigerant Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Cooling Capacity, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Cooling Capacity, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Refrigerant Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Refrigerant Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by End Use, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Cooling Capacity, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Cooling Capacity, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Refrigerant Type, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Refrigerant Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by End Use, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by End Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Cooling Capacity, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Refrigerant Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Cooling Capacity, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Cooling Capacity, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Cooling Capacity, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Cooling Capacity, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Refrigerant Type, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Refrigerant Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Refrigerant Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Refrigerant Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 26: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Cooling Capacity, 2023 to 2033

Figure 28: Global Market Attractiveness by Refrigerant Type, 2023 to 2033

Figure 29: Global Market Attractiveness by End Use, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Cooling Capacity, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Refrigerant Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Cooling Capacity, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Cooling Capacity, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Cooling Capacity, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Cooling Capacity, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Refrigerant Type, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Refrigerant Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Refrigerant Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Refrigerant Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 56: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Cooling Capacity, 2023 to 2033

Figure 58: North America Market Attractiveness by Refrigerant Type, 2023 to 2033

Figure 59: North America Market Attractiveness by End Use, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Cooling Capacity, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Refrigerant Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Cooling Capacity, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Cooling Capacity, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Cooling Capacity, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Cooling Capacity, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Refrigerant Type, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Refrigerant Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Refrigerant Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Refrigerant Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Cooling Capacity, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Refrigerant Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Cooling Capacity, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Refrigerant Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Cooling Capacity, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Cooling Capacity, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Cooling Capacity, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Cooling Capacity, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Refrigerant Type, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Refrigerant Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Refrigerant Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Refrigerant Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 116: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 117: Europe Market Attractiveness by Cooling Capacity, 2023 to 2033

Figure 118: Europe Market Attractiveness by Refrigerant Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by End Use, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Cooling Capacity, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Refrigerant Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by End Use, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Cooling Capacity, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Cooling Capacity, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Cooling Capacity, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Cooling Capacity, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Refrigerant Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Refrigerant Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Refrigerant Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Refrigerant Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Cooling Capacity, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Refrigerant Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by End Use, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Cooling Capacity, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Refrigerant Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by End Use, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Cooling Capacity, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Cooling Capacity, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Cooling Capacity, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Cooling Capacity, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Refrigerant Type, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Refrigerant Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Refrigerant Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Refrigerant Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by End Use, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by End Use, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 176: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 177: MEA Market Attractiveness by Cooling Capacity, 2023 to 2033

Figure 178: MEA Market Attractiveness by Refrigerant Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by End Use, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA