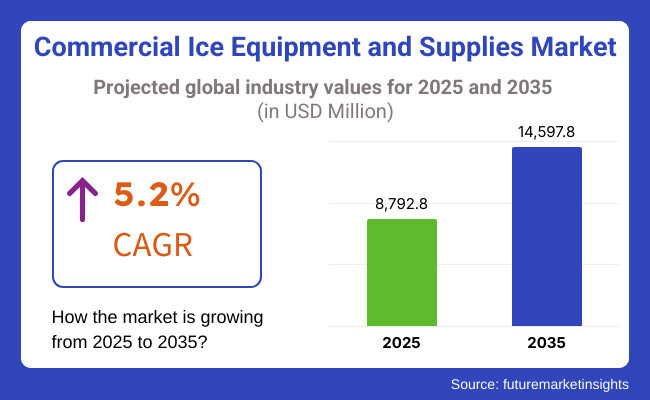

The commercial ice equipment and supplies market is anticipated to see steady expansion, aided by growing demand from those in the foodservice, healthcare, and hospitality sectors, innovations in energy-efficient ice-making technologies, and increasing popularity of specialty beverages. The market is anticipated to value USD 8,792.8 million in 2025 and USD 14,597.8 million by 2035, with a growth rate of 5.2% across the forecast period.

Commercial ice equipment ice makers, dispensers, crushers, and storage units are essential for hygiene and operational efficiency in multiple sectors. Market expansion is being driven by the rising popularity of chilled and frozen drinks, especially in QSRs, cafes and bars. Moreover, strict health and safety regulations in the foodservice and health care sectors are driving high-quality ice-making equipment purchase as well.

However, factors such as high initial investment costs, maintenance complexities, and fluctuating raw material prices may hinder the growth of Extrapolate Processing market. To meet these challenges, manufacturers are targeting smart ice machines, modular designs, and sustainable refrigerants that lower energy use and operating costs.

The commercial ice equipment and supplies market is segmented as per product type, end-user application and technology integration. In line with current trends, there is a growing adoption of touchless ice dispensers and machines with remote-monitoring capabilities to improve cleanliness and operational efficiency. In addition, cutting-edge compressor and environmentally-friendly refrigerant technologies continue to develop to meet the changing landscape of ice-making technologies into the future.

North America is the largest market for commercial ice equipment and supplies, with the USA and Canada being early adopters, thanks to the large number of restaurants, hotels, and healthcare facilities. As companies invest to comply with cleanliness policy, the need for high-capacity and energy-demanding ice machines is also increasing.

And increase in premium cocktails, specialty beverages, and cold brew coffee in foodservice outlet is also, fuelling demand for specialty ice makers. Moreover, rising regulatory pressures to decrease carbon emissions are advocating for the introduction of eco-friendly ice-making solutions by manufacturers, as well as the adoption of advanced water filtration systems and energy-efficient cooling technologies.

The UK, Germany and France are the major contributors to the growth of ice machines in the European region. The strong hospitality sector in the region and the demand for gourmet cocktails and chilled beverages are driving angels for advanced ice machines. Increasing EU regulations on energy-efficient refrigeration solutions continue to influence the industry, driving investment in smart ice-making technology.

Moreover, an increase in the usage of ice in the medical sector, including for cold storage for vaccines and laboratory cooling, is broadening market prospects Compact, high-performance ice makers are projected to drive market growth despite challenges, including high equipment costs and complex regulatory compliance.

Asia-Pacific is anticipated to witness fastest growth in the commercial ice equipment and supplies market, on account of rapid urbanization, increasing number of foodservice chains and surge in demand for cold beverages in the nations like China, Japan, India and South Korea. The growth in convenience stores, bubble tea shops and fast-food franchises is driving demand for ice machines. The higher efficiency, lower carbon footprint ice making solutions are being driven by energy efficiency programs from the government department as well commercial appliance energy efficiency programs.

However, some challenges, including inconsistent supply of electricity in some developing areas and high maintenance costs of equipment, may limit widespread adoption. Despite these difficulties, it is anticipated that the growth of the tourism and hospitality sectors and the rising consumer preference for premium beverages will propel market growth in these regions.

Challenge

High Equipment Costs and Maintenance Requirements

High initial investment for buying advanced type of ice machines will be one of the major restraint for global commercial ice equipment market, mainly for small and medium enterprises. Some operational costs include routine maintenance, water filtration, and sanitation requirements.

Some businesses may be discouraged from higher-grade solutions due to the complexity of the high-demand environment for large-scale ice machine installation and maintenance. In response to these challenges, manufacturers are creating modular, easy-to-clean systems that include automated self-sanitizing technology, reducing long-term maintenance costs.

Opportunity

Smart Ice Machines and Sustainable Refrigeration Solutions

Rising adoption of smart ice machines with remote monitoring capabilities are likely to create high-growth opportunities in the market. Artificial intelligence (AI)-driven sensors that sound the alarm on machine performance, automate cleaning cycles, and provide users with alerts when something seems to be malfunctioning are transforming the way commercial ice equipment is managed.

Moreover, move to green refrigerants along with energy-efficient compressors is proving to be a major trend as enterprises are looking for reducing their environmental footprint while reducing costs. The continuous focus of various regulators on evolving energy-efficient cooling methods is anticipated to create demand for innovative and effective energy-efficient ice-making systems, which in turn, would be a key factor driving the market growth over the long term.

With the increasing demand from the hospitality, food service, healthcare, and industrial sectors, the Commercial Ice Equipment and Supplies Market witnessed gradual growth between 2020 and 2024. The rise of QSRs, cloud kitchens, and the increasing consumption of cold beverages fostered the areas of high-efficiency ice makers, ice storage, and dispensers.

Besides, manufacturers based on energy-saving, self-cleaning, and antimicrobial-coated ice machines to comply with stringent health and safety regulations. Disruptions in the supply chain, the high cost of maintenance, and the evolving though capped energy-efficiency standards created headwinds to new investments by businesses in ice equipment.

Looking forward 2025 to 2035, AI-enabled ice producers, smart apps for remote monitoring, and green refrigerants will be the new standards for the market. Industry innovations industry will be a lot influenced by the combination of hydrocarbon-based cooling systems, IoT-enabled predictive maintenance, and self-disinfecting ice-making technologies.

Developments in AI-driven ice demand forecasting, block chain-supported supply chain tracking and modular, space-saving ice machines will improve efficiency and sustainability. Commercial ice production will align with global energy and sustainability goals with the introduction of zero-water-waste ice machines, solar-powered ice-making units, and biodegradable packaging for ice supplies.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with EPA, DOE, and Energy Star efficiency standards for ice-making equipment. |

| Ice Production Technology | Use of high-capacity, air-cooled, and water-efficient ice machines. |

| Industry Adoption | Growth in restaurants, hotels, bars, healthcare facilities, and industrial food processing. |

| Smart & IoT-Enabled Ice Equipment | Early adoption of remote monitoring, self-cleaning features, and antimicrobial coatings. |

| Market Competition | Dominated by commercial refrigeration manufacturers, ice machine suppliers, and food service equipment providers. |

| Market Growth Drivers | Demand fuelled by hospitality expansion, growth in cold beverage consumption, and hygiene-focused ice production standards. |

| Sustainability and Environmental Impact | Early adoption of low-water-use ice makers, energy-efficient compressors, and refrigerant alternatives. |

| Integration of AI & Digitalization | Limited AI use in basic remote diagnostics and energy monitoring. |

| Advancements in Manufacturing | Use of stainless steel, antimicrobial coatings, and insulated ice storage bins. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter carbon-neutral mandates, AI-driven regulatory monitoring, and refrigerant phase-out policies for HFCs. |

| Ice Production Technology | Adoption of AI-optimized ice production, hybrid cooling technologies, and IoT-enabled automated ice supply management. |

| Industry Adoption | Expansion into smart, decentralized ice production networks, on-demand ice subscription models, and AI-driven ice logistics optimization. |

| Smart & IoT-Enabled Ice Equipment | Large-scale deployment of AI-powered predictive maintenance, block chain-based ice distribution tracking, and real-time machine learning-driven efficiency optimization. |

| Market Competition | Increased competition from AI-driven refrigeration firms, energy-efficient appliance innovators, and sustainable ice production start-ups. |

| Market Growth Drivers | Growth driven by zero-emission cooling systems, AI-powered ice demand forecasting, and energy-efficient self-sanitizing ice machines. |

| Sustainability and Environmental Impact | Large-scale shift to solar-powered ice machines, zero-water-waste technology, and AI-assisted carbon-neutral cooling. |

| Integration of AI & Digitalization | AI-driven real-time ice production optimization, machine-learning-based ice demand forecasting, and self-healing refrigeration coatings. |

| Advancements in Manufacturing | Evolution of 3D-printed cooling components, graphene-enhanced thermal conductivity systems, and modular, ultra-efficient ice-making technology. |

High demand from hospitality, foodservice, and healthcare industries remains a major driver behind the USA being the largest market for commercial ice equipment and supplies. In addition, the growth of quick-service restaurants (QSRs), bars, and hotels increases demand for efficient high-capacity ice machines.

Moreover, the increasing consumer emphasis on energy-efficient and smart ice-making devices, like the use of IoT-embedded ice dispensers featuring remote-monitoring and operating facilities, is influencing the market trends. The growing emphasis on hygiene and health is also fuelling the market through the adoption of touchless and self-cleaning ice machines by businesses. The increasing demand for cold chain logistics along with beverage cooling applications are also propelling the market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.5% |

The UK commercial ice equipment and supplies market is showing moderate growth, propelled by the growing demand from the food and beverage industry, the expansion of catering businesses, and the increasing adoption of efficient ice machines. The rise in cocktail culture and high-quality drinks in the hospitality sector is driving demand for specialty ice makers.

Moreover, the emergence of advanced refrigeration and ice-making technology, annex with the energy-efficient & water-saving models is accelerating the product adoption. The growth of e-commerce and digital procurement platforms is increasing access to premium ice-making and maintenance equipment.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.9% |

With robust foodservice industries, the highest demand for high-capacity ice makers, and an increasing number of users adopting sustainable refrigeration solutions, Germany, France and Italy continue to retain the largest share of the commercial ice equipment and supplies market in the European Union. The EU's tough environmental regulations are spurring businesses to invest in energy-efficient and low-emission ice-making equipment.

The growing trend of craft cocktails and signature drinks offered at restaurants and bars is also contributing to the demand for advanced ice making solutions, such as nugget, flake and gourmet ice machines. Trends in refrigerated storage and distribution, along with the increasing demand for reliable ice production in medical and pharmaceutical use, continue to steer the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 5.1% |

The commercial ice equipment and supplies market in Japan is growing due to rising demand from the hospitality, retail, and healthcare sectors. The nation’s long-standing commitment to energy efficiency coupled with its popularity of small-kitchen appliances is helping inspire space-saving high-performance ice machines.

Furthermore, Japan’s high-end food and beverage sector from sushi bars to fine-dining restaurants is driving the demand for high-clarity and specialty ice production. With the adoption of advanced filtration and self-clean technologies in ice-making equipment, hygiene is improved, thereby helping market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

The increasing urbanization and rapid growth of coffee chains, and fast-food outlets are pushing the respective industry growth, thus, making South Korea a significant market for commercial ice equipment & supplies. The country’s burgeoning café culture and increasing demand for visually appealing ice cubes to be used in specialty drinks are driving growth in the market.

Also, the latest smart ice machine features like remote monitoring and AI-powered maintenance alerts are improving the overall efficiency of their operations. Growing emphasis on sustainability and energy-efficient cooling mechanisms is further fuelling the demand for the next-generation ice equipment across commercial sectors.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.3% |

Adding to the growth of the Commercial Ice Equipment and Supplies Market is the segment for Floor-Standing and Under-Counter Machine segment where demand for these machines comes from restaurants, bars, hotels, and healthcare providers. Types of these installations are crucial in supplying ice serve, helping spare kitchen and bar space, and improving beverage and food serve operation.

Commercial high-volume ice machines have witnessed a steady growth in demand due to changing industry dynamics and increasing demand for space-saving ice-making equipment; consequently, the adoption of under-counter and floor-standing machines continues to expand at a consistent pace across commercial setups worldwide.

These floor-standing ice machines have become popular in the food business for the need to generate food-grade ice in big volumes efficiently. These machines serve large-scale food service applications unlike smaller ice-making solutions, used for continually supplying ice for beverages, food preservation, and in various industrial cooling applications.

Due to the growing demand for high-output ice machines in hotels, hospitals, cruise ships and banquet facilities, the market adoption has increased. Research shows that more than 70% of high-volume commercial kitchens and hospitality establishments have a floor standing ice maker as they are a stalwart choice in terms of reliability and production.

To this end, the demand has been bolstered by the introduction of high advanced floor-standing ice machines that incorporate elements like artificial intelligence (AI) production optimization, real-time cleaning and operational monitoring, and environment-friendly refrigerant and PCBs technologies keeping the ice production and working of machines cost-effective and sustainable.

Smart ice storage and dispensing solutions with touch-free operation, automated self-cleaning systems, and antimicrobial ice bin coatings have also encouraged adoption as they guarantee better hygiene and hygiene with low maintenance needs.

Demand for eco-friendly floor-standing ice machines with hydrocarbon refrigerants, low-energy compressors, and optimized water filtration systems has driven market growth, ensuring compliance with regulations and sustainability.

Modular ice machine designs with production-output scalability options, remote monitoring functionality, and automatic energy-consumption adjustments, have cemented market growth by helping maintain flexibility in varying commercial applications.

Although the floor-standing ice machine category possesses advantages like high-volume ice production, durability, and operational efficiency, it is challenged by space constraints in smaller kitchens, higher energy consumption relative to smaller units, and higher upfront investment cost.

Ice collecting in an ice machine, innovations in AI-driven ice production analytics, next-gen rapid freezing tech, and advanced ice bin insulation materials have individual and cumulative enhancements in efficiency, adaptability, and cost-effectiveness that ensure that the global floor-standing ice machine marketplace remains well-supported thanks to the increasing spend of next-gen products.

Under-counter ice machines would continue to hold a considerable share in the Commercial Ice Equipment and Supplies Market owing to their space-efficient designs, accessibility and seamless integration of machine into the restaurant and bar countertops. Since they don't take up a lot of space as compared to floor standing units, these machines are perfect for smaller food service establishments, or busy bars.

The growing demand for compact and energy-efficient ice machines, especially in quick-service restaurants, coffee shops, and boutique hotels, has spurred adoption. Studies show that more than 65% of under-counter ice machines are placed in beverage-centric PS spaces where ice is needed on demand for operational efficiency.

Continual growth of high-performance under-counter ice machines, characterized contributing quick ice production cycles, twin-generate size options, and noiseless performance, has had an increased marketplace demand, thus enhancing client services efficiency.

Artificial intelligence-powered ice-making automation, with real-time ice level tracking, adaptive ice production algorithms, and intelligent water conservation technologies, has further accelerated adoption, delivering optimized energy consumption and minimized operating costs.

The segmented solutions such as low-power compressors, air-cooled condenser designs and optimized insulation materials in under-counter ice machines is set to boost operational sustainability and associated electricity consumption mitigation, leading to energy-efficient machines, further fostering market growth.

Compact ice machine solutions designed for portability with modular installation features comprising integrated ice scooping stations and self-contained water filtration systems have bolstered market growth owing to enhanced convenience across user segment and battered hygiene compliance.

Even though the market for under-counter ice machines has seen an increased demand within this segment due to their better space efficiency, user access, and kitchen integration, these models have shortcomings like low ice storage capacity, dependency on more frequent refilling of water supply tanks, and lower production output than larger models.

But new technologies such as artificial intelligence-assisted ice demand forecasting, self-cleaning antimicrobial bin liners and compact energy-efficient freezing systems are enhancing performance, reliability and cost-effectiveness, ensuring under-counter ice machines embrace wider use across the globe.

The market for Commercial Refrigeration & Ice-Making Head and Self-Contained Units are contributing a substantial amount in the overall Commercial Ice Equipment and Supplies Market as the hotels, restaurants, healthcare, and convenience stores are spending on high-performance ice-making technologies that guarantee there's always an abundant supply of ice, simple incorporation and energy-efficient operation.

These classes of equipment drive industry trends, inform design of products, and maximize the operation of ice machines for a large range of commercial pursuits.

The strong market adoption of ice-making heads stems from their ability to deliver high-volume ice production while providing plenty of flexibility for customizing the storage and dispensing solutions that any business uses.

Ice quality is essential for those who serve drinks, and ice-making heads can be scaled from small to large and produce a large amount of ice on demand, making them less of a one-size-fits-all option that integrated systems may require more.

With growing demand for these flexible and high-capacity ice production systems, especially in hotels, supermarkets and stadium concession stands, adoption is growing. Research suggests that more than 70% of industrialized ice machines use ice-making heads to avoid wasting electricity and water by serving at peak demand.

The seamless interconnection of multi-unit modular ice-making head designs, with customizable ice production settings and AI-powered energy efficiency management, has fuelled the demand in the market, resulting in optimized ice output availability for businesses with variable demand patterns.

While scalable ice as well as long-term operational cost savings, and modular installation are the key drivers in the ice-making head segment, the challenges facing ice-making heads such as high configuration set-up cost, required space for separate outdoor ice storage bins, and extra dependency on external condensers for heat dissipation are hindering the growth of the ice-making head segment.

But development of such technologies is inevitable, focusing on ice flow tracking through artificial intelligence and pressure sensors, cloud-based scenario analysis for ice demand forecasts, advanced ice screening technologies, and more - resulting in higher success rates, adaptability and increasing energy efficiency, removes doubt from potential ice-making heads.

As the market shifts towards compact, integrated self-contained ice machines that produce, store, and dispense ice from one compact footprint, self-contained ice units continue to show strong growth. Unlike ice-making heads, these machines require little installation and give instant access to ice without additional storage bins.

Growing demand for easy-to-use and space-efficient ice machines in small restaurants, cafés, and mobile food service operations has propelled adoption. Over 65% of compact ice machine installations in quick-service applications are self-contained because of their plug-and-play capabilities, according to studies.

The proliferation of high-efficacy individual ice-making equipment, which includes shorter freeze cycles, advanced water filtration systems to alleviate bacterial growth, and built-in antimicrobial safety systems, has reinforced market demand, promising greater hygiene and equipment operational assurance.

Although being convenient, easy to install, and compact in design, the self-contained ice unit segment must overcome challenges of lower ice production capacity as well as increased maintenance frequency due to integrated cooling and storage functions, and larger energy consumption per unit of cooling versus modular setups.

However, ground breaking advancements in AI-backed ice production optimization, antibiotic water purification technology, and ultra-quiet refrigeration systems are increasing efficiency, hygiene standards, and user friendliness, paving the way for the global expansion of self-contained ice units.

Commercial Ice Equipment and Supplies industry one of the high-growth markets in the coming years, which is the reason why an increasing number of patented intellectual properties become available to the market.

The market is steadily expanding with increasing adoption of energy-efficient and smart systems in the ice-making machines. Its key trends include the integration of IoT for remote monitoring, antimicrobial ice production technologies, and advancements in rapid ice-making systems.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Hoshizaki Corporation | 12-16% |

| Manitowoc Ice (Welbilt, Inc.) | 10-14% |

| Scotsman Ice Systems | 8-12% |

| Ice-O-Matic | 6-10% |

| Follett LLC | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Hoshizaki Corporation | Develops high-performance, energy-efficient commercial ice machines with smart connectivity. |

| Manitowoc Ice (Welbilt, Inc.) | Specializes in modular and self-contained ice makers with advanced antimicrobial technology. |

| Scotsman Ice Systems | Offers innovative nugget, flake, and cube ice machines for foodservice and healthcare applications. |

| Ice-O-Matic | Focuses on high-speed ice production systems with built-in water filtration technology. |

| Follett LLC | Provides ice storage and dispensing systems tailored for healthcare and hospitality sectors. |

Key Company Insights

Hoshizaki Corporation (12-16%)

Hoshizaki leads in the commercial ice equipment market with advanced, energy-efficient ice machines designed for high-demand environments.

Manitowoc Ice (Welbilt, Inc.) (10-14%)

Manitowoc Ice specializes in antimicrobial, modular ice makers that optimize hygiene and efficiency in foodservice applications.

Scotsman Ice Systems (8-12%)

Scotsman is a key player in flake, nugget, and cube ice machines, serving the foodservice, healthcare, and hospitality industries.

Ice-O-Matic (6-10%)

Ice-O-Matic develops high-speed ice production systems with integrated water filtration and smart monitoring features.

Follett LLC (4-8%)

Follett focuses on ice storage and dispensing solutions, with a strong presence in healthcare and premium hospitality services.

Other Key Players (45-55% Combined)

Several ice equipment manufacturers contribute to the expanding market. These include:

The overall market size for the Commercial Ice Equipment and Supplies market was USD 8,792.8 Million in 2025.

The Commercial Ice Equipment and Supplies market is expected to reach USD 14,597.8 Million in 2035.

The demand for commercial ice equipment and supplies will be driven by increasing demand from the foodservice and hospitality sectors, rising adoption of energy-efficient ice-making machines, expanding applications in healthcare and retail, and advancements in smart ice production technologies.

The top 5 countries driving the development of the Commercial Ice Equipment and Supplies market are the USA, China, Germany, Japan, and the UK.

The Ice-Making Machines segment is expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Equipment type, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Equipment type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Ice Maker, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Ice Maker, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 12: Global Market Volume (Units) Forecast by Distribution Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Equipment type, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Equipment type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Ice Maker, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Ice Maker, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 22: North America Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 24: North America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Equipment type, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Equipment type, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Ice Maker, 2018 to 2033

Table 32: Latin America Market Volume (Units) Forecast by Ice Maker, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 34: Latin America Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 36: Latin America Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Equipment type, 2018 to 2033

Table 42: Europe Market Volume (Units) Forecast by Equipment type, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Ice Maker, 2018 to 2033

Table 44: Europe Market Volume (Units) Forecast by Ice Maker, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 46: Europe Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 48: Europe Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 52: Asia Pacific Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Equipment type, 2018 to 2033

Table 54: Asia Pacific Market Volume (Units) Forecast by Equipment type, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Ice Maker, 2018 to 2033

Table 56: Asia Pacific Market Volume (Units) Forecast by Ice Maker, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 58: Asia Pacific Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 60: Asia Pacific Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Installation, 2018 to 2033

Table 64: MEA Market Volume (Units) Forecast by Installation, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Equipment type, 2018 to 2033

Table 66: MEA Market Volume (Units) Forecast by Equipment type, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Ice Maker, 2018 to 2033

Table 68: MEA Market Volume (Units) Forecast by Ice Maker, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Cooling Method, 2018 to 2033

Table 70: MEA Market Volume (Units) Forecast by Cooling Method, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Distribution channel, 2018 to 2033

Table 72: MEA Market Volume (Units) Forecast by Distribution channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Installation, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Equipment type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Ice Maker, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 12: Global Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Equipment type, 2018 to 2033

Figure 16: Global Market Volume (Units) Analysis by Equipment type, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Equipment type, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Equipment type, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Ice Maker, 2018 to 2033

Figure 20: Global Market Volume (Units) Analysis by Ice Maker, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Ice Maker, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Ice Maker, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 24: Global Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 28: Global Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Installation, 2023 to 2033

Figure 32: Global Market Attractiveness by Equipment type, 2023 to 2033

Figure 33: Global Market Attractiveness by Ice Maker, 2023 to 2033

Figure 34: Global Market Attractiveness by Cooling Method, 2023 to 2033

Figure 35: Global Market Attractiveness by Distribution channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Installation, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Equipment type, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Ice Maker, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 48: North America Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Equipment type, 2018 to 2033

Figure 52: North America Market Volume (Units) Analysis by Equipment type, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Equipment type, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Equipment type, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Ice Maker, 2018 to 2033

Figure 56: North America Market Volume (Units) Analysis by Ice Maker, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Ice Maker, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Ice Maker, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 60: North America Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 64: North America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Installation, 2023 to 2033

Figure 68: North America Market Attractiveness by Equipment type, 2023 to 2033

Figure 69: North America Market Attractiveness by Ice Maker, 2023 to 2033

Figure 70: North America Market Attractiveness by Cooling Method, 2023 to 2033

Figure 71: North America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Installation, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Equipment type, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Ice Maker, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 84: Latin America Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Equipment type, 2018 to 2033

Figure 88: Latin America Market Volume (Units) Analysis by Equipment type, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Equipment type, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Equipment type, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Ice Maker, 2018 to 2033

Figure 92: Latin America Market Volume (Units) Analysis by Ice Maker, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Ice Maker, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Ice Maker, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 96: Latin America Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 100: Latin America Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Installation, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Equipment type, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Ice Maker, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Cooling Method, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Distribution channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Installation, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Equipment type, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Ice Maker, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 120: Europe Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Equipment type, 2018 to 2033

Figure 124: Europe Market Volume (Units) Analysis by Equipment type, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Equipment type, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Equipment type, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Ice Maker, 2018 to 2033

Figure 128: Europe Market Volume (Units) Analysis by Ice Maker, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Ice Maker, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Ice Maker, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 132: Europe Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 136: Europe Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 139: Europe Market Attractiveness by Installation, 2023 to 2033

Figure 140: Europe Market Attractiveness by Equipment type, 2023 to 2033

Figure 141: Europe Market Attractiveness by Ice Maker, 2023 to 2033

Figure 142: Europe Market Attractiveness by Cooling Method, 2023 to 2033

Figure 143: Europe Market Attractiveness by Distribution channel, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Installation, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Equipment type, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Ice Maker, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 156: Asia Pacific Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Equipment type, 2018 to 2033

Figure 160: Asia Pacific Market Volume (Units) Analysis by Equipment type, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Equipment type, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Equipment type, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Ice Maker, 2018 to 2033

Figure 164: Asia Pacific Market Volume (Units) Analysis by Ice Maker, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Ice Maker, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Ice Maker, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 168: Asia Pacific Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 172: Asia Pacific Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Installation, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Equipment type, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by Ice Maker, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by Cooling Method, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Distribution channel, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Installation, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Equipment type, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Ice Maker, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Cooling Method, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Distribution channel, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Installation, 2018 to 2033

Figure 192: MEA Market Volume (Units) Analysis by Installation, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Installation, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Installation, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Equipment type, 2018 to 2033

Figure 196: MEA Market Volume (Units) Analysis by Equipment type, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Equipment type, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Equipment type, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by Ice Maker, 2018 to 2033

Figure 200: MEA Market Volume (Units) Analysis by Ice Maker, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by Ice Maker, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Ice Maker, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by Cooling Method, 2018 to 2033

Figure 204: MEA Market Volume (Units) Analysis by Cooling Method, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by Cooling Method, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Cooling Method, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Distribution channel, 2018 to 2033

Figure 208: MEA Market Volume (Units) Analysis by Distribution channel, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Distribution channel, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Distribution channel, 2023 to 2033

Figure 211: MEA Market Attractiveness by Installation, 2023 to 2033

Figure 212: MEA Market Attractiveness by Equipment type, 2023 to 2033

Figure 213: MEA Market Attractiveness by Ice Maker, 2023 to 2033

Figure 214: MEA Market Attractiveness by Cooling Method, 2023 to 2033

Figure 215: MEA Market Attractiveness by Distribution channel, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA