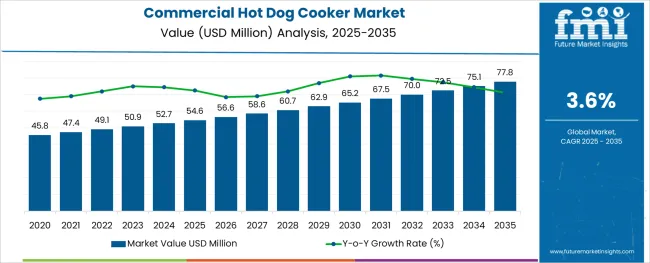

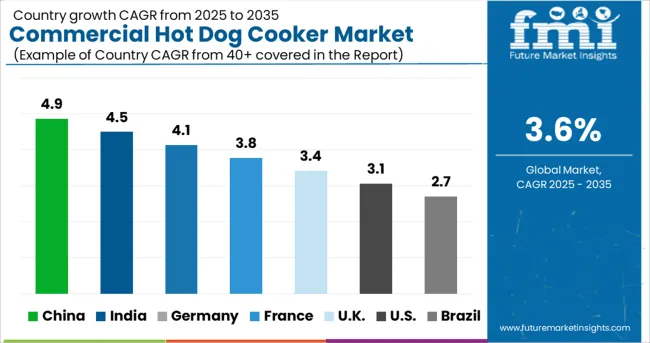

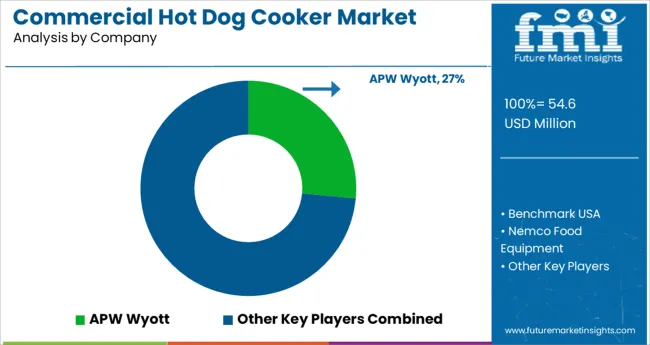

The Commercial Hot Dog Cooker Market is estimated to be valued at USD 54.6 million in 2025 and is projected to reach USD 77.8 million by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

The commercial hot dog cooker market is witnessing consistent growth fueled by rising demand for quick service food solutions, expansion of the hospitality sector, and increasing preference for compact cooking equipment that delivers efficiency and consistency. Growing urbanization and evolving consumer dining habits have encouraged foodservice operators to invest in specialized appliances that optimize preparation time and maintain food quality.

Manufacturers are introducing innovative designs focused on energy efficiency, durability, and ease of cleaning, which are further enhancing market adoption. Future opportunities are expected to arise from the integration of smart temperature controls, customizable capacities, and materials that align with hygiene standards.

The combination of operational efficiency, consumer convenience, and competitive differentiation is paving the way for sustained growth and broader adoption across various foodservice settings.

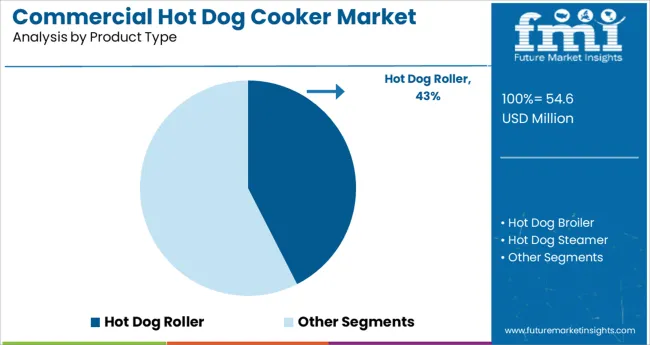

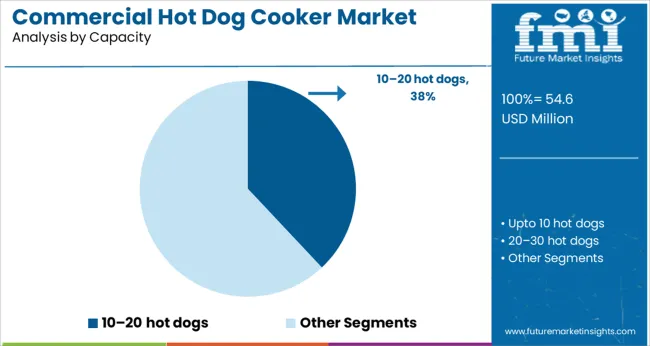

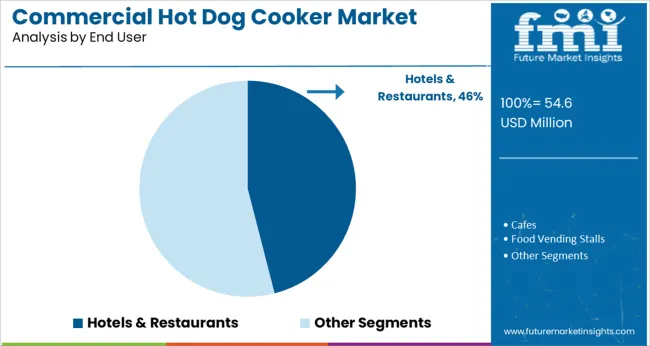

The market is segmented by Product Type, Capacity, and End User and region. By Product Type, the market is divided into Hot Dog Roller, Hot Dog Broiler, and Hot Dog Steamer. In terms of Capacity, the market is classified into 10-20 hot dogs, Upto 10 hot dogs, and 20-30 hot dogs. Based on End User, the market is segmented into Hotels & Restaurants, Cafes, Food Vending Stalls, and Food Processing Units. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by product type the hot dog roller segment is projected to hold 42.5% of the total market revenue in 2025 making it the leading product category. Its leadership is attributed to the simplicity and reliability of its design which enables even cooking, continuous rotation, and easy visibility of products to customers.

The hot dog roller’s ability to maintain consistent temperatures across all units has improved food safety and minimized wastage which has enhanced its appeal to commercial operators. Furthermore the low maintenance requirements and long operational lifespan have provided cost efficiency for high volume establishments.

The segment’s dominance has also been reinforced by its compatibility with self service setups which has become increasingly popular in convenience stores and cafeterias. These factors combined have established the hot dog roller as the preferred choice in environments where speed, consistency, and customer engagement are critical.

Segmenting by capacity shows the 10 to 20 hot dogs category is expected to capture 38.0% of the total market revenue in 2025 positioning it as the most prominent capacity segment. This dominance has been driven by its optimal balance between space efficiency and output making it suitable for both small and mid sized establishments.

Operators have favored this segment due to its ability to meet moderate demand without occupying excessive counter space or requiring large investments. The compact size and portability have also allowed operators to adapt to variable customer flows and seasonal fluctuations effectively.

Additionally the segment has benefited from growing adoption in quick service environments where turnover speed and minimal footprint are essential. These advantages have solidified the 10 to 20 hot dogs capacity segment as the most practical and widely adopted configuration within the market.

When segmented by end user the hotels and restaurants segment is forecast to hold 46.0% of the total market revenue in 2025 establishing itself as the leading end user category. This prominence has been shaped by the increasing emphasis within hotels and restaurants on delivering diverse menu offerings and enhancing operational efficiency. The segment has capitalized on rising demand for convenient high quality snacks and quick meal solutions that complement traditional dining services.

Hotels and restaurants have also leveraged these cookers to improve service speed during peak hours and to expand their food offerings without significant kitchen modifications. The ability to cater to both sit down and grab and go formats has further amplified adoption.

Additionally the focus on customer experience and hygiene standards has prompted these establishments to invest in durable and visually appealing cooking solutions that align with brand image and operational needs. These combined factors have firmly positioned the hotels and restaurants segment at the forefront of the market.

Easy-to-read graphics and heavy-duty knobs facilitate the operation of the cooker

Manufacturers of commercial hot dog cookers incessantly develop various features to facilitate the operation of the equipment for end users. For instance, they provide easy-to-read graphics and heavy-duty knobs on the control panel. Moreover, the Infinite Control System offered by most key players gives the operator the maximum ability to adjust temperatures to a variety of hot dogs, sausages, egg rolls, etc. Raised rollers and detachable grease collection pans on these hot dog cookers enable cleaning in confined spaces.

The demand for commercial hot dog cookers is rising owing to the capability of these machines to hold from 20 to 230 hot dogs, depending on the size and features. Each of the cooker’s rollers rotates a full 360 degrees to ensure that the food item is evenly heated for customers to come back for more. Furthermore, these cookers take roughly 10-20 mins to cook hot dogs, and some of these cookers feature two independently controlled adjustable thermostats that allow the operator to warm the product on the front rollers while cooking on the back.

In addition, for added convenience, the non-stick rollers and removable drip tray that help expedite end-of-day cleaning. Key players pride themselves in their commercial hot dog cookers that have a sleek stainless unit and high-torque motor combined that provide the operator with a machine that is not only built for long-lasting performance but also with easy cleanability in mind. This contributes to the commercial hot dog cooker market growth.

Tempered glass panel and merchandising graphics - attracting customers!

Considering the popularity of hot dogs, especially in countries like the USA, the UK, Germany, and Japan, key players yielded different types of hot dog cookers to cater to various hot dog preparations, according to the specific requirement of the end user. The list of this equipment and products include a doghouse hotdog cooker, hotdog roller grills, hotdog mini cart steamer, condiment stations, and hotdog supplies and accessories.

Certain market players work with their customers, to provide them with the right and most ideal equipment in accordance with their business. They have a team of experienced professionals who may guide the customers from the point of consultation to the purchase of the equipment. Meanwhile, some market players are selling their products on e-commerce platforms with a wide product portfolio that is visually appealing to customers, encouraging rapid sales. These factors are anticipated to generate lucrative market opportunities and expand the global commercial hot dog cooker market size.

Apart from hot dog vendors, restaurants are also deploying commercial hot dog cookers. This is because this equipment helps restaurants cook hot dogs quickly and easily. Moreover, they are able to serve them at a lower cost than if they were to be purchased from a grocery store. This is likely to expand the global market size.

Hotels usually prefer to host fine dining experiences in their establishments. However, certain hotels favour opening their own bakery or a small snack station. Therefore, hotels wish to offer their visitors different types of hot dogs and other quick and easy meals, and hence, play a huge role in the commercial hot dog cooker market trends.

In addition, the Infinite Control System provided by the majority of the large companies offers the operator the greatest flexibility in temperature control for a variety of hot dogs, sausages, egg rolls, etc.

The cooking time for hot dogs in these cookers is between 10 and 20 minutes, and some of them include two independently regulated adjustable temperatures that let the user warm the food on the front rollers while cooking it on the rear.

Important manufacturers take pleasure in their commercial hot dog cookers, which feature a stylish stainless-steel unit and a powerful motor to give the operator a device that is not only made for enduring performance but also for simple cleaning. This aids in the expansion of the market for commercial hot dog cookers.

The statistics accumulated by Future Market Insights, reveal the global forum of commercial hot dog cookers which has witnessed an unprecedented surge over the past few years. The manufacturers in the market are in conjunction with the increasing demand for commercial hot dog cookers. There has been a gradual rise from a CAGR of 2.7% registered during the period of 2020 to 2025 and is likely to expand at a steady rate of 3.6% over the forecast period.

The significant growth in the market can be attributed to the increasing need for hot dog equipment by restaurants, cafés, and individual hot dog vendors. By investing in commercial hot dog cookers, food outlets are available to serve high-quality, fresh hot dogs to their customers in a very short amount of time. This not only boosts the sales of these outlets but also generates creative recipes for hot dogs and other food items that can be prepared in these machines.

In the contemporary world, hot dogs are being sold by small to big vendors in stalls and stands in cities across the world. Its growing popularity is compelling key manufacturers to incorporate advanced technologies that further facilitate the cooking process. In addition, these technologies are likely to allow the operators to create variations in recipes and have a longer warranty period. This is anticipated to increase the adoption of commercial hot dog cookers over the forecast period.

By product type, the market is segmented into hot dog roller, hot dog broiler, and hot dog steamer. It has been studied by the analysts at Future Market Insights that the segment is estimated to hold a major market share for hot dog steamer, registering a CAGR of 3.8% over the forecast period.

The pivotal elements determining the momentum of this segment are:

By end-use industry type, the market is segmented into hotels & restaurants, cafés, food vending stalls, and food processing units. It has been researched by the analysts at Future Market Insights that the food vending stalls segment is likely to hold a major market share, registering a CAGR of 4.2% over the forecast period.

The vital attributes determining the momentum of this segment are:

It has been observed, that hot dog consumption increases especially during occasions such as Labour Day, Memorial Day, and Independence Day, particularly in developed countries. Moreover, the growing number of sports events across the world are further expected to increase the demand for commercial hot dog cooker.

Hot dog appliances are available in compact dimensions, that have high efficiency and can be cleaned easily. Furthermore, there has been a growing demand for convenience, on-the-go foods, especially amongst the millennials and Generation Z. These factors are estimated to support the global market growth.

The sales of commercial hot dog cookers are likely to boost since they are designed with polytetrafluoroethylene the seals at the edge of the rollers which restrict grease to enter the motor and chains and ensure easy cleaning of the equipment. In addition, the growing trend of street food and convenience stores has increased sales in the retail sector, evidently contributing to global market growth.

Carbon gets accumulated in commercial hot dog cookers due to the continuous operations throughout the day. Carbon build-up leads to uneven temperature distribution to hot dogs and in some cases, may lead to overheating and damage to the equipment. Moreover, contact with metal utensils, steel wool (used for cleaning), and abrasives can also damage the coatings.

Conversely, the influx of focus on product design by key manufacturers with improved features. For instance, the players are concentrating on developing machines that utilize aligning chains which help in ensuring noise-free and smooth functioning and further eliminate the challenge of chain slipping. Additionally, key players aim to incorporate advanced technologies such as Artificial Intelligence (AI), IoT, robotics, and so on., which is anticipated to create market opportunities.

The USA commercial hot dog cooker market is expected to grow with a revenue of 2.6%. This is attributed to the extensive consumption of hot dogs in this country. Moreover, although culturally imported from Europe, the snack increased in demand in the USA since the early 1900s.

Hot dog cookers are always being improved by manufacturers in order to serve the freshest dogs and keep the buns hot and fresh so that they can always be supplied at the ideal temperature. Furthermore, certain hot dog cookers in the USA come decorated with brightly colored labels to help boost impulse sales at hot dog stands, kiosks, snack bars, food courts, or fast-food joints. This is expected to drive the sales of commercial hot dog cookers.

As a popular working-class street food, key players in the USA recognize the importance of the quality of hot dogs. Hence, both restaurant chains and individual stands that serve hot dogs, require the highest quality, industrial-strength hot dog cookers. This is because this type of equipment cooks the sausages quickly, keeping them hot and ready to serve to the hungry concession stand crowds and customers in fast-food joints.

Most of these hot dog cookers are offered with the ability to hold up to 230 hot dogs and 60 buns. In addition, these cookers prepare the dogs in less than 20 minutes and then hold them at a food-safe temperature until they are ready to serve. Moreover, some key companies offer accessory items such as hot dog wrappers and bags to their revered clients. This is likely to surge the global commercial hot dog cooker market growth.

With a revenue of 2.2%, Germany is a significant commercial hot dog cooker market. This is because there are so many moveable street hot dog vendors in crowded areas throughout different German cities. Moreover, the country is the origin place of hot dogs and it is a cherished snack amongst the people.

Germany is known for the availability of different types of hot dogs of various sizes. Most of their sausages are longer than the standard size, with each of them having different tastes and textures. Furthermore, each hot dog requires different grilling techniques and cooking time. Hence, the demand for commercial hot dog cookers is estimated to increase in this country.

Hot dog stands in Berlin are not standard like in the USA For instance, walking hot dog stands with a makeshift special design costume including a hot dog tray, and an umbrella is a striking and appealing sight for customers. Key companies in the country are hence developing portable commercial hot dog cookers so that the vendors can easily carry the entire stand, cook hot dogs whenever needed, and change their location to reach a wider customer base across cities.

Japan is a lucrative commercial hot dog cooker market, growing significantly at a rate of 2.8%. This is attributed to the growing popularity of hot dogs in the country. The Japanese population is increasingly adapting to the western lifestyle, which includes their eating habits, and hence, hot dogs have become a popular snack in the country, in the last few years.

Japan has grasped the concept of hot dogs but has incorporated traditional Japanese flavors and ingredients that are becoming progressively popular across the globe. For instance, Japadog is the trendy hot dog variation that is doused in teriyaki sauce and wasabi, instead of the traditional ketchup and mustard, and drizzled with bits of nori seaweed, instead of relish. This is expected to raise the adoption of commercial hot dog cookers in the country.

Apart from hot dogs, Japanese people, like Americans, enjoy grilling and barbecuing in their homes with friends and family. Additionally, there is a pit-stop food stall across different cities that serve Japanese-style barbeque (teriyaki) food, all year round. Both these instances require the deployment of some type of commercial hot dog cooker.

In Australia, hot dogs are a popular item in many fast food stands, stadiums, cafés, and restaurants. This is because the snack is an ideal grab-and-go food item, that is convenient owing to the hectic lifestyle of the major population. In addition, different regions of Australia love hot dogs prepared in various ways, such as grilling or dressing.

Food outlets in Australia have secured a high adoption of commercial hot dog cookers to create these affordable, and palatable snacks for their customers with the ideal cooking levels specifically designed for juicy hot sausages. Moreover, key players ensure that the cookers come with 2-4 grills in a range of sizes to cater to different business needs.

Owing to a fast-paced lifestyle and a heavy influx of customers, food outlets require commercial equipment that is convenient and facilitates each step of cooking. Therefore, they turn to commercial hot dog cookers since they are easy to use, maintain the serving temperature of the food, require less cook time, and are very easy to clean. These factors are likely to contribute to the commercial hot dog cooker market growth.

Start-up companies are getting creative with the accumulation of commercial hot dog cookers and implementing various strategies to develop products that are energy-efficient and equipped with advanced technologies such as AI, IoT, robotics, and so on.

The increasing need for portable commercial hot dog cookers is accelerating the market share. This is because hot dogs are becoming popular and are savored by people across the world, and is a very convenient fast-food snack that can be prepared quickly.

Start-up companies are recognizing the high demands from restaurants that are fast-food joints and receive a rush of orders every day, which surges them to generate new and exciting trends. Through the advent of technology, and efforts by start-up companies, restaurants are able to access different kinds of used commercial kitchen equipment easily at affordable prices, which is likely to expand the global commercial hot dog cooker market size.

Market players are coming up with different solutions for a seamless user experience in commercial hot dog cookers, for both personal use, and businesses. With the growing advent of technology, as well as sports and music events, market players are constantly coming up with newer innovations that will keep the demand for commercial hot dog cookers fastened, in the market.

TOP MARKET PLAYERS IN THE COMMERCIAL HOT DOG COOKER MARKET:

The global commercial hot dog cooker market is estimated to be valued at USD 54.6 million in 2025.

It is projected to reach USD 77.8 million by 2035.

The market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types are hot dog roller, hot dog broiler and hot dog steamer.

10–20 hot dogs segment is expected to dominate with a 38.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Blast Freezer Market Size and Share Forecast Outlook 2025 to 2035

Commercial Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Turboprop Aircrafts Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA