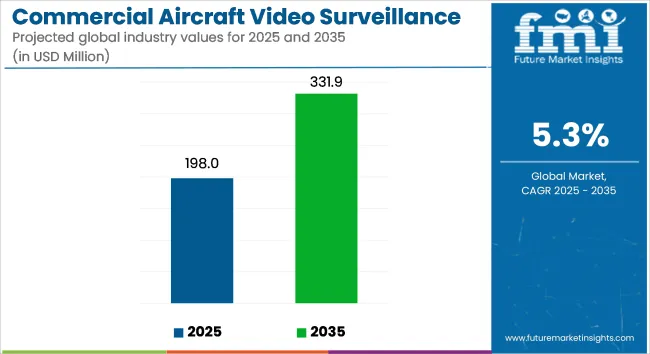

The commercial aircraft video surveillance systems market is projected to grow from USD 198.0 million in 2025 to USD 331.9 million by 2035, registering a compound annual growth rate (CAGR) of 5.3%. This growth is expected to be supported by regulatory mandates, rising demand for real-time in-flight monitoring, and advancements in high-definition surveillance technologies tailored to aviation environments.

Enhanced surveillance coverage across cockpits, passenger cabins, and cargo holds is being prioritized to improve situational awareness and incident response during flight operations. Regulatory authorities across several regions have mandated updates to airborne monitoring systems. In India, the Directorate General of Civil Aviation (DGCA) issued a directive requiring all flying training organizations to install cockpit and cabin video systems by early 2025. This mandate has been introduced to improve transparency during pilot instruction and strengthen oversight during training operations.

In Europe, Regulation (EU) 2023/1770 under the Single European Sky initiative has been enforced to mandate harmonized deployment of communication, navigation, and surveillance equipment. These requirements are accelerating the integration of compliant onboard video systems across both new deliveries and retrofit programs. Compliance with such frameworks is expected to drive uniformity in airspace operations while supporting safety modernization goals.

Surveillance system upgrades are being increasingly integrated with other onboard technologies to form part of a broader digital cockpit infrastructure. According to Curtiss-Wright Defense Solutions, retrofit demand has seen a significant rise due to evolving compliance standards.

“We have seen a significant uptick in demand for the 25-hr. CVR, with compliance being mandated by 2030,” says Steve Leaper, director of customer facing/avionics, video and systems for external sales at Curtiss-Wright Defense Solutions. “The mandate is a positive step forward to increase retrofit, since so many aircraft operators are using 2-hr. CVRs.”

Technology providers have been investing in AI-based analytics and real-time connectivity capabilities to support advanced event detection, faster pilot response, and post-flight audit processes. These developments are enabling predictive safety frameworks, reducing human error, and aligning with global safety management system (SMS) protocols.

With a combination of regulatory alignment, advanced retrofit opportunities, and evolving safety imperatives, sustained demand for commercial aircraft video surveillance systems is anticipated. Market expansion through 2035 is likely to remain robust, driven by mandatory compliance cycles and innovation across global aviation ecosystems.

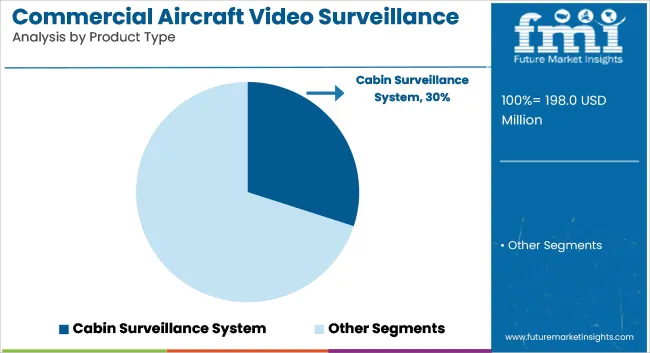

Cabin surveillance systems are estimated to contribute approximately 30% of the global commercial aircraft video surveillance system market as of 2025. Over the forecast period from 2025 to 2035, the segment is projected to expand at a compound annual growth rate (CAGR) of 5.5%. This sustained growth is being driven by regulatory pressure to improve in-flight security, increased passenger monitoring protocols, and the adoption of digital surveillance solutions by airline operators.

These systems are being used to monitor cabin crew activity, detect suspicious passenger behavior, and provide real-time visual feeds to cockpit personnel. The data captured is also being utilized post-flight for incident verification and security audits. Airlines are integrating cabin surveillance as part of broader safety management systems, particularly in long-haul and wide-body aircraft categories.

Further traction is expected with the inclusion of AI-powered anomaly detection, motion tracking, and data storage enhancements. As onboard safety standards are elevated globally, cabin surveillance is likely to remain a core investment focus for fleet operators seeking compliance and operational resilience through 2035.

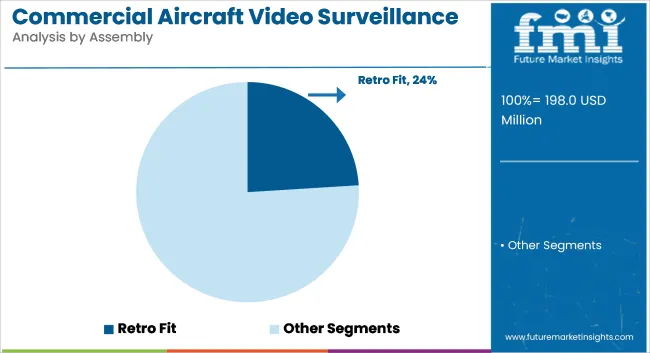

Retrofit installations of commercial aircraft video surveillance systems are projected to hold approximately 24% of the market share as of 2025. This segment is expected to grow at a CAGR of 4.8% through 2035. Growth is being supported by regulatory mandates, aging aircraft fleets, and rising demand for standardized safety upgrades across existing commercial platforms.

Older aircraft, particularly narrow-body and regional jets, are being retrofitted to comply with updated surveillance and monitoring protocols. These modifications are being prioritized in response to directives from aviation authorities, including requirements for continuous cabin monitoring and cockpit security reinforcement. Airlines are leveraging retrofit opportunities to extend operational lifespan while aligning with safety expectations set by agencies such as the FAA, EASA, and DGCA.

System suppliers are offering retrofit-compatible kits with modular interfaces to simplify integration into legacy avionics. Retrofit demand is also being supported by cost-efficient upgrade cycles that align with scheduled maintenance intervals. As global fleets undergo modernization and compliance-driven retrofitting becomes routine, this segment is expected to remain a steady contributor to overall market volume through 2035.

The Commercial Aircraft Video Surveillance Systems Market is primarily occupied by North America because of its mandate on strict aviation security and the presence of prominent aircraft manufacturers, including Boeing. Federal Aviation Administration (FAA) has implemented strict security measures in the cockpit area, which include the installation of cockpit door surveillance systems to prevent access by unauthorized personnel.

Moreover, a considerable increase in the number of aircraft sent for delivery in the USA and Canada, which is part of the reasons, demands cabin and cargo monitoring applications. The North American airlines are also expanding their operations by incorporating cutting-edge technology like AI video analytics for the protection of their flights from the disturbances caused by passengers. With the new generation of planes being built with complex surveillance systems, the market in this area will have moderate expansion.

The EASA regulations that are the main drivers of the European market are primarily focused on passenger safety and aircraft security. The leading manufacturers like Airbus are making use of utilizing the latest surveillance technologies in their aircraft models to meet these specific requirements. Moreover, having a large number of passengers and the strict security measures that are being enforced in airports throughout Europe have directly caused a greater need for video monitoring solutions.

The increased stage of the retrofitting process is being observed in the installation of modern surveillance systems in older aircraft. The rising interest in data protection laws in the European Union makes it difficult to sort out and record surveillance footage. But on the other hand, the changing requirement of aircraft efficiency based on the introduction of more wide-body and long-haul aircraft in the fleet means the introduction of AI behavioral monitoring systems in European airlines really is a major development.

The Asia-Pacific region is the prime market sector expanding at the fastest pace, and this is primarily due to the increasing air travel and fleet. Surging passenger traffic catches the eye of the airlines that operate in countries like China, India, and Japan. As a result, these airlines are now equipping their planes with real-time surveillance in addition to the security measures already in place.

The national authorities in the area are enacting stricter aviation security norms, thereby forcing airlines to install cockpit door and cargo surveillance solutions. Besides, due to the appearance of new aircraft manufacturers, the demand for locally engineered video surveillance technologies is growing.

Furthermore, low-cost carriers (LCCs) are making cost-effective video monitoring solutions an integral part of their new fleets in a move to comply with international aviation safety regulations. The market's growth is also a result of the rise in the number of smart airports that incorporate aircraft security measures powered by artificial intelligence (AI).

Recent expansion in the fleets of airlines and the soaring concern about aviation safety are the two joint factors that have made the Middle East, Latin America, and Africa the major markets for commercial aircraft video surveillance systems. The Middle East, with major airlines like Emirates, Qatar Airways, and Etihad, is investing in high-definition surveillance for luxury aircraft specifically targeting passenger safety and in-flight service monitoring.

The region's aviation sector in Latin America is on the rise as airlines renew their security systems in the light of higher traffic. The modification of the prevailing aviation safety regulations is the main driver of the use of video surveillance in Africa, along with the infrastructural investments in the airports. However, lack of budget and regulatory gaps are the other reasons which are primarily affecting the market growth.

High Installation & Maintenance Costs

Installing and maintaining surveillance systems is one of the key issues that commercial aircraft video surveillance systems market faces. The direction of the aircraft's modernization ie., video monitoring solution is, among others, to include high-definition cameras, real-time analytics software, and secure data transmission networks.

All of these components are significantly driving up the operational costs of airlines. Moreover, the video surveillance systems' integration into older aircraft is expensive, as it may involve structural changes and the coupling of previously-installed avionics systems.

The LCCs, who are particularly suffering from the matters of insufficient profit, consider it hard to pre-finance such systems, thus, prohibiting the marketing development. Costs of the continuous video session's maintenance and data storage increase the financial pressure even more, which is a normative disruptive factor to be faced.

Data Privacy & Cybersecurity Concerns

The combination of AI-based video analytics and cloud storage in aircraft surveillance systems not only improves the efficiency but also poses serious threats to data privacy and cybersecurity. Surveillance systems keep track of passenger activities, crew operations, and cargo movements so they generate a lot of sensitive data that needs to be secured properly.

Admittance without permission or hacking these systems can result in privacy breaches, data breaches, or even the alteration of security footage, leading to the companies involved as well as the passengers being at risk. Furthermore, the enforcement of strict laws on data protection in regions like Europe (GDPR) adds a hurdle for airlines to deal with when they have to store and process surveillance data reverentially.

The manufacturers and airline operators have to take the hassle of fortifying the systems to end-to-end encryption, instigating real-time monitoring to avoid legal culminations, and following international cybersecurity standards as a crucial task.

AI-Powered Surveillance & Real-Time Threat Detection

One of the great chances for the Commercial Aircraft Video Surveillance Systems Market is the implementation of AI-operated surveillance units. The use of î-based analytics that enable real-time behavior monitoring, anomaly detection, and predictive security alerts has led to the aircraft increased safety and efficiency. Besides, these systems can find suspicious passenger behaviors automatically, skills such as cockpit entry without permission or the ability to spot flight-crew emergency triggers, all of which are directed by the flight crew to respond proactively.

Moreover, AI-driven facial recognition and biometric incorporation will make passenger verification and security checks quicker and easier at terminals. The aviation industry is now pouring more and more money into a machine learning program that has the effect of boosting the accuracy of threat detection over a period of time. As the aviation security needs keep getting tougher, the necessity for intelligent video analytics will keep increasing which in turn, will push aircraft surveillance systems to develop technologically.

Wireless & Cloud-Based Surveillance Technologies

The upgrade from traditional wired surveillance systems to wireless, cloud-based is a revolutionary move in aircraft security. The wireless video surveillance systems that take out the need for additional cabling reduce both the installation times and maintenance costs of the airlines.

The cloud-based system of monitoring gives a real-time view from a distance of the plane, making it possible for the ground control to have live footage of the airplane and take countermeasures on the security threats before it happens. Also, the cloud will be able to increase their storage and thus users can keep archived data on high definition formats securely, avoid issues, and have footage for investigations in the future.

Hence these technologies will ensure an automatic connection to the airport security network creating a fully integrated security structure. The trend among airlines to move towards cost-effective and scalable security alternatives will lead the growth of the market for wireless and cloud-based video surveillance.

The rise in security issues and the advancement of inflight monitoring technologies are the main factors behind the increase in the commercial aircraft video surveillance systems market from 2020 to 2024. Lifespan entry of new safety regulations for the aircraft, during this period, requirements for the cockpit door surveillance, cabin monitoring, and cargo bay, tracking were on the top of the list, especially because of the threat of unlawful seizures and incident during the flight with no one on board.

The combination of HD cameras with real-time data transmission turned the onboard security from a complicated problem into an easy task. Hypergeolocation systems are predicted to solve various activities like, employee management, environmental control, maintenance, emergency alert systems, and other safety measures to improve the overall of aviation and but at the same time, the technology will be inducing video surveillance capabilities in the future.

Automation and the further deployment of cloud-based storage solutions are believed to be the main drivers of further advancement in video surveillance technology. Moreover, the regulatory framework will foresee be more demanding through the introduction of new safety compliance protocols that will boost the market.

Comparative Market Analysis

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Introduction of stricter safety mandates post 9/11, requiring cockpit and cabin surveillance. |

| Technological Advancements | HD and infrared cameras, real-time transmission improvements. |

| Industry-Specific Demand | Increased adoption due to security threats and airline safety priorities. |

| Sustainability & Circular Economy | Limited focus on eco-friendly surveillance solutions. |

| Production & Supply Chain | Dependence on conventional supply chains for camera components. |

| Market Growth Drivers | Heightened aviation security measures, increased passenger traffic. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Enhanced global aviation security regulations, mandatory AI-based surveillance integration. |

| Technological Advancements | AI-driven monitoring, facial recognition, and automated threat detection. |

| Industry-Specific Demand | Rising demand driven by autonomous aircraft development and cybersecurity needs. |

| Sustainability & Circular Economy | Increased use of energy-efficient, lightweight surveillance systems with sustainable materials. |

| Production & Supply Chain | Localized manufacturing and integration of IoT-based production optimization. |

| Market Growth Drivers | Growth in smart aircraft technology, demand for enhanced cybersecurity in video feeds. |

The USA market for commercial aircraft video surveillance systems is a result of the growing threats to the aviation sector and the strict FAA regulations. Airlines are equipping the latest in-flight monitoring and cockpit surveillance systems with a view to passenger safety. Furthermore, the implementation of the AI-driven surveillance system is advantageous in terms of growth.

Due to the presence of established aircraft manufacturers such as Boeing, the demand for the integration of surveillance technologies is further augmented. Also, the increased number of air travelers and the rise of domestic fleets contribute to the institutionalization of the market.

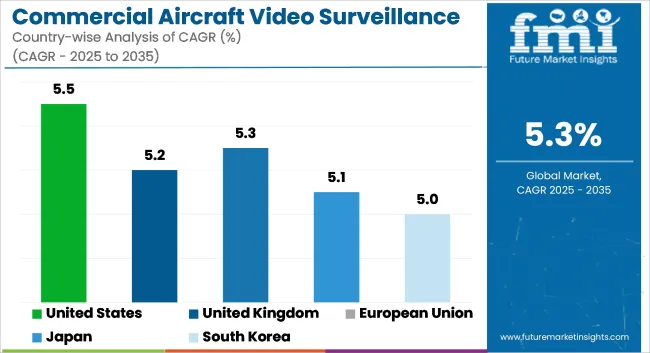

The trends of sustainability are also affecting the industry, focusing energy on surveillance units that are eco-efficient. The USA Commercial Aircraft Video Surveillance Systems Market is projected for a CAGR of 5.5% for the period 2023 to 2026.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.5% |

One of the reasons for the expansion of the UK market is the airline's compliance with EASA and CAA safety standards. Airlines are now implementing state-of-the-art surveillance systems to not only minimize in-flight security risks but also to update their monitoring capabilities. The presence of major aerospace firms and MRO (Maintenance, Repair, and Overhaul) service providers is another factor that could promote the market growth.

Technological innovation, like AI-oriented surveillance and real-time analytics, is also on the rise. The focus of the country on the cyber discipline of aviation-associated systems is also, in a way, the reason behind the order for encrypted video surveillance solutions.

The aftermath of the Brexit vote in the aviation industry has also been seen in the investing patterns in the security programming of the aircraft. For the UK Commercial Aircraft Video Surveillance Systems Market, CAGR was recorded at 5.2%.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.2% |

The fact that EASA regulations are being adopted more and more strictly and that security requirements are also increasing for both short- and long-haul flights has led to a steady growth of the EU market. The innovative companies in the field like airlines now use advanced surveillance solutions such as cabin monitoring and cargo bay security cameras.

A considerable number of large manufacturers like Airbus and the amount of money spent on R&D, e.g., in the aerospace field, are points for the sector to grow. Besides, the shift towards green technologies is causing the incorporation of lighter and more energy-efficient systems to be more prevalent. The transition to smart aviation security, benefited by the surveillance analytics driven by AI, is thought to lead to the further penetration of the market.

The EU, being the hub of innovation in cross-border aviation safety regulations, is likely to see the emergence of cutting-edge surveillance technologies. As for the European Union Commercial Aircraft Video Surveillance Systems Market, it is predicted that CAGR will be 5.3%.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 5.3% |

The aviation sector in Japan is blending smart video monitoring with obligatory changes for security regulations and insists on the safety of international passengers. One of the key market drivers is the greater consumer base of AI-operated facial recognition and behavioral analytics in airliner monitoring.

Aircraft companies are advancing the surveillance equipment as part of the sector's aviation modernization program and the increase in passenger volume. Besides, the drive towards smart airports and advanced aerospace technologies has opened a new market for next-generation surveillance technologies in Japan.

The active collaboration of local firms with global companies is expected to be a major propellant of the market's growth in the near future. Japan Commercial Aircraft Video Surveillance Systems Market is having a CAGR of 5.1%.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.1% |

The South Korean market shows a solid path towards growth due to increased investment in aviation security infrastructure. Airlines are planning to set up systems that allow real-time surveillance to improve the security of both cockpits and cabins. The country's effort to digital transformation of the aerospace sector is speedily driving the use of AI-integrated video surveillance. The increasing number of international passengers and the corresponding expansion of airline fleets further add to the market growth.

The government's primacy on the safety of the aviation industry, along with the backing of the state-of-the-art aerospace technologies, is the reason behind the need for the most advanced surveillance systems. Alliances between Korean airlines and global security solution companies are also the forces shaping the market. South Korea's Commercial Aircraft Video Surveillance Systems Market has a CAGR of 5.0%.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.0% |

The Commercial Aircraft Video Surveillance Systems Market, which currently shows constant growth, is being partly driven by the ever-increasing rate of concerns related to aviation security, the safety of passengers, and the legislation of rules.

The major players in this market are the manufacturers of airlines as well as of the above-mentioned aircraft, supplemented by the integration of the aforementioned solutions for the improvement in the safety of the cockpit, monitoring the cabin, and securing cargo.

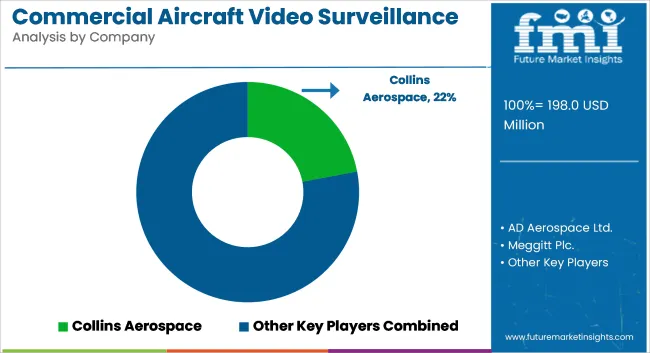

Market growth is promoted by the continuous development of new technologies including AI-powered monitoring and high-definition imaging solutions. Collins Aerospace, AD Aerospace Ltd., Meggitt Plc, Latécoère, Global ePoint Inc., and KID-Systeme GmbH are major entities within the sector. These business addresses concentrate on product innovation as well as adherence to aviation security regulations along with state-of-the-art partnership ties with airline operators.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Collins Aerospace | 18-22% |

| AD Aerospace Ltd. | 12-16% |

| Meggitt Plc. | 10-14% |

| Latécoère | 8-12% |

| Global ePoint Inc. | 5-9% |

| KID-Systeme GmbH | 3-7% |

| Other Companies (combined) | 35-45% |

| Company Name | Key Offerings/Activities |

|---|---|

| Collins Aerospace | Develops high-end aviation security solutions, including AI-powered video analytics and surveillance cameras. |

| AD Aerospace Ltd. | Specializes in cockpit security and cabin monitoring systems for commercial aircraft. |

| Meggitt Plc. | Provides video surveillance solutions integrated with aircraft avionics and emergency response systems. |

| Latécoère | Focuses on lightweight, high-resolution surveillance systems for improved flight safety. |

| Global ePoint Inc. | Manufactures advanced video monitoring solutions tailored for commercial aviation applications. |

| KID-Systeme GmbH | Offers intelligent cabin surveillance solutions with real-time data analysis and remote monitoring. |

Key Company Insights

Collins Aerospace

Collins Aerospace is at the forefront as a tech provider in the aerospace industry whose concentration is on advanced security systems. It utilizes state-of-the-art surveillance methods with the help of AI-based analytics to have a bird's eye view of real-time conditions of the aircraft's cabin, cargo holds, and cockpits. The company seeks to comply with international aviation security regulations for the enhancement of flight safety as a priority.

By closely working with the world's leading aircraft manufacturers like Boeing and Airbus, Collins Aerospace is able to provide integrated security solutions. The firm proceeds to the inclusion of the newest imaging technologies as well as the deployment of cloud-based surveillance solutions.

By making strong investments in research and development, Collins Aerospace's goal is to upgrade data-empowered oversight and preemptive threat indication abilities, thus reinforcing its competitive edge in the aviation security market.

AD Aerospace Ltd.

AD Aerospace Ltd. is a company that focuses on cockpit door surveillance and cabin monitoring solutions for commercial aircraft. The firm is prominently positioned in the aviation security industry where it provides real-time surveillance technologies which aid the prevention of unauthorized cockpit access and the detection of suspicious activities.

AD Aerospace, a leader in the high-tech optical imaging and sensor technology, is synonymous with high-resolution video monitoring. They also incorporate their systems in the aircraft communication network, which provides the security team with the ability to remotely monitor from the ground.

With a focus on lightweight, camera solutions that are easy to install, AD Aerospace serves the airline operators looking for affordable security enhancements. Switching to AI-driven analytics to reinforce threat detection and enhance passenger safety is the latest innovation in the company’s portfolio.

Meggitt Plc.

Meggitt Plc is a top-tier aerospace solutions provider known for its full suite of surveillance systems for commercial aircraft. The company gives priority to security on the flight by developing high-performance monitoring systems. The aircraft integrated with avionics and the onboard monitoring systems can talk to the flight crews and the ground security teams directly.

The emphasis of the company on the latest imaging technology guarantees that there is a high resolution available for monitoring the cabins, cargo bays, and external aircraft areas. By means of special durable and reliable materials, Meggitt's surveillance solutions are made to be used in extreme aviation settings.

In addition, the company is funding the use of cloud-based analytics for continued real-time monitoring and data analysis which, in turn, could help airline operators, who request the strongest possible security arrangements, with decision-making based on data evidence.

Latécoère

Latécoère is a premier manufacturer of aerostructures and airplane electronics, focusing on ultra-light and high-definition video surveillance systems. The company embeds its surveillance cameras with the cutting-edge data analytics to provide a real-time view of the aircraft interiors.

In addition to this, the company's priority on the system weight reduction is a significant factor in aircraft fuel efficiency enhancement besides the full compliance with security standards. The company has partnerships with airlines and aircraft designers on the cutting-edge security solutions to the new aviation regulations.

The systems are fitted with AI-threat detection features, thus, increasing the flight crew's performance. Latécoère remains active in the aerospace security market, providing affordable and technologically advanced monitoring solutions.

Global ePoint Inc.

Global ePoint Inc. is a multinational company that specializes in advanced video surveillance technology for passenger aircraft. Its emphasis is on high-definition imaging solutions that let you see all the activities concerning passengers on board, cockpit access, and baggage handling. Global ePoint's surveillance systems are compatible with the in-flight entertainment platforms of the airlines, thus providing a total security solution for the airlines.

The company's primary concern is data security and it makes sure that the video footages are encrypted and are stored in a secure place so that they can be analyzed. Global ePoint is a rapidly advancing company in the aviation industry, offering its customers a wider range of products, like remote access surveillance and cloud-based video storage for enhanced threat detection and response capabilities.

KID-Systeme GmbH

KID-Systeme GmbH is the provider of intelligent cabin surveillance solutions, which is built upon the foundation of persuading the passengers to feel safe and improving the monitoring capabilities for the crew. The range of the company's products consists of intelligent cameras along with real-time data analysis, which assist crew members in identifying potential onboard security threats in a very short period of time.

KID-Systeme links its surveillance solutions with in-flight communication systems so that airlines can install security measures "pre-emptively". The company's cameras are made to be installed in a fully automatic mode in commercial aircraft with almost no effect on the processes that would have been normally carried out in such a situation.

Within the framework of the development of AI, KID-Systeme is also bringing out new surveillance facilities/ functions, for example, facial recognition and autonomous identity threat detection. The firm is extending its range of markets by reaching out to airlines that are looking for the latest in aviation security system solutions.

In terms of Product Type, the industry is divided into Cabin Surveillance System, Cargo Surveillance System, Cockpit Access Surveillance System, Ground Maneuvering Camera System

In terms of Application, the industry is divided into Personal and Passenger, Logistics and Cargo

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The global Commercial Aircraft Video Surveillance Systems market is projected to reach USD 198.0 million by the end of 2025.

The market is anticipated to grow at a CAGR of 5.3% over the forecast period.

By 2035, the Commercial Aircraft Video Surveillance Systems market is expected to reach USD 331.9 million.

The Cabin Surveillance System segment is expected to dominate the market, due to rising passenger safety concerns, regulatory mandates, real-time monitoring needs, and increasing adoption in commercial aircraft to enhance security, crew efficiency, and incident response.

Key players in the Commercial Aircraft Video Surveillance Systems market include Collins Aerospace, AD Aerospace Ltd., Meggitt Plc., Latécoère, KID-Systeme GmbH.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 17: South Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: South Asia Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 19: South Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 20: South Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: East Asia Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 23: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 25: Oceania Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Oceania Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 27: Oceania Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Oceania Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 29: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 30: MEA Market Value (US$ Million) Forecast by Aircraft Type, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 32: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 19: Global Market Attractiveness by Application, 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 37: North America Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 39: North America Market Attractiveness by Application, 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 57: Latin America Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 77: Europe Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 79: Europe Market Attractiveness by Application, 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: South Asia Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 82: South Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 83: South Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 84: South Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: South Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: South Asia Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 89: South Asia Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 90: South Asia Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 91: South Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 92: South Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 93: South Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 94: South Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 95: South Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 96: South Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 97: South Asia Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 98: South Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 99: South Asia Market Attractiveness by Application, 2023 to 2033

Figure 100: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 101: East Asia Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 102: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 103: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 104: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: East Asia Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 109: East Asia Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 110: East Asia Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 112: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 113: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 114: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 115: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: East Asia Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 118: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 119: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 120: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 121: Oceania Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 122: Oceania Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Oceania Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: Oceania Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: Oceania Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 127: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 128: Oceania Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 129: Oceania Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 130: Oceania Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 131: Oceania Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 132: Oceania Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 133: Oceania Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 134: Oceania Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 135: Oceania Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: Oceania Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: Oceania Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 138: Oceania Market Attractiveness by Product Type, 2023 to 2033

Figure 139: Oceania Market Attractiveness by Application, 2023 to 2033

Figure 140: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 141: MEA Market Value (US$ Million) by Aircraft Type, 2023 to 2033

Figure 142: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 143: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 144: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 145: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 146: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 147: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 148: MEA Market Value (US$ Million) Analysis by Aircraft Type, 2018 to 2033

Figure 149: MEA Market Value Share (%) and BPS Analysis by Aircraft Type, 2023 to 2033

Figure 150: MEA Market Y-o-Y Growth (%) Projections by Aircraft Type, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 152: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 153: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 155: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 156: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 157: MEA Market Attractiveness by Aircraft Type, 2023 to 2033

Figure 158: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 159: MEA Market Attractiveness by Application, 2023 to 2033

Figure 160: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial High-Speed Oven Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Foundation Brakes Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle Brake Chambers Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicles LED Bar Lights Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vehicle AMT Transmission Market Size and Share Forecast Outlook 2025 to 2035

Commercial Greenhouse Market Size and Share Forecast Outlook 2025 to 2035

Commercial Vessel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Slush Machine Market Size and Share Forecast Outlook 2025 to 2035

Commercial Medium Voltage Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Earth Observation (CEO) Market Size and Share Forecast Outlook 2025 to 2035

Commercial Ozone Generator Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas-Fired Boiler Market Size and Share Forecast Outlook 2025 to 2035

Commercial Deep Fryer Parts & Accessories Market Size and Share Forecast Outlook 2025 to 2035

Commercial Gas Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Countertop Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Electric Restaurant Ranges Market Size and Share Forecast Outlook 2025 to 2035

Commercial Distribution Panel Market Size and Share Forecast Outlook 2025 to 2035

Commercial Liquid-Tight Flexible Non-Metallic Conduit Market Size and Share Forecast Outlook 2025 to 2035

Commercial Solar Cable Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA