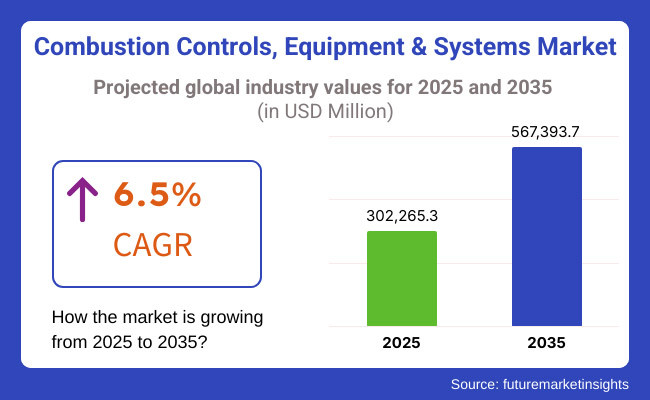

The market for combustion controls, equipment and systems is anticipated steady growth due to growing focus on energy-efficient industrial combustion systems, stringent environmental regulations and advancements in smart combustion technologies. This market was valued at USD 3,02,265.3 million in 2025 and is anticipated to reach USD 5,67,393.7 million by 2035, registering a CAGR of 6.5% during the forecast period.

Across sectors including power generation, chemicals, oil & gas and manufacturing, combustion control systems are used to optimize fuel efficiency, minimize emissions and enhance operational safety. The increasing use of automation and IoT-based combustion monitoring solutions is also contributing to market growth. Moreover, government rules about emission of carbon and energy efficiency of industries is forcing companies to upgrade to advanced combustion systems.

Nevertheless, the market growth may be hindered by factors such as high upfront investment costs, complexities in integration, and change on fuel prices. Manufacturers are therefore actively working towards the design and development of cost-effective AI combustion control systems with improved precision, sustainability, and long-term stability to combat these challenges.

The Market for Combustion Controls, Equipment and Systems can be Segmented among components, Controllers and Monitoring Systems that hold the highest growth owing to their importance in the aspects of combustion efficiency control and compliance with emission regulations. By application, the leading share is held by power generation, followed by oil & gas and chemical processing industries. As industries focus on predictive maintenance and cost optimization, the adoption of cloud-based combustion analytics and real-time monitoring solutions is also on the rise.

Explore FMI!

Book a free demo

With the presence of strict environmental regulations and growing industrial automation investments, the USA and Canada are the most lucrative markets for combustion controlling, equipment, and systems in North America.

Regulatory agencies like the USA Environmental Protection Agency (EPA) are increasing the stringency of emissions control and higher energy efficiency that industries are expected to achieve,making smart combustion control systems the better solution.

Moreover, increasing penetration of artificial intelligence and machine learning into combustion optimization is improving system efficiency along with saving operational cost. The presence of key combustion technology manufacturers and a strong focus on industrial sustainability initiatives also contribute towards the growth of the regional market.

Europe have accounted for a significant share of the combustion control systems market due to stringent industrial emissions and energy conservation policies implemented by the European Union (EU). DERA is at the forefront of advanced combustion technology adoption as it works to make carbon neutrality a reality and others follow;the likes of Germany, the UK, and France.

The world of hydrogen-based combustion and system for alternative fuel is on the brink of change. In addition, the emergence of Industry 4.0 and smart manufacturing is increasing demand for automated combustion control solutions. The market in Europe is projected to grow as technological advancements and government incentives for adopting clean energy are likely to encourage market expansion, despite challenges pertaining to regulatory complexities and elevated implementation costs.

The combustion controls, equipment and systems market in Asia-Pacific is expected to increase at the highest CAGR during the forecast period due to rapid growth in industrialization, increasing energy demands and various government-driven initiatives to help transitioning to clean energy. The market has huge demand generation for high-efficiency combustion systems in China, India, Japan, and South Korea with huge investments in power generation and industrial automation.

Meanwhile, increase efforts to reduce air pollution and improve energy efficiency in manufacturing and chemical processing further encourages the market adoption. Nonetheless, factors like unvarying regulatory scenery and huge dependence on ERCOT (fossil fuel-based combustion systems) could hamstring growth. This has made adoptions of integrated combustion solutions more cost-efficient and effective, and such factors would drive market growth despite the aforementioned challenges.

Challenge

High Implementation Costs and Integration Complexities

High capital investments needed for the implementation of advanced combustion optimization solution is one of the key challenges in the combustion controls, equipment, and systems market. Retrofitting existing industrial plants with modern combustion controls is expensive and complicated, especially for small and mid-sized enterprises (SMEs), which have limited R&D budgets.

The accuracy of these technologies must be proven with data that goes beyond traditional human ability, especially as much of the industry in question is bound by emission regulations that vary by sector. They will need a gas turbine combustion revolution in the form of cost-effective solutions and modular combustion control technologies.

Opportunity

Expansion of AI-Driven and Hydrogen-Based Combustion Technologies

The rising penetration of AI, analytics, as well as automation in the combustion controls market has made ways to several growth opportunities. AI solutions in this domain include combustion optimization powered by AI so that fuel to be more cost-effective, emission reduction; and enhanced predictive maintenance capabilities.

Furthermore, growing acceptance of hydrogen-based combustion systems and biofuel-compatible burners is in line with international sustainability objectives. The innovative and eco-friendly combustion control technologies are anticipated to drive the long-term growth of this market over the upcoming decade, as industries control in using combustion solutions that are cleaner and relatively more efficient.

Energy efficiency and environmental protection are among the several aspects pushing the growth of the Combustion Controls, Equipment, and Systems Market between 2020 and 2024. The transition to low-emission combustion technologies and opt products for real-time monitoring and digital combustion control systems increased efficiency and compliance with strict emission standards.

Power generation, oil & gas, chemicals, and metal processing where some investment went to optimise the performance and leave a lower carbon footprint. On the other hand, factors like high set-up costs, complexities due to regulatory compliance, and fluctuations in raw material prices hampered the market growth.

From 2025 to 2035 the market will change to AI powered combustion optimization, hydrogen-compatible combustion systems and decentralized energy integration. The use of smart combustion sensors, AI-driven predictive maintenance, and block chain-based emissions auditing collectively will redefine the way we manage industrial combustion.

The focus of hydrogen ready burners and carbon capture integrated combustion systems, as well as self-adaptive AI infused fuels with fuel way optimization will thrive sustainability and efficiency. Meanwhile, advancements such as 3D printed combustion components, flame stabilizers developed with nanotechnology, and waste heat recovery technologies will also improve durability and performance metrics and accelerate net-zero emission targets.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with EPA, EU Industrial Emissions Directive (IED), and Clean Air Act regulations. |

| Fuel & Emission Control | Adoption of low-NOx burners, gas-fired combustion systems, and dual-fuel burners. |

| Industry Adoption | Growth in power plants, oil refineries, metal smelting, and industrial heating applications. |

| Smart & AI-Driven Combustion | Early-stage adoption of real-time combustion monitoring and automated fuel-air ratio control. |

| Market Competition | Dominated by boiler manufacturers, combustion control system providers, and energy optimization firms. |

| Market Growth Drivers | Demand fuelled by tightening emission regulations, industrial automation growth, and energy efficiency improvements. |

| Sustainability and Environmental Impact | Early adoption of low-emission combustion chambers, exhaust gas recirculation (EGR), and catalytic converters. |

| Integration of AI & Digitalization | Limited AI use in burner tuning, predictive diagnostics, and digital combustion controls. |

| Advancements in Manufacturing | Use of stainless steel and cast iron for combustion components, basic automated fuel-air control. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter global carbon-neutral policies, AI-driven compliance monitoring, and block chain-based emissions verification. |

| Fuel & Emission Control | Transition to hydrogen-compatible combustion, carbon capture-integrated burners, and AI-driven emission reduction technologies. |

| Industry Adoption | Expansion into AI-managed decentralized energy systems, waste-to-energy combustion, and autonomous fuel blending technologies. |

| Smart & AI-Driven Combustion | Large-scale deployment of AI-powered adaptive combustion controls, self-learning burners, and digital twin simulations for predictive efficiency optimization. |

| Market Competition | Increased competition from AI-driven combustion efficiency start-ups, hydrogen fuel integration firms, and block chain-powered emission tracking platforms. |

| Market Growth Drivers | Growth driven by AI-powered combustion diagnostics, carbon capture integration, and decentralized energy optimization. |

| Sustainability and Environmental Impact | Large-scale transition to carbon-neutral combustion technologies, self-cleaning combustion components, and waste heat recovery-based fuel efficiency solutions. |

| Integration of AI & Digitalization | AI-driven real-time performance analytics, predictive failure prevention, and autonomous fuel mixture optimization. |

| Advancements in Manufacturing | Evolution of 3D-printed high-temperature combustion components, nanotechnology-infused flame stabilizers, and regenerative burner technology for ultra-efficiency. |

The USA continues to be a powerhouse market for combustion controls, equipment and systems due to highly industrialized demand for energy-efficient combustion solutions, stringent environmental regulations and, increasing utilization of low-emission technologies. The drive for limiting carbon emissions in the manufacturing, power generation, and oil & gas sectors are boosting the demand for advanced combustion control systems.

Moreover, the availability of government incentives for the adoption of smart combustion technologies, such as AI-integrated monitoring systems and real-time emission control solutions, is also propelling the market growth. The expansion of market is further propelled by the dawning trends of automation and Industry 4.0, particularly impacting process heating and fuel management.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 6.8% |

The UK combustion controls, equipment, and systems market is primarily driven tree of steady growth owing to favourable government initiatives to decarbonise industries, increasing investments in cleaner combustion technologies and transition to hydrogen-based fuel systems. This is leading to increased operational efficiencies, especially with the growing adoption of industrial automation and real-time monitoring systems in combustion processes.

Moreover, stringent regulations, e.g.,UK Emission Trading Scheme, are driving industries towards low-carbon combustion technologies. Increasing demand for combustion control systems for waste-to-energy projects and the development of smart grids in several regions are also contributing to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.1% |

Germany, France, and Italy drive The combustion controls, equipment, and systems market in European union, followed by the UK and Spain. The EU’s Green Deal policies are motivating companies to shift to the use of energy-efficient combustion systems, resulting in the wider adoption of advanced control and monitoring solutions.

Moreover, the development of AI-based optimization of combustion and real-time emission monitoring further augments the market growth. Market trends are also being shaped by a focus on sustainable industrial processes and circular economy practices.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 6.4% |

Japan combustion controls, equipment, and systems market revenue is propelled by growing investments toward industrial efficiency, whooping adoption of low-emission combustion solutions, regulatory niches toward compliance, and government backing of smart manufacturing platforms. The commitment of the country towards reducing industrial carbon footprints, growth in demand for AI-integrated combustion control systems as well as IoT-enabled combustion control systems has bolstered the growth of this segment.

Furthermore, next-generation combustion monitoring solutions are shaped by Japan’s leadership in robotics and automation. The transition toward such alternative fuels as hydrogen and biomass is also boosting the growth of the market. Smart factory initiatives and the adoption of digital combustion analytics are expected to drive efficiency and sustainability.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.0% |

Driven by rapid industrialization, increasing adoption of efficient combustion technologies and government policies to promote energy efficiency in manufacturing, South Korea is increasingly becoming a key market for combustion controls, equipment and systems. Demand remains robust as the country pushes for green hydrogen production and adoption of AI-integrated systems that monitor combustion.

Investments in real-time emission reduction technologies and smart factory initiatives by South Korea further open doors to industrial efficiency. The adoption of combustion optimization solutions is being supported further by the expansion of the petrochemical, power generation, and automotive sectors. The growing trend for adopting digital twin technology for the monitoring of combustion processes is also impacting the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 6.7% |

Components and Systems segments of Combustion Controls, Equipment, and Systems Market have the highest market share among all the industrial sectors, such as energy production, metallurgy and petrochemicals, that demand advanced combustion solutions to improve efficiency, lessen emissions and abide by government regulation and environmental laws.

They are vital in supporting safe, reliable and sustainable fuel combustion across a breadth of industries.The global demand for industries such as low-emission technologies as well as the energy efficiency of combustion components and integrated systems is continuing to increase with industries transitioning to more sustainable options.

Due to their role in controlling air-fuel ratio mixtures, enhancing burner performance, and maintaining a stable flame, combustion control systems have been widely used. Component upgrades are also a more incremental option than total systems replacements, allowing the power and process industries to improve combustion efficiency without significant changes in the rest of the plant and gain cost efficiencies.

This demand for energy-efficient combustion control solutions, especially in refining, petrochemicals, and metallurgical industries, is driving the market adoption. More than 65% of industrial combustion systems are had implemented advanced components to optimize either fuel usage or minimize carbon output, as confirmed by studies.

The range of high-performance combustion components on the market which include AI-enhanced open-loop and closed-loop fuel-to-air ratio controllers, real-time burner efficiency monitoring, and adaptive flame stabilization technology has only bolstered market demand, offering unrivalled process reliability and regulatory compliance.

Last but not least, adoption has been further driven by the incorporation of cutting-edge fuel injection systems, as next generation atomization technology, precise flow-control devices, and AI-based combustion pattern analysis guarantee fuel optimization and diminished operational expenses.

Self-diagnostic combustion sensors that come with IoT-enabled real-time data tracking, failure predictive analysis as well as maintenance alerts are further aiding in the growth of the market aided by the provision of safety, downtime reduction as well as enhancement in the longevity of the system.

Furthermore, hybrid combustion control components with dual fuel burner adaptability, integrated emission monitoring sensors, and real-time flame temperature regulation have become popular, making it compliant with global emission standards and efficiency benchmarks thereby driving the market growth.

The growth of the combustion components market is driven by the many advantages of modular retrofitting, cost-effective efficiency gains, and emission control. Nevertheless, a fresh generation of fuelling technologies such as AI-based combustion optimization, nanotechnology-based combustion stabilization systems, and digital twin-based combustion modelling are driving adaptability, performance accuracy, and stakeholder market penetration to ensure that combustion control components will be a viable global supplier for years to come.

Complete combustion control systems globally cover a substantial portion of the Combustion Controls, Equipment, and Systems Market owing to the reliable end-to-end automation process, real-time emission monitoring, and smart fuel management. Unlike any components in isolation, these systems combine sophisticated monitoring devices, burner control systems, and safety devices to enable the continuous optimization of burning across industrial applications.

Rising demand for fully automated combustion system for large-scale power plants, cement production and aerospace propulsion technologies has driven adoption. According to studies, more than 70% of investments in industrial combustion control today are now also opting to transition to a fully integrated solution to improve their operational reliability and energy efficiency.

The market demand has been further bolstered by the rollout of AI-driven combustion automation solutions with self-learning flame detection models, real-time emissions tracking, and the ability to adjust processes in real time as necessary to ensure better energy savings and environmental sustainability.

The adoption has also accelerated via Cloud connected combustion monitoring platforms, which offer remote diagnostics, predictive maintenance notifications as well as multi-location combustion control analytics, enabling heightened scalability and enterprise-wide optimization.

Hybrid fuel combustion systems, with intelligent fuel-switching algorithms, adaptive burner characteristics and thermal efficiency control, are the key factors behind the optimized growth of such advanced fuel combustion systems, adapting better to changing energy prices and adoption of renewable fuels.

Industry-leading cost-effective solutions, supported by the installation and maintenance of regulatory-compliant combustion control frameworks along with features, such as, AI-enhanced compliance tracking, automated emissions reporting, and real-time pollutant filtration mechanisms, have boosted the adoption that drives market growth, ensuring that industries operate within stringent environmental and safety norms.

This is the most prominent segment with advantages such as process automation, optimization of combustion conditions, and emission reduction, although some drawbacks in this segment such as high initial costs, complex integration with existing systems, and the requirement for specialized technical expertise to operate such systems is restraining the segment growth.

However, innovations such as AI-driven, self-calibrating combustion controls, next-generation combustion chamber design enhancements, real-time machine learning-assisted emission reduction technologies, etc. are solving challenges related to efficiency, reliability, and cost-effectiveness, heralding continued expansion of combustion control systems across the globe.

As manufacturing plants, energy providers and industrial processing units invest in efficiencies for fuel utilization, regulatory compliance and workplace safety, the Process Industries and Energy & Power segments accumulate the Combustion Controls, Equipment and Systems Market share. These types of applications serve as functional segments that will help define product innovation, between industries and will drive long term growth.

With a great market adoption these industries require precise fuel management, real-time combustion monitoring and automated process control within high-temperature manufacturing environments. Improved combustion controls based on AI techniques provide intelligent process optimization, avoiding excess heat loss and enhancing overall industrial production efficiency as opposed to the traditional manual combustion process.

Proliferating demand for high-efficiency combustion control solutions, especially in the chemical processing, metal smelting and food production, has proliferated adoption. It is reported that automated combustion monitoring technologies in industrial process applications have increased from 25% to over 65% of those applications, due to the cost savings and production stability that they have resulted in.

The deployment of intelligent combustion control platforms, consisting of self-regulating burner units, AI-assisted real-time process optimization, and performance advantageous fuel injector regulation, has bolstered market demand, to guarantee increased operational agility and eco-friendliness.

Also, the process industries segment faces challenges such as fuel quality variation, regulatory landscape uncertainty, and complexity in retrofitting legacy combustion equipment, even though the segment has advantages of improved energy efficiency, reduced costs, and increased process stability.

Yet a wave of recent innovations including AI-powered industrial combustion analytics, next-generation heat recovery mechanisms, ultra-low-emission combustion designs are increasing the scalability, adaptability, and compliance that will allow process industry combustion controls to continue to grow in reach across the globe.

As emission reduction, thermal efficiency improvement, and grid stability make the utility and power generation companies invest in advanced combustion technologies, the energy & power sector loaded the market growth from the in-field installers. In comparison to typical combustion setups in power plants, AI-based systems also optimize fuel-air ratios and NOx emissions, and provide real-time operational performance and plant monitoring.

Further acquisition of combustion control solutions has been driven by the growing need for high-performance capability especially in gas-fired and biomass power plants. With tighter energy efficiency standards now taking hold globally, studies show that more than 70% of the world's thermal power generation field is adopting next-generation combustion controls technology.

The energy & power segment, however, encounters challenges including volatile fuel prices, the shift to renewable energy sources, and regulatory policies limiting fossil fuel combustion, despite carrying the potential for increased fuel savings, emissions savings, and regulatory congruence.

Nevertheless, innovations in AI-powered predictive combustion modelling, carbon capture-integrated combustion control systems, and hybrid renewable-fossil fuel co-firing technologies are increasing sustainability, operational flexibility, and long-term cost effectiveness, ensuring the continued expansion of energy & power combustion control systems in global markets.

A wide variety of factors are contributing to the growth of the combustion controls, equipment, and systems market, which include rising demand for energy-efficient combustion technologies, more stringent emissions regulations, and many advances in automation and digital monitoring.

As low-NOx burners and smart combustion management systems gain traction, the market is evolving steadily. Continued to be a leader in integration of IoT for combustion control, hybrid fuel systems, and advanced emission reduction technologies.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| General Electric (GE) | 12-16% |

| Honeywell International Inc. | 10-14% |

| Siemens AG | 8-12% |

| Mitsubishi Hitachi Power Systems | 6-10% |

| ABB Ltd. | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| General Electric (GE) | Develops high-efficiency combustion control systems with advanced monitoring capabilities. |

| Honeywell International Inc. | Specializes in smart combustion equipment with real-time emission control technology. |

| Siemens AG | Offers industrial combustion automation solutions with AI-driven optimization. |

| Mitsubishi Hitachi Power Systems | Focuses on low-emission combustion technologies for power generation. |

| ABB Ltd. | Provides integrated combustion control systems with IoT-based efficiency management. |

Key Company Insights

General Electric (GE) (12-16%)

GE leads in combustion control innovation, offering high-performance solutions for industrial and power applications.

Honeywell International Inc. (10-14%)

Honeywell specializes in advanced combustion equipment, integrating real-time monitoring and automated efficiency enhancements.

Siemens AG (8-12%)

Siemens focuses on AI-driven combustion automation, optimizing energy use and reducing emissions in industrial settings.

Mitsubishi Hitachi Power Systems (6-10%)

Mitsubishi Hitachi develops next-generation low-emission combustion technologies, particularly for power plants.

ABB Ltd. (4-8%)

ABB is known for integrating IoT-based combustion control systems, enhancing energy efficiency and sustainability.

Other Key Players (45-55% Combined)

Several combustion control system manufacturers and industrial technology providers contribute to the expanding market. These include:

The overall market size for the Combustion Controls, Equipment, and Systems market was USD 3,02,265.3 Million in 2025.

The Combustion Controls, Equipment, and Systems market is expected to reach USD 5,67,393.7 Million in 2035.

The demand for combustion controls, equipment, and systems will be driven by increasing industrial automation, stringent environmental regulations on emissions, rising adoption of energy-efficient combustion technologies, and growing demand for advanced control systems in power generation and manufacturing sectors.

The top 5 countries driving the development of the Combustion Controls, Equipment, and Systems market are the USA, China, Germany, Japan, and India.

The Energy & Power Sector is expected to command a significant share over the assessment period.

Security Inspection Market Insights – Trends & Forecast 2025 to 2035

Tactical Radios Market Analysis by Type, Application, and Region Through 2025 to 2035

Mobility as a Service Market - Demand & Growth Forecast 2025 to 2035

Infrared Sensors Market Analysis – Growth & Trends 2025 to 2035

Laser Marking Market Insights - Growth & Forecast 2025 to 2035

Laser Hair Removal Devices Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.