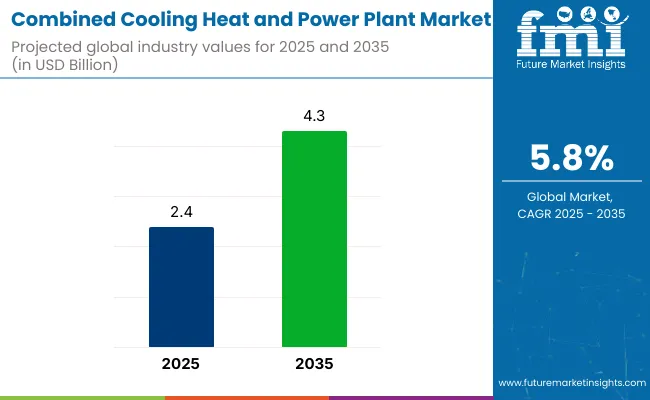

The global combined cooling heat and power (CCHP) plant market is valued at USD 2.4 billion in 2025 and is projected to reach USD 4.3 billion by 2035, reflecting a CAGR of 5.8%. This growth is primarily driven by the rising demand for energy-efficient solutions and the increasing emphasis on reducing carbon emissions.

CCHP plants, which simultaneously generate electricity, heating, and cooling, are gaining traction due to their ability to enhance energy efficiency and lower operating costs. Additionally, the growing need for decentralized energy systems, along with advancements in cogeneration technologies, is expected to further propel the market’s expansion.

Recent innovations in the combined cooling heat and power plant focus on enhancing energy efficiency and reducing environmental impact. New cogeneration technologies, such as organic Rankine cycle systems, are improving heat recovery processes. Smart grid integration is enabling real-time monitoring and optimized energy distribution, while advances in micro-CHP units allow for more flexible, smaller-scale applications in residential and commercial sectors.

Government regulations in this market are increasingly focused on enhancing energy efficiency and reducing carbon emissions. Many countries have implemented policies that incentivize the adoption of CCHP systems, such as tax credits, grants, and feed-in tariffs.

Regulatory frameworks often require CCHP plants to meet specific energy performance standards, including efficiency thresholds and emissions limits. Additionally, governments are pushing for stricter energy management guidelines, encouraging the integration of renewable energy sources with CCHP systems, and promoting smart grid technologies to optimize energy distribution and consumption.

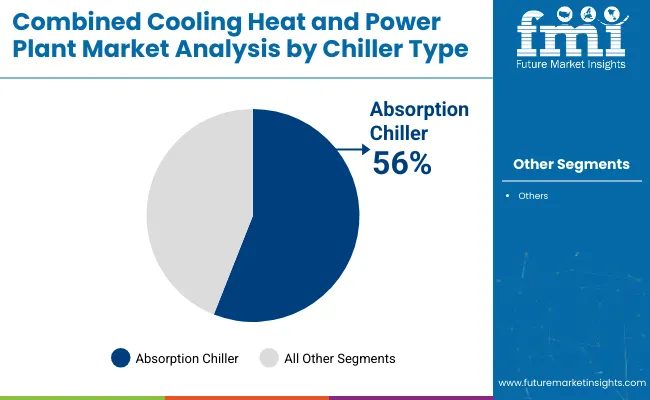

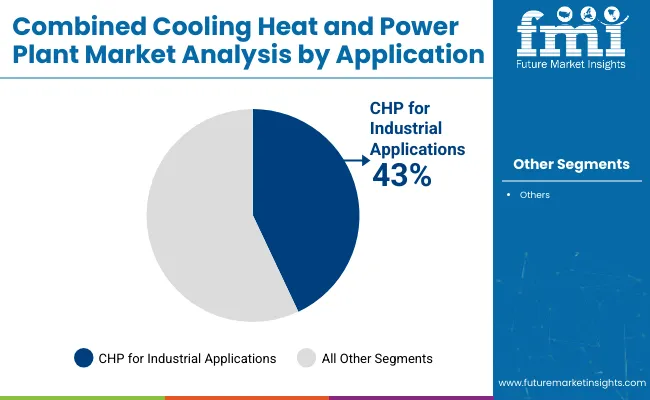

Germany is expected to be the fastest-growing market in the combined cooling heat and power plant sector, with a projected CAGR of 5.5%. Absorption chillers will lead the chiller type segment with a 56% market share in 2025. CHP for industrial applications will dominate the application segment, holding a 43% market share. The USA and the UK are also expected to see significant growth, with CAGRs of 5.2% and 4.8%, respectively.

The global combined cooling heat and power plant market is segmented by chiller type, application, and region. By chiller type, the market is bifurcated into absorption chiller and engine drive chiller. In terms of application, the market is categorized into CHP for industrial applications, CHP for commercial applications, and CHP for institutional applications. Regionally, the market is divided into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

Absorption chillers are projected to lead the chiller type segment, accounting for 56% of the global market share by 2025. These chillers are preferred for their energy efficiency and are increasingly used in areas where waste heat is available.

Combined heat and power (CHP) for industrial applications is expected to dominate the application segment, securing 43% of the global market share by 2025. This growth is driven by the increasing demand for energy-efficient solutions and the rising focus on reducing operational costs.

The global CCHP plant market is experiencing robust growth, driven by the increasing demand for energy-efficient and sustainable solutions in various sectors such as industrial, commercial, and institutional applications. CCHP systems are becoming essential for providing combined heating, cooling, and power with enhanced energy efficiency.

Recent Trends in the Combined Cooling Heat and Power Plant Market

Challenges in the Combined Cooling Heat and Power Plant Market

The global combined cooling heat and power plant market is experiencing robust growth, driven by the demand for energy-efficient and sustainable solutions across industrial, commercial, and institutional applications. CCHP systems, which provide combined heating, cooling, and power, are becoming increasingly important for improving energy efficiency and reducing environmental impact.

The sales of combined cooling heat and power plants in the USA are expected to grow at a CAGR of 5.2% from 2025 to 2035, driven by the demand for sustainable energy solutions and energy-efficient systems in industrial and commercial sectors.

The UK combined cooling heat and power plant market is projected to grow at a CAGR of 4.8% from 2025 to 2035, supported by the country’s commitment to energy efficiency and reducing carbon footprints.

Revenues of combined cooling heat and power plants in Germany are projected to grow at a CAGR of 5.5% from 2025 to 2035, driven by the country’s leadership in energy-efficient technologies and industrial innovations.

The French combined cooling heat and power plant market is expected to grow at a CAGR of 4.4% from 2025 to 2035, fueled by the country’s growing emphasis on energy efficiency and renewable energy integration.

Combined cooling heat and power plant market revenue in Japan is expected to grow at a CAGR of 4.2% from 2025 to 2035, driven by the increasing need for efficient energy solutions in industrial, commercial, and residential applications.

The global CCHP plant market is moderately consolidated, with key players including General Electric Company, Siemens Energy AG, Caterpillar Inc., Bosch Thermotechnology GmbH, Kawasaki Heavy Industries Ltd., Cummins Inc., Veolia Environnement, ABB Ltd., MAN Energy Solutions, and Mitsubishi Heavy Industries Ltd.

These companies dominate by providing cutting-edge and energy-efficient solutions tailored to industrial, commercial, and institutional applications. General Electric and Siemens Energy offer high-efficiency gas turbines, along with integrated smart grid and renewable energy capabilities, making them essential players in large-scale CCHP systems.

In addition, Caterpillar Inc. and Cummins Inc. provide reliable and adaptable CCHP solutions, focusing on reciprocating engine systems for various energy needs. Bosch Thermotechnology GmbH and Kawasaki Heavy Industries Ltd. specialize in absorption chillers and cogeneration technologies, which are crucial for district energy and industrial sectors. Companies like Veolia Environnement, ABB Ltd., MAN Energy Solutions, and Mitsubishi Heavy Industries Ltd. offer comprehensive solutions that enhance sustainability, operational efficiency, and cost-effectiveness.

Recent Combined Cooling Heat and Power Plant Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 2.4 billion |

| Projected Market Size (2035) | USD 4.3 billion |

| CAGR (2025 to 2035) | 5.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | USD billion for value/Volume in million units |

| Chiller Type Analyzed | Absorption Chiller and Engine Drive Chiller |

| Application Analyzed | CHP for Industrial Applications, CHP for Commercial Applications, and CHP for Institutional Applications |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players Influencing the Market | General Electric Company, Siemens Energy AG, Caterpillar Inc., Bosch Thermotechnology GmbH, Kawasaki Heavy Industries Ltd., Cummins Inc., Veolia Environnement, ABB Ltd., MAN Energy Solutions, Mitsubishi Heavy Industries Ltd. |

| Additional Attributes | Dollar sales growth by chiller type, regional demand trends, competitive landscape, technological innovations |

In terms of Chiller Type, the industry is divided into Absorption Chiller, Engine Drive Chiller

In terms of Application, the industry is divided into CHP for Industrial Applications, CHP for Commercial Applications, CHP for Institutional Applications

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, and the Middle East and Africa (MEA).

The market is valued at USD 2.4 billion in 2025.

The market is forecasted to reach USD 4.3 billion by 2035, reflecting a CAGR of 5.8%.

Absorption chillers are expected to lead the chiller type segment with a 56% market share in 2025.

CHP for industrial applications is expected to dominate the market with a 43% market share in 2025.

The Germany is projected to grow at the fastest rate, with a CAGR of 5.5% from 2025 to 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Combined Charging System Market Size and Share Forecast Outlook 2025 to 2035

Combined Cycle Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Combined Cycle Power Plant Market Size and Share Forecast Outlook 2025 to 2035

Combined Heat and Power (CHP) Systems Market Growth - Trends & Forecast 2025 to 2035

Recombined Milk Market

Micro Combined Heat and Power Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Fans Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Cooling Agents Market Size and Share Forecast Outlook 2025 to 2035

Cooling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cooling Essences Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Market Size and Share Forecast Outlook 2025 to 2035

Cooling Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cooling Tower Rental Market Size, Growth, and Forecast 2025 to 2035

Cooling Management System Market - Growth & Demand 2025 to 2035

Cooling Fans Market Growth - Trends & Forecast 2025 to 2035

Cooling Water Treatment Chemicals Market Growth - Trends & Forecast 2025 to 2035

Cooling Laser Power Measurement Sphere Market Size and Share Forecast Outlook 2025 to 2035

Cooling and Heating as a Service Market Growth – Trends & Forecast 2025-2035

Gas Cooling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA