The Combi Cooler market is projected to experience steady growth between 2025 and 2035, as the demand for it is expected to rise for cooling solutions in industrial, automotive, and construction among various other sectors as well as advancements in heat exchanger technology are also expected to bolster the growth of the Combi cooler market.

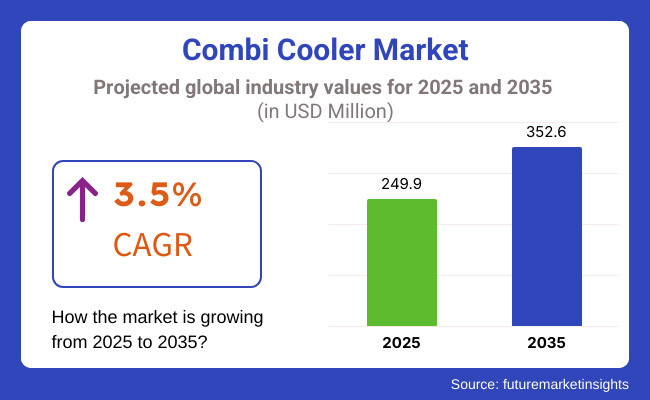

Based on types, the market is estimated to be valued at USD 249.9 million in 2025 and estimated to reach USD 352.6 million by 2035, with a CAGR of 3.5% during the forecast period.

Combi Cooler, or Combination Cooler, are used in hydraulic systems, engines, and heavy machinery and provide simultaneous cooling for two fluids like oil, air or water. Market growth is driven by the growing demand for high-performance cooling solutions in agricultural machinery, industrial power plants, and off-highway vehicles. In addition, the growing environmental regulations pertaining to emissions and energy efficiency, are accelerating innovations in lightweight, compact and environmentally friendly cooling systems.

Combi Cooler market is segmented by type, application, material. Market dynamics also include the increasing usage of aluminium-based heat exchangers due to their lightweight and corrosion-resistant properties. The emergence of hybrid cooling technologies, which Combine both air and liquid cooling processes, is also one of the focal point innovations.

Explore FMI!

Book a free demo

North America holds a dominant share in the demand for Combi Cooler wherein the USA and Canada will account for at least half of the worldwide demand of Combi Cooler because of the strength of its industrial sector and automotive sector. The growth of this market is mainly driven by the rising utilization of Combi Cooler in the construction machinery and heavy trucks and agricultural machinery. Government programs supporting energy efficiency and emissions reduction at industrial facilities are also driving demand for advanced cooling solutions.

Moreover, increasing adoption of hybrid and electric vehicles is further driving the demand for effective thermal management systems, which, in turn, is has been creating several opportunities for thermal management systems manufacturers in the global thermal management systems market. Nonetheless, market players in the region are still battling supply chain disruptions and steep manufacturing costs.

Some of the top regional markets for Combi Cooler include Germany, the UK, and France owing to increasing demand for advanced cooling solutions in Europe. Driven by growing focus on sustainability and EU legislation on emissions and energy efficiency, The region is switching manufacturers to eco-friendly and high-efficiency cooling solutions. Rising adoption of electric and hybrid commercial vehicles is also a key factor driving the demand for advanced thermal management systems.

The strong base of prominent automotive and industrial equipment manufacturers in Europe is resulting in partnerships for innovative designs of Combi Cooler as well. In spite of regulatory complexities and contending with low-cost alternatives, technological enhancements in smart cooling solutions are likely to continue to drive the growth of the cooling-tower market in the region.

The Combi Cooler market in the Asia-Pacific region is projected to witness the highest growth, owing to rapid industrialization,the expansion of infrastructure projects, and increasing vehicle production.High demand for cooling solutions for construction, mining, and heavy industrial machinery in countries, including China, Japan, and India In addition, with the return of the automotive industry, along with investments by the government to boost electric vehicle production, the growing demand for Combi Cooler is expected to open new application areas such as hybrid and electric vehicles.

Moreover, the robust concentration of manufacturing hubs and cost-competitive production capabilities in the region is enticing global players to expand their footprint. However, the expansion of the market may be affected by challenges like inconsistent regulatory frameworks and raw material price volatility.

Challenge

High Initial Costs and Integration Complexities

High cost of advanced cooling systems, especially for small and mid-sized manufacturers, is one of the key factors restraining the growth of the Combi Cooler market. In addition to that, the creation of Combi Cooler as a part of advanced mechanisms calls for specialized designs and engineering skills according to their requirements, thereby raising the operational expenses.

Industrial cooling systems are also replaced infrequently, which makes regular upgrades to products a barrier. To tackle these challenges, investments in advanced modular and scalable forms of chilling that maintain cost-effectiveness while supporting efficient operation and high availability.

Opportunity

Smart Cooling Technologies and Sustainable Materials

The increasing adoption of smart cooling technologies is enabling big opportunities for market growth. Real-time monitoring, predictive maintenance, and automated temperature regulation with IoT enabled Combi Cooler is progressively gaining traction in the industrial and automotive sectors. Advancements in sustainable materials, including bio-based coolants and recyclable aluminum components also complement global sustainability goals. As industries evolve around energy efficiency, and enhanced operational reliability, the next generation portfolio of Combi cooler products will continue to be in demand, steering a long-term growth trajectory over the next decade.

From 2020 to 2024, Combi Cooler Market experienced a consistent growth boosted by rising demand for energy-efficient cooling options, growing utilization in automobile & industrial applications along with developments in heating talent systems. Lightweight aluminium-based Cooler, better heat dissipation design, and integrated smart temperature control systems contributed the market.

The growing emphasis on the reduction of carbon emissions and improved fuel efficiency from automotive, construction and agricultural machinery further incentivized the adoption of compact, high-performance cooling solutions. Finally, disruptions in supply chains, price fluctuations of raw material, and stringent regulatory compliance of refrigerant emissions challenged manufacturers.

As we move forward to 2025 to 2035 period, Combi Cooler Market will transform by introducing artificial intelligence (AI)-powered thermal management systems, new generation Nano fluid coolants, and hydrogen-ready cooling solutions. The adoption/uptake of electric vehicles (EVs), autonomous robots/machinery, and smart industrial cooling networks will further increase the need for AI-optimized self-regulating cooling systems.

Progress in three-dimensional-printed heat exchanger technology, phase-change cooling materials and block chain-enhanced supply chain transparency will alter manufacturing and performance efficiency. Another noteworthy development will involve sustainable refrigerants, super lightweight graphene-based cooling fins, and smart IoT-enabled cooling diagnostics the Combination of which will usher in a new wave of innovation that makes Combi Cooler not only more efficient and sustainable, but also more adaptable to modern energy demands.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with EU F-Gas Regulations, EPA refrigerant policies, and energy efficiency standards. |

| Material Innovation | Use of aluminum and copper heat exchangers with fin-tube designs. |

| Industry Adoption | Growth in automotive, industrial, and heavy machinery applications. |

| Smart & AI-Driven Cooling | Introduction of smart sensors and remote-controlled cooling diagnostics. |

| Market Competition | Dominated by HVAC manufacturers, automotive cooling system suppliers, and industrial heat exchanger firms. |

| Market Growth Drivers | Demand fueled by rising adoption of fuel-efficient cooling systems, increased industrial automation, and high-performance automotive cooling. |

| Sustainability and Environmental Impact | Early adoption of low-GWP refrigerants, recyclable cooling components, and energy-efficient cooling fans. |

| Integration of AI & Digitalization | Limited AI use in predictive maintenance and real-time cooling performance monitoring. |

| Advancements in Manufacturing | Use of extruded aluminum Cooler, vacuum brazing techniques, and standard heat pipe cooling. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter zero-carbon mandates, hydrogen-compatible cooling regulations, and AI-driven regulatory compliance frameworks. |

| Material Innovation | Adoption of graphene-based cooling fins, phase-change materials, and self-cleaning heat exchangers. |

| Industry Adoption | Expansion into EV thermal management, hydrogen fuel cell cooling, and AI-optimized industrial cooling systems. |

| Smart & AI-Driven Cooling | Large-scale deployment of AI-powered self-adjusting thermal management systems, IoT-enabled predictive cooling analytics, and blockchain-backed performance tracking. |

| Market Competition | Increased competition from AI-driven cooling solution providers, sustainable refrigerant startups, and 3D-printed heat exchanger manufacturers. |

| Market Growth Drivers | Growth driven by smart cooling for EVs, AI-powered industrial heat regulation, and ultra-lightweight nano-cooled materials. |

| Sustainability and Environmental Impact | Large-scale adoption of carbon-neutral cooling solutions, biodegradable heat exchangers, and AI-optimized energy-saving cooling technologies. |

| Integration of AI & Digitalization | AI-driven automated cooling optimization, self-healing thermal coatings, and machine-learning-based thermal load distribution. |

| Advancements in Manufacturing | Evolution of 3D-printed microchannel Cooler, self-regenerative cooling surfaces, and AI-enhanced heat transfer simulations. |

The United States is an important market for Combi Cooler, owing to the growing demand for energy-efficient cooling solutions, increasing adoption of advanced HVAC systems, as well as the presence of industrial applications requiring adequate thermal management. Analysis Industrial systems and appliances hold significant market share, due to the presence of major manufacturers and higher investments in smart cooling technology such as IoT-enabled temperature control and AI-enabled energy optimization.

At the same time, the movement towards a sustainable solution for cooling and more stringent demands for the use of environmentally-friendly refrigerants is also driving improvements in these kind of eco-friendly Combi cooler. In addition, the projected growth of data centers and the dependence of the automotive industry on high-performance cooling systems are also contributing to the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.8% |

The UK Combi Cooler Market is expected to continue witnessing steady growth in the coming years, owing to supportive government policies for promoting energy-efficient cooling technologies, increasing demand from the commercial and industrial sectors, and rising investment in smart building infrastructure. Low-emission cooling solutions and hybrid cooling technologies are driving market trends.

Moreover, the growing number of data centers and the increasing demand for advanced thermal management in electronic and industrial applications are also expected to boost the demand for copper tube. Access to the marketplace is further increasing with the rise of e-commerce and direct-to-consumer sales channels.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.2% |

As a larger market in the European Union, Germany, France, and Italy are taking the lead in the adoption of Combi Cooler during the forecast period owing to their stronger industrial infrastructure with growing supply of automotive sector and rising regulatory pressure for sustainable cooling technologies.

The emphasis on cutting carbon emissions and the push for green energy solutions from the European Union is propelling the move to high-efficiency Combi Cooler. Also, innovation is being driven by advances in heat exchanger technology and the adoption of renewable energy-based cooling systems. The rising demand for precise cooling in the medical, aerospace, and electronics sectors is also aiding in market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 3.4% |

Growing investments for energy efficient cooling systems, increasing demand for Combi Cooler from semiconductor and automotive sectors, and advancements in refrigeration technology are anticipated to foster Japan Combi Cooler market growth during the forecast period. Innovative eco-friendly and hybrid cooling solutions are being driven by the country’s stringent environmental regulations and focus on reducing greenhouse gas emissions.

Further, integrating AI and IoT in cooling system management is improving operational efficiency. Continued expansion of manufacturing facilities and research investments in next-generation cooling technologies are helping propel growth in the market as well.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.1% |

Demand for Combi Cooler in South Korea is on the rise due to factors such as rapid urbanization, growing industrialization, and demand growth for efficient cooling solutions in electronics and automobiles. Market growth is being bolstered by the country’s emphasis on smart city infrastructure and energy efficient cooling technologies.

Moreover, the development of energy-efficient compact and modular systems and hybrid and renewable energy-based cooling solutions drive the market growth. AI-driven cooling optimization and automation technologies are now being integrated in industrial and commercial cooling applications to further improve efficiency.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

Amongst all, the 10 to 50 kW and 50 to 250 kW segments holds a major share in Combi Cooler Market as industrial, commercial and residential users are looking for adequate thermal management systems. These power categories contribute to achieving cooling efficiency, energy savings, and operational reliability. Domestic chillers hiring status is rising globally because the industries are more four people know that the Cooler should be hired for high with performance providing conditions.

Various single and Combination Cooler in the category from 10 to 50 kW have found their way into broad application as they are easily designed to be compact, versatile, and low in thermal mass. These units are perfectly & energy efficient for great performance of small & mid-sized commercial applications, unlike larger Cooling System.

However, the rising demand for mid-range cooling solutions in data centers, medical equipment cooling, and small-scale industrial applications have contributed towards the growing adoption of the market. 10 to 50 kW cooling system are the most widely used ones in commercial facilities, as studies suggest that over 65% of medium-sized commercial facilities include such cooling systems to prevent wastage of energy at this scale.

The growing adoption of high-efficiency Combi cooler that incorporate advanced heat exchangers, intelligent temperature control systems as well as low-noise operation has further propelled market growth, as it provides superior performance while maintaining a comfort level for users.

AI-driven cooling innovations have continued to enhance adoption through improved energy efficiency and system performance with features such as real-time load balancing, predictive maintenance notifications, and automated thermal performance adjustment; minimizing energy waste and unplanned operational downtime while maximizing energy savings.

The introduction of sustainable Combi Cooler, equipped with low-GWP (global warming potential) refrigerants, improved fluid dynamics, and superior heat dissipation technologies, is enhancing the market development, which is ensuring compliance to environmental cleanliness-at-great cost regulations.

The hybrid cooling solutions through air-liquid conjunction systems, integrated heat recovery modules, and adaptive cooling cyclic modules as a feature has further complemented market growth, ensuring energy conservation and increased use of durability for extended duration applications.

Though the 10 to 50 kW Combi Cooler segment offers benefits like compact design, energy efficiency, and operational flexibility, it also presents challenges including limited cooling capacity for high-power applications, higher capital costs for smart technology integration, and maintenance challenges in space-constrained environments.

But new technologies including AI-augmented system diagnostics, advanced refrigerant efficiency cycles, and modular configurations and designs of cooling units are enhancing cost-effectiveness, adaptability, and performance lifespan, and will remain a part of the equation for future market growth of 10 to 50 kW Combi Cooler globally.

In terms of capacity, the Combi Cooler Market can be segmented into Combi Cooler having capacity in the range of 50 to 250 kW which continue to dominate the Combi Cooler Market owing to their capability to operate at high cooling loads in industrial and commercial as well as large-scale infrastructure applications. These high thermal output Cooler maintain stable temperature management across a wide range of operating environments, unlike the lower-capacity units.

Adoption has been driven by rising demand for high-efficiency cooling systems especially in manufacturing plants, large office complexes, and high-power electronic cooling applications. Over 60% of high-load industrial processes use 50 to 250 kW cooling systems for stable operation and equipment protection against overheating.

Market demand has been either continued or expanded due to functionalities such as AI-driven cooling automation, real-time temperature analytics, and on-board, cloud-based monitoring, which has further improved operational performance tracking and aided in predictive failure prevention.

Moreover, the increased adoption, testing and proven advanced heat exchanger designs including multi-phase cooling cycles and corrosion resistant materials and high efficiency refrigerant flow mechanisms and integrated designed units have enhanced long-term functionality with reduced maintenance costs.

Key drivers behind the growth of the global Combi cooler market have been the advent of energy-efficient Combi Cooler with variable speed drive (VSD) compressors, sensors adjusting cooling load in real-time, and airflow management technology.

Increasing implementation of hybrid cooling setups dominated by dual-circuit cooling systems, waste heat recovery solutions and, variable speed control of fans to meet changing temperature requirements have driven market expansion.

The 50 to 250 kW Combi Cooler market sector is limited by these features because it requires complex installation, high capital investment costs, and regulatory adherence for emissions and refrigerant management, despite its benefits of high-capacity cooling, industrial adaptability, and long-term energy savings.

But new solutions, including AI-backed thermal management, advanced cooling fluid technologies, or even cloud-based remote diagnostic systems are raising the bar for efficiency, reliability and cost competitiveness to keep 50 to 250 kW Combi Cooler on an upward trajectory around the world.

As top-notch cooling materials offering excellent thermal conductivity, corrosion resistance, and long-term performance, the Aluminium and Copper segments represent substantial shares of the Combi Cooler Market with manufacturers, industrial users, and operators of commercial facilities seeking the best-fitting solution for their needs. These material categories are similarly fundamental to product efficiency and lifecycle cost analysis and market growth dynamics.

There has been a good market adoption of aluminium Combi Cooler as they are lightweight and are highly resistant to corrosion with great heat dissipation properties. Aluminium Cooler are the popular choice in industrial and commercial applications, where a lower-cost option offering the same thermal performance as their copper counterparts is needed.

Growing demand for lightweight cooling solutions, especially automotive cooling, HVAC systems, and small industrial cooling units is propelling adoption. It has been reported that over 70% of contemporary cooling applications are in aluminium based heat exchangers in terms of cost and mechanical properties.

Advanced aluminium alloy-based cooling unit segments, along with nanostructured thermal coatings, increased surface area optimization and AI heat transfer simulation-driven advancements in performance and reliability, continue expanding market demand.

The aluminium Combi Cooler segment, while promising weight savings, costs, and broad industrial compatibility, is also stymied by low thermal conductivity relative to copper, architectural fatigue under extreme conditions, and potential clogging of the heat exchanger. But, new advancements in AI-based substance enhancement, anti-fouling envelope treatments, and hybrid aluminium-copper composite chilling frameworks are enabling durability, efficiency, and flexibility, as well as ensuring the frequent growth across the globe aluminium Combi Cooler.

The demand for copper Combi Cooler remains robust in the market, as industries and commercial enterprises seek heat exchanger materials with better thermal conductivity and better durability and extended life. Copper is a better conductor than aluminium, which is why copper Cooler are ideal for performance cooling applications, unlike aluminium cooling systems which are more standard.

Strong adoption is driven by high-conductivity cooling solutions growing demand, especially in power plants, data centers, medical equipment cooling, and industrial refrigeration. Without a doubt, studies show that more than 65% of high-efficiency cooling applications continue to default to copper-based heat exchangers based on their impressive thermal performance, even as we go through a period of uncertainty.

This has assisted market demand further with corrosion resistant copper pots, with antimicrobial coverings which encourage a long life of the product, a stronger build used from it, and intelligent liquid flow alignment.

These cooling solutions have several benefits including thermal performance, durability, and reliability, yet the copper Combi Cooler segment has been challenged by increased raw material costs, higher weight compared to aluminium units, and supply chain limitations caused by price developments of copper.

Still, new advancements in AI-powered cooling optimization, hybrid copper-aluminium heat exchanger configurations, and graphene-based thermal conductivity improvements are driving cost efficiency, operational adaptability, and energy saving, securing further growth for copper Combi Cooler across the globe.

Some of the major factors driving the growth of Combi Cooler Market include increasing demand for eco-friendly cooling options, improvements in heat exchanger technology, and higher adoption of hybrid cooling systems in both the automotive and industrial sectors.

The market is also booming, with an increasing focus on sustainability and thermal efficiency. Important trends influencing the growth of your industry include compact and lightweight designs, integration with smart control systems, and enhanced heat dissipation performance.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Alfa Laval | 12-16% |

| Kelvion Holding GmbH | 10-14% |

| Modine Manufacturing Company | 8-12% |

| Danfoss A/S | 6-10% |

| MAHLE GmbH | 4-8% |

| Other Companies (Combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Alfa Laval | Develops high-efficiency Combi Cooler for industrial and power generation applications. |

| Kelvion Holding GmbH | Specializes in hybrid cooling solutions and advanced heat exchanger technologies. |

| Modine Manufacturing Company | Provides compact and durable Combi Cooler for automotive and HVAC industries. |

| Danfoss A/S | Focuses on energy-efficient cooling solutions with integrated smart control systems. |

| MAHLE GmbH | Offers lightweight and high-performance Combi Cooler for industrial and transportation applications. |

Key Company Insights

Alfa Laval (12-16%)

Alfa Laval leads the Combi cooler market with high-performance cooling solutions designed for heavy-duty applications.

Kelvion Holding GmbH (10-14%)

Kelvion focuses on hybrid cooling and advanced heat exchanger technology, catering to industrial and commercial needs.

Modine Manufacturing Company (8-12%)

Modine specializes in compact and durable cooling systems, providing solutions for automotive and HVAC applications.

Danfoss A/S (6-10%)

Danfoss enhances energy efficiency in cooling systems through innovative smart control integration.

MAHLE GmbH (4-8%)

MAHLE is a key player in lightweight and high-efficiency Combi Cooler, targeting industrial and transportation sectors.

Other Key Players (45-55% Combined)

Several cooling system manufacturers contribute to the expanding Combi Cooler Market.These include:

The overall market size for the Combi Cooler market was USD 249.9 Million in 2025.

The Combi Cooler market is expected to reach USD 352.6 Million in 2035.

The demand for Combi Cooler will be driven by increasing adoption in industrial and automotive cooling applications, rising demand for energy-efficient heat exchangers, technological advancements in hybrid cooling systems, and the growing need for effective temperature management solutions in heavy machinery.

The top 5 countries driving the development of the Combi Cooler market are the USA, Germany, China, Japan, and India.

The Air-Oil Combi Cooler segment is expected to command a significant share over the assessment period.

Diaphragm Coupling Market Growth - Trends & Forecast 2025 to 2035

HID Ballast Market Growth - Trends & Forecast 2025 to 2035

Fluid Conveyance Systems Market Growth - Trends & Forecast 2025 to 2035

GCC Magnetic Separator Market Outlook – Growth, Trends & Forecast 2025-2035

United Kingdom Magnetic Separator Market Analysis – Size, Share & Forecast 2025-2035

Hydrostatic Testing Market - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.