Growing demand of energy-efficient heating solutions and smart heating technology between 2025 to 2035. The combi boiler market is expected to grow steadily over the next decade, driven by growing demand of energy-efficient heating solutions, stringent environmental regulation and innovations in smart heating technology.

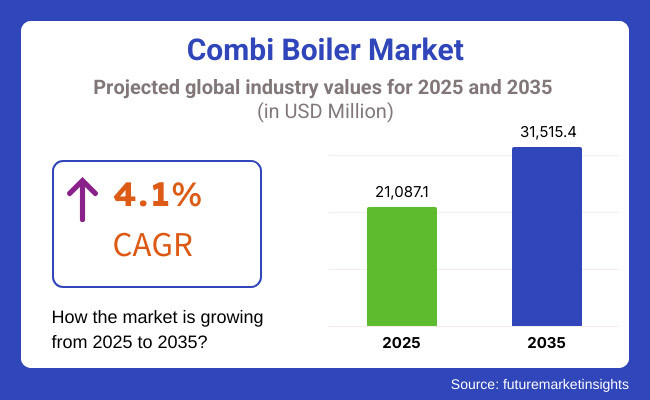

The quote market value in 2025 is predicted to be USD 2,1087.1 million and projected to reach USD 31,515.4 million by 2035, at a CAGR of 4.1% throughout the forecast period.

A combi boiler combines central heating with hot water in one unit, which means no separate water tank is necessary, perfect for residential and commercial use. The growing focus on carbon emissions reduction and increased uptake of smart home systems is driving the need for high-efficiency condensing boilers.

Moreover, supportive government initiatives and subsidies to adopt environmentally beneficial heating technologies will offer lucrative growth opportunities for the market during the forecast period. But expansion could be hindered by volatile raw material prices, regulatory hurdles, and installation restrictions in older buildings. Manufacturers are taking on these challenges with hybrid boiler technology, digital connectivity, and compact designs the help create efficient systems that can increase market adoption.

The combi boiler industry is further segmented based on the aforementioned factors: fuel type, capacity, and end-user applications.The market is witnessing developments with the advent of IoT-enabled boilers where consumers have the ability to remotely monitor and control their heating systems, leading to energy efficiency and consumer convenience.

Explore FMI!

Book a free demo

The market in North America holds a significant share of the combi boiler market with the United States and Canada being the leading countries in terms of adoption driven by growing consumer awareness of energy-efficient heating solutions. The demand in the market is propelled by the push for sustainable home heating as well as tax credits and government rebates for high-efficiency boiler installations.

The adoption of smart home technology is also boosting the integration of Wi-Fi-enabled and AI-based boilers. As the world moves towards alternative greener heating options, the USA market is a lot of advantage from this trend ensuring that end users would like different types of heating systems. Yet adoption can be uneven due to retrofitting challenges in older buildings and the particularities of the gas infrastructure in different regions.

Europe accounts for the largest market for combi boilers, due to strict energy efficiency regulations in EU and in addition to this, widespread acceptance of condensing boilers. Under continuing government policies, countries such as the UK, Germany and France are shifting to solutions like hydrogen-fuel-ready and hybrid heating solutions, phasing out gas boilers.

The region’s priority on reaching net-zero emissions by 2050 has spurred vigorous investment in boiler efficiency and alternative heating technologies. Meanwhile, district heating networks and smart thermostats are adding to the market dynamic. Consumer capital incentives and growth of green technology are anticipated to continue growing in the region despite regulatory complexities and the high cost of installation in the beginning.

The combi boiler market in Asia-Pacific is anticipated to grow at the quickest rate due to rapid urbanization, rising disposable incomes, and demand for space-efficient heating solutions. Regions including but not limited to China, Japan and South Korea are seeing the adoption of high-efficiency boilers thriving, thanks to government policies encouraging clean energy.

In China, there is a major trend in changing coal type heating in place of gas and electric boilers, which is supporting the market demand. In Japan, strong energy conservancy and innovation in hydrogen-powered boiler are creating trends in the market. Yet several issues, including inconsistent gas supply infrastructure and variable regulations from country to country, could hinder market growth.

Challenge

Regulatory Compliance and Retrofitting Constraints

Combi Boiler Market Features Emission Control and Energy Efficiency Regulations Compliance Challenges that regulatory authorities around the world are putting stringent policies in place due to which manufacturers need to innovate and upgrade their product portfolio.

Further, retrofitting older buildings to include modern combi boiler systems can be expensive and complicated especially in parts of the world where infrastructure is aging. Tackling these issues will involve collaboration between policymakers, manufacturers, and energy providers to create affordable and flexible heating options.

Opportunity

Expansion of Smart and Hydrogen-Ready Combi Boilers

Rapid integration of smart technologies in the space heating solutions in turn represents lucrative growth opportunities in the combi boiler market. Consumers with a taste for technology are gravitating toward IoT-enabled boilers that can monitor performance in real-time, diagnose remote problems and perform predictive maintenance. A

nd the increase in hydrogen-ready and hybrid boilers is complementary to global decarbonisation efforts, opening up fresh opportunities for innovation. As authorities slowly end their reliance on old gas boilers, issuing grants and funding for green heating alternatives, high efficiency and innovative combi boiler market is slated to see prolonged growth over the next ten years.

The period between 2020 and 2024 witnessed a consistent increase in demand for Combi Boilers, driven by the growing need for energy-efficient heating solutions, government initiatives encouraging the installation of low-emission heating systems, and a shift towards space-saving heating systems in densely populated urban areas.

Conversely, the movement toward condensing combi boilers with higher efficiency ratings has become more common as policies on carbon footprint reduction have tightened. By facilitating energy management, smart thermostats, IoT-enabled remote monitoring, and hybrid heating systems provided consumers with added convenience a trend bolstered by technology. However, factors like disrupted supply chains, volatile prices for raw materials and elevated installation costs exerted pressure on the market stability.

In the market for 2025 to 2035, rest assured that hydrogen-ready combi boilers will be available, while energy optimization will be supported and driven by AI and with huge deployments of heat pump hybrid systems. Governments across the globe are killing off gas-only boilers and moving to hydrogen-blended and fully electric alternatives.

Moreover, innovations in nanotechnology-based heat exchangers, block chain for energy trading, and AI-driven predictive maintenance will reshape the industry itself. These include zero-emission combi boilers, heating solutions integrated into the smart grid, and decentralized residential heating networks for inherent sustainability and energy independence.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with ErP (Energy-related Products) directive, Energy Star certification, and CO₂ emission reduction policies. |

| Fuel Source & Efficiency | Dominance of natural gas-powered condensing boilers with 90%+ efficiency ratings. |

| Industry Adoption | Growth in residential retrofits, multi-family housing installations, and smart heating adoption. |

| Smart Home Integration | Introduction of Wi-Fi-enabled combi boilers, smart thermostats, and mobile-based remote monitoring. |

| Market Competition | Dominated by traditional boiler manufacturers, HVAC suppliers, and regional energy service providers. |

| Market Growth Drivers | Demand fuelled by rising urbanization, energy efficiency mandates, and consumer preference for compact heating solutions. |

| Sustainability and Environmental Impact | Early adoption of low-NOx emission boilers, recycled steel components, and eco-friendly refrigerants. |

| Integration of AI & IoT | Limited AI use in performance monitoring and maintenance scheduling. |

| Advancements in Manufacturing | Use of standard stainless-steel heat exchangers, conventional cast iron designs, and modular components. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter net-zero emission regulations, mandatory hydrogen-ready boiler standards, and renewable energy integration requirements. |

| Fuel Source & Efficiency | Transition to hydrogen-ready, hybrid heat pump-integrated, and fully electric combi boilers. |

| Industry Adoption | Expansion into smart city heating networks, decentralized energy storage integration, and AI-driven demand response systems. |

| Smart Home Integration | Large-scale deployment of AI-powered self-learning boilers, block chain-backed energy transactions, and real-time performance analytics. |

| Market Competition | Increased competition from smart home tech companies, AI-driven energy efficiency firms, and decentralized heating start-ups. |

| Market Growth Drivers | Growth driven by hydrogen infrastructure expansion, AI-assisted predictive maintenance, and zero-carbon heating goals. |

| Sustainability and Environmental Impact | Large-scale shift to carbon-neutral combi boilers, circular economy-based boiler recycling, and zero-waste manufacturing. |

| Integration of AI & IoT | AI-powered real-time energy efficiency optimization, smart grid integration, and automated fault detection. |

| Advancements in Manufacturing | Evolution of 3D-printed heat exchangers, graphene-enhanced thermal conductivity materials, and self-healing boiler coatings. |

The USA continues to account for a large share of the combi boiler market owing to heightened uptake of energy-efficient heating solutions, surging demand for space-saving home appliances, and growing focus on curtailing carbon footprints. Moreover, government incentives toward high-efficiency heating systems along with traditional heating units replacement with modern condensing combi boilers is also expected to fuel the market growth.

Furthermore, the recent improvements in smart boiler technology such as Wi-Fi for temperature control and AI-based predictive maintenance are pushing user convenience and operational efficiency to a new level. The growth in new residential construction and renovation projects is also driving market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.4% |

The UK combi boiler market is experiencing steady growth, driven by the enactment of stringent government regulations encouraging the adoption of energy-efficient heating solutions, increasing consumer demand for compact and efficient home heating equipment and the growing adoption of renewable energy based heating technologies.

The shift from traditional boilers to condensing combi boilers to meet carbon reduction targets is the primary market driver. There is also the higher uptake of hydrogen-ready boilers and hybrid heating systems impacting future market trends. Increasing integration of smart home systems and remote controlling aids in heating systems is also propelling market penetration.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

High regulatory assistance doing towards energy efficiency in Germany, France, and Italy support their dominance in the combi boiler market in the European Union, along with the consistent acceleration in the adaptation of hybrid and gas fired boilers to the home heating system, and an increasingly conscious consumer, aware of sustainable home heating solutions.

Modern condensing boilers are also being adopted in significant numbers due to the EU’s roadmap toward decreasing dependence on heating-based fossil fuels and ramping up deployment of low-carbon technologies. Rising market growth is also observed due to increasing adoption integrated, smart heating solutions and need for compact, high efficiency combi-boilers. This is closely related to future developments in the industry towards hydrogen and renewable energy-based boilers.

| Country | CAGR (2025 to 2035) |

|---|---|

| EU | 4.0% |

The growth of the combi boiler market in Japan is driven by growing need of high-efficiency home heating solution measures by the consumer, adoption of smart home technology, and strong government support related to energy conservation. Demand for advanced condensing and hybrid boilers in UK residential buildings is a product of the country’s prioritization of combating carbon emissions and improving energy efficiency.

Further, surging demand for tank less water heating systems and implementation of AI-driven temperature control features are influencing the growth of the market. The growing real estate sector and increasing acceptance of green building solutions are also driving growth through the construction industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

South Korea is the growing regional market for combi boiler due to increasing urbanization, demand for high-efficiency heating solutions, and government incentives on eco-friendly home appliances.The shift in the country’s home heating technology in favour of more sustainable options, such as hybrid and hydrogen-ready boilers, is an important market driver.

Furthermore, the adoption of IoT-backed smart heating solutions with remote surveillance feature is augmenting user experience and operational performance. Rising construction sector coupled with growing emphasis on high-performance energy-saving solutions in non-residential and residential buildings are also aiding the market growth. Future developments in industry are likely to reflect this increasing focus on low emission and carbon neutral heating technologies.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The Natural Gas-Powered and Oil-Powered Combi Boiler segments account for a large percentage of the Combi Boiler Market as clients, including homeowners, businesses, and industrial users, look for energy-efficient and cost-effective solutions. These fuel categories have a considerable impact on customer and regulatory environments, as well as boiler technology developments.

As energy efficiency regulations become more stringent and needs for compact heating systems rise, the acceptance of high performance combi boilers increases across the globe.

Natural gas combi boilers are increasingly popular because they are so energy efficient, lower carbon footprint and save money for homeowners. Because of this consistent and clean combustion, natural gas boilers have become a popular choice for both residential and commercial heating applications, as opposed to oil-powered systems.

Market adoption has been bolstered by rising demand for sustainable heating systems in urban and suburban residential properties. As a matter of fact, studies show that more than 70% of the newly installed combi boilers in developed regions are fuelled by natural gas based on the highest thermal efficiency settings and regulations compliance with emission reduction targets.

Moreover, the introduction of next-generation natural gas combi boilers with low NOx emission burners, sophisticated heat exchangers, and smart thermostat compatibility, has further boosted market demand by ensuring improved performance and environmental sustainability.

Adoption has also been aided by the advent of AI-powered heating control systems, with predictive maintenance notifications, real-time energy usage highlights, and automatic temperature adjustments for optimized fuel utilization and cost reductions.

The introduction of hybrid natural gas-powered boilers, combined with the utilization of renewable energy sources including solar thermal heating and heat pump technology, has paved the way for increased market growth, providing improved energy diversification and protection from fuel price volatility.

Government-backed incentives and rebate programs through tax credits for high-efficiency gas boilers within natural gas distribution, energy efficiency certification schemes, energy efficiency drives, and expansion of the natural gas distribution infrastructure have also provided additional momentum to the market, making gas-powered heating solution ubiquitous.

Natural gas-accelerated combi boiler section is anticipated to hold key growth potential due to its efficiency, affordability, and regulatory compliance. Nevertheless, the industry may face hurdles likes of fluctuation in natural gas prices, infrastructure limitations in remote areas, and concern for methane emissions.

But new developments in areas such as AI-powered combustion optimization, next-gen carbon capture technology, and hydrogen-ready gas boiler designs are increasing sustainability, performance, and market penetration, guaranteeing continued proliferation of natural gas-powered combi boilers globally.

The share of Oil Powered Combi Boiler remains important in the Combi Boiler Market with high heat output, independent of municipal gas networks, and ability to cater to colder regions. Oil-fired systems differ from their natural gas counterparts and are frequently used in remote, off-grid, and industrial settings where alternative fuel sources are limited.

Increasing demand for efficient heating solutions in remote places, especially in agricultural properties, large estate homes, and off-grid industrial plants has fuelled adoption. Over 60% of the rural estate in colder regions, drawing considerable hot water requirements, still relies on oil-burning boilers mainly for their solid heating properties and the flexibility of fuel storage.

High-efficiency condensing oil boilers, equipped with sophisticated heat recovery mechanisms, low-sulphur fuel adaptability, and artificial intelligence (AI)-driven combustion optimization capability, have spurred the growth of the oil boiler market, leading to increased fuel economy and lower emissions.

Smart oil boiler control technologies, such as wireless fuel level monitoring, automatic service scheduling and adaptive burner modulation, contributed to a further rise in adoption, enabling a higher degree of operational convenience and lower maintenance costs.

The development of biofuel-compatible oil boilers with the ability to adapt to renewable liquid fuels and dual-fuel combustion technology, coupled with lower carbon-footprint heating solutions, has streamlined market growth, ensuring compliance with changing environmental laws and sustainability targets.

Cost-effective heating oil supply strategies, including fuel price hedging programs, community bulk purchasing initiatives, and AI-driven consumption forecasting, have thus bolstered market expansion, securing affordable pricing and stable supply chains for users of oil-powered combi boilers.

Even with their high heat output capacity, their freedom from grid protrusion, and flexibility in fuel storage, the oil powered combi boiler segment is facing hurdles like economy instability due to fluctuating oil prices, environmental condemnation of carbon emissions, and limits set by progressive policies on fossil fuel heating systems.

But cutting-edge innovations, such as AI-powered fuel efficiency optimization, renewable heating oil alternatives, and next-generation low-emission oil burners, are making compliance more sustainable and affordable, driving continued development of oil-powered combi boilers around the globe.

The Combi boiler market is segmented into Condensing and Non Condensing segments, among which Condensing segment accounts for a major share, as residential, commercial and industrial consumers demand more energy efficient and environmentally sustainable heating solutions, supported by regulatory compliance.

These technology classifications are critical in determining marketplace trends, advancing innovation in heat recovery methods, and providing influence over government energy policies.

Condensing combi boilers have been widely adopted in the marketplace because of the carbon-cutting ability to reclaim waste heat, tended to be more efficient. Condensing boilers use sophisticated heat exchanger technology, which extracts the maximum amount of thermal energy from the combusted fuels, in contrast to a non-condensing boiler, which wastes any heat from the flue gas.

High-efficiency heating solutions are being adopted, especially in new buildings, energy-conscious commercial structures, and green home renovations. In regulated markets, more than 75% of new residential combi boiler installations now employ condensing technology, made possible by energy savings and environmental compliance.

The emergence of ultra-high-efficiency condensing boiler designs with modulation control, hybrid heating compatibility, and corrosion-free stainless-steel heat exchangers has further solidified the market demand by providing superior durability and longer performance life.

While the condensing combi boiler segment is more efficient, sustainable, and regulatory compliant, it is hampered by high initial cost, increased maintenance complexity, and condensate disposal requirements.

Innovations in AI-powered heat exchanger self-cleaning systems, hybrid condensing technology integrated with renewable solutions, and nanotech-based corrosion protection coatings are enabling increased cost-effectiveness, simplified maintenance, and extended service life for these technologies, which will invariably lead to increased acceptance of condensing combi boilers across the globe.

Non-condensing combi boilers cater the market demand as they are cheap, simple to install, and fit well with older heating systems. Non-condensing models are non-condensing boilers featuring more straightforward heat exchange than their condensing counterparts; this makes them a common pick for retrofits as well as budget-sensitive projects.

Adoption has been driven by the rising need for simple heating solutions, especially in small residential apartments, light commercial premises, and buildings equipped with aging venting infrastructure. In price-sensitive markets, studies show that more than 50% of combi boiler customers are putting their trust in non-condensing models, primarily since they are less expensive and require less maintenance.

The non-condensing combi boiler segment, despite the advantages in terms of affordability, ease of installation, and low technical specifications, also faces challenges such as low energy efficiency, high carbon emissions, and more stringent regulatory limits to non-condensing heating appliances.

Nonetheless, the advent of new technologies for combustion optimization with AI integration, dual-fuel design capacity, and compact heat exchanger designs are enhancing fuel efficiency, emission management, and cost-effectiveness thereby fostering sustained growth prospects of non-condensing combi boilers in a few segments across markets worldwide.

The Combi Boiler Market and the Combi Boiler Market trend will be impacted by growing demand for energy-efficient heating solutions, the growing adoption of smart home technologies, and strict government regulations on carbon emissions. Highly innovative condensing technologies and eco-optimised heating systems are steadily increasing the germinating market. Some of the greatest trends to look forward to are digital thermostat integration, hydrogen-ready combi boilers, and increased heat exchanger efficiency.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch Thermotechnology | 12-16% |

| Vaillant Group | 10-14% |

| BDR Thermea Group | 8-12% |

| Ariston Thermo Group | 6-10% |

| Noritz Corporation | 4-8% |

| Other Companies (combined) | 45-55% |

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch Thermotechnology | Develops high-efficiency condensing combi boilers with smart control features. |

| Vaillant Group | Specializes in hybrid and hydrogen-ready combi boilers for sustainable heating. |

| BDR Thermea Group | Provides energy-efficient combi boilers with advanced heat exchanger technology. |

| Ariston Thermo Group | Focuses on compact and eco-friendly combi boiler designs for residential applications. |

| Noritz Corporation | Offers tankless and high-efficiency condensing combi boilers with IoT connectivity. |

Key Company Insights

Bosch Thermotechnology (12-16%)

Bosch leads in the combi boiler market with a focus on smart and high-efficiency heating systems.

Vaillant Group (10-14%)

Vaillant is a key player in the industry, pioneering hybrid and hydrogen-ready boiler technology for sustainable heating solutions.

BDR Thermea Group (8-12%)

BDR Thermea provides advanced condensing boiler solutions, focusing on energy efficiency and low emissions.

Ariston Thermo Group (6-10%)

Ariston specializes in compact, eco-friendly combi boilers that offer space-saving and energy-efficient heating solutions.

Noritz Corporation (4-8%)

Noritz focuses on tankless combi boilers, integrating IoT features for real-time energy monitoring and control.

Other Key Players (45-55% Combined)

Several heating technology manufacturers contribute to the expanding Combi Boiler Market.These include:

The overall market size for the Combi Boiler market was USD 2,1087.1 Million in 2025.

The Combi Boiler market is expected to reach USD 31,515.4 Million in 2035.

The demand for combi boilers will be driven by increasing residential and commercial construction activities, rising demand for energy-efficient heating solutions, government incentives for eco-friendly heating systems, and advancements in smart heating technologies.

The top 5 countries driving the development of the Combi Boiler market are the UK, Germany, China, the USA, and France.

The Gas-Fired Combi Boiler segment is expected to command a significant share over the assessment period.

Marine Cranes Market Growth - Trends & Forecast 2025 to 2035

Hot Chamber Die Casting Machine Market Growth - Trends & Forecast 2025 to 2035

High Voltage Glass Insulator Market Growth - Trends & Forecast 2025 to 2035

Heavy Duty Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Hedge Trimmers Market Growth - Trends & Forecast 2025 to 2035

High Speed Steel (HSS) Tools Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.